A NEW FACE

A few months ago, Priority One Credit Union's President, Charles R. Wiggington, Sr., obtained authorization from Board Chair, Diedra Harris-Brooks, allowing him to again, hire consultants to try and resolve the effects of his horrendous decisions which have left the credit union in a perpetual cycle of losses.

In the weeks before terminating Ms. Walker, the President and Board interviewed Cindy Garvin who they alleged would serve as the new Director of Lending, however, their plan was to have Ms. Garvin replace Ms. Walker. Unfortunately, since her arrival in August 2011, Ms. Garvin has been the recipient of the President's many projects that he is either too lazy or too unqualified to perform. Her efforts to reverse the effects of the problems created by the President have consistently failed in part because she has not been provided the tools needed to succeed and because the problems she is expected to resolve fall far outside of her scope of expertise.

Last month, the President unveiled some of the solutions developed by the consultants which will begin to dispel the impediments which have robbed the credit union of it's former competitive edge and hopefully, will begin salvaging Priority One's horrendous public reputation. Amongst the newly introduced changes is a revamped webpage and a smart phone "app". These changes and additions are the result of weeks of analysis of the credit union's marketplace, procedures, and marketing. This includes mailing surveys to members, some of which included mailings sent to current and former employees.

Though the new website went online in October, it has already undergone several changes. The refurbished website contains all of the same information found in the previous webpage and it appears that most of the changes are purely superficial including the addition of icons and changes to it's color scheme. Thus far we see absolutely no improvement that could result in increased business.

Because of the many changes to the webpage since it went online last month, it appears it's launching was premature without it having been properly reviewed. So why the urgency to publish the newly refurbished webpage?

The site's launching was fueled by the fact that Priority One no longer offers the number of convenient locations it had in t he years before Charles R. Wiggington, Sr. was appointed President. The credit union is now forced to emphasize other services that suggest it still possesses the ability to service all members. Conspicuously, the new webpage veers away from all inferences of the "personal touch" in service to the advantages and convenience of online and telephone banking. New references on the website include:

- Mobile Banking

- Financial Calculators

- MILLIE (phone banking)

- Online new membership application

The graphic shown below links users to an online loan application, however, when using it, we were taken to a page containing a CU Student HELP Smart Option Student Loan application. Evidently, someone at the credit union erred when creating the link.

A BRIEF HISTORY

The credit union provides an explanation of what differentiates a credit union from a bank. Evidently, the President and his executive staff don't know the definition of the word "history."

The consultants also advised introduction of a smart phone "app" to add convenience and help simplify a member's personal home banking experience. Though automation can enhance convenience neither a new website or smart phone app can serve as substitutes for competent, ethical and effective leadership, quality member service or convenient branch locations.

Since 2007, the annual amounts spent on consultants has increased by more than four times and yet, the credit union continues in it's downward cycle. What is evidently clear to everyone but President Wiggington and the chronically obtuse Board Chair, Diedra Harris-Brooks, is that immense amounts spent on consultants is not resolving the problems created by the President. Furthermore, more than $200,000 in salary were spent during the years of 2009 through 2011 on the services of former COO, Beatrice Walker, who not only failed at every attempt to create successful streams of income but who indulged in widespread spending on numerous failed and superficial project none of which alleviated the credit union's cycle of losses.

Exacerbating the challenges she is forced to contend with is the fact that she has been provided the assistance of AVP, Joseph Garcia, an officer who has a well-documented failure at every position that he has been appointed to. Currently, Ms. Walker oversees the Real Estate, Consumer Loan, Real Estate Loan, Teller, Credit Resolutions, and the Call Center in addition operations for the South Pasadena, Los Angeles, Burbank, Van Nuys, Airport and Santa Clarita branches. Last month, Mr. Garcia confided that she is stressed and overworked.

