On the surface, 2014 appeared to be just another uneventful and unsuccessful year for Priority One Credit Union in South Pasadena, California. Business remained stagnant as the Credit Union continued experiencing tremendous difficulties trying to draw Member interest to their products and services. Relationships with Members fared poorly with ties to their once largest member sector- employees of the United States Postal Service, continuing to weaken. Complaints citing poor service continued to escalate for the unpopular Credit Union while the President continued to insist that sales take precedence above all else, including service.

Unlike previous years which were saturated with scandals, this year was marred by only one incident which surfaced during the last half of the year and involved a scheme designed by President Charles R. Wiggington, Sr.; Vice President of Operations, Yvonne Boutte; and Credit Resolutions Supervisor, Alex Suarez. The offensive tactic involved the creation of Facebook accounts, using the fictitious names and photographs of attractive young women. Ms. Suarez's staff were ordered to send "friend requests" from the bogus Facebook accounts to Members whose Credit Union accounts were the subject of collection proceedings. Members unwittingly accepting an invitation, were promptly sent a message to their Facebook account, informing them of their past due balances and demanding they remit payment, immediately. The tactic served as a reminder of the disdain Priority One's current management team has for Members in addition to the fact that the creation of fraudulent accounts were a violation of Facebook policy. The incident might never have come to light had the arrogant Ms. Suarez not chosen to boast about it to employees of the South Pasadena branch.

Surprisingly, few people knew that during 2014 the Credit Union's unraveling relationship with two businesses culminated in the filing of two separate lawsuits. grew strained. One business, a former business associate automobile broker, Auto Alliance, introduced to the Credit Union in early 2010 by then COO, Beatrice "Bea" Walker and with approval of President Charles R. Wiggington, Sr. The second lawsuit was filed by the Credit Union's own contracted accounting and auditing firm, Turner, Warren, Hwang & Conrad AC.

The lawsuits signal a new low for the Credit Union whose public image lies in tatters due to the horrendous decisions and acts committed by the President over the past seven years and the protection allotted him by the ignorant and inept, Board of Directors. Since January 1, 2007, President Wiggington's often injurious acts have laid waste to the Credit Union's once strong relationship to Members and business associates. The lawsuits remind us that Charles R. Wiggington, Sr. is a man who doesn't play or know how to play nice and who has no concept of how to make or keep friends.

Auto Alliance's Lawsuit

In this post, we will only focus on the lawsuit filed by Auto Alliance and we will report about the lawsuit filed by Turner, Warren, Hwang and Conrad AC in next month's post. Auto Alliance's lawsuit names Charles R. Wiggington, Sr. a Defendant. This is certainly not the first time the obnoxious President has been named a Defendant. In 2012, in a lawsuit filed by the former Valencia Branch Manager President Wiggington was accused of allowing his COO, the notorious, Beatrice "Bea" Walker to abuse, sexually harass, stalk, and retaliate against the Branch Manager. The Branch Manager had tried to bring an end to Ms. Walker's merciless attacks, reporting allegations of same-sex sexual harassment and numerous other violations of State and Federal law to President Wiggington; EVP, Rodger Smock; and then Human Resources "clerk", Esmeralda Sandoval. The three not only refused to intercede and stop Ms. Walker but at the direction of Boad Chairperson, Diedra Harris-Brooks, tooks steps to squash and even invalidate the egregious allegations brought against the horrendous COO. At the time, the lawsuit was filed, the Credit Union hired the services of attorney, Paul F. Schimley, of Richardson, Harman, Ober PC.. In forging a defense, Mr. Schimley accused the Plaintiff of lying. He promised that she would have to spend weekends attending depositions and even contacted her new employer, informing them that their newly hired executive had filed a lawsuit against her former employer. Of course, in hammering out a defense to exonerate his client, the bottom-feeder showed no qualms in creating duress for Mr. Wiggington and Ms. Walker's victim.

The attorney went further. He contacted the Plaintiff's attorney and informed her that his client, President Wiggington, was suffering from cancer and undergoing chemotherapy and was too ill to participate in litigation. He warned that if his client's name was not removed from the lawsuit, that he would have no choice but to file a motion informing the court about his client's health, which would result in postponements that would ultimately drag out litigation indefinitely. The Plaintiff agreed to remove the President's name as a Defendant though retaining the right to re-introduce his name if his health improved. The President's attorney used a simple manipulative ploy intended to frustrate the Plaintiff and her legal counsel. It amounted to nothing more than a rudimentary strategy at an elementary level.

