Priority One Credit Union ended 2011 in the BLACK. This is a huge improvement over 2008, 2009, and 2010, during which it ended each of those years immersed in the negative.

Black could suggest that President Charles R. Wiggington, Sr. has finally implemented strategies that are generated increased new business and amassing profit, but this isn't the case. Stabilization of the credit union's financial standing can be attributed in great part to the closure of the Redlands and Valencia branches in 2010, the closure of the Riverside branch in 2011, and the drastic reduction of budgets and elimination of employee benefits.

Last November and December 2011, the President visited some of the credit union's remaining branches and told employees that Priority One is experiencing a resurgence in business. To lend credence to his claims, the President said net capital had increased well above 6%. Net capital is not necessarily the result of increased new business. The President's "story" was just another lie perpetrated to dupe employees.

However, the President's proclamations of success came to an abrupt end at the start of January 2012. During several meetings with managers, the President admitted Priority One is in deep financial straits and that unless lots of new business is gotten by the start of February 2012, the credit union may have to close the Burbank branch. The President lied again. Unbeknownst to most employees, the President called the management company overseeing the property where the Burbank branch is located and informed them that the branch will have to close by the end of May 2012.

Over the last six months, the President has carried on a campaign in which publicly states that our reports are all untrue and maliciously motivated to smear his "good character." Amongst our statements that he has labeled untrue, are:

- The credit union has never been sued by any former employee.

- He has never been accused or investigated for allegedly sexually harassing a female employee.

- The credit union has not suffered financial setbacks at anytime over the past five years.

SETTLEMENT

Priority One has settled the lawsuit filed by former Burbank Branch Manager, Linda Nisely. Not only was the settlement entered into voluntarily by the credit union but it was the credit union's often arrogant attorney, Paul F. Schimley of Richardson Harman Ober who called the Plaintiff's attorney and requested that they meet to hammer out a settlement agreement.

So what happened the Mr. Schimley's boastings verbalized week after week over the past few months, proclaiming that his firm had acquired evidence and testimonies from current and former employees which would expose Mrs. Nisely of being a racist and of being insubordinate and unwilling to carryout her assigned responsibilities? And what about Mr. Schimley's insistence that labeling the lawsuit "frivolous" and without merit?

The Plaintiff and the credit union have agreed through a signed agreement, that neither will divulge any information which might serve to malign either party or to publicly discuss the term so the settlement. Unfortunately for the credit union, Director of Project Management, Yvonne Boutte, could not refrain from making comments about the settlement.

According to Mrs. Boutte, the Plaintiff used a part of the money from the settlement to pay-off her delinquent Priority One loan. Mrs. Boutte also disclosed that for months prior to entering into a settlement agreement with the credit union, when calling Mrs. Nisely to demand she submit payment against her delinquent credit union loan, she would tell collection representatives, "I am a former employee and I'm suing the credit union.”

The reason why the credit union anxiously sought to settle the lawsuit has little to do with evidence provided by Mrs. Nisely supporting her insistence she was terminated because of her age and race. In fact, for all intents and purposes, her case was highly deficient and for awhile, it appeared it could be dismissed.

The greatest flaw in her case, was Mrs. Nisely herself. There is no denying, she was a caustic presence while employed by the credit union. During the few years of her employment, she smeared the reputations of many staff members. And she indeed, often show a disdain towards Latins. She did spend her days playing on the Internet and not working it her alleged medical condition which she said precluded her from physically leaving the Burbank branch to visit the community served by that office was never substantiated by medical records. As far as we know, it was a pretext she used to justify her stay in the branch. No, Linda Nisely wasn't so nice.

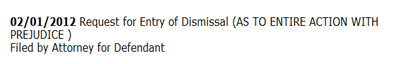

Mrs. Nisely's case was aided by a copy of a letter, written by the last Valencia Branch Manager to the credit union in which were documented abuses perpetrated by former COO, Beatrice Walker, and which President Charles R. Wiggington, Sr.; Executive Vice President, Rodger Smock; and Board Chair, Diedra Harris-Brooks, refused to stop. It was the credit union's refusal to stop Ms. Walker's heinous campaign which proved lethal to the credit union's planned defense. The following record, obtained from the Los Angeles Superior Court, confirms dismissal of Mrs. Nisely’s lawsuit.

