MISSING

During the May 2010 Annual Meeting conducted at Priority One Credit Union's main branch in South Pasadena, California, Board Chair, Diedra Harris-Brooks declared that in her opinion and that the of Board and referring to then COO, Beatrice Walker, and Loan Manager, Joseph Garcia, that “We believe we now have the right management team in place”. Five months following her speech, the credit union closed the Redlands office and a month later, the Valencia office. This past July, Ms. Walker was terminated for failing to carryout her assigned responsibilities which included implementing lucrative streams of income and for insubordination. How things change in just a matter of months.

Mrs. Harris-Brooks also poured accolades over Mr. Garcia and his efforts which were improving employee morale issues. Mr. Garcia has been noticeably missing from the credit union for several months prompting rumors about his whereabouts.

Inarguably, Mrs. Harris-Brooks' opinion about any matter should never be trusted. The woman is messy an analyst as she is a Board Chair. Mrs. Harris-Brooks is both ignorant and dishonest and her need to control all things has often spurred her to violate credit union policies and state and federal laws. So what has happened to Joseph Garcia?

GONE AGAIN

In January 2009, the COO, Beatrice Walker, recruited Joseph Garcia, the Branch Manager of the now defunct Redlands office and transferred him to the main branch in South Pasadena. Ms. Walker's interest in Mr. Garcia had nothing to do with his skills or competencies but rather, that he pandered to her every whim and fueled her god complex.

- She used the ruse that he would "temporarily" serve as interim supervisor of the newly created call center until a permanent supervisor was found. Two-weeks following his arrival,Mr. Garcia was appointed permanent call center supervisor.

- A few weeks later, she added the titles of Real Estate Loan Manager, Consumer Loan Manager and Credit Manager to his impressive repertoire of titles. Unfortunately for Mr. Garcia and Ms. Walker, he wasn't very good at any of the positions he held. Under his supervision, complaints about member service and the call center, increased dramatically.

- He was never able to understand the procedures or principles governing real estate loan funding.

- Under his supervision, consumer loan development nose-dived.

- He knew nothing about being a credit manager.

And in spite of Board Chair Diedra Harris-Brooks' outpouring of praises for Mr. Garcia during the May 2010 Annual Meeting, by late June 2010, it was obvious that he was failing everyone of his responsibilities. Forced to enact corrective measures, Ms. Walker transferred the Real Estate Department to newly hired CFO, Saeid Raad. However, Mr. Garcia's failures continued, unabated.

In mid-2010, Mr. Garcia and Mrs. Boutte suffered a falling out. Mrs. Boutte soon started telling staff members that "Joseph [Garcia] isn't what he appears to be." Look who's talking.

By December 2010, Mr. Garcia's relationship with Beatrice Walker deteriorated and the two ceased speaking to one another. Ms. Walker's stable of confidants who she once said would accompany her when she was finally appointed President had fallen apart and would never come together again.

In January 2011, Ms. Walker promoted Branch Manager, Gema Pleitez, granting her control over the small and insignificant Riverside branch and over the call center which was taken away from Mr. Garcia.

Mr. Garcia, who like President Wiggington and COO, Beatrice Walker, is not one to adhere to the policies governing confidentiality, informed some employee of the South Pasadena branch that he was starting to look for a new job, complaining that Ms. Walker "doesn't know how to treat people" and accusing her of being "cruel" and vindictive. Mr. Garcia had forgotten that throughout 2010, he willingly provided Ms. Walker and President Wiggington with fraudulent statements which accused employees of violating policy and which were used to seal their terminations. He also expressed his fear that Ms. Walker was "after him" and wanted to also terminate him.

We've recently learned that Mr. Garcia was scheduled to return to work on August 26th, but recently extended his "medical" leave to September 6, 2011. Mr. Garcia has sustained a great fall from grace, but its not over. Upon his return, he will be informed that he is no longer the Consumer Loan Manager. He will instead serve as the assistant to the new Director of Lending, Cindy Garvin. Here is the order of promotions and demotions sustained by Mr. Garcia since his arrival to South Pasadena in January 2010:

- January 2010: Supervisor Call Center

- February 2010: Promotion to Manager of the Real Estate and Consumer Loan Departments

- February 2010: Title of Credit Manager added to his list of titles

- July 2010: Stripped of the Credit Manager title

- August 2010: Stripped of his position as Real Estate Loan Department Manager

- January 2011: Stripped of his title of Call Center supervisor

- January 2011: Given the title of Member Services' supervisor and removed from the Loan Department

- February 2011: Stripped of his title of Member Services supervisor and returned to serve as Consumer Loan Manager

The failures of Mr. Garcia are all attributable to Ms. Walker and the President who promoted him, granted him increases in pay and allowed him to commit failure after failure, all at a cost to the credit union.

