THE BEST AND WORST LAID PLANS OF MEN and MICE OFTEN GO AWRY

As of September 2013, the most notable change at Priority One Credit Union is that its President, Charles R. Wiggington, Sr. no longer traipses about the main branch in South Pasadena, California boasting about a non-existent resurgence in business or that the credit union’s legal troubles are now a thing of the past. One reason may be because as reported her previously, he only comes to work one to three days each week and while at work spends a great portion of his time on non-work related matters like talking on the phone to friends and perusing the Internet or gossiping with his closest confidants. The credit union once known for its friendly and helpful employees is less a less visible presence in the communities it serves and rarely do employees of the credit union attend credit union industry or city chamber events. In fact, nowadays the credit union is the subject of derision amongst many of its members.

Since our last publication, we’ve confirmed that many of the President’s former responsibilities are being managed by members of his executive staff. Vice President, Yvonne Boutte oversees operations for all branches while CFO, Saeid Raad, handles a hefty amount of other issues usually assigned to the President. Though not referenced on the credit union’s webpage, Mr. Raad’s title has been changed to CFO/Senior Vice President to reflect his expanded authority. Of course, one has to wonder why the Board of Directors and Supervisory Committee continue to employ a part-time President possessing a long history of failures and whose administration has been marred by chronic scandal and lawsuits.

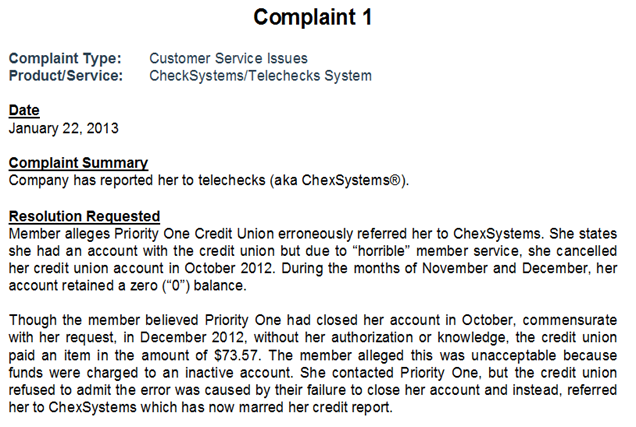

We previously reported that earlier this year, Executive Vice President, Rodger Smock, attended a deposition at the law offices of Richardson, Harmon, and Ober in the capacity of Human Resources Director of Priority One Credit Union. During the deposition, he provided testimony about his handling of the 2010 complaint filed by the former Valencia Branch Manager which alleged she had been harassed by then COO, Beatrice Walker. He not only stated that he was the Director of Human Resources at the time the complaint was filed but stated he remains the department’s Director.

We’ve also recently learned that Employee Services Manager, Esmeralda Sandoval, also attended a deposition and answered questions about her role in the 2010 investigation of the Branch Manager’s complaint. More recently, President Wiggington and Employee Services Director, Robert West, also participated in depositions, each also answering questions about their handling of the Valencia Branch Manager’s complaint and its investigation. The answers provided by the four officers reveal much about the credit union’s defense and about each person’s character.

To review, in his letter dated October 13, 2010 and sent to the Valencia Branch Manager, President Wiggington stated:

- He investigated the complaint filed against COO, Beatrice Walker.

- He interviewed all parties implicated in the complaint; and

- He arrived at the conclusion that the conflict between the Branch Manager and Ms. Walker was not work-related and spurred by a misunderstanding on the part of the Valencia Branch Manager though omitting any specific reference describing what it is she allegedly misunderstood.

Possibly forgetting about his letter, in 2012 and earlier this year, President Wiggington disclosed to staff members that he delegated investigation of the complaint to the Human Resources Department. We were surprised that the credit union’s allegedly sharp attorney, Paul F. Schimley of Richardson, Harmon, Ober didn’t help the President devise a more clever and less deficient account of his involvement in his handling of the Branch Manager’s complaint. Here is a brief summary of what he other officer now allege transpired in 2010:

Rodger Smock, Executive Vice President

According to the Executive Vice President, in September 2010, he delegated investigation of the Branch Manager‘s complaint to his staff in Human Resources. This is rather peculiar, since in September and October 2010, Rodger Smock was not a member of the Human Resources Department, having been unceremoniously ousted from the department by then COO, Beatrice Walker.

Esmeralda Sandoval, Manager of Employee Services

Miss Sandoval testified she referred investigation of the complaint to her superior, Rodger Smock. This too is peculiar since on the date the documented complaint was received by the credit union, Miss Sandoval’s immediate supervisor was Robert West. Also, just before Mr. West’s appointment as Manager of Human Resources and Education and Training, Miss Sandoval’s immediate supervisor had been then COO, Beatrice Walker. Her testimony is also inconsistent with the disclosures made by President Wiggington in his October 13, 2010 letter to the Valencia Branch Manager in which he attest he alone investigated the complaint. It is also important to note that in 2010, Miss Sandoval was wholly unqualified to investigate a complaint whose allegations cited violations of state and federal law. Miss Sandoval also does not possess a BA in Human Resource studies.

Robert West, Director of Employee Services

According to Mr. West, he only followed instructions provided him by others. Prior to his appointment as overseer of Human Resources in September 2010, Mr. West had not experience, training nor had he completed studies in Human Resources. So who’s telling truth?

