Priority One Credit Union ended 2011 in the BLACK. This is a huge improvement over 2008, 2009, and 2010, during which it ended each of those years immersed in the negative.

Black could suggest that President Charles R. Wiggington, Sr. has finally implemented strategies that are generated increased new business and amassing profit, but this isn't the case. Stabilization of the credit union's financial standing can be attributed in great part to the closure of the Redlands and Valencia branches in 2010, the closure of the Riverside branch in 2011, and the drastic reduction of budgets and elimination of employee benefits.

Last November and December 2011, the President visited some of the credit union's remaining branches and told employees that Priority One is experiencing a resurgence in business. To lend credence to his claims, the President said net capital had increased well above 6%. Net capital is not necessarily the result of increased new business. The President's "story" was just another lie perpetrated to dupe employees.

However, the President's proclamations of success came to an abrupt end at the start of January 2012. During several meetings with managers, the President admitted Priority One is in deep financial straits and that unless lots of new business is gotten by the start of February 2012, the credit union may have to close the Burbank branch. The President lied again. Unbeknownst to most employees, the President called the management company overseeing the property where the Burbank branch is located and informed them that the branch will have to close by the end of May 2012.

Over the last six months, the President has carried on a campaign in which publicly states that our reports are all untrue and maliciously motivated to smear his "good character." Amongst our statements that he has labeled untrue, are:

- The credit union has never been sued by any former employee.

- He has never been accused or investigated for allegedly sexually harassing a female employee.

- The credit union has not suffered financial setbacks at anytime over the past five years.

SETTLEMENT

Priority One has settled the lawsuit filed by former Burbank Branch Manager, Linda Nisely. Not only was the settlement entered into voluntarily by the credit union but it was the credit union's often arrogant attorney, Paul F. Schimley of Richardson Harman Ober who called the Plaintiff's attorney and requested that they meet to hammer out a settlement agreement.

So what happened the Mr. Schimley's boastings verbalized week after week over the past few months, proclaiming that his firm had acquired evidence and testimonies from current and former employees which would expose Mrs. Nisely of being a racist and of being insubordinate and unwilling to carryout her assigned responsibilities? And what about Mr. Schimley's insistence that labeling the lawsuit "frivolous" and without merit?

The Plaintiff and the credit union have agreed through a signed agreement, that neither will divulge any information which might serve to malign either party or to publicly discuss the term so the settlement. Unfortunately for the credit union, Director of Project Management, Yvonne Boutte, could not refrain from making comments about the settlement.

According to Mrs. Boutte, the Plaintiff used a part of the money from the settlement to pay-off her delinquent Priority One loan. Mrs. Boutte also disclosed that for months prior to entering into a settlement agreement with the credit union, when calling Mrs. Nisely to demand she submit payment against her delinquent credit union loan, she would tell collection representatives, "I am a former employee and I'm suing the credit union.”

The reason why the credit union anxiously sought to settle the lawsuit has little to do with evidence provided by Mrs. Nisely supporting her insistence she was terminated because of her age and race. In fact, for all intents and purposes, her case was highly deficient and for awhile, it appeared it could be dismissed.

The greatest flaw in her case, was Mrs. Nisely herself. There is no denying, she was a caustic presence while employed by the credit union. During the few years of her employment, she smeared the reputations of many staff members. And she indeed, often show a disdain towards Latins. She did spend her days playing on the Internet and not working it her alleged medical condition which she said precluded her from physically leaving the Burbank branch to visit the community served by that office was never substantiated by medical records. As far as we know, it was a pretext she used to justify her stay in the branch. No, Linda Nisely wasn't so nice.

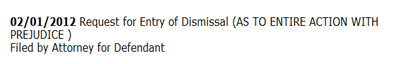

Mrs. Nisely's case was aided by a copy of a letter, written by the last Valencia Branch Manager to the credit union in which were documented abuses perpetrated by former COO, Beatrice Walker, and which President Charles R. Wiggington, Sr.; Executive Vice President, Rodger Smock; and Board Chair, Diedra Harris-Brooks, refused to stop. It was the credit union's refusal to stop Ms. Walker's heinous campaign which proved lethal to the credit union's planned defense. The following record, obtained from the Los Angeles Superior Court, confirms dismissal of Mrs. Nisely’s lawsuit.

The Request for Entry of Dismissal (with prejudice) confirms that the lawsuit has been resolved. Congratulations to the former Burbank Branch Manager and her highly competent attorney. As for Mr. Schimley, he should try to control his addictive need to boast prematurely of successes which just never seem to occur.

"WE HAVE NEVER BEEN SUED"

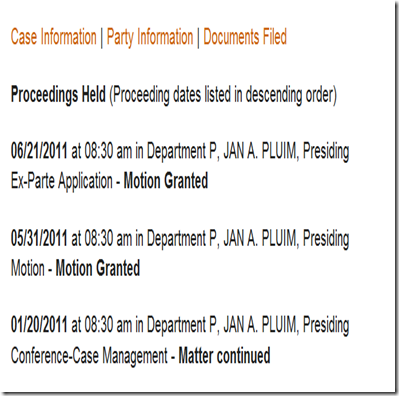

President Wiggington's latest campaign is intended to dupe employees, members and anyone else who will listen to his dribble, that Priority One has never been sued by any former employee. The President's foolhardy campaign ignores the fact that there is physical evidence proving Priority One has indeed been sued by more than one employee. Either the President is living in denial, delusional or just outright lying.Here is a Case Summary describing the motions filed in Mrs. Nisely's lawsuit:

Well it looks like the credit union was indeed sued by Mrs. Nisely a former employee which should dispel any confusion by the President that Priority One has never been sued by any former employees.

"I've never been accused of sexual harassment"

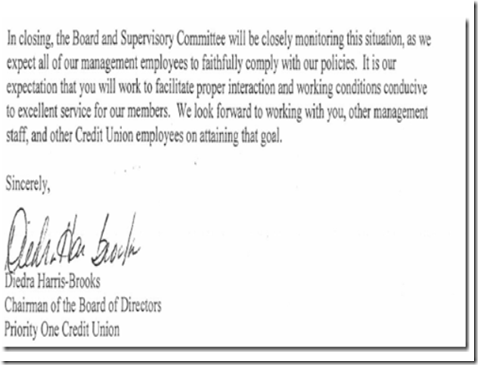

President Wiggington is not only a man who refuses to be accountable for his vast failures but he is one who is mired in denial. In his latest campaign, he has tried to convince employees that the accusations that he was accused by a former employee of sexually harassing her for several years is completely and utterly untrue. Of course, like his denial that any former employee has sued the credit union, his denial that he was ever accused of sexual harassment is also untrue. Here is a copy of the letter, written, signed and hand delivered to the President following an investigation of allegations he sexually harassed a former employee.

The letter should job President Wiggington's memory and help dispel any confusion he may have regarding whether or not he was ever accused of sexually harassing an employee.

EXTINCTION

Due to President's Wiggington's inability to develop sound strategical measures, Priority One remains mired in metaphorical tar pit and in the process of continual decline. Last month, President Wiggington met with employees and managers and ordered that they exert all efforts to obtain immense amounts of new business over the next eight weeks or he would have order lay-offs, further reduce budgets and even move to close the Burbank branch. .

Charles R. Wiggington, Sr. is again, being more than just a little delusional. He hopes to achieve in an eight-week period what he has failed to do over a five year period. As usual, when he issued his edict it was unaccompanied by a plan on how he hopes employees will achieve his lofty expectations.

Historically, the Burbank branch has not performed well even under the self-proclaimed business genius of AVP, Sylvia Perez. In fact, the office's decline began with Mrs. Perez's arrival. Throughout 2011, Mrs. Perez boasted that the branch experienced immense amounts of walk-in traffic with a large amount of business generated from Shared Branching transactions. Of course, Mrs. Perez who is not quite the financial expert she'd like people to believe she is, doesn't understand that the obtainment of new business is necessary to produce increased levels of profit needed, in part, to offset overhead and justify the $5200 per month paid to rent the branch location.