The Request for Entry of Dismissal (with prejudice) confirms that the lawsuit has been resolved. Congratulations to the former Burbank Branch Manager and her highly competent attorney. As for Mr. Schimley, he should try to control his addictive need to boast prematurely of successes which just never seem to occur.

"WE HAVE NEVER BEEN SUED"

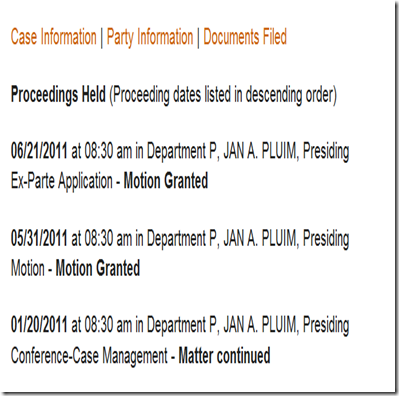

President Wiggington's latest campaign is intended to dupe employees, members and anyone else who will listen to his dribble, that Priority One has never been sued by any former employee. The President's foolhardy campaign ignores the fact that there is physical evidence proving Priority One has indeed been sued by more than one employee. Either the President is living in denial, delusional or just outright lying.Here is a Case Summary describing the motions filed in Mrs. Nisely's lawsuit:

Well it looks like the credit union was indeed sued by Mrs. Nisely a former employee which should dispel any confusion by the President that Priority One has never been sued by any former employees.

"I've never been accused of sexual harassment"

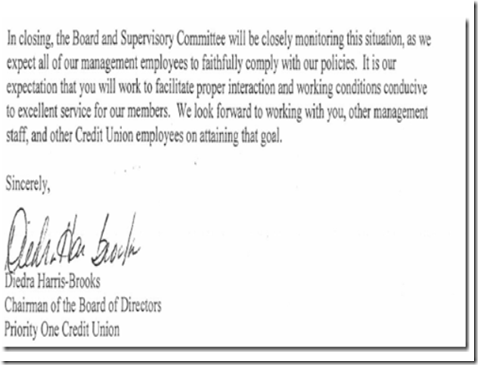

President Wiggington is not only a man who refuses to be accountable for his vast failures but he is one who is mired in denial. In his latest campaign, he has tried to convince employees that the accusations that he was accused by a former employee of sexually harassing her for several years is completely and utterly untrue. Of course, like his denial that any former employee has sued the credit union, his denial that he was ever accused of sexual harassment is also untrue. Here is a copy of the letter, written, signed and hand delivered to the President following an investigation of allegations he sexually harassed a former employee.

The letter should job President Wiggington's memory and help dispel any confusion he may have regarding whether or not he was ever accused of sexually harassing an employee.

EXTINCTION

Due to President's Wiggington's inability to develop sound strategical measures, Priority One remains mired in metaphorical tar pit and in the process of continual decline. Last month, President Wiggington met with employees and managers and ordered that they exert all efforts to obtain immense amounts of new business over the next eight weeks or he would have order lay-offs, further reduce budgets and even move to close the Burbank branch. .

Charles R. Wiggington, Sr. is again, being more than just a little delusional. He hopes to achieve in an eight-week period what he has failed to do over a five year period. As usual, when he issued his edict it was unaccompanied by a plan on how he hopes employees will achieve his lofty expectations.

Historically, the Burbank branch has not performed well even under the self-proclaimed business genius of AVP, Sylvia Perez. In fact, the office's decline began with Mrs. Perez's arrival. Throughout 2011, Mrs. Perez boasted that the branch experienced immense amounts of walk-in traffic with a large amount of business generated from Shared Branching transactions. Of course, Mrs. Perez who is not quite the financial expert she'd like people to believe she is, doesn't understand that the obtainment of new business is necessary to produce increased levels of profit needed, in part, to offset overhead and justify the $5200 per month paid to rent the branch location.

In 2009, even the inept and corrupt former COO, Beatrice Walker, realized that the Burbank branch was not producing the level of new business needed to justify its continued operation and at the time, marked it for closure.