FOLLOWING THE EVIDENCE

If Executive Vice President, Rodger Smock, was the Director of Human Resources in September and October 2010, then why would Mr. West who had no experience in Human Resources be asked to write to the former Branch Manager? Mr. West’s response to the Branch Manager was not only unusual, it was unacceptable.

In previous posts, we’ve describe how COO, Beatrice Walker, took possession of Human Resources at the start of August 2010, casting long-time Director, Rodger Smock, aside. Her intent for taking possession of the department was to eventually drive Mr. Smock out of the credit union because in her opinion, he was “lazy”, “overpaid” and who she said, needed to “retire.” Ms. Walker’s plan might have succeeded had she not been blindsided by the Valencia Branch Manager’s complaint which exposed a vicious and personal campaign orchestrated by Ms. Walker against the Branch Manager.

In September 2010, President Wiggington’s authority as President, had waned with much of his power absorbed by Ms. Walker. When the President learned of the Branch Manager’s complaint against Ms. Walker, he moved quickly to manipulate the circumstances and try and use the complaint as leverage in regaining some of his lost authority. Traveling to Santa Clarita in early September 2010, the President in company of EVP, Rodger Smock, requested letters from the Valencia Branch Manager and Business Development Representative to Santa Clarita, documenting their allegations that Ms. Walker had indeed carried out a vicious campaign against the then Branch Manager. Three days after meeting with the Valencia Branch Manager and the Business Development Representative, the President obtained approval from Board Chair, Diedra Harris-Brooks, to remove Human Resources from under Ms. Walker and assign it to then Training and Education Manager, Robert West. Mr. West was also provided a change in title to Manager of Human Resources and Training and Mr. Smock, the department’s former Director, was not reinstated despite the fact Mr. West had absolutely no experience in anything related to Human Resources.

Mr. West also carbon copied (“cc’d”) President Wiggington, then COO, Beatrice Walker, and then Human Resources “clerk”, Esmeralda Sandoval. If Mr. Smock was the Director of Human Resources in September and October 2010, then why was he not also carbon copied in Mr. West’s letter? The answer is, because at the time, Mr. Smock was not the Director of Human Resources nor a member of that department. So did Mr. Smock perjure himself during the deposition? It is also highly unlikely that Mr. West, who had not actual experience or education in anything related to Human Resources, would have authored the letter to the Branch Manager. Not only was he unqualified to compose a response, but the statements contained in the letter were dictated to him by President Wiggington and COO, Beatrice Walker.

In October 2010, Mr. West had only served as Manager of Human Resources, Education and Training for a little less than one month. As we’ve often stated, he also did not possess studies or actual hands on experience in anything related to Human Resources. At the time, the Board had grown displeased with Mr. Smock’s performance which they believed had left the credit union vulnerable in the lawsuit filed by the former Burbank Branch Manager.

The letter signed by Mr. West was actually dictated to him by both President Wiggington and former COO, Beatrice Walker. Mr. West’s letter as well as President Wiggington’s October 13, 2010 letter prove Mr. Smock was not the Director of Human Resources nor was he involved in investigating the complaint filed by the former Valencia Branch Manger. Contrary to his statements made during the deposition, Mr. Smock was not the recipient of the complaint nor did he investigate the Branch Manager’s contentions. One would think that the aged EVP would have been adverse to lying but evidently his role in the investigation of the Branch Manager’s complaint proves he had not problems lying during his deposition.

Reduced to its lowest denominator, the credit union’s defense amounts to another feeble effort by the President and some of his lackeys to try and escape accountability for a situation they alone created. What remains puzzling is that this last lawsuit filed by a former employee has not been dismissed. In mid-2012, President Wiggington boasted that the credit union’s attorney allegedly assured him that the lawsuit lacked merit and would be overturned before it would ever go to trial.

At the end of 2012, the President bragged that a motion to dismiss the lawsuit was about to be filed by the credit union’s attorney as he laughingly proclaimed the case was “as good as dismissed.”

At the beginning of 2013, the President boasted that the attorney obtained unspecified evidence which served to impugn the Plaintiff’s character and that according to the credit union’s attorney, this would bring an end to the Plaintiff’s complaint.

It is now the end of September 2013 and it appears the credit union’s and its overly confidant legal counsel are dragging their metaphorical feet. Why the delay if the lawsuit lacks evidence to support the Plaintiff’s accusations? We would have thought that a credit union alleging an extensive arsenal evidence impugning the Plaintiff’s character and her allegations, would have made an example of the former employee and publicly obliterated her lawsuit as a testament to its might. Then again, Priority One settled three lawsuits filed by former employees in 2012 and a fourth filed by a member. The odds are, Priority One doesn’t possess an infallible defense and based on what we do know of the story so far concocted by the credit union and its overpaid attorney, their defense amounts to childish storytelling hoping someone will believe that Priority One is the innocent victim in a heinous unified effort by former staff to extort money from the well-meaning organization.

THIS POST

We perused our files, locating documents and emails which up until now, had never been made public and provide insight into some of the activities occurring at Priority One over the last three years and which relate in part, to the last remaining lawsuit pitting Priority One against yet another of its former officers.

Early on, President Wiggington unwittingly setup the destructive course which would in injure the credit union’s once good reputation and undermine its ability to sell its wares in the marketplaces it served. His behaviors, methodologies and actions would also contribute to the credit union’s decline. In late 2006, almost immediately after being informed he was to be the credit union’s new President, Charles R. Wiggington, Sr. walked about the South Pasadena branch verbalizing who he intended to terminate when he did become President. The people he said would be fired under his regime included the Branch Managers of the no longer existent Worldway branch and the Los Angeles branch as well as the Director of Marketing. At the time, the President branded them “Harris’ people”, a reference to his predecessor, William e. Harris. In the years which followed he terminated a large contingent of employees who he labeled insurgents or who posed an intellectual threat to his style of doing business.

