COUNTING THEIR EGGS

BEFORE THEY HATCH

In January, President, Charles R. Wiggington, Sr., jubilantly conferred with Executive Vice President, Rodger Smock, informing him that Bauer Financial had finally bumped up Priority One Credit Union from its long held three-star standing, to four stars. The President declared the upgrade would serve to assure members and potential new members, that Priority One is a sound and prospering credit union. Evidently, President Wiggington may hope the new and improved rating will magically jump start the credit union’s sluggish sales performance and possibly even deal a lethal blow to his most avid critics.

Bauer’s disclosure couldn’t have come at a more opportune time for the troubled credit union and sheds a positive light on an organization whose performance over the past six years, has been marred by failures, losses, and widespread disorganization. The four-star rating issued by the bank research firm is based on an independent analysis of data obtained from the credit union’s quarterly Call Reports filed by the credit union with government regulators. So should the four-star rating be viewed as a sign that Priority One is finally amassing new business and reaping a substantial amount of profit? We believe President Wiggington is again being presumptuous. As an opportunist we foresee him trying to squeeze everything he can from Bauer Financial’s assessment.

IS IT MUCH ADO ABOUT NOTHING?

Understandably, President Wiggington is desperate and will cleave to anything that sheds a positive light on the declining organization while deterring attention away from the credit union’s well-documented record of failures. Almost immediately after receiving notification from Bauer, the President and his Executive Vice President published Bauer’s emblem and declaration (shown above) on the credit union’s webpage and Facebook pages. So what exactly does the four-star rating say or not say about Priority One’s performance.

Priority One’s performance lagged throughout 2012. During the year, the credit union permanently closed the doors to its Burbank branch. They also terminated a large contingent of long-time employees in an effort to eliminate the payment of salaries and benefits which were taking a financial toll on the credit union. During 2012, there were also an unprecedented number of medical leaves taken and all alleging work-related stress. At then end of 2012, the President terminated CLO, Cindy Garvin, for failing to resolve the credit union’s inability to create new business. Like his efforts in 2008, 2009, 2010, and 2011, the President again failed to develop or implement a single strategy which translated into success. In the end, 2012 turned out to be as unremarkable as any of the 5 years which preceded it.

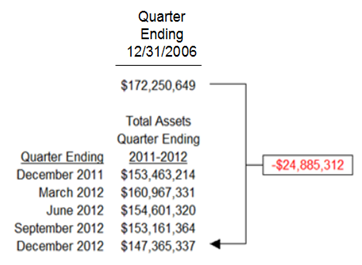

Since becoming President, Charles R. Wiggington’s, Sr.’s performance has been characterized by shrinkage versus growth; losses versus gains. Priority One is not only a physically much smaller credit union than it was on January 1, 2007, its asset size has also decreased by more than $20 million over the past 6 years.

The credit union’s monthly income statements and quarterly Financial Performance Reports and a large amount of circumstantial evidence point to deficiencies permeating the poorly managed credit union, hardly what one would expect from a four-star credit union. Curious as to how Bauer determined that Priority One is a four-star credit union, we visited their website where we extracted the following disclaimer:

Explanation of Criteria Used to Determine BauerFinancial Star Rating™

Financial data is compiled for credit unions as reported to the National Credit Union Administration (NCUA, the governing body for credit unions. Although the financial data obtained from this source is consistently reliable, the accuracy and completeness of the data cannot be guaranteed by BauerFinancial, Inc.

The disclaimer reveals that Bauer Financial’s assessment is gotten from a review of information obtained from the National Credit Union Association (“NCUA”). The information obtained from the NCUA was gotten from the credit union. It is safe to conclude that the information is only as good as the employee who prepared and submitted it to the NCUA. If the data contained any inaccuracies, the Bauer’s assessment would be incorrect.

We were also reminded that in 2009, President Wiggington and his then friend and COO, Beatrice Walker, conflicted with CFO, Manny Gaitmaitan, who at the time, refused to use creative accounting in reporting the credit union’s monthly profits and losses. Because of his refusal, the President and COO disclosed that Mr. Gaitmaitan was uncooperative and not a “team player.” They along with Executive Vice President, Rodger Smock, quickly distanced themselves from Mr. Gaitmaitan and soon stopped stopped inviting the ostracized CFO from their meetings. The rift between the CFO and three officers became so pronounced that in November 2009, Mr. Gaitmaitan tendered his resignation. Though his final date of employment was not to be until Thursday, December 31, 2009, Mr. Gaitmaitan left the credit union at the beginning of December returning only at the end of the month to bid good-bye to his staff.

At the end of January 2010, just weeks following Mr. Gaitmaitan’s departure, the credit union closed its books for the month of January and reported a small but substantial amount of profit. Considering the credit union’s horrendous performance throughout 2009, the amount of profit generated for the month of January was nothing short of a miracle. At the time, then COO, Beatrice Walker, boasted that the credit union’s newly acquired profit came as a result of improvements she introduced. However, her declarations were met with suspicion by some long time employees who viewed the sudden surge in new business as both odd and suspicious. It just didn’t make sense that following a year (2009) of the highest losses incurred in the credit union’s 81 year history, that a sudden spurt of profit would have occurred. Furthermore, January is traditionally a slow month for business at the credit union. So how did Beatrice Walker and President Wiggington produce profit using allegedly new and innovative methodologies?

The mystery as to how the credit union acquired profit surfaced at the end of February 2010, when a member of the Accounting Department disclosed that the President and the COO had actually moved funds from other credit union ledgers and reported these as profit for the month of January 2010. The purpose of their deceptive tactic was to create the impression that changes introduced by Beatrice Walker had suddenly produced high amounts of new business. However, the effects of their manipulative ploy was short-lived. By March 2010, the credit union’s monthly income began to plummet and by the end of December 2010, the credit union reported losses in excess of half a million dollars.

Another incident suggesting the credit union’s performance is continuing to lag is the December 28th termination of former CLO, Cindy Garvin. We know that at the beginning of December, the President conferred with Board Chair, Diedra Harris-Brooks. They concluded that Ms. Garvin had failed to resolve the issues impeding the acquisition of new business. Her efforts had continually failed to achieve the heights, Ms. Garvin assured them would be attained if she was allowed to implement unhampered changes to how the credit union sells its products. A review of the promotions she designed and strategies she introduced showed little if any success. The concluded that Ms. Garvin’s failures were sufficient to warrant her termination.

