A SHIFT IN FOCUS

Priority One Credit Union's shift in focus from business to an addictive reliance on expense reductions was set into motion by President Charles R. Wiggington, Sr. in early 2009 and magnified by now former and notorious COO, Beatrice Walker.

Unfortunately, the credit union's reliance on cut-backs will probably not be a practice that will dissipate anytime soon unless the President miraculously develops an understanding of marketing, accepts the importance of member service and learns how to listen. Don't expect any of these to ever occur.

He has been careful to ensure that his often brutal reductions in spending never effect his salary or that of the executive sector and instead, have deeply impacted non-exempt personnel through a wage freeze that was implemented in early 2009, elimination of benefits and reducing marketing and business development budgets.

Recently, Director of Project Development, Yvonne Boutte, disclosed that "charge-offs have decreased." What she never mentioned was that charge-offs decreased because they were written off. In fact, the amount of accounts referred to collection proceedings remain quite high and many can be attributed to Courtesy Pay, Priority One's overdraft protection which was introduced by Beatrice Walker. Courtesy is a wonderful example of how Priority One Credit Union is not anyone's "financial fitness center" or able to help any member "win with money."

Though in 2007, President Wiggington ordered reduced efforts made to develop new business amongst employees of the United States Postal Service, in recent months he's made a turn about face. His change in attitude was prompted by the failure of his plan to displace members who are employees of the United States Postal Service with employees and owners of Select Employer Groups. Unfortunately, his sudden interest in employees of the postal sector comes as a time which the postal service is suffering economic set-backs which have forced the closure of postal facilities, laying-off of postal employees and reduced the amount of payroll deposits received from employees of the postal service. A large number of postal employees who have been laid-off have closed their credit union accounts.

Priority One due to the imprudent decision of President Wiggington is now forced to obtain money where ever it can. This certainly isn't the credit union that for years viewed members as it's First Priority.

Unfortunately, the credit union's reliance on cut-backs will probably not be a practice that will dissipate anytime soon unless the President miraculously develops an understanding of marketing, accepts the importance of member service and learns how to listen. Don't expect any of these to ever occur.

He has been careful to ensure that his often brutal reductions in spending never effect his salary or that of the executive sector and instead, have deeply impacted non-exempt personnel through a wage freeze that was implemented in early 2009, elimination of benefits and reducing marketing and business development budgets.

Recently, Director of Project Development, Yvonne Boutte, disclosed that "charge-offs have decreased." What she never mentioned was that charge-offs decreased because they were written off. In fact, the amount of accounts referred to collection proceedings remain quite high and many can be attributed to Courtesy Pay, Priority One's overdraft protection which was introduced by Beatrice Walker. Courtesy is a wonderful example of how Priority One Credit Union is not anyone's "financial fitness center" or able to help any member "win with money."

Though in 2007, President Wiggington ordered reduced efforts made to develop new business amongst employees of the United States Postal Service, in recent months he's made a turn about face. His change in attitude was prompted by the failure of his plan to displace members who are employees of the United States Postal Service with employees and owners of Select Employer Groups. Unfortunately, his sudden interest in employees of the postal sector comes as a time which the postal service is suffering economic set-backs which have forced the closure of postal facilities, laying-off of postal employees and reduced the amount of payroll deposits received from employees of the postal service. A large number of postal employees who have been laid-off have closed their credit union accounts.

Priority One due to the imprudent decision of President Wiggington is now forced to obtain money where ever it can. This certainly isn't the credit union that for years viewed members as it's First Priority.

HOLD YOUR BREATH

In January 2011, then COO, Beatrice Walker informed numerous employees at the South Pasadena office that she was planning on opening a new branch in Santa Clarita no later than June 1, 2011. According to Ms. Walker, the new branch would be located just outside the gates of the Santa Clarita Processing & Distribution Center located at 28201 Franklin Parkway, Santa Clarita, CA 91383.

She and later, President Wiggington, would boast that the new office was actually being constructed by the USPS and that the annual cost to lease the space would be $1.00.

With consideration to the fact that June 1, 2011, has passed and in light of Ms. Walker's untimely departure, can we expect the opening of the branch, anytime soon?

