IT’S A DOMINO EFFECT

Almost incredibly, during the month of July, Priority One Credit Union’s collection attorney, Bruce P. Needleman* became the recipient of a counter-lawsuit from a member, alleging that an officer or officers of the credit union knowingly violated the credit union’s policy governing confidentiality and the Privacy Act.

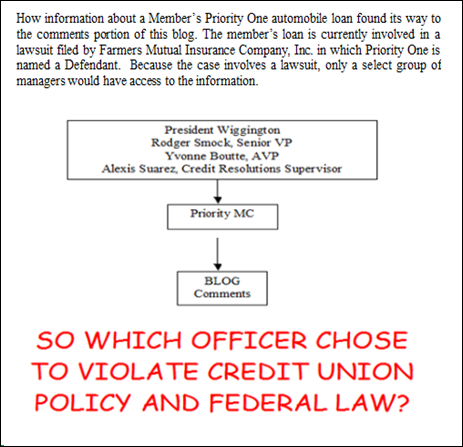

The violation was committed by a poster using the handle, Priority MC, who published comments in response to our May post, publicly divulging information about the member’s credit union automobile loan. As disclosed in our previous post, the member’s loan is currently the subject of collection proceedings and of a lawsuit filed by Farmers Mutual Insurance Company, Inc. Though the statements posted by Priority MC disclosed confidential account formation, they also included distortions of the truth, making the comments both libelous and a violation of the Privacy Act. Because the disclosures are quite specific, the information could only have been gotten and/or published by an officer of the credit union. The list of officers who would have had knowledge of the account is short and shown below:

- Charles R. Wiggington, Sr., President and CEO

- Yvonne Boutte, Assistant Vice President of Support Services

- Alex Suarez, Supervisor of Credit Resolutions

- Rodger Smock, Executive Vice President

What we find inexplicable is why any officer of the troubled and scandal-ridden credit union would consciously commit acts exacerbating Priority One’s legal problems. To date, and in less than a two-year period, Priority One has been named Defendant and now co-Defendant in the following lawsuits:

- The 2010 lawsuit filed by the former Burbank Branch Manager.

- The 2011 lawsuit filed by a former Business Development Representative.

- The 2012 lawsuit filed by the former Valencia Branch Manager.

- The 2012 lawsuit filed by Farmers Mutual Automobile Insurance Company, Inc.

Though the credit union’s ability to acquire new business is faltering, the President and some his managers have found the time to continue defying policies and laws, leaving the credit union vulnerable to lawsuits. In view of the latest lawsuit, it is difficult to believe Priority One is a “financial fitness center” capable of helping members and employees “win with money”.

One might have thought, the President and his lackeys would have chosen to focus their sights on the development of new strategies designed to produce growth rather than attract more lawsuits. Erasure of Credit Union’s presence throughout all of Riverside County and the loss of the Redlands, Riverside, Valencia and Burbank branches have crippled the credit union’s ability to sell its financial products and services while reduced staff size is compromising Priority One’s ability to dispense quality member service. Wisdom dictates that after compiling an extensive and well-documented record of debacles, the President and his pack might have opted to don a more discreet persona and one which at least mimics professionalism. Not so for President Wiggington who in 2008, declared, “No one tells me what to do!” Obviously, no one does.

THIS POST

This post is dedicated to Priority One’s infamous and ethically devoid Board Chair, Diedra Harris-Brooks, and monocrat, AVP of Support Services, Yvonne Boutte.

This post is also shorter than our last several posts though not because we lack information (actually we have too much information) but because we’ve chosen to reduce the scope of this month’s publication. After reading this post, you may be left asking, “Where would Priority One be today, if Mrs. Harris-Brooks had never been elected to the post of Chairperson?” Mrs. Harris-Brooks contributions as Chairperson of the Board are best attested to by Priority One’s:

- Reduced size.

- Employee lay-offs.

- Inability to acquire new business.

- Internal discord.

- Decimation of employee morale.

- Three employee lawsuits citing an array of heinous acts and abuses.

Mrs. Harris-Brooks’ competency is also attested to in the manner she chooses to resolve problems created by President Charles R. Wiggington, Sr. Her usual objective when faced with a cascade of evidence proving violations of policies and laws committed by the President, is to find whatever means is necessary to squash the evidence. The President’s disastrous five-year performance, marred by blunders, abuses and scandals have inexplicably, failed to realize his ouster. In fact, Mrs. Harris-Brooks remains Charles R. Wiggington’s most avid and greatest defender. Thanks to her complete lack of leadership skills coupled by her dishonest tendencies, Mrs. Harris-Brooks has helped leave Priority One a weaker and less effective credit union.

We are also including excerpts from the member’s lawsuit which describes, in part, the member’s conversations with Mrs. Harris-Brooks. The Chairperson’s responses serve to show she is disinterested or maybe even incapable, of initiating proactive measures to resolve issues, even those which threaten to escalate into lawsuits. Quite frankly, after five years of observing Mrs. Brooks behaviors, we know she lacks the professional acumen and abilities, to enact proactive measures to resolve the issues created by the credit union’s managers.

The member’s lawsuit differs from those filed by three former employees in that it specifically targets Chairperson Diedra Harris-Brooks and the Board of Directors, asserting that over the past five years, they failed to initiate existent safeguards as described under credit union policy, when ensure protection of member account information. Furthermore, when the existent safeguards failed to protect member information, neither Mrs. Harris-Brooks or the Board felt impelled to develop new safeguards which would have protected member information. The excerpts from the lawsuit may leave you asking, “Why would I ever wish to open an account at Priority One Credit Union?”

The phenomena of employee lawsuits filed in the past year and a half, is an unprecedented development in Priority One’s long history and a backlash to the years of abuses committed by and under, Charles R. Wiggington, Sr. Evidently, Mr. Wiggington and some of his executive staff have redefined what it means to be an “executive.” Their well-documented history of abuses beginning on January 1, 2007 (the date Charles R. Wiggington, Sr. became President) suggests that within Priority One, the word “executive” is merely a title that should never be construed to imply professionalism, competency, or adherence to ethics.

We’ve also added two lists of links, located to the right of our post. Under the section, titled “What Charles R. Wiggington, Sr. has to say about Himself”, we provide links to websites containing the President’s embellished biography, which began to appear throughout the Internet, several months ago. Clearly, the President is trying to remedy his reputation and may want to deter attention from his disastrous performance. The President’s “bio” omits reference to the $20 million loan borrowed in 2008, from the credit union’s line-of-credit and which until recently, cost the credit union approximately $30,000.00 per month in interest alone. He also fails to reference closure of four branches since October 2010, employee lay-offs, elimination of critical budgets used to promote the credit union’s name, services, and products. There is also the matter of three employee lawsuits. Mr. Wiggington may not have realized that presenting an inaccurate portrayal of his abilities doesn’t dispel the fact that since he became President, Priority One has experienced ongoing decline.

The second list, under the heading, “What Do Others Say About Priority One” contains links posted by members describing their real-life experiences with the troubled credit union including the avoidable “2007 mailing fiasco” which occurred when the President refused to adhere to security measures established and maintained by his honorable predecessor. Realizing the President views himself through rose colored lenses, we suggest it’s time for an eye exam.

MORE TROUBLE?

IS THERE A FOURTH EMPLOYEE LAWSUIT?

For the past few months, there’s been a rumor, circulating that a former Burbank FSR filed a lawsuit against Priority One alleging harassment committed by AVP of Region 3, Sylvia Perez. In July, we received an email advising us of the lawsuit and we recently read the comment posted by “Priority MC”, alleging filing of a lawsuit by the former FSR.

Aside from the post and email, we have no corroborating evidence that an actual lawsuit was filed, though we are investigating. If true, this would constitute the fourth employee lawsuit filed against Priority One in less than two years. The former employee, once worked under supervision of former Burbank Branch Manager, Linda Nisely. Though highly knowledgeable in banking procedures and ATM management, the FSR was known to be rude to members, many of who lodged complaints citing her rude and abusive attitude.

The FSR was openly disliked by Mrs. Perez, who on several occasions, described the FSR as “difficult”, “insubordinate”, and “not a team player.” In 2009 and 2010, Mrs. Perez often complained to Senior Vice President, Rodger Smock about the FSR, requesting he transfer the employee to another branch. Perturbed, Mrs. Perez would periodically and quite publicly exclaim that she needed someone who followed instruction though we believe what she wanted, was a person who obeyed her explicitly. During one of her erratic and very public mood swings, Mrs.. Perez told the FSR that she should find employment with some other company. The disparagement of the FSR continued for many months until the FSR left the credit union on a medical leave of absence. Eventually, her employment was terminated by the Credit Union relegating the FSR to the world of the unemployed.

