Is He Worth the Pay?

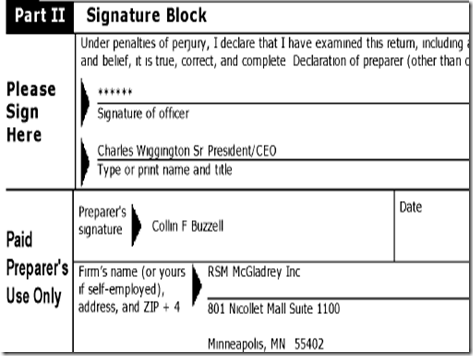

A reader of this blog recently provided information about how to view Priority One Credit Union's Form 990 IRS tax filings which are available for public viewing and include a record of salaries paid to it's officers. And so we've decided to publish excerpts from the credit union's 2008 and 2009 filings which show, in part, that President Charles R. Wiggington, Sr. was paid in excess of $150,000 per year. In view of his history of immense business failures and voluntary involvement in scandals, we find it incredulous that the Board of Directors concluded he is deserving of such a high salary. Clearly, the Board believes in rewarding failure.

To put things into perspective, since January 1, 2007, the date Charles R. Wiggington, Sr. began his stint as President, the credit union has lost millions of dollars in assets, What's more, 2009 ended with the credit union immersed more than $5 million in the negative. In October 2006, Directors, O. Glen Saffold, Thomas Gathers, and Janice Irving all revealed they selected Charles R. Wiggington, Sr. because "the credit union needs a Black president." As his well-documented record of performance proves, Black trumped competency and the results are self-evident.

President Wiggington is hardly the highest paid President/CEO in any industry but he is one of those rare cases where his performance has become public as have his personal indulgences in non-business related activities, prompting us to ask, is he worth the salary he receives? Actually, should he even continue to be employed by Priority One Credit Union?

Despite his abysmal performance and array of failed business decisions, Priority One's incompetent Board of Directors not only retain his employment but continue to grant him annual increases in salary. But the President and the Board have established a set of double-standards which have created a disparity in what are the performance expectations placed on managers including executives and those placed on non-exempt staff.

In September 2008, during one of the credit union's quarterly all-staff meetings, President Wiggington declared, "No one in this credit union is going to get a raise unless they get a 5 on their [performance] evaluation and prove they are performing above average. You’re going to have work hard for a raise.” So how could the person who has caused the credit union to lose millions of dollars in assets, who has wasted hundreds of thousands of dollars on failed projects and who was found guilty of sexual harassment in 2008, not only retain his employment but continue to receive salary increases?

TELLING WHOPPERS

The image shown above, was copied from the credit union's website and is of course, a huge exaggeration. Priority One hasn't been a $175 million credit union since 2008, when Charles R. Wiggington, Sr. borrowed $20 million from the credit union's line-of-credit all to create an increase on paper, of the credit union's asset size. His ploy was authorized by the Board and forced the credit union to pay monthly interest payments which approximated $30,000 to more than $50,000.'

On January 1, 2007, the credit union's asset size was $172 million. In mid-2008, the President borrowed $20 million which increased the asset size to $181 million though the actual asset size was $161 million. This was a loss of $11 million since January 1, 2007, the date Charles R. Wiggington, Sr. was appointed President.

On December 31, 2010, the credit union's actual asset size was $144,486,639. This was almost a $30 million drop of the credit union's net income size since January 1, 2007.

Inarguably, Priority One is not a $175 million credit union. The highly erroneous reference on the credit union's webpage is just part of the same old sham constantly perpetrated by the President to create an appearance of success that is non-existent. Under President Wiggington and the Board of Directors, creating false impressions is the goals since apparently all of the officers are incapable of forging effective strategic planning.

"A PROGRESSIVE 175 M CREDIT UNION"

The credit union's actual asset size is less than $150 million clearly revealing Priority One is not a $175 million credit union or progressive. The President and the Board should familiarize themselves with the definition of the word progressive. We suggest they amend their current statement to read:

“Priority One Credit Union,

a regressive $144 M Credit Union”

We always appreciate reader comments whether for or against us. One astute reader recently provided us a summary of the credit union's for the quarters ending December 31, 2008 through the quarter ending December 31, 2010. The summary document a pattern of losses that neither the President or Board of Directors are equipped to stop. Here is the comment posted by the reader using the handle, "Look at Their Reports":

It is clear that in spite of President Wiggington's insistence that business is thriving that the credit union's own documented financials prove Priority One has been traversing a losing streak.

