DEFYING ETHICS

This month's post continues where last month's left off, exposing the unethical and illegal acts committed by Priority One Credit Union's President, Charles R. Wiggington, Sr. His acts and personal and embarrassing indiscretions all began after he was appointed President on January 1, 2007.

In recent months, the President hasn't entered into personal campaign publicly denying that he has ever been accused of sexual harassment or that Priority One has ever been sued by any former employee. The documents we published last month should serve to bring an end to his denials and lies.

We understand that he has described the writers of this blog as "dangerous", "trouble", and "trouble-makers." The only response we have is that if we are indeed trouble, then it's only to him and those on his staff who chose to violate policies and laws.

AN INSIDIOUS EPIPHANY

In 2009, Priority One Credit Union President,

Charles R. Wiggington, Sr. had the brilliant idea of reinstating a business

relationship with automobile broker, Henry Justice, the former owner of Justice Auto Sales.

Mr. Justice was and remains a close friend of

the President. In the 1990’s, then Vice President of Operations, Charles R.

Wiggington, Sr., introduced Mr. Justice to the credit union suggesting that the

dealership owner become one of the credit union’s recommended automobile

broker. An agreement was signed by Mr. Justice and soon, the credit union began

referring members to the dealer.

In 2000, the credit union sent Mr. Justice

money to pay for automobiles purchased from the dealer by four (4) members of

the credit union. Once Mr. Justice received payment, he should have released

the pink slips for each vehicle to the credit union so that Priority One could

add it’s name as lienholder until each automobile loan had been paid in full.

Mr. Justice did not release the titles.

The credit union began writing to Mr. Justice

requesting that he release the pink slips, but he refused. Soon, the credit

union’s attorneys began writing to Mr. Justice but to no avail.

A lawsuit was filed by the credit union

against Mr. Justice. Mr. Justice responded by filing for bankruptcy and

informed the court that he never received the money paid by the credit union.

He alleged that the money was received by his daughter who absconded with the

funds.

Mr. Justice’s request for bankruptcy was

approved and he did not have to release the titles.

Because of Mr. Justice’s actions, the members

who had purchased vehicles from his dealership were unable to obtain

Registration Cards. This forced the credit union’s DMV Specialists to visit the

office of the Department of Motor Vehicles in Lincoln Park each month to obtain

temporary registration cards.

It was not until 2006, that one DMV

Specialist drove to Carson where Mr. Justice was now working for a brokerage

owned by his son. The DMV Specialist convinced Mr. Justice to sign the Power of

Attorney forms for each vehicle bringing an end to the case involving Mr.

Justice.

Despite the losses of over $80,000 to the

credit union and the public relations nightmare caused by the President’s

friend, in 2009, Mr. Justice and his son visited the South Pasadena branch and conferred

with Charles R. Wiggington, Sr. who agreed to reinstate a working relationship

with the automobile broker.