SUBLIME AND RIDICULOUS

![clip_image002[1] clip_image002[1]](https://blogger.googleusercontent.com/img/b/R29vZ2xl/AVvXsEhd2K_7oB6KJ4uZfuXvgYH1bJUDFipGnw8yf94MeOEKMC_5kWcl7C-FClpGSkdNjiyrzlrasr4kjLQMIDY4RzfrEY6L4ohbrcEZf3WCmhCkb26bQiVH42nihPV0o8InpYAkz_4W5wXfx0-O/?imgmax=800)

Priority One CU Intranet, July 28, 2011

President Wiggington has allegedly ordered a tactical change to the credit union's highly corrupt Human Resources Department, allegedly to introduce improvements that will enable the credit union to keep abreast of changes impacting social (?) environments and "the world we live and work" in. The verbose announcement shown above, allegedly written by AVP, Rodger Smock, was actually composed by Robert West.

The fact is, the change is not motivated by a genuine interest to improve the functionality of the Human Resources Department but rather a reaction by the credit union to disclosures made by Priority One's legal counsel which asserted that over the years, Human Resources has violated credit union policies and laws and failed on a miserable scale to document employee complaints and resolve them. According to Richardson Harman Ober, the

department under leadership of Rodger Smock, had left the credit union vulnerable to lawsuits

as attested by by two lawsuits filed in 2010 and 2011 by former employees.

We've rewritten, as shown below, Mr. Smock's (actually Mr. West's) notice to employees, just in case the image shown above is difficult to read.

Author: Rodger Smock (AVP/Senior Vice President/Executive Vice President)

Date: 7/28/2011 12 AM

Please join me in congratulating Robert West and Esmeralda Sandoval.

Robert is being promoted to Director [of] Employee Services and Esmeralda Sandoval to Manager [of] Employee Services.

The concept of "Employee Services" encompasses key competencies of Human Resources/Education functions (i.e., staffing, education, employee engagements and special services). This new concept of Employee Services will allow for POCU to keep pace with the changing social environment within the world we live and work.

They both will be accepting new responsibilities and certainly new challenges for their new positions.

As stated previously, the change is strictly a preventative measure and one which is wholly insincere. As you will see in the next several months, the only change is the department's name and the Mr. West's and Miss Sandoval's titles (and salaries). Other than that, Rodger Smock will continue serving as the unofficial or should we say, invisible Director over Human Resources.

Portions of the language in the memorandum were plagiarized from numerous consulting sites strewn about the Internet. And we'd like to know that "special services" specifically refers to?

Mr. Smock/Mr. West wrote, "The new concept of Employee Services will allow for POCU to keep pace with the changing social environment within the world we live and work." Versus what, the social environment outside the world we live in?

On August 17, 2011, while speaking to CFO, Saeid Raad, Mr. West was heard exclaiming, "I'm not HR anymore!" No, Mr. West, you were never HR. You have no prior experience in HR including no education or training that would qualify you to serve in the department. Your appointment is purely political and no one knows this better than you. What's more, the change affecting Human Resources is only that of its name. The department will remain intact as will your responsibilities. And if you're not HR, then why is their a sign on your door that contains the words, "Robert West, Human Resources"?

Can someone please explain to Mr. West that contrary to his statement, he remains a member of Human Resources whose name has been changed on paper to reflect a disingenuous attempt to show that the corrupt Human Resources Department is trying to create an impression that it is concerned about the development of all employees.

Portions of the language in the memorandum were plagiarized from numerous consulting sites strewn about the Internet. And we'd like to know that "special services" specifically refers to?

Mr. Smock/Mr. West wrote, "The new concept of Employee Services will allow for POCU to keep pace with the changing social environment within the world we live and work." Versus what, the social environment outside the world we live in?

A MESSAGE TO ROBERT WEST

On August 17, 2011, while speaking to CFO, Saeid Raad, Mr. West was heard exclaiming, "I'm not HR anymore!" No, Mr. West, you were never HR. You have no prior experience in HR including no education or training that would qualify you to serve in the department. Your appointment is purely political and no one knows this better than you. What's more, the change affecting Human Resources is only that of its name. The department will remain intact as will your responsibilities. And if you're not HR, then why is their a sign on your door that contains the words, "Robert West, Human Resources"?

