FIRST IMPRESSIONS

As reported in our last post, in late 2011, the credit union again hired consultants to determine and resolve the issues impeding Priority One’s ability to attract substantial amounts of new business and revamp the President, Charles R. Wiggington, Sr.’s undesirable public persona.

This past May, several versions of the President’s amended biography began to appear on various websites throughout the Internet. According to the President, the consultants informed him publishing officer biographies ensures potential members that a business is being managed by competent leaders and this is a selling took guaranteed to generate new business. Huh? Reading through the various biographies, some of whose images are shown below, we identified numerous embellishments which make the biographies both inaccurate and disingenuous.

As shown below, the intent of one of the President’s online biographies is to emphasize his vast “executive banking” experience. Unfortunately, his alleged years of experience are not synonymous with success as attested to by the credit union’s monthly and quarterly reports. Priority One’s reduced Net Income, closure of four branches, and four separate lawsuits filed by former employees all attest to incompetence and mismanagement and not success or long-term experience.

The last paragraph of Mr. Wiggington’s www.resume.com biography, states he possesses a Bachelor of Arts degree though failing to disclose it is in Afro-American studies.

Shown below, are the President’s alleged objectives. The President should take a few minutes to acquaint himself with what defines “Objectives”.

The statement in his us.viadeo.com biography, that Charles R. Wiggington supervises “all branch operations at his company” is inaccurate. In 2007, he created the AVP sector. Each AVP was assigned a specific region to manage. Branch operations in each region were delegated to assigned AVP’s. In 2009, the task of operations was transferred to former COO, Beatrice Walker. Following her termination, the task was temporarily transferred to Executive Vice President, Rodger Smock. In December 2011, oversight over all branch operations was transferred to CLO, Cindy Walker. The reference to “loan origination” is incorrect. Loan origination refers to a specific process used in opening a new loan application and the initial steps enacted to gather documentation required to determine an applicant’s eligibility. Changes in oversight over the Real Estate and Consumer Loan Departments is shown below:

- Prior to January 1, 2007, the Real Estate and Consumer Loan Departments were under administration of the Director of Lending and Assistant to the Director of Lending.

- Beginning on January 1, 2007, the Real Estate and Consumer Loan Departments were under administration of the AVP of Lending and his assistant.

- In 2009, the Real Estate Loan Department was placed under authority of the Real Estate Loan Supervisor.

- In 2010, the Real Estate and Consumer Loan Departments were placed under the authority of then newly appointed Loan Manager, Joseph Garcia.

- By mid-2010, due in part to Mr. Garcia’s inability to understand the processes governing mortgage lending, the Real Estate Department was placed under authority of CFO, Saeid Raad.

- In August 2011, the Real Estate and Consumer Loan Departments were placed under authority of then newly hired Director of Lending, Cindy Garvin, while Mr. Garcia remained Loan Manager over consumer loan development.

- Ms. Garvin currently possesses sole authority over the Real Estate and Consumer Loan Departments.

So what the does the reference to President Wiggington’s “responsibility for loan origination” mean? Not a thing. It is both inaccurate and untrue. Furthermore, Mr. Wiggington has failed consistently over the past five years to enact any strategy that translates into growth and profit. The loss of four branches and the credit union’s reduced Net Income size suffice as evidence to his failure to produce real growth in business.

The statement that President Wiggington “strives to ensure good relationships with all members” is certainly not evidenced in the strained relationship he introduced between Priority One and one of its formerly most loyal SEG, Providence, Inc.’s medical centers- St. Joseph, Tarzana, and Holy Cross.

In the end, the biographies are part of an expensive publication relations effort which includes published embellished and inaccurate versions of the President’s biographies. The biographies have been tweaked ever so carefully to create the impression of professionalism and success but amount to nothing more than gross exaggeration of a man who has shown no proclivity towards leadership.

IS IT SEXY, ART, PROVACATIVE OR JUST BAD TASTE?

We can’t think of a single manager at Priority One who qualifies as a consummate professional and we certainly can’t think of a single manager who can be characterized as either dignified or noble. AVP, Yvonne Boutte’s (the Assistant Vice President of Support Services) subordinate, AVP, Gema Pleitez, has recently revealed that she like President Wiggington, marches to the sound of a different drummer and that she will not be constrained to comply those dictates governing what is and what is not, appropriate.

