During the month of February, just a few days following discovery of another internal theft at Priority One Credit Union’s Los Angeles Branch, President Charles R. Wiggington, Sr. disclosed the lawsuit filed in mid-2012 by a former FSR had imploded because the Plaintiff had no tangible evidence supporting her allegations she’d been harassed by her former supervisor, AVP, Sylvia Perez, and deprived of her employee rights as guaranteed under credit union policy and state and federal law. The President alleged, he’d been told by credit union attorney, Paul F. Schimley, the lawsuit teetered on the verge of dismissal. For Priority One Credit Union in South Pasadena, California, this was indeed good news.

On February 27, 2013, Priority MC, an emphatic supporter of the President and periodic poster on this blog, published a comment echoing the President’s statements. The comment alleged the former FSR had lodged several complaints alleging harassment with then interim Burbank Assistant Branch Manager, Nidia Reyes. According to Priority MC, Mrs. Reyes never documented the complaints and the arbitrator presiding over the proceedings, was not tolerating the Plaintiff’s failure to provide documentation that might support her accusations against her former employer. Priority MC added the former FSR had been reduced to groveling, begging for any monetary amount to settle her lawsuit. If one chooses to believe the President and Priority MC, then the former FSR’s case had been decimated and targeted for dismissal. That is of course, ONLY if one chooses to believe them.

As usual, the credit union’s version of what actually transpired is saturated with inaccuracies, exaggerations, and ironically, devoid of tangible evidence. The statements verbalized by the President and later published by Priority MC, have since been proven to be untrue.

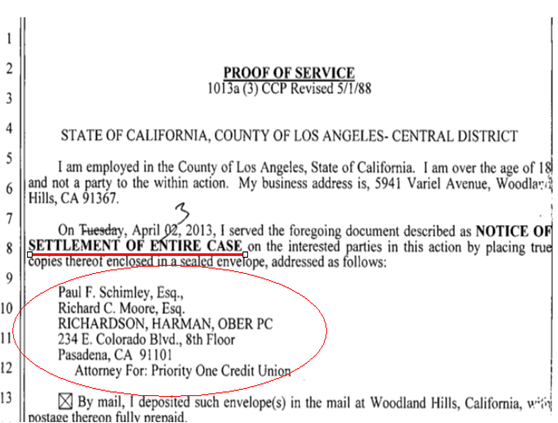

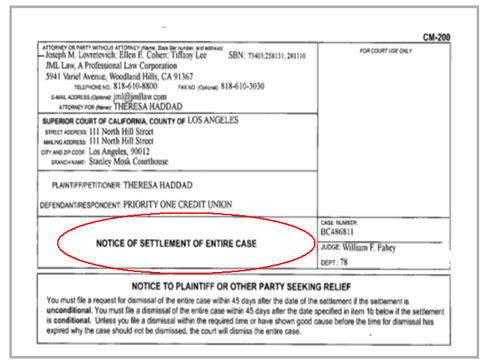

This past April, only two months after the President and Priority MC declared a victory over the former FSR, a notice was filed by the Plaintiff’s attorney, with the Superior Court of Los Angeles, announcing the lawsuit had been settled. So how is it possible that the lawsuit was settled when President Wiggington and Priority MC insisted the FSR had been defeated and even humiliated? The notice suggests the FSR possessed tangible evidence and that whatever she had, was sufficient to incriminate the credit union in wrongdoing. Inarguably, the credit union through its attorney, found it preferable to dole out another settlement than face a potentially costly and embarrassing court trial. This is also the third lawsuit filed by a former employee that is settled at the request of the credit union. Based on the President’s and Priority MC’s statements and the eventual settlement of the case, it appears President Wiggington and Priority MC don’t comprehend that in addition to documented evidence, witness statements and/or circumstantial evidence are admissible in a court of law.

The latest settlement doesn’t signal an end to the credit union’s legal woes nor does it exonerate Priority One of the allegations described in all of the settled lawsuits. If the credit union’s officers were truly innocent of wrongdoing, why would the Board of Directors, Supervisory Committee, and the President concede to paying out monetary settlements? The settlements create a gaping hole in the President’s insistence that each lawsuit was filed filed by disgruntled former employees and that each lacked evidence. What the President continually denies and refuses to accept is that former employees would never have obtained the services of attorneys if their complaints were not supported by some form of evidence- witness testimonies, circumstantial evidence, or documentation.

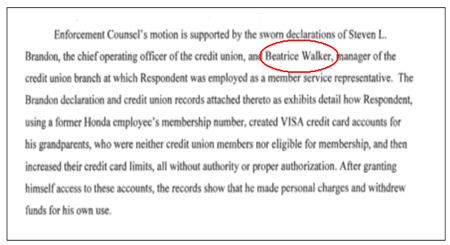

At present, the credit union continues to litigate a fourth lawsuit filed in mid-2012 by the former Valencia Branch Manager. Late last year, the President confidently declared that the credit union’s attorney succeeded in diffusing the former Valencia Branch Manager’s lawsuit. According to the President, the Plaintiff had been forced to dismiss her case against former COO, Beatrice Walker. On June 3, 2013, an anonymous poster, published the following comment:

Following posting of the anonymous comment, we sent out inquiries and rather quickly, confirmed Beatrice Walker had indeed been removed as a named defendant in the Branch Manager’s lawsuit. The fact the anonymous poster knew this, confirms President Wiggington again violated credit union policy and divulged confidential information about the lawsuit.

We haven’t yet discovered why Ms. Walker’s name was removed but we can confidently state the removal of her name does not bring an end to her involvement in the lawsuit. In fact, the accusations that Ms. Walker carried out a ruthless campaign which harassed and victimized the former Branch Manager, remain intact and unchanged. Apparently, Ms. Walker will still be required to answer questions regarding the acts she committed. Like Ms. Walker, the President and probably the entire Human Resources Department aka Employee Services, will have to answer questions why they chose not to bring an end to Ms. Walker’s alleged heinous attacks on the former Branch Manager.

Based on credit union’s settlement of the first three lawsuits, we believe credit union attorney, Paul F. Schimley, will again attempt to forge another settlement so his undisciplined client may avoid going to court. Undoubtedly, a court trial would result in creation of a public record describing the allegations of abuse lodged against his client along with creating a public record of witness testimonies and of documented evidence presented during the trial. The record would also include the court’s final determination. A trial would force the President to answer questions about his particular brand of management and might include:

- Revelations about President Wiggington’s and former COO, Beatrice Walker’s frequent clandestine meetings, during which plots were forged targeting employees who they viewed as an ethical threat to their regime. .

- Clarification why the now small credit union employs a Human Resources (aka Employee Services Director), an Employee Services (aka Human Resources) Director, and an HR/Employee Services Manager.

- An explanation why the Human Resources/Employee Services chose not to bring an end to Beatrice Walker’s persecution of the Branch Manager.

- Why despite having solicited a letter from the former Branch Manager, documenting her complaints against Beatrice Walker, the President chose not to bring an end to Ms. Walker’s vendetta.