Can someone please explain to Mr. West that contrary to his statement, he remains a member of Human Resources whose name has been changed on paper to reflect a disingenuous attempt to show that the corrupt Human Resources Department is trying to create an impression that it is concerned about the development of all employees.

Mr. Smock’s/Mr. West's notice to employees may not be written in cuneiform but it remains saturated in ambiguity and is the equivalent of the credit union trying to "pull a fast one." After all, they're being sued and the actions of the Human Resources Department will be a subject of litigation.

We know that Robert West is completely unqualified to serve in Human Resources and that his position in the department was orchestrated by the President to justify Mr. West's continued employment. But how was it determined that Esmeralda Sandoval would be given the title of Manager?

Esmeralda Sandoval is a caustic presence at the credit union. In 2009, Beatrice Walker disclosed that Miss Sandoval was not the image of what she wanted in Human Resources. Miss Sandoval is a high school graduate with no education in Human Resources. In 2009, when Miss Sandoval learned that Ms. Walker had targeted her for termination, the clerk enrolled in classes at the University of Phoenix but never completed her course of study.

In what may have been an attempt at self-preservation, Miss Sandoval spent 2009 and 2010 immersed in providing fraudulent witness statements to the President, to Mr. Smock and to COO, Beatrice Walker. Her statements caused several employees to be persecuted, ostracized and subsequently, terminated.

And if knowledge was truly the goal of the renamed department, then why didn't they ever use the information provided to them in 2009 and 2010 by consultants, Lillestrand and Associates to introduce changes that might have improved employee performances, created a more cohesive working environment and helped ameliorate some of the damage caused by President

We know that Robert West is completely unqualified to serve in Human Resources and that his position in the department was orchestrated by the President to justify Mr. West's continued employment. But how was it determined that Esmeralda Sandoval would be given the title of Manager?

Esmeralda Sandoval is a caustic presence at the credit union. In 2009, Beatrice Walker disclosed that Miss Sandoval was not the image of what she wanted in Human Resources. Miss Sandoval is a high school graduate with no education in Human Resources. In 2009, when Miss Sandoval learned that Ms. Walker had targeted her for termination, the clerk enrolled in classes at the University of Phoenix but never completed her course of study.

In what may have been an attempt at self-preservation, Miss Sandoval spent 2009 and 2010 immersed in providing fraudulent witness statements to the President, to Mr. Smock and to COO, Beatrice Walker. Her statements caused several employees to be persecuted, ostracized and subsequently, terminated.

And if knowledge was truly the goal of the renamed department, then why didn't they ever use the information provided to them in 2009 and 2010 by consultants, Lillestrand and Associates to introduce changes that might have improved employee performances, created a more cohesive working environment and helped ameliorate some of the damage caused by President

A JACK OF ALL TRADES, A MASTER OF NONE

A few years ago, Training and Education Manager, Robert West, described the credit union as a place "where the devil lives." His statements describing the credit union as the dwelling place of an evil entity stopped when he became the ally and confidant of President Wiggington and more recently, the recipient of a promotion into a position he is ill-qualified to serve in. The fact is, Robert West has never contributed anything to help reverse the effects of the problems created by his "buddy", Charles R. Wiggington, Sr.

Just as Charles R. Wiggington, Sr. now owes everything to Diedra Harris-Brooks for squashing evidence he sexually harassed a former employee, Robert West now owes everything to President Wiggington for helping him avoid being laid-off in 2010 and earlier this year, when he'd been targeted for removal by COO, Beatrice Walker.

Mr. West has not been necessary to the credit union for many years. The credit union no longer has an official training department and even when it did, Mr. West was only mildly familiar with many of the credit union's processes, often forcing him to induct the assistance of employees who actually do the work. His placement into Human Resources, now referred to Employee Services, was just a ploy by the President to ensure that he could justify the continued employment of the unnecessary, Mr. West.