No matter how colorful the story, no matter how positive the message, the fact is President Charles R. Wiggington, Sr. is a chronic and compulsive liar. There is a lesson to be learned in all of this and it is that like his stories that he resides in a $1 million estate, that he is an avid collector of art, and like his fleet of fabulous vintage BMW's, his claims that Priority One is again thriving is nothing more than another colorful imaginary concoctions.

No matter how colorful the story, no matter how positive the message, the fact is President Charles R. Wiggington, Sr. is a chronic and compulsive liar. There is a lesson to be learned in all of this and it is that like his stories that he resides in a $1 million estate, that he is an avid collector of art, and like his fleet of fabulous vintage BMW's, his claims that Priority One is again thriving is nothing more than another colorful imaginary concoctions.

CRYING WOLF

On February 22, 2011, AVP/Executive Vice President, Rodger Smock, post a notice via the Intranet, informing employees of the credit union that President Wiggington had been hospitalized during which he suffered a stroke causing paralysis to one of his legs.

A few days later, Mr. Smock informed some staff members of the South Pasadena branch that the President had been taken to Kaiser Permanente - Sunset during which fluid had been discovered in his lungs. During his stay, he allegedly suffered the stroke. While hospitalized tests disclosed the President had cancer. Later, following his return to the credit union, the President would traverse the South Pasadena branch telling staff he had "ball cancer." Several employees said the President had become ill just a few days after the arrival of state auditors at the main branch in South Pasadena, California.

On February 28th, the Senior Vice President informed some employees that the President had been released from the hospital and returned home and would have to undergo therapy to help regain use of his paralyzed leg.

Within a few days following his release and almost miraculously, the President called Rodger Smock; COO, Beatrice Walker; CFO, Saeid Raad; and sent text messages to AVP, Gema Pleitez, sharing details about his ordeal while at the hospital and describing his impending medical treatment to help regain use of his paralyzed let. He also found the time and courage to call AVP's, Lynnette Fortson and Sylvia Perez and numerous other employees of the credit union's other branches, to talk about his illness, the tests he had been subjected to the prescribed treatment that would be administered.

A few days later, Mr. Smock informed some staff that the President who had allegedly had fluid in his lungs, suffered a stroke, and been found to have "ball cancer" was scheduled to return to work on March 17, 2011.

On March 3rd, Mr. Smock traipsed through the main branch informing employees that the President is "in good spirits", "feels like new", and "it's like nothing ever happened." Maybe nothing did. After all, Charles R. Wiggington, Sr. is a story-teller. Not an interesting story-teller nor an interesting story-teller, but a story teller. nonetheless.

There is no evidence he ever had fluid in his lungs. If he suffered a stroke it apparently had no effect on his addiction to blabbing. We've never heard of someone who suffers a stroke who returns home and indugles themselves in calling anybody and everybody they know.

There is no evidence he ever had fluid in his lungs. If he suffered a stroke it apparently had no effect on his addiction to blabbing. We've never heard of someone who suffers a stroke who returns home and indugles themselves in calling anybody and everybody they know.

So was he really ill? A few days before auditors arrived, President Wiggington disclosed he wasn't looking forward to answering their questions. Coincidentally, his bout with illness impeded him from having to answer questions.

His alleged recuperation is nothing short of a miracle. The gravity of his illness should have precluded him from returning home so quickly much less spending hours on phone gabbing about his alleged illness. He was admitted to the hospital on February 22, 2011 and scheduled to return to work on March 17, 2011.

It's also peculiar that during his absence, authority over the credit union was delegated to Rodger Smock and not COO, Beatrice Walker. What prompted the Board of Directors, actually it's Chair, Diedra Harris-Brooks, to bypass Ms. Walker and instead temporarily transfer all authority over the credit union to the historically incompetent, Rodger Smock? In 2010, wasn't Mr. Smock been marked for termination by Ms. Walker? Inarguably, Ms. Walker no longer holds sway over the Board Chair.

We recently obtained copies of the credit union's Form 990 IRS filings which reveal amongst other things, the salaries of the credit union's executive sector.

Despite the history of failures caused by Charles R. Wiggington, Sr. since he became President on January 1, 2007, the Board of Directors and in particular, it's Chair, Diedra Harris-Brooks have not only fought to retain him on payroll but granted him annual salary increases. Evidently, Priority One's Chair is a woman who believes the President's horrendous performance is worthy of being rewarded.