- There may also be questions asked about the qualifications, experience, and education which qualifies Executive Vice President, Rodger Smock; Director, Robert West; and Manager, Esmeralda Sandoval, to oversee Human Resources.

- Questions about Ms. Walker’s behaviors, including her unwanted attentions forced upon the former Branch Manager and questions about her sexuality.

- A real life court setting would bring to the forefront questions about President Wiggington’s long history of abuses and violations of state and federal laws and as enabled by the Board of Directors, Supervisory Committee and Human Resources/Employee Services.

For attorney, Paul F. Schimley, a trial could be a wonderful opportunity to display his allegedly well-honed talents, tactical cunning, and his other amazing skills that make him a top-notch attorney- this according to other attorneys who are the only people who have either voted and posted a single compliment on the Internet, extoling his immense expertise in the area of employment law. Mr. Schimley will have the opportunity to stand before a judge, a jury, the Plaintiff and all other attendees of the trial; and eloquently articulate his client’s innocence. We sincerely hope he doesn’t disappoint.

It also wouldn’t surprise us if the President, Executive Vice President, and entire Human Resources Department band together and blame former COO, Beatrice Walker, for the abuses perpetrated upon the Branch Manager. They may allege Ms. Walker was ordered to desist her campaign but unbeknownst to them, she refused. That of course, would tie in nicely with the fact Ms. Walker was terminated for failing and/or refusing to carry out her assigned responsibilities, for failing to implement programs and products that induced growth, and because she had grown more and more defiant to the Board of Directors. There is also the FACT she had become a polarizing presence in the credit union and evolved into a potential liability Priority One could no longer afford to keep. Whatever the outcome, a court trial would provide a bird’s eye view into the credit union’s inner-most sanctum and serve to reveal the extent of incompetence and disdain for policies and laws demonstrated by President Wiggington and his gang of drudges.

THIS POST

In this post, we focus entirely on the contents of Priority One Credit Union’s 2012 Annual Report. Earlier this month, several readers of this blog, posted comments which accused President Wiggington of withholding publication of the annual report. In recent years the report usually appears on the credit union’s webpage just a few days following the annual meeting. This year, the meeting took place the evening of Wednesday, May 22, 2012 yet the report was not published until Friday, June 7, 2013 and only after any anonymous published comment on this blog, suggested filing a complaint with the NCUA.

The 2012 Annual Report, like all of the reports published by the credit union since 2007, serves as a vehicle through which the President, Board Chair, Board Treasurer, and Supervisory Committee Chair dispense information about the credit union’s performance in the previous year and express their hopes for a promising and success-filled future.

Our review of the 2012 Annual Report identified some conspicuous inconsistencies between the information described in the addresses written by the President Board Chair, Board Treasurer, and Supervisory Committee Chair; and the actuaries presented in the same report. Obviously, the officers chose not to proofread their statements before sending them off to be published.

The general tone of the 2012 report is subdued and deplete of energy. The addresses all declare 2012 a good year and end with the hope 2013 will be an even better year. There are no references to many of the events which impacted the credit union in 2012, including:

- The settlement of two lawsuits filed by a former Burbank Branch Manager and a former Business Development Representative.

- The settlement of the lawsuit filed by a member who accused the credit union of violating the Privacy Act and slandering her personal reputation.

- The termination of the largest contingent of employees to ever be terminated in the credit union’s more than 60-year history.

- The termination of CLO, Cindy Garvin, for failing to implement strategies that promoted growth and generated profit; and

- Increased spending on attorney fees and court-related costs.

January 1, 2013, Charles R. Wiggington, Sr. celebrated his 6th year as President and CEO of the once successful credit union. On the day he took office, Priority One had branches located in the cities of South Pasadena, Los Angeles, Burbank, Van Nuys, Redlands, Riverside, Valencia, and Burbank. The credit union also maintained a small office at the mail processing plant located in the City of Commerce which for years, opened every Friday and served members employed at that facility. As of 2013, the credit union no longer possesses a physical presence in all of Riverside County. Members in that region are forced to rely on Shared Branching. The Burbank office is now home to the Law Offices of Cameron H. Totten, while the Santa Clarita branch which opened in February 2012 with the intent of replacing the former Valencia branch, has proven a bust. As for the office located at the mail processing plant in the City of Commerce, its doors have not opened in many months.

The former Burbank Branch

Haven’t 6 years been more than sufficient time for Charles R. Wiggington, Sr. to have proven his competency? We believe its time for members to contact the DFI and demand removal of the entire Board of Directors who under Board Chair, Diedra Harris-Brooks, have made a debacle of the once well managed credit union. And evidently, the Supervisory Committee has never felt ethically inclined to halt Board Chair, Diedra Harris-Brooks’, horrendous decisions and circumvention of state and federal laws; or bring an end to the President’s perpetual cycle of failures.

BUT FIRST…..

After the ungraceful expulsion of former COO, Beatrice Walker, in July 2011, we sincerely believed she would never again be the subject of our posts. We were wrong. Ms. Walker resurfaced in 2012 when the former Valencia Branch Manager filed a lawsuit naming the former COO a defendant and accusing her of creating a hostile work environment and same-sex sexual harassment.

Last month we provided excerpts from Ms. Walker’s two LinkedIn profiles, one which describes her as the current COO of Priority One Credit Union and a second which references her name as as Beatrice W. while omitting all reference to Priority One Credit Union.

In 2009, Ms. Walker admitted she is a follower of this blog and has programmed her cellular to advise her each time a new post is published. Since our last publication, we again visited her LinkedIn accounts and discovered that she amended one of her records which now includes a photograph of herself. We believe she felt impelled to amend one of her accounts after we exposed that her biographies are incomplete and brimming with misleading information and omissions. Additionally and as stated previously, Ms. Walker will be called as a witness in the lawsuit filed by the former Valencia Branch Manager. As such, she appears to have enhanced her work history to possibly create the impression she is accomplished and a consummate professional. Of course her efforts are thwarted by the fact she was terminated in 2011 by Priority One Credit Union.

Her revised LinkedIn biography continues to omit the names of Electricore, Inc. and AIRCO FCU while she has chosen to identify herself as Beatrice W. The overall impression we are left with is that she is hiding information about herself. We suggest the Plaintiff’s attorney subpoena Ms. Walker’s employee files from Priority One Credit Union, AIRCO Federal Credit Union, Electricore, Inc., and Universal City Studios Credit Union. It would be interesting to see why she left AIRCO and Universal Studios Credit Union and verify whether or not she competently satisfied the responsibilities assigned to her. If there are adverse references in her personnel files or if she was terminated by other past employers, then this would establish her credibility as a witness for Priority One Credit Union.

So what happened to Deatrice?

Following our previous post, Ms. Walker removed the recommendation written by Interior Design Educator, Dorothy Minarsch. Ms. Minarsch had erroneously spelled Beatrice’s first name as Deatrice.