We don't foresee a change in the credit union's decline. We also don't expect the new website, smart phone app, Ms. Garvin or Mr. Garcia overcoming the debacles authored by President Wiggington and the Board of Directors. What we do see is a credit union that indulges itself in wasteful spending at a time when spending should be monitored closely. Apparently, Charles R. Wiggington, Sr. is a gambling man with money that doesn't belong to him.

Priority One Credit Union is being sued again. In June, the lawsuit-laden credit union became the recipient of a fourth lawsuit filed by yet another former employee. This time the plaintiff is a former Financial Services Representative ("FSR") who was once assigned to the now defunct Burbank branch.

The former employee accuses the credit union of wrongful termination and alleges that AVP, Sylvia Perez, who had been her supervisor, subjected the "White" former employee to various abuses of federal law. The AVP allegedly also carried out a scurrilous campaign against the former employee which included racial discrimination, slander and the creation of a hostile working environment. Prior to her termination, the employee allegedly informed Director of Human Resources, Rodger Smock, of the abuses but in what is apparently a well-documented record of behavior, the aged director refused to respond to the employee's concerns.

This is the fourth lawsuit filed against the credit union. Two were previously filed by former employees and another by a member whose confidential account and personal information were intentionally published on the Internet by an employee of the credit union.

Last January, President Wiggington launched another of his periodic campaigns intended to save face and stated that at no time while he's been president has any former employee ever filed a lawsuit against the credit union. He of course, lied.

The latest lawsuit also lays waste to Director, O. Glen Saffold's statements to employees of the United States Postal Services insisting that at no time in recent years has any former employee filed a lawsuit against the credit union. Evidently, he lied.

A WALK DOWN MEMORY LANE

We recently came across of the letter issued to members by President Wiggington in 2007, following his intentional refusal to abide to the credit union's security procedures and which resulted in the mailing of ballots in envelopes on whose exterior were printed member account and social security numbers. In view of the fact that Priority One is the subject of four lawsuits, that business remains in decline and the recent prosecution of a former employee once assigned to the Los Angeles branch who absconded with more than $60,000 in early 2009, we thought it appropriate to publish the letter.

Sunday,

June 03, 2007

CREDIT UNION DON'TS

Priority

One Credit Union recently sent election ballots to members. Printed on the

outside of the envelope were some numbers... Each member's account number and

SSN. Text from President, Charles R. Wiggington, Sr.’s letter of apology:

Important

Security Message to Members

During the last week, we

mailed our election ballots to members. Unfortunately, an error

occurred* during the distribution of this ballot, and personal

information was inadvertently included above your address on

the envelope. This information was not printed in a format that would be

immediately recognizable, and we have no indication your personal information

has been accessed or misused in any way.

We

apologize for this distribution error, and deeply regret any

inconvenience or concern it may cause you. Your privacy and security are our

top priority, and we have taken precautionary measures to help ensure your

protection.

New protocols are

in place to thoroughly validate your identity before any account transaction

can be made. New member authentication procedures will further ensure you are

the only person who can open new accounts, apply for a loan or do business with

our credit union.

We

will provide, at no cost to you, a one-year membership in a credit monitoring

service. Equifax will monitor your credit daily and immediately alert you if

there is any unusual activity. You will soon receive a separate letter about

Equifax explaining exactly how you can enroll and how the program works. If you

have any questions, please call us at 626/441-1999 or 323/682-1999.

Additional

operational and security enhancements will ensure this situation cannot happen

again. We are committed to protecting your personal information, and will

closely monitor your account for the next year. We are also happy to change

your member number, upon your request.

We

will take whatever steps are necessary to protect you and your confidential

information, and your accounts remain safe and sound with your credit union. Please

don’t hesitate to call us at 626/441-1999 or 323/682-1999 or visit your local

branch if you have any questions or concerns about this issue.

