“Did you fall down and smack your little head on the pavement?”

Miranda Priestly, “The Devil Wears Prada”

Did the President and His Vice President Blunder Again?

President Charles R. Wiggington, Sr. and Board Chair, Diedra Harris-Brooks, have often said they hate this blog yet for some inexplicable reason, they remain the two biggest contributors of information we publish. Quite frankly, if it wasn’t for their chronic need to violate policies and state and federal laws, we probably would have little to write about.

We recently discovered that the credit union has been informed they may be sued again by the same member whose confidential account information was published on the Internet by an employee of the credit union in early 2012. Evidently, the ability to learn from one’s mistakes is something every executive and manager of Priority One Credit Union in South Pasadena, California is oblivious to.

Last October 2012, the credit union negotiated a settlement agreement to bring closure to the lawsuit filed by the former member whose confidential information was intentionally published on the Internet by an employee of the credit union using the handle, Priority MC. In November, the credit union and the former member signed the settlement agreement and the President issued what should have been an apology letter, trying in vain to convince anyone who read his statement, that the credit union never authorizes employees to publish confidential information about members, on the internet. Unfortunately, Tricky Wiggington’s letter failed to convince us that the credit doesn’t ever authorize the publication of confidential information since logically only employees of the credit union had access to the confidential information illegally published on the Internet.

Though the settlement agreement was signed on November 27, 2012, which should have brought an official end to the relationship between the credit union and former member, someone at the credit union allegedly chose to violate the terms of the agreement and without authorization, submitted a request to Experian, the credit reporting company, inquiring about the former member’s credit history. The inquiry was submitted in January 2013, approximately two-months following signing of the agreement which should dispel the excuse that the inquiry was submitted in error.

Credit Union procedure requires that the credit union obtain authorization from a member to order a copy of their credit report. Because the member was a former member, there was no reason why she would have granted authorization to the credit union to order a copy of her credit report. The member also hadn’t applied for a loan nor requested reinstatement of her membership, either of which would have justified requesting a copy of her credit report. This latest breach should be a concern to all current members and any person who might be considering opening an account at Priority One Credit Union.

There is an employee or employees who are obviously incapable of adhering to credit union protocols. This past February, more internal thefts were found to have occurred at the Los Angeles branch. Historically, the Los Angeles branch has been the site of thefts committed by employees of the credit union. On March 1, 2013, a long-time officer who served as the AVP overseeing both the Los Angeles and Airport branches, was terminated and soon afterwards, Vice President, Yvonne Boutte ordered the staff of the Los Angeles branch not to communicate with the former AVP, disclosing that she may have embezzled funds from member account. Mrs. Boutte’s disclosures constitutes a violation of the policy governing confidentiality and reminding us that the credit union seems quite incapable of protecting member assets and confidential information concerning members and employees. It is also important to note that these violations of security protocols began in the years after Charles R. Wiggington, Sr. was appointed President and CEO of the credit union. So can any member or employee feel confident that their funds and personal account information are safe at Priority One Credit Union?

In what is now known as the infamous 2007 Breach of Security, President Wiggington allowed envelopes, on whose exterior were printed member account and social security numbers. The President would later place the blame on the then IT Supervisor, however, it was the President who approved all the information that was sent to the printer who published the envelopes.

We personally believe the member has cause to file another lawsuit. Clearly, Priority One was unauthorized to request a copy of her credit report. There was also no justification to support the credit union’s actions. The latest incident has probably incurred duress for the former member. There is also a question regarding Privacy which has been violated once again, by the credit union. The latest incident also violates the terms of the settlement agreement. So who at Priority One Credit Union requested a copy of the member’s credit report without her authorization?

CREDIT RESOLUTIONS

Working Hard to Maintain

Second Rate Service

Through a process of elimination, we believe the most likely culprit perpetrating the latest violation of credit union policy and state and federal law is the credit union’s own in-house collection department- Credit Resolutions.

Requests submitted to Experian are often submitted by the credit union’s Loan Department but ONLY in response to an applicant’s request for a loan. The credit report is one of several criteria used to determine a person’s eligibility for a loan.

According to the language contained on the backside of a New Membership Application, the Member Services Department may request a copy of a person’s credit report as part of its screening to determine eligibility, though historically this has never been done because verification from ChexSystems takes precedence as a qualifying factor to membership.

The only other department that communications to credit reporting companies is Credit Resolutions who may advise Experian when a member’s loan or other product, has become subject to collection proceedings or when a delinquent account has been paid-off or written-off.

Since the member has not applied for a loan or requested reinstatement of her former membership, we can immediately cross-out the Loan and Member Services Departments as the perpetrator in this latest abuse. We must add that this disqualifies the Accounting and Teller departments who are not authorized to request credit reports.

So why would Credit Resolutions request a copy of the member’s report without authorization?

In 2012, the member contracted Board Chair, Diedra Harris-Brooks, by phone and informed her that confidential information pertaining to her now former automobile loan and defamatory statement about her person, had been published on the Internet. The chronically dull Board Chair contacted the even more obtuse President and ordered him to investigate and resolve the alleged violation of the Privacy Act. The dull President deferred resolution of the complaint which alleged a violation of federal law, to Vice President, Yvonne Boutte. Ms. Boutte who had previously served in the capacity of a collections clerk, collection’s supervisor, collections manager, and eventually a director and Vice President was completely unqualified to manage and resolve the complaint which posed potentially adverse legal reverberations to the credit union.