Ms. Walker has also replaced Ms. Minarsch’s recommendation with one composed by Lori Wejbe, a Notary Public, who “worked indirectly” for Ms. Walker while both women were employees of Pasadena Service Federal Credit Union. We might have been impressed had Ms. Walker gotten a recommendation from someone who actually worked directly with her, like Executive Vice President, Rodger Smock or her former friend, President Charles Roger Wiggington, Sr.

The only other remaining recommendation is submitted by Sylvia Nash of Lillestrand and Associates. Apparently, Ms. Nash worked with Beatrice Walker while she served as Branch Manager of Honda Federal Credit Union in Torrance, California. For those who may not recall, Lillestrand and Associates is the consulting firm hired by President Charles R. Wiggington, Sr. in 2009, at the recommendation of Beatrice Walker. Loren Lillestrand, the firm’s founder, owner, consultant met with the President and Ms. Walker in 2009 at the home of Executive Vice President, Rodger Smock. During what was intended to be a secretive meeting, Mr. Lillestrand provided the officers with examples of “tests” that he would administer to employees of the credit union and which would gauge their likes, dislikes, talents, and interests. The findings would be used to place employees in positions where their interests and talents would serve to maximize their performance. Additionally and as would be disclosed by President Wiggington in the months to come, the three officers agreed to hire Lillestrand and Associates as a means in identifying rebel employees who were undermining the President’s authority.

In meetings conducted in 2009 and 2010, Mr. Lillestrand met groups of employees from all branches during which he dispensed tests gauging their interests. He also met one on one with employees pre-selected by the President, Executive Vice President, and COO and who they believed were the blogger, bloggers or supporters of the blogger or bloggers. Information gathered by Mr. Lillestrand was turned over to Ms. Walker but she and the President never used the data to enact changes that improved employee performances.

During his visits to the credit union, Mr. Lillestrand disclosed that he and Ms. Walker were friends and had worked together when he had been hired as a consultant to Honda Federal Credit Union. He at times, described Ms. Walker as “smart” and “caring”, words also echoed in Ms. Nash’s recommendation, however, in her capacity as COO, Ms. Walker established a reputation for being conniving, divisive, and for authoring the termination of many employees. What employees and former employees of the credit union never witnessed was Ms. Walker’s great caring spirit. She also failed in her efforts to introduce growth and prosperity there was nothing in her conduct that proved competency. On the day of her termination, Ms. Walker succeeded in establishing a reputation for being underhanded, vindictive, and exhibiting an unusual and uncontrolled obsession for gossip, intrigue and provoking conflict. In the months preceding her dismissal, her relationship with President Wiggington and Executive Vice President, Rodger Smock, had grown tenuous while the members of her former inner circle had ceased speaking to her. By mid-2011, Ms. Walker found herself literally ostracized. Furthermore, she had fallen into disfavor with what she had often described as the ignorant Board of Directors.

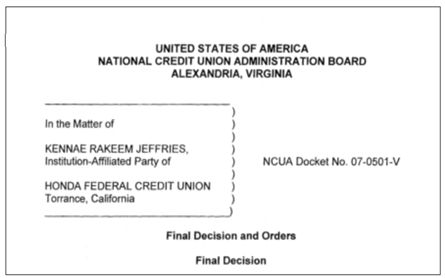

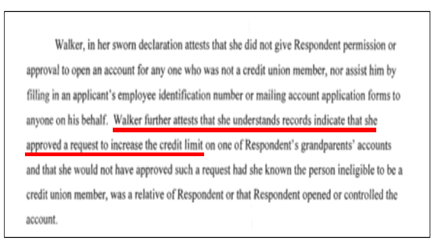

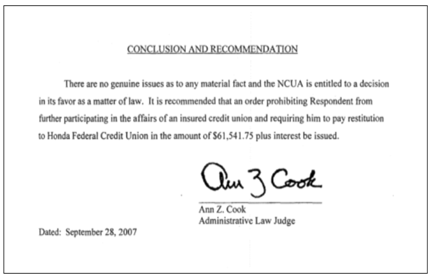

For those who may not remember, while employed by Honda Federal Credit Union, a temporary employee assigned under Beatrice Walker’s supervision, issued two credit cards without authorization, in the names of his grandfather and grandmother. He also increased the amount on one card, alleging he obtained approval to do so from his then supervisor, Beatrice Walker. He was found guilty by the NCUA and ordered to pay restitution in the amount of $61,541.75 (as referenced in the Conclusion and Recommendation, shown below):

Source: NCUA Docket

We’re certain many people, including the President and the entire Board of Directors, were relieved when Beatrice Walker succumbed to the same underhanded tactics she liberally employed while serving as COO. Her return to the credit union’s stage is both unwelcome and costly. We’ve recently learned her attorney’s fees are being paid by the credit union which is incredulous when one considers that it was her abhorrence of policies and laws which provoked the filing of at least three of the four lawsuits. Beatrice Walker serves as a stark reminder of President Wiggington’s inability to make sound decisions. In 2009, the President with the assistance of Board Chair, Diedra Harris-Brooks, hired Ms. Walker. Upon her arrival to the credit union on June 1, 2009, Executive Vice President, Rodger Smock, described Ms. Walker as an expert in operations, declaring she would introduce new streams of income and reduce expenses. The President who is incapable of guarding confidentiality, also revealed Ms. Walker would help him drive out the sector of rebel employees who were undermining his efforts to promote growth and development of new business.

Instead of fulfilling her role as COO, Ms. Walker became fixated with becoming the next President and CEO and often expressed her aspirations to succeed Charles R. Wiggington, Sr. who she described as unqualified to lead Priority One. Within weeks of her arrival, she busily set about forming an inner circle of confidants who would support all of her efforts and who would follow her when she succeeded in unseating the President. Regrettably for Ms. Walker, her indulgence in gossip, racist comments, and her participation in fueling office intrigue may have ultimately done her in. The more than $200,000 spent on a Call Center, refurbishments of the main branch and the Burbank office, and the introduction of products that performed poorly or failed all together, ebbed away at her plan to topple the President. By the time she was terminated, Beatrice Walker had magnified the credit union’s burgeoning business problems and contributed in the ruination of employee moral. She also added to the credit union’s amassing legal problems. The recent revamping of her online biography is tantamount to applying lipstick to a bear. In other words, it serves no purpose and changes little.

THE 2012 ANNUAL REPORT

Priority One Credit Union has finally published its 2012 Annual Report, albeit it may have taken some coaxing from readers of this blog. Usually, the report appears in PDF form on the credit union’s webpage, just a few days following the date of the annual meeting. This year, the meeting took place during the early evening of Wednesday, May 22, 2012 yet the report, emblazoned by the words, A Brighter Future Ahead was not published immediately. The credit union responded almost immediately after several comments were posted by readers, complaining why the annual report had not yet been published.

Since 2007, Priority One’s report has evolved into a vehicle through which the President and members of the Board of Directors have annually published statements embellishing accomplishments and understating failures occurring over the past year and proclaiming a promising and successful upcoming year. The main problem with their statements is that their failures are more far reaching than the credit union would want readers to know and the assurances of impending success have yet to be realized.