The following excerpts were taken from the credit union's 2008 and 2009 Form 990 IRS filings.

Despite the history of failures caused by Charles R. Wiggington, Sr. since he became President on January 1, 2007, the Board of Directors and in particular, it's Chair, Diedra Harris-Brooks have not only fought to retain him on payroll but granted him annual salary increases. Evidently, Priority One's Chair is a woman who believes the President's horrendous performance is worthy of being rewarded.

2008 FORM 990 IRS FILING

The following excerpts were taken from the credit union's 2008 and 2009 Form 990 IRS filings.

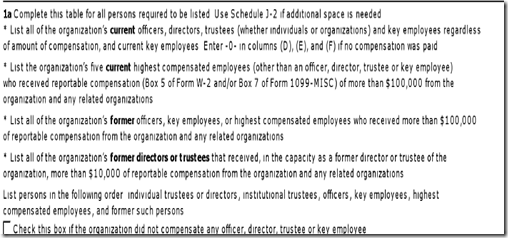

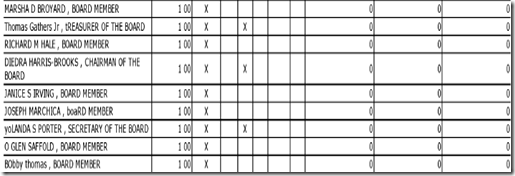

As shown below, the credit union states that each Director contributes one ("1") hour each week serving on the Board. This is of course, untrue. The Board meets once per month and usually Joe Marchica, Thomas Gathers, and Janice Irving are not present.

Though not stated in the Form 990 IRS filing, not all of the executives work eight (8) hours per day, five (5) days a week. As we reported last years, since being hired, COO, Beatrice Walker, has said she sometimes leaves work early to go to her second employment and William Sonoma in the city of Pasadena, California. is this one reason why the $100,000 a year COO has yet to develop products or services that prove successful?

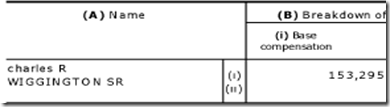

President Wiggington, despite his immense ineptitude as President, is paid a salary of $153,295 per year. Clearly, he is not being paid this amount because of his competency.

charles R. WIGGINGTON SR, PresiDENT/CEO 1.0

153,295 22,756

As shown above, he received "other compensation" totaling $22,756. The total paid to President Wiggington in 2008 was $176,051.

Since 2009, the President has implement expense reductions including a freeze on all non-exempt staff salaries but note, that not only has the freeze not impacted his salary, he has actually been given raises and bonuses. His decision to borrow $20 million from the credit union's line-of-credit in mid-2008, forced the credit union to pay monthly interest payments which amounted from $30,000 to more than $50,000. In 2008, he was also found guilty of having sexually harassed a former employee. Evidently, in the midst of the credit union's woes, Charles R. Wiggington, Sr. has prospered.

In 2008, AVP/Senior Vice President, Rodger Smock, was paid a salary of $101,053 plus an unspecified additional $15,236 for a total of $116,289. Evidently, Mr. Smock has also prospered in the midst of the credit union's troubles.

Since 2009, the President has implement expense reductions including a freeze on all non-exempt staff salaries but note, that not only has the freeze not impacted his salary, he has actually been given raises and bonuses. His decision to borrow $20 million from the credit union's line-of-credit in mid-2008, forced the credit union to pay monthly interest payments which amounted from $30,000 to more than $50,000. In 2008, he was also found guilty of having sexually harassed a former employee. Evidently, in the midst of the credit union's woes, Charles R. Wiggington, Sr. has prospered.

In 2008, AVP/Senior Vice President, Rodger Smock, was paid a salary of $101,053 plus an unspecified additional $15,236 for a total of $116,289. Evidently, Mr. Smock has also prospered in the midst of the credit union's troubles.

Rodger Smock, Senior Vice President 1.00 x 101,053 15,236

The Unsecured notes and loans payable refer to the $20 million borrowed in mid-2008 by President Wiggington while the reference to $5 million indicates the remaining unpaid balance.

Line 24 Unsecured and loans payable.... 5,000,000 20,000,000

The President's 2008 Salary and unspecified payments

According to the credit union's statement, shown below, members possess the right to approve who will be elected into either of the two governing bodies, i.e., Board of Directors, Supervisory Committee.