Irrelevant of the final outcome, a fourth employee lawsuit would further adulterate the credit union’s reputation which would in turn, impede its ability to sell what they offer. Certainly, the President’s insistence that lawsuits are being filed by disgruntled employees who want to “get money from us” sounds more like the death throes of a desperate man hoping to convince others that all is well at a credit union struggling to regain momentum. After three employee lawsuits and one from a member, alleging violations of federal law, can’t deemed mere coincidence. What’s more, why would any attorney agree to represent an employee if there weren’t some evidentiary foundation validating their accusations of wrongdoing?

LIVING IN A BUBBLE

We are more than a little perplexed by the noticeable absence of the Supervisory Committee who has chosen to remain quiet if not invisible during the past five years.

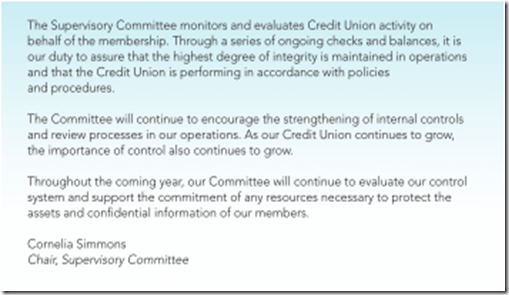

The Committee is ultimately responsible to ensure safeguards are maintained, updated, and implemented which protect member information and assets. Year after year and as shown below, Supervisory Committee Chair, Cornelia Simmons, publishes the same old stale statement in the credit union’s Annual Report, assuring members that the Committee has monitored and evaluated Priority One’s activities.” Though what she describes as “ongoing checks and balances” allegedly performed by the committee to assure “the highest degree of integrity” is maintained in “operations” and “in accordance with policies and procedures” we see nothing that attests to a high degree of in integrity in operations. The violations of confidentiality openly committed by and under the President over the past five years and now, four lawsuits, more than infers that the committee’s system of checks and balances is in dire need of an over-haul while the “degree of integrity” alleged by Ms. Simmons is non-existent.

In her address, contained in the 2011 Annual Report, Ms. Simmons assures that the Committee’s efforts are intended to strengthen internal controls, concluding that in the committee’s opinion, the “Credit Union will” continue to grow. Has Ms. Simmons noticed Priority One is much smaller in size than it was in mid-2010? Does she even realize that four branches have been closed since October 2010? In fact, at the time the 2011 Annual Report was distributed, the credit union was preparing to close the doors to its Burbank office.

Ms. Simmons ends her address by stating the Committee will continue its evaluation of its own “control system” and is committed to utilize all resources which “protect assets and confidential information of our members.” So is the latest lawsuit, alleging violation of the Privacy Act, an example of the Committee’s finely tuned oversight and of their commitment to protect confidential information?

Over the past five years, the Committee has intentionally distanced itself from the credit union’s problems and scandals, their presence hidden from employee and member view. Based solely on Ms. Simmons’ address, the Committee may be living in denial, hoping exposure of the President’s chronic violation of policies and laws will miraculously go away. Ms. Simmons’ address which ignores branch closures, may suggest she doesn’t actually comprehend the significance of what she states in her address. She also seems sorely out-of-touch. We suggest she amend or all together replace the template containing her annual address. Maybe she can begin all future addresses by stating, According to our extremely limited understanding….”

TRACKING THE EVIDENCE

All evidence regarding the latest lawsuit, points to management as the perpetrator, but this is hardly news. As we’ve reported over the past three and a half years, the policies governing confidentiality have consistently been violated by President Wiggington and some of his managerial sector. The comments posted by Priority MC on this blog in response to our April and May postings contained information which could only originated from the offices of their legal counsel. What’s more, the attorneys would only have disclosed the confidential information to either Diedra Harris-Brooks or President Wiggington. It is more than likely that the President was the recipient of the information which he then dispensed to members of his executive staff. After doing so, the information was published by Priority MC. It’s neither conjecture nor a theory as all roads lead back to the President.

There are only a few managers who have access to member accounts involved in litigation. No matter how much Diedra Harris-Brooks denies management involvement in violations of policies and laws, the comments published by Priority MC could only have originated from the executive sector.

Priority MC is someone who had intimate knowledge about the member’s automobile loan. Because the loan was subject to collection proceedings, the number of employees privy to the account is further reduced. However, because the account is now subject to a filed this past January by Farmers Mutual Automobile Insurance Company, the number of employees having access to the account’s information would have been limited to officers of the credit union.

Priority MC also possessed intimate knowledge about the details contained in the second lawsuit filed by a former Business Development Representative. The only persons who should have knowledge of the case are Board Chair, Diedra Harris-Brooks, President Wiggington and Executive Vice President, Rodger Smock, unless one of them chose to further violate policy by disclosing the confidential information involving the second lawsuit and its settlement, to unauthorized personnel.

Instead of wasting years suppressing evidence of wrongdoing committed by management, Mrs. Harris-Brooks should have spent time shoring up breaches of confidentiality committed by the executive sector and done everything in her power to ensure safeguards were implemented. She also should have insisted that disciplinary action be taken whenever an officer was found guilty of violating credit union policy and state and federal laws. At the end of the day, Mrs. Harris-Brooks and the entire Board are culpable for failing to ensure the privacy and confidentiality of member information.

Of course, the latest violation of policy is merely a by-product of an internal system of operation which stands in shambles and which allows President Wiggington to freely abuse policies and ignore laws. Because Diedra Harris-Brooks has proven time and time again, that she is incapable of conducting fair and objective investigations, she should have authorized hiring of an outside firm to monitor management’s adherence to state and federal laws. A contracted third party could also have conducted unbiased investigations and recommended terminations when justified by a preponderance of evidence. Of course, we know the Chairperson would never have authorized hiring of third party to monitor adherence to policies, because this may have resulted in transparency and forced the Board’s own adherence to policies and laws and required she conduct herself in a manner that is above reproach.

Current Record of Verified Lawsuits Filed Against Priority One Credit Union

CAUGHT UNAWARE

On Friday, June 22nd, Board Chair, Diedra Harris-Brooks was contacted by phone, by a concerned member who informed the Chairperson, that an employee of the credit union had posted slanderous statements about the member’s automobile loan in the comments section of this blog. The member also told the Chairperson that the posting constituted a violation of the Privacy Act and that the comments were untrue and thus libelous.

Mrs. Harris-Brooks empathized with the member, admitting that over the past “five years” she attempted to remove all references to her name from this blog, but her requests had been denied by Google.com. Mrs. Harris-Brooks’ statements suggest she is profoundly daft and should never be allowed to answer calls from members. Her responses bring into question her competency as Chairperson of the credit union’s Board of Directors.

In her replies, Mrs. Harris admits she and the Board have been aware that over the past “five years”, unnamed “employees” of the credit union have successfully violated the credit union’s policy governing confidentiality and the statutes underlying the Privacy Act. So why hasn’t she and the Board, implemented safeguards described in Credit Union Policy which ensure protection of member information? If they did and these failed, then what new safeguards did the Board create and implement to ensure member information is protected?

One reason why Mrs. Harris-Brooks and the Board may have avoided enforcing existent policies or refused to develop new and better policies is that she and the entire Board know too well that over the past five years, the biggest violator of confidentiality has been President Charles R. Wiggington, Sr. and some members of his executive staff. It is also a well-known fact, that whenever a management representative was found guilty of violating policies and laws, the Board refused to order disciplinary action.

- In 2007, former Director, Dave Davidson, received an anonymous letter, advising him that AVP, Liz Campos, had incurred approximately 40 NSF incidents between a two-month period. Mrs. Campos had been handpicked by President Wiggington, to serve as one of his newly appointed AVP's. One would reasonably assume that at the time he selected her for promotion, that he had already conducted all necessary checks needed to validate that she was fully qualified to serve in her new capacity. Mr. Davidson delivered the letter to then credit union attorney, William Adler. The attorney contacted Diedra Harris-Brooks and President Wiggington and strongly suggested, an investigation be conducted.