The 2012 annual report seems less enthusiastic than the reports for the years ending on 2006, 2007, 2008, 2009, 2010, and 2011. Its almost as if those responsible for its production have lost motivation. The addresses contained in the report, discreetly attempt to divert attention from the credit union’s failures in 2012 and hope readers will embrace what is written, at face value. The President, Board Chair, Board Treasurer, and Supervisory Committee Chair express their hope for future success as the credit union traverses the path towards A Brighter Future Ahead. Their expressed assurances are undermined by the President’s decisions and acts in previous years.

2008

President Wiggington borrowed an unprecedented $20 million from the credit union’s line-of-credit. Aside from using the money to augment the amount of the credit union’s reported Net Income, there was no logical reason or need, for obtaining the loan. On a side note, his predecessor never borrowed money from the credit union’s line-of-credit and under his leadership, the credit union’s Net Income and physical size grew.

2009

The year ended with more than $5 million in losses. The President also hired Beatrice Walker to serve as the credit union’s first COO. During her brief stay, Beatrice Walker spent large amounts of money remodeling the main branch and now defunct Burbank office. She created the credit union’s first Call Center which has proven an utter fiasco and fail to live up to any of Ms. Walker’s promises. She also was unable to introduce highly lucrative streams of income or restructure strategical planning that garnered new business and proved cost-effective.

2010

The President ordered closure of the Redlands and Valencia branches because Priority One could no longer afford to pay the leases on either location. The year ended more than $500,000 in the negative. During the year, a former Burbank Branch Manager filed a lawsuit alleging racial and age discrimination. The credit union closed the doors to its Redlands and Valencia offices.

2011

The President ordered closure of the small and insignificant Riverside branch . A few weeks later, with authorization of the Board, he terminated COO, Beatrice Walker. He also hired Cindy Garvin who began serving as Director of Lending on August 1, 2011. By December 2011, he increases Ms. Garvin’s authority to include oversight of all branches and promotes her to Chief Loan Officer. The credit union receives they are being sued by a former Business Development Representative. By the end of the year, the credit union initiates settlement negotiations to settle the lawsuit filed by the former Burbank Branch Manager.

2012

The President orders closure of the Burbank branch because the credit union could no longer afford to pay its lease. He along with the CLO, assign monthly sales quotas to almost all employees. The Valencia branch opens up to much fanfare, with the President declaring the branch will bring in tremendous amounts of new business. Six months later, CLO, Cindy Garvin, discloses the credit union may have to close the Santa Clarita branch due to poor performance. Ms. Garvin with assistance of AVP of Sales and Business Development, Joseph Garcia, begin terminating employees who failed to achieve their assigned monthly quotas. Termination begin in April and come to an abrupt end on or about October 2012. The credit union settles the lawsuit filed by a former Business Development Representative. A member files a lawsuit alleging the credit union intentionally published information about her automobile loan along with defamatory information about her person, on the Internet. The lawsuit is settled quickly and by November, a check is issued to the member along with a letter signed by the President admitting that confidential and defamatory information about the member was published though never authorized by the credit union. CLO, Cindy Garvin, is terminated on Thursday, December 28, 2012, for failing to introduce strategies that increase business.

2013

The credit union demotes AVP of Sales and Business Development, Joseph Garcia, to its only Business Development Representative. Mr. Garcia is instructed to service the vast territory from Riverside to Ventura County. The credit union also settles the lawsuit filed in 2012 by a former FSR.

We can only assume, based on the credit union’s performance, that the failures we’ve witnessed over the previous six (6) years, will continue. The President may hope members and employees will ignore the credit union's performance documented in its monthly income statements and Financial Performance Reports (“FPR”), accepting at face value his assurances of a brighter future.

If you chose to believe President Wiggington and Board Chair, Diedra Harris-Brooks, then Priority One does indeed have a bright and sunny future awaiting just around the next bend. However, if you don’t ignore the closure of the four branches, the termination of a COO and CLO, or the fact the credit union is quite incapable of creating strategical planning that produces new business, Priority One’s future looks bleak versus bright.

THE PRESIDENT & BOARD CHAIR’S ADDRESS

The President’s and Board Chair’s address presents an optimistic assessment of the credit union’s performance in 2012 and of a promising future. Of course, the vast failures by the President and his executive staff coupled by those of the Board of Directors and Supervisory Committee are never alluded to, possibly in the hope no one would remember how disastrous 2012 really was.

”…we continue to maintain a safe and sound Credit Union.”

In last month’s publication, we reported that in 2009 an audit disclosed that a former employee, once assigned to the Los Angeles branch, embezzled approximately $60,000 from member accounts. The incident was not discovered until several months after the thefts occurred. Following an audit confirming the thefts, then COO, Beatrice Walker, and President Wiggington decided that the best way to avoid exposure of the thefts was not to prosecute the employee. They also decided monies would only be restored to accounts where actual claims were filed. They also agreed that would not be reimbursed to accounts for deceased members unless their beneficiaries filed a claim.

This past March, an AVP, who had been employed by Priority One for approximately 40 years, was terminated. Shortly following her termination, Vice President, Yvonne Boutte, revealed the AVP was under investigation by a private firm who hoped to gather evidence implicating her in internal thefts occurring at the Los Angeles branch.

We invite the President and Board Chair to explain how they are maintaining a “Safe and Sound credit union” when evidence proves the incidence of internal thefts occurring at the Los Angeles branch. Evidently, the protocols designed to protect member assets are either ineffective, not being utilized, or in dire need of revamping.

“Most importantly we are improving our net income.”

The President and Board Chair allege Priority One’s net income has improved but the credit union’s “Total Assets” (shown below) referenced under the Summary of FINANCIAL CONDITION in the 2012 Annual Report, document losses. According to the summary, Priority One’s net income has declined by more than $8 million for the period of March 31, 2012 through March 31, 2013. So how did the President and Board Chair conclude that Net Income improved?

As shown above, Priority One reported its Net Income size for the year ending on 12/31/13, at $152,938,281. In contrast, Bankrate.com reported Priority One’s Net Income size for the year ending on 12/31/13, at $147 million. That’s a difference of approximately $5 million. So who’s not telling the truth? To determine whose figures can best be trusted, all one has to do is ask, “Who has the most to gain by exaggerating the amount of its net income?”

Source: Priority One CU, 2012 Annual Report and Bankrate.com

“We are starting to see improvements in real-estate values, delinquencies and unemployment.”

The above-shown statement alluding to improvements is extremely disjointed. The reference to real-estate values is a reference to state and/or national real estate values and not a comment about the state of the credit union’s mortgage funding efforts. Nowadays, the credit union only funds HELOCs with all other mortgage loan requests, forwarded to CU Partners. Also, the President and Board Chair fail to explain how improved real-estate values has served to positively impact Priority One’s performance. Clearly, it has failed to benefit the amount of their Net Income which declined by approximately $8 million during a 12-month period suggesting that the alleged improvement to real-estate values had absolutely no positive impact on the credit union’s lagging performance. Other areas where improvements allegedly took place, are:

- The reference to delinquencies refers to the credit union’s versus state or national statistics. The statement is correct- delinquencies have indeed declined though the officers fail to mention how many accounts were recoded as charge-offs because collection efforts failed.