However, Mr. West who has never contributed anything that actually generates profit, expands business or helps to resolve employee morale issues will probably best remembered for his 2010 performance during an all-staff meeting. During the meeting, he chastised those employees he labeled "the blogger" and "bloggers" and who he labeled "haters" by reading Biblical scripture. The former college disc jokey apparently wanted to prove he is President Wiggington's own personal knight in shining armor.

Unlike the Employee Services Manager, Esmeralda Sandoval, Mr. West actually maintains an online biography alleging attesting to his expertise as a trainer, financial planning expert, and public speaker. Don't be fooled however, Mr. West is slightly more impressive than he is in person. The robotic and boring trainer lacks the talent or presence to be an effective trainer.

Just as Charles R. Wiggington, Sr. now owes everything to Diedra Harris-Brooks for squashing evidence he sexually harassed a former employee, Robert West now owes everything to President Wiggington for helping him avoid being laid-off in 2010 and earlier this year, when he'd been targeted for removal by COO, Beatrice Walker.

Mr. West has not been necessary to the credit union for many years. The credit union no longer has an official training department and even when it did, Mr. West was only mildly familiar with many of the credit union's processes, often forcing him to induct the assistance of employees who actually do the work. His placement into Human Resources, now referred to Employee Services, was just a ploy by the President to ensure that he could justify the continued employment of the unnecessary, Mr. West.

However, Mr. West who has never contributed anything that actually generates profit, expands business or helps to resolve employee morale issues will probably best remembered for his 2010 performance during an all-staff meeting. During the meeting, he chastised those employees he labeled "the blogger" and "bloggers" and who he labeled "haters" by reading Biblical scripture. The former college disc jokey apparently wanted to prove he is President Wiggington's own personal knight in shining armor.

Unlike the Employee Services Manager, Esmeralda Sandoval, Mr. West actually maintains an online biography alleging attesting to his expertise as a trainer, financial planning expert, and public speaker. Don't be fooled however, Mr. West is slightly more impressive than he is in person. The robotic and boring trainer lacks the talent or presence to be an effective trainer.

NOT THE CONSUMMATE PROFESSIONAL

Mr. West, like President Wiggington, has often violated credit union policy and has been paid by Priority One for hours in which he actually didn't work. He has, at times, been seeing sleeping comfortably in his office during working hours. In 2006, he authored a personal self-help book what at work. The book was not related to business nor was it related to any of his responsibilities as a trainer.

As stated previously, in 2009, Beatrice Walker targeted him for future termination. At the time, she disclosed the credit union had no need for a trainer. What's more, she found him to be an ineffective leader and concluded he contributed nothing to the credit union's operation. However, the President interceded and managed to stave-off Ms. Walkers plans and eventually justified Mr. West's continued employment by transferring him to the Human Resources Department though Mr. West had absolutely no experience or education in anything related to human resources.

In 2010, Ms. Walker resurrected her intent to expel Mr. West but a letter filed by the then Valencia Branch Manager which accused Ms. Walker of harassment, same-sex sexual harassment, stalking and creation of a hostile working environment, diffused her plan to remove Mr. West.

As stated previously, in 2009, Beatrice Walker targeted him for future termination. At the time, she disclosed the credit union had no need for a trainer. What's more, she found him to be an ineffective leader and concluded he contributed nothing to the credit union's operation. However, the President interceded and managed to stave-off Ms. Walkers plans and eventually justified Mr. West's continued employment by transferring him to the Human Resources Department though Mr. West had absolutely no experience or education in anything related to human resources.

In 2010, Ms. Walker resurrected her intent to expel Mr. West but a letter filed by the then Valencia Branch Manager which accused Ms. Walker of harassment, same-sex sexual harassment, stalking and creation of a hostile working environment, diffused her plan to remove Mr. West.

So what does Robert West have to say about himself? Well, we’re glad you asked. His biography, shown below, describes is accomplishments:

Robert West, Manager, HR/Education & Training, Greater Los Angeles Area / Financial Services.

Education

- Western CUNA Management Schools

- ASTO/USC Institute

- Ambassador University

- Connections: 14

Source: PROFILE

If you've ever had to endure listening to one of Mr. West's public addresses you'd quickly realize he is not a gifted or even slightly interesting orator.