Weeks before fleeing the credit union on a medical leave of absence whose excuse was pure fraud, Mr. Garcia was removed from under Ms. Walker's authority and reassigned to report directly to President Wiggington. Shortly following his reinstatement, Mr. Garcia told employees that the President is highly knowledgeable about finances and "knows what he's doing." Yes, that's why the credit union's asset size has decreased by over $30 million. This was another complete turn about face on the part of Mr. Garcia who in early 2010 joined Beatrice Walker's efforts to displace President Wiggington.

BIG CHANGES

Following Beatrice Walker's termination this past July, President Wiggington and AVP/Senior Vice President/Executive Vice President/Director of Human Resources, Rodger Smock, announced that "big changes" are going to take place.

Change One

- Minnesota’s government shut-down.

- Casey Anthony having been found not guilty of murder.

- Budget talks heating up as the debt ceiling deadline approached (July 19, 2011).

- A last minute agreement reached to end the debt crisis.

- Standard and Poor’s lowering of the U.S. credit rating.

- President Obama calling for the Congress to vote for the new jobs plan.

- A bomb threat revealed as 9/11 approached.

We, of course, wait with bated breath to see the fabulous changes that will be introduced by Mr. West, Miss Sandoval and Mr. Smock.

Change Two

A second change which occurred over the past two weeks is that the President has transferred some of Beatrice Walker's former responsibilities to notorious and incompetent AVP, Sylvia Perez. The AVP has been less than grateful. She has complained to employees of the Burbank and Van Nuys branches that she has been given too many responsibilities which are impeding her form visiting communities.

Though Mrs. Perez is the first to tell you how great she is at cross-selling products, there is no evidence of this in the production reports submitted by her to the credit union. In fact, there are no contributions from the San Fernando Valley's two offices- Burbank and Van Nuys that show increases in new business.

Ideally, the job of any AVP should not usually include visiting businesses to distribute new membership and loan applications. That's the job of the business development team but in 2010, both the President and COO broke apart the team leaving it a no longer effective means by which to garner new business.

What's more, Sylvia Perez is not qualified to serve as an AVP. She was a Branch Manager whose management skills were undeveloped and over the years, provoked the filing of employee complaints often describing her as abusive and intolerant. In 2010, then COO, Beatrice Walker, described Mrs. Perez as problematic, "a whiner", and even asked, "Why doesn't she shut-up?"

Change Three

A third more recent change has been handing all authority over all branches to AVP/Executive Vice President/Senior Vice President/Director of Human Resources, Rodger Smock. This of course means he is now taking over some of the responsibilities usually assigned to a COO. Like Mrs. Perez, he recently complained that he's "stressed", "over-worked" and that "my legs and back hurt."

A third more recent change has been handing all authority over all branches to AVP/Executive Vice President/Senior Vice President/Director of Human Resources, Rodger Smock. This of course means he is now taking over some of the responsibilities usually assigned to a COO. Like Mrs. Perez, he recently complained that he's "stressed", "over-worked" and that "my legs and back hurt."

Change Four

The fourth change is the hiring of Cindy Garvin, formerly of Clearpath Federal Credit Union and now serving as Priority One’s new Director of Lending. We don't wish her ill will but in light of the many failures implemented by the President, we doubt she'll survive working with him. Here are some of his business failures:

- Purchase of a $600,000 technically flawed phone system

- The hiring of COO, Beatrice Walker

- The attempt to displace members who are employed by the United States Postal Service with Select Employer Groups

- More than $100,000 spent on remodeling the South Pasadena and Burbank branches

- More than $70,000 spent on what is a failing call center

UNRAVELING

AVP, Sylvia Perez, the woman whose voicemail message says, "This is Sylvia Perez the Assistant Vice President of Region 3" seems unusually emotionally fragile these days. As mentioned previously, her anxiety's increased substantially when she was delegated responsibilities formerly assigned to COO, Beatrice Walker.

