After a little more than 4 years, we decided to take what was intended to be a one month leave from the blog so that we could each focus on other pursuits. Upon our return, we discovered that Priority One Credit Union’s President, Charles R. Wiggington, Sr., interpreted our absence as a sign the blog had finally come to an abrupt end. Never one to ignore an opportunity, the President has since November 2013, perpetuated rumors the blog is “dead”, having been “shut down” by his efforts. The puzzling part is that over the years, his efforts to terminate our reporting have been met with failure. In 2008, he and former CFO, Manny Gaitmaitan, drove to Glendale, California and met with then credit union attorney, William Adler of Styskal, Wiese and Melchione, LLP but were informed they were unable to do so. In the years that followed, Board Chair, Diedra Harris-Brooks contacted Google but her efforts also failed. In our absence and beginning this past November, the President has carried out a campaign which again touts his alleged prowess and keen tactical skills which lent this blog a final and deadly blow. His efforts were willingly assisted by Vice Presidents, Yvonne Boutte and Patricia Loiacano. Some employees of the South Pasadena unwittingly repeated the rumors though at no point did anyone at the credit union take a moment to verify the validity of the President’s statements choosing to instead, embrace his declarations at face value despite his long history of abuses, lies, and failures. Since January 1, 2007, the date Charles R. Wiggington, Sr. began his stint as President, we’ve often published evidence of the scandals he immersed himself in and exposed his insatiable misappropriation of authority which contributed to the decline of the once promising credit union.

Inspired by absence of the blog, President Wiggington recently also declared that Priority One has returned to a state of prosperity and is currently experiencing growth. His statements are of course unaccompanied by evidence that could lend some credence to his declarations.

The President has also resumed working on an almost full-time basis. In late 2012 and throughout 2013, the President reduced his work week from 40 hours to 6 1/2 to 16 hours allegedly because he suffered a relapse of cancer first diagnosed in 2012. .

So has the credit union overcome the many problems created by President Wiggington since he was first appointed President? Has Priority One now entered a period of prosperity and are they generating profit? Have they recouped the millions of dollars lost in Net Income since 2007? If the credit union has recovered it has done so in spite of President Wiggington and his legion of inept executives and managers?

The President recently also boasted that his “ball cancer” (his words, not ours) is in remission. Since resuming full-time hours, he traipses through the South Pasadena branch visiting the offices of CFO, Saeid Raad, Vice President, Yvonne Boutte and Executive Vice President, Rodger Smock and boasting loudly that “2013 was a great year” and blaming the credit union’s allegedly past failures on the incompetence of former COO, Beatrice Walker, and former CLO, Cindy Garvin, have now been resolved. Evidently, Charles R. Wiggington, Sr. is feeling much better.

Joining the President’s spin efforts are declarations by Vice President of Lending and Compliance, Patricia Loiacano, who asserts “business is good” and “we’re doing great.” In recently weeks, Mrs. Loiacano’s declarations have been further echoed by Vice President of Operations, Yvonne Boutte, who also boasts that she has single-handedly succeeded in subjugating employees of all branches, an achievement she alleges her predecessor, former COO, Beatrice Walker, and Executive Vice President, Rodger Smock, failed to do. Mrs. Boutte evidently suffers from selective memory forgetting that in late 2012, she acted alone and provoked a member into filing a lawsuit against the credit union. The lawsuit ended in payment of a settlement to the member.

Though the credit union’s Human Resources department continues to act in title as liaison between employees and the credit union, the filing of four lawsuits by former employees during the years of 2010 through 2012 have transformed the department into a powerless puppet head under the unofficial leadership of Executive Vice President, Rodger Smock. In 2011, we frequently exposed that the promotion of former Training and Education, Robert West, to Director over Human Resources, was nothing more than a sham designed to draw attention from Mr. Smock’s failures as Director over the department and his violation of credit union policies and state and federal laws which left the credit union open to lawsuits. In early 2013 during a deposition conducted at the offices of Richardson Harman Ober PC, Mr. Smock identified himself as the Director of Human Resources (not Employee Services). This finally and officially exposed President Wiggington’s lie and chronic insistence that Robert West is the Director over Human Resources.

Each January, we present a forecast of what may lie ahead for Priority One during the new year. Our assessments published in 2010, 2011, 2012, and 2013 have been on consistently on point because we consider the credit union’s past performance, take into account its ability to generate new business, consider its relationship with members, take into account any lawsuits filed against the organization, and examine the behaviors and ethics of its officers. So is the credit union generating sorely needed profit and experiencing growth?