This past February, Charles R. Wiggington, Sr. terminated the last of Mr. Harris’ people. The termination immediately followed disclosure from an audit revealing that funds had been embezzled from the Los Angeles branch. The President concluded that the AVP overseeing the branch had been lax in enforcing security protocols and must be terminated for unsatisfactory performance. Almost immediately following the AVP’s termination, Vice President, Yvonne Boutte, prohibited employees from communicating with the former AVP whether while at work or from their homes. Mrs. Boutte, like her mentor, President Wiggington, could not refrain from violating the credit union’s policy governing confidentiality and revealed that the AVP was suspected of having embezzled some of the funds stolen from the Los Angeles Branch. Mrs. Boutte remained working at the Los Angeles branch for several months as the credit union anxiously searched for a Branch Manager to replace the fired AVP. During her stay in Los Angeles, Mrs. Boutte let it be known that she intended to terminate some of the staff at the Los Angeles branch. On September 18, 2013, the credit union terminated a Receptionist/FSR who had been one of the people targeted by Mrs. Boutte. Another very long-time employee, fled that office in July 2013, alleging stress though she is allegedly slated to return to work in December of this year.

Mrs. Boutte like President Wiggington, suffers from the same predisposition of having to verbalize their most intimate plots against staff members. We can’t personally comprehend why Mrs. Boutte and the President act as if they are exempt to abiding to credit union policy but evidently several lawsuits filed by former employees and at least one member suggest that the two officers have learned absolutely nothing from their catastrophic behaviors.

Nowadays the once-thriving Los Angeles branch has like almost all of Priority One’s branches, has been weakened by the horrendous decisions wrought by the credit union’s highest executives. Employees of the neighboring Postal Distribution Center have grown weary of the credit union’s internal conflicts and its evident inability to provide satisfactory member service. And as we’ve learned from speaking to many former employees, there seems to be a sense of relief that they no longer have to work under duress or in fear of being terminated. We know Priority One’s future is bleak. There is nothing to suggest any improvement in business or morale and let’s face it, as long as Charles R. Wiggington, Sr. remains President, the credit union will never recuperate any of the four branches it lost since 2010.

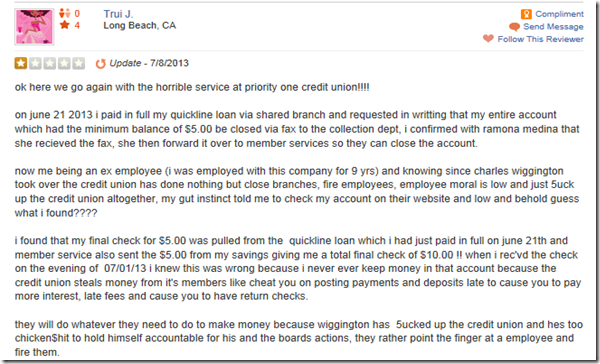

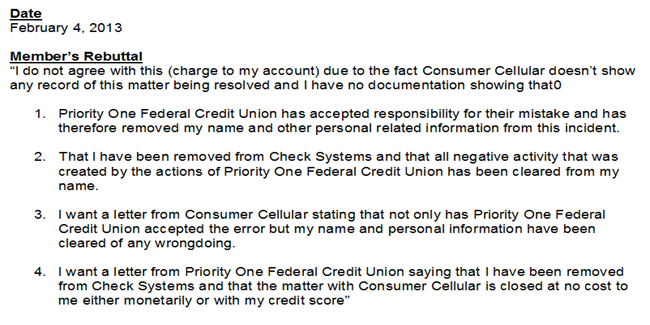

Last year, we reported that confidential information about a member had been posted on the Internet by an employee of the credit union. Though the incident constituted a violation of the Privacy Act, neither Board Chair, Diedra Harris-Brooks, President Wiggington or Vice President, Yvonne Boutte, were moved to rectify the violation of policy and law. Instead, the matter was turned over to the chronically callous Mrs. Boutte who thought it prudent to try and subjugate the member. The result of her action was the filing of a lawsuit which the credit union settled in November 2012 bringing closure to the incident.

A few months ago, the same member discovered that the credit union submitted unauthorized inquiries to Experian, the credit reporting company about her credit history. What was unusual is that the member never submitted a request to reinstate her membership nor did she apply for a loan, prerequisites which would have justified what turned out to be three (3) separate inquiries.

The member contacted the credit union’s attorney, advising her that Priority One breached the terms of the settlement agreement. Someone at the credit union informed the attorney that there was no record on file proving the credit union ever initiated inquiries to Experian. Of course, the attorney being unfamiliar with Priority One’s internal procedures did not know that inquiries to Experian are performed electronically via the credit union’s XP operating system and so contrary to what the attorney was told, the credit union’s online member records would reference the date the inquiry was submitted and the name of the operator submitting the request.

Unable to rectify the violation through the credit union’s legal counsel, the member informed the attorney she would have no other course but to file a lawsuit. The attorney responded that she would file a motion to dismiss the lawsuit indicating that the attorney is unfamiliar with Priority One’s internal procedures. Experian’s records showed that Priority One initiated the request. This is not a mistake regardless of the effort by the credit union to deny this fact. Furthermore, the reference in the member’s credit report that references Priority One as the entity issuing the inquiry is ample evidence to prove Priority One violated the terms of the settlement agreement entered into with the member.