- The investigation disclosed that Mrs. Campos had been kiting- a federal offense, using checking accounts opened at three separate financial institutions. Mr. Adler ordered her termination, though the President would later complain and declare Mrs. Campos should not have been fired, despite having violated federal law. He also told the Card Specialist Supervisor while in the presence of the Consumer Loan staff, that the letter had been written by the former Marketing Director. The President was again wrong in his conclusion.

- Upon learning that an investigation was to be conducted, the President removed all documents from Mrs. Campos file, showing he approved the reversal of all 40 NSF fees. He also told the auditor that the reversals had erroneously been performed by the Member Services Department.

- The compulsively corrupt Mrs. Harris-Brooks chastised Mr. Davidson during a Board meeting, warning him that should he again receive information alleging wrong doing by a manager, that he provide the evidence to the Board who would derive a decision without involving the credit union’s attorneys. Mrs. Harris-Brooks may have struck her head against a blunt object and in her confusion believed she was a real-life licensed attorney who possessed the ability to litigate matters involving violations of federal law.

- In 2008, Mrs. Harris-Brooks suppressed evidence obtained during a 2008 investigation which proved President Wiggington sexually harassed a former employee. Based on her history of squashing evidence, we know she cannot be trusted to rectify wrongdoing committed by the President and his executive staff.

- Following conclusion of the investigation, Mrs. Harris-Brooks issued a letter stating that “sexual harassment” as defined by federal law, had not occurred. The employee then responded by filing a complaint with the Department of Fair Employment and Housing. The Board responded by first offering the employee $20,000.00 to settle her case. When she declined, the Board extended an offer in the amount of $40,000.00. This hardly bodes well for Mrs. Harris-Brooks who had concluded that sexual harassment had not occurred.

- At the end of 2009, Mrs. Harris-Brooks and the President entered into a conspiracy which disrupted the credit union’s annual electoral process. The two posted announcement of the upcoming election which includes inviting members to submit their names as nominees to run for a seat on the Board and/or Supervisory Committee. Mrs. Harris-Brooks and the President chose to limit publication of the notice to newsletters only sent to members who have a checking account and thus excluded mailing of the notice to the vast number of members who only have a savings account.

- Following our exposure of her malicious disruption of the election, the Board and Supervisory Committee convened in South Pasadena and decided to hold new elections all of which incurred a loss of money to the credit union who had to reprint ballots and mail these to all members in good standing.

Under Mrs. Harris-Brooks the enforcement of disciplinary actions against members of the executive sector has been ignored and consistently influenced by favoritism and politics. Furthermore, Mrs. Harris-Brooks has participated in covering up evidence of wrong doing and as occurred in the 2009 electoral process, willingly attempted to subvert the sanctity of the process all in an effort to preserve the almost all Black board who are subservient to her every whim and wish.

Here are excerpts from the latest complaint:

ALLEGATIONS AGAINST PRIORITY ONE

MORE ALLEGATIONS

LIBEL BORN OUT OF MALICE

Undoubtedly, Diedra Harris-Brooks lacks the abilities needed to respond intelligently to member complaints which threaten to escalate into a lawsuit. During her conversation with the member, Mrs. Harris-Brooks made disclosures which were inappropriate. She also failed to derive a single solution to resolve the member’s complaint. This of course leaves us wondering why she remains Chairperson of the Board.

The latest lawsuit alleging libel, was borne out of a desire by an officer of the credit union to publicly disparage the former employee who filed the second lawsuit against Priority One. The information published by Priority MC in response to our April post, could only have originated from the offices of the credit union’s attorneys. The comments specifically stated the former employee’s lawsuit had been “crushed” and that his attorney had resigned. The information originated from the offices of Priority One’s legal counsel was provided to the credit union and President Wiggington. It was the President who afterwards disclosed the information to a member(s) of his managerial staff.

In 2010, we published the reasons the employee filing the second lawsuit, was terminated. In June 2010, the President and an investigator called the employee into a private meeting inside the President’s office. During the meeting, the employee was informed he was being terminated though neither the Director of Human Resources, Rodger Smock, or then Human Resources “clerk”, Esmeralda Sandoval, were present. Their exclusion in the meeting was purposely planned by the President, who chose to perpetrate a plan leveling false charges against the employee. During the meeting, the investigator, who refused to disclose his name, and who was not an employee of the credit union, informed the employee he was being terminated for the reasons that he was found to-

- Be the blogger; a blogger; or providing the blogger(s) with confidential credit union information.

- Have downloaded same-sex pornographic images from his credit union PC.

- Have sexually harassed co-workers.

If we didn’t know better, we would have thought the investigator was describing the President who in 2008 was found of having sexually harassing a former employee; or describing one of the President’s male managers, some of who have been known to frequent pornographic websites while at work.

The preposterous attempt by the President to disparage an employee was easily dispelled by the fact that Priority One has firewalls in place which impede all employees except managers of being able to access pornographic websites. The President may suffer from psychological projection and may believe others choose to behave as he does. The allegations leveled by the credit union may have lacked substance because earlier this year, the credit union through its attorneys, offered to settle the former employee’s claim against the credit union.

Following issuance of the settlement payment, Priority MC posted again, stating that the amount of the settlement was small and the former employee would have fared far better if he had worked on a part-time basis for Burger King. Who else but Priority One’s management would know if the amount of the settlement? Priority MC’s statement proved to be yet another breach of confidentiality and may also have been a violation of the settlement agreement entered into by the former employee and the credit union. And once again, the amount of the settlement could only have originated from the office’s of Priority One’s legal counsel and trickling its way down through the credit union via President Wiggington.

In an effort to rescind the postings, Priority MC posted a comment that the statements about the employee were not directed at the blogger or bloggers but were rather about a member who allegedly sued the credit union and “ran off” with her automobile apparently being financed by Priority One. It is the very specific disclosures about the member’s Priority One loan that now constitute a violation of the Privacy Act. Sir Walter Scott was absolutely correct when he wrote, “'Oh what a tangled web we weave when first we practice to deceive.” Of course, we expect Mrs. Harris-Brooks and her stoolie, the President, to resort to their usual tactics which include denying wrongdoing , hoping to place blame on some unsuspecting employee, and raising some droll excuse that the violation of law was probably caused by a ghost. Mrs. Harris-Brooks will also take whatever evidence is found and bury it in her backyard.

WHATTTTT?

Indubitably Mrs. Harris-Brooks is ill-equipped to respond to problems and challenges in general, much less incidents threatening a lawsuit. Still, despite her obvious limitations, Mrs. Harris-Brooks has always found it appropriate to meddle, we mean, intervene when complaints are reported directly to her. Her involvement is however, not motivated by seeking a fair resolution but always, an attempt to personally squash complaints. After the filing of three lawsuits, all by former employees, Mrs. Harris-Brooks may find herself pushed to the limit, making it imperative she try and deflect the potential filings of even more complaints. Though as we’ve shown, her bungling of the latest complaint, filed by a member, may have actually resulted in the filing of the newest lawsuit. Furthermore, the allegations contained in the member’s complaint, echoes the allegations contained in the first, second, and third lawsuits.

Mrs. Harris-Brooks uncontested rulership over the Board, beginning in 2006, seems to have imbued her with the confidence that she has a right to suppress evidence, subvert ethics, and raise obstacles that might serve to impede public exposure of the acts and failures committed by and under President Wiggington.

In 2007, the credit union mailed ballots to members, though erroneously, the exterior of the envelopes contained member Priority One account numbers and Social Security numbers. The Board ordered the President to conduct an investigation and ordered termination of the employee or employees who committed the error resulting in the exposure of confidential member information. The error occurred because the President refused to review a sample batch of envelopes that had been prepared for mailing. The procedure had been established by his predecessor, William Harris, and served to prevent errors or as what occurred in 2007, avoid the disclosure of confidential information. Though the President was asked to review a sample batch of envelopes contained the ballots, but he replied, “I’m the President, I don’t do that!”

When the mistake was made public, the Board ordered the President to conduct and investigation and to terminate the employee who committed the breach. Despite having ignored protocols ensuring the safety of confidential information, the President found a victim in the then IT Supervisor. Though the Board demanded the manager’s termination, the President convinced them that they should only order suspension. The President would later tell the manager that he personally fought to keep the manager from being terminated when in actuality, he used the manager as a scapegoat. Mrs. Harris-Brooks was well aware of the President’s deceitful ploy and Mrs. Harris-Brooks knew that the President’s failure should have resulted in his immediate expulsion.