Mrs. Boutte may have become confused and thought she was a member of a goon squad and tried to verbally subjugate the member, verbalizing warnings forbidding the member from ever calling Mrs. Harris-Brooks again. The member who is intellectually superior to Mrs. Boutte hung-up and instead filed a lawsuit. A few weeks later, the credit union offered a monetary settlement in an effort to avoid an embarrassing court trial.

The only persons who would have intimate knowledge of the legal conflict involving the member’s formerly delinquent account is Credit Resolutions. However, the case was referred to the credit union’s attorneys by either the Supervisor of the Department, Alex Suarez, and/or Vice President, Yvonne Boutte. Not only would subordinate staff not have been privy to much of the information first published in April 2012 by a poster using the handle, Priority MC, but it is only an officer who would have had access to the highly confidential information. Furthermore, the only person who was allegedly personally and emotionally affected by the member’s lawsuit was Mrs. Boutte who was also reprimanded in 2012 for her bungling of the member’s complaint.

In early 2011, we received the following colorful email, commenting about then Director of Project Management (whatever that meant), Yvonne Boutte, who at the time only oversaw Credit Resolutions. We thought it appropriate to finally share, since it is impossible to separate Priority One’s business failures from the characters and abilities of its managers.

“We were called into an impromptu meeting. Bea (Walker) walked in and said, “Oh, this is where all the important people are!” I felt like replying, “Yeah, if by important you mean all the useless, good for nothing people who are destroying this place but think they’re important, then yes, you’re right.”

I found out that the Accounting Department were warned that Charles (Wiggington) or Bea (Walker) are looking at everybody’s emails. In fact, we were told, Charles called Diane McDougal and Jennifer Kelly to his office and warned them he was reading all emails that are being sent to Manny (Gaitmaitan) by the staff. He said that no one is allowed to talk to Manny while at work or from their homes. Manny told us before he left that we could call him if we needed help with the procedures or anything else. I guess Charles is paranoid and afraid people are plotting to get him. Everyone knows he and Bea backstabbed and drove Manny out. Guess they think Manny is going to do something to get even or spill the beans on all the illegal things they make us do with the books. They obviously don’t know Manny. He’s not vindictive and he’s glad not to be here anymore.

We also had a book meeting this morning. Yvonne was so loud. She told us how they (I guess she’s referring to Charles and herself) plan on getting rid of more people who they say are not “team players” and who don’t contribute to changing the credit union to a better place. Yvonne even said, “If they don’t wanna be on our bus, then we can give them (severance) packages and send them on the little yellow school bus. They want to use any excuse to fire more people and they’re going to place [the] people they don’t like in positions where they will fail and at branches that are far from their homes. Bea says, “If you want to get rid of someone, put them in a branch far from their home. They’ll quit and you won’t have to pay them unemployment.” Why not just put Charles and Bea in the garbage since neither of them contributes anything good to the credit union. Oh and before I forget, Joseph (Garcia) is still annoying. He’s now talking about Bea. I thought they were friends? He says he hates the things she’s done to a lot of employees and said she abused Susanna. And no one trusts Esmeralda. Adolfo said she goes to Smock every day and gives him the names of people she says are the enemy. She tells him who she overhears complaining and who talks about the blog. Everyone around hear except for Cecibil, doesn’t trust her. Got to get to bed so I can go back to work in that awful place. Write to you soon.”

Yvonne Boutte’s alleged statements are consistent with her attitude and behaviors. Since her arrival in 2008, Mrs. Boutte has proven a divisive influence whose disdain for subordinate staff is unveiled. She understands that most employees may fear reporting her abuses because of her vindictive attitude and because of the credit union’s Human Resources Department whose decisions are tainted and biased and always in favor of management. Her derogatory statement about employees who disagree with the way the credit union is run, denotes much about her character and as many know, “little yellow school” buses are used to transport special needs children and young adults. Despite her reprehensible behaviors and inappropriate and uneducated verbalizations, Board Chair, Diedra Harris-Brooks, and President Wiggington have chosen to protect and promote Mrs. Boutte. The preferential treatment shown her by the Mrs. Harris-Brooks is reminiscent of the preferential treatment shown President Wiggington who despite his crass behaviors, unprofessional decorum, illegal acts, and detrimental business decisions, has continually found protection under the Board. So can we also attribute Mrs. Boutte’s upward mobility and continued employment to skin color?

Mrs. Boutte’s bungling in 2012 of the complaint filed by the member could have been resolved diplomatically, tactfully, and with care, but Mrs. Boutte, an undisciplined authoritarian and control freak, chose instead to exact her authority and tried to subjugate the member which in turn, provoked filing of a lawsuit which the credit union subsequently settled.

Patti Loiacano, another long-time employee, is the credit union’s in-house Vice President of Compliance and Lending but one has to wonder if she realizes that she is ensure preemptive measures are continually being implemented to ensure member information and assets are protected. Based on the numerous breaches, we have to question her effectiveness in compliance. We are aware that in 2008, Mrs. Loiacano was informed by a now former Loan Processor that the DMV Specialist had obtained permission from then AVP, Aaron Cavazos, to recruit the assistance of a temporary employee who was ordered to forge the signatures on a large stack of unsigned Power of Attorney forms which had not been signed by members who obtained vehicle loans. At the time, Mrs. Loiacano stated she could do nothing to stop the illegal signing of the forms because the order to sign these came from her supervisor, Mr. Cavazos. We certainly understand the delicate nature of politics and how at times, stopping illegal acts can produce negative repercussions to the person exposing wrong doing. Certainly, the history at Priority One under President Wiggington is permeated by persecution of whistle blowers, but Mrs. Loiacano who at the time was the Assistant to the Lending Director, had a legal and ethical duty to step forward and inform Mr. Cavazos that the act he authorized was illegal. She chose not to do so.

