Often high salaries and bonuses paid to executives and managers are associated with their exemplary performance. Evidently, achievements, competency and contributions to the betterment of a business are not factors important to Priority One Credit Union's Board of Directors. Under leadership of Chairperson, Diedra Harris-Brooks, the Board has deemed it prudent over the past five years to issue year-end-bonuses to President, Charles R. Wiggington, Sr. despite a well-documented history of business failures, abhorrent personal behaviors and indulgence in gossip and in scandals including sexual harassment.

In spite of having ended 2008, 2009, and 2010 with massive financial losses, the President and some members of his executive staff continued being paid hefty salaries and in some cases, bonuses. Beginning in 2008, the credit union's asset size plummeted by millions of dollars. In late 2010, the credit union began closing branches in a frantic effort to ensure net capital remained well above 6%. In 2010 the former Burbank Branch Manager filed a lawsuit against the credit union alleging she was subjected to age and racial discrimination. Since then the credit union has been sued by three other former employees and one former member. There is no arguing that under Charles R. Wiggington, Sr. the credit union's infrastructure has unraveled creating a dynamic addictively reliant upon expense reductions as key to the credit union's survival.

We recently obtained copies of the credit union's IRS Form 990 filings for 2010. As shown below, President Wiggington received Base Compensation in the amount of $151,221.00. It is undeniable that his salary is not based on the quality of his performance. He was also paid an additional $3223.00 for "retirement" and other compensation. He was also paid an additional $12,124.00 in "non-taxable benefits." The total paid to the President in 2010 was $166,568.00.

Line 19 of the filing discloses that in 2009, the credit union incurred losses of $5,458,432 and in 2010, losses totaling $563,830. Does Priority One Credit Union's Board of Directors maintain two separate standards of performance expectations for it's employees?

Since April 2012, we've reported that employees who failed to attain their assigned monthly quota for a one-month period would be issued a written warning. Failure to attain their assigned monthly sales quota for a consecutive two-month period would be issued a written warning and/or termination. In contrast, President Wiggington's inept business decisions have caused the losses of net assets, forced the closures of four branches, and caused the ruination of the credit union's once respected public reputation.

In spite of having ended 2008, 2009, and 2010 with massive financial losses, the President and some members of his executive staff continued being paid hefty salaries and in some cases, bonuses. Beginning in 2008, the credit union's asset size plummeted by millions of dollars. In late 2010, the credit union began closing branches in a frantic effort to ensure net capital remained well above 6%. In 2010 the former Burbank Branch Manager filed a lawsuit against the credit union alleging she was subjected to age and racial discrimination. Since then the credit union has been sued by three other former employees and one former member. There is no arguing that under Charles R. Wiggington, Sr. the credit union's infrastructure has unraveled creating a dynamic addictively reliant upon expense reductions as key to the credit union's survival.

We recently obtained copies of the credit union's IRS Form 990 filings for 2010. As shown below, President Wiggington received Base Compensation in the amount of $151,221.00. It is undeniable that his salary is not based on the quality of his performance. He was also paid an additional $3223.00 for "retirement" and other compensation. He was also paid an additional $12,124.00 in "non-taxable benefits." The total paid to the President in 2010 was $166,568.00.

Line 19 of the filing discloses that in 2009, the credit union incurred losses of $5,458,432 and in 2010, losses totaling $563,830. Does Priority One Credit Union's Board of Directors maintain two separate standards of performance expectations for it's employees?

Since April 2012, we've reported that employees who failed to attain their assigned monthly quota for a one-month period would be issued a written warning. Failure to attain their assigned monthly sales quota for a consecutive two-month period would be issued a written warning and/or termination. In contrast, President Wiggington's inept business decisions have caused the losses of net assets, forced the closures of four branches, and caused the ruination of the credit union's once respected public reputation.