Mrs. Harris-Brooks insists on discussing matters which fall far outside her scope of authority and knowledge. This, by the way, is the same Chairperson who in 2011, assured Consumer Loan Processor, Patricia Lopez, that she would personally conduct an investigation as to why, Mrs. Lopez was laid-off and even assured the former employee that her employment would be reinstated. In that incident, Mrs. Harris-Brooks chose to act in the capacity of a Human Resources Director. Obviously, it never occurred to Mrs. Harris-Brooks that she might have chosen to refer the member to the credit union’s attorneys, because….

- The member’s automobile loan is the subject of collection proceedings; and

- Because the member and the credit union have been named co-Defendants in a lawsuit filed by Farmer’s Mutual Automobile Insurance Company, Inc.;

- And because the member had threatened to file a lawsuit alleging violation of the Privacy Act and libel committed by officers of the credit union.

It is possible Mrs. Harris-Brooks was simply caught in stupor which forced her to expound upon a subject she has no business interfering in? Here are additional facts we know of:

- The lawsuit makes reference to a “settlement”, possibly offered by the member, which Mrs. Harris-Brooks agreed to consider.

- Following the conversation with the member, Mrs. Harris-Brooks never documented what she had been told by the member.

- Mrs. Harris-Brooks is aware that the credit union has again, refused to abide to the terms and conditions stipulated under the Privacy Act.

- Mrs. Harris-Brooks is completely unqualified to analyze and evaluate incidents involved in, or threatening litigation in a court of law.

- Mrs. Harris-Brooks did not conduct research of credit union policies and state and federal laws, to ascertain the credit union’s legal position with regards to the latest allegations of wrongdoing committed by the credit union.

Mrs. Harris-Brooks may be suffering from the effects caused by the credit union’s dizzying and erratic legal problems which might explain some of her dim-witted replies and false assurances made to the member during their conversation on June 22nd, June 23rd, and again, on July 13th. We are also perplexed by Mrs. Harris-Brooks statement that breaches of confidentiality have been ongoing for the past five years. This blog came into inception in January 2009, which is approximately three and a half years ago. So was Mrs. Harris-Brooks referring to breaches of confidentiality which may have occurred prior to the inception of this blog? What are the breaches she referred to and were these breaches committed by President Wiggington? Mrs. Harris-Brooks also failed to inform the member that in 2009, President Wiggington and former CFO, Manny Gaitmaitan, conferred with the credit union’s former attorney, William Adler, for the purpose of finding a way to “shut down the blog” but were told they could not do so because the information provided here, is verifiable and true and is covered under the first amendment.

We believe that another reason for Mrs.. Harris-Brooks’ tremendous exasperation is that she knows that the information presented on this blog is true and unlike her efforts and those of the President, we never have to fabricate facts. Mrs. Harris-Brooks is also aware that in 2007 through February 2008, President Wiggington spent as much as two each day, lounging on a loveseat in the Consumer Loan Department, boasting loudly to the Card Services Supervisor about the employees he intended to terminate and publicly divulging the reason, other employees had been fired. Some of people whose names he disclosed publicly, included:

- The former Marketing Director.

- The then Branch Manager and current AVP of the Los Angeles branch.

- A former Card Services Specialist who was later promoted to Lead Teller at the Los Angeles branch and eventually terminated because the President was informed that she may criticized his management of the credit union.

The problem Priority One is currently faced with is that the comments published by Priority MC point to management as the violator of confidentiality. Priority MC’s confirm that some managers of the credit union refuse to abide to policies and laws. It also shows that Mrs. Harris-Brooks as Chairperson of the Board, has no control over the breaches of confidentiality committed by management and confirms the gross inability or refusal by the Board, to enforce safeguards designed to protect member data along with their apparent inability to develop and implement improved protocols protecting confidentiality.

So why would the Chairperson admit to her failure? We chalk that up to plain old fashion incompetence by a woman who has openly and freely violated credit union policies, covered up wrong doing, suppressed evidence proving violations of state and federal laws and who has done everything in her power, to retain the President’s employment, despite his long history of abuses and failures.

Yvonne Boutte was hired in 2008, to serve as Manager of Credit Resolutions. A few weeks before her arrival, President Wiggington ordered mailing of a letter to his long-time and now former friend, Mike Lee, advising him that the credit union would not renew its agreement with Associated Management Company, Inc., the contracted collections company owned by Mr. Lee. The President also ordered the AVP of Lending, Patti Loiacano to verbally advise Mr. Lee that his agreement with the credit union would not be renewed because the President had decided to create an in-house collections department which he alleged, would eliminate the amount of money spent on an outside collector and increase revenue. According to the President, Associated Management wasn’t achieving the amount of collections needed to attain profitability.

Ms. Boutte arrived quietly and worked alongside the remaining employees of Associated Management, Inc. Following their departure, Mrs. Boutte brought in new staff, all of who she worked with previously. The new staff included Alex Suarez, Sandra Whitt, and Naira Gevorkyan. Mrs. Whitt left in 2011, after her friendship with Mrs. Boutte deteriorated and she found herself the subject of Mrs. Boutte’s very public criticisms.

In her four years of employment, Mrs. Boutte quickly climbed Priority One’s corporate ladder and now serves as AVP of Support Services (whatever that means). However, overshadowing her accomplishments are her erratic mood swings and disparaging treatment of employees. As employees know, Mrs. Boutte is adept at quickly altering her behaviors and personality, dependent upon who she is speaking to any given moment. The façade she dons when speaking to the Board of Directors, projects the impression she is cooperative, respectful and even pliable. When not meeting with the Board, she is one of their most avid critics, often declaring they are incapable of comprehending financial idiosyncrasies.

When meeting with the President, she strains to remain tolerant, describing him as too talkative. She has even instructed her staff to call whenever she remains in the President’s office for more than 45 minutes; and use the excuse that an urgent matter has arisen, requiring she return to Member Services immediately.

When speaking to her staff and other, non-exempt personnel, she is often condescending and can easily resort to ridicule and belittlement. She is in arguably, a woman with more than two faces.

On June 22nd and June 23rd, the member whose account information had been published by Priority MC, called Chairperson, Diedra Harris-Brooks, advising her of the violation of confidentiality and explaining to the Chairperson why Priority MC must be an officer of the credit union. She advised Mrs. Harris-Brooks that if the matter isn’t resolved immediately, a lawsuit would be filed. Mrs. Harris-Brooks asked the member to provide her with the terms of the member’s proposed settlement, assuring she would review it and provide a response afterwards.

On Friday, July 13th, the member called Mrs. Harris-Brooks and asked if she had read the proposed settlement and arrived at a decision. Not surprisingly, Mrs. Harris-Brooks stated she never received the proposal. Being the consummate unprofessional, it never occurred to the Chairperson that if she hadn’t received the settlement that maybe she should have made an effort to contact the member. The member next forwarded another copy of the settlement and asked the Chairperson to provide a response by the end of the day or she would proceed in filing a lawsuit which would name Mrs. Harris-Brooks, President Wiggington, and Mrs. Boutte co-Defendants.

While the member remained on the line, Mrs. Harris-Brooks called the President and ordered that someone from the credit union, call the member that same day. When Mrs. Harris-Brooks returned to the phone, the member informed her that since their initial conversation on June 22nd, she located additional references to her name and account information on other Internet sites, reiterating that the disclosures could only have been made by someone in the management sector. Mrs. Harris-Brooks remained quiet momentarily and then said that over the past “three (3)” she has requested removal of her name from the blog, but her requests had been denied. Mrs. Harris-Brooks advised the member, that AVP of Support Services, Yvonne Boutte, would be calling her within a few minutes.

- If Mrs. Harris-Brooks called the President and informed him about an alleged violation of the Privacy Act which threatened to escalate into a lawsuit, then why would the President refer the matter to Yvonne Boutte who is neither an licensed arbitrator or attorney?

- Why did Mrs. Harris-Brooks call the President and request that an employee call the member rather than contacting the credit union’s own highly paid, attorneys who are allegedly experts in litigating legal matters?

A few minutes after concluding her call with Mrs. Harris-Brooks, the member received a call from Yvonne Boutte. Being the quintessential authoritarian, Mrs. Boutte aggressively told the member she is no longer allowed to call Mrs. Harris-Brooks. Evidently, Mrs. Boutte suffers from delusions of grandeur and may believe that everyone is subject to her dictates. The member replied, that Mrs. Harris-Brooks had invited her to call at “anytime”, adding that Mrs. Boutte had no authority to try and force the member to comply with her lofty demands (our words, not the members).