In

addition to the steps we are taking to protect you and your accounts, here are

other security precautions you can take:

Place

a Security Alert on your credit bureau file. Security alerts provide added

protection because they recommend creditors contact you before opening new

accounts. To place a Security Alert or to obtain a copy of your credit report,

please contact:

Transunion 1-800-680-7289 www.transunion.com

Experian 1-888-397-3742 www.experian.com

Equifax 1-800-525--6285 www.equifax.comTransunion 1-800-680-7289 www.transunion.com

Contact

the following resources for additional information and guidance relating to

privacy and identity theft:

Federal

Trade Commission (FTC): 1-877-IDTHEFT www.consumer.govidtheft

Social

Security Administration’s Fraud Hotline: 1-800-269-0271

Call

us right away if you have any questions or concerns, or suspect any unusual

activity, at 626/441-1999 or 323/682-1999.

We appreciate your

continued support of Priority One Credit Union, and want you to know that “you

are our first priority.”

Charles R. Wiggington, Sr. CEO/President

The 2007 breach may not have been intentional but it was entirely avoidable. What's more, though it was President Wiggington who caused the breach, he found a scapegoat in the IT Supervisor who was suspended by the Board's chronically dull Directors none of who asked the President for evidence proving it was the IT Supervisor who violated security protocols.

THE APPLICATION

The new webpage contains a copy of the credit union's revised new membership application ("Master Account Signature Card"). The application was allegedly revised but it continues to contain outdated references. Why hasn't the credit union's AVP of Compliance or one of it's attorneys reviewed the card to ensure it is updated? It is after all, a legal document.

The allegedly carefully revised membership application references ATM card even though ATM cards were eliminated in 2009 by President Wiggington.

The credit union has a new blog. Correction, in October, the credit union disclosed it has a new blog, however, when visiting the page which contain a link their blog, a messages asks visitors to "check back soon." A week ago the reference to the new blog was removed.

EARLY DIRECT DEPOSIT

Priority One offers to post member payrolls before their scheduled payday. Unfortunately, the service is only offered to employees of the United States Postal Service. Of course as shown below, there is no reference to this on their newly revamped webpage.

Another problem we discovered is if you select the Early Direct Deposit link you are taken to a page containing a description of the credit union's membership eligibility requirements. Clearly, quality control measures to ensure that links were correctly synchronized was never performed.

In 2007, President Wiggington ordered all AVP's and Branch Managers to desist efforts to develop new business amongst employees of the United States Postal Service and instead, focus upon Select Employer Group ("SEG") development. At the time, he stated he wanted to change the credit union's membership demographics which had been dominated for many decades by employees of the postal service. He wanted to instead induct business owners and their employees and add more white collar versus blue collar workers to the membership.

The President ignored the fact that historically, SEG's were never profitable to the credit union. And though postal employees had shown their allegiance to the credit union for many decades, he intentionally chose to discard that relationship opting instead for something that was more superficially pleasing to his deluded views. Understandably, his plan failed. Not only did the credit union fail to increase the number of participating SEG's.

In September 2010, the President immediate cessation to all SEG development because the credit union could no longer afford trying to develop new business in a sector that has never been lucrative to the credit union. The actual reason why SEG developed was halted is because it is unprofitable and the money spent to draw SEG interest in what the credit union offers has not only failed to reap profit but SEG's are a loss of revenue.

In 2009, Executive Vice President, Rodger Smock, was informed that the SEG list which he personally oversees, is inaccurate and in dire need of being updated. He was informed that many former SEG's are no longer in business while others have sold to new owners who do not have agreements with the credit union. His response was that the inaccurate SEG list would remain intact and unchanged because a large number of SEG's on record enhances Priority One's public image. Clearly, the man is unethical and as addicted to creating superficial impressions as is his mentor, Charles R. Wiggington, Sr.