Identifier

Form 990, Part VI,

Section A, Line 7b

Explanation

Members of the credit union have the right to approve the governing body's election and removal of members of the governing body as well as other matters that are subject to the approval of members of the credit union as they occur.

As shown below, the credit union also states it has a Compliance Officer who monitors and ensures all policies are enforced. The currently Compliance Officer, Patricia Loiacano, is also the former AVP of Lending. However, last year, COO, Beatrice Walker, alleged that Mrs. Loiacano could not as an AVP, simultaneously over the Loan Departments and Compliance. Though Mrs. Loiacano is a highly experienced in consumer and real estate loan processing and has little experience in compliance, Ms. Walker inexplicably decided that she should serve as the AVP of Compliance. Mrs. Loiacano may be adept in loan processing but she is unqualified to oversee compliance.

What's more, in 2010, the termination happy COO, Beatrice Walker. terminated a qualified and experienced BSA Specialist after Ms. Walker, during an all-staff meeting, asked employees to provide suggestions how the credit union could reduce spending. The BSA Specialist suggested that management temporarily reduce their salaries, a suggestion which provoked the ire of President Wiggington, COO Walker, and AVP Smock. The BSA Specialist found herself ostracized, branded and soon afterwards, laid-off.

Identifier

Form 990, Part VI, Section B, Line

12c

Explanation

At present we have a compliance officer who monitors and enforces all of our policies.

The following section states that the credit union's “HR representative receive a comparable data which is based on surveys and makes recommendations to the CEO.” Neither, Rodger Smock, Robert West or Esmeralda Sandoval have an education in Human Resource studies. Though Mr. Smock allegedly studied business while attending the University of Cincinnati, that was more than 45 years ago. It would be interesting to know what "comparable data" derived from surveys is this referring to. Also, is the alleged data actually used by the CEO in making decisions and if so in what instances has he done so?

Identifier

Form 990, Part VI, Section B

Line 15

Explanation

Our HR representative reeive a comparable data whichis based on surveys and makes recommendations to the CEO

2009 FORM 990 IRS FILING

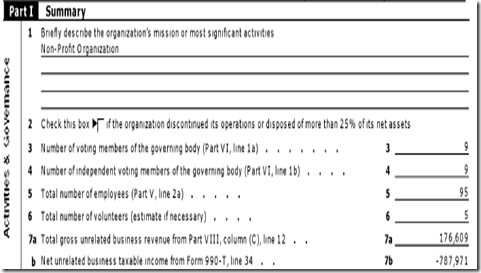

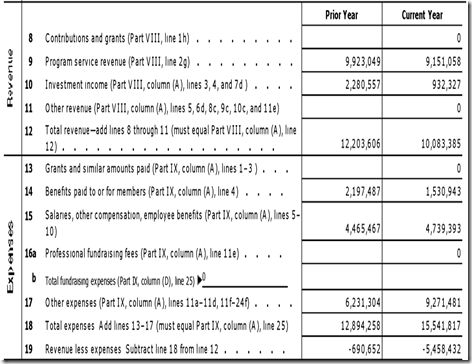

Note again, the complete omission of information under #1, below, which asks, "Briefly describe the organizations' mission or most signification activities." The omission might be due to the fact the credit union no longer provides free financial education within any of the communities it serves.

Line #19, below, confirms that the year 2009 ended with losses amounting to -$5,458,432.

- Line 20, below, disclosed that at the start of 2009, assets totaled $172,119,165 (minus the $10 million unpaid balance due on the $20 million loan borrowed by President Wiggington in mid-2008.

- At the end of the year, the credit union reported it's assets at $165,835,129 (minus $10 million). This is an approximate loss of $7 million over a 12-month period.

Under Part III, Statement of Program Service Accomplishments, shown below, the credit union briefly describes it's mission as "To Achieve financial independence for our members-owners ["member-owners"] and employees. We are committed to the delivery of a solid financial foundation that provides quality products and services."

In 2009 implemented a wage freeze of non-executive personnel wages. This is hardly a way of helping employees achieve financial independence. In fact, in 2011, employees are paid at 2009 wage levels. Evidently, the President has no problem lying to the federal government.

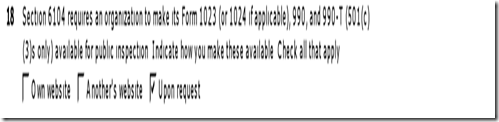

On page 6 of Form 990, the credit union discloses that a copy of the 990 and 990-T(501(c) (3) is available for public inspection upon request. We assume written request and don't expect the President to easily release the requested report.