In 2009, even the inept and corrupt former COO, Beatrice Walker, realized that the Burbank branch was not producing the level of new business needed to justify its continued operation and at the time, marked it for closure.

In November and December 2011, President Wiggington in company of Senior Vice President, Rodger Smock, frequently visited the Burbank office. The visitations by the two should have been viewed as a harbinger of bad news for the branch and its staff. The two also frequently visited the Valencia branch prior to announcing it's closure.

The fact that Priority One is struggling to pay $5200 a month to rent the Burbank branch speaks volumes about it's financial capabilities and further dispels the chronic insistence by President Wiggington that business is "good" and "growing." Obviously, it's not!

What's more, there is a detrimental impact to the ability of the credit union to do business in the communities where branches are closed. The Burbank branch serves the large, heavily populated eastern regions of the San Fernando Valley and one of the credit union's largest SEG's, St. Joseph Medical Center. Though the credit union does maintain an office in the city of Van Nuys it's location is inconvenient to members residing and working in Burbank. We know that Shared Branching will not be selling point to people who presently utilize the Burbank office.

We've no doubts the Burbank branch will close either in May or June of this year because it is virtually impossible to achieve what the President says is needed in a 30, 60, or 90 day period. If the Burbank branch closes, it will raise net capital which will in turn, enable Priority One to remain in business but it will have absolutely no impact on generating profit from new business though the President deceptively insists it does. It doesn't.

Despite his November and December proclamations that business is increasing by January he seemed genuinely concerned by indicators which threatened to return Priority One into the RED. As of February 2010, President Wiggington is again faced with the same dilemma encountered by the credit union in 2008, 2009, 2010, and 2011.

On January 5, 2012, during one of the credit union's quarterly all-staff meetings, the President assured employees business was doing well and emphasized the importance of reaching out to the communities served by the credit union. In the days which follow, he did a complete turn about face and while meeting with managers including Senior Vice President, Rodger Smock; CLO, Cindy Garvin; Loan Manager, Joseph Garcia; and Director of Project Management, Yvonne Boutte, expressed deep concern over the credit union's inability to attract new business and seeking suggestions on how to spruce up the credit union's aged loan portfolio without having to actually spend money implementing new products. Unless the President has a magic wand, don't expect any of his directives to be realized.

In response, AVP, Sylvia Perez has begun scouting new more affordable locations where the Burbank branch could potentially relocate to. Mrs. Perez doesn't comprehend or is mired in denial, that the Burbank branch must close to eliminate spending and raise net capital. Relocating the branch to another site is costly and will again require the credit union to pay a monthly lease it cannot afford.

The growing and promising credit union inherited by President Wiggington in 2007 is a thing of the past and will never exist again under Charles R. Wiggington, Sr. His ship shod leadership, unscrupulous acts, his clouded and fantastical so-called "vision" for the credit union, his disregard for members and employees have caused Priority One to lose sight of it's role to members, it's branding and has muddled all perception of it's direction. Let's face it, Priority One is not only ineffective and no longer competitive, it's invisible.

MASKING INTENTS

In January of 2010, at the request of then COO, Beatrice Walker,

In 2011, the President promoted the Assistant to the Loan Manager, Joseph Garcia, to AVP of Sales and Business Development despite the well-documented fact that Mr. Garcia fails at every position he's ever held while employed by the credit union.

In 2011, the President promoted the Assistant to the Loan Manager, Joseph Garcia, to AVP of Sales and Business Development despite the well-documented fact that Mr. Garcia fails at every position he's ever held while employed by the credit union.

According to the President, Mr. Garcia, who over the past year and a half, been stripped of his titles as Credit Manager, Real Estate Loan Manager, and Call Center Supervisor will be implementing changes that will eventually produce large amounts of new business and generate substantial profit for the beleaguered credit union. So how could Mr. Garcia who fails at all that he does, suddenly be imbued with the ability to acquire large amounts of desperately needed new business? It's of course untrue and more wishful thinking by the inept President. Don't expect Mr. Garcia to succeed in his new capacity. He just doesn't have the knowledge, education, or intellect to achieve the goals set for him by the President. He's being setup for failure.

The President may be daft but he's isn't entirely stupid. He knows that his goals for the next 60 to 90 days are unrealistic. So with the assistance of CLO, Cindy Garvin, and Mr. Garcia, the three have created a new plan that contains a twist that will help the credit union reduce spending. It would almost be clever if it weren't so heinous.

Having grown weary of criticisms that he is inept, the President, the CLO, and the newly appointed AVP have assigned monthly sales quotas to every employee, even those employees who never meet with members, i.e., accounting, IT personnel, etc. Employees who fail to achieve their monthly quotas in one month, will be issued written warnings. If they fail to achieve their quotas during two consecutive months, they will be terminated.

By implementing this newest plan, the focus changes from the President to the employee. If employees are terminated, the reason is due to their failures and not the failure of the President. At least that's what the President hopes. Unfortunately, Mr. Wiggington has never provided employees with the tools needed to achieve goals. That's because he has no idea on how to do so. Subsequently, employees will be expected to attain their assigned goals without being taught how they are to realize their assigned directives. This vicious tactic will enable the credit union to reduce spending on salaries and benefits and replace full-time staff with part-time employees who are never paid benefits.

Last month, CLO, Cindy Garvin, posted a memorandum informing all employees that the Call Center staff had acquired 14 automobile loan applications which she said were the result of diligence and hard work. According to Ms. Garvin, if the Call Center could achieve this so could all other employees.

Ms. Garvin was being more than a little dishonest in her assessment of the Call Center's achievement. As Ms. Garvin knows. receipt of a loan application is not synonymous with new business. Following approval of a loan application, members must actually fund the approved loan. At the end of January, the 12 of the automobile loan applications were denied due to poor credit while two remain in pending status which means not one of the applications has been funded. Presumptuous on the part of Ms. Garvin, wasn't it?

The new plan requires that the staff of all branches begin cold calling measures which includes calling members whose applications for loans have been approved. Calls will be made to members at their homes on Wednesday evenings. The business development team and all AVP's and branch managers are now placed under authority of Mr. Garcia. Unless goals are met, the President has vehemently stated he will introduce more drastic measures, including laying-off staff, reducing work hours, and closing the Burbank branch.

Note that the President's new plan utilizes threats and subjects employees to duress all to achieve his ends. Don't expect this latest plan to succeed. Expect more failures, more terminations, and the introduction of more drastic cutting to spending.

STRESS

In December (2011) former Loan Manager, Joseph Garcia, revealed that Chief Loan Officer (“CLO”), Cindy Garvin, was under tremendous stress. Describing Ms. Garvin as a “nice person”, he said she was constantly bombarded with demands by the President, to increase consumer loan funding. Mr. Garcia also recently divulged that Ms. Garvin had been called to a Board meeting and asked why business is not improving. The question is one the Board thought logical in view of their very illogical and unwavering support of President Wiggington over the past five years. It is also a logical question to a Board whose Directors have little comprehension of financials along with their proven ability to circumvent ethics like Superman scales tall buildings in a single bound. It shouldn’t surprise anyone with a modicum of intelligence that the Board believes one person- Ms. Garvin, can come in and unravel the horrendous mess created by President Wiggington, former COO, Beatrice Walker, and Senior Vice President, Rodger Smock. Oh yes, and the messes perpetuated by the Board of Directors under leadership of Chairperson, Diedra Harris-Brooks.

The credit union’s troubles have been further magnified by the revamping of the Real Estate Loan department, which now only finances Home Equity Lines of Credit (“HELOCs”). Applications for all other types of mortgage loans which were until several months ago, funded by the credit union, are now referred to CU Mortgage. CU Mortgage in turn, pays Priority One a fee (“finders fee”). Before resigning in 2011, former Real Estate Loan Manager, Yuling Li, warned President Wiggington and CLO, Cindy Garvin, that elimination of all but the HELOC loans would prove counter-productive and undermine the credit union’s need to instill growth and produce profit. In 2011, Mr. Wiggington admitted the credit union cannot afford to finance first mortgages though we wonder why, if the credit union is immersed in excessive capital? In January, the President complained that the terms assigned to first mortgages are “too long” to “turn a fast return” reminding us that this is a President who wants quick fixes and quick profits without investing the time and energy needed to achieve these. Good luck Mr. Wiggington, because you’re going to need that and a lot more.

