IT’S A DOMINO EFFECT

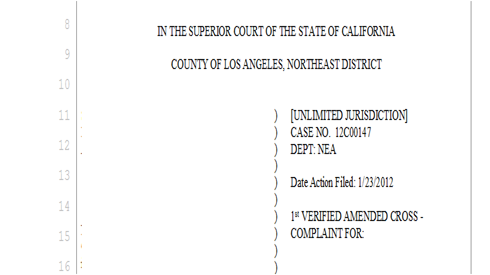

Almost incredibly, during the month of July, Priority One Credit Union’s collection attorney, Bruce P. Needleman* became the recipient of a counter-lawsuit from a member, alleging that an officer or officers of the credit union knowingly violated the credit union’s policy governing confidentiality and the Privacy Act.

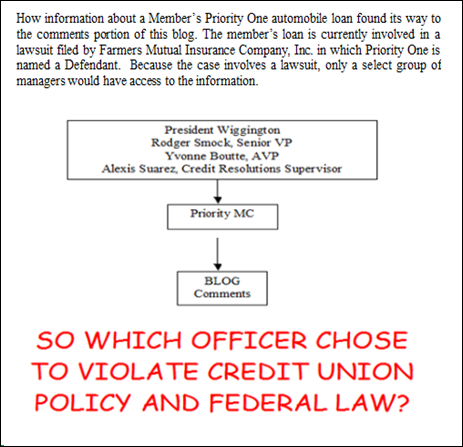

The violation was committed by a poster using the handle, Priority MC, who published comments in response to our May post, publicly divulging information about the member’s credit union automobile loan. As disclosed in our previous post, the member’s loan is currently the subject of collection proceedings and of a lawsuit filed by Farmers Mutual Insurance Company, Inc. Though the statements posted by Priority MC disclosed confidential account formation, they also included distortions of the truth, making the comments both libelous and a violation of the Privacy Act. Because the disclosures are quite specific, the information could only have been gotten and/or published by an officer of the credit union. The list of officers who would have had knowledge of the account is short and shown below:

- Charles R. Wiggington, Sr., President and CEO

- Yvonne Boutte, Assistant Vice President of Support Services

- Alex Suarez, Supervisor of Credit Resolutions

- Rodger Smock, Executive Vice President

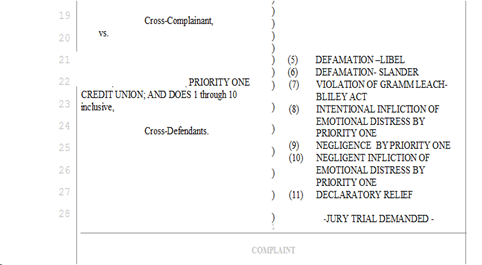

What we find inexplicable is why any officer of the troubled and scandal-ridden credit union would consciously commit acts exacerbating Priority One’s legal problems. To date, and in less than a two-year period, Priority One has been named Defendant and now co-Defendant in the following lawsuits:

- The 2010 lawsuit filed by the former Burbank Branch Manager.

- The 2011 lawsuit filed by a former Business Development Representative.

- The 2012 lawsuit filed by the former Valencia Branch Manager.

- The 2012 lawsuit filed by Farmers Mutual Automobile Insurance Company, Inc.

Though the credit union’s ability to acquire new business is faltering, the President and some his managers have found the time to continue defying policies and laws, leaving the credit union vulnerable to lawsuits. In view of the latest lawsuit, it is difficult to believe Priority One is a “financial fitness center” capable of helping members and employees “win with money”.

One might have thought, the President and his lackeys would have chosen to focus their sights on the development of new strategies designed to produce growth rather than attract more lawsuits. Erasure of Credit Union’s presence throughout all of Riverside County and the loss of the Redlands, Riverside, Valencia and Burbank branches have crippled the credit union’s ability to sell its financial products and services while reduced staff size is compromising Priority One’s ability to dispense quality member service. Wisdom dictates that after compiling an extensive and well-documented record of debacles, the President and his pack might have opted to don a more discreet persona and one which at least mimics professionalism. Not so for President Wiggington who in 2008, declared, “No one tells me what to do!” Obviously, no one does.

THIS POST

This post is dedicated to Priority One’s infamous and ethically devoid Board Chair, Diedra Harris-Brooks, and monocrat, AVP of Support Services, Yvonne Boutte.

This post is also shorter than our last several posts though not because we lack information (actually we have too much information) but because we’ve chosen to reduce the scope of this month’s publication. After reading this post, you may be left asking, “Where would Priority One be today, if Mrs. Harris-Brooks had never been elected to the post of Chairperson?” Mrs. Harris-Brooks contributions as Chairperson of the Board are best attested to by Priority One’s:

- Reduced size.

- Employee lay-offs.

- Inability to acquire new business.

- Internal discord.

- Decimation of employee morale.

- Three employee lawsuits citing an array of heinous acts and abuses.

Mrs. Harris-Brooks’ competency is also attested to in the manner she chooses to resolve problems created by President Charles R. Wiggington, Sr. Her usual objective when faced with a cascade of evidence proving violations of policies and laws committed by the President, is to find whatever means is necessary to squash the evidence. The President’s disastrous five-year performance, marred by blunders, abuses and scandals have inexplicably, failed to realize his ouster. In fact, Mrs. Harris-Brooks remains Charles R. Wiggington’s most avid and greatest defender. Thanks to her complete lack of leadership skills coupled by her dishonest tendencies, Mrs. Harris-Brooks has helped leave Priority One a weaker and less effective credit union.