- Like the reference to real-estate values, the reference to unemployment refers to state and national unemployment statistics. According to information dispensed by the government, unemployment has decreased however this does not consider the fact that many recipients of unemployment benefits no longer qualify for continued federal extensions and remain both unemployed and unable to receive further assistance through state unemployment programs or federal extensions. The President and Board Chair fail to draw a connection between the alleged improvement to unemployment with the credit union’s performance. A review of Priority One’s financials fails to show any improvement impacting the credit union’s performance, i.e. increased new business, rise in profits, membership growth, physical expansion including reopening of formerly closed branches.

Another fact is that Charles R. Wiggington, Sr., despite having served as President over the past six years, has continually failed to develop methodologies that translate into growth and increased membership. Furthermore, in 2009 and again in 2011, he wasted hundreds of thousands of dollars when he hired former COO, Beatrice Walker, and former CLO, Cindy Garvin, both of who failed to fulfill their responsibilities and who in time, were terminated by the same Board of Directors who authorized their hiring.

“Hundreds of members have taken advantage of Mobile Banking…… Launching these enhancements has allows us to rebrand the entire Internet experience.”

The second paragraph of the President and Board Chair’s address, loftily asserts that through the revamping of e-statements and website and introduction of a mobile banking app, they single-handedly rebranded a member’s entire Internet experience. We doubt it. There is no evidence gathered by the credit union proving that revamping e-statements and the spiffing up of their website has in anyway increased business or augmented membership. It also seems highly improbable that the new mobile app has had any effect on increasing business which according to the credit union, remains stagnant. It is also peculiar that they reference that “Hundreds of members have taken advantage of [the] Mobile Banking [App]” when their membership approximates 29,000 (members). Hundreds is a paltry amount and prompts us to wonder how many of their approximate 29,000 members, have ever obtained products or services from the credit union? We know Priority One has a huge untapped sector of members who have never been recipients of what the credit union offers. We also know that President Wiggington has never tailored strategies to connect with this undeveloped group.

"We will continue to deliver the best products and services to our members at a reasonable cost.”

There is so much in their entire address that the President and Board Chair fail to say. They never mention what products proved to be cost leaders. They don’t describe the areas where business increased or ever state how much actual growth was experienced. The entire address amounts to more lip service.

“We will continue to deliver the best products and services to our members at a reasonable cost.”

The inference that they deliver the BEST products and services is undermined by lagging sales. Also, a review of their webpage reveals that the products and services they offer can be obtained from other credit union’s and banks. In other words, there is no evidence that what they offer constitutes the BEST in the marketplace.

The two officers extend an invitation for suggestions from members and employees, to improve Priority One. In 2007, the President informed staff he would be placing a suggestion box in the employee lunch room because he wanted to “hear” what employees had to say. The box was never installed and over the years whenever a person suggested improvements and changes, they were ostracized and/or driven from the credit union.

In 2009, during an all-staff meeting, the President asked for suggestions on how the credit union could reduce spending. The BSA Specialist suggested that executives voluntarily reduce their salaries until the credit union’s financial performance improved. Within two weeks, she was ordered to relocate her work station to a desk located in the teller store room, behind a wall and surrounded by boxes, empty desks, and supplies. Two months later, she was told her position was being eliminated and given the option of either accepting part-time employment or a severance package. Having children and a household to maintain, she accepted the severance package. A few days following her departure, the President hired a temporary BSA Specialist to assist the AVP of Compliance who was in the process of training as she had never worked in the field of compliance.

Over the years, the President targeted and ousted many employees who stepped forward and presented ideas on how to improve business. He viewed their suggestions as criticisms to his mode of management. Furthermore, the person who has most enabled the President’s bad behaviors is Board Chair, Diedra Harris-Brooks. Inarguably, without her patronage and protection, the President could never have decimated the credit union’s success. We can only conclude that her invitation to readers is as insincere as anything else she’s said over the years and that her invitation is a means by which to create the impression she and the President are reasonable people open to suggestions. Nothing could be further from the truth.

“Our committed staff, executives, and volunteers will continue to provide viable products and services and also keep you informed of any new promotions or events.”

Source: POCU Webpage

Like the addresses published in the Annual Reports for the years, 2007 though 2011, the President and Board Chair provide absolutely nothing of substance to support their statements. Their assurances are void of anything tangible or remotely promising and in the end, their 2012 address is destined for the office shredder.

THE BOARD TREASURER’S REPORT

“Return on Assets…. was better than expected, due in part to reduced operating expenses.”

Board Treasurer, Joseph Marchica’s address intentionally underplays the credit union’s reliance on reduced operating expenses. Undeniably, Priority One Credit Union would have closed its doors and suffered greater losses had it not reduced its operating expenses over the past three years. The Treasurer also expresses his hope the credit union will succeed in overcoming the challenges it faces on its path to A Brighter Future Ahead.

The great challenge facing the credit union is inept and dishonest leadership. The President has proven year after year, that he just doesn’t possess the talent to conceive strategies that produce growth and profit. His failures have been perpetuated by the incompetence and seeming inability by the Board of Directors and the Supervisory Committee to understand the obstacles impeding growth and developing methodologies that remove all impediments leading to success. We do however, agree with the Treasurer that like most (if not all) financial institutions, Priority One faces challenges created by the nation’s “slow economic growth” and federal policies though we would add that many of the challenges faced by the credit union and much of what impedes its ability to gain upward momentum is rooted in credit union’s corroded internal mechanisms.

One of the biggest challenges the credit union faces as it trudges slowly towards an uncertain future is the inability of the President and his entire executive staff to conceive of anything that jump starts growth. Another will be locating areas where operating expenses can be further reduced.

Earlier this month, the credit union posted flyers announcing that beginning this July, the small Airport branch will only open twice a week. According to President Wiggington, the location doesn’t generate sufficient business to warrant continue opening five days per week. The President has evidently forgotten that the Airport branch was opened at the request of postal employees as a substitute for the former Worldway Branch which closed a few years ago. The President never wanted to open the Airport branch but was forced to at the urging of Board Chair, Diedra Harris-Brooks. Following closure of the Worldway branch, the President assured postal employees that he would soon open a new branch, however, he confided to his staff at the time, that he had no intention of opening a new branch near the Los Angeles Airport.

The President began receiving telephone calls from the Postal Manager of the Airport Post Office but chose not to respond. Frustrated by the President’s unresponsiveness, the Postal Manager contacted Board Chair, Diedra Harris-Brooks and offered her an unused portion of his facility for the installation of a post office added that if the credit union refused to accept his offer he would offer it to another credit union or bank or a Starbucks. Mrs. Harris-Brooks contacted the President and ordered him to immediately begin planning out a new branch.