On the day a notice was posted on the Intranet announcing that Bea Walker was no longer an employee of the credit union, Mrs. Perez exclaimed to her staff, “Bea did a lot of bad things to hurt this credit union.” Obviously, Mrs. Perez forgot the role she played i n Mrs. Walker's many campaigns and she seems dull to the fact that she, the President, Rodger Smock, and Board Chair, Diedra Harris-Brooks, have leveled devastating blows to the once successful credit union.

Mrs. Perez has had a polarizing effect upon employees, members and even potential members. She is abrasive, aggressive, moody and her erratic emotional mood swings, more than a little disturbing.

Last year she complained often that emails and telephone calls to COO, Beatrice Walker, and to Human Resources were never responded to. She evidently felt jilted and could not refrain from complaining to the staffs of the Burbank and Van Nuys branches.

Mrs. Perez has also been the hitman who eliminated employees who did not pander to her abusive tendencies and frequent changes in temperament. In 2007, she created fraudulent evidence and with the help of AVP, Rodger Smock, terminated the newly hired Van Nuys Branch Manager who during his short stay at the credit union, discovered that she had never trained her staff in proper and mandated banking standards.

In 2008, she again fabricated evidence to assist President Wiggington in terminating a Jewish Business Development Representative who though accomplished, conflicted with the dysfunctional tendencies of both Mrs. Perez and Mr. Wiggington.

In 2009 and 2010, she again conflicted with another Business Development Representative but her efforts to implicate him were not responded to by Human Resources because unlike her other victims, he is Black and Mr. Smock feared, going after him could result in the filing of a lawsuit.

In 2011, the Business Development Representative resigned and Mrs. Perez assured Mr. Smock that she could easily takeover his responsibilities. She was wrong.

Mrs. Perez is caustic and disliked. When she tried to force ambassadors of numerous post offices located across the San Fernando Valley, to attend monthly ambassador meetings, the entire contingent refused and not one showed up to her planned meetings. It would seem that the ambassadors, unlike Priority One's employees, don't respond well to Mrs. Perez's aggressive tactics. Who would have thought? Refusing to accept accountability for her failure, she blamed the former Business Development Representative who was no longer an employee of the credit union.

Undaunted, she scheduled a second ambassador meeting. This time only three ambassadors showed up. Her efforts were an utter disaster.

Tenacious to the end, Mrs. Perez decided to visit postal facilities without first scheduling an appointment. When she arrived at the facilities, she attempted to conduct impromptu meetings but was quickly informed by managers that she is not allowed to enter federal property without permission much less order meetings. She was asked to leave the premises.

Over the years, the Human Resources Department had been the recipient of employee complaints about Mrs. Perez but it's Director, Rodger Smock, refused to respond or investigate the allegations against the horrendous Mrs. Perez. However, her behaviors were no longer consigned to the credit union and in her erratic emotions and aggressive approach to business had begun to have an adverse impact on Priority One's ability to do business.

Her grating personality were sufficient to recently cause Director of Employee, Robert West, to exclaim that he doesn't like her. Mrs. Perez is evidently aware of this and told employees of the Burbank branch that Mr. West "is mean to me" and "he cuts me off when I'm talking." All we can say is, "it's about time."

The always useless Mr. Smock recently advised Branch Managers to "be nice to her [Sylvia Perez], she's stressed." Mr. Smock truly is an ineffective dolt incapable of taking steps to address disruptions, like Mrs. Perez, of the working environment. We doubt there is anyone who would ever advise dealing with a troublesome and disruptive employee like Mrs. Perez by coddling her gently and handling her with kit gloves.

Mrs. Perez has continued complaining that she is burdened with too many responsibilities. She should actually be elated that she has more work which serves to justify the need to keep her employed. On the day the credit union announced Ms. Walker was no longer an employee of the credit union, Mrs. Perez called the President and volunteered to take over some of the Ms. Walker's former responsibilities. She also confided to the staff of the Burbank and Van Nuys branches that she hoped the President, who she alleges is a "close friend", would consider naming her the new COO. Unlike Ms. Walker, Mrs. Perez doesn't have an MBA. She is a high school graduate who has not undergone formal management training and disclosures that she failed to properly train her staff in proper and mandated banking standards suggest she is completely unqualified to serve as COO of any company.

Last week, Mrs. Perez also called and complained to Human Resources that whenever she calls the South Pasadena branch, employees refuse to assist her and in some cases, hang-up while she is speaking. Who can blame employees.