After exposing this latest incident on this blog, the credit union moved at seemingly light speed to withdraw all references that it submitted inquiries to the credit reporting company. Their effort to rectify what they committed brings an end to this incident and avoids the filing of yet another lawsuit against a credit union that knowingly and willingly violates covenants it is required to adhere to. This normally might bring an end to yet another incident documenting abuse committed by the troubled credit union however in our opinion it does nothing to dispel the fact that the credit union has again shown no qualms in violating its agreements. Can any member be assured their confidential account information is safe with Priority One Credit Union? There is a well documented record of employees who have violated the credit union’s security protocols and interestingly enough, the credit union has not terminated any staff for these alleged abuses. This in itself is suspicious and prompts us to believe that the perpetrators are officers of the credit union. The 2012 publication of the member’s account and personal information on the Internet proved that an employee or employees of the credit union defied the Privacy Act. The inquiries sent to Experian without authorization again show the same disdain for credit union policies and procedures and in this case, for the terms contained in the settlement agreement entered into between the member and the credit union. Earlier this year, an audit revealed that member accounts had been pillaged through internal thefts. Though the the Board of Directors moved quickly to terminate the AVP who had overseen the Los Angeles branch for many years, no action was taken by the Board against the President, the Vice President of Operations, or the Vice President of Compliance, all of who are responsible to ensure protocols are enforced.

As we suggested previously, the latest violation of credit union policy was perpetrated by an employee likely seeking vengeance upon the member who filed a lawsuit against the credit union in 2012. The only person’s who would have a grudge to further harass the former member and order three reports from Experian are either the Credit Resolutions Supervisor, Alex Suarez, or her supervisor, Vice President, Yvonne Boutte.

FICKLE, UNSTABLE, or DYSFUNCTIONAL?

Snared in His Own Trap

In 2010, while an investigation of the Valencia Branch Manager’s complaint was allegedly being conducted, we received the following email from a reader who described the actions carried out by members of the credit union’s Human Resources Department. The communication provides very specific insight into the actions of the Executive Vice President and the Human Resources “clerk” and describes statements made by President Wiggington. The disclosure suggests that Human Resources was duplicitous in helping to undermine the Valencia Branch Manager’s complaint and ensuring the matter was not resolved properly or fairly as guaranteed under credit union policy or state and federal laws.John, I thought you should know what’s going on in this place. Yesterday [Thursday, October 14, 2010] Rodger got a voicemail from Susanna [the Valencia branch manager]. She’s been calling him but he hasn’t been returning her calls. She’s out on PTO because she’s stressing from what Bea’s [Walker] been doing to her. Yesterday, she gets a call from Esmeralda [Sandoval] telling her that she has until 5 p.m. today to tell the company if she’s going to accept the assistant branch manager job in Burbank or if she’s going to accept the severance package offered to her. Here’s the problem, the credit union, actually Wiggington offered her the assistant branch manger position now that Valencia is going to close but no one mentioned anything about a severance package to her.He decided to call her back today. He said she was upset because Esmeralda gave her less than 24-hours to make-up her mind about what she’s going to do plus she hasn’t been shown a copy of the severance agreement which even Rodger knows your supposed to provide when you offer it to employees. She also told Rodger that this is the first time she heard anything about a severance package and that she finds Esmeralda’s ultimatum unreasonable. You probably already know that Rodger plays both sides of any situation and so he agreed with Susanna and suggested she call Esmeralda immediately and tell her she is out on PTO and will not be at work on Friday, October 15th. Susanna told Rodger she had already done that but Esmeralda told her she had not choice and has to provide an answer to the credit union either by email or letter. I happen to know that Esmeralda is doing what Bea Walker told her to say. Esmeralda doesn’t have the experience or smarts to know what to do. She’s way over her head.Susanna told Rodger that Bea alienated her from her staff and that Sylvia [Perez] and Cecilia [Pereyra] don’t talk to her. Rodger told Susanna that she is imagining the whole thing. Its more of his same old BS he uses every time some complains. Either every employee is mentally ill or Rodger is nuts.Rodger was supposedly not happy because Susanna told him he hasn’t responded to her emails. He told her he never got any of them and that he hasn’t received emails from her in a very long time. He said he can’t understand why he doesn’t receive them. Susanna asked him if it is possible that Bea is blocking him from getting her emails. Rodger kept saying, “That’s really strange” and “that’s weird.” Susanna is really naïve. She trusts Rodger but he is someone that can never be trusted. A few weeks ago Wiggington told us that we were not to talk to Susanna but he didn’t give a reason. Rodger is getting her emails, he just isn’t replying to them and now he’s lying.Rodger told Susanna that he’s on vacation and won’t be back at work until Monday, October 18th. He said as soon as he gets back, he’s going to investigate to find out why he isn’t getting her emails. He also told her that maybe her emails are going into his SPAM box. Susanna told Rodger that maybe Randy McBride was instructed by Bea to block her emails from getting to Rodger.Susanna also told Rodger that Esmeralda doesn’t respond to her voicemails or emails and that when she is able to speak to her, Esmeralda never provides answers to her questions and says she will have to first speak to “the executives” before she can give Susanna an answer. Its pathetic that Esmeralda who is supposedly HR can’t answer questions about HR. Esmeralda also told Susanna that it is she who decides “who stays” or “leaves” at the credit union. If that was true, then why does she always have to first speak to “the executives” instead of giving Susanna a straight answer to her questions?Susanna also told Rodger that when she was on medical leave, Sylvia was ordered by Bea to work out of Valencia as the temporary branch manager. While in Valencia, Sylvia got chummy with Dana and Judith and some of the other staff and told them that they should not speak to Susanna if she calls the branch. Susanna also told Rodger that since she got back, she feels alienated from her staff, some who don’t speak to her anymore. She also told Rodger that one day Adrianna told her, “It looks like you don’t have any more power.”Rodger gave Susanna his same old useless advice that never does any good. He told her to confront Sylvia and ask her why she’s not returning calls and why she’s helping Bea alienate Susanna from her staff. Susanna told him that this would not help because Sylvia is her supervisor and stopped talking to Susanna when she was on her leave of absence.Rodger is two-faced. He knows Sylvia is probably the most disliked person at the credit union. No one any department likes to talk to her and Rodger and West are not even providing her with information about things they’re planning for her region. West has even said he can’t stand talking to her. Sylvia called Van Nuys on the day Susanna came back to work and asked Cecilia if she knew if Susanna had come back to work or extended her leave. These managers like to play the stupidest games but that’s just the way Wiggington has made the credit union go down. Why didn’t Sylvia call Esmeralda [Sandoval] or Robert [West]? Plus Rodger isn’t even in HR anymore so why is he giving her advice on what to tell Sylvia? Shouldn’t West be the one telling Susanna what to do? Notice how Rodger never said, “Call Robert. He’s the new director?” Rodger also told Susanna he hoped she didn’t make the wrong decision. He even told her that if he was her, he would have accepted the assistant manager position at Burbank.Susanna told Rodger that when she got back to Valencia she was told Bea offered the Burbank Branch Manager job to Judith Barajas which means that if Susanna accepts the assistant branch manager job, Judith will be her supervisor. How is that even possible when Judith has been her assistant at Valencia? Rodger said he didn’t know anything about this and even told her he didn’t think Bea is allowed to do this but because he isn’t in HR anymore she should talk to West about what Bea supposedly said.

