CONTRADICTIONS

Priority One Credit Union has begun selling postage stamps. In a memorandum dated June 2, 2009, issued by AVP, Rodger Smock, disclosed that then newly hired COO, Beatrice Walker, would be introducing "new streams of income." Is the selling of postage stamps an example of one of her new streams of income? If so, what's next, a lemonade stand?

At a time when the credit union requires well hones strategies that succeed in reaping large amounts of profit, the selling of stamps hardly seems consequential and it's certain, will have absolutely no impact on resolving the credit union's increasing inability to offset its monthly overhead.

Beatrice Walker created solutions like those of President Charles R. Wiggington, Sr., tax members. Courtesy Pay, the credit union's version of overdraft protection, charges members a fee each time they inadvertently or intentionally use Courtesy Pay. The service has subjected increased numbers of members into collection proceedings. What's more, unethically, Ms. Walker had all member accounts coded for Courtesy Pay when she was supposed to "ask" if they wanted to enroll in Courtesy Pay.

The President implemented E-Statements without first gauging members if they wanted the implementation of online account statements. The reason why members should have been asked, is because the majority of members are employees of the U.S. Postal Service. The postal service has reported a decline in the use of mail service which has in turn, forced the closure of facilities and laying-off of a large number of members. E-Statements will inarguably contribute to the decline in mail delivery service. Having first asked members if they wanted to service would have demonstrated that the credit union cares about members who are also employees of the postal service. Evidently, under President Wiggington, members hold little importance and postal employees mean even little.

At a time when the credit union requires well hones strategies that succeed in reaping large amounts of profit, the selling of stamps hardly seems consequential and it's certain, will have absolutely no impact on resolving the credit union's increasing inability to offset its monthly overhead.

Beatrice Walker created solutions like those of President Charles R. Wiggington, Sr., tax members. Courtesy Pay, the credit union's version of overdraft protection, charges members a fee each time they inadvertently or intentionally use Courtesy Pay. The service has subjected increased numbers of members into collection proceedings. What's more, unethically, Ms. Walker had all member accounts coded for Courtesy Pay when she was supposed to "ask" if they wanted to enroll in Courtesy Pay.

The President implemented E-Statements without first gauging members if they wanted the implementation of online account statements. The reason why members should have been asked, is because the majority of members are employees of the U.S. Postal Service. The postal service has reported a decline in the use of mail service which has in turn, forced the closure of facilities and laying-off of a large number of members. E-Statements will inarguably contribute to the decline in mail delivery service. Having first asked members if they wanted to service would have demonstrated that the credit union cares about members who are also employees of the postal service. Evidently, under President Wiggington, members hold little importance and postal employees mean even little.

OBSESSED WITH TITLES

In January, we noticed a comment posted by the South Pasadena Branch Manager, Gema Pleitez, on her Facebook page, announcing she had been promoted to the position of Assistant to the Assistant Vice President (AAVP). A few days later, the credit union posted a notice on the Intranet informing employees that Mrs. Pleitez had been promoted to the post of AAVP and would be overseeing operations for the Riverside branch and the Call Center located at the main branch in South Pasadena, California.

We don't understand how Mrs. Pleitez, who is assigned to the South Pasadena branch will oversee operation of the credit union's small and insignificant branch in far-off Riverside county. What is Mrs. Pleitez going to do to oversee operations of that branch when she physically located far from that branch? Mrs. Pleitez is also known for being lazy, often spending a great portion of her workday, playing on the Internet and purchasing products online and having her purchases delivered to the main branch.

A week and a half ago, the credit union also announced the promotion of the Director of Project Management (whatever that means) to the post of Vice President of Support Services (whatever that means).

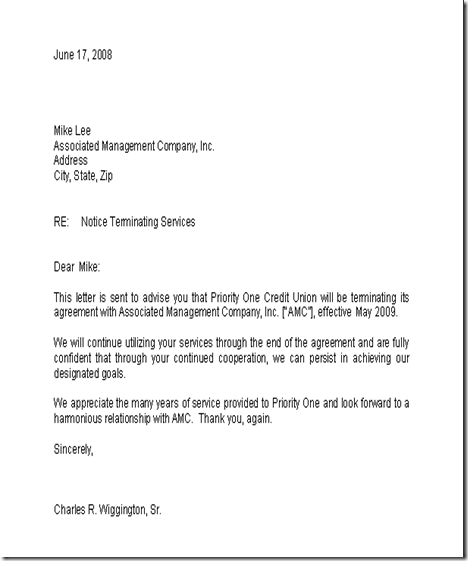

As for Mrs. Boutte, don't expect her new, upgraded title to in anyway change what she currently does. We do know that in 2008, she was hired because at the time, the President believed that Associated Management Company, Inc., the credit union's collection agent was recuperating sufficient delinquent monies due to the credit union. He also disparaged the company's honesty which seems more than a tad hypocritical. Here is a copy of the June 17, 2008, letter handed to Associated Management Company, Inc.'s owner, Mike Lee, which advised him that his company's contract with the credit union would effectively end in May 2009.