We are also including excerpts from the member’s lawsuit which describes, in part, the member’s conversations with Mrs. Harris-Brooks. The Chairperson’s responses serve to show she is disinterested or maybe even incapable, of initiating proactive measures to resolve issues, even those which threaten to escalate into lawsuits. Quite frankly, after five years of observing Mrs. Brooks behaviors, we know she lacks the professional acumen and abilities, to enact proactive measures to resolve the issues created by the credit union’s managers.

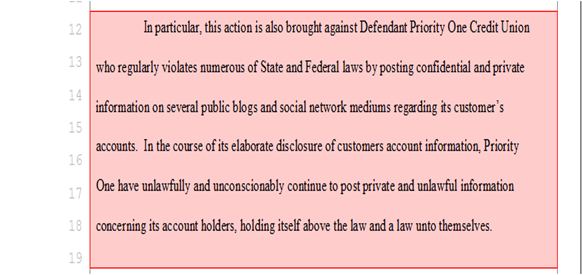

The member’s lawsuit differs from those filed by three former employees in that it specifically targets Chairperson Diedra Harris-Brooks and the Board of Directors, asserting that over the past five years, they failed to initiate existent safeguards as described under credit union policy, when ensure protection of member account information. Furthermore, when the existent safeguards failed to protect member information, neither Mrs. Harris-Brooks or the Board felt impelled to develop new safeguards which would have protected member information. The excerpts from the lawsuit may leave you asking, “Why would I ever wish to open an account at Priority One Credit Union?”

The phenomena of employee lawsuits filed in the past year and a half, is an unprecedented development in Priority One’s long history and a backlash to the years of abuses committed by and under, Charles R. Wiggington, Sr. Evidently, Mr. Wiggington and some of his executive staff have redefined what it means to be an “executive.” Their well-documented history of abuses beginning on January 1, 2007 (the date Charles R. Wiggington, Sr. became President) suggests that within Priority One, the word “executive” is merely a title that should never be construed to imply professionalism, competency, or adherence to ethics.

We’ve also added two lists of links, located to the right of our post. Under the section, titled “What Charles R. Wiggington, Sr. has to say about Himself”, we provide links to websites containing the President’s embellished biography, which began to appear throughout the Internet, several months ago. Clearly, the President is trying to remedy his reputation and may want to deter attention from his disastrous performance. The President’s “bio” omits reference to the $20 million loan borrowed in 2008, from the credit union’s line-of-credit and which until recently, cost the credit union approximately $30,000.00 per month in interest alone. He also fails to reference closure of four branches since October 2010, employee lay-offs, elimination of critical budgets used to promote the credit union’s name, services, and products. There is also the matter of three employee lawsuits. Mr. Wiggington may not have realized that presenting an inaccurate portrayal of his abilities doesn’t dispel the fact that since he became President, Priority One has experienced ongoing decline.

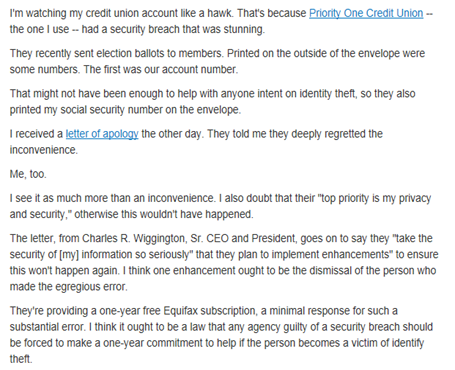

The second list, under the heading, “What Do Others Say About Priority One” contains links posted by members describing their real-life experiences with the troubled credit union including the avoidable “2007 mailing fiasco” which occurred when the President refused to adhere to security measures established and maintained by his honorable predecessor. Realizing the President views himself through rose colored lenses, we suggest it’s time for an eye exam.

MORE TROUBLE?

IS THERE A FOURTH EMPLOYEE LAWSUIT?

For the past few months, there’s been a rumor, circulating that a former Burbank FSR filed a lawsuit against Priority One alleging harassment committed by AVP of Region 3, Sylvia Perez. In July, we received an email advising us of the lawsuit and we recently read the comment posted by “Priority MC”, alleging filing of a lawsuit by the former FSR.

Aside from the post and email, we have no corroborating evidence that an actual lawsuit was filed, though we are investigating. If true, this would constitute the fourth employee lawsuit filed against Priority One in less than two years. The former employee, once worked under supervision of former Burbank Branch Manager, Linda Nisely. Though highly knowledgeable in banking procedures and ATM management, the FSR was known to be rude to members, many of who lodged complaints citing her rude and abusive attitude.

The FSR was openly disliked by Mrs. Perez, who on several occasions, described the FSR as “difficult”, “insubordinate”, and “not a team player.” In 2009 and 2010, Mrs. Perez often complained to Senior Vice President, Rodger Smock about the FSR, requesting he transfer the employee to another branch. Perturbed, Mrs. Perez would periodically and quite publicly exclaim that she needed someone who followed instruction though we believe what she wanted, was a person who obeyed her explicitly. During one of her erratic and very public mood swings, Mrs.. Perez told the FSR that she should find employment with some other company. The disparagement of the FSR continued for many months until the FSR left the credit union on a medical leave of absence. Eventually, her employment was terminated by the Credit Union relegating the FSR to the world of the unemployed.

Irrelevant of the final outcome, a fourth employee lawsuit would further adulterate the credit union’s reputation which would in turn, impede its ability to sell what they offer. Certainly, the President’s insistence that lawsuits are being filed by disgruntled employees who want to “get money from us” sounds more like the death throes of a desperate man hoping to convince others that all is well at a credit union struggling to regain momentum. After three employee lawsuits and one from a member, alleging violations of federal law, can’t deemed mere coincidence. What’s more, why would any attorney agree to represent an employee if there weren’t some evidentiary foundation validating their accusations of wrongdoing?

LIVING IN A BUBBLE

We are more than a little perplexed by the noticeable absence of the Supervisory Committee who has chosen to remain quiet if not invisible during the past five years.