Coincidentally, the President's alleged terminal illness had little effect on his behaviors. He continued to drive to and from the South Pasadena branch each day and took 2 to 3 hour lunches, something you would not think a terminally ill person would be able to do. He would also spend hours per day, strolling through the South Pasadena branch gossiping about staff, telling people about the treatments he was undergoing, complain about his son and wife an spew out boring stories about his cars, superior intellect and view of life in general. It certainly didn't sound like he was ill, much less terminally ill.

Nowadays, the President works a three-day week. He continues to take extended lunches, spends lots of time on personal calls using his company cellular, and walks about the South Pasadena branch pestering people who are actually working. We can't but wonder if his present legal team will try and force removal of the President's name from the lawsuit.

Auto Alliance's Allegations

Auto Alliance's complaint asserts that the auto broker entered into an agreement with the Credit Union in early 2010 at which time they would serve in the capacity of sole vehicle broker. The Plaintiff alleges that not only did the President rescind on his contractual assurance that the broker would be the Credit Union's sole automobile broker but as a result, the Plaintiff suffered financial losses.

In the demurrer, a long twenty-three page response to the Plaintiff's allegations the Credit Union's current attorneys, Frances O'Meara, Wendell F. Hall, and Jenny L. Burke of Thompson Coe and O'Meara, LLP, rebut every one of the Plaintiff's allegations, asserting that the accusations are groundless and unaccompanied by evidence. In the end, the long drawn out reply is generic in content, almost identical to responses filed in the past in response to numerous other lawsuits.

The Credit Union's Defense

In the demurrer, a long twenty-three page response to the Plaintiff's allegations the Credit Union's current attorneys, Frances O'Meara, Wendell F. Hall, and Jenny L. Burke of Thompson Coe and O'Meara, LLP, rebut every one of the Plaintiff's allegations, asserting that the accusations are groundless and unaccompanied by evidence. In the end, the long drawn out reply is generic in content, almost identical to responses filed in the past in response to numerous other lawsuits.

As shown below, the response issued by Priority One's attorneys to the lawsuit, states that the Plaintiff's allegations are in essence, unfounded. What they may be hoping to do is obtain a motion from the court to dismiss the complaint.

Priority One's attorney's state the Plaintiff supposedly entered into an agreement with Priority One Credit Union that promised to make Auto Alliance their exclusive auto broker but contending that the Plaintiff failed to provide a copy of the agreement in accompaniment of its complaint.

The Plaintiff also alleges the President conspired against Auto Alliance and diverted business to other automobile brokers who provided the President with "bribes". For years, employees working closely with Charles R. Wiggington, Sr. before and after he was appointed President, alleged he was the recipient of kick-backs paid by Justice Auto Sales, a dealership and broker whose owner was also a close friend of the President. That dealership eventually made off with $80,000 paid to the owner for vehicles purchased from his company and financed by the Credit Union.

The President is also alleged to have received monies from Associated Management, the Credit Union's former collection agent*. In fact, it was the collection agent who repossessed a BMW from a Member and handed it to the President without an exchange of money. The President, a fan of BMW's, transferred ownership of the vehicle to himself. How coincidental that the current lawsuit, filed by Auto Alliance, alleges "bribes" paid to President Wiggington.

*Associated Management Company Inc, 150 East Meda Avenue # 100, Glendora, CA 91741, (626) 335-4000

If one believes the defense raised by the Credit Union's attorneys, the Plaintiff has no evidence to support his contentions against the President and Credit Union.

In late 2009, then COO, Beatrice Walker, met with the President; EVP, Rodger Smock; and Board Chairperson, Diedra Harris-Brooks. At the time, she informed them that though the Credit Union had successfully utilized the services of a single automobile broker- Universal Leasing and Auto Sales, for many years, she could guarantee more business and increased profits if the Credit Union would instead use the services of her friends at Auto Alliance. Mrs. Harris-Brooks agreed. And though Auto Alliance had not yet been contracted, the President prematurely ordered the Consumer Loan Department not to refer Members who were hoping to purchase an automobile, to Universal Auto Leasing and Sales.