CAN YOU FIND THEIR PROFIT?

Logically, it would be as foolish to believe anything about Priority One and its officers at face value, so as we’ve done in many previous posts, we’ve decided to use the credit union’s own documentation in conducting a review of their performance in 2013 and in determining what may lie ahead for the organization in 2014.

In this post, we use the credit union’s own Balance Sheet/Income Statement for the month of December 2013. Though state law requires the report be displayed in a conspicuous location for members and employees to read and requires the credit union to provide a copy of the report to members who request a copy, a copy of the report is almost impossible to obtain. In 2008, the President issued a directive to all officers prohibiting release of the report to members. He ordered that members provide reasons for requesting a copy of the report. He also ordered that all requests be directed to him for review, despite the fact Priority One is required to provide the report to any active member who requests to see it. One cannot but think that the President implement the stringent and illegal requirement if he has nothing to hide.

Shown below, is a copy of the Income Statement for the month ending December 31, 2013. The report also provides a record of Priority One’s year-to-date actuarials. The December 2013 statement provides irrefutable confirmation that business is as the President has declared, “great” or if it is something less than wonderful.

PRIORITY ONE CREDIT UNION

FOR THE MONTH ENDING DECEMBER 31, 2013

BALANCE SHEET / INCOME STATEMENT

As shown above and below, the credit union incurred a loss of $576,523 in “Unrealized Investment Gain (Loss).” Simply stated, the reference is due to (a market value) loss from investments.

Also of note is the reference to FEES and CHARGES which amounted to $249,327 for the month of December 2013 and for a total of $2,790,532 for the entire year of 2013. This entry is particularly interesting because it proves Priority One Credit Union garners a tremendous amount of their income from fees and charges levied to members for using the credit union’s services. The increased profit being earned from fees and charges is a reflection of the “bank industry mentality” of President Wiggington who prior to being hired as Vice President of Operations, was employed by Bank of America.

The closures of the Redlands, Valencia, Riverside, Burbank, and Airport branches has reduced the amount of monies spent each month on leasing property for the credit union’s remaining locations. In December 2013, the credit union spent a paltry $252 to lease their remaining offices located in South Pasadena, Los Angeles, Van Nuys and Santa Clarita. The reduced spending helps Priority One remain open for business though unfortunately, their financials don’t reference sufficient substantial income generated from new business only because their continued survival is contingent upon expense reductions.

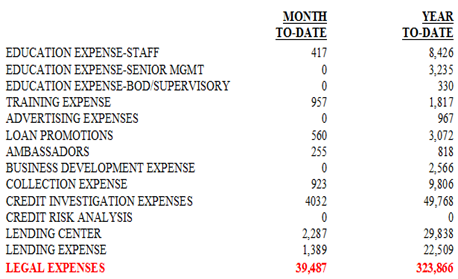

Their financials show that over 2013, the credit union spent a whopping and unprecedented $323,866 in legal fees. In the years prior to Charles R. Wiggington, Sr.s appointment to President, the credit union’s annual expenditures on “legal” approximated $18,000 to $23,000. In 2013, the credit union spent more on legal fees than were spent by the President’s predecessors over a 12 year period. What’s more, in 2011 and 2012, the credit union spent more than $100,000 in legal fees. From 2011 through December 31, 2013, Priority One has spent more than $500,000 in legal fees. This is shocking and should be deemed unacceptable. Clearly, something is sorely awry at Priority One and certainly nothing attests to the incompetence and abuses committed by President Charles R. Wiggington, Sr. that does the filing of lawsuits by former employees and the vast amounts spent on legal fees.

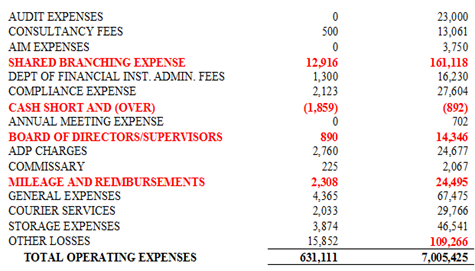

In 2011, President Wiggington boasted that Shared Branching would enable members who worked or moved outside of areas where Priority One maintained branches, to retain their accounts and reap the benefits of membership to Priority One. Unfortunately, the elimination of branches as a means by which to remain in business forced the credit union to promote Shared Branching as a substitute for a real and personal branch. The President's plan failed because many members continue to close their accounts when they move outside of the regions served by Priority One. Furthermore, the credit union’s records show that the majority of people utilizing Shared Branching are members of other credit unions. During 2013, Priority One spent $161,118 in Shared Branching a cost that further erodes any profit generated by the credit union.