In November and December 2011, President Wiggington in company of Senior Vice President, Rodger Smock, frequently visited the Burbank office. The visitations by the two should have been viewed as a harbinger of bad news for the branch and its staff. The two also frequently visited the Valencia branch prior to announcing it's closure.

The fact that Priority One is struggling to pay $5200 a month to rent the Burbank branch speaks volumes about it's financial capabilities and further dispels the chronic insistence by President Wiggington that business is "good" and "growing." Obviously, it's not!

What's more, there is a detrimental impact to the ability of the credit union to do business in the communities where branches are closed. The Burbank branch serves the large, heavily populated eastern regions of the San Fernando Valley and one of the credit union's largest SEG's, St. Joseph Medical Center. Though the credit union does maintain an office in the city of Van Nuys it's location is inconvenient to members residing and working in Burbank. We know that Shared Branching will not be selling point to people who presently utilize the Burbank office.

We've no doubts the Burbank branch will close either in May or June of this year because it is virtually impossible to achieve what the President says is needed in a 30, 60, or 90 day period. If the Burbank branch closes, it will raise net capital which will in turn, enable Priority One to remain in business but it will have absolutely no impact on generating profit from new business though the President deceptively insists it does. It doesn't.

Despite his November and December proclamations that business is increasing by January he seemed genuinely concerned by indicators which threatened to return Priority One into the RED. As of February 2010, President Wiggington is again faced with the same dilemma encountered by the credit union in 2008, 2009, 2010, and 2011.

On January 5, 2012, during one of the credit union's quarterly all-staff meetings, the President assured employees business was doing well and emphasized the importance of reaching out to the communities served by the credit union. In the days which follow, he did a complete turn about face and while meeting with managers including Senior Vice President, Rodger Smock; CLO, Cindy Garvin; Loan Manager, Joseph Garcia; and Director of Project Management, Yvonne Boutte, expressed deep concern over the credit union's inability to attract new business and seeking suggestions on how to spruce up the credit union's aged loan portfolio without having to actually spend money implementing new products. Unless the President has a magic wand, don't expect any of his directives to be realized.

In response, AVP, Sylvia Perez has begun scouting new more affordable locations where the Burbank branch could potentially relocate to. Mrs. Perez doesn't comprehend or is mired in denial, that the Burbank branch must close to eliminate spending and raise net capital. Relocating the branch to another site is costly and will again require the credit union to pay a monthly lease it cannot afford.

The growing and promising credit union inherited by President Wiggington in 2007 is a thing of the past and will never exist again under Charles R. Wiggington, Sr. His ship shod leadership, unscrupulous acts, his clouded and fantastical so-called "vision" for the credit union, his disregard for members and employees have caused Priority One to lose sight of it's role to members, it's branding and has muddled all perception of it's direction. Let's face it, Priority One is not only ineffective and no longer competitive, it's invisible.

MASKING INTENTS

In January of 2010, at the request of then COO, Beatrice Walker,

In 2011, the President promoted the Assistant to the Loan Manager, Joseph Garcia, to AVP of Sales and Business Development despite the well-documented fact that Mr. Garcia fails at every position he's ever held while employed by the credit union.

In 2011, the President promoted the Assistant to the Loan Manager, Joseph Garcia, to AVP of Sales and Business Development despite the well-documented fact that Mr. Garcia fails at every position he's ever held while employed by the credit union.

According to the President, Mr. Garcia, who over the past year and a half, been stripped of his titles as Credit Manager, Real Estate Loan Manager, and Call Center Supervisor will be implementing changes that will eventually produce large amounts of new business and generate substantial profit for the beleaguered credit union. So how could Mr. Garcia who fails at all that he does, suddenly be imbued with the ability to acquire large amounts of desperately needed new business? It's of course untrue and more wishful thinking by the inept President. Don't expect Mr. Garcia to succeed in his new capacity. He just doesn't have the knowledge, education, or intellect to achieve the goals set for him by the President. He's being setup for failure.