So what motivated the unauthorized request by the credit union, seeking a copy of the former member’s credit report? Was it defiance of policy and law, ignorance, or just plain old-fashioned revenge? And if it was revenge, then who at the credit union would be the person most likely to try and retaliate against a member who exposed the nefarious actions committed by the credit union?

This Post

We continue our expose’ on more of decisions made by Priority One Credit Union’s not-so-illustrious executive sector who have helped transform the once respected and well-liked credit union into something far less effective, less competitive, and much much smaller in size. Long-time current and former employees and members can attest to the ongoing decline of Priority One Credit Union, which transformed the organization from promising to struggling and whose downward spiral began with the appointment of Charles R. Wiggington, Sr. as President.

Nowadays, representatives of the credit union no longer attend benefits fairs conducted by contracted hospitals nor are the credit union’s booths seen at community street fairs. Representatives of the credit union are no longer invited to speak at new hire orientations conducted by Providence St. Joseph Hospital or by the U.S. Postal Service at the Los Angeles Distribution Center. The credit union also no longer attends the Valley Industry Association’s (“VIA”) monthly luncheons in Santa Clarita or the Burbank Chamber of Commerce monthly luncheons. Its also been a long time since any employee of the credit union has attended the monthly Los Angeles Chapter meetings in Monterey Park, California. Though visibility is key to promoting any credit union, under President Wiggington, the credit union has chosen to depart the public light, in part because it can no longer afford to attend meetings, presentations or events. This after all, is the house that Charles R. Wiggington, Sr. built.

This all brings us to the subject of credit unions giving back to the communities they serve or in the case of Priority One, the communities they allegedly service. Priority One, like all other credit unions, enjoys exemption from paying corporate income taxes but this is a privilege non-profits and not-for-profit organizations enjoy because they are required to fulfill certain requirements appointed them under federal law. One such requirement is investing income in a way which benefits members and the organization. Other requirements include:

- Helping people of modest means.

- Loans offered for provident purposes.

- Teaching thrift.

- Free financial education.

- Offering loans to those who might not otherwise have access to credit through more traditional banks.

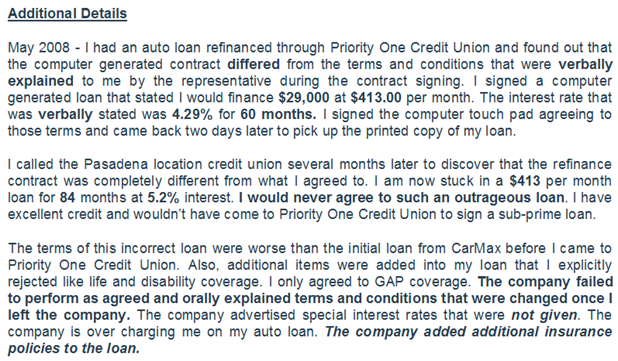

Under Charles R. Wiggington, Sr. and his contingent of lackeys, member complaints citing the refusal by Priority One to approve loans, have actually increased over the past 6 years. The credit union offers personal loans but many applicants cannot meet the credit union’s stringent eligibility requirements. The credit union last offered free financial education under William E. Harris, President Wiggington’s predecessor. Priority One like all other credit unions is required to contribute to the betterment of the communities it allegedly serves. In 1934, Congress passed the Federal Credit Union Act, establishing that the purpose of credit unions was to make credit available to people of small means through a national system of cooperative credit, and to encourage thrift through cooperative saving. Evidently, Priority One has chosen not to satisfy its legal requirements though it continues to enjoy the benefits granted non-exempt organizations while riding on the back of more committed, better managed credit unions.

From a branding perspective, Priority One is not supposed to be in business for money but rather to offer offer affordable rates, less fees, and nothing less than great service to its members. As we will show, quality member service has been trumped by sales. This philosophical change is not only inconsistent with government mandates but serves to undermine the ability of the entire industry to insulate itself from undesirable government legislation. In 1997, the chairman of CUNA reiterated the industry’s legal and social directive by describing credit unions as “the only financial institutions chartered with the social mission of making loans available to people of small means and teaching the benefits of thrift.”

In 1971, President Nixon signed Executive Oder #11580 which gave the NCUA its official seal. He declared that the mission of all credit unions’ is the “cultivation of thrift, encouragement to save regularly, granting of loans for provident purposes at a reasonable interest rate, and budget and consumer counseling.”

The basis of taxing credit unions is that they have a responsibility to provide members and potential members with access to credit markets that traditional banks choose not to lend to.

So is Priority One under President Wiggington, giving back to the community it allegedly serves? A reason why the President may be refusing to satisfy what is required of the credit union is that nowadays, Priority One must limit its spending because it is failing to generate sufficient new business to offset its overhead. In the meantime, the credit union remains the recipient of benefits reaped from the hard work and contributions of all other credit unions that actually strive to live the credit union industry’s motto of people helping people.

