DEPLETION

Priority One Credit Union's Financial Performance Report for the quarter ending on September 30, 2015 is now available at www.ncua.gov and in spite of the President's insistence, business isn't improving.

Late last year President Charles R. Wiggington, Sr. somberly stated that "people don't understand the reason I closed branches is to make profit." He of course never took the time to explain how closing branches which eliminates convenience serves to generate profit.

2008, 2009, and 2010 ended in the negative for the once prosperous credit union and in 2010, 2011, 2012, 2013 and in 2014, the President was forced to close branches to ensure net capital remained well above 6% so that the credit union could remain in open and in business. Despite the losses and it's continuing financial struggles, the President has been awarded annual raises all approved by the Board of Directors and it's Chair, Diedra Harris-Brooks.

We know of no other credit union whose President has caused losses amounting in the millions of dollars, who has been found guilty of sexual harassment and who has provoked the filing of more than seven lawsuits since 2010, who remains employed and is granted annual wage increases.

What's more, since 2009, the credit union has had a salary freeze in place that only affects the salaries of non-exempt personnel. As we've often reported, often brutal cut-backs implemented by President Wiggington specifically target employee salaries and benefits and never affect the salaries paid to the executive sector.

REWARDING INCOMPETENCE

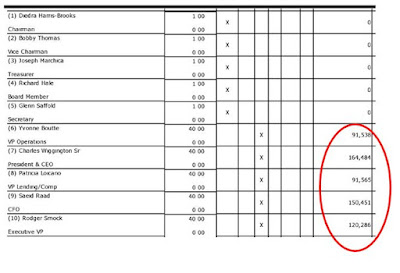

So much how much is the credit union industry's most embarrassing President being paid? As we've done every year since 2010, we are again publishing excerpts from the credit union's most recent Form 990 Form IRS filing. The latest form is for the year 2013 and provides insight into the practices of the Board of Directors who under it's Chair, Diedra Harris-Brooks, has evidently established a policy for rewarding incompetence and over the past eight years, used credit union funds like their own personal piggy bank. Here are the excerpts from the latest filing:

Form 990 IRS Filing

In 2013, now former Vice President of Project Management, Yvonne Boutte, was

paid $91,538. Mrs. Boutte was a polarizing presence and during her

years of employment, was abusive to staff, was an instigator and vicious

gossip, and frequently slandered employees and other officers. In 2012, she

provoked a member who filed a lawsuit against the credit union accusing the

credit union of publishing confidential information about her credit union

automobile loan and her person. Because of the nature of the disclosures, the

information could only have been published by either Mrs. Boutte or one of her

staff in the Credit Resolutions Department. Evidently, her abhorrent behaviors

and lackluster performance were inconsequential to the Board who authorized

that she be paid in excess of $90,000 a year. Can anyone name one thing

Mrs. Boutte did during her seven (7) year stay that resolved some of the

problems created by the President and resulted in increased business?

Charles R. Wiggington,

Sr. was paid $164,484 in 2013 even though he has caused losses

of net income in excess of $20 million since being appointed

President on January 1, 2007. His horrendous personal behaviors including

having been found guilty of sexually harassing a former employee speak as much

to his character as they do to the egregious proclivities of the entire

Board.

AVP, Patricia Loiacano,

was paid $91,565 in 2013. Though actually knowledgeable about

real estate and consumer loan processes, she will go along with abuses

perpetrated by the management sector. In 2007, she was informed by a Loan

Processor that the DMV Specialist had obtained permission from the AVP of

Lending, Aaron Cavazos, to forge member signatures on Power of Attorney forms

where loan processors had failed to obtain signatures while funding automobile

loans. At the time, Mrs. Loiacano replied, "There's nothing I can

do because it came from Aaron." In 2010, she was appointed AVP of

Compliance by Beatrice Walker.

Saeid Raad, the former

CFO, was terminated in 2013 but before leaving, was paid $150,451.

It was while Mr. Raad was CFO that more than $1 million in cash were stolen

from the Los Angeles branch. We wonder if his departure is related to the

discovery of the theft?

Executive Vice

President, Rodger Smock, was paid $120,286 in 2013. It's

nothing less than incredulous that the worst Director over Human Resources and

the man who intentionally violated state and federal laws for several years and

who refused to enforce credit union policies when violated by the President and

his lackeys, would be paid what is an astronomical amount. Can anyone

name anything Rodger Smock has contributed to the betterment of the credit

union? And the answer isn't that he used to cut out coupons and pass them

out to staff.