And though he asserts his specialties include "motivational leadership", "emotional intelligence", "financial literacy, most employees can probably attest they've never witnessed this in any of Mr. West's classes, speeches or even in his 2010 calculated manipulation of staff members.

He also intentionally omits information about what he studied and fails to state if he ever graduated.

He did attend classes at Western CUNA Management Schools at the request of the President who approved payment for Mr. West's so-called education though we've yet to see anything that attests that what he learned while at the management schools was applied to the betterment of the credit union. He also fails to state if he ever earned a BA. Additionally, after 50-years, Ambassador University closed its doors 1997. There is also no mention as to what he studied and what degrees, if any, that he earned during

The credit union's current financial problems indicate that either the President and Board have not tapped into Mr. West's keen and well-honed financial knowledge or he just doesn't have anything to contribute that could improve business.

As for time management, his hours spent sleeping in his office and the hours spend writing a self-help book during working hours suggest he is ignorant about anything related to time management.

If he really possesses the knowledge and abilities documented in his biography, then wouldn't the credit union have utilized his alleged expertise in Integrity Selling® and Integrity Coaching® to develop strategies needed to induce growth and resolve the mess created by President Wiggington?

WHO IS CINDY GARVIN?

On August 25th, AVP, Rodger Smock issued a notice to all employees, announcing that on Monday, August 29th, the credit union will be welcoming its new Director of Lending, Cindy Garvin. Until recently, Ms. Garvin was a member of the Business Services and Marketing Department at Clearpath Federal Credit Union in Glendale, California.

Ms. Garvin is actually intended to be the solution to the issues created by President Wiggington and former COO, Beatrice Walker. Unless she has a magic wand, don't expect her to resolve the mountains of blunders caused by Mr. Wiggington and Ms. Walker and sanctioned by Board Chair, Diedra Harris-Brooks.

According to Rodger Smock, Ms. Garvin has more than 28-years of experience in collections, business development, branch operations and marketing. If she's that qualified, why would she come to work for the declining credit union. As a reminder, former COO, Beatrice Walker, was allegedly an expert in marketing, product development, business development, Human Resources and in developing viable new streams of income. Her July 2011 termination suggests she could not live up to her own hype.

Ms. Garvin is actually intended to be the solution to the issues created by President Wiggington and former COO, Beatrice Walker. Unless she has a magic wand, don't expect her to resolve the mountains of blunders caused by Mr. Wiggington and Ms. Walker and sanctioned by Board Chair, Diedra Harris-Brooks.

According to Rodger Smock, Ms. Garvin has more than 28-years of experience in collections, business development, branch operations and marketing. If she's that qualified, why would she come to work for the declining credit union. As a reminder, former COO, Beatrice Walker, was allegedly an expert in marketing, product development, business development, Human Resources and in developing viable new streams of income. Her July 2011 termination suggests she could not live up to her own hype.

HER BIO

Source: LinkedIn

Source: http://clearpathfcu.org/content/view/27/42/

Clearpath FCU

Total Income Gain/Loss

Quarterly Earnings/Losses

12/2010 – 06/2011

Dec 2010

-$643,159

March 2011

$180,873

June 2011

$249,112

Clearpath's performance in 2010 is not a reflection of Ms. Garvin's abilities but it does make one wonder why Priority One, a credit union in continuous decline, would hire an officer from a credit union whose financial standing denotes failures. Would any of you hire Charles R. Wiggington, Sr. to oversee your company's operations?

So will Ms. Garvey succeed in carrying out her assigned responsibilities or will she meet the same fate as Beatrice Walker?

THE LETTER

In October 2006, then Vice President of Operations revealed that he planned on implementing a sector of Assistant Vice Presidents, effective January 1, 2007, the date he was scheduled to begin his new role as President and CEO of the then growing credit union.