THE LATEST

Another change that has been implemented is mandatory overtime on Saturdays to all employees. Employees will be divided into groups and on a rotating basis, be required to spend one Saturday each month in "training sessions" conducted at the South Pasadena branch. According to some employees attending the so-called training sessions, the classes fail to teach staff how to develop new business. This may be due to the fact the the instructors- Joseph Garcia and Yvonne Boutte, no absolutely nothing about business development.

In January, the credit union opened it's new branch in Santa Clarita. The new branch is located outside the gates of the Santa Clarita Processing & Distribution Center, 28201 Franklin Parkway, Santa Clarita, CA 91383 in an area which is inconveniently located in a rural portion of the Santa Clarita Valley. It is a peculiar choice for a location in which to attract business.

The President spent November and December and early January expounding about the potential the new branch has in reversing the credit union's financial problems but logistically, the location makes absolutely no sense. It is far from downtown Valencia, there is no community located near the new office, and it offers absolutely nothing that would prompt a person to drive miles out of their way to conduct their personal banking transactions. The branch will also only open on Mondays, Tuesdays, Thursdays and Fridays. Apparently the chronically dull President believes the inconveniently located branch will replace a full-service, full-time location, conveniently located branch.

The credit union has also not lifted its freeze on employee salaries and is now using the excuse that if assigned goals are not met, employees will be denied raises.

Earlier this month, AVP, Joseph Garcia revealed Priority One may have to merge if employees fail to meet their assigned goals. Merge with whom?

AVP, Sylvia Perez continues her search for another, less expensive location in which to relocate the Burbank branch and proving she is incapable of understanding that the President seeks to entirely erase the amount currently being spent on leasing office space.

Mrs. Perez, the credit union's biggest whiner, recently complained that business at Burbank could improve if she were provided more staff. The Burbank office is currently over-staffed. The problem at Burbank is members are not interested in the location. Currently, the poorly functioning location is staffed by one long-time teller, a full-time business development representative, two part-time employees, a former real estate mortgage loan officer who due to cut-backs, now works in the capacity of an FSR and another employee who recently returned to work following a brief leave but who Mrs. Perez describes as possessing a "bad attitude."

BMW OBSESSED

Priority One might be in the throes of prosperity if President Wiggington only possessed the passion for the credit union, it's members and it's employees that he has for BMW's.

The President often boasts about his many BMW's which according to him are "collector" quality and one which is worth $100,000. In fact, he almost boasts about his BMW collection as he once boasted about the number of women he's bedded.

We recently came across a site containing photographs of one of his collector automobiles which was apparently photographed at his home in Echo Park, California. Here are the photographs:

.

HOPELESSNESS

Don't expect the assignment of monthly sales quotas to improve business. The purpose of the quotas are to justify the termination of staff so that the President can save face and not have to order lay-offs as a means by which to keep the credit union's doors open for business.

The President's November and December declarations to renewed success ceased in January when he issued warning that unless lots of new business gotten over a 30 to 60 day period, he will have to implement more lay-offs and close the Burbank branch. You should expect the President to begin laying off staff by the end of April. You should also expect the Burbank branch to close its doors by the end of May or June. There is no way his unreasonable deadlines will be met. It's just another Wiggington delusion.

Though he spent the first week of January 2012 denying the credit union has ever been sued by any former employee; or that he has ever been accused of sexual harassment, his statements as we've proven, are an utter lie and an attempt to try and dredge up his appalling public reputation from the cesspool he kicked it into.

Mr. Wiggington's weapon of choice is lying. He just doesn't possess the self-discipline not to lie. It's who he is. He may choose to view the world through rose-colored glasses or immerse himself in utter denial, but his failures are well-documented in credit union records and in allegations contained in complaints filed with the Superior Court of Los Angeles.

Mr. Wiggington's bumbling decisions continue unabated. His appointment of Yvonne Boutte over operations and of Joseph Garcia over sales is so absurd, so inane and so illogical, it defies explanation. All we can say is expect the worst. 2012 should prove to be another disastrous year for the horrendous credit union.

To be continued……..

Kindly Share The Love»»

|

|

|

Tweet | Save on Delicious |

181 comments:

Linda won her lawsuit? Wow, that's great. Goes to show you that all the lies Wigg, Smock and the lawyers had planned, didn't cut it in the end. Does anyone know what Linda had that made the credit union want to settle?

I know Linda got what she wanted because she never would of settled for less. You can blame to board for keeping Wiggington and letting him screw over the business. Congratulations Diedra, Saffo, Gathers and the rest of you clowns.

All the pressure Wiggs put is making everyone miserable. You are so right, he did say things were great which was another big lie.

Anonymous said...

All the pressure Wiggs put is making everyone miserable. You are so right, he did say things were great which was another big lie.

Wigg has been making everyone miserable for many, many years.

So Linda Nisely won. I thought Wigg said he never did anything wrong. Thought he said that he had run the credit union honestly. Thought he said that they fired Linda fair and square. Sure Wigglenuts, keep telling stories that only you'll ever believe. Dumbass.

I would have thought that Tsui, the 2 Kims, Dane, Theresa, Whitney, Maggie, Marc and a lot of other employees would have sued by now. Losing to Linda is big. That could mean she had something on them they didn't want to come out, sort like all those employees who said he was sexually harassing. Does any body know how much they paid her? If she paid off a loan, it was probably a good amount. Wigg has been lucky he hasn't been sued like he should of been cause homeboy has a lot of dirt and skelatons.

Manny Gaitmaitan knew a lot of what Wigg did from changing records to make it look like Priority 1 was doing great when it was really doing bad. Isn't that one BIG reason why Manny left? He got tired of Wigg and Bea Walker trying to force him lie on records which he told them was illegal but which pissed them off. In fact, auditors should look at this past January's records because Wigg asked Saeid to inflate them. All a good auditor has to do, is look at the actual paperwork that proves the amount of business they really made. A report is only as reliable as the correct information you put in it.

Priority One settled with Linda. That's amazing! What happened? Wiggington said that Manny was going to give testimony proving Linda had to be cut because they could afford to pay her salary. Sylvia said that she was asked to give testimony that Linda refused to go into the field and that she spent a lot of time at work shopping on HSN. She also said she had abused her staff including Martha. So what happened? You know the only thing you can walk away with is knowing you can't believe anything Wiggington has to say.

Is that old BMW one of the ones he bragged about? LOL.

Wigg is the stupidest. Does anybody at P1 have a bigger mouth than him? Not even Mrs. Smock has a mouth like his. When it comes to Wigg, if he says business is good then you know its bad. If he says the credit union is going to win a lawsuit then you can guess, they're not. For years, his big mouth let us know who got fired and why? He let everyone know who was on his sh*t list and who he was going to fire and he even let you know about his sex life. Disgusting. Keep talking Wigg otherwise employees will never know what your up to.

I was reading one of your earlier posts and found 2 comments that were posted way before you guys started providing copies of documents.

Anonymous said...

Charles Wigginton ruined a once fine credit union. I miss Mr Harris!

October 2, 2009 11:40 PM

Anonymous said...

It definitely seems as though the writer of this article has nothing better to do than express hate and negativity towards Mr. Wiggington. I am a member of the credit union who respects him and his decisions. This is just so sad... a typical and pathetic attempt to undermine someone who is on a higher level. Mr. Wiggington if you read this, keep doing your thing and remember that there will always be people who try to bring you down. Just keep smiling and stay strong!

November 18, 2009 7:50 PM

The last one was written by a retard. Anyone that thinks Wigg has done a good job has their eyes shut and doesn't know how to read so its probably a board member.