We don't understand how Mrs. Pleitez, who is assigned to the South Pasadena branch will oversee operation of the credit union's small and insignificant branch in far-off Riverside county. What is Mrs. Pleitez going to do to oversee operations of that branch when she physically located far from that branch? Mrs. Pleitez is also known for being lazy, often spending a great portion of her workday, playing on the Internet and purchasing products online and having her purchases delivered to the main branch.

A week and a half ago, the credit union also announced the promotion of the Director of Project Management (whatever that means) to the post of Vice President of Support Services (whatever that means).

As for Mrs. Boutte, don't expect her new, upgraded title to in anyway change what she currently does. We do know that in 2008, she was hired because at the time, the President believed that Associated Management Company, Inc., the credit union's collection agent was recuperating sufficient delinquent monies due to the credit union. He also disparaged the company's honesty which seems more than a tad hypocritical. Here is a copy of the June 17, 2008, letter handed to Associated Management Company, Inc.'s owner, Mike Lee, which advised him that his company's contract with the credit union would effectively end in May 2009.

Mrs. Boutte was hired several weeks before Associated Management Company, Inc. vacated their offices at the South Pasadena branch. Mrs. Boutte was not only hired to help implement a less costly new in-house collections department but to reduce write-offs and increase the amount of delinquent payments due the credit union. Thus far, Mrs. Boutte's achievements have been slow in being realized and delinquencies remain high.

After her arrival on June 1, 2009, Beatrice Walker quickly forged a relationship with Mrs. Boutte and a few months later promoted Mrs. Boutte to Director of Project Management.

We don't believe Mrs. Boutte's has fulfilled the President's vision of what he hoped an in-house collections department would achieve. What's more, she's proven to be a narcissist like the COO and President and wields an iron rod demanding subservience of all employees.

Clearly, the fascination and obsession with titles continues to thrive under President Wiggington. The titles are actually empty and childish appointments that realistically mean absolutely nothing because the recipients of titles are mostly inept, self-serving louts who have more concern with their status than they do for the credit union's well-being.

RATINGS

As shown below, Bauer Financial financial assessment of Priority One Credit Union rated it two stars. So what do two stars indicates:

Two stars is defined as "Problematic." That is one-star above "troubled" and only two tiers above ZERO. It's a low rating.

Just to put things into perspective. On December 31, 2006, the day William E. Harris retired, the credit union was rated four-stars which assesses the credit union's overall performance as "Excellent."

NOV/DEC 2010 FINANCIALS

ASSETS

November 2010

$103,039,647.00

December 2010

$103,644,634.00

LESS ALLOWANCE for LOSSES

November 2010

-$2,840,340.00

December 2010

-$3,817,664.00

NCUA DEPOSIT

November 2010

$1,417,073.00

December 2010

$1,417,073.00

NOTES PAYABLE

November 2010

$10,000,000

December 2010

$10,000,000

SUPERVISORY COMMITTEE

EDUCATIONAL EXPENSES

YTD

-$2,153.00

TRAINING EXPENSE

November 2010

898.00

December 2010

$2061.00\

YTD

$21,336.00

BUSINESS

DEVELOPMENT

November 2010

$0.00

December 2010

$0.00

YTD

$2,684.00

LEGAL

EXPENSES

November 2010

$1823.00

December 2010

$11,109.00

YTD

$90,000.00

$90,000.00

CONSULTANCY FEES

November 2010

$6700.00

December 2010

$7543.00

YTD

$168,820.00

LOSS/GAIN

SALE OF LOANS

November

$0.00

December

-$45,967.00

NET INCOME/OSS

November

$11,528.00

December

$85,358.00

YTD

-$563,830.00

November 2010

$6700.00

December 2010

$7543.00

YTD

$168,820.00

LOSS/GAIN

SALE OF LOANS

November

$0.00

December

-$45,967.00

NET INCOME/OSS

November

$11,528.00

December

$85,358.00

YTD

-$563,830.00

PROMISES & ASSURANCES

Bauer Financial's assessment prompted us to revisit the credit union's 2009 Annual Report, inappropriately titled Reaching New Heights Together to review the statements made by some of the credit union's key officers. What they wrote is the best testament to their commitment to the credit union and to their integrity. Remember, the report was made public in May 2010 and also provides a forecast of the credit union's future performance.