MORE SIGNS OF A NOT-SO-BRIGHT FUTURE

The $5.00 monthly charge is inconsistent with President Charles R. Wiggington, Sr.’s and Board Chair, Diedra Harris-Brooks’ address, published in the credit union’s 2012 Annual Report, declaring Priority One Credit Union looks forward to a Brighter Future Ahead. Clearly, the $5.00 fee constitutes a new stream of desperately needed income for a credit union whose efforts to promote new business have continually been met with failure. The $5.00 charge also comes at yet another cost to members which will serve to further estrange Priority One from some of its membership. Furthermore, just last year, the credit union eliminated a $5.00 fee introduced by former COO, Beatrice Walker, charged to members who called the credit union to request a transfer of funds between their credit union accounts.

So is the newest $5.00 charge the only solution left to the declining credit union. The charge suggests Priority One is desperate for money. The charge will also not serve to solve the credit union’s financial shortcomings. A better solution would have been for President Wiggington to develop strategies that reach out to members who only have a saving account. Of course, any such plan of action would have required that the President actually expend real time needed to formulate a strategy.

We recently contacted one of the credit union’s branches to ask questions about the new charge. We were told that if the monthly $5 charge zeroes out a member’s remaining account balance, the account remains open. Unless the member specifically requests closure of the account, a $5.00 charge will continue to be charged month after month. This of course will force force a negative balance which will subject the account to collection proceedings and possibly referral to ChexSystems. That was disconcerting and hardly evidence that Priority One either values or wishes to create a lasting relationship with what should be its valued Membership.

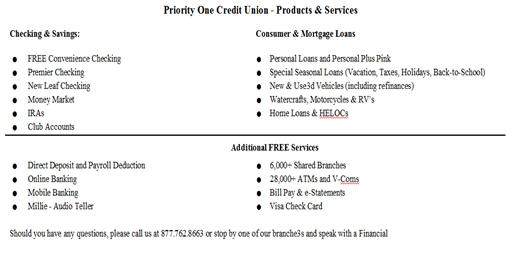

The notice asks members to increase their “average daily balance to $500, or better yet, take advantage of one of our qualifying products or services. Please see the bottom of your statement for a list of our products and services.” Actually, the list appears on the backside not the bottom of the statement. The invitation to acquire products or enroll in services is a means by which members may avoid incurring the $5.00 fee.

According to President Wiggington’s and Executive Vice President, Rodger Smock’s, online biographies, the two possess extensive experience in the banking industry yet evidently, neither ever acquired an understanding that to successfully sell the credit union’s products and interest members in enrolling in its services requires educating members on how these may potentially benefit them. The no-frills and lackluster list does nothing to inform members about the purpose of some of the products or how the services may add convenience to their personal banking experience. The inability by the credit union’s highest officers to present the credit union’s wares in an appealing light may be the reason why the credit union’s business developments have failed year after year, since Charles R. Wiggington, Sr. was appointed President. We’re even more surprised, since in May 2012, the Executive Vice President unveiled a previously unknown fact that back in the 1960’s, he graduated with a Bachelor of Business Administration in Marketing from the University of Cincinnati. Because we don’t see evident of real marketing at the credit union, we invite Mr. Smock to send us a copy of his diploma or college transcripts validating his alleged studies.

THE QUARTERLY SUMMER NEWSLETTER

The President’s address expounds on the increased possibility that fraud can occur to accounts that are dormant. This by the way, doesn’t represent the norm. In fact, it is less likely that a dormant account will be targeted for fraud than is an active account whose number is being widely used by a member in completing transactions such as purchases and payments. We think the President is building a case which tries to raise an issue where none exists. If Priority One’s leadership was truly concerned with protecting member assets then why has the Los Angeles branch been the site of several internal thefts? Over the years, the losses have been substantial and all first discovered by members not the credit union. There is a clear disconnect between the President’s alleged assurance that the credit union is concerned with protecting member assets and the failure by the credit union to effectively monitor member accounts. Does the fault lie in the President, the staff or the credit union’s security protocols?

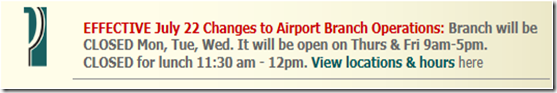

Yet another indicator that Priority One is not presently traversing upon a road leading to a Brighter Future Ahead, is President Wiggington’s recent decision to reduce the hours of operation for the Airport Branch. Beginning Saturday, July 22, 2013, that office only opens on Thursdays and Fridays, from 9 a.m. to 5 p.m. This past June, the President revealed that the Airport Branch is not drawing sufficient traffic to warrant opening 8 hours a day, five days per week. Unlike the Santa Clarita branch, the problem affecting the Airport branch is not its location but rather, the failure of President Wiggington to promote the location. The failure is 100% attributable to President Wiggington’s apathetic and slovenly approach to business.

Like the Airport Branch, business at the Santa Clarita branch has fared poorly since its opening in February 2012. Prior to its opening we warned the location would fail because of its inconvenient location outside of downtown Valencia in what is the edge of an agricultural region and standing outside the gates of the Santa Clarita Bulk Mailing Processing Plant.

Despite our warnings, the President declared the Santa Clarita branch would attract immense amounts of new members who live and work in the Santa Clarita Valley and adding that the $1.00 per year spent to lease the location, would prove his abilities as a clever tactician. Of course, his opinions were based only one what he believed to be true and nothing more substantial like an actual study to determine the feasibility of the location. His YES men like Executive Vice President, Rodger Smock, and Employee Services Director, Robert West, pandered to the President, affirming that the new branch held the promise of new business and added membership. As is always the case at Priority One Credit Union, the declarations proved to be speculative and unfounded and the Santa Clarita branch has proven to be yet another waste of time and money.