The President may hope people will ignore the credit union’s towering internal issues and its inability to acquire new business and cleave to the credit union’s current declaration that a member’s money is “safe” at Priority One Credit Union. Based on documented evidence, i.e. monthly income statements and Financial Performance Reports, the loss of four branches, lawsuits, terminations, lay-offs, etc. and a multitude of circumstantial evidence, we suggest taking any claim of success with the utmost grain of salt. After all, we’re not ignorant of President Charles R. Wiggington, Sr.’s devices.

*Read more: http://www.city-data.com/forum/economics/577199-strong-banks-weak-banks-credit-financial.html#ixzz2LH2ZAKFf

THIS POST

In this post, we continue our expose’ on the issues, we believe, will continue to undermine Priority One Credit Union’s ability to achieve success in 2013.

A problem that has persistently hampered Priority One from escaping its inability to draw member interest in what they sell is the deficient level of member service they presently dispense. This is not a new problem. In 2009, former COO, Beatrice Walker, entered into an ambitious plan to resolve the problems permeating member service. On the surface, Ms. Walker’s intents seemed good but as she would later reveal, her efforts were designed to impress the Board of Directors and prove that unlike President Wiggington, she possessed the talent needed to build a better and bigger credit union. Her efforts were carried out using manipulation and driven by greed.

Ms. Walker began planning out what she would describe as a “state-of-the-art one-stop call center” that would possess the capacity to respond to member inquiries, requests, concerns, and complaints. It was an impressive enterprise but like almost all things endeavored by Ms. Walker and President Wiggington, one doomed for failure. Her first big mistake was her refusal to conduct extensive and in depth research which would have determined the feasibility and cost-effectiveness of a call center and more importantly, whether the department would meet the needs of the membership.

Another failure was her horrendous disregard for the then IT Supervisor who she described as difficult and incapable of comprehending her vision. The problem was not so much a lack of comprehending her intents as much as it was conceding to her unethical proclivities. Shortly following her arrival at the credit union, Ms. Walker purchased an expensive laptop for work. Under the credit union’s procedures, she was to confer with the IT Supervisor who would order the laptop and charge it to the credit union’s account. In addition to circumventing the IT Supervisor, Ms. Walker tried to obtain reimbursement without providing acceptable proof of the purchase. By the way, Ms. Walker was also the same officer who would submit receipts seeking reimbursements for supplies purchased for the job but who would tear off the portion of the receipt containing the names of the businesses where the item had been purchased. In planning out her call center, Ms. Walker complained that the IT Supervisor was incorrigible and difficult and impossible to work with.

A large portion of the research allegedly carried out by Ms. Walker merely consisted of visiting other credit unions with Executive Vice President, Rodger Smock, in tow, and asking a series of questions about their call centers. She proved incapable of understanding the importance and necessity of logistics. Furthermore, her final schematic for the Call Center ignored a number of variables that would have proven the call center’s feasibility. Ms. Walker also refused to consider hiring an outside contractor who might be able to provide services satisfying the credit union’s needs. By the way, hiring an outside contractor may have proven far less expensive than her self-indulgent enterprise. It’s also important to remember that Ms. Walker’s call center could not have been implemented without approval of President Wiggington and Board Chair, Diedra Harris-Brooks.

Since its implementation, the Call Center has never lived up a single promise made by Ms. Walker. The call center has continually been beset by technical problems. e department has been mismanaged by various officers including its first supervisor, Joseph Garcia, and AVP’s, Yvonne Boutte, and Gema Pleitez. The staff has been overloaded with an immense amount of incoming calls while be required to fulfill unreasonable expectations including monthly sales goals of $100,000. Not so surprisingly, neither Mrs. Boutte, Mrs. Pleitez*, or Mr. Garcia has ever generated $100,000 in new business during any single calendar month. At present, AVP, Gema Pleitez, serves as the department supervisor under authority of AVP, Yvonne Boutte. Mrs. Pleitez monitors phone calls to ensure calls are kept brief. She stated that the purpose of the call center is not service but sales. Like President Wiggington, Mrs. Pleitez considers member service inconsequential to the acquisition of new business.

We don’t foresee improvement in the credit union’s performance over the next twelve months. The greatest impediment facing Priority One is its President- the same person who caused the credit union’s decline. As we’ve often stated, it is wholly illogical that the person who caused its decline is responsible to lead it out of its financial quagmire.

*Sales obtained by Mrs. Pleitez during 2012, included sales actually obtained by her subordinate staff but credit to her so that she could meet her assigned monthly goals.

“Not everything that shines is gold” and nowhere is that more true than at Priority One Credit Union where President, Charles R. Wiggington, Sr. and Board Chair, Diedra Harris-Brooks, have spent years and immense amounts of credit union funds on creating facades that create the impression Priority One Credit Union is a well-oiled machine. The costly veneers have always had a short shelf life, usually crumbling in the light of public exposure. The money spent on deflecting attention from failures could have been spent on solutions and strategies that resulted in the growth and expansion of business.

Of course, the December 28th termination of Cindy Garvin testifies that Priority One is in trouble and unable to rectify the problems impeding it from acquiring new and substantial levels of new business. It is reasonable to conclude that Ms. Garvin would not have been terminated if business were actually good with high sales being reaped; if expansion of the credit union’s presence within the communities it serves was actually occurring; and if high profits had been gotten from their minimal marketing efforts. Her termination was the result of a review of the credit union’s financials by the President and Board Chair, Diedra Harris-Brooks, which concluded Ms. Garvin’s strategies had failed to acquire a solid level of profit. To be fair, Cindy Garvin, accepted employment with a heavily mismanaged credit union and agreed to resolve problems authored by the credit union’s inept President. We also remember that it was President Wiggington and the Board Chair who hired Beatrice Walker in 2009, for the expressed purpose of streamlining business; reducing costs; eliminating enemy employees; and creating new and prosperous streams of income. As we’ve referenced in numerous past posts, in 2010 during the Annual Meeting, Mrs. Harris-Brooks declared that “We believe we have the right management team in place.” Evidently, Mrs. Harris-Brooks assessment proved another indictment of her evident ineptitude as Board Chair and her inability to intelligently assess the management team’s performance.