We also thought it appropriate to share the following comments posted by readers of this blog.

We also thought it appropriate to share the following comments posted by readers of this blog.

COMMENT 1

Anonymous said…..

"John

How do you know so much in regards to their complains? How did you get copies of the letters? Is way too much confidential information out there. It does make me wonder if my information is secure. I should be afraid to say or write anything at priority one and later have it publicized. We asked Darlene and Suzanne why were they leaving and Suzanna keep on saying the same thing over and over and she seemed sad though. Oh well they're gone! So John or blog[g]ers leave us employees alone stop the gossiping half of your story is or have been made up.

November 17, 2010 2:56 PM"

COMMENT 2

"Anonymous said...

Good morning Priority One people

I wish you all a Happy New Year!!

I hope this disappears by 2011. You people need to find a job and leave us in peace. We have enough hell up here and this blog doesn't help us. Happy New Year everyone!!

December 31, 2010 6:57 AM"

The credit union's would-be defenders reveal just how terrible things are within Priority One's working environment. In the first comment, the writer contradicts him or herself and admits to the accuracy of our reporting and even expresses concern about the security of the credit union's most confidential information. However, the writer concludes rather confusedly that we should "stop gossiping half of your story is or have been made up." So is our information confidential pointing to a problem with Priority One's ability to guard the confidentiality of it's information or is it made-up? We'd suggest the writer reread his/her comment.

The second comment urges we leave the credit union "in peace" and that employees of the credit union "have enough hell up here." How can a person be in peace of their being subjected to "hell"? We also advise the writer rethink his opinion which is riddled with inconsistencies.

- As of 3/31/09, the credit union reported its asset size at $181,441.854.

- As of 12/31/10, that amount decreased to $154,486,639.

- Deduct $10 million for the remaining unpaid balance due on the $20 million loan borrowed in mid-2008. This reduces Priority One's asset size to $144,486,639

- Total losses since January 1, 2007, the date Charles R. Wiggington, Sr. began his appointment to President exceed $37 million.

Report of the

SUPERVISORY COMMITTEE

The principal function of the Supervisory Committee is to make sure Priority One Credit Union (POCU) is adhering to established state and federal laws and credit union Bylaws. The committee confirms and validates that the financial information reported to the Board of Directors and members accurately reflects the fiscal condition of POCU.

The Committee is pleased to report that the Board of Directors has worked carefully to perform their duties and responsibilities. Additionally, President/CEO, Charles R. Wiggington Sr., and staff have carried out their duties and obligations to be your “Financial Fitness Center” and help you win with money.

The Committee members sincerely appreciate the opportunity to serve and look forward to serving you again in 2010.

Cornelia Simmons

Chair, Supervisory Committee

Cornelia Simmons' address suggests she is far more than a little dull. According to her report, "the Board of Directors has worked carefully to perform their duties and responsibilities." We invite Ms. Simmons to explain why if the Board has carried out is appointed responsibilities, has Priority One lost $37 million.

For those who may not recall, Ms. Simmons is also one of four officers who in 2008 and in spite of evidence proving Charles R. Wiggington, Sr. sexually harassed a former employee, she deemed it prudent and for that matter, ethical, to vote for his reinstatement. That is sufficient to impugn the veracity of any of Ms. Simmons' observations.

She also states that the Board and President have carried out their duties to be every member's "Financial Fitness Center." She is able to state this despite the loss of more than $37 million bringing into question her faculties as Chair of the obviously incompetent Supervisory Committee.

Chair, Supervisory Committee

Cornelia Simmons' address suggests she is far more than a little dull. According to her report, "the Board of Directors has worked carefully to perform their duties and responsibilities." We invite Ms. Simmons to explain why if the Board has carried out is appointed responsibilities, has Priority One lost $37 million.

For those who may not recall, Ms. Simmons is also one of four officers who in 2008 and in spite of evidence proving Charles R. Wiggington, Sr. sexually harassed a former employee, she deemed it prudent and for that matter, ethical, to vote for his reinstatement. That is sufficient to impugn the veracity of any of Ms. Simmons' observations.