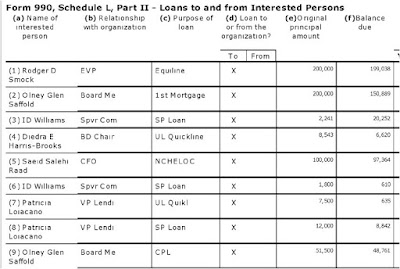

We would be very interested in reviewing the loan

documents for some of the officers who obtained loans from the credit union.

The board approves loan applications for officers of the credit union which may

not be illegal but is a conflict of interest. We are particularly curious to

know if each of the officers satisfied the same credit union's eligibility

requirements non-employees are expected to comply to.

As shown above., the credit union also provided the following responses to inquiries set in the form which we've retyped below:

- "Members have rights to elect the members of the governing body. Members also received a share of the organization's profits in the form of cash dividends."

- "Members have he right to elect one or more members of the organization's governing body, whether periodically as vacancies arise, or otherwise."

- "Members have the right to approve the governing body's election and removal of members of the governing body, as well as other matters that are subject to the approval of members as they occur."

The statements are superficially true but the fact is, in 2009 and again in 2010, Board Chair, Diedra Harris-Brooks and her accomplice, President Wiggington, disrupted the electoral process in an effort to keep new officers from being elected to the either the Board of Directors or Supervisory Committee.

Under California state law, credit union's must inform members in good-standing of the impending election and extend an invitation that if they'd like, they can nominate themselves to vie for a seat on either the Board of Directors or Supervisory Committee. Mrs. Harris-Brooks and Mr. Wiggington intentionally only chose to publish the mandated notices in the Winter newsletter which was only mailed to members who have a checking account and excluding the large sector of members who only have a savings account.

The two wanted to maker certain that none of the Directors or Supervisors were displaced because the two governing bodies are comprised of ineffective and ignorant officers who are subservient to Mrs. Harris-Brooks' every whim.

They might have gotten away with their plot had we not exposed. Our exposure of what they had done forced the credit union to hold a "second" annual election which resulted in having to reprint ballots, letters, and the cost of postage to all active members in good standing. The financial impact their ploy had upon the credit union was inconsequential to the two corrupt officers who freely use credit union monies as if they were their own.

Please note the credit union has new accounts- Richards and Associates. We certainly hope the credit union doesn't sue them at some point in the future as they've done with Turner, Warren, Hwang and Conrad.

SHRINKAGE

Though it now more than eight years since Priority One Credit Union began it's ascent towards failure, President Wiggington has avoided a complete shut down of the organization by closing branches, implementing what is now a five year wage freeze that only impacts non-exempt staff salaries, and reduced marketing and business development budgets.

His reductions have come at a heavy cost, compromising convenience, quality member service and ruination of the credit union's public reputation. But no other person has contributed more to financial losses than has the incompetent President's wasted spending.

- In 2007, he refused to resolve issues affecting the conversion of Inland Counties Postal Credit Union member account records into Priority One's network. Though he could have responded immediately but enacting steps that would have immediately implemented remedial measures to all Inland Counties Postal Credit Union accounts, he instead ordered that the member service department only respond to members who actually took the time to call the credit union. His slothful response forced the credit union to spend $100,000 obtaining services from Experian' to monitor member credit reports for one-year, at no cost to members.

- Later in 2007, he refusal to abide to security protocols resulted in the mailing of ballots in envelopes on whose exterior were printed member account and social security numbers. His error forced the credit union to spend more than $80,000 in remedial measures.

- In 2008, he spent credit union monies purchasing a $600,000 technically flawed phone system.

- In 2008, the President was placed on paid suspension and during the six-weeks which followed, an investigation took place to determine if he had sexually harassed a former employee. The evidence which was eventually provided to the credit union by EXTTI, Inc. proved he had indeed violated federal law but Board Chair, Diedra Harris-Brooks, chose to reinstate the President and literally squash the evidence.

- In mid-2008, he borrowed $20 million from the credit union's line-of-credit, forcing the credit union to pay between $30,000 to $50,000 per month in interest alone, over the next two years.

- In 2009, he hired his friend, Beatrice Walker, to serve as the credit union's first COO and to help him flush out the blogger, bloggers and confederates of the blogger who he said were trying to force the failure of the credit union. After paying her approximately $100,000 a year, in 2011, he fired Ms. Walker only 25-months after she had begun working for the credit union.

- Also in 2009, the President and Board authorized the spending of more than $30,000 to procure the services of Lillestrand and Associates. Though the owner, Loren Lillestrand visited the South Pasadena several times during which he met with employees, none of the information he gathered that was to be used to improve how the operation was ever utilized.