IS IT REALLY CORPORATE RESTRUCTURING?

On December 29th, one day following the termination of CLO, Cindy Garvin, the President announced yet another corporate restructuring. We’re uncertain if this was the 5th restructuring introduced by the President since January 1, 2007 or if it is his 15th, whatever the number, we don’t expect any improvement anytime in the new future, that might finally and for once resolved Priority One’s evident inability to sell its wares on a wide scale. It became obvious when he announced the latest change that he must have been preparing his restructuring for sometime before informing Ms. Garvin that her employment was being severed.

The President’s latest scheme gives notorious AVP, Yvonne Boutte, authority over branch operations for all of Priority One’s remaining offices. Over the years, Mrs. Boutte has proven she isn’t a people person and refuses to work well with others. She has continually demonstrated a need to subjugate people, exacting control over staff and circumstances. She is also known as meddlesome and opinionated even about things she knows nothing about. Despite her acerbic personality and well documented record of abuses, she has been given authority over the Member Services Department in South Pasadena, California, over Credit Resolutions (“collections”), and over the South Pasadena Teller Department. All we can say is, “Yikes!”

In 2009, Mrs. Boutte’s department worked overtime, on Saturdays, during which they called members whose credit union accounts were delinquent. During that period, she boasted that she and the President had programmed the collection department’s outgoing calls so that a member’s Caller ID would show the name of the California Lottery instead of Priority One Credit Union. Mrs. Boutte’s deceptive tactic is possibly illegal. One would have thought that an alleged “expert” in collection proceedings would try to work within in compliance to state and federal laws rather than employing deceptive tactics by which to ensnare members. Mrs. Boutte is also the same officer who in mid-2012, provoked a member into filing a lawsuit alleging the credit union had knowingly and with malicious intent published the member’s confidential account information on the Internet. Additionally, an employee of the credit union also published defamatory statements about the member’s person.

The other internal change is the reinstatement of AVP of Compliance, Patricia Loiacano, over the Real Estate and Consumer Loan Departments. Mrs. Loiacano unlike the President and Executive Vice President, is actually knowledgeable about the processes, laws, and policy governing loan funding. Though possessing extensive experience in loan funding, her authority over loan development was removed by former COO, Beatrice Walker, who declared that it was illegal under state law, for Mrs. Loiacano to oversee lending and compliance. According to Ms. Walker, this was a conflict of interest. On the surface, it appeared that Ms. Walker was exacting efforts to ensure Priority One complied to state law and something she rarely did during the two years of her employment. However on close inspection her directive ordering removal of Mrs. Loiacano over loans was actually motivated by her personal desire to transfer authority over lending to her then friend and confidant, Joseph Garcia.

Though Mrs. Loiacano is probably the best choice for overseeing all things related to loan development, her presence at the credit union has not been without incident. Years ago, while serving in the capacity of Lending Supervisor, then Vice President of Operations, Charles R. Wiggington, Sr. demoted Mrs. Loiacano because in his opinion, she did not know how to work well with her subordinate staff.

Over the years, Mrs. Loiacano became known for an unwillingness to share her knowledge and the condescending manner in which she speaks to employees. In 2008, a concerned Loan Processor informed Mrs. Loiacano that the then DMV Specialist had asked a temporary employee to forge member signatures of the DMV’s Power of Attorney form for only those loans where members were not asked to sign the Power of Attorney. The forgeries constitute fraud and are illegal. When informed of the situation, Mrs. Loiacano, the then Assistant of the Lending Director, stated there was nothing she could do as the DMV Specialist obtained approval form the Director of Lending. Evidently, the illegality of the incident or the potential legal repercussions to the credit union were insufficient to prompt Mrs. Loiacano to do what was ethically and legally correct.

DETERIORATING RELATIONS

In January 2007, he ordered his then new, shiny contingent of AVPs to focus on SEG development, declaring that he wanted to change the credit union’s membership demographics to include more and more business owners and their employees. Inclusive, was his directive that less be placed on the development of new business amongst employees of the United States Postal Service.

The motive behind the President’s vision was clear. For years he had boasted about his past employment in the banking industry and had often stated that if given the opportunity he would develop products and services that resembled those offered by banks.

In September 2010, then COO, Beatrice Walker, and Executive Vice President, Rodger Smock, drove to Santa Clarita where they met with members of the no longer existent Business Development team and informed them that SEG development was to cease immediately. The Executive Vice President explained that the credit union did not possess the resources needed to continue SEG development, adding that the decision was only temporary. Priority One’s records clearly prove SEG participation has not been a lucrative venue of income for the credit union. SEGs have often shown an almost complete disinterest in anything offered by the credit union though there are a handful of SEGs that have remained loyal to the credit union, though the total business received from these is hardly consequential in helping reverse the credit union’s many issues impeding its ability to attract member interest in what they offer. The Business Development team was also ordered to focus sales efforts on reaching employees of the United States Postal Service and employees of Providence St. Joseph, Providence Holy Cross, and Providence Tarzana medical centers.

In the months which followed, officers of Providence St. Joseph sent inquiries to the credit union, requesting a decision regarding the space offered to Priority One. Their inquiries were continually ignored by the Executive Vice President, the COO, the Collections Manager, the AVP, and the President. In mid-2010, the hospital withdrew its officer and by 2011, sent notification to the credit union advising them they were no longer invited to attend monthly new hire presentations, during which they had been allowed to meet with new employees and advise them about the benefits of membership to Priority One. In 2011, Providence St. Joseph contacted the credit union and informed them that were no longer invited to participate in the medical center’s monthly new hire orientation. Incensed, the President ordered the cessation of all business development efforts to the hospital and its affiliates. Evidently, it never occurred to the President that it is Priority One Credit Union who needs Providence St. Joseph and not the other way around.

Since late 2010, complaints from the postal sector have steadily increased. These cite poor service, the inability of the credit union to manage its own ATM’s, and the difficulty applicants have in obtaining loans. Following closure of the Burbank branch, many members closed their accounts with a large number of other members referred to other credit unions by former employees of the credit union.