TEN THINGS WIGGINGTON DOESN'T KNOW

1. O.J. did it.

2. Tupac is dead.

3. Teeth shouldn't be decorated.

4. Weddings should start on time.

5. Tooth paste is meant to be used.

6. Jesse Jackson will never be President.

7. Red is not a Kool Aid flavor, it's a color.

8. Crown Royal bags are meant to be thrown away.

9. Your rims and sound system should not be worth more than your car.

10. Deodorent is not an option.

Don't forget, Purple drink is known to the rest of the world as Grape soda!

FIVE THINGS THE BOARD OF DIRECTORS DON'T KNOW

1. If the President tells an employees he's going to "whip her ass" and he wants "to sop you up like gravey", then its probably sexual harassment.

2. Like a rainbow which has a lot of different colors, people come in a lot of different colors.

3. -$5 million on a financial report is not good.

4. Paying attorneyes more than $100,000 a year is a sign of a big problem.

5. Way too much capital could be a sign your Presidet is not using the money to fund loans.

What's really incredible is Wigg doesn't understand that they got sued and that they settled with Linda Nisely. I wonder if he even realizes that he's president of P1?

I like this post, enjoyed this 1 appreciate it for putting up.

84HLUL3NT3

Vimax Vimax

vimax vimax

vimax vimax

vimax vimax

Does anyone know how much money Linda got?

I am wondering how Yvonne Boutte is supposed to supervise tellers and member services if she doesn't know a damn thing about either. She's not a people person and she's horrible with members who are delinquent. What a stupid move? She's a control freak and never remembers anything.

And you are right, Wigg has been talking about closing Burbank this May but he thinks he's covering his ass. He got the board to buy a new ATM that for Providence St. Joseph that has check 21 capabilities and its state of the art and doesn't require all the maintenance the old one has. He knows he's going to have to close Burbank because like he says, "I can't afford to pay $5200 a month!" No, Mr. Wiggington can't afford to pay $5200 but how much did the credit union lose on his phone system or defending him when he was accused of sexually harassing? He thinks the machine will help replace the Burbank branch and staff that will no longer be there. He hopes shared branching will substitute for no branch. Good luck on that Wiggington because you've learned nothing the past 5 years. And where did you dig up the money to buy that new, spanking over-priced ATM?

A new ATM instead of a branch. That's what they have in Victorville, don't they? Now that that they don't have anything in Riverside unless you use shared branching, do they really on the Victorville atm and how business do they get out of that?

Wow after reading that Wiggington is STILL threatening employees to look for business he may as well slit his own throat and laid off himself along with the rest of the hasbeens because all his so called brilliant idea ARE NOT WORKING..lol...*I GOT POPCORN IN HAND AND PATIENTLY WAITING FOR DFI TO SHUT THE DOORS FOR GOOD*

Wigg knows that P1 survived for 3 years more than it should have because he cut and cut but he's run out of places to cut. Lately, he's not even all that nice to some of his managers. I think he's willingly to now let them lose their jobs. Lynnette is bein kicked to the curb with Gema and Sylvia who got her way by nagging people to death, is not getting her way no more and she looks awful. She complains "they" have her all over the place like driving to Valencia, trying to get new business, and trying to get the dying Burbank office, going. Joseph is making sure that AVPs get out in the field but what's really confusing is that Cindy Garvin now over sees all branches. I thought she was loans and if Joseph is over AVPs and even branch manager, Cecilia, then why is Cindy ALSO over branches? Wigg is so confused and afraid P1 will have to merge. Oh well, he wasted 5years, caused P1 to lose money and he caused a lot of employees to lose their jobs.

I wish the laid off employees would get together and bring a lawsuit against Wiggs and P1. Hey Linda just showed you the way and there is strength in numbers. Lets get it going.

There is strenght in numbers. Wigg gave a lot of ex-employees a reason to sue and he created a nice, big army of witnesses, thanks to what he did, what he said and of course the help he got from useless, old boy loving Smock.

Yvonne over member services and tellers and Joseph over sales? That's like making Wigg President and Rodger, Senior VP? Oh wait, they are President and Senior VP.

Wigg always said Riverside was a big mess because Harris screwed it up and never should have merged with inland counties. When he closed Valencia he said that office never made any money and that the member in Santa Clarita were disloyal to the credit union. Yeah, that's why he had his people do the work to get approval from Mr Tapia so they could open the new Santa Clartia branch. The problem never was Santa Clarita it was homeboy and the fat boy SVP who never tried or knew how to get new business just like they never tried to get business in Riverside. Easy to blame everyone else for what they can't do but its the same problem they have at Burbank. First of all where's their marketing? What's their brand? What happened to their advertising. You can drive past the Burbank branch and never know its there. Plus for years, he let big chola, hyper, uneducated, employee abusing, Sylvia Perez, his GOOD FRIEND, run that branch into the ground. The woman is like Wigg and Smock, she couldn't sell shit. If Burbank closes even old Wigg knows that is going to look horrible because as you guys have been saying, the problem is that he doesn't know how to get business. I bet they will be merged or close their doors within a year...tops. Used to be a real nice credit union before Wigg became President or Diedra decided to become the board's big hog.

Anonymous wrote:

Wow after reading that Wiggington is STILL threatening employees to look for business he may as well slit his own throat and laid off himself along with the rest of the has beens because all his so called brilliant idea

His bright ideas include the useless AVPs, doing away with the money making tax, back to school, computer, & holiday loans, hiring Bea Walker, doing away with the Marketing Director, Marketing Department, and Marketing Specialist. Yeah, when it comes to good ideas, he's king, I mean failure. Big failure.

And there's a lot of people who have been watching this train wreck for a long time. Guess it hasn't helped his lies that he lost 3 branches and might lose a 4th and that they settled Linda's lawsuit. Tsk, tsk Wigglebottoms, did you really think anyone would ever buy into your load of crap?

Well I know Sylvia is pissed that Linda won. She was looking so forward to going to court against Linda (probably thought that would gain her points with Wigg). I spoke to one of the credit union's witnesses and she is livid that Priority One settled. She said they told her that they had great evidence and they would beat Linda in court. She's wondering what happened? She's also made because all the people that were forced to give their depostion weren't paid for their time (but that's exactly the way it usually goes) and she believes Linda was fired with good cause. Well, its over and Linda won fair and square.

Linda won.

Linda won

Linda won.

Linda won.

Linda won.

Linda won.

Linda won.

Linda won

Linda won.

Linda won.

I mean, the credit union settled.

You should see some of the bright ideas Wigg, Cindy and Smock have in the pipeline. They're pathetic.

One of Wigg's newest ideas is having everyone work until 7 pm every Wednesday. We've been calling members who have been with us since 1995 and who only have savings accounts. They don't want loans! Wigg could have done this a lot sooner but now he wants staff to clean up his mess. Nothing like waiting to the last minute and threatening to layoff or not give raises. Great incentives! This is all his fault. He can't blame anyone though now instead of the economy, he's blaming staff and AVP's.

I see no branch in Burbank.

I see no branch at St. Joseph hospital.

I see very little business in Santa Clarita.

I see employees losing their jobs.

I see more backstabbing.

I see bad morale.

I see Wiggington running out of excuses.

Doesn't take a fortune teller.

I'm confused. My friend said that the credit union's attorneys said they needed her testimony to show Linda hated Latins and that she was lazy and didn't do her job. They even let her know that Linda didn't have a case. So what happened? If they had all the evidence to shoot Linda down then why did they settle? What a bunch of liars.

They probably THOUGHT they had a good defense. Remember, P1's lawyers are only going to believe they have a good case if Wigg and his crew, provide them with information that is valid to build a case against whoever sues them. If they told any witness, which I am assuming that's what your friend was, its because they based it on whatever they were told and given by the credit union. At this point the question is what did evidence did Linda present that gave her the upper hand over the credit union? If you can find out what she said, got, or did, then you have the answer why the board and attorneys decided to settle and pay Linda.

PS It wasn't Wiggington who ordered they pay Linda. This thing was over his head and the decision to pay Linda was not based on his approval, it was strictly the board and supervisory committee who gave the okay. Even though the board's covered for Wigg for many years, they can't be happy that they settled and PAID LINDA MONEY which means the company did something wrong, even though they'll deny till the day they die.