The email reveals Rodger Smock was not the Director of Human Resources in September October 2010 which explains why he was not referenced in President Wiggington’s October 13, 2010 letter or in Robert West’s letter dated October 20, 2010. Despite this fact, Mr. Smock attended a deposition earlier this year in which he stated under oath that he was the Director in September 2010 and that he was the recipient of the Branch Manager’s complaint. He also stated under oath that he assigned investigation of the complaint to his staff in Human Resources though as it now appears, he was not part of Human Resources and thus had no staff. If one believes the story described in the email, then Mr. Smock is unusually glib about the responses issued by Human Resources in response to the Branch Manager’s complaint and in particular, to the acts committed by then COO, Beatrice Walker, AVP, Sylvia Perez, and Human Resources “clerk”, Esmeralda Sandoval. If he was in fact the Director then how could he have been so grossly misinformed by the acts being committed by his peers and his alleged assistant?

Either Mr. Smock lied during the deposition or he is immensely dull. The advice dispensed to the Branch Manager during their September 2010 was counter-productive, betraying his alleged expertise in psychology, a subject he studied during the 1960’s while attending the University of Cincinnati. Mr. Smock was and remains a man deeply out-of-touch and ineffective as attested to by his ignorance of the very activities occurring under his metaphorical nose. His bungling and ill advice dispensed to the Branch Manager reminds us that Rodger Smock is the same man who in 2008 insisted President Wiggington never sexually harassed a former employee and that the President’s statements to the victim inviting to “spank” her “ass” was merely said in jest. Evidently, Mr. Smock was also ignorant about the inappropriate and illegal nature of the President’s sexualized verbalizations.

If you tried to access Priority One Credit Union’s webpage between Saturday, September 21st through the morning of Monday, September 23rd, a message would have informed you that the credit union’s security certificate had expired. Not surprisingly, members calling the credit union to inquire about the message were responded to by employees who didn’t know anything about the problem.

According to Microsoft, when a security certificate is not renewed or revoked, then the webpage may adversely affect computers attempting to access the website. There are ways to circumvent the message but it is at one’s own risk and could cause one to inadvertently download harmful materials, i.e., spyware, malware, and virus’.

On Monday, September 23rd, we called the credit union to inquire about the problem and when it might be corrected. During each of our three calls, we were provided differing information. The reasons provided us were that:

- Employees had just been informed about the problem but were not given any information as to why the security certificate had expired or when it might be renewed.

- Another employee informed us that no one knew when the issue might be resolved.

- A third representative told us the credit union’s website would be “down” during the week and they thought someone was attempting to resolve the problem.

The inability to deal with any problematic situation is further attested to by the inept responses to any critical situation. Clearly, Microsoft, Internet Explorer and other sites warn that attempting to access a website whose certificate has expired or been revoked poses a security risk. The gravity of the situation was insufficient to prompt President Wiggington to properly address the problem though not because of a lack of executive staff. Evidently, his Executive Vice President, Rodger Smock, or Vice President, Yvonne Boutte felt significantly motivated to address the issue with employees. Certainly, Manager, Gema Pleitez, didn’t feel a need to provide her staff with information needed to answer member concerns. The credit union also has an IT Manager who never issued information that might have been informed employees. The variety of answers we obtained clearly indicates that the need to provide employees with the tools needed to satisfactorily carryout their assigned responsibilities are not being dispensed by managers who as we’ve often said, are inept and unqualified.