President Wiggington’s fickle and emotionally erratic decisions, have served to weaken the credit union’s relationship to its once loyalist members. His current hope to obtain community charter in South Pasadena seems delusional when one considers he has failed to maintain relations with the SEGs and communities served by the credit union. If not true, then ask Mr. Wiggington when was the last time the credit union visited Riverside County for the expressed purpose of connecting with postal employees in that region?

BRANCH CLOSURES

The President would probably like members to ignore that Priority One was forced to close four branches over the past 27 months. In 2010, the credit union was unformed by auditors that capital had dropped and was teetering on 6%. The President was told to reduce expenses, lest the credit union be taken over by the NCUA. At the time, it became clear that Priority One could no longer afford to pay its monthly leases for the Burbank, Redlands, or Valencia branches. According to disclosures made by former COO, Beatrice Walker, those branches were not bringing in sufficient new business on a monthly basis to offset the expense of leasing the spaces occupied by each branch. Evidently, prior to the Charles R. Wiggington, Sr.’s appointment to President, the credit union was able to pay the leases for each office. Coincidence? Hardly. Though the closure of the branches eliminated the payment of expensive leases and salaries and benefits paid to the former employees of those offices it did save Priority One from closing its door. The closures also eliminated convenience the credit union once could afford to offer.

LAWSUITS

Few credit union’s can boast the number of lawsuits filed by ex-employees in less than a two-year period as can Priority One. The lawsuits filed by four employees each allege wrongful termination and a hostile working environment. Some cite abuses committed by Beatrice Walker while others cite abuses perpetrated by Charles R. Wiggington, Sr. All allege involvement of Priority One’s Human Resources Department in perpetuating the abuses.

In response to the first and second lawsuits, the President declared innocence of all wrongdoing, even asserting that the Plaintiffs were disgruntled employees who were trying to take advantage of the former employer. Despite cries of innocence, the credit union requested settlement of each lawsuit, though a few months later, the President divulged confidential information pertaining to each lawsuit, some of which was thereafter published on the Internet by one of his confidants.

Unfortunately, the President’s assertions that he and his staff could never have committed the acts described in each lawsuit appear untrue by the mere fact Priority One requested and settled the first two complaints. It may never have occurred to the chronically dull President that the settlements speak volumes of who he is the President and CEO and who the credit union is as an employer.

A WRINKLE IN HIS STORY

Despite the President’s boasting and that of his Executive Vice President, that Priority One is a bonafied four-star credit union, the companies performance in October, November, and December 2012, were sufficiently bad to force termination of CLO, Cindy Garvin. We again reviewed the credit union’s Financial Performance Reports for the quarter ending December 31, 2011 through December 31, 2012. If Priority One is in fact prospering as the President and his Executive Vice President would like members and employees to believe, then the President may want to explain why Priority One has lost $24,885.312 since the date he became President. Additionally, from October 1, 2011 through December 31, 2012, the credit union’s Net Income has declined by $6,098,077.

The drop in Net Income has been accompanied by employee terminations and lay-offs, account closures, and drastic budgetary cuts. This hardly supports the President’s contentions that Priority One is experiencing a period of prosperity and growth.

BURSTING

THE

PRESIDENT’S

BUBBLE

The strength or for that matter, the weakness, of any credit union to acquire new business, expand membership, or promote its name is inconsequential in determining their rating. The National Credit Union Association (NCUA) is most concerned with a credit union’s capital and ensuring it falls within mandated perimeters.

Bauer Financial does not provide a list of the specific factors that were used to determine Priority One’s rating, at least not without payment of a fee. Even if the information were available, most consumers might have difficulty understanding what the data means. However, amongst companies that rate financial institutions, Bauer Financial and Bankrate are the most credible. Since Bauer Financial now rates Priority One a four-star credit union, we decided to search for some record of the specific information used to assess Priority One’s rating. We again visited Bankrate.com, who we first visited in 2012, obtaining a record of the strengths, weaknesses and the conclusion the derived from reviewing Priority One’s performance through the quarter ending September 2012. The information they compiled is shown below with negative findings highlighted in RED and positive findings, highlighted in BLUE. Please note that the earnings assessment is based on the credit union’s latest four quarters (9/1/2011 – 09/30/2011) of reported income and expenses.

Priority One Credit Union

STAR RATING: 3

Predictive Indicator neutral

Predictive Indicator neutral

Net Capital / Assets 8.21

Below Peer Norm

Capital (1) / Assets 9.31

Below Peer Norm

Below Peer Norm

Nonperforming Asset Ratio (2)

8.44

Somewhat Higher Than Standard

Loss Reserve Coverage (3)

140.98

Much Better Than Normal

140.98

Much Better Than Normal

Asset Growth Rate

-3.28

Below Normal

-3.28

Below Normal

Return on Average Assets

0.35%

Below Average

0.35%

Below Average

Overhead / Average Assets

4.87

Significantly Higher Than Average

4.87

Significantly Higher Than Average

Balance Sheet Liquidity

34.73

Strong

34.73

Strong

Bankrate’s review identified two areas of concern: Capital Adequacy and Overhead. The Capital Adequacy Ratio (CAR) is a ratio representing the bank’s capital against its risk or potential loss. Tracking Capital Adequacy ensures the credit union can absorb a reasonable amount of loss while complying with statutory Capital requirements (ratio of liquid assets that must be held against the amount of money that can be lent). Evidently, Bankrate is concerned that Priority One’s Capital Adequacy may fall. Overhead on the other hand, represents operational costs. The concerns suggest that Priority is NOT generating sufficient profit to offset outgoing spending which in turn, might affect the amount of their Capital Adequacy Ratio. All roads point back to Priority One’s inability to generate sufficient new businesses needed to pay overhead and operate securely.

Bankrate declares that as of 9/30/12, Priority One exhibited a “generally satisfactory condition” though its performance is characterized by:

- Below standard capitalization

- Good asset quality

- Substantially lower than normal profitability

- Ample liquidity

Bankrate closes by stating:

Hence, our Safe & Sound Star ratings should not be deemed predictive of likely future ratings. However, in view of early warning indicators set forth within this report, in combination with the institution's financial data, we believe that the Star rating for this institution is unlikely to change within the ensuing twelve month period.