At many companies- possibly even most companies, members of the management and non-exempt sector are expected to conduct themselves in a manner that is above-reproach. Apparently, not so at Priority One Credit Union where rules are defiantly broken by executives and managers, alike. On November 12, 2012, one of our readers published their thoughts about AVP, Gema Pleitez’s Facebook photograph which accompanied her comment, shown below:

ORIGINAL POST

We admit we didn’t notice the photograph until after it was brought to our attention by the person posting the following comment:

Anonymous said...

Anonymous said...

Not to mention she (Gema) comments on her employer's website with a facebook profile that has a collage of pics including a provocative picture of her in a bikini showing a tramp stamp. I thought employers reprimanded that type of representation, especially by an AVP. Maybe Yvonne will use that in her growing pile of reasons to fire Gema.

November 12, 2012 10:23 AM

In late November, Mrs. Pleitez was ordered by the credit union to amend her Facebook photograph and remove the image displaying her tattoo. Mrs. Pleitez’s new Facebook photograph is shown below:

AMENDED PHOTO IN POST

Currently, Mrs. Pleitez’s Facebook page, displays the following photograph:

Though we believe in freedom of expression we realize that certain compromises must be made when employees post images and statements on public media. An employee’s extracurricular activities can negatively impact their employer and their person. Though Mrs. Pleitez is more than 30 years old, she is evidently ignorant of what constitutes appropriate and inappropriate photographs and posting. She, as a long-time officer of the credit union, should be expected to comply, uphold, and enforce credit union policies. We were fortunate enough to obtain a copy of her original Facebook photograph, which is shown below and which she partially amended, following the comment which addressed the inappropriateness of her photograph.

APPROPRIATE or INAPPROPRIATE?

What any person finds provocative is purely subjective, however, what is appropriate and certainly proper within an organization is subject to policies which govern what an employer wishes to project about themselves, their employees, and their clients.

Looking at Mrs. Pleitez’s Facebook photograph we were reminded that shortly after being hired in June 2009, former COO, Beatrice Walker, described Priority One’s environment as “ghetto” and periodically disparaged “Mexican” employees for their conduct, behaviors and mode of dress yet Ms. Walker like Human Resources, never was impelled to enforce rules governing conduct and dress- at least not for certain, favored employees. From another perspective, Mrs. Pleitez’s photograph certainly serves as an appropriate metaphor for what Priority One is as a professional business.

Once known for his grandfatherly demeanor, Executive Vice President’s once almost pristine reputation has deteriorated over the more than past five years. Mr. Smock’s downfall can be attributed in great part for his disregard of credit union policy as four lawsuits have insinuated for federal and state laws.

In late 2009 and throughout 2010 and part of 2011, former COO, Beatrice Walker, targeted Executive Vice President, Rodger Smock, for expulsion, referring to him as “lazy”, “useless”, and “overpaid.” The man, whose responsibilities once included overseeing the credit union’s Human Resources Department, were transferred in 2011, to former Training and Education Manager, Robert West, following filing of two lawsuits. So what exactly does the Executive Vice President do, nowadays? We know that in 2011, he and CLO, Cindy Garvin, issued an email requesting that all employees in possession of company-issued cellulars, return these to his office. We also know that he used to spend hours clipping and distributing coupons to employees. And we know that secretly (actually not so secretly), he serves as an unofficial consultant to Human Resources, in great part because current Director, Robert West, is inexperienced and unqualified to oversee the department. More importantly, we also know that the allegations described in each of the lawsuits filed by former employees took place while Mr. Smock served as Director of Human Resources. This fact is extremely telling, isn’t it?

RODGER SMOCK, EXECUTIVE V.P.

As shown below, his LinkedIn account contains sparse information. It also erroneously references his position as that of Senior Vice President.

As shown below, his LinkedIn account contains sparse information. It also erroneously references his position as that of Senior Vice President.