Several months later, the Airport branch opened, however, the President never tried to advertise the location which remained obscure to most members of the credit union. The President’s refusal to bring attention to the location undermined the opportunity to create a presence in the community just outside the Los Angeles Airport.

The President’s refusal to promote the credit union name has forced the downsizing of the credit union’s presence in the communities it serves. It was this same refusal which caused the credit union to lose its presence in Riverside County and it is this same refusal to create a presence which contributed to the failure of the credit union’s Burbank and Santa Clarita branches. What we do know is that the President is faced with a predicament. Can he afford to reduce the hours at the Santa Clarita branch or should he close the Santa Clarita branch? The offices are owned by the U.S. Postal Service and have only cost the credit union $1.00 per year to lease. The spaces were also offered to the credit union by the postal service as a good-will gesture and affirmation of its long relationship with the credit union. Closure of either location could prove further detrimental to the credit union’s tenuous relationship with employees of the United States Postal Service.

During 2012, the credit union terminated the largest contingent of employees that ever occurred during its more than 85 year history. According to the credit union, the terminations occurred because employees failed to achieve their monthly sales quotas. The reason was a smoke screen to cover-up the fact Priority One was in dire need of reducing expenses, quickly. It was a ploy by the President to save face where this is none left to save.

REPORT OF THE SUPERVISORY COMMITTEE CHAIRPERSON

“As your Supervisory Committee, it is our responsibility to ensure the Board of Directors and Credit Union Management

establish practices and procedures to properly safeguard the members’ assets.”

Last year we criticized Cornelia Simmons, the Supervisory Committee Board Chair, for using the same template utilized year after year, declaring the Supervisory Committee performed its due diligence. She obviously read our message and this year, provided a differently worded statement. This year’s message remains disingenuous, ignoring the very public events which transpired at the credit union throughout 2012 and hoping readers will believe the Supervisory Committee concluded the Board of Directors and management sector implemented practices and procedures designed to safeguard member assets. Unfortunately for Ms. Simmons, her declaration is laid waste by real events.

- In November of last year, the credit union settled the lawsuit filed by a former member who accused the credit union of publishing information about her automobile loan and defamatory information about her character. Evidently, the safeguards alluded to by Ms. Simmons did not succeed in protecting the member’s personal account information.

- As described previously, during the month of February the credit union received a complaint from alleging monies had been siphoned from a member’s account. In response, an audit was conducted of the Los Angeles branch’s records, during which the AVP who had overseen the branch, was placed on suspension.

- The audit was so extensive, the credit union forced closure of the Los Angeles branch on Friday, February 1st and did not reopen the branch until Tuesday, February 5th. The AVP was terminated for unsatisfactory performance, however, Vice President, Yvonne Boutte disclosed to employees that because the AVP was suspected of having perpetrated internal thefts, the credit union had proceeded in hiring a private investigative firm to conduct a far more extensive examination in the hopes of discovering other thefts attributable AVP. Mrs. Boutte also issued a verbal directive to employees of the Los Angeles branch, forbidding them from all communication with the former AVP.

- Another interesting fact is that Ms. Simmons was the Supervisory Committee Chair in 2009, when $60,000 were stolen from the Los Angeles branch by a former receptionist/FSR/Teller.

Obviously, the Supervisory Committee failed to ensure the safeguards purportedly installed by the Board of Directors and management sector were actually used, enforced, and taught to all employees. Either that or the safeguards are in desperate need of revamping. Ms. Simmons like the President, Board Chair, and Treasurer, has attempted to sell a bill of fictitious goods that the credit union failed to deliver throughout 2012.

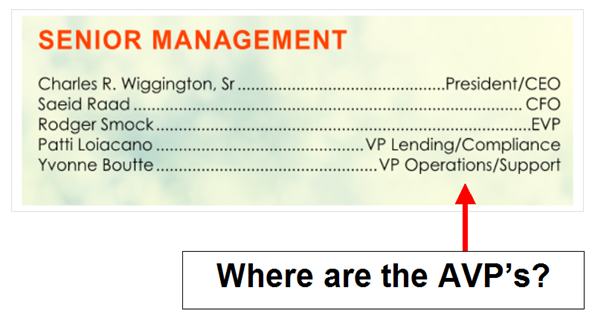

Conspicuously missing from the 2012 Annual Report is all reference to the AVP sector who apparently met its demise earlier this year following termination of the long-time AVP who for years managed the Los Angeles and Airport branches.

Not so long ago, President Charles R. Wiggington, Sr. unveiled his proud and shiny new AVP sector, which he boasted, would be key in developing vast amounts of new business in the vast territories served by the credit union. He went further, asserting the amounts of new business they would each produce would be unprecedented in the credit union’s long history. Of course this was in 2007, just a few years before he would have to close four branches to avoid closure or merger of the once successful credit union. This past March, the credit union terminated its last remaining AVP.

In 2009, we wrote extensively about the AVP sector which we determined unnecessary to the then medium-sized credit union. There was nothing in Priority One’s physical size to justify installation of an AVP sector. We also cited that the high salaries paid to each AVP would serve to further tax the credit union’s finances. Over the years, the AVPs failed to bring in the level of new business needed to offset the credit union’s overhead and offset their high salaries. We also noted, that with the exception of one officer, all the AVPs were hand-picked by Charles R. Wiggington, Sr. Of all the AVPs, only the one who oversaw Riverside County and the one who oversaw compliance, were qualified to carryout the responsibilities of their post. All the others were unqualified, inexperienced, unethical, dishonest, and lacked the education to fulfill their assigned responsibilities.

In 2007, President Wiggington was informed by state auditors that the credit union needed to create policies and procedures for many of its internal processes. He immediately assigned the lofty task to then AVPs, Liz Campos and Sylvia Perez though neither woman was qualified to satisfy any of the tasks related to compliance. At the time, Mrs. Perez would boast, “Our president has given us the task of reviewing compliance. We will be very busy and won’t have time for anything else.” Within six months, the task of rewriting policies and procedures was abruptly removed from Mrs. Campos and Mrs. Perez after the President realized neither woman possessed the ability to complete the project.

Over the years, the AVP sector has been the focus of scandal and marred by lackluster performance. Just three months after the sector was created, one AVP was terminated for kiting. One year later, a second was terminated following a verbal altercation with the President. A third was driven out of the credit union because former COO, Beatrice Walker, who was prone to imaginative delusions, believed he was leaking confidential information to this blog. Another retired after her assigned branch was closed by the credit union. Another fled the credit union in 2012, fearing she was targeted for termination. When she tried to return to work earlier this year, she was informed her position had been eliminated and there wasn’t an available position for her to fill. Another was demoted and now serves as the credit union’s sole Business Development Representative and another has been bumped down and now assists Vice President, Yvonne Boutte at the South Pasadena branch. The last remaining AVP was terminated this past March for unsatisfactory performance and has been the subject of an investigation intended to prove she was involved in internal thefts occurring at the Los Angeles branch.