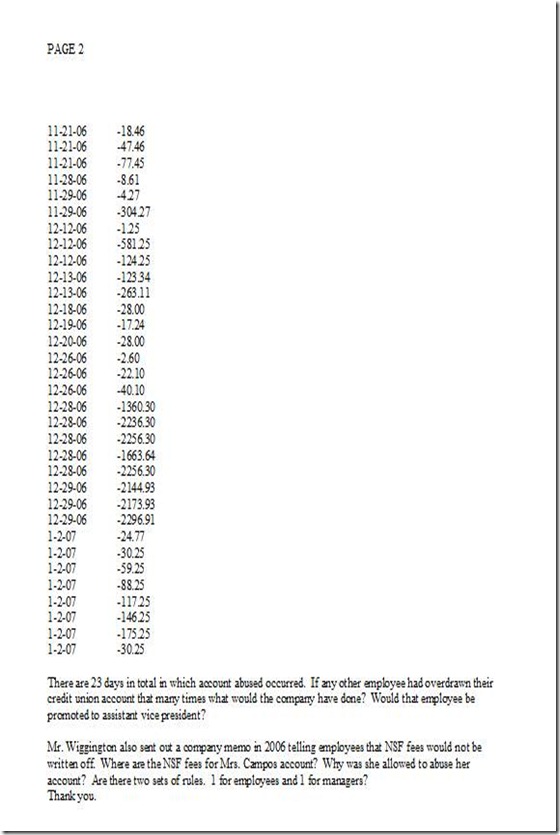

Of the four officers he intended to promote, two, Aaron Cavazos and Sylvia Perez, had a complied a well-documented history of abuses against employees. A third, Liz Campos, was known to commonly borrow money from co-workers and frequently overdraw her credit union checking account. Despite her abysmal mismanagement of her personal finances, President Wiggington chose to promote her. In October 2006, Mr. Wiggington stood in the lunchroom in the South Pasadena branch speaking to Director of Human Resources, Rodger Smock, and in the presence of several employees who sat eating lunch, told Mr. Smock, "I'm going to have to talk to Liz about her checking account." Mr. Wiggington never did and on January 1, 2007, Mrs. Campos began her knew though short-lived role as one of the President's new AVP's. Clearly unqualified to serve as AVP and like President Wiggington began abusing her authority. In March 2007, an anonymous letter was sent to then Director, David L. Davidson, advising him that Mrs. Campos had overdrawn her account more than 50 times during the period of 9/05/06 to 1/02/07. The Director delivered the letter to the credit union's attorney who in turn, ordered an investigation and audit of Mrs. Campos' credit union accounts. An investigation soon revealed that she had been kiting which is a federal offense and at the recommendation of the attorney, Mrs. Campos was terminated.

However, despite the illegality of her actions, the President became infuriated promising publicly to "I'm going to get Dave Davidson." Both an irrational and disturbing response revealing that Charles R. Wiggington, Sr. is a man incapable of differentiating between right and wrong.

The fact is, Mrs. Campos abuses were all known by Mr. Wiggington. He after all was the Vice President of Operations when most of the abuses occurred which means, he is the only one would could approve reversing each NSF fee incurred by Mrs. Campos. Though he admitted that normally it is he who approves or denies NSF fee reversals for employees, he insisted that everyone of the more than 50 NSF fees were reversed without his knowledge by the Member Services Department. A lie, no doubt. Here is the infamous anonymous letter which was used to expose Mrs. Campos' violation of federal law.

Of the four officers he intended to promote, two, Aaron Cavazos and Sylvia Perez, had a complied a well-documented history of abuses against employees. A third, Liz Campos, was known to commonly borrow money from co-workers and frequently overdraw her credit union checking account. Despite her abysmal mismanagement of her personal finances, President Wiggington chose to promote her. In October 2006, Mr. Wiggington stood in the lunchroom in the South Pasadena branch speaking to Director of Human Resources, Rodger Smock, and in the presence of several employees who sat eating lunch, told Mr. Smock, "I'm going to have to talk to Liz about her checking account." Mr. Wiggington never did and on January 1, 2007, Mrs. Campos began her knew though short-lived role as one of the President's new AVP's. Clearly unqualified to serve as AVP and like President Wiggington began abusing her authority. In March 2007, an anonymous letter was sent to then Director, David L. Davidson, advising him that Mrs. Campos had overdrawn her account more than 50 times during the period of 9/05/06 to 1/02/07. The Director delivered the letter to the credit union's attorney who in turn, ordered an investigation and audit of Mrs. Campos' credit union accounts. An investigation soon revealed that she had been kiting which is a federal offense and at the recommendation of the attorney, Mrs. Campos was terminated.