THE DIRECTOR OF LENDING

The new Director of Lending has revealed one of her first acts will be to cross-train employees of the Real Estate and Consumer Loan Departments. We find it an odd plan considering the President Wiggington has dramatically reduced the types of real estate loans once offered by the credit union and reducing these to mostly just HELOC's.

Ms. Garvin's first objective should be to find a way to increase consumer loan development. He's often complained real estate loans take too much time to pay-off for the credit union to realize profits, then logically, the goal of the credit union should be to increase consumer loan funding.

Earlier this year, the credit union generated profits from selling some of its real estate loans and some foreclosed properties, but real estate loan funding has declined dramatically since 2008.

Furthermore, is the credit union allowed to cross-train consumer loan processors as real estate loan processors officers? Doesn't the state require licensing for staff who process real estate loans?

We'll hope Ms. Garvin succeeds but from what know of President Wiggington, don't expect her to achieve the goals she sets.

Ms. Garvin's first objective should be to find a way to increase consumer loan development. He's often complained real estate loans take too much time to pay-off for the credit union to realize profits, then logically, the goal of the credit union should be to increase consumer loan funding.

Earlier this year, the credit union generated profits from selling some of its real estate loans and some foreclosed properties, but real estate loan funding has declined dramatically since 2008.

Furthermore, is the credit union allowed to cross-train consumer loan processors as real estate loan processors officers? Doesn't the state require licensing for staff who process real estate loans?

We'll hope Ms. Garvin succeeds but from what know of President Wiggington, don't expect her to achieve the goals she sets.

METAMORPHOSIS

In 2007, President Wiggington declared that he had a "vision" for Priority One to turn what he thought of as an unsophisticated and lagging credit union into a state-of-the art organization that would rival bigger, richer credit union. His vision turned out to be a delusion and was never to be realized.

What he has succeeded in doing is amassing a well-documented history of failures. Despite his chronic blunderings, the credit union continues to insist in can help it's member thrive financially. How can a credit union that can't help itself financially, help it's members? Here are some of the credit union's published claims alluding to its abilities:

What he has succeeded in doing is amassing a well-documented history of failures. Despite his chronic blunderings, the credit union continues to insist in can help it's member thrive financially. How can a credit union that can't help itself financially, help it's members? Here are some of the credit union's published claims alluding to its abilities:

*Since publishing this post in 2011, the credit union has removed the aforementioned references

JPR, 11/22/15

As of October 2011, the credit union no longer offers financial planning, real estate loan types have been drastically reduced and they've closed the Redlands and Valencia branches further reducing convenience to members.

There is also a current freeze on SEG development. And the credit union is trying to re-establish relations with employees of the United States Postal Service.

Member service standards have deteriorated. The credit union no longer offers the "personal touch" which it proudly promised to provide all members in the years before Charles R. Wiggington, Sr. was named President.

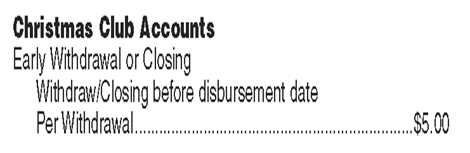

The credit union's new phone system has proven to be a technical nightmare and on August 15, 2010, the credit union implemented and increased its service fees. Priority One now resembles a bank more than it does a credit union.

The horrendous business mistakes perpetrated by the President over the past four-years have come at a cost to members who are now charged for services that were formerly free and at a cost to employees who are subject to what is now a more than three-year wage freeze.

Before being terminated in July 2011, then COO, Beatrice Walker said the adoption of increased charges would serve to "educate" members and prompt them to use MILLIE, the credit union's new upgraded telephone banking system.

Are the added fees and charges evidence that Priority One is a "financial fitness center" or able to help members and employees "win with money"?

SELF-PROMOTION

Letter from President Wiggington to Members, December 15, 2006

In retrospect, everyone of the President's assurances is proven to be completely untrue. Charles R. Wiggington., Sr. has proven that his tendency is to create a positive impression on paper but he is quite incapable of follow through and ever realizing what he says he has the ability of doing.

WIGGINANISMS

We thought we'd end this post by publishing some of the President's most memorable statements which we've dubbed Wigginasims. The quotes reveal much about the brutish President both as an officer and man.

“Rodger is lazy. When I become President, I’m gonna make him work.”

-Charles Wiggington to former President, William E. Harris about Rodger Smock, 2006

“That woman (Kathy Santos) is not going to make me lose my job. If I’m going down, I’m taking her with me.”