Ignoring the member, Mrs. Boutte again prohibited the member from speaking to anyone but attorney, Norman Needleman. The member reminded Mrs. Boutte that Mr. Needleman is a bankruptcy attorney and possibly unqualified to respond to complaints alleging liable or violations of the Privacy Act.

Incensed that the member was unwilling to bend to her will, Mrs. Boutte resorted to a more childish tactic and began interrupting the member as she tried to resolve the violation committed by a representative of the credit union. Mrs. Boutte resorted to spewing out slang and street vernacular. Realizing Mrs. Boutte had no control over her behavior and had no intent of listening, the member hung-up. Mrs. Boutte did not call the member back though she called the President and Mrs. Harris-Brooks and told them both the member was being uncooperative.

Poor Mrs. Boutte, like most tyrants, she must assert her will through force even if it exacerbates problems. In her conversation with the member, she revealed her insecurities and how truly misinformed she truly is. We’ve decided to elucidate upon some facts, which will hopefully dispel Mrs. Boutte’s obvious confusion. If a lawsuit filed by or against a member, which alleges bankruptcy, then inquiries regarding that case, must be referred to attorney, Bruce Needleman*. On the other hand, if a complaint alleges abuse including harassment or liable, then inquiries must be referred to the offices of Richardson & Harman, PC. Mrs. Boutte’s involvement in litigation of any legal matter, is tantamount to handing a loaded gun, to a child.

- If the member’s complaint could only be responded to by Mr. Needleman, then why did Mrs. Harris-Brooks order Mr. Wiggington have one of his staff call the member that same day?

- Shouldn’t Mrs. Harris-Brooks have asked that the attorney call the member?

- And why involve the incompetent and emotionally undisciplined Mrs. Boutte when her field of expertise is collections and not litigation?

In responding to the member’s complaint, Mrs. Harris-Brooks shirked her responsibility (big surprise) and referred the member to AVP, Yvonne Boutte, though the AVP is sorely unqualified to respond to or resolve any legal matter. Mrs. Boutte could have referred the complaint to the credit union’s attorneys or at least assured the employee an investigation would be conducted. Instead, blinded by ego and pride, she gave in to her chronic need to subjugate.

The member’s conversation with Mrs. Harris-Brooks, was intended to resolve the unlawful violation perpetrated by an employee of the Priority One but which ultimately proved to be an exercise in futility. Possibly, as a result of low self-esteem, Mrs. Boutte chose to respond to the challenge by resorting to verbal tactics characteristic of the uneducated and reacting emotionally, subjected the member with her brand of street vernacular and in the end resolved nothing.

Mrs. Harris-Brooks and Mrs. Boutte are over their heads in trying to resolve any matter which requires the expertise of an attorney versus the meddling of a glorified collections clerk and a retired ex-postal store worker.

*Bruce P. Needleman, Esq., Warner Center Plaza VI, 21700 Oxnard Street, Suite 1290, Woodland Hills, CA 91367-3660, 818-715-7007, Facsimile 818-715-7090

DO YOU REALLY REAP WHAT YOU SOW?

The Root to Evil at Priority One isn’t Just Greed

During her conversation with the member, the magniloquent Board Chair failed to provide a single rationale that might serve to explain why the credit union’s current safeguards ensuring the safety of member information, have successfully been undermined, time and time again.

Since January 1, 2007, the date he became President and CEO, Charles R. Wiggington, Sr. has languished comfortably behind Mrs. Harris-Brooks, knowing that no matter how much he defied policies and laws, or how many monetary losses were incurred as a result of his ineptitude, that she would always exert every means by which to protect him and vanquish his critics.

On the other hand, Mrs. Harris-Brooks enjoyed the privilege of knowing she could exact and exceed her authority; and when necessary, approve referral of all legal matters to the credit union’s expensive attorneys. Mrs. Harris-Brooks ineptitude in handling the member’s complaint, clearly signals in our opinion, that she has over-stayed her welcome and should be voted out of office and sent home.

Over the past five years, Mrs. Harris-Brooks has done absolutely nothing to help reverse Priority One’s financial woes or its inability to force the President to create sorely needed strategies that might attract new business and bring in real and necessary profit. The University of Phoenix graduate has also refused to acquaint herself with some of the legalities underlying credit union policies or the laws, requiring financial institutions to safeguard member information. If she had demonstrated any concern for the problems she alluded to while speaking to the member on June 22nd and June 23rd, it is possible confidentiality would never have been violated at the credit union.

The causes to Priority One’s continuing demise run deep and are rooted in the behaviors and attitudes of it dysfunctional managerial sector and Board. The only silver lining to this story of debacles is that credit union appears to possess sufficient funds needed to pay its legal team.

CONCLUSION

Priority One’s problems are far from subsiding. Their seemingly compulsive involvement in lawsuits can be attributed entirely the bungling mismanagement of the credit union, refusal by management to abide to credit union policies and laws and the inept manner they choose to respond to and resolve complaints. The President’s efforts and those of Mrs. Harris-Brooks and Mrs. Boutte are to hide evidence, shirk all accountability and concoct lies that will help them escape retribution through a court of law.

- Mrs. Harris-Brooks comportment over the past five years has been nothing less than reprehensible and she should have been removed long before the credit union’s finances plummeted and four branches closed. If she had taken the time to develop her knowledge about credit union’s finances and acquainted herself with some of the legalities underlying policy and laws governing the protection of member information, then maybe the President would have been stopped long ago, when he first revealed a proclivity for violating laws and policies. If she had chosen to be proactive versus corrupt, information might never have been posted on social media websites by employees like Priority MC. The credit union might also, never have been sued. Under California and federal law and bylaws, employees of financial institutions are prohibited from posting member names and information on public social pages and blogs including “social media network, public blogs and public forums.”

- What’s more, privacy protections are afforded under the Uniforms Commercial Code as adopted by the State of California, which states in part:

- No agency shall disclose any record which is contained in a system of records by any means of communication to any person, or to another agency, except pursuant to a written request by, or with the prior written consent of, the individual to whom the record pertains [subject to 12 exceptions]." 5 U.S.C. § 552a(b).

- Mrs. Harris-Brooks may feel tremendously frustrated with the President and some of his staff, knowing that her years of effort to suppress evidence, cover-up wrong doing, and perpetration of lies intended to exonerate the credit union of any wrongdoing, is being challenged and undermined by the very people she protected.

- Following publication of our last post, we thought that just maybe, Priority One would try to distance itself from its many legal problems and exact some effort to comply to its own policies and state and federal law. Priority MC’s comments, reminded us that within Priority One’s management sector, there is no intention to try and adhere to laws and policies.

- As for Mrs. Harris-Brooks, the Board and the Supervisory Committee, each leaves much to be desired. The public circumvention of policies and laws proves that they have consistently abused their appropriated authority. We anxiously await to see how Mrs. Harris-Brooks handles the latest complaint and if whether, she will try and rectify a wrong committed by an officer of the credit union or will resort to her usual evasive tactics, to avoid culpability for the reverberations caused by violation of the Privacy Act.

- We located the following complaint on www.yelp.com, written by a member of the credit union and succinctly, describing the problems she encountered while trying to rectify an error committed by Priority One.

-

Mrs. Harris-Brooks, the President and Mrs. Boutte may have deluded themselves into believing their abhorrent behaviors are justified. They may even have convinced themselves that they are the victims of some grand and elaborate scheme, designed to subvert their authority. In the light of tangible evidence, their assertions have continually been proven to be nothing more than hogwash. It is unfathomable to us why this herd of aged officers has chosen to conduct themselves in a manner that is both reprehensible and detrimental to the credit union. Based on the current state of things at the credit union, it wouldn’t again surprise us if other lawsuits are filed by former employees or by members whose personal account information has been compromised and once again, made public by an officer of the credit union.

Technorati Tags: Diedra Harris-Brooks,Diedra Harris,Diedra Brooks,Priority One Credit Union,Priority One Board of Directors,Priority One Supervisory committee,credit union board of directors,credit union supervisory committee,board of directors,supervisory committee,Yvonne Boutte vice president of support services,AVP Yvonne Boutte,Mrs. Boutte,Ms. Boutte,AVP support services,charles r wiggington,charles wiggington resume,charles r. wiggington,sr.,Charles Wiggington,Rodger Smock,Executive VP,Executive Vice President,Senior vice President Rodger Smock,Executive Vice President Rodger Smock,Bruce P. Needleman,Attorney bruce needleman,attorney bruce p needleman,violation of confidentiality,breach of confidentiality,social media,blogs,member lawsuit,bankruptcy,collection accounts,farmers mutual automobile insurance company,priority mc,second lawsuit,slander,defamation of character,libel,superior court,los angeles superior court,12C00147

Kindly Share The Love»»

|

|

|

Tweet | Save on Delicious |

165 comments:

John you are Hero.