The idea of an AVP sector was born out of President Wiggington’s imaginative and unrealistic vision that an AVP sector would enhance Priority One’s public image and performance. He had boasted that while employed by Bank of America, he had witnessed the achievements of the bank’s AVP sector which he insisted could be duplicated at the credit union. The Board, who are immensely obtuse, approved installation of the AVP sector despite the fact there was no logical reason or actual need for another line managers. At the time of their inception, all AVPs were assigned goals developed by President Wiggington and former AVPs, Liz Campos and Sylvia Perez. The President also handed all authority over the staffs of all offices to Mrs. Campos and Mrs. Perez. Unfortunately, the two women proved acerbic and quickly estranged themselves from all other staff.

For President Charles R. Wiggington, Sr., the demise of the AVP sector serves as another testament to his inability to make sound decisions. The AVP sector proved to be another expensive waste of money and time. Of course, none of this is consequential to the President who treats the credit union as his own personal piggy bank and who continually finds protection from the inept Board of Directors. Here is the list of AVP name’s in the order they were promoted by President Wiggington:

Liz Campos

Terminated for kiting

Sylvia Perez

Sylvia Perez, who once boasted she and her husband were close friends of President Wiggington, left the credit union on medical leave in June 2012. In the two months preceding her departure, Mrs. Perez received two written warnings for failing to achieve her assigned monthly sales quotas. In the weeks prior to leaving, she complained incessantly to employees of the now defunct Burbank branch, that she knew AVP, Joseph Garcia, and then CLO, Cindy Garvin, had targeted her for termination.

She also complained that her friend, President Wiggington, was no longer responding to her voicemails or emails. Complaining that she was tired, unable to sleep, losing hair, and breaking out with pimples, she left the credit union. On the day the credit union posted notice that CLO, Cindy Garvin, had been terminated, Mrs. Perez informed an employee of the Van Nuys branch that she was ready to return to work, however, she was shortly afterwards informed her position is no longer available.

Aaron Cavazos

The President used employee complaints filed against Mr. Cavazos prior to his promotion to AVP, to seal the AVP’s termination.

Jodi Hurst

Retired in 2010, following closure of the Redlands Branch.

Lynnette Fortson

Terminated for unsatisfactory performance, the credit union is currently gathering evidence to prove she was allegedly involved in internal thefts, all occurring at the Los Angeles branch.

Dane Simmons

Position was phased out.

Gema Pleitez

Mrs. Pleitez was discreetly demoted earlier this year. She once served as Branch Manager of the South Pasadena branch, overseeing its Member Services Department and Teller Departments. In January 2011, she was promoted to the position of AVP and assigned control over the Call Center (which was taken from then Call Center Supervisor/Consumer Loan Manager, Joseph Garcia) and the Riverside branch. A few months later, the Riverside branch was closed and in February 2012, her authority over Members Services, tellers, and the Call Center removed and assigned to VP, Yvonne Boutte. Currently, Mrs. Pleitez serves as the temporary Branch manager overseeing Member Services, the Call Center, and Teller department pending return of VP, Yvonne Boutte, who is temporarily working at the Los Angeles branch. Joseph Garcia

On January 15, 2012, following a second three-month medical leave of absence (the second leave taken within a 17-month period) Mr. Garcia returned to work but was almost immediately informed that his position- AVP of Sales and Business Development, had been eliminated during his absence. He was informed that he would begin serving immediately, as the credit union’s new and only Business Development Representative, however, the credit union would not announce the change of title and responsibilities. A visit to Mr. Garcia’s LinkedIn account quickly confirms he is a Business Development Representative. Since his return, he spends days allegedly visiting the communities served by the credit union. However, since his return he has consistently failed to satisfy his assigned monthly quotas. This is rather ironic when one considers that throughout most of 2012, he was pivotal in terminating employees who failed to achieve their monthly goals. Furthermore, he conducted an aggressive campaign, aggressively pushing employees to achieve their sales quotas or face expulsion from the credit union. More on Mr. Garcia in next month’s blog post.

Like so many of his other inspired enterprises, President Wiggington’s once shimmering and allegedly promising AVP sector, crashed and burned. The AVP sector serves as a metaphor for almost everything endeavored by the President. Over the years, his inventions have consistently failed to achieve their targeted purpose and in time, contributed to the credit union’s financial losses. The AVP sector, permeated by scandal and failure, proved in the end to be another of President Wiggington’s disasters.

THE MISSION STATEMENT

To our surprise, the credit union published its Mission Statement in the 2012 Annual Report. A search on their web, Facebook and Twitter pages, reveals that nowadays, the statement only appears on their Twitter account. One would have thought that if the credit union truly believes they are a financial fitness center, possessing the ability of helping members and employees win with money, that they would have boasted about this on all their account pages. One has to ask, how can a credit union that lost more than $8 million during the period of 3/31/2012 through 3/31/2013 possess the ability to help its members achieve financial fitness? The facts versus their Mission Statement, strongly suggest Priority One Credit Union is no one’s Financial Fitness Center.

COMPLAINTS

FEAR AS A MOTIVATOR

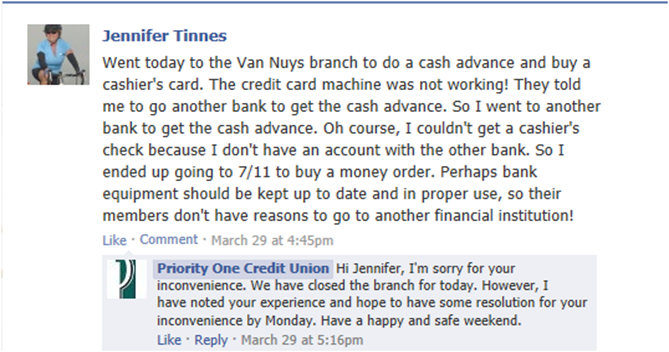

Despite installation of its Call Center in January 2010, complaints citing poor quality member service, have actually increased. The once touted, “one stop Call Center” has failed over the years, to live up to the hype once proclaimed by President Wiggington and then COO, Beatrice Walker.

Earlier this year, we learned the Board was exacting increased pressure, demanding the President either find a way of curtailing member complaints. The credit union is now allowing some member complaints to be published on their Facebook page. Of course, these are censored to ensure that nothing is published that is too difficult for the credit union to resolve. The President’s latest ploy is to create the impression of transparency though most complaints and internal issues remain well-guarded behind figurative walls, buttresses and looming towers.

As shown above, the only compliment we located on their credit union’s Facebook page was posted by AVP, Gema Pleitez, and agreed to by Marketing Specialist, Daniel Ballesteros. All we can say is if you can’t get members to compliment your credit union, then compliments from salaried employees will do. Okay, maybe not.

We receive numerous emails from members expressing their dissatisfaction over the level of service provided by Priority One Credit Union. Amongst the most frequent complaints are allegations that representatives of the credit union don’t return calls, long wait period when calling the Call Center and branches, and being rushed when speaking to representatives.

According to some of the emails, Priority One’s employees are described as disinterested in listening to member concerns and much more concerned with selling loans. Though we understand the need for cross-selling products, the reduced focus on member service has an adverse impact on the credit union’s ability to garner new business.