EVIDENCE

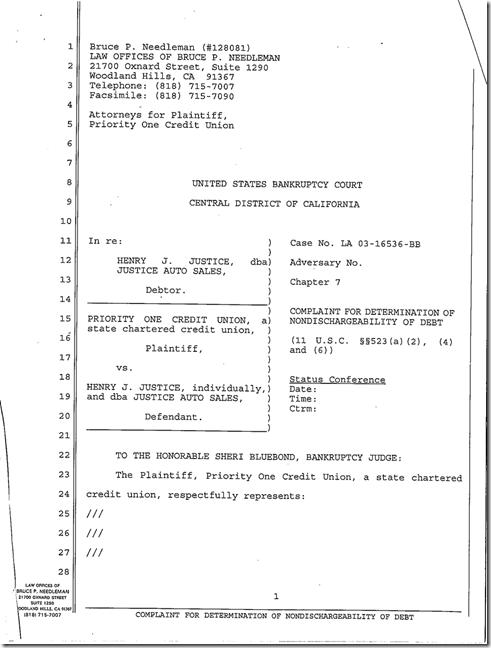

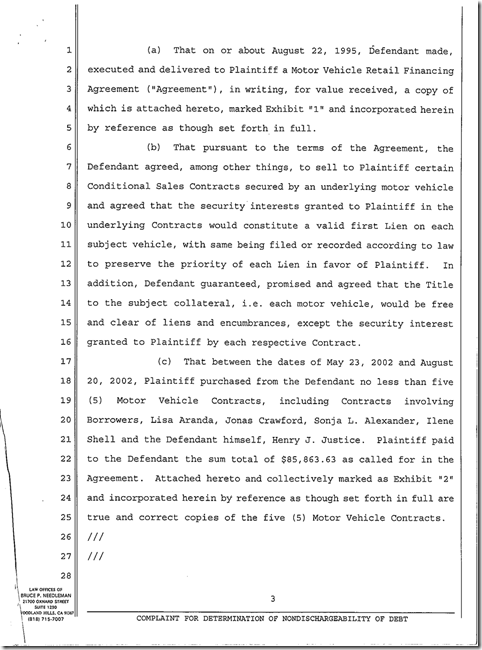

Shown below, on page 2, article 6, of the "COMPLAINT FOR DETERMINATION OF NONDISCHARGEABILITY OF DEBT" filed with the United States Bankruptcy Court by Priority One Credit Union in 2003, states that among the debts owed by the Defendant, Henry Justice, are obligations owed to Plaintiff [Priority One Credit Union] in the sum total of $85,863.63, plus interest.

Under article 9 of the complaint, the credit union states that the “Defendant, Henry J. Justice, dba Justice Auto Sales, having obtained Plaintiff’s (Priority One Credit Union) funds through FRAUD with no intent on remitting payments to the automobile auction to clear Title to the vehicles, and in addition, while acting in his fiduciary capacity as agent of Plaintiff (Priority One Credit Union), and as a result of the willful and malicious injury by Defendant (Henry J. Justice), and as a result of the CONVERSION, LARCENY and/or EMBEZZLEMENT of said funds by Defendant, Defendant is not entitled to have these obligations discharged in Bankruptcy pursuant to 11 USC §§523 (a) (2), (4) and/or (6).” Based on an investigation, the credit union gathered sufficient evidence suggesting Mr. Justice embezzled the money paid to him in good faith by the credit union. Despite the credit union's beliefs, in 2009, Charles R. Wiggington, Sr. chose to resurrect a relationship with Mr. Justice.

The credit union accused Mr. Justice committed of "conversion, larceny and/or embezzlement" and owing Priority One “in excess of $85,863.63. '' What's more, in a letter dated July 1, 2004, sent by the Department of Motor Vehicles to the credit union, the department states that “the dealer [Justice Auto Sales] went out of business on April 7, 2003 and did not transfer the vehicle registration” to the credit union, adding that “Investigations was unable to retrieve any documentation from the dealer, in order to assist you in registering the vehicle[s].”

Even if the Mr. Justice's statements that it was his daughter who absconded with the money paid to his dealership by the credit union were true, why didn't he attempt to rectify this incident with his friend, Charles R. Wiggington, Sr.?

THE PACT

On the day, Mr. Justice visited the main branch in South Pasadena, he wa me at the reception desk by his good and long-time friend, Charles R. Wiggington, Sr. The President led Mr. Justice and his son to the credit union's Board Room where they remained behind closed doors for approximately one hour. Leaving the Board Room, the three men proceeded into Mr Wiggington's office where they remained for another 45 minutes. The President told his administrative assistant that he would be leaving the office to have lunch with Mr. Justice and his son. The three men drove to The Barkley where they remained for another hour and a half before returning to the branch.

Four days later, the President informed Senior Vice President, Rodger Smock; the AVP of Lending, Patti Loiacano; the Accounting Department Supervisor, Jennifer Kelly; and CFO, Manny Gaitmaitan, that he had decided to reinstate a business relationship with the dealership managed by Mr. Justice’s and owned by his son. All were surprised, remember the losses incurred when Mr. Justice embezzled the monies paid to him by the credit union, just a few years earlier. He told Mrs. Loiacano that was to order her staff in the Loan Department that they were to start promoting the reinstated broker and said the credit union would be paying to print fliers that would be distributed to all loan processors and officers and members who expressed interest in purchasing an automobile. He also disclosed that in a few days, he would hand every loan department representative Mr. Justice's business cards which would be handed out to members whose automobile loan applications were approved for funding.