We offer auto loans and personal loans and HELOCs but there's not a whole lot more we offer that members really want. I called one member who told me he had never received a call from us even though he's been around for years. Another one told me she was interested in anything and said she had several accounts. She does, a savings and youth account with $5 in each. Its frustrating and people are more miserable. Like someone said, Wigg made the mess and now we have to clean it up for him or we pay for it while he still gets a fat salary and gets to leave early because his health is bad.

Priority One might be in more trouble. For years they depend on the deposits from the post office which have decreased a lot since 2010. Today CNNMoney reported that the postal service to consolidate or close 223 mail processing plants putting 35,000 jobs at stake starting in late May or June. Wonder if Wigg is scheduling closing Burbank in May so it correlates with the post office's plans? LOL.

The USPS is in debt because less first-class mail deliveries. Guess Wigg contributed to this when he started pushing E-Statements.

The post office is also talking about stopping Saturday delivery, delaying first-class mail delivery and closing post offices and raising the cost for stamps to .50 cents which is going to affect everybody's postal fees including P1 that can't afford much now days. They also might close 14 mail processing plants in California. P1 better hope they don't close the Commerce plant becauswe they get so much business from that location or the Santa Clarita plant, because they have an office in the plant and one outside the plant.

Wigg had time to organize. Their FPR shows positive influx of monthly income but with losses in the millions so that they are worth less now then they were 4 to 5 years ago. Plus, in the industry they offer nothing that makes them unique. You can play with your mission statement and make it sound purdy, but it doesn't amount to anything if there's nothing to back it up. Obviously, a less Wigg never learned and still hasn't learned because he's still trying to find quick fast cash. Even as a trickster, he sux. Too bad he ruined what others worked so hard to build.

The place has gotten worse the last 2 weeks. Its like you come back to work on any Monday and everything is worse. I don't get the arrangement. Joseph is over BD which is just Hector and Cindy because Martha is out on medical leave. She is so good and nice and we don't know what happened. Wiggington had to promote and give Joseph a raise so he could manage only 2 people? Just stupid. Cindy is over the AVPs and branches. Sylvia says she likes her but Sylvia also complains that they have her driving to Santa Clarita and taking care of Van Nuys and Burbank. She's another one that looks horrible.

Joseph and Cindy convinced stupid Wiggington that if we work Saturdays and late Wednesdays, we'll get the new business we need. So far its a big failure. Members don't want loans and making us work til 7 at night and cutting our weekends short isn't making attitudes better. Its like someone said, he made the mess but we're supposed to fix it. And then you have Joseph, who doesn't know how to do anything and who we all know is a big dummy, giving orders like he knows what he's talking about.

Hey John, you're talking about O. Glen Saffold, aren't you? He is a big liar if he's going around saying that they've never been sued and that business is bad. Maybe he thinks its true because he is too dumb to pass the bar and because he thinks OJ was innocent.

The credit union deciding to pay Linda isn't so strange. They probably gave her exactly what she asked for because the case was complicated or they wanted to avoid paying high litigation costs or because P1's attorneys thought it would be less expensive to settle after they looked at all the evidence and what the credit union could end up losing which includes that the court could have award Linda more damages then what she sued for. Settling the case was best for the credit union and gave Linda what she wanted.

I still don’t get why they settled. Wigg said that they had everything they needed to crush Linda. He said they had a lot of witnesses who could prove she was a horrible manager and that she hated Latins. He also said there was no way the credit union could lose. If they settled they lost because they had to pay. I know Linda said the company promoted Nora and even gave her Linda’s job at Valencia which I think was bullshit, since Linda ended up having to drive less time when they transferred her to Burbank. Plus didn’t she go from assistant branch manager to branch manager? Where’s the discrimination? Plus Wigg was so cocky and sure that there was no way the credit union could lose. I don’t get it. What happened? Does anyone know?

The real questions is, why would you believe wigglenuts? I question your sanity, you sound like miss west or booble head Irma.

Things are bad enough that Wigg is worried and impatient which he thinks is going to get what he wants. I bet your going to see more employees quit in the next weeks and others either laid-off or their hours cut. Wigg said he needs big business quick and a lot of it or he'll close Burbank in May. We're not getting as many applications as Wigg wants and the one's we're getting are being denied, so we're not getting what Wigg wants. No doubt, we're entering March and then April. No way we're going to get millions of dollars before May so I bet anybody money that Burbank will close either in May like Wigg said or at the latest, June 1st. After that he'll have to decide whether to close Los Angeles or the main branch or Van Nuys or Santa Clarita. You don't need AVPs anymore and you don't need Smock, West and Esmeralda in HR and you sure don't need a senior VP, so I'd close down the South Pasadena office and Wigg can move to Los Angeles which is more of a check cashing office than a branch. Maybe they can turn it into a quick cash store.

Linda won fo sho. She got what she want. Wonder if the board is pissed with Wigg? Nah, there too stooped.

Bobble head Irma. Unbelievable that useless Wigg replaced Kim for Irma- a pushy, not so bright, control freak. I don't know why Kim neve sued. He made her cry so many times even though she was a great assistant. He said horrible things about her because he was jealous people like her and couldn't stand him. He had fat Missy Smock write her up several times and even two-faced Esmeralda back stabbed her. These people are all trash and Kim was too good for them or the ghetto credit union Wigg created. But she should have sued. There were lots of employees who would have testified for her and exposed not-so-healthy, Wigg.

I remember when that phoney Diedra even asked Kim to tell her if Wigg mistreated her which was crap because he did abuse her and Diedra didn't do a thing just like she didn't do a thing when he sexually harassed, when he caused the credit union to lose money, and when he destroyed marketing.

First Redlands, then Valencia, Riverside and now MAYBE Burbank? Geez, thanks Wigg for being such a great president. I know that he has said that Riverside was a problem Mr Harris created and that he tried to fix it but couldn't. If you were to believe that then maybe he should explain why Valencia was closed and why he might have to close Burbank. Of all the branches, Burbank was probably the worst, Valencia was actually great under the last branch manager and Riverside had potential that knucklehead couldn't tap into because he doesn't have the talent. Plus look at his staff. Smock, West, Sylvia, Saeid, prove anyone has the ability to create new business. What a mess from a really messy President.

Oh, and I forgot, what about that genius Beatrice Walker? He brought her in because she supposedly was an expert and could turn anything into gold. I think all he proved was he's an idiot when it comes to hiring and anything she touched turned to mold.

Some of my co-workers got emails from Nidia, saying she was quitting and has another job. I heard she sent a real nice resignation letter to Robert West who appreciated it. Everyone knew she was miserable because they promoted her to work in real estate and for a long time sent her to Burbank to work as assistant branch manager. Then they finally sent her back to South Pasadena where she was happy. Then when they got rid of first mortgages and after Yuling left, they sent her back to Burbank to do FSR work. She should have been truthful and told them why she was leaving. It doesn't help to put up a front to a company that doesn't appreciate employees. Wigg is probably happy to see her go because it saves money plus he didn't need her. On the other hand, Sylvia was crying for years that Burbank was short staffed. Nidia is gone and Martha is on medical leave. Leroy has been working in South Pasadena for a long time. That leaves Dana and 2part-time tellers which means the old chola is going to have to spend more time at Burbank and also have to go out into the field to meet her goals. I hope she doesn't have a nervous breakdown, after all she is such a nice person.

Shouldn't come as a surprise, but Wigg lied to ALL the employees when he told them he MIGHT have to close Burbank unless we got a lot of new business. Turns out when he said that, he had already sublet the space to a new business that's coming in on May 1st!!!! Big mouth Sylvia told the manager of the Allstate office located next door at 4000 W Magnolia Boulevard # J. She also told me at the Burbank Chamber hoping someone might refer her to some affordable office space. Of course, Wigg hasn't even told the staff at Burbank but they already know, because they've met the new tenants.