TOP HEAVY

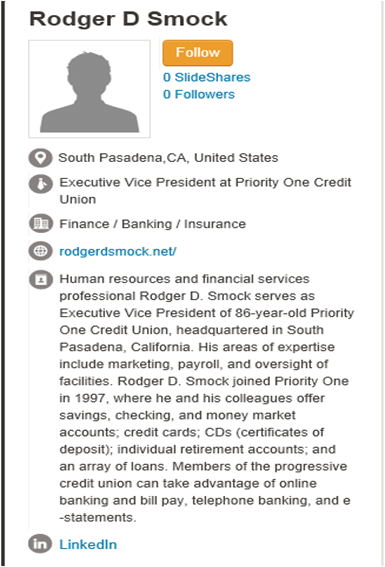

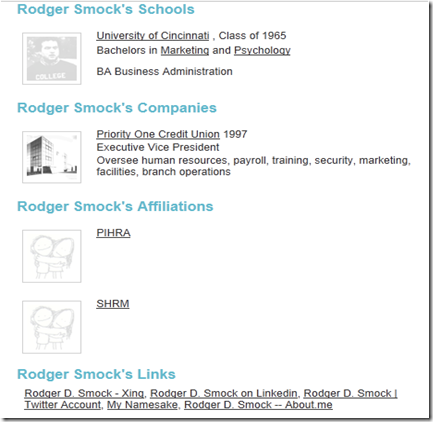

The filing also discloses that Senior Vice President, Rodger Smock, was paid $98,189 plus another $9763 in "estimated" compensation. We find it interesting that Mr. Smock's title is referenced as Senior Vice President in the IRS filing when at the credit union his title is Executive Vice President. What's more, he continues to serve as Director of Human Resources. Aside from the myriad of titles imbued upon the aged officer, what is it that he actually does at the credit union? His total salary amounted to $107,952. This seems steep and unreasonable when one considers it was Human Resources under leadership of Rodger Smock that created the opportunity for the filing of lawsuits by four former employees.

A common complaint amongst members is the increasingly difficulty in obtaining loans from the credit union. Since 2008, Priority One has implemented more stringent eligibility requirements making it more difficult for many members to obtain loans. A reason for introducing stricter rules was to reduce the incidence of bad loans. Bad loans are those which possess the potential of becoming delinquent and if unpaid, being written-off aka charge-offs. Thankfully, the rules that apply for most members aren't always enforced for officers of the credit union. The excerpt shown below is obtained from the credit union's Form 990 filing and references the names of officers who have loans obtained from Priority One Credit Union. Whenever an officer requests a loan, their application is reviewed by the Board of Directors though we've noticed that at no time has any officer been denied their request. And though all officers are to maintain excellent credit we know that some of the Directors and Supervisors have in recent years incurred negative/derogatory references on their credit report. Under Board Chair, Diedra Harris-Brooks, there is no enforcement of the credit union's by-laws which pertain to a Director's or Supervisor's credit history.

FAILURES AND MORE LIES

Earlier this year, President Wiggington ordered that all branches begin opening on Saturdays. The idea was the brainchild of CLO, Cindy Garvin, and a response to Foresee Consulting who suggested that opening longer hours would surely result in increased new business. It hasn't.

The credit union not only failed to see any increase in new business but the added hours resulted in increased spending on employee salaries and utilities. Last month, the credit union posted messages on it's website disclosing that branches would no longer open on Saturdays. As we've often reported, President Wiggington and his executive staff frequently implement strategies based upon their personal belief systems versus information obtained from actual studies.

In an effort to reduce spending, the President is more and more, utilizing the credit union's webpage as the primary means by which to keep members informed of important announcements. According to the President, this is reducing the amounts usually spent on postage.