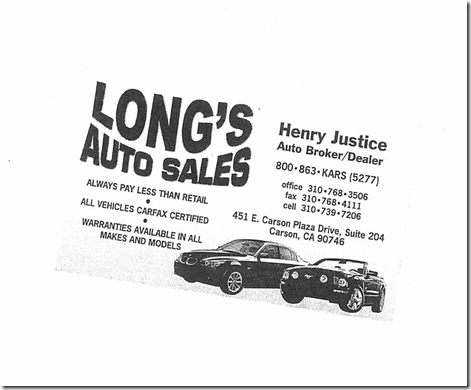

Surprisingly and out of character, Mrs. Loiacano contested his decision to reinstate Mr. Justice as "the" preferred automobile broker and informed the President that should be asked to repay a portion of the $85,000 he embezzled from the credit union. Mr. Wiggington contacted Mr. Justice who submitted a check in the amount of $1300 which the President said was sufficient to reinstate a working relationship with the automobile broker. And so the President passed out business cards for Long's Auto Sales, the new dealership owned by Mr. Justice's son.

Mr. Wiggington's plan would have succeeded had we not exposed what he had done on this blog. After exposing his plan on this blog, the President was called at his cellular by Board Chair, Diedra Harris-Brooks, who asked if what we reported was true. He denied our report, describing it as a lie but immediately after concluding his conversation with Mrs. Harris-Brooks, he made his way to the Loan Department and retrieved what he thought were all of the business cards he distributed several days earlier. Returning to his office, he called Mr. Justice and told him that if contacted by any of the Directors, that he was to deny all knowledge of a plan to re-enter into a working relationship with the credit union. Here is a copy of the business card distributed by the President:

Four days later, the President informed Senior Vice President, Rodger Smock; the AVP of Lending, Patti Loiacano; the Accounting Department Supervisor, Jennifer Kelly; and CFO, Manny Gaitmaitan, that he had decided to reinstate a business relationship with the dealership managed by Mr. Justice’s and owned by his son. All were surprised, remember the losses incurred when Mr. Justice embezzled the monies paid to him by the credit union, just a few years earlier. He told Mrs. Loiacano that was to order her staff in the Loan Department that they were to start promoting the reinstated broker and said the credit union would be paying to print fliers that would be distributed to all loan processors and officers and members who expressed interest in purchasing an automobile. He also disclosed that in a few days, he would hand every loan department representative Mr. Justice's business cards which would be handed out to members whose automobile loan applications were approved for funding.

Surprisingly and out of character, Mrs. Loiacano contested his decision to reinstate Mr. Justice as "the" preferred automobile broker and informed the President that should be asked to repay a portion of the $85,000 he embezzled from the credit union. Mr. Wiggington contacted Mr. Justice who submitted a check in the amount of $1300 which the President said was sufficient to reinstate a working relationship with the automobile broker. And so the President passed out business cards for Long's Auto Sales, the new dealership owned by Mr. Justice's son.

Mr. Wiggington's plan would have succeeded had we not exposed what he had done on this blog. After exposing his plan on this blog, the President was called at his cellular by Board Chair, Diedra Harris-Brooks, who asked if what we reported was true. He denied our report, describing it as a lie but immediately after concluding his conversation with Mrs. Harris-Brooks, he made his way to the Loan Department and retrieved what he thought were all of the business cards he distributed several days earlier. Returning to his office, he called Mr. Justice and told him that if contacted by any of the Directors, that he was to deny all knowledge of a plan to re-enter into a working relationship with the credit union. Here is a copy of the business card distributed by the President:

When planning to reinstate Mr. Justice's new business, President Wiggington ignored the fact his friend, Henry Justice, absconded with money paid to him by the credit union a few years earlier.

The President also ignored the tremendous inconvenience caused to the four members who unfortunately bought cars from Mr. Justice.

The President had absolutely no consideration over the fact that Mr. Justice caused the credit union's DMV Specialists a huge inconvenience which forced them to visit the office of the Department Motor Vehicles to obtain temporary Registration Cards for the four members who purchased cars from Justice Auto Sales.

A few months ago, we received the following email from a reader and former employee of the Credit Resolutions Department describing the incident involving Justice Auto Sales:

I worked at Bank of America but went to work at Credit Resolutions with Mike Lee. I decided I wanted to finance my car with Priority One. I traded my car with Henry Justice. Henry told me that how much I was going to be paid for my vehicle. The car was under my name and my girlfriend. Priority One paid Justice but Justice never paid off the amount due on my Camero. I ended up delinquent and it affected my co-signers credit. One of the loan offices told Charles Wiggington but he told her some “dealers do that but it’ll be okay.” Problem is Henry Justice never paid off my car and I became delinquent and ruined my friend’s credit. Charles didn’t ever car or show that he cared and he didn’t do anything probably because Henry Justice and Charles Wiggington were friends.