As shown below, the credit union is hoping to “sell” employers on the idea that membership to the credit union can be included in an employer’s benefit package “for FREE.” Yes, the materials, i.e., membership packages and applications are provided to employers at no cost but joining the credit union requires that an approved member make a minimum deposit of $5.00 into a savings account and pay, a one-time membership fee in the amount of $5.00. Obviously and contradictory to what the credit union states on their webpage, actual membership is NOT free. And because the credit union no longer possesses convenient branch locations, we disagree that membership to Priority One is the “best idea” a company might have.

As shown below, the credit union is hoping to “sell” employers on the idea that membership to the credit union can be included in an employer’s benefit package “for FREE.” Yes, the materials, i.e., membership packages and applications are provided to employers at no cost but joining the credit union requires that an approved member make a minimum deposit of $5.00 into a savings account and pay, a one-time membership fee in the amount of $5.00. Obviously and contradictory to what the credit union states on their webpage, actual membership is NOT free. And because the credit union no longer possesses convenient branch locations, we disagree that membership to Priority One is the “best idea” a company might have.

CONVENIENCE

After conferring with highly paid consultants, Priority One has had to accept they are a much smaller credit union with evident limitations which serve to compromise service as was provided in the years before President Wiggington created the debacles that led to the credit union’s reduced size and limitations. The credit union can no longer tout itself as a “Financial Fitness Center” or boast it possess the capability of helping members and employees “win with money.”

Priority One must now promote Home Banking, Mobile Banking, Phone Banking, e-Statements, Bill Pay, and Shared Branching. The change in focus in which emphasizes what the credit union offers should never be construed that they are offering actual convenience or superior service. As of November 5, 2012, loan development remains in decline while complaints asserting poor member service continue to amass. The change in focus may be President Wiggington’s attempt to deter attention away from the credit union’s gross limitations and bring attention to the non-human services they offer.

Priority One must now promote Home Banking, Mobile Banking, Phone Banking, e-Statements, Bill Pay, and Shared Branching. The change in focus in which emphasizes what the credit union offers should never be construed that they are offering actual convenience or superior service. As of November 5, 2012, loan development remains in decline while complaints asserting poor member service continue to amass. The change in focus may be President Wiggington’s attempt to deter attention away from the credit union’s gross limitations and bring attention to the non-human services they offer.

As shown below and contradictory to the reference currently found in the credit union’s New Membership Application (“Master Account Signature Card”) MILLIE is the name of Priority One’s phone banking system sand not Express Teller Audio Response System.

FACEBOOK

If utilized properly, Facebook can serve as a venue through which to keep clients informed and through which to promote one's name and brand. Not so at Priority One Credit Union where it's Facebook page is utilized to post mundane, uninformed messaging.

The credit union's Facebook page was created by order of former COO, Beatrice Walker. Though Ms. Walker's limited imagination was dwarfed by her inability to comprehend the potential purposes of social media. Despite having come online two-years ago, the page has garnered less than 200 "likes" to date, many entered by employees of the credit union.

The lack of interest shown the credit union's webpage mirrors the same disinterest members have in the credit union's products and services. We've located the following comments posted on the Facebook page. One, written by AVP, Gema Pleitez, states, "Loving the new website." There is a "Like" entered by Daniel Ballesteros, the credit union's Marketing Specialist and a third, from a person who has been a member since 1995, complains about the credit union's introduction of added charges.

The credit union's new webpage is riddled with issues which suggests no one at the organization though it prudent to review the accuracy of the information being published or testing the links to ensure they worked.

The link shown below, states you can earn up to $100 if you open an account, however, when the linked is selected, users are transferred to either the "Forms and Disclosures" page, “A brief history of Priority One Credit Union” page, "Benefits of Membership to Priority One:" page, or "Your co-workers can enjoy POCU membership too!": So what happened to the page where the $100 offer is described?

In October 2006, Board Directors, O. Glen Saffold, Thomas Gathers, and Janice Irving disclosed that they selected Charles R. Wiggington, Sr. to serve as Priority One's new President beginning on January 1, 2007 because "Priority One needs a Black President."

