Following her undignified ouster from Priority One Credit Union on July 8, 2011, former COO, Beatrice Walker has returned though in the capacity of defendant in the lawsuit filed by the former Valencia Branch Manager. The lawsuit also names President Charles R. Wiggington, Sr. and the organization as defendants and accuses each of egregious violations of state and federal laws.

Ironically, the credit union that terminated Ms. Walker must now rely in part, upon her testimony in an effort to raise a defense that supports the President's chronic contentions that he never violated any laws. We beg to differ.

Because the allegations leveled against Ms. Walker while she served as COO of the credit union, Priority One will have to pay for her defense. One would have thought that the days which she abused spending ended when she was fired. Apparently not.

Ms. Walker may have arrived quietly at the South Pasadena branch on June 1, 2009, but over the next 25 months which transpired, she would create havoc, perpetrate abuses and spend hundreds of thousands of dollars on wasted efforts to allegedly attract new business. Inarguably, she and the President are cut from the same piece of mud.

PROCLIVITIES

Beatrice Walker, like President Wiggington, shared the same predilection for divulging confidential information about employees, about her plots, and about her aspirations to one day become President and CEO of Priority One Credit Union.

The hiring of Ms. Walker was completely orchestrated by President Charles R. Wiggington, Sr., who at the time was both her friend and a long time associate of hers. The decision to hire Ms. Walker was authorized by Board Chair, Diedra Harris-Brooks. There were three reasons for hiring Ms. Walker. These were:

- The President insisted he needed someone to assist him who could process the projects he was too busy to attend to.

- He needed someone who was a marketing and business development expert who would help resolving the issues which were impeding the credit union from attracting sufficient levels of new business.

- He required someone who would help drive out his enemies.

In business, Charles R. Wiggington, Sr. is both inept and slovenly. From the day he began his appointment to President, he chose to "play" instead of work. For example, in January 2007, he implemented the expensive and unnecessary sector of AVP's. At the time, he said, "They're going to be responsible for bringing in the business and all I have to do is sit back and watch." He sat back but they all failed to bring in the business because none possessed the ability to do so.

He hired Beatrice Walker because he really believed she possessed the competency to create new business but time proved that she was as inept and limited in her understanding of marketing and business development as he was.

Ms. Walker proved quite pliable in the hands of the President and shortly after her arrival, began implementing scathing efforts to trap, persecute and oust employees the President identified as his enemy.

The fact that she's been subpoenaed to again provide testimony, can be attributed in great part to the President and Board Chair, Diedra Harris-Brooks. After all, it was the President who provided her with a mandate to go after his imagined enemies. The two broke state and federal laws to carryout their scurrilous campaigns and found solace in the fact that Senior Vice President, Rodger Smock, who is also Director of Human Resources, would ensure the department did not interrupt their often illegal plots.

Ms. Waker and President Wiggington are Defendants in the lawsuit filed by the last Valencia Branch Manager. They actually have little choice but to support one another and provide whatever testimony is necessary to extricate them from the legal predicament they created. At time of Ms. Walker's termination, their alleged friendship had ended, with Ms. Walker becoming an avid and vocal critic of both the President and the entire Board of Directors.

THE ROAD TO HELL

IS PAVED WITH GOOD INTENTS

During her approximate two-year stay, Ms. Walker introduced products and services which she claimed would serve to create new sources of income for the struggling credit union. Though she spent tens of thousands of dollars in "developing" new products and services, almost all failed to attain the level of success she promised would be achieved.

Ms. Walker's products and services were not so much her creation but entirely plagiarized. During her first three-months of employment, she would call associates in the industry asking for suggestions which she could introduce as her ideas. One of the first products she said she created which cost the credit union $30,000 to develop, was "Skip-a-Pay." The product received a lukewarm response from members and clearly, was not deemed a success.

Another of her creations was Priority Pay, the credit union's version of a pay-day styled loan like those obtained from store front vendors. The reasoning behind Priority Pay is that it allows a person to borrow up to $700 without being victimized financially by the exorbitant charges and fees levied by predatory lenders. Unfortunately, the terms of the loan were not quite as wonderful as described by Ms. Walker and the actual loan was being provided by a third-party lender who was not the credit union. Members rejected the offer, making this one of Ms. Walker's first failures.