Wigg is a BIG liar! Your sure they are closing Burbank? The whole thing is so unprofessional. Its nice to see HR or whatever their called, is doing such a wonderful job. Idiots.

So if they're closing Burbank then they don't need sylvia any more, right?

And Joseph, Wigg, and Smock. And someone from HR. BTW, why do they have Rodger, West and Esmeralda in HR when the company is so much smaller and with less people? When they had Riverside, Redlands and Valencia, they had 2 people in HR, now that they don't have them and have already decided to close Burbank, they really don't need 3 people- never did.

BURBANK BRANCH CLOSING MAY 1, 2012.

Thanks Wiggington, you really did change the credit union forever.

WHEN'S SOUTH PASADENA CLOSING?

Maybe Wigg just forgot to mention that Burbank is closing? Either that or he's a BIG LIAR.

Joseph is supposedly rallying us to do better, but he is being pushy and making everything worse. He says we all have to "try harder" and "stretch ourselves" and he visits every branch not knowing that he's not making things better but worse. What did he do he was in loans? Not a damn thing. He's useless and everyone sees him as dumb, except Wigg who will use anyone even someon dumb like Jospeh to get the new business. Most loan applications are being denied and AVPs have gotten ridiculos goals of over $75,000 a month.

It sounds like a miserable place to work.

Wigg are you going to fire the AVP's if they don't meet their goals. What's good for the goose is good for the gander.Wigg when will you get it these are not the people that can go out and get you business people don't like them and never will they have never gotten you businees and you are stupid to think they can suddenly go out and save your ass lol.

Two years ago I started reading this blog and at first thought it was some bitter employee. Then I read the monthlies and other documents and everything pointed to a real problem. Still, the credit union didn't go under and when I spoke to a relative of one of the board members, he told me that business was doing really good and that Charles had made improvements and that the bloggers were people who were trying to make the credit union look bad. It seemed a little much energy for one or more people to spend trying to make an obscure credit union look bad. It didn't make sense. Losing the branches was the first real big thing that pointed to a problem with how old man Wiggington runs the place. In the industry we don't see as Priority One offering anything, certainly nothing if they intend to sell and forcing a merger might save some part of the credit union though you can bet that any merger will mean the end of Wiggington and his executives. No more high salaries that haven't been earned and no more wasting time trying to back stab staff and lying. Its the bed he and the board made and now it looks like they're going to sleep in it. Good night, Wiggington.

As account holders and part OWNERS of the CU how cn we rally together and get a petition going to get Wigg out of P1?

I will check with the DFI. This horrible President who would be an embarrassment in any industry and the ignorant board, under unethical, Diedra Harris-Brooks are the reason the credit union has lost business, is unable to get business, has lost good employees, has lost branches and will probably not survive another year.

Wigg may have to let some or all of the AVPs go so that he can try and keep the doors open, though how many doors, is hard to say. They closed Riverside, Redlands, and Valencia. They're about to close Burbank. Airport is small and makes little money but they pay $1 a year for the space. Santa Clarita is new and the other day Wigg said its not making enough money to keep it open full time. They won't close that office because they only pay $1 a year for it, but if the Santa Clarita processing plant closes you can say good bye to their 2 Santa Clarita offices. Los Angeles has lots of walk-in traffic but its mostly a check cashing office. South Pasadena is a ghost town. The place is horrible, business is slow and worst of all that's where Wigg, Smock, West, Saeid, Esmeralda and Yvonne are. Wigg was extra stupid when he created the AVPs which never accomplished anything. Overpaid and unncessary but he wanted P1 to look like a bank. Now it looks like a bank thats going out of business. Hey, he used work at Security, is he the reason they're not around anymore? And the AVPs and BD and all the staff are not going to be able to save his old tired sick ass. Karma sucks doesn't Wiggy?

Yes we all need to get a petition to get Wigg, Smock, West and all other executives, AVPs and the board out of P1. They are the real reason why P1 is has such little business. These untalented uneducated backstabbing punks need to be kicked to the curb.

I agree with the last comment call dfi and find out how we can kick all their asses out before it's too late. Wigg has to go and the rest of his useless crew.

None of the avp's look to good. Gema is stressing because finally she is being pushed to work and prove that she works. She's always had the knowledge but she's lazier than a dead frog. Lynnette is unhappy that she has to leave her office but bet you she's sneaky enough to find ways of making it look like she's getting apps. Sylvia is the biggest mess of them all. She looks haggy. No make up, she looks like she lost weight and her clothes are wrinkled. She's worried because if they close Burbank and they keep her, she's going to have to drive to Santa Clarita but that's only if they keep her.

Wigg tried to keep the settlement a secret and he hasn't told staff that Burbank is closing though they already know. This is truly a stupid man and board.

Redlands- RIP

Valencia- RIP

Riverside- RIP

Burbank- Closing 5/01/12.

4 down, 3 to go.*

*LAPDC

*Van Nuys

*South Pasadena

Airport & 2 Santa Clarita branches make little money and will fold if the LAPDC, Van Nuys, or South Pasadena close.

The only one that's done well at P1is Linda Nisely. LOL.

The only one that's done well at P1is Linda Nisely. LOL.

So it looks like business is up, Wigg is letting Cindy keep approved applications open for up to 60 days. Approvals are good for only 30 days and if a member tries to get the loan after 30 days, a whole new credit report has to be requested along with pay stubs. The reason is that a person's credit can change in 30 days since creditors reports once every 30 days. Also, current pay stubs are needed because a person could lose their job within the 30 days. The procedure protects the credit union and the member. Its also possible that a member's score could go up and that could get them a better APR. Since we're in February, the applications Cindy is extending were approved in December and January. February has been so bad and so slow and it doesn't look like big mouth Joseph Garcia is able to get new business.Why? Because all he knows how to do is say things like "we've all got to try," "we have to stretch ourselves", "we need the money so go get the sales." He doesn't know a thing about teaching anyone how exactly you go about getting the business. That's probably why Bea Walker got tired of him. She realized after a long time that Joseph is a talker, like Wiggington, and will say anything to look good to management but he knows zero about how to get new business.

Another thing. Has anyone noticed that Burbank has been bad and not producing business for a long, long time even though Sylvia Perez worked out of that branch. Now if Sylvia is all that, then why did that branch never do good? She's another one that tells you how good she is at what she does but looking at Burbank's lack of business, she didn't do a thing to help the branch and that's why they're closing. Of course, Joseph and Sylvia are monsters like Wigg and reflect him and how he does business.

All the warnings Wigg got over the years but he used to say, "no one tells me what to do." So we can pretty much assume that things are bad at priority 1 because Wigg did exactly what he wanted and didn't let anyone tell him what to do. He need to be a man for once in his life and accept that losing branches and lay-off employees always means business isn't good. He also needs to man it up and admit he's the one that failed the credit union, members and all the employees and its because of him, that HR and people like, B Walker, broke the law which caused them to get sued. All fingers point to Wigg.

If they're extending the 30 day period then their playing with eligibility. Don't they have policy that says 30 days is the period a member has to fund an approved loan?

Priority One does have a policy governing loan applications. On 8.3, Credit Report, it says:

"A new credit report is required EACH time a member applies for a loan UNLESS a previous ran credit report is LESS THAN 30 DAYS OLD. The rationale for doing this is that change can occur rapidly, and in addition, the inquiries show us where the member is attempting to get new credit."

The policy was approved by the Board of Directors which means that the Board is allowing the President and the CLO to violate Priority One policy. OBVIOUSLY, they created the clause because according to the CU, "change can occur rapidly." Another example how Charles Wiggington and his staff, violate credit union policy.

Does anyone know if P1 is going to have a liquidation sale and when? I saw a desk I'd like to buy.

NCUA's toll-free line is available 24/7 - consumers may leave a recorded message outside of regular business hours.

You may also request assistance via e-mail at consumerassistance@ncua.gov.

Please be sure to include your contact information, the credit union's name, the state the credit union is located in and the nature of your request.

No one is making their goals. Some of the managers keep talking about all the applications that are in but what they don't say is how many are denied and how many of the approved ones are not getting financed.