Jack them up. They are all a bunch of lowlifes. About time they got turned out so everyone can see what they really are.

You know what makes Yvonne dangerous, its that she thinks she's smart and better than everyone else. She likes to stick her nose in everything but name one thing she's ever done that made Priority 1 better? When has she made money for the credit union. She's hated because she's horrible with people and she's a black Bea Walker or a tall Cindy Garvin but what she's not is a good and honest manager.

How do you get this information? Never mind. I don't know whether to cry or laugh. I used to think the credit union was being picked on but with all the evidence you put out, they're guilty as sin. I know they're in big trougle because Cindy is leading the way to find ways of cutting costs.

Yvonne was saying the attorney had to go to court yesterday about this members case. Why they hell would she repeat that and why would Diedra ever get that 7 foot drag queen involvd<

Jennifer K was fired, she went crying to Charles and he gave it back to her at 75k a year.

Jennifer K is back? How? If all it took was crying than Bea Walker has a chance to come back.

Jen K: Wigg, please let me come back to work.

Wigg: No!

Jen K: So does that mean you don't want me to ever tell anyone how you have me cook the books?

Wigg: Ahhh....

Jen K: How about how you don't report all the losses and how you inflate profit?

Wigg: Ahhh...

Jen K: How about the books. You sure you don't want me to tell anyone about the book with the real figures and the one you have us show the auditors?

Wigg: Well...

Jen K: And should I try to forget how much we spent on legal and settlements?

Wigg: On second thought, come on back and how about a little raise to help you and your son. Looks like you need a new car. Let me see what I can do. Welcome back, Jennifer.

Patt Loiacano is compliance, instead of calling Yvon who is useless, Diedra should have called Patti & the attorney

Patti Loiacano is compliance in the losest sense of the word. She's always been an opportunist who borrows of the work of others and then takes credit like it was her idea. You're right, why did Bucky Beaver Teeth Diedra think it was okay to have Wigg and Big Foot handle the member complaint when it involved a violation of the law which means they needed an attorney? She could have called Patti but really, Patti is compliance and not an attorney. I hope the member give them a new one, that's if there's any room for one.

Aye, aye, aye, aye. When is they going to stop getteeng zooed? Pendejos.

Rumor is out that someone from call center got fired and that one of the girls from credit res is on stress leave. Sounds like Yvonne's got something to do with all that.

Last month Yvonne told Alex that she wants anyone fired who might be lsaying negative things about the credit union. That means they are going to have to fire everyone. Yvonne needs to be put away she is stupid and crazy.

I think Wigg is an idiot. He gave Cindy power to run the place but all she's doing is making things worse. Cindy wants sales, I get it. But people don't answer incoming calls because their all running around trying to meet their goals or they'll get fired. They fired so many people that now we can't give good service. Its stupid and puts so much stress on us. They need to first of all fire the whole board. They're useless and Diedra is MORON! They need to get rid of Wigg and Smock. They should both be happy because they took P1 for everything they could. They need to send Cindy back to Clearpath CU where she could run them into the ground. And most of all they need to get rid of Yvonne and Alex. One is as dumb as dirt but she thinks she smart and the other is pure evil.

ALL YOU GUY NEED TO PLAN A WALK OUT AT THAT BITCH AND LET IGNORANT MANAGEMENT AND THE BOARD GET THERE ASSES BEHIND THE TELLERLINE AND WORK MEMBER SERVICE AND TAKE OVER MAKING THOSE REDICULOUS GOALS AND SEE IF THEY CAN DO IT WHICH I DOUBT SERIOUSLY! AND YOU ALL NEED TO START LOOKING FOR WORK ELSEWHERE!!! ...BECAUSE AT THE END OF THE DAY PRIORITY ONE MANAGEMENT AND THE BOARD DONT GIVE TWO RATS ASS ABOUT ANY OF YOU!!!

So true. Cindy is only interested in making numbers so she looks good. Wigg and she and idiot Yvonne have turned P1 into a sweat shop. You don't make your goals, you're out. Screw member service, screw employee morale, screw a healthy working environment all that matters to these losers is that they make the goals.

And what an idiot Diedra is! She's got to be the stupidist bitch around. She must of thought she was Perry Mason when she tried to take care of the members complaint all on her own. And she was even more stupid to get Yvonne involved. Yvonne only cares about one person- Yvonne. Thats why when her former buddy Bea got fired, she started dropping big hints that she wanted Bea's job. She is HORRIBLE with employees and HORRIBLE with members. You know how often she told members who lost their jobs and couldn't pay their loans that it wasn't P1's problem. And then when they hung-up on her she would say, "They don't know who they're dealing with." Sorry Yvonne, but they knew they were talking to a useless heartness sack of crap, that's why they hung up.

There are jobs out there. If you absolutely can't take it, there are agencies that only deal with credit unions. Go to the Nevada California Credit Union League they have jobs posted. Everyone in the industries knows P1's days are numbers- as long as Wigg is President and Diedra is on the Board. Cindy will be fired if a new company merges with them and so will Alex and Yvonne. As for Rodger, he's old but the only reason he hangs on is because he's greedy and wants whatever money he can get.

They fired Luis? Why? He was a good employee. And Alex's friend is out on med leave.

THIS BEARS REPEATING:

Anonymous said...

John you are Hero.

AND I WOULD LIKE TO ADD:

THANK YOU AGAIN JOHN, YOU ARE INDEED A HERO TO ALL P1 EMPLOYEES. BECAUSE OF YOU WE KNOW WE ARE NOT TO BE BLAMED FOR WHAT IS HAPPENING AT P1.

Luis was tired that he works in the call center and has to answer phones but is expeced by CINDY GARVIN, to call members so he can make sure his numbers are met. Its stupid! Then again, Cindy is an idiot, what can one expect? The call center just like the loan department is so busy having to call out that we're not answering incoming calls. Members are waiting 10 to 20 minutes before their calls are answered. Cindy, Joseph and sick Wiggington don't get it that if you have lousy service that's going to make it more difficult to get new business. So sad, because Luis was a great employee. Now they have Colleen and Lorena answering 5 lines. Ridiculous. Oh and they fired Johnny too but he was more kiss ass than good employee.

Mary Bowen quit. I can't believe that. She was there so many years and she was a very nice person. That means only Lino is left at Airport because Gerardo got laid-off, Mary quit and now they have one teller. I'd like to know if this all part of Wigg's master plan?

Wigg is a typical..... He blames everybody else for all his mistakes and expects everybody else to fix what he ruined. All the years of sitting back, breaking policies and federal laws are finally catching up to him. Now all the overworked and underpaid employees are expected to meet impossible goals to save their job. Wigg is a gutless coward! He hids in his office, picks on the weak and threatens employees with their job. See how tough he is walking down the street with no office to hid or stolen car to dive away in. Yeah he fits the sterotype like a glove!

Johnny got fired? You sure? Wow, that's one guy I never thought would get fired. He was really good at kissing ass. That means that kissing ass doesn't help anymore. Unlike Johnny, Louis will be missed.

One more question. Why are Wigg, Yvonne, Rodger, West, Cindy and Gema not fired?

PRIORITY ONE IS HISTORY! BUSINESS STINKS AND CINDY'S BIG IDEA TO FIRE EMPLOYEES WHO DON'T MEET THEIR GOALS IS HELPING LOSE BUSINESS BECAUSE THERE'S A LOT LESS PEOPLE TO ANSWER PHONES AND CALL OUT FOR SALES. NO WONDER SHE SIT AT HER DESK WITH THAT "I'M CONSTIPATED" LOOK ON HER FACE.

IF YOU'RE AN EMPLOYEE YOU CAN EITHER START LOOKING FOR NEW WORK OR WAIT TIL THEY FIRE AND GET UNEMPLOYMENT. THERE ARE JOBS OUT THERE. A LOT OF THE PEOPLE WHO WORKED AT BURBANK HAVE NEW JOBS AND IF YOU TALK TO ANY OF THE, THEY WILL TELL YOU THEY DON'T MISS PRIORITY ONE AT ALL!