Priority One's Directors have used credit union monies to ensure Charles R. Wiggington, Sr. remains employed despite his well-documented record of business failures, his abhorrent personal behaviors and the fact he was found guilty of sexual harassment during a 2008 investigation. What's more, with the exception of Joe Marchica, all of the Board's Directors are Black as are all Supervisor's on the Supervisory Committee. In 2009, the President hired his then friend, Beatrice Walker, to serve as the credit union's first COO but on July 8, 2011, she was terminated, in part, due to her failed performance. However, unlike the President, Ms. Walker is White.

Shown below, is a photograph of Priority One's founders. They founded the credit union in 1926 (not 1929 as insisted upon by President Wiggington). Apparently, their decision to create an organization that would provide financial services to people who might not be able to obtain services from traditional banks did not take skin color into account.

https://www.priorityonecu.org/membership/apply/

BEATRICE WALKER.... AGAIN

Note: Since our publication of the photograph of Priority One's founders, the picture has been removed from the credit union's webpage.

BEATRICE WALKER.... AGAIN

Unable to find employment since being terminated from Priority One on July 8, 2011, former COO, Beatrice Walker, is now working as contracted consultant has found temporary work with her former employer, Honda Federal Credit Union . She is currently working within the Administration Department located at 19701 Hamilton Avenue in Torrance, California.

We've learned that she has informed her temporary employer that she is being "stalked" and "harassed" and so they've agreed to screen all incoming calls requesting to speak to Ms. Walker. Interesting that she has chosen to don the role of victim after her reign of terror at Priority One. Of course, Priority One is not the only credit union which she's been terminated from. As we've reported previously, employers displeased with her performance include AIRCO Federal Credit Union and Universal City Studios Credit Union.

WHIPPING BOY/GIRL

In the most recent lawsuit filed against Priority One, a former Financial Services ("FSR") accuses the credit union of wrongful termination, harassment, and of refusing to stop a scurrilous and discriminatory campaign carried out by notorious AVP, Sylvia Perez.

The FSR, once assigned to the no longer existent Burbank branch, had been employed by the credit union for a number of years and was also "White." According to co-workers, she was highly competent and liked by members though her work unlike that of other staff at the branch, was continually being scrutinized by Mrs. Perez. In fact, Mrs. Perez is referenced throughout the lawsuit and according to the employee, Mrs. Perez is now considered a liability to the corrupt and incompetent Board of Directors. Here is a list of the individual complaints cited in the lawsuit:

Complaint #5 states, "Failure to Prevent Discrimination and Harassment in Violation of Govt. Code § 12940 (j) and (k) [FEHA].” Prior to her termination, the FSR informed Human Resources that she believed she was being singled out and thus discriminated against, by AVP, Sylvia Perez. As we've reported for years, Human Resources Director and Executive Vice President, Rodger Smock, refused to respond to the employee's concerns. In fact, he was wholly and typically, unresponsive. And so the abuses perpetrated by Mrs. Perez were allowed to continue, unimpeded. This is also the same complaint cited in three previously filed lawsuits by former employees.

The Opening Declaration

As documented below, the alleged abuses perpetrated by Mrs. Perez and allowed by the credit union caused the former FSR, "stress and anxiety". Coincidentally, AVP, Sylvia Perez, is currently out on medical leave due to stress.

Unfortunately, for the credit union, the FSR's complaints were both verbal and written and common knowledge at the Burbank branch where staff often witnessed the abuses perpetrated by Mrs. Perez.

The lawsuit also echoes some of the same complaints contained in the lawsuits filed by the last Burbank and Valencia Branch Managers and a former Business Development Representative. The complaints also serve to dispel the President's insistence that the similarities in each lawsuit is purely coincidental.