She also introduced Courtesy Pay, the credit union's overdraft protection program. Under the law, the credit union had to ask members if they wished to enroll in Courtesy Pay but Ms. Walker stated that this was too tedious a process and ordered that all member accounts be coded for Courtesy Pay. President Wiggington and Board Chair, Diedra Harris-Brooks allowed it seeing Ms. Walker's decision as one that would benefit the credit union in collecting a large amount of fees and charges and thus helping to ameliorate the cycle of losses caused by President Wiggington's detrimental business decisions.

Ms. Walker's decision to code every member's records for Courtesy Pay (overdraft protection). forced increased numbers of members into collections. Ms. Walker also learned that she would have to issue letters to all members inviting them to enroll in Courtesy Pay, though the letter was sent after the fact and it is probable that many employees were unaware they had been enrolled in overdraft protection.

Ms. Walker also obtained authorization from the Board of Directors to build a more than $70,000 call center which she dubbed "a one-stop call center" and which she said would resolve the credit union's member service-related issues. Not only didn't it fail to achieve it's intended purpose but it actually exacerbated Priority One's service problems.

Ms. Walker also obtained approved from the Board of Directors to remodel the entire main branch which included installation of wall-to-wall carpeting, painting, new window treatments, and ordering two customized large silver colored logos for the lobbies of the South Pasadena and Burbank branches. According to Ms. Walker, remodeling of the entire South Pasadena branch including the employee lounge room and employee patio; and remodeling of the Burbank branch's lobby would attract increased business. Her more than $150,000 spent on the superfluous missed it's mark and had absolutely no impact on eliciting member interest in the credit union's financial offerings. A year and five months after remodeling the lobby of the Burbank branch had been completed, the branch closed permanently. Clearly Ms. Walker's promises were never realized making this project a complete waste of money.

A NOT SO SUPER WEAPON

Beatrice Walker arrived quietly at the main branch in South Pasadena on June 1, 2009. Her arrival was quiet and without fanfare but her 25-month stay would further unravel the organization resulting in internal strife amongst managers, lead to the rapid decay of employee morale and in the end, immerse the credit union in even more scandals. What's more, Ms. Walker's arrival would mark the start of a period defined by lawsuits.

On her first day of employment, Ms. Walker was escorted through each department by Senior Vice President, Rodger Smock. The Senior Vice President merely introduced her as "This is Bea Walker. She'll be working with us." Ms. Walker was haughty and refused to respond to employees who extended their hands to welcome her or who welcomed her. In the weeks before her arrival, rumors swept through all branches which disclosed a COO had been hired and "she's a hatchet woman." The description would makes it's way to then Human Resources "clerk", Esmeralda Sandoval, who immediately informed Rodger Smock and the President about what was being said. The President became incensed, stating he was tired of the rumors and the lies festering amongst the non-exempt sector. He of course was not being forthright again and as employees would soon learn, Beatrice Walker was indeed President Wiggington's own, personal "hatchet woman."

Several weeks after her arrival, Ms. Walker stood before employees during one of the credit union's quarterly all-staff meetings and for some reason, felt impelled to explain how she was hired. In her account, she stated that she answered an ad in a newspaper. She submitted her resume and received a telephone call inviting her to interview with the Board of Directors and afterwards, offered the job of COO. She also made tremendous effort to point out that prior to the date she started to work at the credit union, she had never met Charles R. Wiggington, Sr. Her tremendous emphasis on pointing out they'd never met prior to the date she started working at the credit union caused some employees to grow suspicious and to question why Ms. Walker felt it necessary to tell people she'd never met the President until the first day she began working at Priority One. Ms. Walker's "story" would eventually be exposed to be a lie.

Beatrice Walker suffered from the same insatiable need to expound upon her above-average leadership abilities as does President Wiggington. And like the President, time proved she was devoid of competencies she boasted she possessed.

A search on LinkedIn discovered several accounts all created by Ms. Walker. Some are inactive though a fourth provides an accurate record of her current biography.

The biography references “Priority One Credit Union” as her current employer where she serves in the capacity of its COO but fails to reference that her employment with the credit union ended on July 8, 2011.

Biography 2, like Biography 1, references Ms. Walker’s current capacity as COO of Priority One Credit Union. This of course is incorrect.