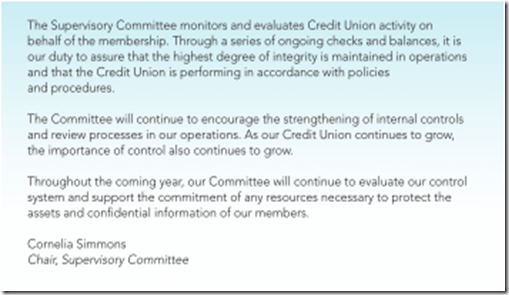

The Committee is ultimately responsible to ensure safeguards are maintained, updated, and implemented which protect member information and assets. Year after year and as shown below, Supervisory Committee Chair, Cornelia Simmons, publishes the same old stale statement in the credit union’s Annual Report, assuring members that the Committee has monitored and evaluated Priority One’s activities.” Though what she describes as “ongoing checks and balances” allegedly performed by the committee to assure “the highest degree of integrity” is maintained in “operations” and “in accordance with policies and procedures” we see nothing that attests to a high degree of in integrity in operations. The violations of confidentiality openly committed by and under the President over the past five years and now, four lawsuits, more than infers that the committee’s system of checks and balances is in dire need of an over-haul while the “degree of integrity” alleged by Ms. Simmons is non-existent.

In her address, contained in the 2011 Annual Report, Ms. Simmons assures that the Committee’s efforts are intended to strengthen internal controls, concluding that in the committee’s opinion, the “Credit Union will” continue to grow. Has Ms. Simmons noticed Priority One is much smaller in size than it was in mid-2010? Does she even realize that four branches have been closed since October 2010? In fact, at the time the 2011 Annual Report was distributed, the credit union was preparing to close the doors to its Burbank office.

Ms. Simmons ends her address by stating the Committee will continue its evaluation of its own “control system” and is committed to utilize all resources which “protect assets and confidential information of our members.” So is the latest lawsuit, alleging violation of the Privacy Act, an example of the Committee’s finely tuned oversight and of their commitment to protect confidential information?

Over the past five years, the Committee has intentionally distanced itself from the credit union’s problems and scandals, their presence hidden from employee and member view. Based solely on Ms. Simmons’ address, the Committee may be living in denial, hoping exposure of the President’s chronic violation of policies and laws will miraculously go away. Ms. Simmons’ address which ignores branch closures, may suggest she doesn’t actually comprehend the significance of what she states in her address. She also seems sorely out-of-touch. We suggest she amend or all together replace the template containing her annual address. Maybe she can begin all future addresses by stating, According to our extremely limited understanding….”

TRACKING THE EVIDENCE

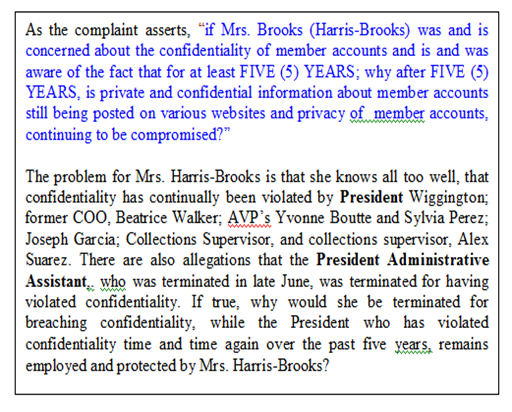

All evidence regarding the latest lawsuit, points to management as the perpetrator, but this is hardly news. As we’ve reported over the past three and a half years, the policies governing confidentiality have consistently been violated by President Wiggington and some of his managerial sector. The comments posted by Priority MC on this blog in response to our April and May postings contained information which could only originated from the offices of their legal counsel. What’s more, the attorneys would only have disclosed the confidential information to either Diedra Harris-Brooks or President Wiggington. It is more than likely that the President was the recipient of the information which he then dispensed to members of his executive staff. After doing so, the information was published by Priority MC. It’s neither conjecture nor a theory as all roads lead back to the President.

There are only a few managers who have access to member accounts involved in litigation. No matter how much Diedra Harris-Brooks denies management involvement in violations of policies and laws, the comments published by Priority MC could only have originated from the executive sector.

Priority MC is someone who had intimate knowledge about the member’s automobile loan. Because the loan was subject to collection proceedings, the number of employees privy to the account is further reduced. However, because the account is now subject to a filed this past January by Farmers Mutual Automobile Insurance Company, the number of employees having access to the account’s information would have been limited to officers of the credit union.

Priority MC also possessed intimate knowledge about the details contained in the second lawsuit filed by a former Business Development Representative. The only persons who should have knowledge of the case are Board Chair, Diedra Harris-Brooks, President Wiggington and Executive Vice President, Rodger Smock, unless one of them chose to further violate policy by disclosing the confidential information involving the second lawsuit and its settlement, to unauthorized personnel.

Instead of wasting years suppressing evidence of wrongdoing committed by management, Mrs. Harris-Brooks should have spent time shoring up breaches of confidentiality committed by the executive sector and done everything in her power to ensure safeguards were implemented. She also should have insisted that disciplinary action be taken whenever an officer was found guilty of violating credit union policy and state and federal laws. At the end of the day, Mrs. Harris-Brooks and the entire Board are culpable for failing to ensure the privacy and confidentiality of member information.

Of course, the latest violation of policy is merely a by-product of an internal system of operation which stands in shambles and which allows President Wiggington to freely abuse policies and ignore laws. Because Diedra Harris-Brooks has proven time and time again, that she is incapable of conducting fair and objective investigations, she should have authorized hiring of an outside firm to monitor management’s adherence to state and federal laws. A contracted third party could also have conducted unbiased investigations and recommended terminations when justified by a preponderance of evidence. Of course, we know the Chairperson would never have authorized hiring of third party to monitor adherence to policies, because this may have resulted in transparency and forced the Board’s own adherence to policies and laws and required she conduct herself in a manner that is above reproach.