–Charles Wiggington about the Valencia Branch Manager, 2006

“Get over here. I’m gonna whip that ass. You know you want it.”

–Charles Wiggington about the Real Estate Loan Officer, 2005-2008

“I’m going to turn this credit union into a state-of-the-art credit union., something Mr. Harris couldn’t do because he was too old school.”

-Charles Wiggington, January 4, 2007

“Mr. Harris was jealous of me and always kept me down."

-Charles Wiggington to AVP, Patti Loiacano 2007

“I’m going to get rid of Harris’ people. They're going to have to go.”

-Charles Wiggington to Rodger Smock & Manny Gaitmaitan, October 2006

“I know Maggie exposed Liz and am going to get her.”

–Charles Wigginton to VISA Supervisor, May 2007

“I am going to get that Karen and see what I do to her. She’ll know who’s she dealing with.”

–Comment about the Assistant Branch Manager of Redlands. 2007

“I’m tired of Kim. I told her I wanted her here so these people could see my new secretary. Wait and see what I’m going to do with her. She doesn’t even look like what I want in a secretary. I want a fine one sitting outside my office.”

Speaking to Rodger Smock about his then Assistant, 2007

“I want to get more SEGs. I want more businesses in here as members. We’re going to start catering to them and less to postal people. We need a better class of people in here.”

- Charles Wiggington to AVP staff, 2007

“I didn’t know Liz was kiting. I had no idea. Its as much a surprise to me.”

– Charles Wiggington to Board Chair, Diedra Harris-Brooks, 2007

“Give it a week, no more. I didn’t know she (Liz) was that way when I made her AVP. Just wait a week and see what happens.”

- Charles Wiggington to Rodger Smock (about AVP, Liz Campos), February 2007

“Diedra is a bitch and she’s not gonna tell me what to do!”

-Charles Wiggington to Manny Gaitmatan & Rodger Smock, 2008

“Fuck Saffold. He’s not going to tell me how I should dress.”

-Charles Wiggington to Rodger Smock about Director, O. Glen Saffold, 2008

“See her ass. See it! I’m gonna hit that ass.”

–Charles Wiggington to the Director of Lending, 2007

“I don’t care what you have to pay her, just get her off my back. Let’s give her what she wants and send her on her way.”

–Charles Wiggington about the Former Employee who Accused him of Sexual Harassment, 2008

“I saw a picture of Henry (Campos) on Rodger’s nightstand. What’s wrong with that guy (Rodger Smock)?”

- Charles Wiggington about Rodger Smock, 2008

“I don’t understand my sister. She’s a snob and she’s selfish. The woman has the wrong attitude.”

- Charles Wiggington to Rodger Smock & Dane Simmons, 2008

“I’m tired of Whitni. I don’t know what she really does. I sent her to L.A. because I didn’t want her here no more.”

–Charles Wiggington to VISA Specialist about Lead Teller at L.A. branch, 2008

“A lot of people were jealous because I got the position. Do you see them anywhere? Where are they now?”

-Charles Wiggington to Patti Loiacano and Georgina Duenas, 2009

“The board interviewed a lot of people, but I played the game and I won.”

-Charles Wiggington to Patti Loiacano and Georgina Duenas, 2009

“Chuckie is really pushing it. I don’t know what I’m gonna do about that boy. Don’t know why he acts that way.”

-Charles Wiggington speaking about his son, 2009

“I know my office is bugged. Their getting the things on the blog because someone is listening to my conversations. I called Sepia and they’re coming out this week.”

-Charles Wiggington speaking about Blogger(s), 2009

“Sex with fat girls is the best. They are so grateful and will do anything.”

-Charles Wiggington, 2009.

“I am going to hire me a COO to do all those projects I don’t have time to do.”

– Charles Wiggingto to Rodger Smock, 2010

“I talked to my Aunt Jenny and she said we should give that employee a drug test cause it’s the second time he hit the (company) van.”

-Charles Wiggington about an employee who was in an accident while driving the credit union van, 2010

“I don’t care if God told you to do it, you don’t do it unless I tell you too. Understand?”

-Charles R. Wiggington to Administrative Assistant, 2010

“I wish I had a hundred Sylvia’s working for me. I wish all my employees were like Sylvia.”

–Charles Wiggington during AVP staff meeting, 2011

“I have ball cancer.”

-Charles Wiggington about his Prostate Cancer, August 2011