The 2009 Form 990 filing differs from the 2008 filing in that it states President Wiggington contributes 40-hours per week to the credit union whereas the 2008 filing cited he only contributes 1-hour per week.

In the 2009 filing, his salary decreased by $4000 but under "other compensation" he was paid $24,754 which brought his total earnings in 2009 to $175,708. So what does "other compensation" refer to?

In the 2009 filing, his salary decreased by $4000 but under "other compensation" he was paid $24,754 which brought his total earnings in 2009 to $175,708. So what does "other compensation" refer to?

Rodger Smock earned a total of $117,280 in 2009. His salary actually increased from 2008 even though the credit union ended 2009 deeply immersed in the negative. It should be clear that Priority One's highest officers are gouging the credit union of its monies, all at the cost to employees and services offered members. The only people who can call Priority One their financial fitness center are the President and his executive staff.

President Wiggington's total earning in what was probably the worst year in the credit union' history, is shown below:

It is disturbing to discover that amidst employee terminations and lay-offs; the elimination of employee benefits; deterioration of member service; and the closure of two regional branches, that President Wiggington prospered despite his bungling decisions and inept leadership.

THE JOJO EFFECT

Last year we reported that following filing of a complaint by the Valencia Branch Manager, accusing Beatrice Walker of harassment, same-sex harassment, stalking and creation of a hostile working environment, the President obtained authorization from Board Chair, Diedra Harris-Brooks, to remove Ms. Walker's authority over Human Resources and transfer it to then Training and Education Manager, Robert West. At the time, we viewed the reassignment as another Wiggington sham. Human Resources has been the subject of two lawsuits filed by former employees and the credit union's attorneys discovered that the department's Director, Rodger Smock, violated credit union policies and allowed the violation of state and federal laws which left the credit union vulnerable to lawsuits. Superficially, it was important to create the appearance that Mr. Smock had been stripped of his authority over Human Resources. What we always found suspicious is if he was no longer really in charge over Human Resources then why wasn't he terminated?

On February 4th, authority over Human Resources was returned to Rodger Smock. The credit union disclosed that both Robert West, the Training and Education Manager and former temporary Director of Human Resources; and Esmeralda Sandoval, the Human Resources clerk, would be reporting to Mr. Smock. If the latest reassignment doesn't seem to make sense be comforted in knowing that it is preposterous and part of a ploy by the Board of Directors and President to create the appearance that the credit union maintains a responsible and efficient Human Resources Department. It doesn't.

Here is an overview of what has become the transitory re-assignment of Senior Vice President, Rodger Smock:

Pre-2007

Vice President and Director over Human Resources

January 1, 2007 - August 2009

AVP of Operations/Senior Vice President, and Director of Human Resources

No longer involved in the hiring process. No longer administrating employee benefits. Oversees employee terminations.

August 2010

HR taken over by COO, Beatrice Walker. Mr. Smock assigned to assist the President with "special projects"

September 2010

HR taken from COO, Beatrice Walker, and transferred to Training and Education Manager, Robert West. Mr. Smock continues to assist the President with "special projects."

February 4, 010

Human Resources returned to Mr. Smock who is not the Executive Vice President. Robert West and Human Resources "clerk", Esmeralda Sandoval placed under his authority.

On February 4th, authority over Human Resources was returned to Rodger Smock. The credit union disclosed that both Robert West, the Training and Education Manager and former temporary Director of Human Resources; and Esmeralda Sandoval, the Human Resources clerk, would be reporting to Mr. Smock. If the latest reassignment doesn't seem to make sense be comforted in knowing that it is preposterous and part of a ploy by the Board of Directors and President to create the appearance that the credit union maintains a responsible and efficient Human Resources Department. It doesn't.

Here is an overview of what has become the transitory re-assignment of Senior Vice President, Rodger Smock:

Pre-2007

Vice President and Director over Human Resources

January 1, 2007 - August 2009

AVP of Operations/Senior Vice President, and Director of Human Resources

No longer involved in the hiring process. No longer administrating employee benefits. Oversees employee terminations.

August 2010

HR taken over by COO, Beatrice Walker. Mr. Smock assigned to assist the President with "special projects"

September 2010

HR taken from COO, Beatrice Walker, and transferred to Training and Education Manager, Robert West. Mr. Smock continues to assist the President with "special projects."