We were also contacted by a former Loan Officer who was friends with one of Mr. Justice's former employees. She informed us that Mr. Justice's assistant told her that while Vice President of Operations, Charles R. Wiggington, Sr. was paid kick-backs by the dealer. The President's corrupt tendencies are certainly not new.

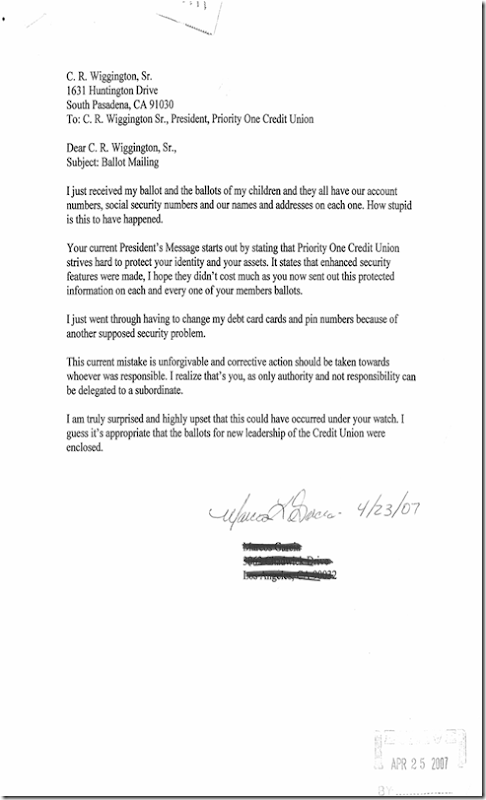

In 2007, President Charles R. Wiggington, Sr. refused to comply with security procedures designed and implemented by his predecessor, William E. Harris. At the time, the President's reasons for refusing was that he as President didn't have to carryout security protocols. His refusal resulted in what would become a public relations nightmare. Envelopes containing ballots for that year's election were mailed on whose exterior were printed member credit union account and social security numbers. His refusal to abide to security protocols also cost the credit union $100,000 to pay for remedial measures. The President found a victim in the then IT Manager who he told the board had committed the violation of security when in fact, it was Charles R. Wiggington, Sr.

The following are copies of just some of a large number of letters sent to President Wiggington by members who were angered and concerned about the breach in security. The President refused to respond to any of the letters stating that replying to member concerns was not the job of the President and instead, delegated the task to a member in the Business Development Department.

The President committed yet another breach of security when instead of filing or shredding the letters, simply discarded them in his trash can. Fortunately, we were able to dredge these up from the credit union's trash bin. So does President Wiggington suffer from a disdain for rules and policies or is he just stupid? You be the judge.

AN ONLINE COMPLAINT

Some members wrote to the President while others called, leaving messages on his voicemail, with his administrative assistant, and with personnel in the Member Services Department. But one member, Steve Bass, chose to express his displeasure by both writing to the President's office (erroneously sent to retired President, William E. Harris) and by posting an article on the Internet. Here is the copy of Mr. Bass' letter sent to the office of the President along with a republished copy of Mr. Bass' original letter published on the Internet.

.

Priority One Credit Union touts itself as possessing the ability to help members and employees "win with money." The freeze on non-exempt staff wages implemented by the President in 2009 serves as evidence that the credit union is incapable of helping employees win with money. But what about members?

The following letter was mailed to the credit union by Ruben A. Spivey, an attorney representing a member who had been subject to extreme duress by the credit union's refusal to release the elderly member's funds after she requested closure of her account because she was moving out of state.

The elderly member's credit union account was pillaged by her former housekeeper who used both a check card issued in the member's name and forged the member's signature on a number of checks drawn from the member's checking account.

In fact, Priority One never realized that fraud had been perpetrated. It was only6 after the member called the credit union and spoke to a highly competent Bank Secrecy Act ("BSA") named T. Castrol. The specialist reviewed the member's computer records and verified which transactions had not been performed by the member. With the assistance of the BSA Specialist, the member filed the necessary paperwork needed to conduct an investigation of the thefts and whose findings would be used to reimburse all stolen monies to the member's account. What the member didn't realize is that the President and some of his executive staff would subject the member to further duress.