A

GIVING CREDIT WHERE CREDIT IS DUE

Beginning in May of last year, biographies for the President and Executive Vice President began popping up around the Internet, each exaggerating the alleged achievements of each officer and all declaring achievements that are non-existent.

In another biography we located recently, we discovered that the President takes full credit for Priority One’s current success. Based on what we’ve presented thus far in this post, Priority One is not thriving. We’d like to know how the President defines success as we believe it probably differs entirely from how everyone else defines success. We suggest the President amend his current biographies and substitute all references to the word “success” with the word failure.

Source: http://www.linkedin.com/

The President boldly asserts he alone “shaped the company’s continued success which dates back to 1926.” Syntax errors aside, the statement declares Priority One is successful because of his aptitude as its President. Obviously, the President doesn’t read the credit union’s own Financial Performance Reports or is it possibly, he doesn’t comprehend the information they contain?

WHEN

WALLS CLOSE IN

On January 15th, AVP of Sales and Business Development, Joseph Garcia, returned to the credit union following a three-month medical leave of absence. This was the second medical leave of absence taken by Mr. Garcia during a 14 month period. The reason for each of leave was work-induced stress.

Two months prior to his most recent leave of absence, Mr. Garcia confided to some employees that he was stressed and seeking other employment. He complained that his now former supervisor, CLO, Cindy Garvin, and President Wiggington were overloading him with unrealistic expectations and that each complained that under his authority, the staffs of all branches were not generating enough new business to produce the amount of desperately needed profit to keep Priority One solvent.

He also stated that Ms. Garvin had ordered him to spend more time visiting businesses in the communities served by the credit union and order to gather new loan and membership applications. He was also told to enroll new SEGs (“Select Employer Groups”). To ensure he remained focused, Mr. Garcia was ordered not to return to the main office in South Pasadena, prior to 4:30 p.m., Monday through Friday. For Mr. Garcia, the demands stirred angst and frustration and at times, prompting him to ask, “Should a man in his 40’s look for a new job?”

Mr. Garcia became an employee of Priority One in 2006, after his former employer, Inland Counties Federal Credit Union merged with Priority One. Over the years, Mr. Garcia has severed in several capacities, including Branch Manager of the now defunct Redlands Branch, Call Center Supervisor, Credit Manager, Loan Manager, Consumer Loan Manager, and finally, AVP of Sales and Business Development. Mr. Garcia’s upward mobility can be attributed to schmoozing versus actual competency.

Mr. Garcia’s greatest asset is his ability to pander. In 2009, just months following COO, Beatrice Walker’s arrival to the credit union, Mr. Garcia quickly endeared himself to the COO. After being introduced to her, he told her about the tremendous respect and admiration he had for her keen understanding of finances and savvy business administration skills. He promised to support her in all her endeavors. In January 2010, Ms. Walker introduced Mr. Garcia to the staff of the South Pasadena branch and said he would serve as the Interim Call Center Supervisor, pending hiring of a permanent supervisor. During his first few weeks in South Pasadena, he would dopily follow Ms. Walker throughout the credit union and quickly became known as her “Yes man.”

Shortly after “temporarily” transferring to South Pasadena where he was to serve as “interim” Call Center Supervisor, Ms. Walker announced that Mr. Garcia would be the new, permanent Supervisor though he did not possess a college degree or previous call center experience as required of the position.

Just three months after being appointed Call Center Supervisor, Ms. Walker added the title of Loan Department to Mr. Garcia’s quickly growing repertoire of titles. Within a few weeks, Ms. Walker added the title of Credit Manager. At the time, Mr. Garcia would disclose that Ms. Walker promised that in time, he would be promoted into an executive capacity.

Unfortunately for Mr. Garcia, by mid-2010, the Real Estate Loan Department was removed from under his authority when it was realized he not only did not comprehend the principles governing real estate loan processing. Over the next six months, Mr. Garcia never designed or implemented a single strategy which propelled loan development. During this same period, Mr. Garcia would confer privately and on a daily basis with his mentor, Beatrice Walker, and her other confidant, Yvonne Boutte. The three would meet not-so-secretly in Ms. Walker’s office, several times a week. During this period, Mrs. Walker amassed sufficient authority to preclude President Wiggington and Executive Vice President, Rodger Smock, from her clandestine gatherings.

During the May 2010 Annual Meeting, Board Chair, Diedra Harris-Brooks declared that in her opinion and that of the Board, Priority One “finally had the right management team in place” and arrogantly credited Mr. Garcia with creating a more cohesive working environment. We’re uncertain what Mrs. Brooks was drinking as her assessment was not only grossly inaccurate but would serve to further validate just how ignorant and out-of-touch the Board Chair really is.

By October 2010, Mr. Garcia and Mrs. Boutte were no longer speaking to one another. Mrs. Boutte would soon began spewing criticisms about Mr. Garcia, describing him as “he isn’t what he appears to be.” The falling out also ruptured Ms. Walker’s secret circle.

By December 2010, Mrs. Boutte and Ms. Walker were no longer speaking. Furthermore, Ms. Walker finally had to accept that Mr. Garcia lacked the intellect and knowledge needed to head consumer loan development efforts. For an entire year, Mr. Garcia had lazily languished under the shadow of protection allotted by Ms. Walker. His most noticeable efforts were to conduct daily and unnecessary meetings with his staff during which he would hammer in the importance of increasing loan development though continually failing to enact a single methodology that might translate into growth and profit.

To her chagrin, Ms. Walker discovered that member complaints citing poor member service had actually increased while Mr. Garcia supervised the Call Center. Ms. Walker was also informed by the Board that her alleged “state-of-the-art” call center failed to live up to the hyperbole once shelled out by the COO. Ms. Walker became resentful and blamed Mr. Garcia for the Call Center’s failure. This was the beginning of Mr. Garcia’s rapid fall from grace.