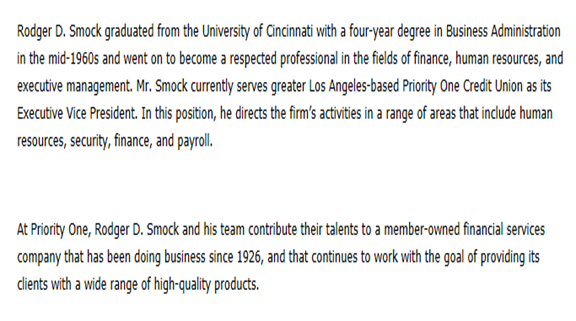

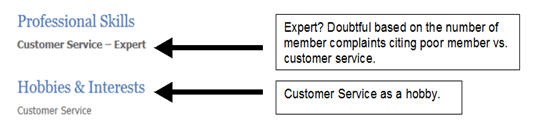

Upon the advice of it's paid consultants, the credit union has now saturated the Internet with copies of President Wiggington's and Senior Vice President, Rodger Smock's, biographies. Reviewing each published history we immediately noticed exaggerations, omissions and inaccuracies. As usual, Charles R. Wiggington, Sr. and the Senior Vice President have chosen to embellish their past employment histories, including referencing non-existent accomplishments. President Wiggington's biographies state he has been President since 1992. This is completely untrue. He attended the retirement party for his predecessor in November 2006 and effective January 1, 2007, began his appointment as President. Mr. Smock states he studied business, marketing and psychology in the mid-1960's while attending the University of Cincinnati. He has for years said he majored in psychology but until just a few weeks ago and following publication of his biography, no one was aware that he ever allegedly studied marketing. If so, why has there been no evidence of his marketing skills at any time since he took over the department in 2008?

January 1, 2013, will also mark the 6th year anniversary in which Charles R. Wiggington, Sr.'s was appointed President and CEO of the shrinking credit union. Since his appointment, the credit union's net asset size has declined by approximately $14 million. 2012 also marked the first time in the credit union's over 80-year history that it was forced to lay-off and terminate a large contingent of full-time staff members. But don't expect 2013 to fare better for the declining credit union. The biggest impediment to reversing the credit union's financial woes is that the one person who set the organization's decline in motion, remains President and is expected by the ignorant Board of Directors to forge a solution for the mess he alone created.

LAWYERING 101

Priority One Credit Union's attorneys may not be bright and they certainly aren't ethical, but they are unscrupulous. Currently, the credit union's defense team is being headed by attorney, Paul F. Schimley, who leads the Employment Practices Department of Richardson, Harman, Ober PC, a Pasadena-based law firm.

Mr. Schimley also states that if the Plaintiff had been the victim of illegal acts perpetrated by her former supervisor, AVP, Sylvia Perez, then the Plaintiff failed to pursue all remedial channels available under credit union policy.

Mr. Schimley is intimately acquainted with the allegations contained in all the lawsuits filed by former employees. He is not so dull that he hasn't noticed the similarity in the accusations contained in each. What's more, on more than one occasion he has had to contact President Wiggington and Board Chair, Diedra Harris-Brooks, to remind them to stop divulging confidential information about the lawsuits.

The Burbank Branch Manager

In the lawsuit filed by the former Burbank Branch Manager, Mr. Schimley's firm planned a defense which not only impugned the manager's work ethic but would portray her as a racist who hates Latins. He also threatened numerous times, to file a motion seeking dismissal of the case. So if t there case was in essence "open and shut", then why did his firm contact the manager's attorney and ask to enter into settlement negotiations?

A Business Development Representative

The second, filed by a former Business Development Representative, alleged liable, sexual same-sex discrimination and failure by Human Resources to intervene in the abuses committed by President Wiggington and COO, Beatrice Walker.

Mr. Schimley contacted Eileen Cohen, an attorney at the firm of Joseph Lovretovich and Associates who were representing the former Business Development Representative. Ms. Cohen contacted the Plaintiff via email informing him that she is an associate of Mr. Schimley and that though her firm agreed to represent the Plaintiff in his lawsuit against Priority One, it had now been decided that after more than a year, that his allegations lacked merit and that he should enter into a settlement agreement with his former employer. Ms. Cohen's written admittance that she is an associate implies she has a relationship with Mr. Schimley. Whether professional and/or personal, doesn't it seem like a conflict of interest?