Biography 3 like Biographies 1 and 2, states that Ms. Walker is COO of Priority One Credit Union. Does Beatrice Walker understand the definition of the word “current”?

The fourth LinkedIn account we located contains a list of Ms. Walker's past employers which are Universal Studios

City Credit Union, Pasadena Service Federal Credit Union, and Honda Federal

Credit Union, but the record is intentionally incomplete. Why would this highly educated and based on her biographies and verbal statements, accomplished executive find it necessary to publish a partial history of her actual employment? Notably missing from her biography are:

- Priority One Credit Union

- Electricore, Inc..

- Airco Federal Credit Union

Just prior to her arrival at Priority One, Ms. Walker was employed by

Electricore, Inc. a company located in Valencia, California. On June 2, 2009, we called Electricore and were informed that she resigned suddenly on Friday, May 29, 2009, without providing the customary two-week notice. While working for Electricore, Ms. Walker served in the capacity of a contracts specialist with alleged experience in Human Resources.

She had also been employed by Airco

Federal Credit Union, located in Glendale, California. We received an email from a former co-worker of Ms. Walker who informed us that while employed by Airco, Ms. Walker allegedly caused monetary losses which forced the credit union to file a claim with CUMIS, the company's insurance carrier.

There's are good reasons why Ms. Walker has chosen to intentionally omit references to specific past employers from her online biographies. While at Priority One, the products and services she introduced failed to achieve their intended results. Ms. Walker was also instrumental in terminating the last Burbank Branch Manager and a former Business Development Representative, both of which have filed lawsuits against the credit union. She also launched and carried out a vicious campaign against the last Valencia Branch Manager who was allegedly was subjected to harassment, same-sex sexual harassment, retaliation, coercion and even stalked by Ms. Walker. Her performance during her 25-month stay at the credit union was disastrous and her personal behaviors, appalling. What is also clear is that the Board of Directors and specifically, it's Board Chair, Diedra Harris-Brooks, failed and possibly even refused. to conduct the necessary mandated background check of Ms. Walker's past employment and performance.

As shown below, Ms. Walker's past employment record in LinkedIn, describes her as a "Financial Services Professional" who had once been employed by Universal City Studios Credit Union. We've been contacted by former employees of that credit union who informed us that Ms. Walker was also a polarizing presence while at that credit union and that she was allegedly terminated by it's President because of her failure to make sound business decisions.

Ms. Walker’s current bio also includes the following two recommendations written by associates and each praising her abilities and allegedly fine character.

Sylvia N. is a "Senior Consultant" at Lillestrand and Associates. In 2009, during a meeting with employees in South Pasadena, Loren Lillestrand described Beatrice Walker as a “close friend” who was allegedly “wonderful”, “highly intelligent”, "nice" and “charming.” He was wrong.

Sylvia N. describes Ms. Walker as "an amazing leader." The evidence of her leadership abilities while at Priority One prove that she is not amazing at anything she endeavors to do. And her termination on July 8, 2011 suggests that Board was not pleased with her "amazing" leadership skills.

Sylvia N. also describes Ms. Walker as possessing "great intuitive sense" and "great caring spirit with her colleagues." No, she doesn't. She is neither intuitive or caring though she is conniving and brutal. Her business failures aside, her scurrilous persecution of the Valencia Branch Manager attests to her actual character which proved vicious and vindictive.

With approval of Board Chair, Diedra Harris-Brooks, she also proved to be an undisciplined and wasteful spender adding to the losses begun by President Wiggington's deficient business decisions. She, like the President, proved to possess a disdain for policies and rules and it is her intentional violation of policies and laws which provoked the filing of lawsuits by three former employees. It was also she who ordered that every member's account be coded for Courtesy Pay (overdraft protection) though the law requires that the service FIRST be offered to members who can decide to accept or decline the offer.

Sylvia N's statements certainly don't hold true at Priority One Credit Union and certainly as COO, Beatrice Walker never demonstrated a "can-do attitude" towards anything she endeavored to do. .

Sylvia N. is not the only person to publish a recommendation of Ms. Walker. Here is a second recommendation written by Dorothy M., an Interior Design Educator at the College of the Canyons:

*Since publishing of our post on September 25, 2012, Ms. Walker has removed all recommendations under this account.