On January 3, 2011, Ms. Walker and President Wiggington announced yet another corporate restructuring. The newest change promoted South Pasadena Branch Manager, Gema Pleitez, to the post of AVP. Under her new title, Mrs. Pleitez was appointed authority over the distant and unprofitable, Riverside branch. Due to increasing member complaints, authority over the Call Center was transferred to Mrs. Pleitez. The promotion of Mrs. Pleitez provoked Mr. Garcia to anger and soon he complained that Ms. Walker had once promised to make him an executive and with a promotion, a substantial increase in salary.

The Member Services Department, formerly under authority of Mrs. Pleitez, was reassigned to Mr. Garcia but one month later, authority over the department was returned to Mrs. Pleitez.

During this same period, Ms. Walker’s once growing and formidable power, began to collapse and the President moved quickly, reassigning Mr. Garcia from under Ms. Walker’s authority and placing him directly under his own. The strategy resulted in a devastating blow to Ms. Walker’s former regime. Within days after being appointed to the President, Mr. Garcia began proclaiming that Mr. Wiggington was a highly knowledgeable and competent President who understood the complex principles governing all things financial. Evidently, Mr. Garcia was incapable of comprehending the credit union’s monthly income statements and quarterly Financial Performance Reports.

Possibly fueled by resentment and rejection, Mr. Garcia also began verbalizing criticisms about Ms. Walker, describing her as abusive and expressing his disdain for the ruthless tactics she employed to subjugate employees. He also expressed fear that she had targeted him for future termination. Mr. Garcia seemed to have forgotten his own duplicity in helping Ms. Walker and President Wiggington slander and terminate employees.

By mid-2011, Mr. Garcia’s fear of being terminated had become so critical that he concocted a fictitious excuse alleging he was ill and left the credit union on an indefinite medical leave of absence. The stress caused by the deterioration of his working relationship with Ms. Walker and an impending divorce, had taken their toll on Mr. Garcia though his allegations that he was ill, were purely fictitious.

In July 2011, Ms. Walker was terminated and a few weeks later, a relieved, Mr. Garcia happily returned to work, resuming his role of Consumer Loan Manager. Upon his return, he was informed that he would assist newly hired Director of Lending, Cindy Garvin. Dissatisfied with his role of Consumer Loan Manager and desirous for the executive post once promised to him by Ms. Walker, Mr. Garcia entered into an aggressive self-promotion campaign, promoting his alleged expertise in business development though not possessing any actual experience in business development. He certainly had never amassed a record of actual sales, yet he insisted that he alone possessed the ability and knowledge needed to motivate employees to acquire new business. During meetings with the President and the Director of Lending, he told them that if given the chance, he could introduce methodologies that would reap profit. The President forgot about Mr. Garcia’s failures as Call Center Supervisor, Real Estate Loan Manager, and Consumer Loan Manager. For some inexplicable reason, the President deemed it prudent to cleave to Mr. Garcia’s spiel and soon promoted him to the post of AVP of Sales and Business Development. In his new role, Mr. Garcia was given authority over all AVP’s, Branch Managers, and employees of all offices.

Mr. Garcia convinced the President that many employees were unproductive and lazy and offered to aggressively push staff to attain their goals or they would be subject to disciplinary actions as described under policy. By November 2011, Mr. Garcia and Ms. Garvin developed monthly sales quotas for almost all employees though never divulging methods were used to develop the goals.

Though employees were provided their monthly goals in early December it wasn’t until February 3, 2012 that they were made effective. Under the rules developed by Ms. Garvin and Mr. Garcia and approved by President Wiggington, an employee who failed to attain their goals within one calendar month would be issued a written warning. If they failed to attain their goals for two consecutive months, they would be issued a second written warning and/or terminated.

In December 2011, Ms. Garvin was promoted to the position of Chief Lending Officer (“CLO”) while Mr. Garcia was promoted to the post of AVP of Sales and Business Development. Ms. Garvin’s new responsibilities included oversight over the Real Estate and Consumer Loan Departments, Member Services, Collections and operations for all branches. Despite her title of CLO, for all intents and purposes, Ms. Garvin was now serving as the unofficial COO and successor to Beatrice Walker.

By April 2012, the first wave of employees who failed to achieve their sales quotas, were terminated. Though the credit union alleges they offered training, the fact is that the information dispensed during weekend training sessions were limited to reminding and reminding and reminding employees that failure to attain their assigned goals would result in termination. Despite the aggressive positioning taken by the credit union towards employees who failed to achieve their goals, business continued to fare poorly and by June 2012, the President and Ms. Garvin were demanding explanations as to why Mr. Garcia’s tactics were failing. Soon, Mr. Garcia began complaining to co-workers that he was stressed and over-worked, asserting that both the President and Ms. Walker were making unreasonable demands. In all fairness, it was Mr. Garcia who had promoted his alleged expertise in business development and who assured both the President and Ms. Walker that he could reap results that would enrich the credit union. Mr. Garcia’s actual performance had again failed to live up to his own hyperbole. It may never have occurred to Mr. Garcia that if you are going to exaggerate your own abilities that you might want to occasionally do something to live up to your bloated self-promotion.

At the end of July, some of Mr. Garcia’s co-workers divulged that he was seeking new employment and had even used his company-issued computer, to submit applications to other companies. By August, Ms. Garvin warned Mr. Garcia that he must begin spending a lot less time at the main branch and begin visiting the communities served by the credit union in an effort to drum up new business. She also informed him that he was no longer allowed to return to the main branch earlier than 4:30 p.m. Adhering to her directive, Mr. Garcia began visiting the credit union’s remaining branches. On some days, he would drop in at the Los Angeles branch and sit down at a computer where he would remain for a few hours. During his visits, he would loiter about the office and remind employees they had goals to attain. He also visited the Van Nuys branch where he pestered employees about achieving their goals or warned they could be terminated. He also visited the slow Santa Clarita branch where he again reminded staff that they had goals to meet despite the quite obvious fact hardly any members ever visited the Santa Clarita location.

Mr. Garcia also visited a few post offices but was promptly turned away by employees who did not know who he was despite of Mr. Garcia’s use of the line, “We are your credit union” which fell upon deaf ears. Mr. Garcia hasn’t learned that postal employees are suspicious of people who have never been employed by their industry or that they have no previous experience with.