The theme of the 2012 Annual Report of a Brighter Future Ahead will never be realized because neither the President or Board of Directors are capable of making sound business decisions as attested to by the closure of four key branches during the years of 2010 through 2012; the hiring and termination of an overpaid COO and CLO along with the bludgeoning of key budgets needed to promote the credit union’s name, products and services.

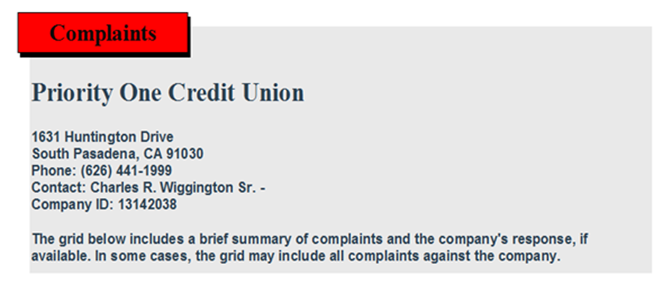

COMPLAINTS

COMPLAINTS

COMPLAINTS

It’s one thing for us to write about the issues plaguing Priority One Credit Union’s level of Member Service and quite another to actually read complaints filed by members.

Beginning in May 2012 and again in January 2013, the President increased efforts to create a more positive public image of the credit union and to convey the idea it is capable of providing sound financial management of member assets. As part of their revamping efforts, in January, the President ordered publication of Bauer Financial’s assessment that Priority One is a four-star credit union. The image of Bauer’s logo disappeared from the credit union’s webpage in February immediately after it was disclosed internal robberies were found to have occurred at the Los Angeles branch. In recent weeks. the logo has reappeared on the credit union’s webpage though there is little in terms of service and products that validates things are well at the troubled credit union. However, if you visit the credit union’s SEG page, you’ll find that the credit union continues to declare itself as a FIVE-STAR credit union which is wholly untrue and inconsistent to Bauer’s actual rating.

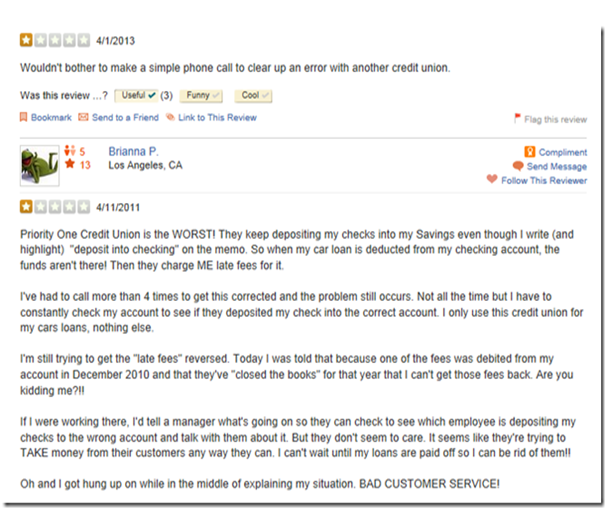

We traverse the Internet frequently and we’ve notice, that member complaints are increasing as more and more members publish their concerns and frustrations on the Internet. There is tremendous dissatisfaction with the credit union’s Member Service which we believe is related to Priority One’s inability to obtain new business at a level that offsets its overhead.

All Member Service dispensed by Priority One falls under authority of Vice President, Yvonne Boutte though in South Pasadena, supervision of the Call Center has been delegated to former Branch Manager and former AVP, Gema Pleitez, who assists Mrs. Boutte. Mrs. Pleitez allots approximately 3 minutes to be spent on an individual call irrelevant of the requests or concerns of the member. If an employee exceeds the 3-minute limit, she types out a message which appears on the representative’s PC monitor, advising them to wrap up the call. She also demands that a certain number of calls be answered by each per day and reminds them frequently the sales takes precedence above all else. This of course has a direct impact on the quality of service provided by representatives and relegates Member Service to a secondary and less important role than sales. What is acutely clear is that neither Mrs. Boutte, Mrs. Pleitez or for that fact, the President, understand the relationship between creating a positive member experience and repeat business and written and word-of-mouth recommendations of the credit union. What’s more, the Call Center seats 5 to 6 representatives, the President has chosen to only employ 3 full-time employees, citing the need to reduce expenses. Evidently, Mrs. Boutte, the Human Resources Department, and Executive Vice President, Rodger Smock, cannot fathom the importance of keeping a well-manned Call Center.

Here are some of the complaints we located on the Internet, all citing Member Service related issues. We believe most businesses which find themselves the subject of online complaints would try to enact measures that proactively resolve the causes which undermine their ability to provide satisfactory service. Not so at Priority One where complaints are ignored and their importance trivialized. Then again, how can the people responsible for creating these problems possess the ability to resolve them?