Current Record of Verified Lawsuits Filed Against Priority One Credit Union

CAUGHT UNAWARE

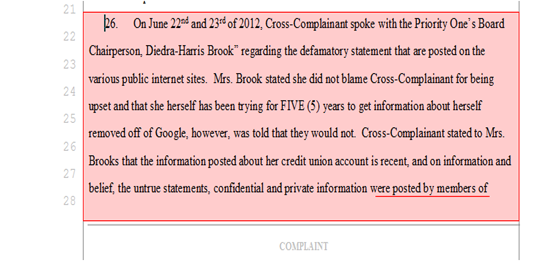

On Friday, June 22nd, Board Chair, Diedra Harris-Brooks was contacted by phone, by a concerned member who informed the Chairperson, that an employee of the credit union had posted slanderous statements about the member’s automobile loan in the comments section of this blog. The member also told the Chairperson that the posting constituted a violation of the Privacy Act and that the comments were untrue and thus libelous.

Mrs. Harris-Brooks empathized with the member, admitting that over the past “five years” she attempted to remove all references to her name from this blog, but her requests had been denied by Google.com. Mrs. Harris-Brooks’ statements suggest she is profoundly daft and should never be allowed to answer calls from members. Her responses bring into question her competency as Chairperson of the credit union’s Board of Directors.

In her replies, Mrs. Harris admits she and the Board have been aware that over the past “five years”, unnamed “employees” of the credit union have successfully violated the credit union’s policy governing confidentiality and the statutes underlying the Privacy Act. So why hasn’t she and the Board, implemented safeguards described in Credit Union Policy which ensure protection of member information? If they did and these failed, then what new safeguards did the Board create and implement to ensure member information is protected?

One reason why Mrs. Harris-Brooks and the Board may have avoided enforcing existent policies or refused to develop new and better policies is that she and the entire Board know too well that over the past five years, the biggest violator of confidentiality has been President Charles R. Wiggington, Sr. and some members of his executive staff. It is also a well-known fact, that whenever a management representative was found guilty of violating policies and laws, the Board refused to order disciplinary action.

- In 2007, former Director, Dave Davidson, received an anonymous letter, advising him that AVP, Liz Campos, had incurred approximately 40 NSF incidents between a two-month period. Mrs. Campos had been handpicked by President Wiggington, to serve as one of his newly appointed AVP's. One would reasonably assume that at the time he selected her for promotion, that he had already conducted all necessary checks needed to validate that she was fully qualified to serve in her new capacity. Mr. Davidson delivered the letter to then credit union attorney, William Adler. The attorney contacted Diedra Harris-Brooks and President Wiggington and strongly suggested, an investigation be conducted.

- The investigation disclosed that Mrs. Campos had been kiting- a federal offense, using checking accounts opened at three separate financial institutions. Mr. Adler ordered her termination, though the President would later complain and declare Mrs. Campos should not have been fired, despite having violated federal law. He also told the Card Specialist Supervisor while in the presence of the Consumer Loan staff, that the letter had been written by the former Marketing Director. The President was again wrong in his conclusion.

- Upon learning that an investigation was to be conducted, the President removed all documents from Mrs. Campos file, showing he approved the reversal of all 40 NSF fees. He also told the auditor that the reversals had erroneously been performed by the Member Services Department.

- The compulsively corrupt Mrs. Harris-Brooks chastised Mr. Davidson during a Board meeting, warning him that should he again receive information alleging wrong doing by a manager, that he provide the evidence to the Board who would derive a decision without involving the credit union’s attorneys. Mrs. Harris-Brooks may have struck her head against a blunt object and in her confusion believed she was a real-life licensed attorney who possessed the ability to litigate matters involving violations of federal law.

- In 2008, Mrs. Harris-Brooks suppressed evidence obtained during a 2008 investigation which proved President Wiggington sexually harassed a former employee. Based on her history of squashing evidence, we know she cannot be trusted to rectify wrongdoing committed by the President and his executive staff.

- Following conclusion of the investigation, Mrs. Harris-Brooks issued a letter stating that “sexual harassment” as defined by federal law, had not occurred. The employee then responded by filing a complaint with the Department of Fair Employment and Housing. The Board responded by first offering the employee $20,000.00 to settle her case. When she declined, the Board extended an offer in the amount of $40,000.00. This hardly bodes well for Mrs. Harris-Brooks who had concluded that sexual harassment had not occurred.

- At the end of 2009, Mrs. Harris-Brooks and the President entered into a conspiracy which disrupted the credit union’s annual electoral process. The two posted announcement of the upcoming election which includes inviting members to submit their names as nominees to run for a seat on the Board and/or Supervisory Committee. Mrs. Harris-Brooks and the President chose to limit publication of the notice to newsletters only sent to members who have a checking account and thus excluded mailing of the notice to the vast number of members who only have a savings account.

- Following our exposure of her malicious disruption of the election, the Board and Supervisory Committee convened in South Pasadena and decided to hold new elections all of which incurred a loss of money to the credit union who had to reprint ballots and mail these to all members in good standing.

Under Mrs. Harris-Brooks the enforcement of disciplinary actions against members of the executive sector has been ignored and consistently influenced by favoritism and politics. Furthermore, Mrs. Harris-Brooks has participated in covering up evidence of wrong doing and as occurred in the 2009 electoral process, willingly attempted to subvert the sanctity of the process all in an effort to preserve the almost all Black board who are subservient to her every whim and wish.