Following his return to the credit union on January 15th, Mr. Garcia immediately set about calling SEGs and trying to schedule appointments with managers of the United States Postal Service but his efforts were again met with a lukewarm response. A problem we see with Mr. Garcia’s tactics is that he continually resorts to the same ineffective methodologies. The reason for his continual failures may be that he is simply inexperienced, unqualified, or uneducated in matters pertaining to business development. Exacerbating Mr. Garcia’s efforts are his caustic personality and need to subjugate employees. His interactions with subordinate staff members has often been laced with threats of termination which only serve to undermine his goals. Mr. Garcia is a boat without a rudder and his role at the credit union, blurred by uncertainty. Over the years he was allotted more than ample time to prove his abilities but like President Wiggington and Executive Vice President, Rodger Smock, chose to recline comfortably and opting for what was politically advantageous. What’s more, his two medical leaves suggest Joseph Garcia doesn’t manage stress well and that he lacks the determination of mind needed to face challenges.

THE MYSTERY OF

THE CLOSED

BRANCH

Willingly Perpetrating a Lie

& Fueling Rumors

Over the years, President Wiggington’s business arsenal has included the use of deception. Deception has often been employed to deter attention away from the credit union’s internal problems; to vilify others; and escape accountability. It has also been key in creating an impression of success. Unfortunately for Charles R. Wiggington, Sr., his manipulations and deceptive tactics have always dissipated upon being exposed.

On Friday, February 1, 2012, Priority One posted a notice on the webpage disclosing that the Los Angeles branch had been closed due to a “power failure.” Though power failures are not uncommon and periodically affect businesses, we find it peculiar that the credit union didn’t post a date when the branch was effectively closed and odd that they omitted all reference when a resolution might be anticipated.

Evidently, the closure was sufficient to prompt many members to call the credit union, inquiring why the branch had been closed. Employees of the credit union could only reiterate that the branch had been closed as a result of a “power failure”. Understandably, employees could not provide a date when the problem might be resolved.

The credit union’s first notice posted on their webpage on Friday, February 1, 2012, cites a “power failure.” Included is a suggestion that members use “alternate ATMs and/or Shared Branching” to conduct their personal banking transactions. Evidently, the ATM located just outside the doors leading into the Los Angeles branch, was inoperative, lending credence to their statement that the branch had sustained a power failure. With regards to the use of Shared Branching, the closest branch located near Priority One is Vernon Commerce FCU which is in the city of Vernon and 2.8 miles away. Since much of the Los Angeles’ business comes from the employees of the postal distribution center, it is highly doubtful members would trek a few miles away to conduct their personal banking needs.

Though the credit union did not specify, we are going to assume that their use of the words power failures are synonymous with an electrical problems which are usually resolved quickly. Since the power failure evidently forced closure of the Los Angeles branch, we would assume, resolving the issue became a priority. Since the incident occurred on a Friday, we assume the credit union would resolve the problem over the upcoming weekend.

On the morning of Monday, February 4, 2013, the Los Angeles branch remained closed. The credit union posted a new message on their webpage, advising members that the Los Angeles branch remained closed and inviting members to visit the “LAX branch” (Airport) which would begin opening immediately, at 9 a.m. The hours of operation for the LAX branch were scheduled to change but due to the incident at the Los Angeles branch, the hours became effective immediately.

The following message was posted by Priority One on the morning of Monday, February 4, 2013 and again references a “power failure.”

Meanwhile, back at the main branch in South Pasadena, the circuits were inundated with calls, many constituting complaints and other inquiries, asking why the Los Angeles branch remained closed.

That morning, we contacted the Los Angeles Postal Distribution Center (LAPDC), the sprawling mail processing plant housing Priority One’s Los Angeles branch. We were told that a they were unaware of a power failure as the distribution center had not suffered any such loss of power. So did a power failure actually occur? What seemed peculiar is that despite having an entire weekend in which to resolve the alleged power failure, the branch remained inoperative on the morning of February 4th. So what happened to expediency?

On the afternoon of February 4th, the credit union again amended its online notice, this time disclosing the problem affecting the Los Angeles branch was a “continued system failure.” So what happened to the “power failure”? Obviously, a power failure and a system failure are not synonymous. One indicates a problem affecting electricity while the other implies a possible network issue. So why did Priority One amend the reason for closure of the Los Angeles branch?

The credit union’s message again invited members to visit the LAX branch though that office is located approximately 13 miles west of the Los Angeles branch. Not exactly convenient is it?

Priority One’s revised notice, posted during the afternoon of Monday, February 4th and referencing “system problems.”

In the late afternoon of Monday, February 4th, the credit union issued yet another revised notice, this time announcing the LAPDC branch would reopen its doors on the morning of Wednesday, February 6, 2013. According to the credit union, the branch remained closed for three business days (2/01/13, 2/04/13 & 2/05/13) and an entire weekend. It took a total of 5 days to resolve the alleged power and/or system failure.

Message Posted on the afternoon of Tuesday, February 5, 2012

So what really happened. By far, the Los Angeles branch is the most successful of Priority One’s remaining offices. Much of its business comes from employees of the processing plant and this is the one credit union location which is most frequently used as a check cashing facility by employees of the postal service. However, over the years the Los Angeles branch has not escaped notoriety as revealed by the following incidents:

In 2008, a large number of loan applications were found in the Branch Manager’s desk along with unopened envelopes containing checks mailed for deposit to the Los Angeles branch. The applications and mail had sat unprocessed in the manager’s desk for as long as a year.

The branch has also experienced a problem with rat infestation. During one incidents, rats were seen just outside the doors leading into the branch. Rats have also been allegedly seen in the office located across directly across from the employee lounge room.

In 2009, the branch was invaded by auditors who after a three-week inspection of branch records, determined that a former employee had absconded with approximately $60,000 in member funds.

In 2009 and again in 2010, arguments broke out between two FSR’s and later, between two tellers. In both cases, all employees involved were suspended.

In 2012 and in 2013, numerous complaints were lodged with the main office, alleging that FSR’s at the Los Angeles office are often rude and curt.