Here is the attorney's letter:

The following letter was mailed to the credit union by Ruben A. Spivey, an attorney representing a member who had been subject to extreme duress by the credit union's refusal to release the elderly member's funds after she requested closure of her account because she was moving out of state.

The elderly member's credit union account was pillaged by her former housekeeper who used both a check card issued in the member's name and forged the member's signature on a number of checks drawn from the member's checking account.

In fact, Priority One never realized that fraud had been perpetrated. It was only6 after the member called the credit union and spoke to a highly competent Bank Secrecy Act ("BSA") named T. Castrol. The specialist reviewed the member's computer records and verified which transactions had not been performed by the member. With the assistance of the BSA Specialist, the member filed the necessary paperwork needed to conduct an investigation of the thefts and whose findings would be used to reimburse all stolen monies to the member's account. What the member didn't realize is that the President and some of his executive staff would subject the member to further duress.

- An investigation revealed that the member's signature had been forced by her housekeeper on several of the member;'s checks yet not one person at the credit union ever noticed the disparity between the forged signature and the member's actual signature on file.

- A check card application had been completed and submitted to the Redlands branch. However, the signature of the application was forged by the housekeeper and again, no one at the credit union noticed that the signature was fraudulent.

- The President refused to reimburse the stolen monies, declaring that the robberies had not been perpetrated by the credit union, thus the credit union was in no way responsible for the illegal withdrawals perpetrated using the member's stolen checks and the check card issued by the credit union in her name.

- COO, Beatrice Walker, joined the President, agreeing that the credit union was in no way responsible for the thefts and thus not required to reimburse any of the stolen funds.

Here is the attorney's letter:

DISREGARDING PROCEDURE

A few

months ago,an audit was conducted by a CUNA investigator following the filing

of a claim filed in which Priority One Credit Union reported that $100,000 had

been withdrawn from a HELOC checking account by two members after the date the terms of the HELOC expired. If the terms of the HELOC had

expired, then how could the members have withdrawn any money? The credit union forgot to close

the account on the day the loan expired.

Realizing

the credit union failed to close the account, the members, a married couple,

withdrew approximately $100,000 from the account. They must have thought the

money was being given to them without have to repay the funds.

CUNA's

investigator interviewed present and former employees of the credit union,

discovering that often time, Priority One's representatives forget to close our accounts whose terms

have expired. We're surprised that the credit union's Compliance Officer,

Patricia Loiacano, the President and the staff in the Loan Department all

failed to notice that the HELOC had not been closed.

REALLY STUPID IDEA

In early 2008, months before leading Priority One into the RED, President Wiggington told employees during a quarterly all staff meeting that while relaxing at home, he experienced a sudden, inexplicable spark of inspiration. The fabulous moment was creating a large, bulky unattractive badge on which were printed the words, JUST ASK.

The President declared that he knew for a fact that the badge would help generate lots of new business. This is the first time we publish a photograph of the President’s inspired and inane badge.

We can't at all comprehend the significance of the message or who it was guaranteed to produce new business. Certainly, the credit union's financial performance through the remainder of 2008, all of 2009 and all of 2010 prove the badge had absolutely no mystical properties needed to produce new business. In his zeal to appear clever and imaginative, the President proved that he is ignorant about marketing and advertising and that maybe his decision in 2007, to eliminate the marketing department, proved adversarial and counter-productive.

Also, employees were ordered by AVP of Operations, Rodger Smock, to wear the badges while at work, including during lunch periods, so that strangers could inquire with employees what "Just Ask" meant? Within a month, most of the badges had been discarded and lost making this another bad and costly idea implemented by the simplistic President.

The President declared that he knew for a fact that the badge would help generate lots of new business. This is the first time we publish a photograph of the President’s inspired and inane badge.

We can't at all comprehend the significance of the message or who it was guaranteed to produce new business. Certainly, the credit union's financial performance through the remainder of 2008, all of 2009 and all of 2010 prove the badge had absolutely no mystical properties needed to produce new business. In his zeal to appear clever and imaginative, the President proved that he is ignorant about marketing and advertising and that maybe his decision in 2007, to eliminate the marketing department, proved adversarial and counter-productive.