She also states that the Board and President have carried out their duties to be every member's "Financial Fitness Center." She is able to state this despite the loss of more than $37 million bringing into question her faculties as Chair of the obviously incompetent Supervisory Committee.

Message from the

BOARD CHAIRPERSON and PRESIDENT/CEO

May 2010

May 2010

We are committed to financial fitness not only for your credit union but also for you, as individual members. Last year we promised to help members weather the “great recession”. Loan modifications and workouts, along with adding a free financial education and counseling service (Balance Inc.), exemplify our commitment to your financial fitness.

Shared Branching dramatically enhanced member convenience by way of our network of over 6,400 locations nationwide. No matter where our members’ plans take them, we are there. The many new conveniences, along with our exceptional array of products and superior services, have yielded a significant growth in membership over the past year.

In spite of the financial crisis that engulfed our industry, we are already in the early stages of a turnaround. In the past three months, several key indicators are improving with net income increasing, delinquencies down, and consumer loan growth resuming, in addition to our capital gradually trending upward. It is with a sense of great privilege that we embrace working together in partnership with you towards a future characterized by exceptional financial fitness for each of us.

Charles R. Wiggington, Sr. Diedra E. Harris-Brooks

The two horrible officers should have stopped at "We are committed" or maybe, "should be committed." These two either believe their own lies or are trying to dupe readers into believing their inane distortions of the truth.

President Wiggington does understand financials. That's shy he exerts so much effort and time trying to hide the credit union's actuarials. Diedra Harris-Brooks on the other hand, is ignorant about the credit union's financials relying on the President to provide her and the Board with "his" interpretations. Did some say, "Conflict of interest"?

Shared Branching is a convenience but what these two fail to describe is how Shared Branching has benefited the credit union financially? Has it created profit and if so, how much has been reaped from the service? And the "exceptionalness" of the credit union's products and services is purely subjective and open to personal opinion.

Report of the

President Wiggington does understand financials. That's shy he exerts so much effort and time trying to hide the credit union's actuarials. Diedra Harris-Brooks on the other hand, is ignorant about the credit union's financials relying on the President to provide her and the Board with "his" interpretations. Did some say, "Conflict of interest"?

Shared Branching is a convenience but what these two fail to describe is how Shared Branching has benefited the credit union financially? Has it created profit and if so, how much has been reaped from the service? And the "exceptionalness" of the credit union's products and services is purely subjective and open to personal opinion.

pièce de résistance

TREASURER

As the worst economic recession in decades nears the end, we are seeing signs of improvement and stability all over again. Assets, once on a downtrend, have leveled off around $165 million and Member loans are maintained above the $100 million mark. Income from continuing operations appear to be improving and are projected to be positive for the calendar year 2010.

Loan charge offs remain a challenge but are expected to moderate over time. Members in financial distress are encouraged to seek credit counseling and are offered solutions by a dedicated staff.

Management has a renewed commitment to make operational efficiencies a top priority, as the credit union moves toward lowering operating costs over the next few months. We have begun the year with an emphasis on financial prudence and practice of sound business decisions. We expect all efforts currently underway will result in a better financial performance this year and beyond.

Joseph Marchica

Was it mere oversight that the Treasurer and for that matter, the President and Board Chair, all failed to mention that late last year the credit union was forced out of necessity, to close the Redlands and Valencia branches and with the closures, laying-off a large number of employees? Mr. Marchica's address like that of Cornelia Simmons, brings into question his faculties and ability to properly assess Priority One's performance.

The pièce de résistance

It's actually Training and Education Manager, Robert West's address, that overshadows the reports signed by the President, Board Chair, Supervisory Committee Chair, and Board Treasurer. Mr. West, normally insipid, boring and inconsequential to the betterment of the credit union, provided an address that is both presumptuous and one-year after being published, proven to be untrue. If you know Mr. West, then you realize that he writes to please himself. No one is more impressed by what he says and writes than himself.

Mr. West's is lengthy. Because of this, we've decided to only provide excerpts. His statements are mostly vacuous and though intended to impress he fails to provide anything of substance that could lend some credence to his assertions. .

Priority One Credit Union

Mr. West's is lengthy. Because of this, we've decided to only provide excerpts. His statements are mostly vacuous and though intended to impress he fails to provide anything of substance that could lend some credence to his assertions. .