Littering Memory Lane

Promises are Made to Be Broken

In 2010, we received the following email which is also being published for the first time. Its author provided insight into the President’s handling of the complaint filed by the former Valencia. The contents of the email reveal that the President could not again exercise the personal discipline that should have precluded him from verbalizing his intents. The incidents described reveal that the President as is usual, made promises he had no intent of keeping and suggests that his only purpose for soliciting a written record of the Branch Manager’s complaint was to use it as a weapon by which to steal back some of the power and authority taken from him by then COO, Beatrice Walker. The acts describe also provide insight into how the Board of Directors and more specifically, Board Chair, Diedra Harris-Brooks, chooses to subvert ethics and push her personal agenda which is often to cover-up wrong doing committed by her President.

In November 2011, during litigation of the Burbank Branch Manager’s lawsuit, the chronically gabby President told some members of his staff that credit union attorney, Paul F. Schimley, assured him the Branch Manager’s lawsuit would be dismissed because of a lack of evidence proving her allegations she was the victim of racial and age discrimination. The attorney’s law firm also offered a witness of the credit union- Nora Neale, free legal representation if she testified that the Burbank Branch Manager was a racist who disliked Latinos, lazy, and unwilling to help the credit union develop new business. Based on the President’s disclosures, the case was a slam dunk for the credit union. According to the President, the Priority One’s legal counsel contacted the Branch Manager’s attorney and told her they were preparing to file a motion to dismiss the frivolous lawsuit.

Despite the premature exclamations of a victory and the threat to file a motion to dismiss the Burbank Branch Manager’s lawsuit, in December 2011, the credit union’s attorneys contacted the Plaintiff’s attorney, advising her they were interested in working out a settlement. So what could have happened that dissipated the President’s proclamations of a pre-trial victory? Obviously, the Burbank Branch Manager possessed something tangible that succeeded in displacing the credit union’s confidence in the defense they had carefully hammered out and which allegedly would serve to decimate the Plaintiff. The answer is that the Plaintiff produced documentation of the complaint once solicited by President Wiggington from the Valencia Branch Manager and in which she described the abuses committed by Beatrice Walker and which proved the credit union did not move to stop Ms. Walker’s campaign despite the many illegal allegations contained in the document. The letter was formidable enough to lay waste to the credit union’s intended defense which allegedly would prove the Burbank was a racist and insubordinate. Even the allegedly keen credit union attorney who has often taken on an aggressive, take no prisoners stance when dealing with Plaintiffs was incapable of staving off the documentation which evidently proved egregious acts committed by the credit union and condoned by the President, Human Resources, and even Board Chair, Diedra Harris-Brooks. More on the letter that brought down the credit union’s defense in the lawsuit filed by the Burbank Branch Manager, in next month’s post.

NO LONGER ACCEPTING THIRD-PARTY CHECKS

Last month we received an email from a frustrated and disillusioned member who complained that while visiting the Los Angeles branch he was informed by a teller and the Branch Manager that Priority One no longer accepts third-party checks. Though we admit there are risks when transacting cashing or deposit of a third-party check there are also safeguards and procedures specifically designed to address these. Was the refusal to deposit the third-party check into the member’s savings account an over-reaction on the part of the credit union for their negligence which have periodically caused internal losses of money to occur at the Los Angeles branch? Or is this an actual new credit union wide procedures implemented by both President Wiggington and Vice President, Yvonne Boutte, with approval of the Board of Directors?

The Incident

Certainly one contributor to monetary losses at both credit unions and banks are the cashing of third-party checks. Though this is has historically been a problem, most financial institutions have implement stringent policies and procedures to address the problem without impairing their relationship with their members and customers. Not so at Priority One Credit Union where the solution is not to process third party checks. This is a problem since there are safeguards that would allow the safe cashing of these not the least of which is placing holds on all such checks. We recently received a complaint from an alleged long-time member of the credit union who writes that he recently brought a check in the approximate amount of $60,000 to the Los Angeles branch, for deposit. He was informed that the check would not be cashed and its no longer allowable under the credit union’s stricter and recently revamped procedures. Dissatisfied by the Teller’s statement he spoke to Mrs. Huerta, the Los Angeles branch’s new Branch Manager. She agreed with the teller citing policy for the credit union’s refusal to cash the check. The long-time member informed the staff he did not intend on withdrawing the money and didn’t care if a 30 or more day hold was placed on the instrument. He was told the credit union could not process deposit of the check. The fact he is a long-time member with no adverse incidents marring his membership, he was refused service. He now states that this is the “last straw” and adds to his many excuses why not to continue to doing business with the credit union.

The Solution

If Priority One were managed by qualified leaders and a competent Board of Directors and Supervisory Committee, they might have taken the time to conceive measures that would allow members to deposit and even cash, third party checks. They could have required that a person hoping to cash a third-party check have a real credit union account. They could also have created a procedure that only allows a member to receive the amount of cash equal to the available balance in their account with a hold placed on any remaining funds pending clearing of the check.

The usual other procedures is that the member sign the back of the check. If the check is to be deposited then merely note “For deposit only” above the signature line. The credit union could also require that all third party checks be deposited versus cashed and a hold placed on the check until it clears and proven legitimate.

Of course, a member depositing a check must provide identification such as a driver license, state-issued identification card or passport.