YELP.COM

Complaint #1

Response to Complaint #1

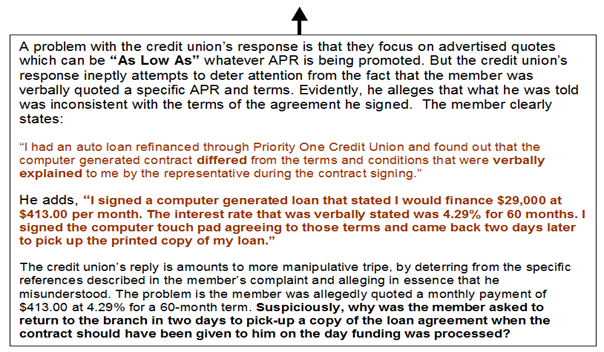

COMPLAINT #2

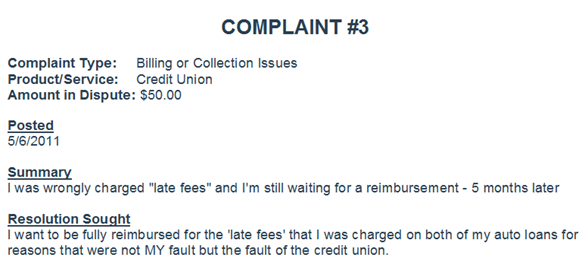

COMPLAINT #3

COMPLAINTS #4 & 5

SECOND SET OF COMPLAINTS

MISSING THE MARK

ADVERTISING GONE AWRY

On January 1, 2007, President Wiggington, Sr. dismantled the credit union’s prize-winning Marketing Department, replacing its experienced Director with inexperienced then AVP of Operations, Aaron Cavazos, who neither had experience or talent in anything related to marketing. With permission of President Wiggington and the blessing of Executive Vice President, Rodger Smock, the AVP installed a Marketing Committee completely populated by employees of the Loan, Member Services, and Card Services Departments. Like the AVP, none had any experience in either marketing. The committee quickly metamorphasized into what can only be described as an Advertising Committee, limiting their efforts to writing copy and selecting graphics for scheduled promotional campaigns. Their first big project was creation of the 2006 Annual Report. At the time the annual statement was completed, Mr. Cavazos, President Wiggington, and Executive Vice President, Rodger Smock, boasted that the report had been produced at thousands of dollars less than any report created by the former Director of Marketing. At the time, the President declared that under his leadership, Priority One would save money and make great advances that would dwarf anything accomplished by his predecessor. President Wiggington was wrong.

The 2006 Annual Report proved what would become a long list of many debacles. The shoddy booklet, was composed of subpar paper stock, bleeding font, runny graphics, and many of its pages appeared faded. The document didn’t convey success nor did it suggest it was the product of cost-effective and prudent planning. The report screamed cheap and was born out of an effort to cut expenses in the wrong areas. The report was certainly a fall from grace and possibly even a harbinger of things to come, proving Charles R. Wiggington, Sr. lacked the understanding, finesse and business acumen of his far more dignified and respected predecessor. The report can also be cited as a marker of when the credit union’s prior prize-winning campaigns came to an abrupt end.

In February 2012, Priority One hired a new Marketing Specialist, at an annual salary of $70,000 per year. The Specialist was the second hired in a less than 3-year period. The first succumbed to a plot hatched by former COO, Beatrice Walker, and President Wiggington, fueled on their personal unevidenced belief the specialist was a conspirator divulging confidential information he had no access to, to the Internet, including this blog.

Nowadays, marketing at Priority One remains substandard and unimaginative. The credit union’s diminishing size attests that marketing which gathers information about the credit union’s marketplace and the needs and wants of its members, is non-existent under the auspices of Charles R. Wiggington, Sr. The current Marketing Specialist, Daniel Ballesteros, arrived at the credit union via former CLO, Cindy Garvin. Prior to her termination, Ms. Garvin disclosed that Mr. Ballesteros was an experienced Marketing Specialist. We don’t understand why the credit union’s current marketing efforts are failing to communicate its mission, values or manifesting strategies that speak to a target audience. Sound marketing produces a stronger and consistent image of the organization and helps foster member loyalty while helping establish and maintain relations with the communities served by the credit union. What’s more, through marketing members learn how the credit union’s brand serves as a valuable and desired commodity. So what is Priority One’s brand? Do members know what Priority One’s brand is? Do members feel satisfied, proud and loyal to Priority One?

We thought it only appropriate to repost some of the credit union’s recent promotional pieces though we can’t discern what sector of the membership these speak to. What is acutely evident is that proofreading is not something the credit union deems necessary when publishing its campaigns.

Source: Priority One Homepage

Though for years, Rodger Smock, the credit union’s Executive Vice President, utilized his alleged writing skills to produce the credit union’s former monthly newsletter and current quarterly newsletter and though the credit union has employed a full-time Marketing Specialist since February 2012, grammatical and syntax errors prevail suggesting that maintaining some semblance of professionalism in what they publish is inconsequential to President Wiggington. In 2009, Mr. Smock stated that there was no reason to sound too educated in the credit union’s newsletters since members might not understand what was written. So are the persistent errors an attempt by the credit union to dumb down advertising? Don’t they believe members have the capacity to understand well-written promotions devoid of errors?

Source: Priority One Winter Newsletter

Maybe the Marketing Specialist meant to write “Keep Yo car keys.” At $70,000 per year, we expect more from the Marketing Specialist, though apparently President Wiggington dos not.

DECIPHERING THEIR MESSAGE

You’re driving down a wide open highway, suddenly your automobile rocks violently, back and forth and in seconds lifts off the highway, the air permeated by the a deafening buzzing sound. That is the impression made by Priority One’s automobile promotion which offers to deliver “Sweet Rides.” We don’t get it.

DECIPHERING A PROMOTION

Delivering Sweet Rides?

1. Bees produce honey.

2. Honey is sweet.

3. Automobiles and SUV’s provide transportation or rides.

4. Using modern day vernacular, a comfortable ride can be described as a “sweet ride”.

5. Conclusion: Honey is sweet and vehicles financed by Priority One Credit Union allegedly provide “sweet rides.” Really?