Also, employees were ordered by AVP of Operations, Rodger Smock, to wear the badges while at work, including during lunch periods, so that strangers could inquire with employees what "Just Ask" meant? Within a month, most of the badges had been discarded and lost making this another bad and costly idea implemented by the simplistic President.

CONCLUSION

The inability of Priority One Credit Union to acquire the level of new business enjoyed in the many years before Charles R. Wiggington, Sr. was appointed President is but one of the many issues plaguing the credit union.

The President has refused to adhere to security protocols and justifying his refusal by declaring that as President, he doesn't have to do so. As a result of his intentional violation of the rules governing security he single-handedly caused the 2007 mailing fiasco. Apparently, it was a breach of security which also allowed a former receptionist of the Los Angeles branch to embezzle funds from member accounts over a period of many months. The thefts she perpetrated were not discovered until earlier this year.

Priority One has proven it is no member's financial fitness center and that it doesn't possess the knowledge or ability to help any member of employee "win with money." It can't even help itself escape the financial quagmire it was pushed into by the President's chronic business blunders and abuses of his appropriated authority.

It was also the corrupt and immoral President who tried to restructure a new and revitalized business relationship with Henry Justice, the owner of the now defunct Justice Auto Sales and manager of his son's dealership, Long's Auto Sales, even after Mr. Justice embezzled more than $85,000 of credit union monies.

Charles R. Wiggington, Sr. has proven he hold a disdain for rules, laws and structures and his actions suggest that he may believe he is exempt from abiding to laws and credit union policies. Certainly the 2008 investigation which gathered evidence proving he sexually harassed a former employee validates his immense contempt for laws.

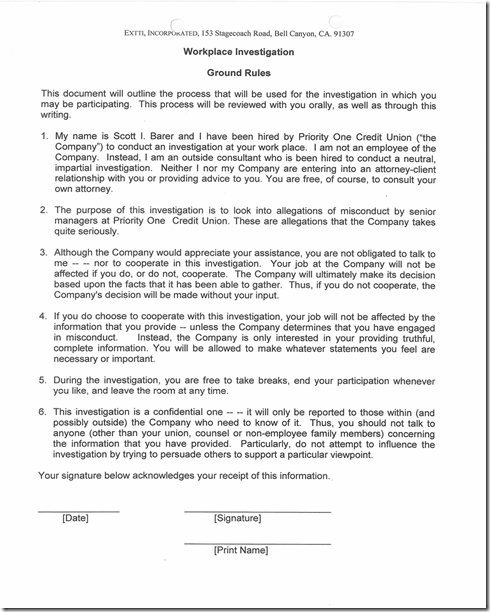

In 2008, the corrupt Board Chair, Diedra Harris-Brooks, pretended that she and the Board were genuinely concerned about employee safety and ensuring staff were protected against sexual harassment. In an act of pure superficiality, the Board hired EXTTI, Inc., the same company that conducted the investigation of the President, tom come and speak to ALL employees about the subject of sexual harassment. In the more than 80-years since the credit union opened it's doors, at no time has any employee- management or non-management ever been accused of sexual harassment except for Charles R. Wiggington, Sr.

Not only did Mrs. Harris-Brooks subject all employees into participating in the sexual harassment seminar, but she, the Directors, the Supervisors and the sexual harasser, Charles R. Wiggington, Sr., all sat at the back of the room, apparently hiding in the shadows where they seem to be most comfortable. The only person who should have been forced to participate in the seminar was the President.

We find it interesting that the Director of Human Resources, Rodger Smock, has never once ever spoken to employees about sexual harassment. Is it because he's unqualified to do so or is it because he once had a very public relationship with a young Hispanic male employee of the Member Services Department?

On another subject, just a few months ago, COO, Beatrice Walker, ordered the mailing of letters to every member who had been automatically enrolled in Courtesy Pay, the credit union's new overdraft protection program. The letter included a form that the credit union asked members to sign and return to the main branch. Ms. Walker dishonestly enrolled every member in good standing in the program but soon discovered that under the law, members must first agree to enroll in overdraft protection. Ms. Walker, like the President, does not feel an obligation to abide to credit union policies or state and federal laws. We anxiously await to see what new scandals the President and his executive staff immerse the credit union.