The problem at Priority One is that its leadership don’t possess the ability to make sound decisions. Either as a result of outright ignorance or fear of being terminated, they implement immovable procedures such as refusing to transact a third-party check. Its preposterous and further compromises the credit union’s already debilitated relationship to its members. Priority One’s member service levels are unsatisfactory and the decisions being made by its leaders only serve to further thwart any effort by the credit union to gain upward momentum. The refusal by the credit union to deposit and place a hold on the member’s check is overkill and is an excessive response to the problem of internal thefts plaguing the credit union. The reaction seems to stem from paranoia versus caution and disables the credit union’s staff from making decisions that are adherent to credit union policy without threatening the safety of member and credit union assets.

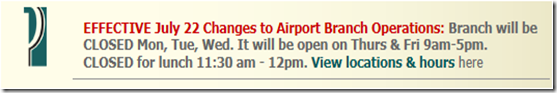

NO BRANCH, NO BUSINESS

We recently received the following email from a frustrated member of the credit union, who resides in Riverside County. The member’s complaint concerns his efforts to withdraw money from his Priority One accounts, via Shared Branching. Because Priority One no longer has any real branches in all of Riverside County, members living and working in that region must utilize Shared Branching for all their banking needs. Members are not allowed to withdraw more than $500 during a single day.

The member tried to withdraw $3000 from this credit union account. Because the amount exceeds the $500 per day maximum limit, the member was informed he would have to visit a Priority One branch. Riverside County is located approximately one hour away from the nearest Priority One location. Forced to drive to South Pasadena, the member closed his Priority One account because the credit union doesn’t provide a convenient branch location in Riverside County.

SEEING RED

Inarguably, the working environment is miserable at least according to many members visiting that office and not-so-secretly amongst employees. Two long-time employees of the company have begun complaining about the state-of-things at South Pasadena. Gema Pleitez, who until last year was an AVP and now works in the capacity of South Pasadena Branch Manager, and long-time Lead Loan Officer, Georgina Duenas.

In years past, we’ve written about how the two senior employees frequently broke credit union policies though always finding protection from Executive Vice President, Rodger Smock. Nowadays, the two women may actually have much to grip about. Mrs. Pleitez after all was an AVP for a very brief period of time until her ineffectiveness resulted in her announced demotion. She now oversees the Member Services Department and Call Center, mostly monitoring the work of her staff. Mrs. Duenas was overlooked for promotion in 2011 despite her many years of service. Former CLO, Cindy Garvin, by-passed Mrs. Duenas and instead promoted Sonia Villa as Supervisor over the Consumer Loan Department despite the fact that Mrs. Villa seems unusually addicted to gossip, talking about her personal issues and should you try and reach her by phone, you’ll find your call answered by voicemail.

We believe the two should be grateful to be employed and though the protection they once enjoyed may be a thing of the past, they at least have jobs that pay more than their worth.

DEAD (TIRED) IN THE WATER?

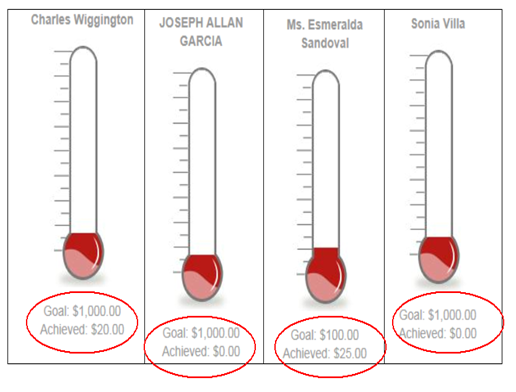

Since January 2013, efforts to jump start business development have consistently failed and if the credit union’s sole business development representative serves as an indicator of things to come, then you can be assured, don’t expect any sudden spikes in business anytime in the near future. For weeks, lone BDR, Joseph Garcia, drives to the credit union’s solitary office space at the Los Angeles Network Distribution Center located at 5555 Bandini Blvd in Bell Gardens, California and sits quietly in the space hoping members will just walk in to bring in their personal banking business. The space was utilized by the credit union for many years and at one time, opened for 3 hours on each and every Friday. After Charles R. Wiggington, Sr. became President, the post office was kind enough to offer a better space on the main floor of the distribution center, where the credit union would have a more visible presence and might better be able to assist members working at the distribution center. However, the President never felt impelled to order installation of an actual working computer that could be used to transact transfers of money between member accounts or provide balances or conduct research. For several years the room which masquerades as an pseudo-office, contains a desk, chair, table and inoperative computer and monitor serving as yet another example of wasted resources never developed by the chronically ineffective President. However, in recent months, Mr. Garcia has found use for the space as his personal hang-out where he can sit far from the miserable working environment in South Pasadena and where he can escape having to go out into the field in search of new business.

Since returning to work on January 15, 2013, following a personal three-month leave of absence, Mr. Garcia has consistently failed to meet his monthly quota of $150,000 in funded loans. In fact, this past August, only $27,000 were funded of the total $150,000 he is allegedly required to bring in. This by the way, was probably one of the highest amounts acquired by Mr. Garcia since his return to work.

Throughout 2012, many employees were terminated for failing to attain their assigned monthly goals. These employees were targeted each month by Mr. Garcia who at the time, was the AVP of Sales and Business Development and then CLO, Cindy Garvin. Despite having been the force behind numerous employee terminations, Mr. Garcia has failed throughout 2013, to achieve his own assigned monthly goal of $150,000 yet he somehow remains exempt from the disciplinary actions enforced with all other employees.