Here are excerpts from the latest complaint:

ALLEGATIONS AGAINST PRIORITY ONE

MORE ALLEGATIONS

LIBEL BORN OUT OF MALICE

Undoubtedly, Diedra Harris-Brooks lacks the abilities needed to respond intelligently to member complaints which threaten to escalate into a lawsuit. During her conversation with the member, Mrs. Harris-Brooks made disclosures which were inappropriate. She also failed to derive a single solution to resolve the member’s complaint. This of course leaves us wondering why she remains Chairperson of the Board.

The latest lawsuit alleging libel, was borne out of a desire by an officer of the credit union to publicly disparage the former employee who filed the second lawsuit against Priority One. The information published by Priority MC in response to our April post, could only have originated from the offices of the credit union’s attorneys. The comments specifically stated the former employee’s lawsuit had been “crushed” and that his attorney had resigned. The information originated from the offices of Priority One’s legal counsel was provided to the credit union and President Wiggington. It was the President who afterwards disclosed the information to a member(s) of his managerial staff.

In 2010, we published the reasons the employee filing the second lawsuit, was terminated. In June 2010, the President and an investigator called the employee into a private meeting inside the President’s office. During the meeting, the employee was informed he was being terminated though neither the Director of Human Resources, Rodger Smock, or then Human Resources “clerk”, Esmeralda Sandoval, were present. Their exclusion in the meeting was purposely planned by the President, who chose to perpetrate a plan leveling false charges against the employee. During the meeting, the investigator, who refused to disclose his name, and who was not an employee of the credit union, informed the employee he was being terminated for the reasons that he was found to-

- Be the blogger; a blogger; or providing the blogger(s) with confidential credit union information.

- Have downloaded same-sex pornographic images from his credit union PC.

- Have sexually harassed co-workers.

If we didn’t know better, we would have thought the investigator was describing the President who in 2008 was found of having sexually harassing a former employee; or describing one of the President’s male managers, some of who have been known to frequent pornographic websites while at work.

The preposterous attempt by the President to disparage an employee was easily dispelled by the fact that Priority One has firewalls in place which impede all employees except managers of being able to access pornographic websites. The President may suffer from psychological projection and may believe others choose to behave as he does. The allegations leveled by the credit union may have lacked substance because earlier this year, the credit union through its attorneys, offered to settle the former employee’s claim against the credit union.

Following issuance of the settlement payment, Priority MC posted again, stating that the amount of the settlement was small and the former employee would have fared far better if he had worked on a part-time basis for Burger King. Who else but Priority One’s management would know if the amount of the settlement? Priority MC’s statement proved to be yet another breach of confidentiality and may also have been a violation of the settlement agreement entered into by the former employee and the credit union. And once again, the amount of the settlement could only have originated from the office’s of Priority One’s legal counsel and trickling its way down through the credit union via President Wiggington.

In an effort to rescind the postings, Priority MC posted a comment that the statements about the employee were not directed at the blogger or bloggers but were rather about a member who allegedly sued the credit union and “ran off” with her automobile apparently being financed by Priority One. It is the very specific disclosures about the member’s Priority One loan that now constitute a violation of the Privacy Act. Sir Walter Scott was absolutely correct when he wrote, “'Oh what a tangled web we weave when first we practice to deceive.” Of course, we expect Mrs. Harris-Brooks and her stoolie, the President, to resort to their usual tactics which include denying wrongdoing , hoping to place blame on some unsuspecting employee, and raising some droll excuse that the violation of law was probably caused by a ghost. Mrs. Harris-Brooks will also take whatever evidence is found and bury it in her backyard.

WHATTTTT?

Indubitably Mrs. Harris-Brooks is ill-equipped to respond to problems and challenges in general, much less incidents threatening a lawsuit. Still, despite her obvious limitations, Mrs. Harris-Brooks has always found it appropriate to meddle, we mean, intervene when complaints are reported directly to her. Her involvement is however, not motivated by seeking a fair resolution but always, an attempt to personally squash complaints. After the filing of three lawsuits, all by former employees, Mrs. Harris-Brooks may find herself pushed to the limit, making it imperative she try and deflect the potential filings of even more complaints. Though as we’ve shown, her bungling of the latest complaint, filed by a member, may have actually resulted in the filing of the newest lawsuit. Furthermore, the allegations contained in the member’s complaint, echoes the allegations contained in the first, second, and third lawsuits.

Mrs. Harris-Brooks uncontested rulership over the Board, beginning in 2006, seems to have imbued her with the confidence that she has a right to suppress evidence, subvert ethics, and raise obstacles that might serve to impede public exposure of the acts and failures committed by and under President Wiggington.

In 2007, the credit union mailed ballots to members, though erroneously, the exterior of the envelopes contained member Priority One account numbers and Social Security numbers. The Board ordered the President to conduct an investigation and ordered termination of the employee or employees who committed the error resulting in the exposure of confidential member information. The error occurred because the President refused to review a sample batch of envelopes that had been prepared for mailing. The procedure had been established by his predecessor, William Harris, and served to prevent errors or as what occurred in 2007, avoid the disclosure of confidential information. Though the President was asked to review a sample batch of envelopes contained the ballots, but he replied, “I’m the President, I don’t do that!”

When the mistake was made public, the Board ordered the President to conduct and investigation and to terminate the employee who committed the breach. Despite having ignored protocols ensuring the safety of confidential information, the President found a victim in the then IT Supervisor. Though the Board demanded the manager’s termination, the President convinced them that they should only order suspension. The President would later tell the manager that he personally fought to keep the manager from being terminated when in actuality, he used the manager as a scapegoat. Mrs. Harris-Brooks was well aware of the President’s deceitful ploy and Mrs. Harris-Brooks knew that the President’s failure should have resulted in his immediate expulsion.