THE ONLY THING CINDY CARES ABOUT IS NUMBERS THAT WAY SHE KEEPS HER JOB. THE ONLY THING JOSEPH GARCIA CARES ABOUT IS NUMBERS BECAUSE HE KNOWS HE DOESN'T HAVE WHAT IT TAKES TO GET NEW BUSINESS SO HE NEEDS YOU EMPLOYEES TO GET THE BUSINESS SO HE KEEPTS HIS JOB. SAME FOR YVONNE BOUTTE. IF SYLVIA WAS AT WORK AND NOT ON SICK LEAVE SHE'D DO THE SAME. BTW, SHE IS SUPPOSED TO COME BACK IN A WEEK OR SO. LET'S SEE IF SHE GETS AN EXTENSION. I SAW HER AT CHURCH AND SHE WAS COMPLAINING ABOUT HER NERVES AND LOSING HAIR AND HOW HER ARMS ARE NUMB. DOESN'T SOUND LIKE SOMEONE WHO SHOULD BE AT WORK.

They fired Cynthia, Judith, Dana, Leroy, Gerardo, Louis, Johnny.... These people didn't cause the problems at the credit union. How come Wiggington, Smock, Yvonne and Cindy are still employed when they're the reason the credit union is so screwed?

Johnny did not get fired. He was on LOA and decided to resign.

Was Johnny stressed too?

Johnny was pushed out. You need to differentiate between he voluntarily and out of the clear blue sky, resigned and having people close doors on him.

I heard he got backstabbed by Gema and Rodger.

No it was Judas West who did it.

Too bad Diedra didn't tell the member about all the coverups she and the board have done.

I worked in the loan dept in 2008 and its true Wigg used to come and sit next to Suzanne and tell her people were jealous of him because he became President. He talked about the people he was going to fire and how he knew what he was doing unlike Mr Harris. He even talked about the board and how they didn't know financials and he talked about his own family. The man has a BIG mouth and doesn't ever SHUT-UP. Guess his momma never taught him good manners. Wigg is the reason some animals kill their young.

Anonymous said...

Johnny did not get fired. He was on LOA and decided to resign.

August 10, 2012 2:01 PM

Bullshit. Get your facts straight!

I called on Thursday and after 15 minute wait I hung up. Called on Friday and after 10 minute wait I hung up. I'm pretty sure I'm not the only person who can't get through. I also was told they're going to start opening all branches on Saturdays. How can they provide service on Saturdays if they can't provide service Monday thru Friday?

Service is bad because they have th call center people over worked. They're trying to make their goals and supposed to answer phones. Since not getting your goals gets you fired, they usually won't answer incoming calls which defeats the whole purpose of having a call center. This is one group who shouldn't have sales goals becuse they do grunt work Cindy is too stupid to realize that. Same for that idiot Joseph Garcia who expects them to make their goals never thinking about what the purpose of the call center really is. Maybe that's one reason why Bea took away the call center from him and gave it to Gema.

The credit union doesn't have muchg money left but Wigg is still spending like on added cubicles to member services. He knows we can't waste money but he's still wasting it and no one, not Saeid or Smock have told him to stop.

You know if the person who posted the information about the member WASN'T a manager, that Wigg would had them fired ASAP. That's why you know its him or someone else in management, that's why Diedra is willing to spend CU money on attorneys to defend managmeent. She's a moron and I don't know why she has been voted about by the membership. This woman is like EBOLA virus.

LOL. I always knew Yvonne Boutte was made in a laboratory in Transylvania. Dr. Frankenstein must of run out of female bodies.

Diedra's a hag.

Thanks Diedra for turning the credit union into a bad soap opera.

Diedra tried to push Mr Harris around but that went nowhere. He let her know that she was on the board and she couldn't just barge into his office anytime she just felt like it. Problem with Diedra is she thinks she's smart. Looking at the mess at P1 proves she's everything but smart. Members had the power to vote her ass out. If they had shown her the door in 2007, maybe P1 wouldn't ever gave lost money or business and employees would still be there and maybe even happy.

Diedra is an idiot. I hope the member wins. Every member should close their accounts. Wigg never cares about service or people, anyway he's never been any good and less now. His work is bein done by Cindy and Yvonne because he says he's too sick to do it. If he's so sick why is he driving himself to work? He's either sick or he's not!

I'm not an employee but the problem at the credit union is the board. I don't see how after so many years of ruining the place why they haven't been given the boot.

Bares repeating....

ALL YOU GUY NEED TO PLAN A WALK OUT AT THAT BITCH AND LET IGNORANT MANAGEMENT AND THE BOARD GET THERE ASSES BEHIND THE TELLERLINE AND WORK MEMBER SERVICE AND TAKE OVER MAKING THOSE REDICULOUS GOALS AND SEE IF THEY CAN DO IT WHICH I DOUBT SERIOUSLY! AND YOU ALL NEED TO START LOOKING FOR WORK ELSEWHERE!!! ...BECAUSE AT THE END OF THE DAY PRIORITY ONE MANAGEMENT AND THE BOARD DONT GIVE TWO RATS ASS ABOUT ANY OF YOU!!!

I never worked at a company where management is so insecure and so uneducated that they have to scare employees into doing the work so that management keeps its jobs.

Its hard to believe that after so many years and being exposed time and time again that the board is still sitting pretty (or ugly) and that they haven't been fired by the DFI.

So what's going on with Suzane's case? Louis and Johnny gone has left a big buden on Colleen who is stressing. Useless Gema goes and helps but Gema is nothing more than a gofor though if you ask her, she still acts like an AVP, when Yvonne is within listening distance. These people don't know what they're doing, service sucks and business sucks and you can see the end for Priority.

Suzanne Sunada resigned. No one can deny, this ship is sinking! Priority One is a lost cause and anyone with half a brain, is going to be looking for other work. Good luck Susanna cause its got to be better whereever you go.

Why would Suzanne quit? Could it be because she's the credit union going down the toilet? Or is it because mgmt got rid of 2 of the 3 call center reps over the past 2 weeks? Maybe its because she couldn't stand working with that psycho-bitch, Yvonne Boutte. Or is it because she and EVERYONE else hasn't got a raise in more than 3 years? Or how about that half-ass, good for nothing HR deptt who will put a knife in your back faster than you can say "Is Wigg ghetto or what?"

Suzanne will be fine. You should be wishing good luck to the poor employees that are left behind and have to work with Yvonne, Cindy, Alex, Wigg, Miss Smock and Miss West.

At least she's leaving on her own terms. So who's going to take over card services. Ramona? I think Yvonne should handle card services on her own. After all she knows everything about anything.

I don't care what Wigg, Yvonne or Cindy say, business at P1 sucks! They're scrambling trying to find ways of fixing their problems but they waited til the last minute again. They've now hired Foresee (www.foresee.com) to figure out why members aren't interested in their products. Here's one of the messages, Foresee is sending out:

"I am trying to find the right person to talk with regarding website customer experience and effectiveness at Priority One Credit Union. ForeSee is a Customer Experience Analytics Provider.....

Our analytics prioritize improvements that have the greatest impact on customer satisfaction while maximizing ROI.

You want to improve performance, begin by firing Wigg, Smock, Yvonne, Alex, Cindy, and Joseph. That's where you start but that's not where you end.

They really need to pay consultants to find out what's wrong with the credit union? First of all you can't sell business if you're not advertising. Second you need a real marketing specialist not a friend of Cindy's. Next, you don't need Cindy. She doesn't seem to know much about loan development just like she doesn't know crap about branch management. Its also Yvonne who is so stupid but thinks she is so smart. And then there's that embecile Joseph who doesn't know anything about business development though he knows a lot about backstabbing.

So Suzanne, the Call Center Supervisor resigned and Louis and Johnny, the two call center representatives are gone. That only leaves Colleen. So is the Call Center now a one-man operation?