February 4, 010

Human Resources returned to Mr. Smock who is not the Executive Vice President. Robert West and Human Resources "clerk", Esmeralda Sandoval placed under his authority.

A LESS THAN STELLAR PERFORMANCE

In February 2011, COO, Beatrice Walker, concocted yet another of her illustrious plans to supposedly create yet another new stream of income which she insisted would generate lots of money for the declining credit union.

In her latest ploy, she has again inducted the assistance of automobile broker, Auto Alliance who she has periodically described as her "friends" and "business associates". She introducing them to the credit union in 2010, the automobile broker has not reaped the results she said would be attained.

Last month, Ms. Walker met with representatives of Auto Alliance and suggested they begin visiting everyone of the credit union's remaining branches so that they could speak to employees and urge they help the credit union in launching membership drives including volunteering to participate at community sponsored events.

Ms. Walker, like President Wiggington, has been pivotal in eliminating the credit union's participating in community and chamber events even though federal law requires that non-profits like Priority One provide free financial education to the communities they serve. Not so at Priority One where the President of the credit union that touts itself as a financial fitness center, says, the credit union cannot afford to provide free financial literacy. Does anyone else see the inconsistency between what Priority One claims to be to it's members and the President's statements?

And so, Auto Alliance's representatives began visiting the credit union's remaining branches but unfortunately, in an effort to elevate their company, resorted to disparaging the services provided by the credit union's two other automobile brokers - Universal Auto Leasing and Sales and Wholesale Investments. In spite of their criticisms leveled against their competitors, the fact is, Auto Alliance charges $75 to search for a vehicle where as the other two brokers do lot levy a charge. The $75 is only credited towards the purchase of a vehicle if a person has the automobile loan financed by Priority One. Not exactly an example of showing members how to "win with money".

However, Ms. Walker's plan is also undermined by the fact that credit union employees continue to recommend Universal Auto Leasing and Sales and Wholesale Investors over Auto Alliance.

WHERE'S THE RETURN?

If you're hoping to obtain a Special Term Share Certificate of Deposit, you might do well to avoid Priority One Credit Union. We fully understand that these are economically difficult times for banks and credit union and certainly returns have decreased dramatically over the past decade but Priority One's rates, as shown below, an as copied from it's website proves Priority One is no one's financial fitness center and if you obtain one of their Special Termin Share Certificates, don't expect to "win with money". .

As shown below, the credit union does provide a choice and offers a $100,000 Term Share Certificate Account which like the $1000 account pays 0.00% in dividends. So why on earth would you ever obtain a Term Share Certificate Account from Priority One?

Their hedge language for the Term Share Certificate Accounts reads:

"About Term Share Certificate Accounts: For purposes of this disclosure, these Dividend Rates and APYs were offered within the most recent seven calendar days and were accurate as of the date set forth above. Please call 877.POCU.ONE to obtain current rate information. If a Term Share (Certificate) Account were opened, the applicable Dividend Rate and APY would be paid for the length of the term listed for such account, with the exception of the 18 month "bump" certificate…A substantial penalty may be imposed for early withdrawal.

"About Term Share Certificate Accounts: For purposes of this disclosure, these Dividend Rates and APYs were offered within the most recent seven calendar days and were accurate as of the date set forth above. Please call 877.POCU.ONE to obtain current rate information. If a Term Share (Certificate) Account were opened, the applicable Dividend Rate and APY would be paid for the length of the term listed for such account, with the exception of the 18 month "bump" certificate…A substantial penalty may be imposed for early withdrawal.

"A substantial penalty may be imposed for early withdrawal"? So the credit union offers a product that pays nothing but you, the member, will be dinged if you withdraw your funds prior to the date of maturity. Is that correct? Doesn't Priority One have a Compliance Officer? What does the credit union mean by "substantial penalty"? How is the penalty assessed? Who is this non-paying product being marketed to?

EDUCATION

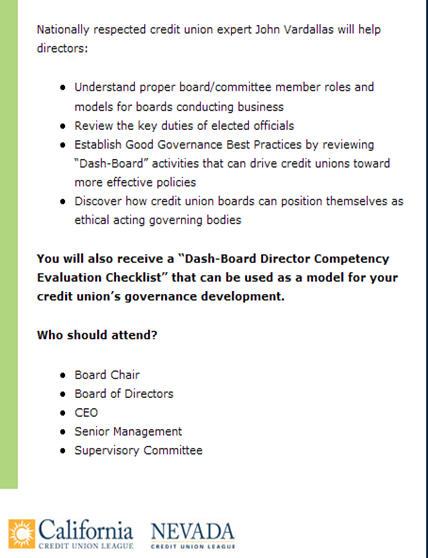

The California/Nevada Credit Union League recently announced that Credit Union Boards

will be required to undergo testing needed to gauge their financial aptitude and knowledge to ensure they are qualified to fulfill their state-mandated responsibilities.