Since 2012, the credit union has often issued directives, demanding sales take precedence over all else. Gema Pleitez, who temporarily oversees the Member Services Department in South Pasadena, even boasts that she makes certain Call Center Representatives and FSR’s limit conversations with members to no more than three minutes. Inarguably, the importance of member service eludes President Wiggington and his dwindling staff of managers.

EMPTY PROMISES

“To help our member-owners and employees achieve financial fitness”, 2009

“We are committed to providing quality products and services that help you win with money”, 2009

“Your money is safe at Priority One Credit Union”, 2013

The internal thefts coupled by their widespread internal issues have served to undermine its assurances to members. Under President Wiggington, the credit union has shown it cannot help members achieve financial fitness nor guarantee that its products and services can actually help members win with money. As far as safety of assets is concerned, the internal robberies at the Los Angeles branch speak volumes about the credit union’s inability to protect member assets.

At the end of 2012, Bauer Financial issued another assessment of Priority One’s performance. Again, as they did earlier in 2012, they cite Priority One’s overhead is above normal. So what does this mean? This indicates the credit union is not bringing in sufficient new business to offset operational expenses. The failure to generate sufficient levels of profit can be pin pointed to the President’s inability to introduce effective business-building strategies. This also speaks clearly to the Board’s failure to populate the executive ranks with qualified people who understand business development, sales, and finances. The President’s dependence on consultants to white wash his mass failures have done absolutely nothing to remedy Priority One’s infirm dynamic. The credit union is in dire need of new business and methodologies that promote its name and products which will never be achieved through the mere revamping of its webpage or introduction of a phone app.

BANKRATE’S ASSESSMENT

EARNINGS ANALYSIS

“For the year ended December 31, 2012, this institution recorded a net profit of $594.98 thousand, which represented a return on average assets (ROA) of 0.39%. Year earlier four quarter results amounted to a net profit of $1,126,513, or a 0.71% ROA. ROA is the key measurement of profitability within the credit union industry, and the industry's ROA, for the twelve months ended December 31, 2012, approximated 0.86%. We have concluded that, for the four quarters ending December 31 2012, the institution achieved a below average return on average assets. A significantly higher than average overhead ratio is in evidence.”

Source: Bankrate.com

Well, none of this sounds like A Brighter Future Ahead, does it?

CONCLUSION

PROMISING THE WORLD, DELIVERING NOTHING

The credit union’s payment of yet another settlement, was intended to bring closure to the lawsuit filed by a former FSR but instead, further impugns the credit union as an employer, who knowingly violates its own policies and state and federal laws. The settlement also dispels the President’s frequent insistence that the lawsuits filed by four former employees were all frivolous and the fabrication of disgruntled ex-employees whose motivation was greed.

The President and Board Chair’s address along with those of the Board Treasurer, and Supervisory Committee Board Chair, provide no evidence proving 2012 was a good year or that the future holds some promise that the damages caused by President Wiggington will somehow be reversed. Clearly, the intent of each officer was to present an optimistic portrayal of Priority One’s future and hoping, readers would accept this at face value. What is also apparent is that the President and Board Chair never proofread the draft of the 2012 Annual Report before sending it off for publication. Their statement that Priority One’s assets or Net Income increased in 2012 is proven untrue by Priority One’s own financials which appear in the same report. The actuaries confirm the credit union’s Net Income plummeted by more than $8 million in 2012.

And contrary to their hope for A Brighter Future Ahead, the credit union’s internal organization remains quite disorganized. To remain in business, Priority One’s has grown reliant on reduced spending and maintaining high capital. The credit union continues its more than three-year freeze on wage increases while the President and his executive staff, continue to demonstrate they are wholly incapable of creating strategies that generate new business, increase membership, and augment growth.

In 2010, we first warned the credit union’s increasing reliance on cut-backs as a means to survival might prove detrimental. We pointed out that if the President didn’t introduce actual strategies to increase business, he might soon exhaust those sources where cut-backs could be implemented. We also warned that the credit union could develop an unhealthy and addictive reliance to expense reductions rather than exploring new and innovative ways to increase business, generate profit and augment membership.

In 2012, the President and Board Chair blamed the credit union’s inability to acquire new business on the Wall Street meltdown. This year, they point to the national economy and the state’s and nation’s unemployment as prime causes for the credit union’s continued inability to garner substantial levels of new business. However, a close study shows that the credit union’s problems began after Charles Roger Wiggington, Sr. was appointed President and CEO of the once prospering credit union.

In 2009 and under authorization of the Board of Directors, President Wiggington began spending hundreds of thousands of dollars in hiring his then friend, COO, Beatrice Walker, and immediately following her termination, hiring Cindy Garvin. The amount spent on salaries and benefits and the numerous projects implemented by each officer which never produced profit, contributed to Priority One’s decline. Under President Wiggington, immense amounts of money have been spent on consultants, refurbishments of the main branch, and a failed Call Center, all of which failed to attain their intended purpose. Reducing the credit union’s internal problems to their lowest common denominator reveals that ignorance of procedures and an acute inability to make sound decisions by the credit union’s executive and managerial sector have severely undermined the credit union’s performance. The credit union’s failure to successfully promote its products and services can also be attributed to its subpar marketing and advertising which clearly denote a failure by the President and his immediate staff to comprehend the changes impacting the credit union’s marketplaces, resulting in the production of poorly planned concepts and an ignorance of perceived value. The President’s fickle and frequent changes to the credit union’s so-called corporate structure proves Charles R. Wiggington, Sr.’s style of mismanagement is “Organizational Disorganization”, characterized by overspending and appointment of overpaid, unqualified executives and managers and as attested to by the now extinct AVP sector.

Despite their looming record of failures. the credit union’s highest officers annually publish the same tired addresses alluding to non-existent successes during the previous year and accompanied by a record of inaccurate data. The most absurd part of their contrived efforts is that the 2012 Annual Report contains financial information that is inconsistent with the statements contained in each officer’s addresses. Their attempt to pull a fast one also reveals they have yet to master the art of deception, begging us to ask, “Is there anything that they do well?”

Technorati Tags: Lawsuits,lawsuit,FSR,Charles R. Wiggington,Sr.,Paul F. Schimley,Rodger Smock,Executive Vice President,Robert West,Director of Human Resources,Director of Employee Services,Esmeralda Sandoval,Manager of Employee Services,Employee Services,settlements,Redlands branch,Riverside branch,Burbank branch,South Pasadena branch,Airport branch,Santa Clarita branch,Valencia branch,AVPs,Sylvia Perez,Yvonne Boutte,Vice President,Liz Campos,Aaron Cavazos,Lynnette Fortson,internal thefts,Los Angeles branch,2012 Annual Report,2012 Annual Meeting,board chair,Diedra Harris-Brooks,Supervisory Committee Chair,Cornelia Simmons,Joseph Marchica,Treasurer,Priority One Credit Union,POCU,Supervisory Committee,Priority One Supervisory Committee