Mrs. Harris-Brooks insists on discussing matters which fall far outside her scope of authority and knowledge. This, by the way, is the same Chairperson who in 2011, assured Consumer Loan Processor, Patricia Lopez, that she would personally conduct an investigation as to why, Mrs. Lopez was laid-off and even assured the former employee that her employment would be reinstated. In that incident, Mrs. Harris-Brooks chose to act in the capacity of a Human Resources Director. Obviously, it never occurred to Mrs. Harris-Brooks that she might have chosen to refer the member to the credit union’s attorneys, because….

- The member’s automobile loan is the subject of collection proceedings; and

- Because the member and the credit union have been named co-Defendants in a lawsuit filed by Farmer’s Mutual Automobile Insurance Company, Inc.;

- And because the member had threatened to file a lawsuit alleging violation of the Privacy Act and libel committed by officers of the credit union.

It is possible Mrs. Harris-Brooks was simply caught in stupor which forced her to expound upon a subject she has no business interfering in? Here are additional facts we know of:

- The lawsuit makes reference to a “settlement”, possibly offered by the member, which Mrs. Harris-Brooks agreed to consider.

- Following the conversation with the member, Mrs. Harris-Brooks never documented what she had been told by the member.

- Mrs. Harris-Brooks is aware that the credit union has again, refused to abide to the terms and conditions stipulated under the Privacy Act.

- Mrs. Harris-Brooks is completely unqualified to analyze and evaluate incidents involved in, or threatening litigation in a court of law.

- Mrs. Harris-Brooks did not conduct research of credit union policies and state and federal laws, to ascertain the credit union’s legal position with regards to the latest allegations of wrongdoing committed by the credit union.

Mrs. Harris-Brooks may be suffering from the effects caused by the credit union’s dizzying and erratic legal problems which might explain some of her dim-witted replies and false assurances made to the member during their conversation on June 22nd, June 23rd, and again, on July 13th. We are also perplexed by Mrs. Harris-Brooks statement that breaches of confidentiality have been ongoing for the past five years. This blog came into inception in January 2009, which is approximately three and a half years ago. So was Mrs. Harris-Brooks referring to breaches of confidentiality which may have occurred prior to the inception of this blog? What are the breaches she referred to and were these breaches committed by President Wiggington? Mrs. Harris-Brooks also failed to inform the member that in 2009, President Wiggington and former CFO, Manny Gaitmaitan, conferred with the credit union’s former attorney, William Adler, for the purpose of finding a way to “shut down the blog” but were told they could not do so because the information provided here, is verifiable and true and is covered under the first amendment.

We believe that another reason for Mrs.. Harris-Brooks’ tremendous exasperation is that she knows that the information presented on this blog is true and unlike her efforts and those of the President, we never have to fabricate facts. Mrs. Harris-Brooks is also aware that in 2007 through February 2008, President Wiggington spent as much as two each day, lounging on a loveseat in the Consumer Loan Department, boasting loudly to the Card Services Supervisor about the employees he intended to terminate and publicly divulging the reason, other employees had been fired. Some of people whose names he disclosed publicly, included:

- The former Marketing Director.

- The then Branch Manager and current AVP of the Los Angeles branch.

- A former Card Services Specialist who was later promoted to Lead Teller at the Los Angeles branch and eventually terminated because the President was informed that she may criticized his management of the credit union.

The problem Priority One is currently faced with is that the comments published by Priority MC point to management as the violator of confidentiality. Priority MC’s confirm that some managers of the credit union refuse to abide to policies and laws. It also shows that Mrs. Harris-Brooks as Chairperson of the Board, has no control over the breaches of confidentiality committed by management and confirms the gross inability or refusal by the Board, to enforce safeguards designed to protect member data along with their apparent inability to develop and implement improved protocols protecting confidentiality.

So why would the Chairperson admit to her failure? We chalk that up to plain old fashion incompetence by a woman who has openly and freely violated credit union policies, covered up wrong doing, suppressed evidence proving violations of state and federal laws and who has done everything in her power, to retain the President’s employment, despite his long history of abuses and failures.

Yvonne Boutte was hired in 2008, to serve as Manager of Credit Resolutions. A few weeks before her arrival, President Wiggington ordered mailing of a letter to his long-time and now former friend, Mike Lee, advising him that the credit union would not renew its agreement with Associated Management Company, Inc., the contracted collections company owned by Mr. Lee. The President also ordered the AVP of Lending, Patti Loiacano to verbally advise Mr. Lee that his agreement with the credit union would not be renewed because the President had decided to create an in-house collections department which he alleged, would eliminate the amount of money spent on an outside collector and increase revenue. According to the President, Associated Management wasn’t achieving the amount of collections needed to attain profitability.

Ms. Boutte arrived quietly and worked alongside the remaining employees of Associated Management, Inc. Following their departure, Mrs. Boutte brought in new staff, all of who she worked with previously. The new staff included Alex Suarez, Sandra Whitt, and Naira Gevorkyan. Mrs. Whitt left in 2011, after her friendship with Mrs. Boutte deteriorated and she found herself the subject of Mrs. Boutte’s very public criticisms.

In her four years of employment, Mrs. Boutte quickly climbed Priority One’s corporate ladder and now serves as AVP of Support Services (whatever that means). However, overshadowing her accomplishments are her erratic mood swings and disparaging treatment of employees. As employees know, Mrs. Boutte is adept at quickly altering her behaviors and personality, dependent upon who she is speaking to any given moment. The façade she dons when speaking to the Board of Directors, projects the impression she is cooperative, respectful and even pliable. When not meeting with the Board, she is one of their most avid critics, often declaring they are incapable of comprehending financial idiosyncrasies.

When meeting with the President, she strains to remain tolerant, describing him as too talkative. She has even instructed her staff to call whenever she remains in the President’s office for more than 45 minutes; and use the excuse that an urgent matter has arisen, requiring she return to Member Services immediately.