The credibility of his recommendation is undermined by the fact that Dorothy M. refers to Beatrice Walker as "Deatrice". Dorothy M. writes, "From a business perspective, Beatrice is smart....:" The recommendation was published on LinkedIn. Any business recommendation attesting to the competencies of an executive should always be written from a business perspective. We do have a question. How does Dorothy M. an instructor at College of the Canyons where Ms. Walker studied interior design, possess knowledge about Deatrice's/Beatrice's competencies in business?

As for the personality traits allegedly possessed by Ms. Walker, it would be impossible to find a single employee of the credit union who would ever describe her as "funny, pleasant, personable and someone you would like as a good friend."

In 2009, shortly after being hired, she developed a "friendship" with then Director of Credit Resolutions, Yvonne Boutte, and with then Assistant Branch Manager of the Redlands office, Joseph Garcia, but by November 2010, her friendships with both ended bitterly and Mrs. Boutte and Mr. Garcia began telling staff members at the South Pasadena branch that Ms. Walker was ruthless, dominating, and cruel. Ms. Walker was also terminated on July 8, 2011, because of insubordination. If she possessed any of the qualities described by Dorothy M., they were never attested to during her employment at the credit union.

Ms. Walker also never possessed an an “Excellent grasp on [of] business practices”. Ms. Walker frequently submitted receipts requesting reimbursement of expenses and would often tear off the portion of the receipt containing the name of the business where she purchased products. Though credit union policy requires that executives who need a laptop submit a requisition form to the IT Department, Ms. Walker refused to abide to policy and in 2009, purchased a $5000 on a laptop and ordered the IT Supervisor to process documentation needed to process a reimbursement. The IT Supervisor refused and so she initiated a campaign which slandered his reputation. She also produced fraudulent evidence which she later used to order his termination.

In spite of having been terminated, Ms. Walker continues to be deceptive, publishing distortions of the truth and conveying an image that she is professional, accomplished and personable when the fact is she is a failure in business and possesses a vindictive and is cruel and dishonest. We suggest she hire a pricey consultant who can taken her horrendous failures and try to spin them into a positive without having to completely distort her actual work history and omit the names of employers who terminated her.

In the end, it isn't her egregious acts and failed business decisions which most standout. It is the Board's failure to conduct a proper background check of her prior employment. We believe that background checks were not performed because she came highly recommended by the President. Board Chair, Diedra Harris-Brooks, may have ordered that the usual and required checks not be initiated because Ms. Walker promised the Board she would identify and remove all of the President's enemies from the credit union. And of course, the corrupt and useless Rodger Smock, the Director of Human Resources willingly circumvented all protocols because as the years have proven, he is the President's personal amoral puppet.

ECHOES OF THE PAST

It's really inexplicable why sexual harassment is such a reoccurring issue at Priority One Credit Union. We can't fully comprehend why sex in general, is such a prevailing factor at what is a rapidly shrinking credit union. Certainly, this was not an issue which ever surfaced prior to January 1, 2007, the date Charles R. Wiggington, Sr. was named President and CEO of a then thriving credit union.

Though prior to his appointment as President it was well-known that one now former executive used to spend a part of his day viewing pornographic sites while at work from his company-assigned credit union. The only reason many employees knew of this is because he openly discussed what he'd seen.

Another person who violated policy was the Director of Human Resources, Rodger Smock. He openly entered into a relationship with a young male employee of the Member Services Department which was witnessed by both employees in the Member Services Department including it's then manager, Betty Hilliard, and by employees in the Loan Department.

A third person who sexually harassed employees in the presence of Director, Rodger Smock, was Aaron Cavazos, the former Director of Lending who would often invite women to see his "anaconda.":

However, actual sexual harassment charges were filed in 2008, when a former employee wrote to the credit union's attorney, William Adler, and informed him that she had been sexually harassed by the President for a number of years. An investigation was ordered and investigator, Scott Barer, of EXTTI, Inc. interviewed employees of the South Pasadena and Los Angeles branches and in the end provided evidence proving the President had indeed violated federal law. What's more, Mr. Barer recommended President Wiggington's termination.

Like the President, Beatrice Walker is accused of same-sex sexual harassment which includes stalking the former Valencia Branch Manager. Coincidentally, while on vacation, the Valencia Branch Manager's two dogs were poisoned. We don't know who poisoned the dogs but it seems more than a little coincidental that this occurred while she was on vacation, a fact known about by the credit union.