In the meantime, the Plaintiff received an email from Joseph Lovretovich, advising him that it had been decided he did not have a case against his former employer and that he must enter into a settlement agreement with Priority One Credit Union. So if the former employee didn't have a case against the credit union then how could he enter into a settlement agreement? No case should mean no settlement. Within the legal profession, back door dealings are common place amongst attorneys and in the case of Mr. Schimley and Mr. Lovretovich's associate, Eileen Cohen, admitted she was an "associate" of Mr. Schimley. The Plaintiff initially refused. Mr. Lovretovich threatened to file a motion requesting the court remove him as legal counsel in the Plaintiff's case. Evidently, Mr. Lovretovich and/or Ms. Cohen chose to violate confidentiality and contacted Mr. Schmiley, advising him that their "relationship" with the Plaintiff had ended. This of course was presumptuous on the part of Mr. Lovretovich, Ms. Cohen and even, Mr. Schimley as the dissolution of a relationship between an attorney and their client requires approval by the court.

Mr. Schimley, possessing the same disregard for confidentiality as does his client, Charles R. Wiggington, Sr., contacted the credit union. According to President Wiggington, Mr. Schimley was gleeful as he allegedly and inaccurately reported that the Plaintiff's attorney had resigned. Again, under the law, an attorney cannot resign without approval by the court. Nonetheless, President Wiggington conferred with Executive Vice President, Rodger Smock, and Director of Project Management, Yvonne Boutte, informing them that the attorney for the former Business Development Representative had resigned and the case was no over.

Mrs. Boutte returned to her office and informed Credit Resolutions Supervisor, Alex Suarez, that the case was over and the Plaintiff's attorney had resigned. Mrs. Suarez in turn, shared the information with her staff in the Credit Resolutions Department.

Priority MC, the handle used by a periodic poster on this blog, published a comment declaring that the Plaintiff's attorney had resigned and the case was officially over.

Mr. Schimley acted abhorrently, divulging highly confidential information which had not been approved by the court. Did he violate the state's code of conduct all attorneys are to required to abide to? Mr. Schimley prematurely assumed the Plaintiff's attorney's request to be dismissed would eventually be approved by the court though he had absolutely no evidence suggesting this would ever occur. What's more, the motion seeking to be remove as legal counsel was never filed by the Plaintiff's attorney bringing into scrutiny the ability to Mr. Schimley possesses to conduct himself in an ethical and respectable manner. Mr. Schimley's statements not only revealed the state of his personal ethics but unwittingly exposed the incompetence of the Plaintiff's own legal counsel.

At the time these events ensued we learned that the Plaintiff is in possession of several emails sent to him by his former attorney, Joseph Lovretovich, which threatened to file the motion with the court if he refused to enter into a settlement agreement. However, these were apparently not the only documented threats leveled by Mr. Lovretovich. The Plaintiff published a review on the Internet, describing his experience with Mr. Lovretovich's law firm. When Mr. Lovretovich discovered the Plaintiff's review, the sent another email to his former client, threatening to sue him for breaching the agreement entered into with the credit union. Clearly, Mr. Lovretovich failed to comprehend that the review criticized his law firm. Mr. Lovretovich seemed also glib to the fact that his threats contained in the emails sent to the Plaintiff had left him vulnerable to ethics charges which the Plaintiff could have filed with the state of California.

On a side note, Mr. Lovretovich's law firm eventually paid all taxes due on the settlement amount paid to their former client. This is hardly what a law firm does if their client had violated a settlement agreement or any state laws.