The President may be daft but he's isn't entirely stupid. He knows that his goals for the next 60 to 90 days are unrealistic. So with the assistance of CLO, Cindy Garvin, and Mr. Garcia, the three have created a new plan that contains a twist that will help the credit union reduce spending. It would almost be clever if it weren't so heinous.

Having grown weary of criticisms that he is inept, the President, the CLO, and the newly appointed AVP have assigned monthly sales quotas to every employee, even those employees who never meet with members, i.e., accounting, IT personnel, etc. Employees who fail to achieve their monthly quotas in one month, will be issued written warnings. If they fail to achieve their quotas during two consecutive months, they will be terminated.

By implementing this newest plan, the focus changes from the President to the employee. If employees are terminated, the reason is due to their failures and not the failure of the President. At least that's what the President hopes. Unfortunately, Mr. Wiggington has never provided employees with the tools needed to achieve goals. That's because he has no idea on how to do so. Subsequently, employees will be expected to attain their assigned goals without being taught how they are to realize their assigned directives. This vicious tactic will enable the credit union to reduce spending on salaries and benefits and replace full-time staff with part-time employees who are never paid benefits.

Last month, CLO, Cindy Garvin, posted a memorandum informing all employees that the Call Center staff had acquired 14 automobile loan applications which she said were the result of diligence and hard work. According to Ms. Garvin, if the Call Center could achieve this so could all other employees.

Ms. Garvin was being more than a little dishonest in her assessment of the Call Center's achievement. As Ms. Garvin knows. receipt of a loan application is not synonymous with new business. Following approval of a loan application, members must actually fund the approved loan. At the end of January, the 12 of the automobile loan applications were denied due to poor credit while two remain in pending status which means not one of the applications has been funded. Presumptuous on the part of Ms. Garvin, wasn't it?

The new plan requires that the staff of all branches begin cold calling measures which includes calling members whose applications for loans have been approved. Calls will be made to members at their homes on Wednesday evenings. The business development team and all AVP's and branch managers are now placed under authority of Mr. Garcia. Unless goals are met, the President has vehemently stated he will introduce more drastic measures, including laying-off staff, reducing work hours, and closing the Burbank branch.

Note that the President's new plan utilizes threats and subjects employees to duress all to achieve his ends. Don't expect this latest plan to succeed. Expect more failures, more terminations, and the introduction of more drastic cutting to spending.

STRESS

In December (2011) former Loan Manager, Joseph Garcia, revealed that Chief Loan Officer (“CLO”), Cindy Garvin, was under tremendous stress. Describing Ms. Garvin as a “nice person”, he said she was constantly bombarded with demands by the President, to increase consumer loan funding. Mr. Garcia also recently divulged that Ms. Garvin had been called to a Board meeting and asked why business is not improving. The question is one the Board thought logical in view of their very illogical and unwavering support of President Wiggington over the past five years. It is also a logical question to a Board whose Directors have little comprehension of financials along with their proven ability to circumvent ethics like Superman scales tall buildings in a single bound. It shouldn’t surprise anyone with a modicum of intelligence that the Board believes one person- Ms. Garvin, can come in and unravel the horrendous mess created by President Wiggington, former COO, Beatrice Walker, and Senior Vice President, Rodger Smock. Oh yes, and the messes perpetuated by the Board of Directors under leadership of Chairperson, Diedra Harris-Brooks.

The credit union’s troubles have been further magnified by the revamping of the Real Estate Loan department, which now only finances Home Equity Lines of Credit (“HELOCs”). Applications for all other types of mortgage loans which were until several months ago, funded by the credit union, are now referred to CU Mortgage. CU Mortgage in turn, pays Priority One a fee (“finders fee”). Before resigning in 2011, former Real Estate Loan Manager, Yuling Li, warned President Wiggington and CLO, Cindy Garvin, that elimination of all but the HELOC loans would prove counter-productive and undermine the credit union’s need to instill growth and produce profit. In 2011, Mr. Wiggington admitted the credit union cannot afford to finance first mortgages though we wonder why, if the credit union is immersed in excessive capital? In January, the President complained that the terms assigned to first mortgages are “too long” to “turn a fast return” reminding us that this is a President who wants quick fixes and quick profits without investing the time and energy needed to achieve these. Good luck Mr. Wiggington, because you’re going to need that and a lot more.