The marketing department is RESPONSIBLE for prioritizing improvements regarding customer experience, website effectiveness and developing NEW strategies for driving in NEW business. Business will not pick up with advertising alone. Marketing research is the key to finding NEW business. Stupid Wigglenutless got rid of everyone incharge of marketing to cut costs. Then the moron hired Cindy's buddy to take over marketing. Now the jackass hired an outside company to figure out what the best strategy for P1 is. So what is the point of having a marketing manager who is making $60k/yr? This is exactly what happens when UNEDUCATED GHETTO BIG HEADED IDIOTS are incharge of a company. Insanity is doing the same thing over and over againg and expecting different results. We have all seen this before and nothing came of it and nothing will come of it this time around. You cannot solve problems with the same thinking that created them. But of course the board, twiggy wiggy, smuck, wuss (west), cin-zilla, king kong yvonne and blow-seph will continue to blame anyone and everyone else for the poor decisions they make. EVERY EMPLOYEE WHO KNOWS WHAT THEY ARE DOING BETTER BE LOOKING FOR A NEW JOB ASAP. It is a lot easier to find a job while you are still employeed then looking for a job while collecting minimal unemployment checks.

Absolutely true! Marketing is the key understanding their marketplace, at least to anyone but brain dead Wiggington who thinks marketing=advertising. To "wish" things are going to get better at P1 is like hoping the board will someday understand financials. It just isn't going to ever happen, at least not while Wigg is President.

Credit Res is also short staffed, crystal is out on maternity leave, one of the new girls is also out on medical leave. All they have are 2 people and dumb ass Alex who thinks she knows it all, and bitch ass Yvonne. Haven't they opened their eyes that something is not right? Employees are dropping like flys!

One of the credit res girls is out on medical leave. Heard she got stressed out when she was rude to a member and he put her in her place. Anyway, isn't it time they spent another $30,000 and brought back Loren Lillestrand so he can save the day just like he did in 2009?

Yeah bring Loren back so the IDIOTS at P1 can promote people based on thier personality not thier education, experience or knowledge

Personality? Have you met Alex Suarez? LOL.

Yvonne said they're looking for someone to replace Suzanne. Did she forget that Ramona was card services until Yvonne had one of her brain storms or aneurysms and moved her to credit resolutions. Has anyone noticed how they took the call center away from Gema who is an AVP and how they gave it to Yvonne and then Yvonne gave it to Suzanne. Now Yvonne has it back with no intention of giving it to Gema. Yvonne plans on using Gema and Lorena to backup the Call Ctr but that she needs Gema in member service because let's face it, Yvonne knows nothing about member service.

With the Call Ctr down to 1 person, this means job security for Gema. P1 is a circus with the ugliest clowns.

Maybe they should just hire Bea back so she and Wigg can break P1 down to one branch.

I couldn’t work with Yvonne. The woman is a tyrant. She's condescending and rude. When she first arrived at Priority she put a big front and appeared professional but when she brought in the Sandra, Alex and Naeyra, the women had attitude and wouldn't talk to anyone which made me think that maybe Yvonne wasn't what she appeared to be. After she and Bea became friends the real her came out and she started backstabbing employees. One day I left the office and Yvonne was walking a few feet in front of me with one of the collection reps. A kid- maybe about 13 years old was walking down the street, cussing up a storm. Yvonne yelled out, “Hey boy, shut-up. Did your momma teach you to talk that way?” Yes, the cussing was annoying but what gave her the right to tell him to shut-up? Anyway, the kid stopped cussing, probably because he had never seen a Big Foot before. She's nosey and a control freak who doesn't get the results she tells you she gets.

Maybe management should show employees how to get business. Cindy should spend a month getting off her ass and hitting the field. I’d like to see what new business she brings in.

Joseph should have goals like everyone else and should get written up each month when he doesn’t meet his goals.

Yvonne should work on the call center and answer phones. The woman is a rude lowlife but it would be good to see how long she can put up a front.

Wigg should be forced to actually work. The man is useless. He should be forced to call members and invite them to get loans.

Smock… What is he good for? He should work as an FSR. Let’s see if he can answer questions and solve problems which he can’t because he’s another big incompetent.

The following employment ad appears on the California Credit Union League webpage (http://www.ccul.org/01consumers/cuconnections_details.cfm?Connectable__ID=9635)

Member Service TEAM PLAYER

8/15/12

Member Services

Priority One Credit Union

Have you ever wished you could work in a professional environment with people YOU TRULY CARE about, do professional work in a PROFESSIONA WAY; produce PROFESSIONAL RESULTS, and experience the TRANSFORMATION OF YOUR LIFE in the process?

Well now you can!

We are Priority One Credit Union. We are GROWING. We are THRIVING, and we are looking for PLAYERS. But we are on a fast track, so you’d better be in a hurry?

We have a full- and part-time Member Service positions available at VARIOUS LOCATIONS in the Los Angeles area. Ideal candidates will possess strong call center, customer service, sales, and cash handling experience, preferably in the credit union/banking industry.

For immediate consideration, please email your resume and salary history to humanresources@priorityonecu.org.

MAYBE THE PROBLEM IS THEY'RE LOOKING FOR "PLAYERS" VS TEAM PLAYERS OR GOOD MANAGERS. GROWING? THRIVING? LAST TIME I LOOKED, THEY LOST 4 BRANCHES. MAYBE SOMEONE OUGHT TO TELL RODGER AND WEST THE DIFFERENCE BETWEEN GROWING AND THRIVING AND SHRINKING AND LOSING.

THIS IS SOME B.S. (AGAIN).

Here is another ad from the California Credit Union League webpage.

DMV/Clerical Support

Southern, CA

Collections

We have an immediate need for someone who can make an IMMEDIATE IMPACT. This position is responsible for tracking and managing titles, and also processing a HIGH VOLUME of paperwork. Being able to work well under pressure and maintaining strong attention to detail will be the KEYS TO SUCCESS.

For immediate consideration, please email your resume and salary history to humanresources@priorityonecu.org.

Human Resources

1631 Huntington Drive

South Pasadena, CA 91030

email: humanresources@priorityonecu.org

Website: www.priorityonecu.org

IMMEDIATE IMPACT? WIGG’S MADE AN IMPACT WHEN HE LOST 4 BRANCHES AND REDUCED PRIORITY 1 FROM A GREAT CREDIT UNION TO BELOW AVERAGE.

Another ad from the California CU League (http://www.ccul.org/01consumers/cuconnections_details.cfm?Connectable__ID=9637)

Call Center/Card Services Supervisor

08/15/12

Member Services

Priority One Credit Union

If you have been looking for the RIGHT OPPORTUNITY to come along at just the right time, consider this “OPPORTUNITY KNOCKING”.

We have a Card Services/Call Center Supervisory position available at our South Pasadena Branch. The candidate we select will have the opportunity to coach and lead the call center team; handle transaction requests from internal and external members; oversee the card services area; resolve disputes, and serve as a liaison between CO-OP® and the credit union.

Previous call center, card services and supervisory experience are required, as well as demonstrated ability to achieve sales goals. At least 5 years of financial institution experience, and college experience are preferred.

For immediate consideration, please email your resume and salary history to humanresources@priorityonecu.org.

Human Resources

1631 Huntington Drive

South Pasadena, CA 91030

email: humanresources@priorityonecu.org

Website: www.priorityonecu.org

IF YOU’RE LOOKING FOR THE “RIGHT OPPORTUNTIY” WHY WOULD YOU WANT TO WORK AT PRIORITY ONE? BASED ON THE MISERABLE WORKING ENVIRONMENT, HIGH TURNOVER RATE, AND HORRIBLE MANAGEMENT THIS IS NOT “OPPORTUNITY KNOCKING.”

AT LEAST 5 YEARS OF FINANCIAL INSTITUTION EXPERIENCE REQUIRED? WHY? WIGG, YVONNE, SMOCK, AND WEST PROVED THAT PREVIOUS FINANCIAL INSTITUTION WORK HASN’T HELPED. COLLEGE? WIGG HAS A DEGREE IN BLACK STUIDES, HOW HAS THAT HELPED HIM HELP THE CREDIT UNION THRIVE AND GROW?

They're looking for players? LOL. That's one of the problems with Wiggington, he thinks he's a player and wants to hire players. I think the ad for a member service teamplayer was probably for some other credit union. No way priority one has a professional environment and definitely managment doesn't care about members and they don't know anything about professionalism. Just more bullshit from a bullshit organization. Anyway, what's the pay $12 an hour with no benefits?

Tsk, tsk, they didn't mention they've been sued by 3 x-employees and a member.

Whoever wrote those ads must have the world's longest nose.

"Have you ever wished you could work in a professional environment with people YOU TRULY CARE about, do professional work in a PROFESSIONA WAY; produce PROFESSIONAL RESULTS, and experience the TRANSFORMATION OF YOUR LIFE in the process?