As we've reported over the past 5 years, Charles R. Wiggington, Sr. is not a great tactician. Actually, he's not even a mediocre strategist. As is always be the case with anything the President hopes to do, his plan to displace one automobile broker with another would never quite pan out.

In the meantime, George Woods, a Business Development Representative assigned to the no longer existent Burbank branch, was attempting to forge an agreement between Wholesale Investments, Inc., another vehicle Broker, and the Credit Union. That broker enthusiastically signed an agreement and like Auto Alliance, spent its own money on advertising which promoted the Credit Union. Though the Broker entered into an agreement with Priority One Credit Union, the President began ignoring the newly inducted broker prompting complaints lodged with Mr. Woods. Now one has to wonder, why would a Credit Union that had a long-time automobile broker (Universal Leasing and Sales) and was planning on entering into an agreement with Auto Alliance, contract the services of Wholesale Investments? It may seem illogical but it is characteristic of the way Charles R. Wiggington, Sr. does business.

At the start of 2010, Auto Alliance became the Credit Union's premiere automobile broker. COO, Beatrice Walker, even created a space and assigned a desk within the Loan Department in South Pasadena, where a representative of Auto Alliance would sit during business hours and meet with Members who had either just been approved for an automobile loan or Members wanting the services of a vehicle broker to purchase a car. By the way, a desk had never been offered or set aside of Universal Leasing and Sales even though they had worked with Priority One for many years. During this period, both the President and Mrs. Walker ordered Consumer Loan staff to only recommend Auto Alliance. The staff, however, were loyal to Universal Leasing and Sales and informed the owner, Mr. Michael Martinez, of the President's orders though Mr. Martinez had already realized he was being provided less referrals.

In March 2010, the Credit Union conducted one of its all-staff meetings, which took place at Almansor Court in Alhambra, California. During the gathering, COO, Beatrice Walker, stood at the podium and spoke about Auto Alliance and how the broker was helping the Credit Union creating new business and providing superior service. There was no mention of Universal Leasing and Sales or Wholesale Investments, Inc. However, Auto Alliance's relationship with Priority One would come to an abrupt end in 2011. In July 2011, the President obtained authorization to terminate COO, Beatrice Walker, who had been hired as the Credit Union's first COO on June 1, 2009. During her brief stay at the Credit Union Ms. Walker's strategies allegedly designed to create new business and infuse profit into the Credit Union had chronically failed. Rumors of her sexuality had caused ripples in her once powerful relationship to Board Chair, Diedra Harris Brooks, but ultimately, it was her defiance and criticisms of the Board of Directors and what she referred to as their "lack of education" and her very public aspirations to displace President Wiggington, which ultimately sealed her fate.

A few weeks following Ms. Walker's quiet though humiliating ouster, the President suddenly ended the Credit Union's relationship with Auto Alliance, ordering the broker to vacate its desk in the Loan Department.

Nowadays the small, poorly performing and no longer competitive Credit Union promotes three different vehicle brokers on its website. Members have a choice of obtaining the services of Universal Auto Leasing and Sales, Wholesale Investments and Direct Auto Sales and Leases. If it seems like overkill, that's because it is. We find it more than a little unusual that Priority One is simultaneously promoting three automobile brokers. Why? We suspect that President knew that Auto Alliance might file a lawsuit against the Credit Union. By keeping the names of three automobile brokers on its website, the Credit Union creates the impression that it offers Members a variety of brokers to chose versus offering the services of a single broker, despite the practice seems more than a little unusual and rather illogical.

- We suggest that someone ask Universal Leasing and Sales owner, Michael Martinez, if he was aware the President was trying to severe the Credit Union's relationship with the broker back in 2010.

- Former COO, Beatrice Walker, should be subpoenaed to explain what were the terms- written and verbal, presented to Auto Alliance. Was the broker ever told that he would be the Credit Union's sole automobile broker?

- Employees of the Consumer Loan Department- both past and present, who were employed by the Credit Union during late 2009 and early 2010, should be subpoenaed and asked if they were ever instructed to cease promoting Universal Auto Leasing and Sales and begin promoting Auto Alliance.

- Employees- past and present, of the Business Development team who were employed during the period beginning in late 2009 through early 2010, should also be subpoenaed and asked if they were ever instructed to start promoting Auto Alliance and stop promoting Universal Leasing and Sales.