However, despite the illegality of her actions, the President became infuriated promising publicly to "I'm going to get Dave Davidson." Both an irrational and disturbing response revealing that Charles R. Wiggington, Sr. is a man incapable of differentiating between right and wrong.

The fact is, Mrs. Campos abuses were all known by Mr. Wiggington. He after all was the Vice President of Operations when most of the abuses occurred which means, he is the only one would could approve reversing each NSF fee incurred by Mrs. Campos. Though he admitted that normally it is he who approves or denies NSF fee reversals for employees, he insisted that everyone of the more than 50 NSF fees were reversed without his knowledge by the Member Services Department. A lie, no doubt. Here is the infamous anonymous letter which was used to expose Mrs. Campos' violation of federal law.

THE PRESIDENT'S ACCOMPLICE

The abuses and violations of credit union policies and state and federal laws could never have occurred without the involvement of the Human Resources Department and it's Director, the incompetent and chronically corrupt, Rodger D. Smock.

Mr. Smock's motivation may simply be retaining his employment. He is over 70 years old and not easily employable. He has intentionally chosen not to document and investigate employee complaints and though policy states quite clearly that a grievant will be informed of how their concerns and complaints were resolved, he has after many years, failed to do this in every single complaint ever filed with his department. In the end, Mr. Smock is corrupt, as unethical and as guilty of committing egregious acts as are President Wiggington and Board Chair, Diedra Harris-Brooks.

The following complaint against AVP, Sylvia Perez, was filed by a Business Development Representative and submitted to the attention of Rodger Smock. Like all other complaints filed over the years, Mr. Smock never investigated the grievant's contentions. He also never provided a response to the grievant. Like any concern sent to Mr. Smock, the complaint was ignored.

- The form described in the Business Development Representative's letter did not contain the credit union's logo or mandated headers.

- It also did not contain required disclaimer language.

- There was also no statement ensuring protection of the member's personal information.

Despite the fact the letter was out-of-compliance with credit union policy and state mandates, neither, Sylvia Perez or Rodger Smock could find anything wrong or inappropriate with the letter. Then again, in 2008, Mrs. Perez and Mr. Smock used fraudulent information to terminate the then newly hired Van Nuys Branch Manager who discovered that Mrs. Perez had, over a period of several years, never provided training to any of her staff in the proper and legally mandated procedures used to count, issue, and bundle cash. The self-righteous Mrs. Perez is never one who accepts accountability for her heinous behaviors and irresponsible acts and who escaped disciplinary actions that should have been leveled against her for her overt violations of credit union policies and state laws. Her ability to escape retribution was not because she is clever but because Rodger Smock is unethical and ignored complaints that exposed Mrs. Perez of wrong doing.

In retaliation to the Business Development Representative's letter, Mrs. Perez launched a bitter campaign, slandering the employee publicly and labeling him a "troublemaker" and accusing him of being "insubordinate". Mr. Smock joined Mrs. Perez and complained to the President, accusing the Business Development Representative of insubordination.

In spite of her unethical proclivities, in 2007, Mrs. Perez was appointed head of the WOW Committee. The committee's purpose was to create a cohesive working environment that fostered solidarity, hope, and happiness within the workplace. On paper, it was a wonderful idea. The problem with the WOW Committee's efforts is that they were being directed by the dishonest, controlling, hyperactive, insolent and abuse Mrs. Perez. You couldn't have picked a worse leader to head a committee whose goal was to foster a healthy working environment.

The committee, like much implemented by and under President Wiggington, was short-lived. It's members began resigning because Mrs. Perez became insufferable. Some complained that she is aggressive, tries to dominate the members and loves grandstanding to make certain that she is fully credited for everything and anything done by the committee.

If Mrs. Perez is monstrous, it's because she has been enabled by the ethically bankrupt, Rodger Smock. It is he who has enabled the abuses of the President and some managers and it is his disdain for rules and laws that has helped perpetuate the egregious acts committed by the credit union's executive sector and which has allowed good, hard-working employees to be slandered, abused and ultimately expelled.