We agree with the intent but how exactly does the California/Nevada Credit Union League

achieve their end and more importantly, will they ever launch their program? It's going to be an expensive endeavor and more so at a time when our state's economy is suffering.

Priority One's Directors have performed abominably and have proven to be unethical and subservient to their Chair, Diedra Harris-Brooks. They've shown time and time again that their greatest efforts seem designed to hide wrong doing committed by President Wiggington and his pack. Shown below, is the information sent by the Credit Union League which informs recipients about planned webinars that will be offered via ETrain:

will be required to undergo testing needed to gauge their financial aptitude and knowledge to ensure they are qualified to fulfill their state-mandated responsibilities.

achieve their end and more importantly, will they ever launch their program? It's going to be an expensive endeavor and more so at a time when our state's economy is suffering.

- Will testing be mandatory? If not, then the league's efforts are in vain.

- If Directors are to be tested, what safeguards will be set to deter incidences of cheating?

Priority One's Directors have performed abominably and have proven to be unethical and subservient to their Chair, Diedra Harris-Brooks. They've shown time and time again that their greatest efforts seem designed to hide wrong doing committed by President Wiggington and his pack. Shown below, is the information sent by the Credit Union League which informs recipients about planned webinars that will be offered via ETrain:

Based on the league's verbiage that states, "who should" attend versus "who must attend", don't expect any of Priority One's Directors to voluntarily attend. None of the Directors is interested in education and as the past 4 years have shown, their voluntary participating on the Board is not driven by a need to direct the credit union's performance.

The league is being presumptuous if not foolish to think they can teach anyone how to position themselves to conduct themselves more ethically. Its impossible. So how can the league inspire Board Chair, Diedra Harris-Brooks and her crew, to conduct themselves ethically? This requires a change of character something no class on planet earth can teach much less instill in any person. Let's face it, Priority One's Directors are fully satisfied remaining an ignorant, ineffective and dishonest body of officers.

The President has recently ordered that public restrooms located in the South Pasadena branch be closed off to all members which no longer makes them public.

Recently, Beatrice Walker's former confidant, Joseph Garcia, informed the President that allowing members to use the restrooms located within the Member Services Department, poses a high security risk. According to Mr. Garcia, member's walking the aisle that leads to the restrooms can spy on or even taken, confidential information lying unattended atop employee desks. Why would employees leave confidential information unattended atop their assigned desks? Wouldn't it be a violation of credit union policy to leave confidential information lying haphazardly atop employee desks?

Mr. Garcia whose history of failure in every position he's ever held while employed by the credit union is nothing short of astronomical, taped hand-written signs on the doors leading to the men's and women's bathrooms on which were written the words "out-of-order." What are the chances that two restrooms would simultaneously be out-of-order? This all of course bring new meaning to the adage, “Not even a pot to piss in.”

Recently, Beatrice Walker's former confidant, Joseph Garcia, informed the President that allowing members to use the restrooms located within the Member Services Department, poses a high security risk. According to Mr. Garcia, member's walking the aisle that leads to the restrooms can spy on or even taken, confidential information lying unattended atop employee desks. Why would employees leave confidential information unattended atop their assigned desks? Wouldn't it be a violation of credit union policy to leave confidential information lying haphazardly atop employee desks?

Mr. Garcia whose history of failure in every position he's ever held while employed by the credit union is nothing short of astronomical, taped hand-written signs on the doors leading to the men's and women's bathrooms on which were written the words "out-of-order." What are the chances that two restrooms would simultaneously be out-of-order? This all of course bring new meaning to the adage, “Not even a pot to piss in.”

Former Training and Education Manager, Robert West, disclosed that he was perplexed by Mr. Garcia's concerns and in his typical inept manner said, "I don't know how to respond to the situation but I'm still trying to familiarize myself with the ladder of authority at this credit union." Mr. West has been an employee of the credit union and is only now, trying to familiarize himself with the credit union's "ladder of authority"? And what does the credit union's ladder of authority have to do with common sense?