Here is a copy of the letter submitted in July of 2008 to attorney, William Adler:

July 12, 2008

c/o William Adler, Esq.

Styskal, Wiese, & Melchione

550 N. Brand Blvd

Glendale, CA 91203

RE: Complaint Against Charles R. Wiggington, Sr. of Priority One Credit Union

Dear Mr. Adler:

I am a former employee of Priority One Credit Union, who was wrongfully accused and terminated for "kiting" in September 2007. Last week I received an anonymous letter filled with allegations regarding numerous slanderous statements made by Charles Wiggington, the current president and CEO of Priority One Credit Union, against current and former employees of the company.

I will begin by explaining the reason I am impelled to write. I was amazed by the fact that a person or persons, actually documented the many incidents of sexual harassment and verbal abuse I was subjected to while working at the credit union's South Pasadena office. I was also dismayed by the fact that I seem to be the only employee terminated for kiting, who was referred to CUNA. Liz Campo's kiting constituted numerous incidents yet she was not referred over to CUNA. I also read that Georgina Duenas and Gema Pleitez, circumvented banking procedures and did not place a hold issued by another financial institution which later resulted in an incident of non-sufficient funds. I called the company after receiving the letter and verified that not only does Georgina continue to be employed but she has also been promoted. I understand that she now oversees Credit Resolutions which is the company's contracted credit collection department, yet she has no experience in collections and as I remember, continually abused policy and procedures. I believe that the disparity in policy enforcement and preferential treatment shown some employees is defined as discrimination. Am I correct?

Of all the acts described in the letter, none is more insidious than that of restoring a business relationship with Henry Justice. At the time I called the office I was told that Charles had been informed that you also received a copy of the anonymous letter and that when informed by Diedra Harris-Brooks of its contents, he denied this newly resurrected business relationship with Mr. Justice. I was also told that upon conclusion of his conversation with Diedra, he immediately called Henry Justice and instructed him to deny any involvement with Priority One. I cannot fathom why I was terminated for one act of kiting while Georgina remains employed and was recently promoted and why the credit union has decided to go into business with Henry Justice, a person who literally absconded with thousands of dollars which belong both to the credit union and its valued Members.

In the weeks following my termination, employees of the company called my home and informed me that employees at the LAPDC and Aaron Cavazos and Georgina Duenas at the South Pasadena office, had been overheard speaking while in the Loan Department, about my termination. Rumors included that I approved and funded a loan for a man I was involved with; that I passed several bad checks; and that I misappropriated funds. I was mortified about the rumors and called Charles on his company cell phone. When I told him about the rumors, he rudely brushed me aside and in a condescending tone, replied that “only management” knew about the reasons why I was terminated. Based on Charles’ words, I concluded that the rumors were being spread by the credit union’s management sector.

My last 3 years of employment at the credit union were at times tormentuous. Every statement in the letter describing what Charles said and did to me is true.

Though many of my co-workers witnessed many of these incidents, including Aaron Cavazos, Patti Loiacano, and Rodger Smock, none did anything to dissuade his harassment. I was also afraid to lose my job because I am a single parent raising a daughter. His statements humiliated and embarrassed me and demeaned my person. I have spent the last few days remembering the many things he said including the abuse termination meeting I was subjected to, as AVP, Lynnette Fortson interrogated me demanding an explanation why I had written a bad check. I now believe my termination, which was ordered by Charles, may have been an effort to quell me from disclosing the many acts he committed against me while I was employed. The duress and harassment and eventual termination, have left me emotionally injured and financially impaired.

Why was Liz Campos not reported to CUNA? Why was Georgina Duenas not terminated for the check she deposited in 2007, which later bounced? Why were the required holds not placed on the check? Does Georgina Duenas or Gema Pleitez have the authority to circumvent banking procedures? Aren't policies to be enforced unilaterally?

Henry Justice robbed the credit union and escaped prosecution. He also filed bankruptcy and avoided having to pay back the money he took, yet Mr. Wiggington has allowed him to enter areas of the company which are usually off-limits to non-members and has decided to re-establish a business relationship with Mr. Justice. Can you please provide an explanation why resuming a business relationship with Mr. Justice is deemed right and why I was terminated?