On Friday, February 1, 2012, the President and Executive Vice President cited a “power failure” as the cause for closing down the Los Angeles branch. On Monday, February 4, 2012, the credit union published an amended reason for the branch’s continued closure, alleging it was due to a “system failure.” On Tuesday, February 5, 2012, the credit union amended the reason for the closure and instead wrote that the branch closure was caused by a “system failure.” Evidently, it finally occurred to someone at the credit union that the excuse of a “power failure” was both lame and suspicious. By Tuesday afternoon, the credit union posted a notice on their webpage, asserting the problem had been corrected by the credit union would not open until Wednesday, February 6, 2012.

On February 4, 2012, at 6:27 p.m., the following cryptic message was posted by a reader:

Anonymous said... If you only knew what was really happening at LAPDC. Very Heavy. A lot more than you know. That's all I'm saying.

Anonymous said... If you only knew what was really happening at LAPDC. Very Heavy. A lot more than you know. That's all I'm saying.

So what really happened at the branch? The President’s absurd reaction and the poorly written and conflicting notices posted on the credit union’s webpage strongly suggest the cause for the closure was neither a power or system failure. No doubt President Wiggington is often glib, frequently talking without thinking or as in the case of this incident, publishing without reading. It was again, his failure to react proactively which turned the closure of the branch into another suspicious event, reminding us again that no one can concoct more bad press for Priority One Credit Union than can its own President and his derelict staff of managers.

If one were to believe President Wiggington, the words failure and success are synonymous. His efforts to present the four-star rating as indicative that Priority One is succeeding to promote its products and services and cultivating increased membership is a stretch, even for an exaggerator like Charles R. Wiggington, Sr. who forgets there is sufficient documentation to disprove his current assertions.

Prognosticating the credit union’s performance over the next ten months only requires reviewing the credit union’s recent past history. What President Wiggington has succeeded in doing is providing a wonderful and immovable blueprint of how he administrates business. He has revealed he is a creature or slave of obsessive and compulsive behaviors and often driven by emotion and a belief system mired in delusion and ignorance.

Additionally, the credit union’s deficient performance is the direct result of decisions made by the Board of Directors, who under the embarrassing leadership of Diedra Harris-Brooks, have proven incapable of understanding financials and ignorant about what constitutes sound business planning. The board has also been pivotal in covering up the President’s botched efforts. Their duplicity in covering up his transgressions have only served to further enable his reprehensible behaviors and acts. Ultimately, is is the board who have kept Priority One at a financial disadvantage and robbed the once promising credit union of its competitive edge.

Periodically, we receive emails describing horrendous member experiences with the credit union. Over the years, President Wiggington has donned a nonchalant demeanor which issues regarding member service, surfaced. He has often chosen not to respond to member concerns unless they became a public matter. Here are are three incidents describing evident deficiencies marring Priority One’s ability to provide quality member service and two of which we’ve never written about previously:

- In the days following the 2007 mailing debacle which occurred because President Wiggington refused to adhere to security protocols established by his predecessor, the President received numerous telephone calls at his office along with a large number of complaints, all describing concerns about the printing of member account and social security numbers on the exterior and front side of envelopes containing ballots for that year’s election. The President refused to respond to the deluge of letters and voicemails. His first response was to find a scapegoat to take responsibility for his indiscretion. After advising the ignorant Board that it was the IT Supervisor who erred, he then delegated the responsibility of responding to all member complaints to an employee of the credit union. The President also signed a form letter approved by the Board, which assured members the credit union was doing all in its power to ensure this type of breach never occurred again. What he conveniently failed to disclose in his correspondence is that he was the sole perpetrator of the breach. He also chose not to disclose that the incident might have gone by unnoticed had he not blabbed about it to his staff who in turn told members and which resulted in a very public backlash.

- This past January, we received an email from a concerned member whose check card had been damaged. The member called the credit union to request a replacement and was informed that the credit union had run out of plastic card stock, as reported by us in our last post. He was also told that new stock would not be available until February 8, 2013. During the week of January 21st, he received his replacement card along with a message that he would receive his new PIN sometime over the next ten days. On February 1, 2013, he called the credit union to advise them that he had not received his new PIN. He was promptly informed that his PIN had not been ordered. Though the representative was apologetic, he was again advised that his PIN would arrive at his mailing address sometime over the next ten days. Evidently, convenience and expediency are irrelevant to the credit union whose reactions are cumbersome and rarely proactive.

- During the first week of February, we received another email about an employee of the United States Postal Service who had visited the South Pasadena branch to deposit a non-payroll check issued by his employer. A teller processed the deposit and afterwards informed the employee that a check had been placed on the check issued by the U.S. postal service. The irate member complained and the teller obtained permission to remove the hold. Evidently, the teller seemed ignorant of the fact that holds are not placed on checks issued by the USPS to their employees. We believe the teller’s oversight was the result of inadequate training. The incident also suggests that employees of Priority One are not taught the role postal employees have played for more than eighty years in ensuring Priority One remains in business. Their loyalty to the credit union is inarguable. In early 2011, Executive Vice President, Rodger Smock stated that postal employees no longer made up the majority of the credit union’s membership. At the time, the amount of members who are postal employees, had declined in number but they remain a pivotal sector and one who for decades, showed tremendous loyalty to the troubled credit union.

The President’s ignorance regarding member service along with his inability to create new business, will continue to hamper growth. President Wiggington’s inability to enact solutions, his apathetic attitude towards members, and the protection he enjoys from the perpetually ignorant Board of Directors will continue to ebb away at the credit union’s unstable foundation. In 2011, President Wiggington succeeded in pulling a fast one when he convinced employees of the credit union that the credit union’s high capital was unwavering proof that Priority One had returned to a state of prosperity though six months later, he was forced to close the Burbank branch.

With President Wiggington securely standing at the credit union’s helm, there is no way Priority One can escape its current problems. The once successful credit union will continue being an unwilling victim of the widespread bungling committed by its chronically undisciplined President.

Nothing is more terrible than to see ignorance in action.

Johann Wolfgang Von Goethe (1749-1832)

Technorati Tags: Charles R. Wiggington,Sr.,President Wiggington,Rodger Smock,Executive Vice President,Yvonne Boutte vice president of support services,Patricia Loiacano,Diedra Harris-Brooks,Board Chair,Board of Directors,Cindy Garvin,South Pasadena,Burbank,Van Nuys,Santa Clarita,Beatrice Walker,Joseph Garcia