THE LATEST

Another change that has been implemented is mandatory overtime on Saturdays to all employees. Employees will be divided into groups and on a rotating basis, be required to spend one Saturday each month in "training sessions" conducted at the South Pasadena branch. According to some employees attending the so-called training sessions, the classes fail to teach staff how to develop new business. This may be due to the fact the the instructors- Joseph Garcia and Yvonne Boutte, no absolutely nothing about business development.

In January, the credit union opened it's new branch in Santa Clarita. The new branch is located outside the gates of the Santa Clarita Processing & Distribution Center, 28201 Franklin Parkway, Santa Clarita, CA 91383 in an area which is inconveniently located in a rural portion of the Santa Clarita Valley. It is a peculiar choice for a location in which to attract business.

The President spent November and December and early January expounding about the potential the new branch has in reversing the credit union's financial problems but logistically, the location makes absolutely no sense. It is far from downtown Valencia, there is no community located near the new office, and it offers absolutely nothing that would prompt a person to drive miles out of their way to conduct their personal banking transactions. The branch will also only open on Mondays, Tuesdays, Thursdays and Fridays. Apparently the chronically dull President believes the inconveniently located branch will replace a full-service, full-time location, conveniently located branch.

The credit union has also not lifted its freeze on employee salaries and is now using the excuse that if assigned goals are not met, employees will be denied raises.

Earlier this month, AVP, Joseph Garcia revealed Priority One may have to merge if employees fail to meet their assigned goals. Merge with whom?

AVP, Sylvia Perez continues her search for another, less expensive location in which to relocate the Burbank branch and proving she is incapable of understanding that the President seeks to entirely erase the amount currently being spent on leasing office space.

Mrs. Perez, the credit union's biggest whiner, recently complained that business at Burbank could improve if she were provided more staff. The Burbank office is currently over-staffed. The problem at Burbank is members are not interested in the location. Currently, the poorly functioning location is staffed by one long-time teller, a full-time business development representative, two part-time employees, a former real estate mortgage loan officer who due to cut-backs, now works in the capacity of an FSR and another employee who recently returned to work following a brief leave but who Mrs. Perez describes as possessing a "bad attitude."

BMW OBSESSED

Priority One might be in the throes of prosperity if President Wiggington only possessed the passion for the credit union, it's members and it's employees that he has for BMW's.

The President often boasts about his many BMW's which according to him are "collector" quality and one which is worth $100,000. In fact, he almost boasts about his BMW collection as he once boasted about the number of women he's bedded.

We recently came across a site containing photographs of one of his collector automobiles which was apparently photographed at his home in Echo Park, California. Here are the photographs:

.

HOPELESSNESS

Don't expect the assignment of monthly sales quotas to improve business. The purpose of the quotas are to justify the termination of staff so that the President can save face and not have to order lay-offs as a means by which to keep the credit union's doors open for business.

The President's November and December declarations to renewed success ceased in January when he issued warning that unless lots of new business gotten over a 30 to 60 day period, he will have to implement more lay-offs and close the Burbank branch. You should expect the President to begin laying off staff by the end of April. You should also expect the Burbank branch to close its doors by the end of May or June. There is no way his unreasonable deadlines will be met. It's just another Wiggington delusion.

Though he spent the first week of January 2012 denying the credit union has ever been sued by any former employee; or that he has ever been accused of sexual harassment, his statements as we've proven, are an utter lie and an attempt to try and dredge up his appalling public reputation from the cesspool he kicked it into.

Mr. Wiggington's weapon of choice is lying. He just doesn't possess the self-discipline not to lie. It's who he is. He may choose to view the world through rose-colored glasses or immerse himself in utter denial, but his failures are well-documented in credit union records and in allegations contained in complaints filed with the Superior Court of Los Angeles.

Mr. Wiggington's bumbling decisions continue unabated. His appointment of Yvonne Boutte over operations and of Joseph Garcia over sales is so absurd, so inane and so illogical, it defies explanation. All we can say is expect the worst. 2012 should prove to be another disastrous year for the horrendous credit union.

To be continued……..