The Human Resources Department at Priority One chose to ignore Charles' mocking, sexual innuendos, and slandering of my person. Why is that the company chose not to protect me, deprived me of my rights, and terminated me when Charles has done far worse to employees, the credit union, and evidently in the case of Danny Wafa, robbed at least one member of his automobile.

I am going to consult an attorney will file a complaint with the Equal Opportunity Comission and any other state or federal agency who will investigate and act upon my complaint. I will also begin efforts to contact other former employees who believe they were abused and mistreated by Charles. The Board of Directors has failed miserably in reining in Mr. Wiggington. Evidently tye years of complaints and rumors of wrong doing were not enough to get them to initiate an investigation. They are responsible for overseeing the credit union's sound operations but refused to intercede and bring an end to his [Charles R. Wiggington, Sr.] insidious regime.

It is interesting that in 2008, Board Chair, Diedra Harris-Brooks, chose to ignore the evidence and the investigator's recommendation and with the help of Directors, O. Glen Saffold and Thomas Gathers and Supervisory Committee Chair, Cornelia Simmons,. voted for reinstatement of the President. Before the investigation was ever conducted, Mrs. Harris-Brooks knew she would fight for the President's reinstatement. Unlike all other employees who are suspended following allegations they have violated credit union policy, Mrs. Harris-Brooks placed Charles R. Wiggington, Sr. on suspension with pay. The gravity of the accusations leveled against him were inconsequential to the corrupt Board Chair. Mrs. Harris-Brooks also issued two letters- one to the victim and the other to the President in which she reduced the accusations against the President as mere humorous though inappropriate repartee encouraged by the victim.

Three years later, Mrs. Harris-Brooks ordered that the President diffuse the Valencia Branch Manager's allegations against Ms. Walker and dismiss the entire matter to a mere conflict of personalities. Ms. Harris-Brooks' dishonest proclivities have again injured the credit union, leaving it open to yet another lawsuit.

In 2010, Mr. Smock also received complaints from female employees alleging that a former Afro-American Business Development Representative and then Call Center Supervisor, Joseph Garcia, had inappropriately touched them. The two males were counseled by Mr. Smock who may only have chosen to issue warnings because of the 2008 complaint filed against the President.

In 2009 through 2010, the Board Chair had no qualms with the abusive tactics employed by Ms. Walker against employees and she purposely ignored the fact that Ms. Walker's so-called efforts to create profit, were all failing. Despite well documented failures by the COO, during the annual meeting which took place in May 2010, Mrs. Harris-Brooks told attendees that in her opinion and that of the Board, they believed the credit union finally had the "right management team in place." Fourteen months later, Mrs. Harris-Brooks ordered Ms. Walker's termination.

Beatrice Walker's vendetta against certain employees was provoked by the President. Not only did she create greater divisiveness but she intentionally fostered discord amongst staff members and created an environment saturated by vicious gossip, strife and intrigue. The decision to finally terminate Ms. Walker was as much an indictment to her chronic failures and abhorrent behaviors as it was to the failures and corrupt nature of the entire Board of Directors and in particular, its Chair, Mrs. Harris-Brooks.

Baby, I’ve been watching you

I want to know you better

I love the way you move and dress

And how you fill that sweater.

When you catch me staring, you always turn away

But I don’t plan on stopping cause I see you as my prey.

It’s time you change the way you think cause I plan to make you mine

You know that I can’t help myself, you’re always looking fine.

The law says its illegal and I will get in trouble

But no law is gonna stop me

Nor going to burst my bubble.

"When a worker complains about

harassment, you take it seriously."

Carol Thorpe

Automobile Club of Southern California

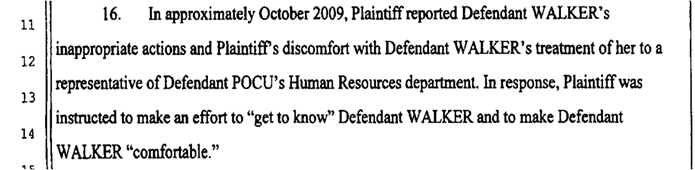

On May 15, 2012, poster and credit union insider, Priority MC wrote, "There is no lawsuit from Suzanna like you keep saying." She lied. Shown below is the summons ordered to be served on former COO, Beatrice Walker, in the lawsuit filed by the former Valencia Branch Manager.