From 2011 through December 31, 2013, Priority One has spent more than $500,000 in legal fees.

|

An expense which we cannot explain and which seems suspiciously high, is the amount spent on the Board of Directors and Supervisors. We cannot fathom how $14,346 were spent on the now much smaller Board and the Supervisory Committee. Furthermore, their ineffectiveness as overseers of the credit union’s internal operation fails to justify this expenditure.

Another equally perplexing expense is Mileage and Reimbursements which in 2013 totaled $24,495. How is it possible that a credit union that only employs 1 Business Development Representative and who no longer participate in community events or attend Chapter meetings would spend almost $25,000 on mileage and reimbursements.

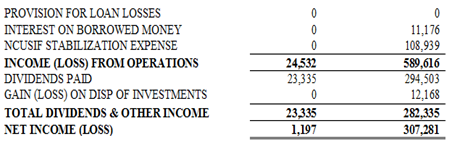

The credit union generated income in the amount of $1197 for December 2013 and $307,281 for the entire year of 2013. Hardly impressive is it? Priority One’s Balance Sheet/Income Statement says much more about the credit union’s actual performance than the unfounded hyperbole being perpetrated by President Wiggington and Vice Presidents, Yvonne Boutte and Patricia Loiacano.

In 2010, President Wiggington and his then COO, Beatrice Walker, manipulated reporting for the month of January 2010 and showed a profit generated during that first month of the year. Historically, January is a slow month. Additionally, the credit union ended December 31, 2009, more than $500,000 in the RED immediately stirring our suspicion that the two highest officers had manipulated the credit union’s reporting. Two months later, in March 2010, we discovered and reported that the President and his COO transferred money from one of the credit union’s general ledgers and reported it as profit for the month of January. Their act was intended to create the impression that Priority One generated profit following 12 months of losses and failures.

In 2007, President Wiggington began the bad habit of dipping into the credit union’s coffers, at first $600,000 on a new phone system which he promised would propel growth and increase profit. He also spent tens of thousands of dollars implementing an improved and allegedly improved email system. Both of his efforts failed miserably.

In 2008, he obtained authorization from the Board of Directors to borrow $20 million from the credit line of credit. Over the next 4 years the credit union spent more than $30,000 each month paying interest alone of the loan.

In 2009, he was overcome by an inspiration to hire a COO who would help him create new streams of income, help oust his enemies from the credit union, and help realize his vision for the credit union. Two years later, she was terminated for insubordination and following rumors regarding her sexuality and a complaint that she’d sexually harassed and abused a Branch Manager. During her approximate two year stint, more than $200,000 were spent on the COO’s salary. At the time of her departure, not only had her alleged streams of income all failed to realize their purpose but she had wasted hundreds of thousands of dollars on a Call Center, remodeling of the South Pasadena and Burbank branches, and spent immense amounts of money on failed enterprises in addition to contributing to the credit union’s financial decline and ruination of its once pristine reputation.

In 2011, the President spent tens of thousands of dollars on hiring a Director of Lending. Several months later, the Director was terminating for failing to stop the credit union’s ongoing decline.

Last year we reported that Bankrate.com issued its report declaring that though Priority One remained buoyant, the credit union’s overhead was sharply undercutting profit and could in their opinion, create future problems for the credit union. They were absolutely correct. In December 2013, the credit union was forced to close the doors of its Airport branch signaling again the deep-rooted failure of President Wiggington to enact methodologies that produce new business, increase profit, and generate member interest in what the credit union has to offer.

During the months of December and January, we visited all of the credit union’s remaining branches for the purpose of observing their working environments. Here is some of what we observed:

Santa Clarita

The Santa Clarita branch opened in 2012 following months of fanfare by President Wiggington declaring the branch would prove an unprecedented success and draw droves of new members. The President was wrong. The branch is starkly devoid of members. Clearly, it is under utilized by members and it is certain, the location is failing to generate sufficient profit to justify its continued operation. Prior to its opening we pronounced the location would fail because of its inconvenient location outside downtown Valencia. As time quickly proved, we were correct. The number one reason why members and potential members choose not to visit the branch is because it lies far outside downtown Valencia and as some members have pointed out, they would prefer opening an account at an institution more centrally located.