When speaking to her staff and other, non-exempt personnel, she is often condescending and can easily resort to ridicule and belittlement. She is in arguably, a woman with more than two faces.

On June 22nd and June 23rd, the member whose account information had been published by Priority MC, called Chairperson, Diedra Harris-Brooks, advising her of the violation of confidentiality and explaining to the Chairperson why Priority MC must be an officer of the credit union. She advised Mrs. Harris-Brooks that if the matter isn’t resolved immediately, a lawsuit would be filed. Mrs. Harris-Brooks asked the member to provide her with the terms of the member’s proposed settlement, assuring she would review it and provide a response afterwards.

On Friday, July 13th, the member called Mrs. Harris-Brooks and asked if she had read the proposed settlement and arrived at a decision. Not surprisingly, Mrs. Harris-Brooks stated she never received the proposal. Being the consummate unprofessional, it never occurred to the Chairperson that if she hadn’t received the settlement that maybe she should have made an effort to contact the member. The member next forwarded another copy of the settlement and asked the Chairperson to provide a response by the end of the day or she would proceed in filing a lawsuit which would name Mrs. Harris-Brooks, President Wiggington, and Mrs. Boutte co-Defendants.

While the member remained on the line, Mrs. Harris-Brooks called the President and ordered that someone from the credit union, call the member that same day. When Mrs. Harris-Brooks returned to the phone, the member informed her that since their initial conversation on June 22nd, she located additional references to her name and account information on other Internet sites, reiterating that the disclosures could only have been made by someone in the management sector. Mrs. Harris-Brooks remained quiet momentarily and then said that over the past “three (3)” she has requested removal of her name from the blog, but her requests had been denied. Mrs. Harris-Brooks advised the member, that AVP of Support Services, Yvonne Boutte, would be calling her within a few minutes.

- If Mrs. Harris-Brooks called the President and informed him about an alleged violation of the Privacy Act which threatened to escalate into a lawsuit, then why would the President refer the matter to Yvonne Boutte who is neither an licensed arbitrator or attorney?

- Why did Mrs. Harris-Brooks call the President and request that an employee call the member rather than contacting the credit union’s own highly paid, attorneys who are allegedly experts in litigating legal matters?

A few minutes after concluding her call with Mrs. Harris-Brooks, the member received a call from Yvonne Boutte. Being the quintessential authoritarian, Mrs. Boutte aggressively told the member she is no longer allowed to call Mrs. Harris-Brooks. Evidently, Mrs. Boutte suffers from delusions of grandeur and may believe that everyone is subject to her dictates. The member replied, that Mrs. Harris-Brooks had invited her to call at “anytime”, adding that Mrs. Boutte had no authority to try and force the member to comply with her lofty demands (our words, not the members).

Ignoring the member, Mrs. Boutte again prohibited the member from speaking to anyone but attorney, Norman Needleman. The member reminded Mrs. Boutte that Mr. Needleman is a bankruptcy attorney and possibly unqualified to respond to complaints alleging liable or violations of the Privacy Act.

Incensed that the member was unwilling to bend to her will, Mrs. Boutte resorted to a more childish tactic and began interrupting the member as she tried to resolve the violation committed by a representative of the credit union. Mrs. Boutte resorted to spewing out slang and street vernacular. Realizing Mrs. Boutte had no control over her behavior and had no intent of listening, the member hung-up. Mrs. Boutte did not call the member back though she called the President and Mrs. Harris-Brooks and told them both the member was being uncooperative.

Poor Mrs. Boutte, like most tyrants, she must assert her will through force even if it exacerbates problems. In her conversation with the member, she revealed her insecurities and how truly misinformed she truly is. We’ve decided to elucidate upon some facts, which will hopefully dispel Mrs. Boutte’s obvious confusion. If a lawsuit filed by or against a member, which alleges bankruptcy, then inquiries regarding that case, must be referred to attorney, Bruce Needleman*. On the other hand, if a complaint alleges abuse including harassment or liable, then inquiries must be referred to the offices of Richardson & Harman, PC. Mrs. Boutte’s involvement in litigation of any legal matter, is tantamount to handing a loaded gun, to a child.

- If the member’s complaint could only be responded to by Mr. Needleman, then why did Mrs. Harris-Brooks order Mr. Wiggington have one of his staff call the member that same day?

- Shouldn’t Mrs. Harris-Brooks have asked that the attorney call the member?

- And why involve the incompetent and emotionally undisciplined Mrs. Boutte when her field of expertise is collections and not litigation?

In responding to the member’s complaint, Mrs. Harris-Brooks shirked her responsibility (big surprise) and referred the member to AVP, Yvonne Boutte, though the AVP is sorely unqualified to respond to or resolve any legal matter. Mrs. Boutte could have referred the complaint to the credit union’s attorneys or at least assured the employee an investigation would be conducted. Instead, blinded by ego and pride, she gave in to her chronic need to subjugate.

The member’s conversation with Mrs. Harris-Brooks, was intended to resolve the unlawful violation perpetrated by an employee of the Priority One but which ultimately proved to be an exercise in futility. Possibly, as a result of low self-esteem, Mrs. Boutte chose to respond to the challenge by resorting to verbal tactics characteristic of the uneducated and reacting emotionally, subjected the member with her brand of street vernacular and in the end resolved nothing.

Mrs. Harris-Brooks and Mrs. Boutte are over their heads in trying to resolve any matter which requires the expertise of an attorney versus the meddling of a glorified collections clerk and a retired ex-postal store worker.

*Bruce P. Needleman, Esq., Warner Center Plaza VI, 21700 Oxnard Street, Suite 1290, Woodland Hills, CA 91367-3660, 818-715-7007, Facsimile 818-715-7090

DO YOU REALLY REAP WHAT YOU SOW?