VALENCIA BRANCH MANAGER

In the third lawsuit filed against Priority One Credit Union, the former Valencia Branch Manager alleges she was retaliated against, harassed, subjected to a hostile working environment, subjected to slander, and sexually (same-sex) harassed by former COO, Beatrice Walker.

As he addictively does in all cases involving Priority One Credit Union, Mr. Schimley chose to skewer the Plaintiff's reputation. Earlier this year, the President revealed that it is imperative that the Valencia Branch Manager's lawsuit not proceed to court. Evidently, the President is afraid that Ms. Walker's acts committed while COO would become a matter of public record. He is also concerned that he and Human Resources would be depicted as purposely refusing to stop Ms. Walker's scathing personal campaign launched against the former Valencia Branch Manager.

According to statements made by President Wiggington, Mr. Schimley's handling of the third lawsuit is commencing along the same road traversed in his handling of the lawsuits filed by the former Burbank Branch Manager and the former Business Development Representative. He has tried to show that the branch manager was derelict in carrying our her assigned responsibilities but his efforts have hit a dead end.

The fact is, every one of the lawsuits litigated by Mr. Schimley has been settled despite his pre-settlement cries that the Plaintiff's cases lacked all merit to proceed to court. In December 2011, weeks after his firm informed President Wiggington that the Burbank Branch Manager's lawsuit would be dismissed by the court, Mr. Schimley scrambled to enter into settlement negotiations to avoid the case proceeding to trial.

What's more, no one believes that a company would voluntarily enter into a settlement agreement if a Plaintiff's lawsuit lacks all merit. In fact, what attorney would ever accept to represent any Plaintiff if their case didn't possess some merit?

A settlement agreement always contains language that the payment issued by the defendant is not an admittance of wrongdoing but realistically, why wold a defendant pay out a settlement if they are not guilty of wrongdoing?

Attorney, Paul F. Schimley's response to the lawsuit filed by a former Financial Services Representative ("FSR:") once assigned to the Burbank branch. Mr. Schimley's response is wordy and droll. We've chosen the following excerpts documenting Mr. Schmiley's response.Mr. Schimley provides nothing that could corroborate the integrity of any of his statements.

Mr. Schimley's statement that his client, the Defendant, "denies generally and specifically each and every allegations contained in the Complaint, and the whole thereof, and further denies Plaintiff has been damaged in any sum or sums whatsoever or at all" is of course, expected. Fortunately, Mr. Schimley will never be a pregnant female who despite her condition, was subjected to duress and harassed by a credit union that has developed a well-documented record of abuses of federal and state laws. Furthermore, wasn't President Charles R. Wiggington, Sr. found guilty of sexual harassment in 2008 and wasn't the evidence of his illegal act covered up by Board Chair, Diedra Harris-Brooks?

By the way, this is the pat answer also provided by Mr. Schimley in his responses to the lawsuits filed by the former Burbank Branch Manager and a former Business Development Representative. Mr. Schimley adds that because the lawsuit filed by the FSR fails to provide substantiating "facts" to justify the Plaintiff's complaint against his client.

In his Third Affirmative Defense, Mr. Schimley states that the former FSR failed to file her lawsuit within statutes of limitations allotted under state law. Under California Code of Civil Procedure §335.1 the Plaintiff had two years following the date of the incident in which to file her claim.

We've recently learned from our favorite source for information - President Wiggington, that Mr. Schimley has declared yet another victory against the FSR. We've, as mentioned previously, have previously heard Mr. Schimley's premature declarations to victories that just never pan out and so we have to view his latest exclamation as the verbalizations of a man who lacks the type of personal self-discipline that is associated with adults. According to the President, Mr. Schimley has described litigation against the former FSR as a "slam dunk.:" According to the President, Mr. Schimley has assured him that there is no way the Plaintiff's case can proceed to court because of her failure to file her lawsuit in a timely manner as allotted under California state law. Evidently the ignorant President doesn't understand that the final determinant in deciding whether or not any case has failed to be filed in a timely manner.