Los Angeles

On the day we visited the credit union’s busiest branch, we found the front doors to the office, wide open. We were informed that the room was hot and the air conditioning was not functioning properly. It was quite evident that the Branch Manager is unaware that leaving the doors open in that manner, poses a potential security threat. We also counted 14 people standing in line waiting to be assisted by a single teller. There was also only one FSR present. She was busy helping a member while another waited for assistance.

South Pasadena

In 2013, the President approved the installation of cubicles in the Member Service Department. Since then, cubicles have also been installed in the Loan Department. Though cubicles are commonly found in many businesses, the cubicles selected by President Wiggington and Vice President, Yvonne Boutte, almost touch the ceiling, creating the undeniable impression of confinement and segregation. So is the intent to create the impression that management at the main branch wishes to segregate itself from members?

Van Nuys

The branch was the only one which we found to maintain some semblance of organization. The staff were helpful and there were actual people visiting the location.

Priority One was once known for its friendly employees and comfortable branch environments. It was also prized as an employer by its employees. In fact, many members who utilized the South Pasadena branch often described it as “cozy” and feeling “like home.” That of course ended after Charles R. Wiggington, Sr. became President. The person currently in charge of branch operations for Priority One’s remaining offices, is notorious Vice President, Yvonne Boutte. Mrs. Boutte is a caustic presence who has often created discord and conflict and not surprisingly, proven she doesn’t possess the ability to reverse the environmental issues plaguing employee morale. No doubt, many employees view Mrs. Boutte as polarizing and having no qualms of exhibiting unfettered hubris. Her confrontational and demeaning treatment of employees and members has often elicited conflicts. In 2012, her overbearing and aggressive zeal provoked the filing of a lawsuit by a now former member. The credit union responded quickly, issuing a monetary settlement to the abused member.

Business Development?

Nowadays, Business Development efforts are solely carried out by failed former AVP, Joseph Garcia. In his latest incarnation, Mr. Garcia allegedly visits the communities served by the credit union though his chronic inability to meet his monthly goal of $150,000 reminds us that Mr. Garcia is a man devoid of any real talent. Despite his shortcomings, Mr. Garcia was once the golden child of former COO, Beatrice Walker, who found it prudent to promote him into positions he proved unqualified to serve in. It was Ms. Walker who single-handedly decided that Mr. Garcia’s loyalty to her would be rewarded with promotions. Though Mr. Garcia continually pandered to the former COO, he proved quite incapable of fulfilling his responsibilities as Priority One’s first Call Center Supervisor, Real Estate and Consumer Loan Manager, Member Services Loan Manager, and AVP of Sales and Business Development. His return to work in January 2013 following a second 3-month leave of absence taken over a 16-month period stripped him of all of his former titles and he was knighted the credit union’s new and only Business Development Representative. Mr. Garcia no longer possesses the authority he once relished in and which for a short time enabled him to target and terminate any employee who allegedly failed to fulfill their assigned duties. His once seemingly immovable relationship with Beatrice Walker deteriorated and by December 2010, she had marked him for future termination. He in turn, became one of her more avid critics, confiding to other employees that she misappropriated her authority which she used to banish employees she believed were her enemies.

Since being appointed Priority One’s single Business Development Representative in January 2013, Mr. Garcia has failed on a monthly basis to meet his $150,000 monthly sales quota appointed to him by President Wiggington. The highest amount attained during any single month, approximates $28,000 and in December 2013, he only achieved $12,000 of his $150,000 quota. For Mr. Garcia, this is a humiliating fall from grace. So why does he continue to be employed despite the fact that better and more accomplished employees were terminated throughout 2012 for failing to attain their assigned monthly quotas? Our guess is that his preservation may be due to the fact that he possess a lot of insider information about how former COO, Beatrice Walker, and President Wiggington chose to do business. We know that following his fallout with Ms. Walker, Mr. Garcia began communicating with former employees terminated by the COO and President and labeled enemies of the credit union. Through emails, text messages, and telephone conversations, Mr. Garcia admitted to wrong doing committed by his superiors. It will be interesting to see if his is subpoenaed as a witness for the credit union when they appear in court to litigate the lawsuit filed by the last Branch Manager of the now defunct Valencia branch.