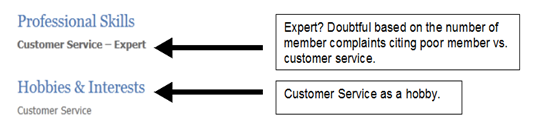

His SlideShare account contains much more information about who he allegedly is as an officer, though we know first hand that his alleged expertise is sharply contradicted by his performance, involvement in credit union operations, and finally, as a contributor to a credit union which is nowadays, much smaller and less competitive. We agree he has experience in payroll but he is most certainly not an expert in anything related to marketing. Certainly the credit union’s inability to sell its wares and the fact that earlier this year, the credit union hired a Marketing Specialist, attest that Mr. Smock is not qualified to serve in a marketing capacity. In the years when he oversaw publication of the credit union’s newsletter and helping creating posters promoting the credit union’s products, Mr. Smock’s efforts were limited to advertising. The credit union’s reduced Net Income, the loss of four key branches, and four lawsuits filed by former employees indicate that his alleged expertise has not been utilized to reverse the credit union’s horrendous performance over the past several years.

Ironic that this allegedly accomplished officer has no followers, as shown below nor does he apparently follow anything.

TWEETING AWAY

On his Twitter account, Mr. Smock describes himself as a “business and human resources specialist” yet the filing of former lawsuits by former employees suggests that he is not only not a specialist but may be more than a little inept in employee-employer relations. He again doesn’t appear to be participating in his own account as shown by the complete absence of tweets.

In his Ziggs biography, Mr. Smock is describes himself as “a respected professional”, as an Executive Vice President who oversees a wide range of operational responsibilities including human resources, security, finance, and payroll. Oddly, in 2011 his authority over human resources was removed and transferred to then Education and Training Manager, Robert West. If so, then why is human resources referenced as one of the areas he currently oversees? The answer: He’s not telling the truth.

He allegedly also oversees security, but just earlier this year, an officer of the credit union began posting responsive comments on this blog using the handle, Priority MC, and revealing highly confidential information about a former employee’s lawsuit and a member who has since sued the credit union alleging violation of the Privacy Act.

In 2007, payroll was transferred to his former assistant, Esmeralda Sandoval. She afterwards, reassigned the task to a representative in the Accounting Department. Mr. Smock has not managed payroll in several years, yet includes it in his present biography.

Contrary to what is written below, Mr. Smock does not provide home, equity, and automobile loans. Mr. Smock does not have any experience in opening a new loan application, determining eligibility or funding an approved consumer or real estate loan. The test to prove so is simple- ask him to process a consumer and mortgage loan from the point of origination through closing.

The closing statement that Mr. Smock “strives to maintain a high level of professional awareness” through his participation in certain organizations is not attested to by his performance at the credit union and is laid waste by four lawsuits filed by former employees. His biographies amount to hyperbole.

The statements describing Mr. Smock’s competency are dispelled by the allegations contained in each lawsuit filed by former employees and years of complaints which included allegations of sexual harassment. Furthermore, his statement alleging he built “a career dedicated to strong human resource management” is easily disputed by the failures of the Human Resources Department to ensure policies were adhered to by both managers and non-exempt personnel. To the contrary, Mr. Smock has not contributed in creating a “strong human resources management.”

Mr. Smock has also no documented record of contributing to the growth and development of new business. If asked to prove what he has actually achieved while serving in the capacities of Human Resources Director, Senior Vice President and Executive Vice President, he would be unable to provide evidence of his alleged accomplishments. Certainly the closure of four branches in less than three years attests that as an alleged contributor, his skills may require considerable improvement and maybe some actual hands on experience in and off the field versus, sitting contently at his desk.

Rodger D. Smock does not routinely visit SEG’s including postal facilities to describe the benefits of becoming a member of the credit union. Having once overseen Business Development, his promotion of products and services was limited to dispensing advice to the former and no longer existent, Business Development Team.

Mr. Smock’s Wordpress biography is as embellished as his other biographies published on other sites. If Mr. Smock truly oversaw all operations then he would not serve as Executive Vice President but would serve as the credit union’s Chief Operations Officer. As readers know, the Board of Directors hired Beatrice Walker in 2009, to serve as the credit union’s first COO. She was fired two years later and nowadays, branch operations are allegedly overseen by Chief Loan Officer, Cindy Garvin. This being true, we can’t understand why Mr. Smock’s biography would assert that he “works with personnel at each of these locations to ensure that the goals set by Priority One’s Board of Directors are being adequately addressed.” Furthermore, Human Resources now named Employee Development, is under directorship of Robert West.