From 2011 through 2013, Priority One spent more than $500,000 on legal fees, most of which went to hiring overpaid and often, unethical attorneys, who spun defenses intended to deflect attention from the allegations leveled against the Credit Union and instead, attack the character of each Plaintiff. How much CREDIT UNION MONEY will Board Chair, Diedra Harris-Brooks, and the Board of Directors authorize spent in defending the President and Credit Union against the allegations filed by Auto Alliance and the firm of Turner, Warren, Hwang and Conrad AC?

Where is the Newsletter and Their ATMs?

Last November, a reader of this blog posted the following comment:

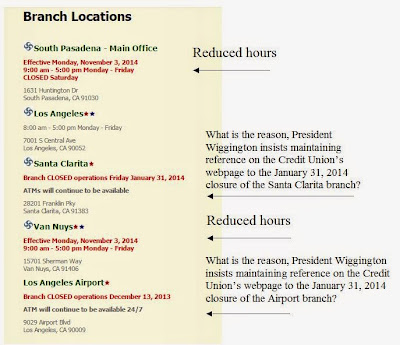

"I went to Priority One's website and noticed they removed their newsletter page. They're also closing three ATM's- Santa Clarita, Victorville, and the one located at the postal facility on Lincoln Avenue in Pasadena. More than a year ago, they posted on the web that they were going to introduce a VISA Credit Card but there's nothing. They duplicated a message twice. They still show a message that the Airport Branch is closing on December 13, 2013."

We thank the reader for taking the time to write. We visited the Credit Union's webpage and discovered they were absolutely correct on all points. Last November, the Credit Union removed the page which once displayed PDF copies of its quarterly newsletters, from itas webpage, though removal of the page came almost one year since the Credit Union last published a newsletter. The demise of the tedious and uninteresting publication is not in itself shocking but coupled with the closure of six branches and elimination of numerous ATMs, the end of the quarterly publication serves as more evidence that Priority One is a Credit Union in decline, despite the insistence of President Wiggington that closing branches somehow increases the potential for profit. Of course this doesn't make sense since he's also eliminated the Credit Union's ability to provide service and without service that meets the needs and expectations of the Membership, Priority One's ability to generate profit is almost impossible.

As of January 2015, Priority One no longer...

As of January 2015, Priority One no longer...

- Participates in community and chamber events

- Is unable to create effective and cutting edge marketing strategies

- Able to advertise at an effective level

- Able to afford a Business Development Department

- Able to provide quality service; and

- Is no longer competative

Despite the evidence proving Priority One's performance continues to falter, the President has not stopped from insisting that Priority One is every Member's and Employee's "Financial Fitness Center", able to help them "Win with Money."

ATM LOCATIONS

1. The LANDC

The ATM located at the Los Angeles National Distribution Center (LANDC) was often utilized by postal employees at that facility. Before Charles R. Wiggington., Sr. became President, the ATM was maintained by an in-house ATM Specialist, who ensured the popular ATM remained fully operational.

The ATM located at the Los Angeles National Distribution Center (LANDC) was often utilized by postal employees at that facility. Before Charles R. Wiggington., Sr. became President, the ATM was maintained by an in-house ATM Specialist, who ensured the popular ATM remained fully operational.

The Credit Union also maintained an office on the second floor of the facility. In early 2010, the post office created a wonderful and attractive space for the Credit Union on the first floor, between the post office's gift shop and cafeteria. However, Charles R. Wiggington, Sr. had no interest in maintaining a relationship with postal employees of the facility and refused to install a computer in the office, that linked to the Credit Union's network. Subsequently, Members of the credit union could not be provided their account balances or make payments to their loans or transfer monies between their accounts. By 2012, the office was not being utilized except by then AVP of Sales and Business Development, Joseph Garcia, who had been ordered by then CLO, Cindy Garvin, to "hit the streets" in search of new business. Not being sales savvy, Mr. Garcia spent his days napping in the office and avoiding the prying eyes of the CLO. Nowadays, the office lies abandoned.

2. PASADENA - USPS RETAIL STORE LOBBY

The Credit Union once strong relationship with the Postal Service's Pasadena Retail Store is clearly a thing of the past. The elimination of the ATM at the Pasadena location testifie again, to the rapid deterioration of the Credit Union's once strong relationship with its most loyal sector. The ATM ceased operation on 11/18/14.