- Immediately after terminating Ms. Walker in July 2011, he hired Cindy Garvin to serve as Director of Lending. Her starting salary approximated $70,000 but within four months, he promoted her COO, increased her salary and gave her authority to manage the operations over the credit union's Airport, Burbank, Los Angeles, South Pasadena and Van Nuys Branches. Ms. Garvin was touted by AVP, Rodger Smock as an expert in loan development, business development and marketing but at the end of 2013, she too was fired.

- Between the years of 2010 through 2014, Priority One spent more than $500,000 on legal expenses though majority of which was defending itself against lawsuits filed by four former employees and one member whose confidential account information was published on the Internet by an officer of the credit union.

- In February of 2012, the President opened the Santa Clarita branch and on January 2014, closed its doors.

EVIDENCE

The

credit union's Quarterly Financial Performance Report ("FPR") for the

quarter ending September 31, 2015, reports the organization's net

asset size as $153,072,823. On January 1, 2007, the date Charles R.

Wiggington,Sr. began his appointment to President, Priority One's asset size

was $172,250,649. and the credit union boasted seven branches

versus the remaining three it operates. And though the amount of net assets

lost since 2007 has often fluctuated, currently the credit union's net assets

are -$19,177,826 less than they were on January 1,

2007.

In 2014, the President

complained that he is often criticized for closing branches but that what

people don't understand is that the closures were intended to increase profits.

No, the closures were intended to reduce spending and raise net capital. Of

course, we invite President Wiggington to explain who reducing the credit

union's presence in the communities it is chartered to serve, how compromised

service and subpar marketing translate into profit. In December 2015, Priority

One no longer has a presence in all of Riverside County, in all of the Santa

Clarita Valley and in most of the San Fernando Valley. So how is it's physical

absence within it's own territories intended to produce profit?

ANOTHER WIGGINGTON BLUNDER

In November 2011, the President gloated over the impending opening of the credit union's newest branch in the Santa Clarita Valley. The structure that would house the new branch was constructed at the request of then Post Master, Ralph Tapia but the President instead, spread rumors that he negotiated a deal in which the postal service agreed to pay for building the location. He also boasted that using his keen negotiating skills, the postal service agreed to only charge the credit union $1.00 per year to lease the space. It would have been an admirable accomplishment if any of it were true.

The branch was built at the request of then Santa Clarita Post Master, Ralph Tapia. It was his way of showing his gratitude for a credit union he sincerely care about. What's more, in November 2011, the cocky and dull President stated that the branch would be opened quietly and without fanfare because in his words, "People are going to want to become members so we don't need to advertise." He was wrong.

In 2013, the credit union was contacted by the office of the new Post Master of Santa Clarita who informed a review of their records revealed the credit union was only paying $1.00 per year to lease the structure built by the post office and that the amount would be increased to the market rate. The news was sufficient to prompt AVP, Rodger Smock, into ask, "What is the post office doing to us?" We don't understand why Mr. Smock was so upset. If the President was the amazing negotiator he declared he was, then why didn't he contact the office of the Post Master and renegotiate reducing the amount of the lease?

In January 2014, the credit union permanently closed the doors to the Santa Clarita branch. According to the President, "no one visits the place." Maybe the location might have had succeeded if the President had chosen to advertise its location. Or maybe, if had chosen to open a location in downtown Valencia versus the unpopulated northern fringes of the Santa Clarita Valley.

FINANCIAL PERFORMANCE REPORT

- The Financial Performance Report for the quarter ending September 31, 2015, also references losses under "other reserves" in the amount of` -$139,613 though no explanation what the "other reserves" pertains to.

- Under Allowance for Loan & Lease (Losses) the credit union reports a negative -$700,000. So did the credit union not set aside sufficient allowance to cover loan losses?

- Membership growth was below the industry average and reported at a negative -3.02%.

President Wiggington

has made a career of lying, including creating a fraudulent impressions of

Priority One's real financial performance. If you visit the credit union's

website, you'll find that he has hidden, to date, the 2014 Annual Report.

Currently, the 2013 Annual Report continues to appear on the website. In 2009,

he attempted a similar antic when he refused to post the credit union's Monthly

Income Statements and finally conceded after two complaints were filed with the

state's Department of Financial Institutions. In business, sometimes "less is more" but at Priority One, "less is always

less."

The credit union's FPR can be viewed at NCUA.gov using charter number, 60024.