CONCLUSION

Since Charles R. Wiggington, Sr. was appointed President on January 1, 2007, we've witnessed frequent changes to the credit union's so-called, corporate structure. We've seen the introduction of drastic expense reductions and we've seen good employees slandered and terminated. We've also watched as the President brings on new, highly paid executives to try to make order of the messes he's created. What we don't see is any improvement.

According to the ad posted a few months ago on job boards, employment websites, industry periodicals and websites, the credit union was in search of a Director of Lending who would be paid approximately $69,000 per year. The person hired by the Board of Directors is Cindy Garvin, but does she possess the experience, talent and patience to try and delve through the chaotic array of blunders created by the President, exacerbated by the former COO, and sanctioned by Board Chair, Diedra Harris-Brooks?

Adding to the fray is the immense of money the credit union is spending on consultants who are allegedly trying to resolve the credit union's horrendous public reputation. The problem at Priority One is that the cause of the credit union's decline remains in place. What's more, the Board and it's abhorrent Chair, Diedra Harris-Brooks, have decided to retain and protect the President despite his far flung failures. It makes no sense except that this is a highly unethical and amoral body of Directors.

And why has Priority One's spending on "legal" more than quadrupled since January 1, 2007? What exactly is the credit union spending so much money on that requires the constant use of attorneys?

The cycle of destructive acts has also been enabled by Human Resources and its corrupt Director, Rodger Smock, who has violated policies and state and federal laws and whose actions provoked the filing of lawsuits by two former employees.

Ms. Garvin will likely fail because what the President and Board Chair will continue to do, is set new executives up for failure. You can't get good fruit from a bad tree and Mr. Wiggington and Mrs. Harris-Brooks are incapable of producing anything that is good for the credit union, good for members and good for employees. It's just not their forte.

- Mr. Wiggington's $600,000 phone system proved and expensive debacle.

- His hiring of Beatrice Walker to serve as his personal hitman, exacerbated the credit union's internal problems and further taxed the credit union's financial resources.

- His inability to create effective marketing strategies resulted in the closure of the Redlands and Valencia branches and the laying off of a large number of employees.

According to the ad posted a few months ago on job boards, employment websites, industry periodicals and websites, the credit union was in search of a Director of Lending who would be paid approximately $69,000 per year. The person hired by the Board of Directors is Cindy Garvin, but does she possess the experience, talent and patience to try and delve through the chaotic array of blunders created by the President, exacerbated by the former COO, and sanctioned by Board Chair, Diedra Harris-Brooks?

Adding to the fray is the immense of money the credit union is spending on consultants who are allegedly trying to resolve the credit union's horrendous public reputation. The problem at Priority One is that the cause of the credit union's decline remains in place. What's more, the Board and it's abhorrent Chair, Diedra Harris-Brooks, have decided to retain and protect the President despite his far flung failures. It makes no sense except that this is a highly unethical and amoral body of Directors.

And why has Priority One's spending on "legal" more than quadrupled since January 1, 2007? What exactly is the credit union spending so much money on that requires the constant use of attorneys?

The cycle of destructive acts has also been enabled by Human Resources and its corrupt Director, Rodger Smock, who has violated policies and state and federal laws and whose actions provoked the filing of lawsuits by two former employees.

Ms. Garvin will likely fail because what the President and Board Chair will continue to do, is set new executives up for failure. You can't get good fruit from a bad tree and Mr. Wiggington and Mrs. Harris-Brooks are incapable of producing anything that is good for the credit union, good for members and good for employees. It's just not their forte.

“No legacy is so rich as honesty.”

William Shakespeare

![clip_image002[1] clip_image002[1]](https://blogger.googleusercontent.com/img/b/R29vZ2xl/AVvXsEhKzPY-ILwcffwtAgx2zrOTaR0Y2OofP_NkD9_nfj7GJhupkAfs2QrFr1fS9wULra-MysHpkfq-gwWmf-89xiFpLbE1i52mYetwrOkyv_ocIAZ6EhBpRCYMz5bSxDiE2yqXzlDSgmOHWrUt/?imgmax=800)