Many past and former employees might take issue with the statement of Mr. Smock’s alleged “dedication” to the employees and members, alike.

Other sites in which Mr. Smock is promoting his experience and abilities, are shown below:

Mr. Smock’s alleged and extensive experience is undermined by the simple fact he is not actually able to perform many of the procedures referenced in his biographies. Any employee who has worked with Mr. Smock for any length of time can attest that he is incapable of opening a new member account, running Red Flags Procedures, processing closure of an existent member account or creating a new loan application- at least not without assistance. Yet, in his biography he is alleged to oversee operations including the aforementioned processes.

Source: http://rodgerdsmock.org/

Other sites containing copies of Mr. Smock’s biography are shown below:

Does Rodger D. Smock actually supervise all aspects of branch operations? Ask any non-exempt employee. Anyone who has worked with Mr. Smock for any amount of time is well-acquainted with his knowledge and work ethics.

Rodger Smock’s interests, as shown below are Rodger Smock. What?

For years, Mr. Smock’s few online biographies referenced a B.A. in psychology though his newly updated biographies reference a B.A. in Marketing and Psychology and in other biographies, a B.A. in Business Administration. Did the consultants ask him to embellish his educational accomplishments? Again, the effort appears to be to create the impression he studied business and is thus qualified to serve in the capacity of an officer. We know that while William E. Harris served as President, Mr. Smock never indicated he possessed a B.A. in Marketing or any actual experience in Marketing. His trek into marketing has been limited to selecting graphics intended to promote products and services and writing copy, those his writing abilities leave much to be desired as attested to by the credit union’s horrendously written and formatted Employee Policy handbook which he authored.

The effort to present Mr. Smock as noble because of his charitable efforts is laid-waste by the many complaints filed with Human Resources while he served as Director, some of which alleged sexual harassment and others accusing managers of abuses, slander, and retaliation. Clearly, the allegations of wrongdoing, alleged by many now former employees, reveal that Mr. Smock is a man who chose to defy the policies he was obligated to enforce. No amount of hyperbole trying to present him as a good and caring person can overshadow the irrefutable facts and evidence attesting to his actual behaviors.

ARE THEY ON THE ROAD TO RECOVERY?

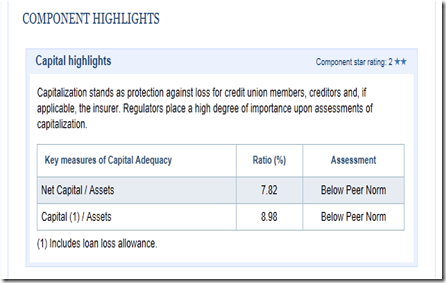

According to BANKRATE.com, is performing satisfactorily but does this suggest improvement? Earlier this year, President Wiggington bragged that Priority One was well on the road to recovery though just four months later, the Burbank branch closed. In December 2011 and during January and February 2012, he pointed to high capital as the evidence of the credit union’s success though by October 2012, a large number of employees were terminated while complaints pointed to deficient member service, escalated.

The credit union has remained afloat (though continuing to take on water) as a result of sometimes drastic cut-backs, which have compromised the credit union’s ability to promote its name and products. The recent efforts to reverse the credit union’s problems have been addressed by the creation of a new allegedly better website and by the President and Executive Vice President’s trumped up biographies. Of course if business were truly succeeding then why has Priority One’s Net Income decreased by approximately $21 million over the past six years and why did the credit union close the Redlands, Riverside, Valencia, and Burbank branches? President Wiggington would like members and employees to ignore these facts, but we won’t as they are critical indicators of Priority One’s performance.