Inarguably, it’s a poorly conceived promotion. The promotion and graphic are confusing, childish and illogical. The catch phrase is a stretch that is neither clever or imaginative. Despite its overwhelming flaws, the advertisement was approved by the President and Executive President, serving again as evidence to their respective limitations and attesting that neither comprehends marketing or advertising. From the graphic to the rhetoric, the advertisement fails to make the point which should have alluded to affordable loans with great terms. Instead, the credit union chose an unimaginative promotion lacking drawing power. By the way, all promotional pieces are approved by President Wiggington and executive Vice President, Rodger Smock and often, reviewed by Diedra Harris-Brooks. We are particularly surprised that this piece was approved for publication when one of Mr. Smock’s online biographies, states that while in college, “Rodger D. Smock [studies] focused on marketing and psychology courses at the University of Cincinnati.”* As we’ve reported in past posts, no one at the credit union knew Mr. Smock allegedly studied or received a degree in marketing (according to some of his other biographies, he received a BA in Marketing) until May 2012, when he literally came out of the closet and revealed he studied marketing in the 1960’s. Evidence of his alleged education and expertise in marketing is yet to be seen and like the story of Atlantis, can relegated to mythology.

WHERE WAS THE MOTIVATION?

At times, the enthusiasm and passion of any organization can be attested to by their participation in non-business events that contribute to the betterment of a community or improve our general way of life.

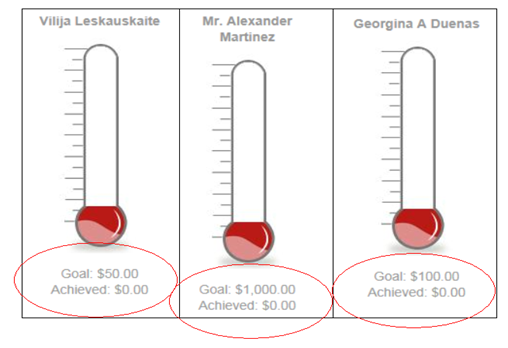

A few years ago, Priority One became an allegedly avid supporter of the annual Revlon Walker, an annual fundraising event which collects money used for cancer research, treatment, counseling and outreach programs. This year, Priority One decided to post the names of its employees and the individual donations each would try to collect for the Walk. On their Facebook page, the credit union touchingly writes, “remembering those we’ve lost [to cancer], sharing stories, and making a difference in the fight against cancers”, affirming their heart-felt concern over the subject of breast cancer.

This year’s participation failed to affirm the credit union’s alleged passion for the subject of breast cancer. Inexplicably, the credit union voluntarily chose to publish the names of this year’s participants, their individual goals and the amounts they collected (and did not collect). We can’t help but draw a relationship between what the credit union failed to collect for the Revlon Walk and their failure as a business and employer. Here is the information published by Priority One documenting what they didn’t achieve on behalf of the Revlon Walk.

The total goal that volunteers agreed to collect was $6250.00. The amount collected as shown on their website is $95.00 though the credit union insists it collected $145.00. Oh that Priority One and their reporting practices.

Evidently, there was little motivation to gather donations. What the volunteers stated they would collect and what they achieved speaks volumes about their sincerity regarding their heart-felt concerns for breast cancer. Their own online disclosures amount to more hyperbole and a superficial effort by an inept organization to create the appearance they care about breast cancer.

The President who earns more than $150,000 per year only collected $20 which was donated by the chronically obsequious Business Development Representative, Joseph Garcia. Here is a list of the names of those other staff members who actually collected donations for the campaign though all failed to meet their stated goals.

We note that Executive Vice President, Rodger Smock, despite his more than $100,000 annual salary, apparently chose not to donate money to this campaign. We must also point out that in his online biography, Mr. Smock is described as a person who “….active role in the community, contributing regularly to Children’s Hospital of Los Angeles as well as various AIDS organizations and homeless shelters. In his free time, he pursues an avid interest in gardening.” To be clear, Mr. Smock has never contributed regularly to Children’s Hospital of Los Angeles. In years past, an Associate Business Development Representative who had once suffered cancer, informed the credit union that Children’s Hospital would be a wonderful organization to contribute to. Mr. Smock along with other employees of the credit union, visited the hospital to present a check from the credit union to the hospital. As we’ve revealed in the past, the President and some of his executives will manipulate facts in an effort to exalt themselves.

Other officers who also did not contribute donations to this campaign include Saeid Raad, the CFO, despite his more than $125,000 annual salary. Neither did the allegedly religious Director of Employee Services, Robert West. Of course, giving to any cause is purely voluntary though quite clearly despite their online declaration that breast cancer research is a cause they believe in, none of the volunteer came even remotely close to collecting the amounts they each pledged to collect. This speaks volumes about their motivation and it wouldn’t be unreasonable to cite the relationship between their failure to collect donations for the Revlon Walk and the credit union’s chronic inability to implement strategies that generate new business, increase membership, and produce profit. One can only imagine how much less money would have collected had the President and volunteer employees not been passionate about the issue of breast cancer?

CONCLUSION

GOING DOWN, ANYONE?

In January 2007, during the first week of his presidency, Charles R. Wiggington, Sr. conducted several impromptu meetings with staff, assuring them he intended to introduce changes that would produce growth and place Priority One Credit Union in a state of prosperity. He described numerous changes he would introduce including assigning two employees to speak to members requesting to close their accounts. He said this would ensure membership retention and provide an opportunity to show members that they are appreciated. His plan was never realized.