We've recently learned from our favorite source for information - President Wiggington, that Mr. Schimley has declared yet another victory against the FSR. We've, as mentioned previously, have previously heard Mr. Schimley's premature declarations to victories that just never pan out and so we have to view his latest exclamation as the verbalizations of a man who lacks the type of personal self-discipline that is associated with adults. According to the President, Mr. Schimley has described litigation against the former FSR as a "slam dunk.:" According to the President, Mr. Schimley has assured him that there is no way the Plaintiff's case can proceed to court because of her failure to file her lawsuit in a timely manner as allotted under California state law. Evidently the ignorant President doesn't understand that the final determinant in deciding whether or not any case has failed to be filed in a timely manner.

In his Fourth Affirmative Defense, Mr. Schimley writes that his client "acted in good faith and with an absence of malice towards Plaintiff."

The Plaintiff called and sent emails to Executive Vice President, Rodger Smock, reporting the abuses perpetrated against her by AVP, Sylvia Perez. Mr. Smock chose not to acknowledge, investigate or respond to her concerns.

The acts perpetrated by Mrs. Perez were witnessed by the entire Burbank branch staff. The staff urged the Plaintiff to contact Human Resources which she did but as stated previously, Rodger Smock chose to ignore all communications.

The Plaintiff conferred with her supervisor, Nidia Reyes, but the supervisors intercession were also ignored by Mr. Smock and by President, Rodger Smock.

Mr. Schimley's response intentionally and all too conspicuously ignores the fact that a total of four lawsuits have been filed by former employees, all of which level similar allegations of wrong doing perpetrated by the President and some of his executive and managerial staff.

Mr. Schimley's response attempts ever so feebly, to ignore the fact that over the years there have been dozens of complaints filed against both President Wiggington and Mrs. Perez. In fact, Mr. Schimley knows that the credit union has acted as maliciously in their treatment of employees as he has been in his treatment of the Plaintiffs.

Mr. Schimley's Fifth Affirmative Defense is nothing more than an unrealistic wish by the manipulative attorney that the court decide that the Plaintiff has failed to provide facts that justify awarding her part or all of the damages she is requesting be paid to her as a result of the abuses perpetrated against her by AVP, Sylvia Perez.

In his sixth and seventh Affirmative Defenses Mr. Schimley states that under state law, the credit union was allowed to terminate the FSR at anytime and without reason because she is an "at will" employee. Though he is correct that Priority One is an at-will employer, he is ever so weakly, trying to circumvent the fact that even at-will employers are not allowed to subject employees to harassment, retaliation or to create a hostile-working environment.

Of course, this again brings into question the ethics of the credit union who in 2008 purposely ignored evidence gathered by the investigator from EXTTI, Inc. which proved President Charles R. Wiggington, Sr. sexually harassed an employee. Does being an at-will employer allow employers to protect officers who violate federal law? Mr. Schimley may not be a forthright attorney and his methodologies may even be considered insidious with the legal community, but he should know it is illegal for any employee to discriminate against any employee on the basis of race, color, national origin, religion, sexual preference, gender, medical reasons such as pregnancy, childbirth or disabilities. The credit union is also not allowed to discriminate based on an employee’s disability, age (40 years or older), citizenship status, and genetic information. Additionally, under state law, the credit union is prohibited to discriminate based on marital status, sexual orientation, AIDS/HIV, medical condition, political activities or affiliations.

In his Eight Affirmative Defense Mr. Schimley states that the Plaintiff's claims are barred by the "doctrine of unclean hands." The doctrine of unclean hands is a rule of law that stipulates that a person who files a lawsuit and is asking for monetary relief must be innocent of wrongdoing or unfair conducted related to any of the accusations referenced in their lawsuit.