Wigg went cut-back crazy and ran out of places. Now he's actually got to get new business but he hasn't done it in 5 years. If he thought he could get it into 2 months then he is crazy stupid.

Couldn't happen to a nicer guy.

Well now that Burbank is out of the bag, watch and see what new tricks Wiggington pulls out of his bag of tricks. He will probably get rid of people who are working at Burbank because they won't be needed and there's no room for them anywhere. Who knows what he do with Sylvia because you sure don't need her for Santa Clarita or Van Nuys. They are too too small. By the same way, you don't need Lynnette or Gema. If he got rid of all of them that's more than $100,000 less a year in salaries plus probably about that for the employees at Burbank. But that doesn't solve his problem with lack of business. Members are starting to talk about the branches closing. They say it shows P1 isn't doing fine which is going to make it impossible for him to prove P1 is a financial fitness center.

Your right. We have members are starting to say they don't trust us because we lost branches and the main branch is depressing and people look unhappy.

I work with Saffold and its true. If you ask him about how the credit union is doing, he says things are good. I don't think he reaizes we're asking about P1.

What's funny (or not) is that Cindy has turned out to be pushy and bad-tempered. She had her desk turned so that she has a whole view of the entire loan department. Joseph never goes out to get new business but he pesters all the branches. He's better at passing out water than getting business. Wednesday he helped cause a big mess. We are supposed to work til 7 pm every Wednesday but homeboy forgot that this past Wednesday was the last day of the month when annuities, deposits and payroll are processed. He had people calling members which interfered with IT's processes and because of his mistake, IT had to stay at work until after midnight. The man never sees the big picture he can only see what's in front of his nose. And I think Cindy might have got the stupid board to change some of the loan policy which is stupid because if they changed the 30 days to 60 days, then their creating the possibility for future problems for member's whose credit score might have dropped.

Joseph's an idiot. Kissing Wigg's ass can get a promotion but doesn't mean you can do the job.

today management bought us food for employee appreciation day. They know we're stressed and tired. I wonder if they're going to announce lay-offs? Anyway, we could have used money more than some food.

today management bought us food for employee appreciation day. They know we're stressed and tired. I wonder if they're going to announce lay-offs? Anyway, we could have used money more than some food.

Food? Why? Appreciation? I think they know employees are m-i-s-e-r-a-b-l-e. And why's Gema working in the call center? Wasn't she supposed to hit the field like all the other avp's?

Food? Why? Appreciation? I think they know employees are m-i-s-e-r-a-b-l-e. And why's Gema working in the call center? Wasn't she supposed to hit the field like all the other avp's?

Its going to take a lot more than "employee appreciation" day to make things better at P1. Wigg and Missy Smock think buying some food will substitute wages, benefits and a good working environment. And they're still not doing a thing to make members feel appreciated. They no longer consider members their first priority and what is their brand? Who are they? The answer is they don't know.

Wigg is also trying to find ways to change eligibility requirements so he can qualify members whose credit score is too low, to be able to get a loan. That's what got our country in trouble 3 years ago but brainiac thinks its a good idea.

Wigg is also trying to find ways to change eligibility requirements so he can qualify members whose credit score is too low, to be able to get a loan. That's what got our country in trouble 3 years ago but brainiac thinks its a good idea.

If he got the board to approve changing eligibility for loans then Wigg is setting up P1 for losses. It could make delinquencies go up. I don't understand him and I sure don't understand what has to be the stupidest board in all credit union land.

What ever happened to the woman who filed sexual harassment?

I think if she wanted to, she could still pursue the matter. If anything, she will make a good witness because she went to Rodger and he didn't do anything plus he witnessesed what happened though Missy is as big a liar as you'll ever meet. Look all the people he helped back-stab.

Did everyone forget about how Wigg let Bea hire Loren Lillestrand to supposedly develop employees? What a waste of money. It was all BS. And if they paid Wigg to develop employees why have Robert West supposedly developing employees which he's not doing because the "man" is as ignorant about HR as Smock and Esmeralda.

I thought Wigg said business was good? He said that at the all staff meeting. How did it go from great to bad. Its going to take a lot more than some food to make things better.

Wigg is a slum lord. He took a great credit union and destroyed it along with the help of Diedra, Rodger, Bea and all the other incompetents. I was at the South Pasadena branch last week and it doesn't have the energy or good feeling it used to have. There was a time the place was comfortable, even homey but not anymore.

Someone from the dfi needs to take a long hard look at P1's books. I don't know how in depth their audits are, but if they conducted a wider deepere audit they would find some suspicious postings. On Feb 29 Priority had about $800,000 in funded loans but on March 1 they reported $1.2 million. How did they end the day with less than the million for the whole month but report more than a million the following day? The answer is easy. Wigg is playing with the numbersw (like what's new?). He's had Cindy not reporting loans financed in Nov and Dec so he could report them in Feb. It makes it look like they're doing great but its dishonest and in the end, they're still doing really bad. The man is so dishonest, he'll do anything to make Priority look like it doing great. If so, they why does he have to close Burbank? Why has he set so many goals? Why does he look like crap? Why does everyone look miserable. This guy buys time and thinks that makes him smart. No, it screws over the credit union and makes him look like the dumb ass he's always been. Someone needs to do a real concise audit of EVERYTHING!!

Someone from the dfi needs to take a long hard look at P1's books. I don't know how in depth their audits are, but if they conducted a wider deepere audit they would find some suspicious postings. On Feb 29 Priority had about $800,000 in funded loans but on March 1 they reported $1.2 million. How did they end the day with less than the million for the whole month but report more than a million the following day? The answer is easy. Wigg is playing with the numbersw (like what's new?). He's had Cindy not reporting loans financed in Nov and Dec so he could report them in Feb. It makes it look like they're doing great but its dishonest and in the end, they're still doing really bad. The man is so dishonest, he'll do anything to make Priority look like it doing great. If so, they why does he have to close Burbank? Why has he set so many goals? Why does he look like crap? Why does everyone look miserable. This guy buys time and thinks that makes him smart. No, it screws over the credit union and makes him look like the dumb ass he's always been. Someone needs to do a real concise audit of EVERYTHING!!

When Cindy got here there was a lot of hype about what she had done and what she was going to do. Sort of reminded me about what they said about Bea and she ended up canned and kicked to the curb. Cindy says things like "good show" and "that's what we need" but I haven't seen her teach one single thing that proves she knows how to get new business. She might know how to process a loan and she might understand real estate loan funding but that's not the same as selling. Same for Joseph but I expect less from him becaue everyone knows he's stupid and nothing more than an overpaid bus boy. And Wigg, Smock and Cindy might have thought that some fried chicken might everyone forget that we're under the gun and morale is shot.

Cindy = Bea

Wigg = shoe

If they are doing bad- which they are, why did they hire a new loan processor for South Pasadena? They have Colleen in the call center who used to be a loan processor and could of been brought back. They had Nidia who was qualified and just quit last week because they took her from real estate loan officer to FSR. What's up?

I think management reads this blog a lot. You read a post and a week later, Wigg is making some change.

Wigg is not reporting loans on the month when they get financed. If an auditor comes in, they should look at the date when the loan was funded and then compare it with the date it was reported. They are going to find that a lot of the loans they supposedly got in February were really processed in December last year. Just check the records.

When I worked at P1 I got to see Wiggington at his worst. I remember how he would go after people based on what his managers told him and nothing else. He's a gossiper and even says horrible things about his son, wife and sister. One time Aaron made up a story about a loan processor and Wiggington immediately wanted her fired. There has to be something wrong with him because you can't do the things he does if you have a conscience. Through the years he back stabbed so many people but he couldn't have done it without the help of Rodger. Rodger is the biggest breaker of policy and that relationship he had with that boy was so inappropriate. He should have been fired. Its no surprise that the credit union is in such a mess with people who bring their personal lives into the work environment.