The President and Vice President, Yvonne Boutte, recently complained that they can’t comprehend why employees are failing to achieve their assigned monthly goals. Clearly, they view the problem as caused by employees and not by their inability to lead or provide employees with tools that help draw new business. A more accurate and realistic reason why goals are not being achieved is that a growing number of members are disinterested in what the credit union offers. This disinterest is born out in part from the credit union’s inability to provide satisfactory member service levels, shoddy marketing, deficient advertising, poor employee morale and an array of lackluster products and services. The President and his Vice President seem unusually obtuse to the fact that the credit union refuses to maintain relations its membership.

We’ve recently learned that the President purchased lunch for all employees as his personal expression of thanks for acquiring new business, however, he also ordered written warnings issued to about 80% of all employees for failing to achieve their assigned monthly sales quotas. His decisions and acknowledgements are schizophrenic and confused sending mixed messages to the workforce. A better and more reliable gauge of the credit union’s financial standing is its Net Income which has declined by more than $15 million since Charles R. Wiggington, Sr. was appointed President on January 1, 2007. Another are the number of member complaints citing deficient member service along with the closure of four branches over the past three years. The President’s mixed messages attest to chaos not order and affirm that he is incapable of leading the credit union out of the mire of problems he created.

Much ado about nothing…….Again

President Wiggington’s many online biographies are riddled with exaggerations and inaccuracies. In an excerpt taken from his incomplete Wordpress blog (shown above), the President states he has been President and CEO of Priority One Credit Union since 1992. The President may have forgotten that he began his employment at Priority One in 1992 in the capacity of Vice President of Operations versus President and CEO. He remained the Vice President of Operations until January 1, 2007, when he began his stint as President and CEO. Either Mr. Wiggington and his staff have again failed to proofread information intended for publication in the world wide web or the President is again dispensing inaccurate information about his less than illustrious career.

The President’s WordPress blog was launched on May 31, 2012 but as is evident, he has yet to post a single article though he asks visitors to leave a comment. Sure, where is your blog?

With the assistance of highly paid consultants, the President saturated the Internet with his biography. The publications are similar and often identical and really serve little purpose as they have not been updated nor do they reference his accomplishments which as we know are nil as attested to by the credit union’s diminished size.

Another example of wasted credit union resources intended to create the impression that Charles R. Wiggington, Sr. is accomplished. Nothing could be further from the truth.

CONCLUSION

Forecasting Priority One’s Future

In his many years of working in the banking and credit union industries, President Wiggington seems never to have learned the relationship between an organization’s ability to generate new business, augment profit and maintain a cohesive working environment and the integrity of its leadership. What may seem obvious to some, apparently eludes the fickly, verbose, and plot-obsessed President. To derive what may lie ahead for the troubled credit union requires that one first study its recent past. Inarguably, Priority One’s leadership relies on lies, manipulation, and always abusing their appropriated authority. Under President Wiggington, Priority One is heavily reliant upon distorting the truth, always hoping they can escape being exposed.

For years we’ve pointed to the compromising relationship between the President and Human Resources, a dynamic which fueled the filing of lawsuits by four former employees. We’ve witnessed their same disdain for policies and rules in the abhorrent manner the credit union dealt with the member whose confidential information was published on the Internet by an employee of the credit union. More recently, an unnamed employee of the credit union may have sought to avenge themselves on the same member and submitted inquiries to Experian, the credit reporting company, requesting information about the former member’s credit history. The credit union refused to rectify the latest abuse until they were again exposed on this blog. Apparently at Priority One, the only reason the credit union feels impelled to rectify its wrongs is when they are publicly exposed.

The remaining lawsuit provided a window, allowing us to peer into the credit union’s inner sanctum and revealing the ethics of the credit union’s highest officers. Apparently, the credit union’s intended defense is riddled with inconsistencies and contradictions and undermined by the credit union’s own documentation. Inarguably, Executive Vice President, Rodger Smock was not the Director of Human Resources in September and October 2010, the period when investigation of Valencia Branch Manager’s complaint was conducted. Furthermore, the only reason the Branch Manager documented her complaint is because President Wiggington requested a physical letter which he said was needed to begin an investigation of her allegations. However, the President’s intent was not to stop Ms. Walker’s campaign but rather recuperate some of his authority lost to the ambitious COO. The President not only failed to resolve the horrendous dynamic created by then COO but he actually perpetuated the abuses the Branch Manager was subjected to. What’s equally amazing is that this group of misfits never imagined their illegal and unethical acts would ever become public or the subject of a lawsuit that would cause the President’s most insidious plots to come into public light. The President’s mode of administration has proven lethal to business and to employee morale and sent far flung reverberations across the credit union. The only thing he’s succeeded in achieving is diminishing Priority One’s presence in the marketplace, marred its public reputation, and caused the closure of four branches and termination of numerous employees. Several weeks ago, the President bought lunch for his staff for succeeding in obtaining new business. Normally, this could signal an improvement in business, however, just 3 weeks ago, more than half of all employees were issued written warnings for failing to attain their assigned monthly quotas. It is these mixed messages that affirm Priority One remains in turmoil, its inner mechanisms in dire need of revamping while its management demonstrating again they are incapable of conceiving strategical planning that increases new business, generates profit, heals injured morale, renews the credit union’s reputation and re-establishes relations with its estranged membership.