Priority One Credit Union

YOUR FINANCIAL FITNESS CENTER

THE TRAINING/EDUCATION MANAGER’S ADDRESS

The philosophy of the credit union industry is a simple three word phrase, "People Helping People." For more than one and-a-half centuries this phrase has attempted to communicate to the world what credit unions are all about, and what is the major difference between credit unions and banks (i.e., "members helping members" vs., "bankers helping themselves").

While all credit unions, everywhere around the world have received direction and inspiration from the high ideals embodied in this simple statement, Priority One Credit Union has decided to make a bold move with regard to it: a move we believe will help you to better understand how we are different from other credit unions, as well as banks.

Our bold move does not involve departing from the spirit of the "people helping people" message. It involves our attempt to redefine it, and as a result, reinvent ourselves and improve our value position with you—our loyal membership.

Recently, we revised our mission statement and tag line to more clearly define what we are in the business of "helping people" to do, and communicate to the world how we want our members to think about us.

Mission: To help our member-owners and employees achieve financial fitness. We are committed to offering quality products and services that help you win with money.

Tag line: Priority One Credit Union - Your Financial Fitness Center.

By making these changes, it is our intent to tell you in a way that maybe we

haven't before, that we are passionately committed to your total financial wellbeing, and to transforming the credit union into a place where you will feel

uniquely connected and celebrated.”

The address is the epitome of arrogance. Mr. West makes reference to the "bold move" allegedly made by the credit union but fails to provide a tangible piece of evidence that might lend some credence to his outlandish statement. Inarguably, less than one year after publishing his address, the credit union has lost millions of more dollars dispelling his declarations that Priority One is a "financial fitness center" capable of helping anyone 'win with money."

haven't before, that we are passionately committed to your total financial wellbeing, and to transforming the credit union into a place where you will feel

uniquely connected and celebrated.”

The address is the epitome of arrogance. Mr. West makes reference to the "bold move" allegedly made by the credit union but fails to provide a tangible piece of evidence that might lend some credence to his outlandish statement. Inarguably, less than one year after publishing his address, the credit union has lost millions of more dollars dispelling his declarations that Priority One is a "financial fitness center" capable of helping anyone 'win with money."

President Wiggington and Board Chair, Diedra Harris-Brooks have expended tremendous energy to dupe people into believing that Priority One is doing well. Losses of $37 million reveal that Priority One is far from doing well. Like street magicians, they want anyone who will listen to look at what they're holding in their hand while deterring attention from the failures that surround them. Their stories are continually contradicted by the credit union's Monthly Income Statements and quarterly Financial Performance Reports. It is the contents of the credit union's financial reports that have continually motivated the two corrupt officers to hide reports and at times, refusing to make these public.

Supervisory Committee Chair, Cornelia Simmons, has frequently aided their plots but the messages contained in her annual addresses are not only impugned by the credit union's financial reports but bring into question her competency and integrity.

It is also the President and Board who sanctioned COO, Beatrice Walker's unbridled spending. The undisciplined COO contributed to the credit union's losses indulging spending on superficial trappings like wall-to-wall carpeting for the main branch and the left-overs of which were delivered to her home in Santa Clarita and charged to the credit union's account. In the midst of losses, the President and Board Chair allowed the COO, a frustrated interior decorator, to indulge in her love of interior decorating using the skills she picked up while attending the College of the Canyons in Valencia, California. In 2010, she spent weeks visiting the reception area in the main branch, watching as workman painted and raised a custom made emblem of the credit union's logo which she commissioned, all at the cost to the credit union. While standing and staring at her handiwork, she would exclaim indiscreetly, "Just beautiful, just beautiful”. Did she think she was building the Great Pyramid?

Supervisory Committee Chair, Cornelia Simmons, has frequently aided their plots but the messages contained in her annual addresses are not only impugned by the credit union's financial reports but bring into question her competency and integrity.

It is also the President and Board who sanctioned COO, Beatrice Walker's unbridled spending. The undisciplined COO contributed to the credit union's losses indulging spending on superficial trappings like wall-to-wall carpeting for the main branch and the left-overs of which were delivered to her home in Santa Clarita and charged to the credit union's account. In the midst of losses, the President and Board Chair allowed the COO, a frustrated interior decorator, to indulge in her love of interior decorating using the skills she picked up while attending the College of the Canyons in Valencia, California. In 2010, she spent weeks visiting the reception area in the main branch, watching as workman painted and raised a custom made emblem of the credit union's logo which she commissioned, all at the cost to the credit union. While standing and staring at her handiwork, she would exclaim indiscreetly, "Just beautiful, just beautiful”. Did she think she was building the Great Pyramid?