“We are doing great!”

President Charles R. Wiggington, Sr.

January 2014

ANOTHER BRANCH CLOSES

This past December, the credit union closed the doors to its Airport branch. The office which opened under much fanfare in 2009, was the victim of poor planning by President Wiggington who could never develop strategies to draw member interest to the location. Its closure, however, did not stop the President from recently proclaiming that business is “great” nor did it inhibit Vice President, Patricia Loiacano, from declaring that the credit union’s performance is doing well. Evidently the two need to acquaint themselves with what defines great and what defines good and well. They might also take the time to what defines poor, bad, and substandard. The President’s latest campaign, touting the alleged renewed success of the credit union attempts to dissimulate the credit union’s actual performance which as we’ve shown, remains subpar. As we’ve pointed out often in the past, on the day (1/01/07) Charles R. Wiggington, Sr. began to serve as President, the credit union’s net income approximated $172 million. As of January 1, 2014, the credit union’s Net Income totals $146,318.298. That is an approximate loss of $25,681,702 in a 7-year period. Couple this with the fact the credit union had 9 branches on the day of President Wiggington’s appointment and now only has 4 remaining branches. Charles R. Wiggington, Sr., his executives, and Board Chair, Diedra Harris-Brooks, would like you to ignore the facts and instead believe what they have to say at face value. Obviously, the credit union is not growing. Its reduced net income attests to losses. The closure of 5 branches denotes decline. And the credit union is not progressing, it is regressing.

We recommend Mr. Wiggington hire a competent spin doctor to concoct a more believable story about Priority One’s actual financial and business standing. Unfortunately, President Wiggington’s reputation precludes him from being trusted or believed and his assertions to success are not only untrue but should never be believed. We must add that in our opinion, the Santa Clarita branch will close either at the end of this year or in 2015.

LAWYERING AT ITS WORST!

Priority One continues to litigate the lawsuit filed against it in 2012 by the former and last, Valencia Branch Manager. Unlike three lawsuits filed by former employees which preceded it, litigation of this lawsuit appears to be dragging. It appears that neither the credit union or its prized attorney, Paul F. Schimley of of Richardson Harmon Ober PC, have tried to resolve this lawsuit in a speedily manner as they apparently chose to do with all prior complaints. The President has revealed that the lawsuit could not proceed to court in 2013 because the court’s calendar was full and later, because of the holidays. That’s odd because the lawsuit was filed in mid-2012 and it is now January 2014. At the time the three previous lawsuits were filed, there were also court calendars and holidays to be dealt with and apparently those did not impede the timely and even expedient litigation of those lawsuits. We find the present delays suspicious particularly in view of President Wiggington’s 2012 and 2013 disclosures that the credit union’s attorney had said the Valencia Branch Manager’s lawsuit was frivolous and devoid of merit. If true, then the lawsuit would have been dismissed at the end of 2012. Evidently, the attorney’s alleged declarations were unfounded and may have constituted mere hyperbole. At the end of 2012, President Wiggington also disclosed that the allegations in the lawsuit were laughable and contrived and attributed the filing on a plot intended to extort money from the credit union. Again, if true, why hasn’t the lawsuit been dismissed?

For those who may have forgotten or who do not know, the lawsuit contains allegations of same-sex sexual harassment perpetrated by former COO, Beatrice Walker, and allegations that the former Branch Manager’s complaint reported verbally and in writing to both Human Resources and the President refused to protect her from the scathing and very public attack carried out by Ms. Walker. The complaint also alleges that the credit union violated state and federal laws and refused to adhere to its own internal policies which prohibit harassment and retaliation.

Though the President would have one believe that attorney Schimley is an expert in litigating employment-related matters, we’ve yet to witness anything that hints at his allegedly keen tactical prowess. Here are some highlights of recent, past litigation by Mr. Schimley:

- In 2010, the attorney threatened to file a motion seeking dismissal of the lawsuit filed by the former last Branch Manager of of the no longer existent Burbank office. According to President Wiggington, the lawsuit lacked merit. At the time, we also spoke to some of the witnesses who the credit union intended to use in its defense. We were told by one, that she was to provide testimony that Mrs. Nisely was a racist who hated “Latins.” The statement was so important that the witness alleges the credit union’s legal counsel offered to represent her at no cost to herself. At the time, then AVP, Sylvia Perez, told employees of the Van Nuys and Burbank office that she was anxious to be subpoenaed as a witness for the credit union and intended to provide testimony that the former Branch Manager was insubordinate and lazy. At the end of 2011, Mr. Schimley contacted the Plaintiff’s attorney and requested mediation to enter into a settlement of the lawsuit. So what happened to the allegations of racism, insubordination, and the Branch Manager’s refusal to develop new business in her region?