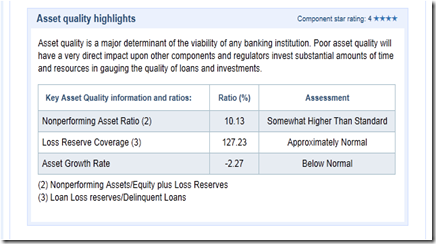

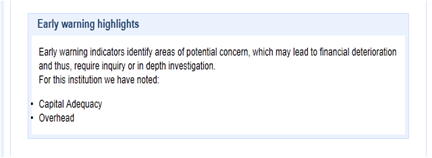

As shown below, at the end of June, the credit union’s Net Capital/Assets were deemed below normal by Bankrate.com. However, Priority One’s Nonperforming Asset Ration was deemed “Somewhat Higher Than Standard.” The lower the ratio of a nonperforming asset ratio, the better. Earlier this year, many financial institution experienced reduced asset ratios as a result of improved economic activity and overall efforts by the industry to reduce the amount of problem loans. In determining the level of nonperforming asset ratio, Bankrate considers the amount of the loan charge-off ratio. The disclosure that Priority One’s nonperforming asset ration is “somewhat higher than Standard” may indicate that the credit union has sustained losses as a result of loans going bad. As also shown below, the rate for asset growth is below normal.

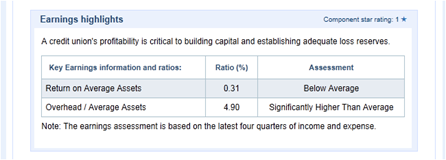

As also shown below, the credit union’s Return on Average Assets was deemed below average while Overhead/Average Assets were “significantly higher than average.” This indicates that Priority One is not utilizing its assets efficiently. If the Return on Average Assets had been deemed “average” this would suggest that Priority One is able to function with the assets it possesses. Evidently, Bankrate’s determination concludes the credit union is unable to do so.

Without question, Priority One’s ability to sell its products and services at a level which enables the credit union to pay its expenses needed to remain in business, is suffering and may serve as an indicator of what lies ahead for the troubled credit union.

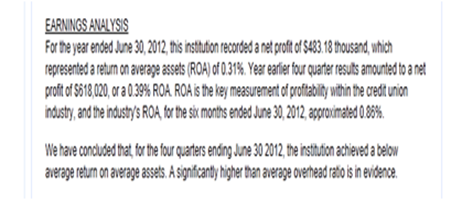

Finally, Bankrate reveals that at the end of June, Priority One reported a return on their average assets (ROA) of 0.31%. In 2011, during the same quarter, the credit union reported an ROA in the amount of .39% which reveals a loss in profitability. This can be compared, as shown below, with the credit union Industry’s ROA of .86%, once again revealing that not only has their ROA dropped but it is substantially lower than the industry’s approximated average. Evidently, Priority One’s profit are being offset by their operation expenditures which seems highly unusual when one considers that they have closed four branches in less than two and a half years; laid-off numerous employees; and reduced overall expenses.

Bankrate’s summary concluded that Priority One’s three-star rating is “unlikely to change within the ensuing twelve month period.” Well that certainly doesn’t suggest a bright and cheery future like the one President Wiggington has tried so hard to present.

AN OLDIE BUT A GOODIE

THE LIGHT BULB CAME ON IN SOMEONE’S HEAD

We are of course pleased, when the credit union listens. CLO, Cindy Garvin, who have decided to enhance the credit union’s lackluster loan portfolio by re-introducing a product offered by President’s Wiggington’s predecessor, the honorable William E. Harris. The products which for years garnered member attention is the Holiday Loan, once named the Christmas Loan. The loan along with the other lucrative seasonal products offered prior to Charles R. Wiggington, Sr.’s appointment to President, were eliminated by Mr. Wiggington who wanted to eliminate anything which reminded him of his predecessor. In giving into his emotional dictates, the President caused the credit union to lose lucrative sources of income and contributed to the credit union’s rapid decline in the years which followed. It is said, “Better late than never” but is it?

CONCLUSION

A WORLD OF INCONSISTENCIES

President Wiggington’s reign has been marred by adverse incidents, many proving detrimental to the credit union’s ability to acquire business and as attested to by Priority One’s diminished size.

On January 1, 2007, the date Charles R. Wiggington began serving as President, Inland Counties Postal Credit Union of Riverside County, effectively merged with Priority One. In the weeks before the merger, the credit union manually converted accounts for members of Inland Counties Postal Credit Union into Priority One’s XP database. The manual conversion became subject of extensive human error. On Tuesday, January 2, 2007, the credit union began receiving a vast number of calls from members of the newly integrated group, who cited they were unable to use their check cards, access their newly created accounts or transfer monies using home banking services. The mishandling of the incident would prove to be the first of a long line of fiascos created by and under President Wiggington.