The Root to Evil at Priority One isn’t Just Greed

During her conversation with the member, the magniloquent Board Chair failed to provide a single rationale that might serve to explain why the credit union’s current safeguards ensuring the safety of member information, have successfully been undermined, time and time again.

Since January 1, 2007, the date he became President and CEO, Charles R. Wiggington, Sr. has languished comfortably behind Mrs. Harris-Brooks, knowing that no matter how much he defied policies and laws, or how many monetary losses were incurred as a result of his ineptitude, that she would always exert every means by which to protect him and vanquish his critics.

On the other hand, Mrs. Harris-Brooks enjoyed the privilege of knowing she could exact and exceed her authority; and when necessary, approve referral of all legal matters to the credit union’s expensive attorneys. Mrs. Harris-Brooks ineptitude in handling the member’s complaint, clearly signals in our opinion, that she has over-stayed her welcome and should be voted out of office and sent home.

Over the past five years, Mrs. Harris-Brooks has done absolutely nothing to help reverse Priority One’s financial woes or its inability to force the President to create sorely needed strategies that might attract new business and bring in real and necessary profit. The University of Phoenix graduate has also refused to acquaint herself with some of the legalities underlying credit union policies or the laws, requiring financial institutions to safeguard member information. If she had demonstrated any concern for the problems she alluded to while speaking to the member on June 22nd and June 23rd, it is possible confidentiality would never have been violated at the credit union.

The causes to Priority One’s continuing demise run deep and are rooted in the behaviors and attitudes of it dysfunctional managerial sector and Board. The only silver lining to this story of debacles is that credit union appears to possess sufficient funds needed to pay its legal team.

CONCLUSION

Priority One’s problems are far from subsiding. Their seemingly compulsive involvement in lawsuits can be attributed entirely the bungling mismanagement of the credit union, refusal by management to abide to credit union policies and laws and the inept manner they choose to respond to and resolve complaints. The President’s efforts and those of Mrs. Harris-Brooks and Mrs. Boutte are to hide evidence, shirk all accountability and concoct lies that will help them escape retribution through a court of law.

- Mrs. Harris-Brooks comportment over the past five years has been nothing less than reprehensible and she should have been removed long before the credit union’s finances plummeted and four branches closed. If she had taken the time to develop her knowledge about credit union’s finances and acquainted herself with some of the legalities underlying policy and laws governing the protection of member information, then maybe the President would have been stopped long ago, when he first revealed a proclivity for violating laws and policies. If she had chosen to be proactive versus corrupt, information might never have been posted on social media websites by employees like Priority MC. The credit union might also, never have been sued. Under California and federal law and bylaws, employees of financial institutions are prohibited from posting member names and information on public social pages and blogs including “social media network, public blogs and public forums.”

- What’s more, privacy protections are afforded under the Uniforms Commercial Code as adopted by the State of California, which states in part:

- No agency shall disclose any record which is contained in a system of records by any means of communication to any person, or to another agency, except pursuant to a written request by, or with the prior written consent of, the individual to whom the record pertains [subject to 12 exceptions]." 5 U.S.C. § 552a(b).

- Mrs. Harris-Brooks may feel tremendously frustrated with the President and some of his staff, knowing that her years of effort to suppress evidence, cover-up wrong doing, and perpetration of lies intended to exonerate the credit union of any wrongdoing, is being challenged and undermined by the very people she protected.

- Following publication of our last post, we thought that just maybe, Priority One would try to distance itself from its many legal problems and exact some effort to comply to its own policies and state and federal law. Priority MC’s comments, reminded us that within Priority One’s management sector, there is no intention to try and adhere to laws and policies.

- As for Mrs. Harris-Brooks, the Board and the Supervisory Committee, each leaves much to be desired. The public circumvention of policies and laws proves that they have consistently abused their appropriated authority. We anxiously await to see how Mrs. Harris-Brooks handles the latest complaint and if whether, she will try and rectify a wrong committed by an officer of the credit union or will resort to her usual evasive tactics, to avoid culpability for the reverberations caused by violation of the Privacy Act.

- We located the following complaint on www.yelp.com, written by a member of the credit union and succinctly, describing the problems she encountered while trying to rectify an error committed by Priority One.

-

Mrs. Harris-Brooks, the President and Mrs. Boutte may have deluded themselves into believing their abhorrent behaviors are justified. They may even have convinced themselves that they are the victims of some grand and elaborate scheme, designed to subvert their authority. In the light of tangible evidence, their assertions have continually been proven to be nothing more than hogwash. It is unfathomable to us why this herd of aged officers has chosen to conduct themselves in a manner that is both reprehensible and detrimental to the credit union. Based on the current state of things at the credit union, it wouldn’t again surprise us if other lawsuits are filed by former employees or by members whose personal account information has been compromised and once again, made public by an officer of the credit union.

Technorati Tags: Diedra Harris-Brooks,Diedra Harris,Diedra Brooks,Priority One Credit Union,Priority One Board of Directors,Priority One Supervisory committee,credit union board of directors,credit union supervisory committee,board of directors,supervisory committee,Yvonne Boutte vice president of support services,AVP Yvonne Boutte,Mrs. Boutte,Ms. Boutte,AVP support services,charles r wiggington,charles wiggington resume,charles r. wiggington,sr.,Charles Wiggington,Rodger Smock,Executive VP,Executive Vice President,Senior vice President Rodger Smock,Executive Vice President Rodger Smock,Bruce P. Needleman,Attorney bruce needleman,attorney bruce p needleman,violation of confidentiality,breach of confidentiality,social media,blogs,member lawsuit,bankruptcy,collection accounts,farmers mutual automobile insurance company,priority mc,second lawsuit,slander,defamation of character,libel,superior court,los angeles superior court,12C00147