Mr. Schimley was presented with a record of written and verbal warning issued to the FSR by no other than AVP, Sylvia Perez. At the time the warnings were issued, the FSR responded by declaring that they were untrue and as stated previously, called and wrote to Executive Vice President and Director of Human Resources, Rodger Smock, who never responded.

Now the credit union is attempting to use documents containing allegations the FSR had previously declared untrue, to strengthen its defense. The issue now is that Priority One is again using fraudulent evidence to try and win it's case. This by the way, is not the first time Priority One uses fraudulent information to justify it's actions.

Mr. Schimley’s tactic is preemptive, possibly hoping to avoid depositions, discovery, and a costly and embarrassing court trial.

In his Ninth Affirmative Defense, Mr. Schimley asserts that the Plaintiff committed unlawful, wrongful and improper acts. Mr. Schimley's declaration of wrong doing is unaccompanied by facts. Mr.Schmiley uses the terms "misfeasance, malfeasance, or nonfeasance" to describe the alleged illegal acts and non-illegal violations of policy and procedures allegedly committed by the Plaintiff.

- Malfeasance is any act that is illegal or wrongful.

- Misfeasance is an act that is legal but improperly performed.

- Nonfeasance is a failure to act which results in harm.

Mr. Schimley's "evidence" is in part, the untrue and fraudulent acts allegedly committed by the FSR as documented by AVP, Sylvia Perez. Though untrue, the credit union is nonetheless using the fraudulent "evidence" in it's defense. In the past, Mrs. Perez with the help of Human Resources, documented untrue accusations against employees, resulting in their termination. She did this with a Branch Manager of the Van Nuys office and with a Business Development Representative assigned to the Burbank office.

One has to also wonder why the FSR was not terminated for her alleged illegal and non-illegal acts and instead fired for acts related to her pregnancy leave?

One has to also wonder why the FSR was not terminated for her alleged illegal and non-illegal acts and instead fired for acts related to her pregnancy leave?

In his tenth defense, attorney Schimley asserts that the injuries (or damages) suffered by the former FSR were the result of her own negligence, nonfeasance, and misfeasance. In other words, while serving as an employee she committed acts that though not illegal, caused injury to herself. She also acted in manner which resulted in harm and subsequently, led to her termination. Furthermore, she and/or a third person contributed in causing all or part of the injuries she sustained or which caused the credit union, harm.

Attorney Schimley states that Priority One Credit Union is thus, not liable to pay any percentage of damages as stipulated under California Civil Code, Section 1431, et. seq. (Proposition 51). The civil code limits the amount of damages the credit union might be liable to pay for any pain, suffering, inconvenience, mental suffering, emotional distress, loss of society and companionship, loss of consortium, injury to reputation and humiliation alleged by the former FSR. In other words, Priority One has done nothing wrong and so it owes nothing to the former employee.

In his eleventh and twelfth defenses, attorney Schimley, declares his client will not pay damages for an physical or emotional injuries suffered by the Plaintiff, simply because the credit union didn’t commit the abuses described in the lawsuit. He further asserts that the FSR can have applied for Workers’ Compensation for any injuries that arose out of and during the course of her employment. Clearly, attorney Schimley is hoping to tap into remedy provisions provided under workers' compensation statutes which are designed to protect employers from common lawsuits filed by employees to recover for work-related injuries. By doing so, attorney Schimley is seeking to protect Priority One from larger damages that might be awarded should the credit union be found guilty of the charges leveled by the Plaintiff.

In recent years, courts have allowed judicial exceptions to workers’ compensation statutes. New standards now hold employer’s liable for harassment. The court should consider several factor including, if the alleged discrimination was severe and pervasive.

Attorney Schimley’s further requests that any order by the court order, demanding Priority One pay damages, be reduced by any compensation previously paid to the Plaintiff from other sources including workers’ compensation, disability, unemployment, or settlements derived from lawsuits filed against other parties.