A few days ago, a member who asked to use the restroom was taken aback when he was informed that both the men's and women's restrooms were out of order. He asked Mr. Garcia how this was possible and the chronically dull manager only replied, "Yes they are." When asked when the restrooms would be repaired, Mr. Garcia replied, "I don't know." Logically, restrooms in disrepair could pose a health issue. Of course we don't believe this ever cross the mind of the dull, Mr. Garcia. The member responded, telling Mr. Garcia, "Then you better start providing members with pampers.”

ANOTHER COMMENT

We received the following comment from a reader, regarding some of the credit union's officers.

Anonymous said...

Anonymous said...

So, Joseph [Garcia] doesn't know loans but he's the loan manager and Gema [Pleitez] knows member services but she's lazy and makes Virginia do all her work. Bea [Walker] doesn't know operations but she's COO and Rodger Smock got fired from HR at Superior Industries but he's over HR. Robert West has no training in HR but he's over HR. And [Charles Wiggington] Wiggington doesn't know how to act like a President but he's a President. See a pattern?

February 14, 2011 4:19 PM

The credit union's current downtrodden financial standing is directly tied to the competency of its executive sector, none of which have demonstrated any knowledge in how to generate new business, increase profits and resolve the multitude of problems created by Charles R. Wiggington, Sr.

Despite his well-documented history of failures, he continues to be paid far in excess of what he's worth and its apparent that the Board and it's notorious Chair, Diedra Harris-Brooks, have no problem rewarding bad business decisions and horrendous personal behaviors. Evidently, all of their moral compasses are broken.

President Wiggington's high and undeserved salary is an example of wasted spending. However, its not the only area where spending is wasted. In the vault located behind the teller area at the South Pasadena branch, lies a check card embosser, collecting dust and never utilized despite the fact that the President once said the credit union required the ability to create check cards whenever a new checking account was opened.

Despite his well-documented history of failures, he continues to be paid far in excess of what he's worth and its apparent that the Board and it's notorious Chair, Diedra Harris-Brooks, have no problem rewarding bad business decisions and horrendous personal behaviors. Evidently, all of their moral compasses are broken.

President Wiggington's high and undeserved salary is an example of wasted spending. However, its not the only area where spending is wasted. In the vault located behind the teller area at the South Pasadena branch, lies a check card embosser, collecting dust and never utilized despite the fact that the President once said the credit union required the ability to create check cards whenever a new checking account was opened.

Lying inside a drawer in the IT Department are several programs whose purpose was to test and identify problems affecting many of Priority One’s programs, including synchronization of its expensive phone system and network. To date these remain unused.

As early as 2008, President Wiggington suggested closure of the former Valencia branch, citing that decreasing profits and declining membership warranted its closure. A new Branch Manager subsequently succeeded in producing profit in that community and over the next 2 1/2 years, the location prospered. Unfortunately, its closure in November 2010, was prompted by the unstable emotions of COO, Beatrice Walker, whose unwanted attentions was promptly rejected causing the scorned COO to order closure of the Valencia branch.

Ms. Walker is paid more than $100,000 per year, yet since arriving at the credit union on June 1, 2009, she has failed to fulfill her assurances that she could return the credit union to the state of profitability enjoyed in the years before Charles R. Wiggington, Sr. was appointed President. Last year Ms. Walker said, "This better work out because where else am I going to get a job that pays this much?" Ms. Walker will probably never find another position that is as lucrative or that provides her the opportunity to violate policies and laws as does Priority One Credit Union.

CFO, Saeid Raad, must be paid extremely well because just a few months ago, the President exclaimed, "He makes more money than me."

CFO, Saeid Raad, must be paid extremely well because just a few months ago, the President exclaimed, "He makes more money than me."

You will probably never find another situation willing to pay you an exorbitant and undeserved salary. Hopefully potential future employees will conduct extensive background checks to verify your performance while working with other companies.

Aside from its financial problems, the President and COO are currently immersed in a power struggle though it seems that she may no longer possess the clout that once enabled her get her way with the Board. The President's alleged illnesses may have actually worked in his favor. We suspect that the three things working against Ms. Walker is her failure to introduce profitable streams of income; rumors about her sexuality; and the fact that she's White.

Aside from its financial problems, the President and COO are currently immersed in a power struggle though it seems that she may no longer possess the clout that once enabled her get her way with the Board. The President's alleged illnesses may have actually worked in his favor. We suspect that the three things working against Ms. Walker is her failure to introduce profitable streams of income; rumors about her sexuality; and the fact that she's White.