- In 2011, Mr. Schimley again threatened to seek dismissal of a lawsuit filed by a former Business Development Representative. In fact, Mr. Schimley contacted the credit union and informed them the Plaintiff’s attorney had resigned because of a conflict with his client. The President shared the information with some of his staff one of who published the information disclosed by Mr. Schimley on this blog. That case was also voluntarily settled by the credit union despite the credit union’s insistence that they had been advised the lawsuit lacked all merit.

- In 2012, a lawsuit was filed by a former FSR assigned to the now defunct Burbank branch. Mr. Schimley contacted President Wiggington and Board Chair, Diedra Harris-Brooks, and informed them the case had no merit. The President who is a chronic violator of confidentiality, shared Mr. Schimley’s statements with members of his immediate staff and soon afterwards one of them posted comments that the FSR had been reduced to begging for any amount of settlement she could obtain from the credit union. Soon afterwards, the credit union voluntarily paid out yet another monetary settlement to close the lawsuit which allegedly lacked all merit.

Late last year, Mr. Schimley conducted a deposition at his Pasadena, California office. He aggressively leveled questions at a former Business Development Representative in his effort to exact contradictions and deficiencies in her testimony as witness for the former Valencia Branch Manager. His efforts failed to force any statement that could be used to break the witness. However, overshadowing his efforts to impugn the witness were a slew of questions that asked if she knew who authors this blog. The questions are perplexing when one considers that this blog is not referenced in the lawsuit filed against the credit union. Furthermore, this blog is wholly unrelated to acts allegedly committed by former COO, Beatrice Walker, President Wiggington, or that may have been perpetrated by the credit union’s Human Resource Department.

The world of attorneys is populated by highly competent and educated lawyers possessing well-developed tactical abilities as well as bottom feeders who litigate cases using tactics that border on abuse and above all else, serve to impugn the character of any Plaintiff and their witnesses.

We have to note that it is not President Wiggington who approves the hiring of attorneys nor is he the person who authorizes paying out legal fees. The more than $500,000 spent on legal fees for the years of 2011 through 2013 are approved by the Supervisory Committee and Board of Directors. Actually, in the case of the Board the person approving hiring and payment is Board Chair, Diedra Harris-Brooks. Over the years, Mrs. Harris-Brooks has shown no hesitancy in spending hundreds of thousands of dollars on attorneys, particularly those hired to squash Plaintiff lawsuits and whose goal is to ultimately protect versus exonerate, President Wiggington and Human Resources of having violated state and federal laws.

However, to keep things in perspective, we must point out that the President and Mrs. Harris-Brooks have often boasted that every lawsuit filed by a former employee was ultimately settled “cheaply.” As usual, the two officers lack the ability to comprehend the actual cost incurred upon the credit union. Settlement payments issued to Plaintiff’s represent but one small and almost insignificant portion of the actual money spent on litigation. The fact is, more than $500,000 spent on legal fees for the years of 2011 through 2013 is excessive and unwavering evidence of the abuses committed by the Board of Directors and President. What’s more, the financial impact to the credit union has proven detrimental, contributing to the continuing depletion of its financial resources. However, the cost to the credit union’s reputation as an employer and business cannot be measured and is far more destructive than its spending on legal services. What is acutely clear is that Mrs. Harris-Brooks is willing to authorize whatever amount is needed to cover-up violations of state and federal law committed by and under President Charles Roger Wiggington, Sr.