3. SANTA CLARITA POSTAL PROCESSING PLANT

In a notice issued by the Credit Union on November 13, 2014, the ATM located in the Santa Clarita Processing Plant was "temporarily unavailable" pending upgrades slated to be completed by December 2, 2014. We've no news that the ATM is back online.

4. VICTORVILLE

In 2013, the Credit Union posted a message on its website announcing the temporary unavailability of their ATM in Victorville. Last month, the Credit Union amended its message, announcing the Victorville ATM "is no longer available."

Its more than a little peculiar that the ATM was temporarily closed down for a period of many months. Can't the Credit Union afford to maintain of what the 2013 Annual Report described as its "fleet" of ATMs? We think Charles R. Wiggington, Sr. should acquaint himself with what defines temporary versus permanent.

Its more than a little peculiar that the ATM was temporarily closed down for a period of many months. Can't the Credit Union afford to maintain of what the 2013 Annual Report described as its "fleet" of ATMs? We think Charles R. Wiggington, Sr. should acquaint himself with what defines temporary versus permanent.

MORE INDELIBLE SIGNS OF FAILURE

What Account Promotions?

Conclusion

President Charles R. Wiggington, Sr. began 2014 boasting, as he does every year, that business was improving and even concocted a story rationalizing that he intentionally closed down 6 out of 9 branches as part of a formula that would increase profit. So where is the fabulous profit he said would be reaped as a result of branch closures?

In 2014, while sitting in the employee lounge room located inside the South Pasadena branch, he blurted out that he contacted the FBI who were investigating two former employees who were, without authorization, selling Credit Union owned property. The rumor came to a sudden end when his statements were published on the Internet.

What the President never mentioned throughout all of 2014 is that Priority One was sued twice during the year by two unrelated businesses. One lawsuit, filed by a former automobile broker and the second, by the Credit Union's contracted accounting and auditing firm. How peculiar that a lawsuit was filed by the accounting and auditing company when for years, Charles R. Wiggington, Sr. boasted that the accountants and auditors at Turner, Warren, Hwang and Conrad AC were his "friends" and "buddies. So what could have severed his "friendship" with the firm? Or is this another case of the delusional President misunderstanding what things constitute business and which constitute friendship?

The allegations contained in the lawsuit filed by Auto Alliance echo similar accusations and rumors about many of the unethical activities the President has immersed himself in over the years. The attorneys currently defending the Credit Union are merely creating a defense based on the story told to them by the President though unfortunately, there are sufficient witnesses who can attest that Auto Alliance was introduced to Priority One in 2010 by then COO, Beatrice Walker, and that she and President Wiggington intended to make the car broker, the Credit Union's sole automobile broker. This would have required the elimination of Universal Leasing and Sales, the Credit Union's only and long-time vehicle broker. Unfortunately, for the Auto Alliance, their stay at the Credit Union was contingent upon the continued employment of COO, Beatrice Walker. Subsequently, after Ms. Walker was ungraciously expelled from the Credit Union in July 2011, so was the auto broker who the President had no further need of.

The allegations contained in the lawsuit filed by Auto Alliance echo similar accusations and rumors about many of the unethical activities the President has immersed himself in over the years. The attorneys currently defending the Credit Union are merely creating a defense based on the story told to them by the President though unfortunately, there are sufficient witnesses who can attest that Auto Alliance was introduced to Priority One in 2010 by then COO, Beatrice Walker, and that she and President Wiggington intended to make the car broker, the Credit Union's sole automobile broker. This would have required the elimination of Universal Leasing and Sales, the Credit Union's only and long-time vehicle broker. Unfortunately, for the Auto Alliance, their stay at the Credit Union was contingent upon the continued employment of COO, Beatrice Walker. Subsequently, after Ms. Walker was ungraciously expelled from the Credit Union in July 2011, so was the auto broker who the President had no further need of.

President Wiggington's legal entanglements have come at a heavy cost to business, to Members and to employees. Despite proving he is the Credit Union's greatest liability, the all Black Board has spent immense amounts of Credit Union monies on protecting the President. If the complaint is not dismissed by the court, expect the matter settled with some sort of financial compensation paid to the former automobile broker though in this particular case, the cost will be hefty and probably paid from the Credit Union's insurance. In the meantime, continue expecting the Board to remove all stops ensuring the President remains well protected behind sham defenses and contrived stories that have no resemblance to the truth. And finally, ask yourselves, "Why would a three-branch Credit Union need to promote three separately owned automobile brokers?"