Like in any large adverse situation, the credit union found itself over-burdened with calls demanding immediate resolutions and threatening account closures. The event could have been used by President Wiggington to prove his abilities as Priority One’s new President and CEO. Instead, the President chose to point fingers at others and extricate himself from all accountability. He quickly placed blame on his predecessor, declaring that “he left me with a mess”. Rather than performing an audit to confirm how many new members had been affected and possibly introducing a technological solution designed to resolve the issues in an expedient and effective manner, President Wiggington dragged his feet and told his receptionist to intercept any calls from irate members who had requested to speak to him. The end result was mass closure of member accounts and further evidence that President Wiggington did not possess the aptitude needed to lead the credit union.

●

During the first quarter of 2007, the credit union mailed out ballots in envelopes on whose exterior were printed member credit union account and social security numbers. The fault lay in President Wiggington who refused to follow security procedures established by his predecessor, though when the problem became public he quickly found a scapegoat and victim in the former IT Supervisor. The supervisor was suspended and a few week later resigned after acquiring better employment.

●

In 2008, President Wiggington was accused of sexual harassment. EXTTI, Inc. conducted an investigation which proved many employees had witnessed him sexually harassing the former employee. Though evidence was provided to Board Chair, Diedra Harris-Brooks, along with a recommendation the President be terminated, Mrs. Harris-Brooks fought to reinstate the President.

●

Though 2009 and 2010 ended in the negative the salary paid to the President remained unaffected. Over the past year, many employees were terminated for allegedly failing to perform their assigned responsibilities commensurate with the credit union’s allegedly high standards and lofty principles. The President remains in office and continues to be paid an high salary despite numerous documented abuses, failures, and scandals which have left Priority One a tattered organization. Nowadays, he supinely languishes in his office, confidant his employment and salary are well-protected by Mrs. Harris-Brooks.

Furthermore, the President and Mrs. Harris-Brook have shown tremendous hubris in their abuse of power and defiance of policies and laws. They may believe they are potentates with unlimited authority to do whatever they please. Obviously, neither believes they owe anything to members and employees and are impervious and above rules.

At the end of 2011, President Wiggington boasted publicly that the credit union was on the road to recovery and not only had business improved but the credit union turned a profit as allegedly attested to by high capital. Unfortunately, employees did not understand the significance of capital or that it not synonymous with profit obtained from new business.

In January 2012, the President continued his ruse, ensuring employees that all was well. However, during the February 2, 2012 all-staff meeting, he warned employees that unless a large amount of new business was gotten within the next three months, he would be forced to close down the Burbank branch. What employees didn’t know was that the President had already contacted the company who the branch was leased through and informed them that they intended to close the branch in April. The branch eventually closed at the end of May 2012.

The President’s administration has been marred with lies and deception, horrendous and illogical strategies, and wild spending which the beleaguered credit union could not and cannot afford. The credit union’s current legal plights are the direct result of mismanagement, defiance to policies and laws and the product of a mode of administration which abhors ethics and organization. Certainly there is nothing in their current efforts to create a new façade that can hide the years of ignominious acts committed by and under President Wiggington.

Total Assets: $153,161,364

Minus Notes & Interest Payable (loans): $3,000,000

Actual Total Assets: $150,161,364

On January 1, 2007, President Wiggington inherited a credit union whose Net Income approximated $172 million. Over the past five years, the credit union’s Net Income has diminished by approximately $22 million.

The President’s current efforts to create a polished façade are nothing more than another superficial make-over intended to hide the deep running cracks marring Priority One’s performance. The President hasn’t learned that his image and that of the credit union are grounded in Priority One’s performance and it’s relationship to its members. His bloated biographies and those of Executive Vice President, Rodger Smock, and the credit union’s new, more colorful website can not rectify the deficiencies afflicting the credit union.

Under President Wiggington, Priority One has lost its relevance and its ability to help members win with money has yet to be proven. Upon the advice of consultants, President Wiggington has placed his hopes in creating a superfluous impression that Priority One is a well-managed organization under administration of highly professional, accomplished and competent executives. Credit union records suggest the exact opposite.