When Mr Harris was presdient, Charles and Smock broke the rules but they never let Mr. Harris know. Plus Mr Harris worked and only took an hour lunch and usually stayed until 7 p.m. in his office working while Charles gets to work late, takes a 2 to 3 hour lunch, plays on the internet, talkes to his friends and family on the phone, opens his personal emails, plays on the internet and leaves at 5. One worked and the other steals fromt the credit union.

When Mr Harris was presdient, Charles and Smock broke the rules but they never let Mr. Harris know. Plus Mr Harris worked and only took an hour lunch and usually stayed until 7 p.m. in his office working while Charles gets to work late, takes a 2 to 3 hour lunch, plays on the internet, talkes to his friends and family on the phone, opens his personal emails, plays on the internet and leaves at 5. One worked and the other steals fromt the credit union.

When Mr Harris was presdient, Charles and Smock broke the rules but they never let Mr. Harris know. Plus Mr Harris worked and only took an hour lunch and usually stayed until 7 p.m. in his office working while Charles gets to work late, takes a 2 to 3 hour lunch, plays on the internet, talkes to his friends and family on the phone, opens his personal emails, plays on the internet and leaves at 5. One worked and the other steals fromt the credit union.

Do anything get better at priority.

The CU doesn't treat members with respect. If you walk by credit resolutions you can hear the horrible way Crystal and Naeyra talk to members. They take everything so personal. Alex Suarez is now the supervisor because Yvonne is now over member service. Alex cheers themm on when they are mean. Members shouldn't be treated like that. If they are having financial problems they should still get respect. I think members should complain to the dfi or whoever it is that will investigate P1.

So many members who end up in collections complain about the horrible people in collections and there are lot of complaints from people who used to visit the main branch. They say the employees look miserable and are unhelpful. Wigg can try to blame everyone but it reflects him. He doesn't talk to members and refuses to even let employees visit his office, why would anyone think he could care about service?

As being an ex-employee myself and I do have loans with this shitty c.u. I WOULD DARE ANYONE FROM CREDIT RESOLUTIONS WHETHER IT BE CHRYSTAL NAYIRA OR ALEX TO TALK TO ME WITH DISRESPECT !!!!

BEST BELIEVE THEY WOULD'NT KNOW WHAT HIT THEM!!!...TRUST ME

Yes life at POCU is not what it was once upon a time. I don’t know of a single person who is happy at work. Well maybe only the overpaid evil ones who think they can get into everyone’s business and believe they are the new CEO. As we all know today POCU was celebrating Godzilla’s birthday. So how are everyones lips feeling after all that boutte sucking? It is sad to say that everything that was done for her wasn’t because her employees love/respect/admire her, it was because they really did not have an option. She is the bitch “Boss”. Isn’t it just sad… Start pulling out your business cards and start looking for jobs people. Things will be going down the hill from here on. Branches will close, good employees will be fired, friends of the “evil” be hired? new cubicles will be set.

"Yes life at POCU is not what it was once upon a time." Ain't that the truth. Word of advice to any member who feels Alex, Naira/Naeyra, or Crystal have mistreated them or abused them, contact the Office of the State Attorney General in California. They will investigate. Report them to the BBB so they can go on record. These people are vultures, preying on members who have hit bad times. They work for a lousy credit union that's going downhill which would make you think that maybe they would try to be more respectful. They can say good-bye to Burbank and lucky for them, they only pay $1 a year for Van Nuys, L.A., and Santa Clarita which means South Pasadena is costing money they really can't afford.

Godzilla? Some of us know her as Big Foot. Employees are so scared of losing their jobs they'll kiss Godzilla's or Wigg's butts. Great environment. Wigg created a work place where people are afraid so even if they think you suck, they'll celebrate your birthday just so they don't have a hizzy fit. Good advice, start looking for new jobs.

Its amazing, they put all these goals but you don't see Smock (who is not HR anymore) or Wigg or even Joseph Garcia, in the field. Joseph throws out orders but doesn't do anything else. They don't believe in setting examples because they can't.

Rodger is not HR anymore? Who is in charge of hr now?

Robert West is over HR since June 2010. In 2011, they changed the department name to Employee Development. It's no longer human resources. West is Director and Esmeralda is Manager.

Smock serves as the unofficial advisor. A memo siad he wasn't over HR anymore but when they have HR/Employee Development issues, he's in the meetings with West and Esmeralda. Smock also doesn't supervise Business Development anymore. They gave that to Joseph Garcia.

What does Smock do? No one knows and Wigg keeps it a secret. If you watch Rodger, he spends most of his day in his office, a lot of the time with the door closed. He cuts and passes out coupons but he's really not a part of the operation. He's still Senior VP but over what? Wigg keeps that a secret.

Maybe the board or lawyers told Wigg to remove Rodger over HR. Think about it. When he was the director he let Gema and Georgina get away with having employees clock them in. The employee handbooks says thats fraud. He also was there when Wigg sexually harassed Kim. He would laugh and when there were complaints about it, he didn't do a thing even though it was a federal offense. He helped Bea make up stories that got so many employees fired plus he helped Wigg harass and then layoff the marketing director. He's covered up, broke policy, and been the reason why Wigg broke so many laws. He's also a reason why they got sued. People used to think he was nice but he is a coward who never even protected employees. He also sucked at benefits. He never shopped around for affordable insurance for employees. He used his old broker that he dealed with for years, that's why employees pay so much for so little. I was told he got fired from Superior Industries where he worked in HR. Don't know the reasons but it would be interesting to know if it had to do with not doing his job well.

Wigg knows that he couldn't have 3 people in HR or whatever its called. The company is so much smaller than it used to be. When it was bigger, it was Smock and Esmeralda. Now that they have a lot less branches, you can have Smock, West and Esme in the department. Changing the department name right after they got sued is so suspicious. Employee Development gives the impression they are developing employee careers but if you work there, they never help improve any body's career. They probably had some expensive consultant tell them to change the name so it looked, like they are really on the ball.

Their legal and consultant fees on their monthlies should be audited. Bet they didn't spend all that huge amount of money on consultants but I bet their spending a sh*t load on lawyers thanks to Wigg and Smock.

Wigg never could of succeeded without diedra or smock. Hope they're really happy with the mess they've made.

The cars for a lot of auto loans are in bad condition because delinquent members can't afford to keep them up. If Naeyra/Naira/Numskull, Crystal (who is related to Wiggington by marriage and should have been fired the first time she got caught having other employees clock her in), or Alex (who looks like a drag queen) call, tell them to pick-up the car. That'll stop them from calling and treating members like crap. Repossession is not a win for any credit union. You would think they'd know that. If they were nice to members and worked out reasonable plans or understood that if the member is broke, paying the car note is not a priority. They forget people have to eat, pay rent, etc.

They do know that repossessions are a loss. They like to threaten but they don't want to pick-up vehicles because it costs to file, pay for someone to pick up the auto, then send it off to auction. Loss, loss, loss.

Stupid Joseph has had mandatory meetings on Mondays to see how the avp's and bd people are doing. He's finding out that goals aren't being met and most loan apps are denied. Maybe he should take the time and teach people how to get new business. He says be "nice" to members but he's not nice to employees. He says "let's go out there and bring in loans" but he doesn't know how. So stupid.

You could tell their trying to hard. We celebrated Yvonne Booty's birthday. The idiot supervisor of collections, Alex, and two-faced Cindy Garvin insisted we all bring food and donate money. The only reason people donated and brought food is because everybody's scared of losing their jobs not because anyone cares for backstabber, Yvonne, who just last year was Bea's best friend until they back stabbed each other. OBVIOUSLY the credit union is doing bad because Wigg didn't pay for the lunch. Its pathetic when you're so scared you might lose your job if you don't put in money and food to celebrate someone as horrible as Yvonne.

Whatever happened to Patti Loiacano? She used to like getting attention but its like she's invisible. No one writes about her anymore. Is she still employed? Is she still an avp?

Patti Loiacano is still there. Still unpopular but quieter.

Patti Loiacano is still there. Still unpopular but quieter.

Their worried. Really worried. I think its because business is still bad, goals are not being met and Wigg's not to happy that it got out Burbank is closing. Well, that could change if the new tenants decide not to take the place.