He also told employees he would install place a suggestion box in the employee lounge room where employees could anonymously submit suggestions on how to improve business and the working environment. This also never occurred.

At the time, there were also rumors originating at the main branch in South Pasadena, that the President intended on terminating many long-time employees, particularly those who had been loyal to his predecessor. The President felt impelled to address the rumors, assuring everyone that they should have no fear of losing their jobs and that he would never terminate senior employees. He lied.During the first six months of 2007, he often ridiculed his predecessor, criticizing what he described as his “old school” tactics and boasted he would push the credit union to new unprecedented heights. As of 2013, the the credit union had closed four key branches, has been sued by 4 former employees, has hired and fired a COO and CLO, and has failed to implement strategies that generate profit and growth.

The President and Board Chair’s address provides just more of the same old lip service, assuring readers that “We will continue to deliver the best products and services to our members….” Their statement clearly implies they are already delivering the best products which is untrue as attested to by their monthly Net Income Reports and quarterly Financial Performance Reports and member complaints.

Priority One is not only failing to provide the best of anything but they are doing absolutely nothing to reverse their failures to develop effective strategies and resolve amassing member complaints citing poor member service. The cause of their member service issues can be attributed in great part to a change in focus which places almost all emphasis on sales and almost none on member service. However, it is not the employee who do the work who have created this destructive dynamic but rather the President and Vice President, Yvonne Boutte. Nowadays, it is Mrs. Boutte who oversees operations for all branches despite her horrendous history of abusive treatment of staff and what some members have reported a her condescending attitude. It is also Mrs. Boutte who bungled the member’s 2012 complaint alleging violation of the Privacy Act and it is Mrs. Boutte who provoked filing of a lawsuit by the same member. What Mrs. Boutte and her assistant, Gema Pleitez, are grossly ignorant of is that providing excellent member service produces loyalty and results in both repeat business and word-of-mouth recommendations of the credit union. Inarguably, the caliber of member service doled out by the credit union these days is immensely subpar.

Another issue which we’ve reported on often since 2010, is that Priority One is now heavily dependent upon expense reduction as a means by which to retain their continued operation. Marketing efforts are ineffective and as we showed, their advertising absurd and embarrassing. In 2009, President Wiggington revealed that due to amassing member complaints, the credit union’s tagline, “You Are Our First Priority” had become obsolete. The always confused President placed blame on the tagline and not on his failure to provide quality service. He asked then Training and Education Manager, Robert West, to come up with a new Mission Statement and tagline and the dull Mr. West concocted new statements describing Priority One as a financial fitness center possessing the ability to help members and employees how to win with money. Evidently, Priority One has again failed to live up to its assurances and as their performance have proven, they can’t even help themselves win with money.

On the legal front, Priority One’s highest officers continue to defy credit union policies and state and federal laws. The latest incidence which is teetering on the filing of yet another lawsuit, reveals that Priority One will at its whim, abuse authority and without justification or authorization, order credit reports for any past or present member. Priority One’s continued abuses of its policies and its inability to protect confidentiality are exacerbated by the internal thefts occurring at the credit union’s Los Angeles branch and bringing into question its ability to protect confidential information and member assets. It is also important to note that these issues are purely internal and cannot be blamed on any external catalyst.

In January 2009, we published our first post, warning that Charles R. Wiggington, Sr. was bad for the credit union. We cited his undisciplined behaviors, his misappropriation of authority, his chronic violation of the policy governing confidentiality, his loud verbal boastings, and his lack of business acumen as issues that might come to harm Priority One Credit Union. As time proved, we were correct though even we could not have predicted the extent of harm he would cause the once promising credit union. However, overshadowing his heinous acts, is the fact that the Board of Directors and Supervisory Committee not only refused to intervene and bring an end to his abuses but have exerted tremendous time, energy, and credit union money protecting him even in the light of evidence proving he has violated policies and laws. The two highest governing bodies gambled on their belief they could squash evidence never knowing that four former employees would filed lawsuits against the credit union’s practices and abuses.

Since being named a Defendant in the lawsuit filed by the former Valencia Branch Manager, Mr. Wiggington has reduced his 40-hour work week to a mere 1 to 3 days per week, prompting us to ask, “Who is running the credit union?” One has to wonder why the Board of Directors and Supervisory Committee continue to employ a part-time President and why he continues to be paid an annual salary in excess of $150,000. We also have to ask, what does a President who only works 8 to 24 hours each week actually accomplish? The total amount of hours worked per week are further reduced by his 2 1/2 daily lunch periods taken on the day he chooses to report to work.

Clearly, President Wiggington is the key reason why Priority One declined and remains in decline; though it would be remiss of us not to attribute an equally large portion of the credit union’s laboring demise on the horrendous and incompetent Board of Directors, the uninvolved and equally incompetent Supervisory Committee and the body of unimpressive and ineffective executives, all of who failed to do anything to reverse the destructive dynamic set into motion by the incompetent President.

Technorati Tags: Charles R. Wiggington Sr,Saeid Raad,Childrens Hospital,Revlon Walk,breast cancer,lawsuit,invasion of privacy,Rodger Smock,Esmeralda Sandoval,lalasweetangel,Pinterest,Diedra Harris-Brooks,Board of Directors,Board Chair,Supervisory Committee Chair,Human Resources,Employee Services,Beatrice Walker,COO,Bea Walker,Yvonne Boutte,lawsuits,Burbank Branch Manager,race discrimination,same-sex discrimination,hostile work environment