CONCLUSION

During our absence, President Wiggington launched yet another verbal campaign proclaiming that Priority One Credit Union had finally returned to a state of profitability following a “great” year during which their performance improved and even excelled. The President’s verbal assertions are laid waste by Priority One’s own Balance Sheet and Income Statement which reveal no growth, reduced Net Income, immense losses from investments, and exorbitant spending on legal fees. The President hopes people will ignore his past history including his manipulation of the credit union’s monthly income statements, his sexual harassment of a former employee and the documented fact he took ownership of a BMW repossessed from a member, or with the help of his former ally, COO Beatrice Walker, targeted “enemy” employees whose reputations were publicly slandered before being terminated. His creation of an expensive AVP sector failed and as of 2014, there are no more AVP’s employed by the credit union. His installation of a Call Center that would drastically improve member service also failed miserably and actually serve to add increased dissatisfaction amongst members. His hiring of former COO, Beatrice Walker, proved not only disastrous but costly as did his hiring of former Director of Lending, Cindy Garvin. Prior to his appointment to President, the credit union had never been sued by former employees yet since his appointment the credit union has been sued by 4 former employees, 3 of whose complaints were voluntarily settled by the credit union. If anything is to be learned from the President’s many fumbled efforts is that he marches to the beat of a different drummer- a drummer no one else sees or hears.

The President’s current campaign exalting his achievements amounts to just more unfounded Wiggington propaganda. His claims that through his efforts, Priority One has finally overcome obstacles and impediments that have crippled its ability to progress forward is wholly absurd when one considers that it was he with the help of Board Chair, Diedra Harris-Brooks, who created the fiascos which caused the credit union’s decline. As the credit union’s Balance Sheet/Income Statement for the month ending December 31, 2013 proves, there is no resurgence, no growth and no improvements!

Business not only remains stagnant but the credit union’s reputation amongst members continues to deteriorate. Efforts to increase new business through one solitary Business Development Representative have proven both futile and ineffective. The Business Development Representative’s goal of $150,000 has yet to be met despite that he served in the capacity of Business Development Representative for a little more than one year. His treks into the communities served by the credit union reaped a paltry $12,000 in newly funded loans. In other words, he missed attaining his monthly goal by $138,000 and obtained 8% of his assigned goal. A review of his monthly performance since January 2013, shows that he has never achieved more than 17% of his assigned monthly goal, an amount that is both inconsequential and of little benefit to a credit union desperately requiring new business and actual monetary profits.

President Wiggington’s statement that business is “great” and Vice President, Patricia Loiacano’s statement that business is doing well are undermined by the credit union’s own reports. Furthermore, the two would like members and employees to ignore the fact the credit union ordered closure of its Airport branch in December 2013. The officers may argue the Airport branch was unprofitable but the fact is that neither President Wiggington, Mrs. Loiacano nor Vice President of Operations, Yvonne Boutte, ever introduced strategies that would have generated interest in the location. Either as a result of ignorance, a lack of imagination, or intentional refusal, the three have proven that they are quite incapable of creating plans that effectively realize what should be the credit union’s intended efforts for success.

As of January 1, 2014, Priority One retains its continuing unhealthy reliance on expense reductions. Inarguably, Priority One would survive without continually having to reduce spending. The hiring of an expensive COO in 2009 proved almost catastrophic. The hiring of a Director of Lending in 2011 proved useless and destructive. The hiring of consultants in 2012 produced a revamped website but did nothing to rectify the credit union’s far flung problems, all authored by the deficient President.

Additionally, an increased portion of the credit union’s income is reaped from charges and fees levied to members. This practice veers far from the credit union industry’s motto of people helping people or offering access to members who might experience difficulty obtaining financial products and services from traditional banks. The gap which once differentiated credit unions from banks is lessening and apparently, President Wiggington has helped close the chasm by charging more fees to members who are nowadays subjected to deficient member service and are offered products and services the can be easily obtained by better credit unions and banks.

So what lies ahead for the apparently impotent credit union? There is absolutely nothing within the credit union’s reports that hint at forthcoming success. What’s more, Board Chair, Diedra Harris-Brooks and the remaining Directors have exerted tremendous effort since 2008, to ensure the destructive dynamic that has diminished Priority One Credit Union from profitable to ineffective, remains protected and intact.

Technorati Tags: Charles R. Wiggington,Sr.,Charles Wiggingotn,Rodger Smock,Yvonne Boutte,Patricia Loiacano,Paul F. Schimley,Richardson Harman Ober PC,board of directors,supervisory committee Chair,priority one credit union,POCU,Diedra Harris-Brooks,Diedra Harris,Diedra Brooks,Robert West,Esmeralda Sandoval,Human Resources,Los Angels branch,Airport Branch,Valencia,Santa Clarita branch,Van Nuys branch,South Pasadena branch,sexual harassment,repossession,stolen car