LEGAL WOES

Inarguably, since

Charles R. Wiggington, Sr. became President of the once successful credit

union, Priority One Credit Union has found itself inundated in lawsuits, a phenomena

that didn't exist prior to his appointment to President.

It would

also be naive to deny or ignore the correlation between his appointment to

President, the ineptitude and corruption of the Board of Directors and the

ignorance of the Supervisory Committee; and the lawsuits filed by former

employees, members, vendors and contracted consultants against the credit

union.

In late

June, CUMIS Insurance Society provided Priority One findings compiled by one of

its analysts, which allegedly found that the credit union's external auditor,

Turner, Warren, Hwang and Conrad ("TWHC") performed annual audits

which violated mandated auditing standards. The specific timeframe which audits

took place were between "early" or "late" 2010 through

2012. TWHC's failure had the following two-fold effect upon the credit union:

- TWHC failed to detect any of the many thefts occurring during the years of 2010-2012; and

- The faulty audits created an opportunity for a former AVP to abscond with more than $1 million in cash from the vault of the Los Angeles branch.

TWHC was first contracted by Priority One Credit Union in 2008. Apparently, any audits performed in 2008 and 2009 were completed compliant to mandated auditing standards.

According to CUMIS' lawsuit, TWHC is solely responsible for the theft of more than $1 million yet for some inexplicable reason neither the President, the CFO, two COO's, the credit union's internal auditor, the Board of Directors, the Supervisory Committee, and the entire Account Department never realized money was being stolen from the credit union.

It's one think to level allegations of wrong doing against another party, but can CUMIS prove it? Using the information provided to it by CUMIS, Priority One filed a cross-complaint accusing TWHC of negligence and contractual violations. The credit union's attorney, John C. Steele, filed a motion requesting the court allow that Priority One sue it's former auditor.

Priority One had little choice but to file its lawsuit. CUMIS paid more than $980,000 against the $1 million claim filed by the credit union in 2014. CUMIS wants to recuperate it's money. Though CUMIS' has taken action against Pearl Lynnette Fortson, the AVP who allegedly embezzled the cash from the Los Angeles branch but Ms. Fortson has filed bankruptcy and if approved by the bankruptcy court, may escape having to pay restitution if she's found guilty of embezzlement. The credit union's lawsuit would serve to strengthen CUMIS's complaint. More importantly, CUMIS has to win to recuperate the money paid to the Priority One'. And Priority One needs to do everything it can to ensure CUMIS wins its lawsuits or their policy with their carrier could be canceled. If canceled and if the credit union is unable to contract the services of a new carrier, Priority One would be unable to continue it's operation. It's a catch 22 for Priority One and the potential ramifications to its business are nothing less than astounding.

LEGAL HURDLE

As reported over the last several months, Priority One Credit Union is currently involved in several lawsuits. And though the lawsuit filed by CUMIS against Turner, Warren, Hwang, and Conrad is scheduled to start on January 25, 2015, it hasn't been without having to scale large numbers of motions filed both by CUMIS, TWHC and the credit union. The motions are really nothing more than a costly means by which to obtain clarification, delineate perimeters, and determine what evidence and testimonies will and will not be allowed by the court.

In the latest episode of the on going saga, CUMIS filed a lengthy motion which is hoping is attempting to block the admissibility of testimony by an alleged TWHC expert. CUMIS alleges the expert is unqualified to provide rebuttal testimony and the testimony was not submitted within the timeframe specified under law.

On November 2, 2015, Turner, Warren, Hwang and Conrad responded to allegations filed CUMIS, asking the court disallow testimony by an expert who would testify on behalf of TWHC.

Shown below is is

TWHC's response to CUMIS' allegations which apparently asked the court to deny

the external auditor to deny expert testimony of a "Mr. Sacher"

because the report was:

- Not submitted on time; and

- Mr. Sacher is unqualified to provide expert testimony on the matter.

TWHC responded by contending that CUMIS' that "expert reports" are not required to be created within a legally specified time frame.

TWHC is also requesting additional time to amend the motion to conform to Mr. Sacher's capacity as an expert so the report is deemed acceptable to the court.

TWHC clarifies that the expert, Mr. Sacher, will be providing rebuttal testimony to CUMIS' allegations against TWHC and that CUMIS has been in possession of the expert's opinions since June 24, 2015, long before the court trial is scheduled to start on January 25, 2015.