In his sixteenth defense, Attorney Schimley argues that imposing punitive damages against the credit union is unconstitutional under state law as these could be construed as “excessive fines and penalties” and constitute “cruel and unusual punishment” and violate the credit union’s right to “due process and equal protection clauses.”

In his seventeenth defense, attorney Schimley states that the former FSR has not stated the truth and even if the allegations are true, the accusations are insufficient to justify the payment of punitive damages.

In his nineteenth defense, attorney Schimley asserts that the former FSR failed to use all of the venues allotted by the credit union under policy which might have resolved her grievances and brought an end to the alleged abuses committed by AVP, Sylvia Perez.

Attorney Schimley has been involved in litigation of the first, second, and third lawsuits. He, more than anyone else, is aware of the allegations contained in each complaint. He also knows, that the credit union refused to follow its own remedial channels and even allowed the harassment and abuse of many, now former employees while ensuring that the perpetrators go unpunished. This speaks volumes about the level of ethics governing the credit union’s efforts to vindicate itself from the allegations. There is also the subject of the many witnesses who have through the years observed the abuses committed by President Wiggington; former COO, Beatrice Walker; AVP, Sylvia Perez; and which were allowed to persist by both Executive Vice President, Rodger Smock; and Board Chair, Diedra Harris-Brooks.

In concluding, attorney Schimley reiterates that the former FSR failed to exhaust her administrative remedies which include contacting the credit union’s Human Resource Department and filing an official complaint. Attorney Schimley also asserts the credit union’s right to introduce any additional defenses as they are obtained or as allowed under the law, asking that the court not grant damages to the Plaintiff, to order she pay all attorney fees, and any additional fees, which would include court-related costs.

The former FSR (Plaintiff) is being represented, as shown below, by the Law Offices of Joseph Lovretovich. In April of this year, President Wiggington alleged that the attorney representing a former Business Development Representative was an associate of the credit union’s attorney, Robert F.Schimley, and bragged that the alleged association would prove a victory for the credit union in that lawsuit.

As we reported in our last two posts, the credit union was litigating a lawsuits (cross-complaint) filed by a member whose confidential information was published by an employee of the credit union and more than likely, an officer, on the Internet.

Bruce Needleman, the credit union’s collection and bankruptcy attorney was given what turned out to be, the unpleasant and possibly even over-whelming task of defending Priority One. Unfortunately, the area of law was apparently outside his scope of expertise and though he tried to litigate the lawsuit, stepped away. In November, following his failure to respond in a timely manner to certain filed motions, Mr. Needleman was replaced by Colleen A. Deziel (#164282) of the law firm of Anderson, McPharlin and Conners.

Within a few days, Ms. Deziel worked out an agreement though we’ve recently learned that the President and Board Chair, Diedra Harris-Brooks, refused to admit in writing, that an officer or employee of the credit union, ever posted the highly confidential information pertaining to the member’s Priority One automobile loan. Of course, one would have to be glib to believe that anyone but an officer would be privy to the highly confidential information which included knowledge of a lawsuit filed by Farmers Mutual Automobile Insurance, Inc. against the credit union; or the fact the member’s loan had been referred over to collection proceedings and afterwards, to collection and bankruptcy attorney, Normal Needleman. On November 15th, Mrs. Deziel presented the credit union’s best and final afterward which the credit union asserted was all they were willing to give. Attorney Deziel also stated that the credit union would be unable to executive a settlement agreement within the stringent deadline presented by the member.

Not so coincidentally, on November 27, 2012, the attorney arrived at the credit union’s main branch in South Pasadena, California, and conducted meetings with employees, advising them that credit union policy prohibits the disclosure of confidential member information- both verbally and published on the Internet. It is apparent, the attorney was duped by the credit union’s President, who over the years have been the single most violator of credit union’s policies and deservedly established a reputation for publicly verbalizing information which is deemed confidential by the credit union.

.

Anonymous said...

Anonymous said...