CUMIS' attorney contacted TWHC and informed them that the expert, Mr. Sacher's opinion were intended to rebut CUMIS' finding and was informed that the intent of Mr. Sacher's testimony was to rebut CUMIS' allegations. Furthermore, on June 24, 2015, TWHC provided CUMIS Mr. Sacher's opinion which mean that CUMIS knew the expert would be providing testimony rebutting CUMIS' allegations.

TWHC concludes by asking the court to impose sanctions against CUMIS whose allegations were unfounded and unsupported by law. It appears CUMIS either didn't comprehend the facts or intentionally filed a motion possibly gambling on the hope the court would decide TWHC expert's testimony would not be allowed. TWHC in response asks for sanctions to be leveled against CUMIS.

On November 5, 2005, the court issued an order scheduling a Motion for Leave to Amend Expert Designation and Request for Sanctions which is scheduled to take place on December 7, 2015.

iNsANitY

Over the

years, two oft the most often asked questions are how has Charles R.

Wiggington, Sr. remained President and why hasn't the Board of Directors been

voted out by members?

There is

more than sufficient documentation, i.e. employee complaints, investigative

reports, lawsuits, etc., proving the President's ruination of the once thriving

credit union. What the obtuse Board is to dense to comprehend is that the

President's business decisions, personal immersion in outrageous scandals, and

his disdain for maintaining relations with the membership have all adversely

impacted the credit union's ability to obtain new business. Subsequently and to

remain open, the credit union is now dependent upon expense reductions. These

are unimportant factors that Board Chair, Diedra Harris-Brooks, has chosen

to ignore. Her mandate is to ensure the inept President remains employed and

she has freely utilized credit union resources to hire expensive attorneys who

are paid to concoct defenses designed to help the President escape retribution

for his egregious acts. In spite of the President's history of failures, Mrs.

Harris-Brooks has deemed her abuses of authority prudent and necessary to

ensure to President remains employed and paid a salary exceeding $160,000.

The credit

union's current legal troubles involving the theft of more $1 million in cash

from the vault of the Los Angeles branch were all completely avoidable. The

credit union is hoping CUMIS wins its case otherwise it could adversely impact

its ability to retain the services of it's the bond company.

And

though CUMIS would like the court to believe that alleged subpar audits

resulted in the thefts perpetrated at the Los Angeles branch, it is logically

impossible to do so. CUMIS has to prove that audits conducted by Turner,

Warren, Hwang and Conrad during the years of 2010 through 2012 failed to

identify any of the cash thefts allegedly perpetrated by a now former

AVP. However, from a layman's point-of-view, there is something more

than a little unreasonable about CUMIS' allegations.

The embezzler had to walk out of

the Los Angeles branch with tens of thousands of dollars each month, over what

CUMIS identifies as a 24-month period. How did the thief do so without

the President, a CFO, two COO's, the Board of Directors, the Supervisory

Committee, the Accounting Department and employees of the Los Angeles ever

noticing a single theft? How could one solitary employee enter the Los

Angeles vault without being observed and leave with either hand, satchel or a

box full of cash during each visit? It is just logistically impossible.

The

thefts allegedly committed by an AVP were discovered in February 2013 by Diane

Huffman, the credit union's Internal Auditor. Shortly afterwards, Priority One

hired Turner, Warren, Hwang and Conrad to confirm Ms. Huffman's findings. Not

long after this, the credit union transferred Mrs. Loiacano from overseeing

Compliance and transferred her back to overseeing the Consumer and Real Estate

Loan Departments. Why was she transferred? Was it that while overseeing

Compliance she failed to ensure policies governing security had been

consistently enforced?

Has

anyone noticed that Priority One has refused, to date, to disclose how the

thefts were perpetrated? What is the President and the Board hiding? We're

certain every credit union would like to know how this could have been done so

that they can instill measures to ensure this doesn't happen to them. We

suspect that the reason Priority One's officers have remained unusually hushed

about this matter is because the methods used to abscond with the money were so

simplistic, so absurd and so phenomenally ludicrous that they are trying to

avoid public ridicule. Either that or someone within the executive sector knew

that the thefts were occurring or might even have been involved in the thefts.

As for

CUMIS, we hope they have prepared a hefty arsenal of indisputable

evidence that will prove beyond a reasonable doubt, that Turner, Warren,

Hwang and Conrad, an industry respected company, is responsible for the thefts

perpetrated by one of the credit union's officers. And we can't wait to hear

testimony from the Supervisory Committee and its Chair, Cornelia Simmons, the

robotic officer who year by year assures members that her committee's reviews

have proven that the credit union's security is in place and functioning at

optimum. This will be a wonderful opportunity to witness the caliber of

executives, Directors and Supervisors representing the credit union.