Another problem for the credit union is that this lawsuit all of the lawsuits portray Human Resources, actually it's Director, Rodger Smock, as apathetic and refusing to either investigate or respond to employee concerns. As we've reported over the years, Mr. Smock was often instrumental in allowing the President and his executive staff, to orchestrate the terminations of employees using fabricated evidence.designed to slander, harass and ultimately, terminate unwanted staff members.

Though Mrs. Perez has established a well-documented history of abuses committed against subordinate staff members, Mr. Smock has continually refused to investigate any of the complaints lodged against her because she was known, until recently, to be a close friend of President Wiggington. In fact, in 2009, President Wiggington exclaimed publicly, “I wish all my employees were like Sylvia [Perez].”

Employees of the Burbank branch were all familiar with Mrs. Perez's emotionally erratic behaviors and all witnessed her habitual and frequent criticisms of the FSR ("Plaintiff"). The FSR's desk was located in the lobby of the Burbank branch, between the teller windows and alongside the desk of another FSR. Mrs. Perez never considered the conspicuous location of the FSR's desk and publicly found it appropriate to chastise the FSR in the presence of her co-workers and visitors to the branch.

Having grown weary of Mrs. Perez's abusive treatment, the FSR finally left the branch on a medical leave of absence. Mrs. Perez who is an insatiable critic, complained that the departure of the FSR would leave her short-staffed and disrupt operations. During her abusive treatment of the FSR, Mrs. Perez never considered that the employee possessed extensive banking knowledge and was intimately familiar with branch operations. As the old adage says, "You don't know what you have until it's gone."

We're uncertain of the extent of written records documenting the alleged abuses perpetrated by AVP, Sylvia Perez but we do know the names of former co-workers who have agreed to provide testimonies of Mrs. Perez's behaviors and actions. The former FSR also possesses copies of emails sent to Human Resources Director, Rodger Smock.

In 2010, then COO, Beatrice Walker, capsulized what she dubbed, the "executive sector's philosophy" regarding employee complaints alleging abuses perpetrated by managers and executives. In Ms. Walker's words, "never put anything in writing" as it will reduce any complaint to hearsay. Evidently, the former COO never heard of witness statements or circumstantial evidence.

The FSR suffered so much angst that she finally turned to her Supervisor, Nidia Reyes, and complained about the abuses she was subjected to at the hands of Mrs. Perez. Unfortunately and at no fault of Mrs. Reyes, she could not bring an end to Mrs. Perez's scathing personal campaign because both the President and Mr. Smock chose to protect the abusive AVP.

RACISM?

The subject of racism arose in the months preceding the appointment of Charles R. Wiggington, Sr. In late 2006 the Board allegedly interviewed numerous applicants vying for the position of CEO. Though the credit union interviewed several highly qualified candidates, Board Chair, Diedra Harris-Brooks, announced that the Board decided that Charles R. Wiggington, Sr. was the most qualified of all the people interviewed. According to Mrs. Harris-Brooks, his past banking experienced was a key factor for selecting him as President despite the fact that in 2006 he had not been employed he had not been employed by the traditional banking industry for almost 16 years.

However, Mrs. Harris-Brooks feeble reasoning was overshadowed by the statements of three Directors- O. Glen Saffold, Thomas Gathers, and Janice Irving, all who disclosed they selected Charles R. Wiggington, Sr. because what Priority One needed is a "Black president." Odd that skin color was the prime factor in their consideration and not competency or a history of achievement. It is seems that ignoring aptitude may be the reason why Priority One has been forced to close branches, lay-off employees and why it's net asset size has fallen since Charles R. Wiggington, Sr. was appointed President.

Mrs. Perez was not only a polarizing presence at the credit union but since being appointed AVP on January 1, 2007, had incessantly complained and slandered employees and provided Director of Human Resources, Rodger Smock, often exaggerated and fraudulent information about employees she wanted terminated. In fact, Mr. Smock not only became her number one enabler, he helped carryout her plots and was pivotal in sealing the fate of a large number of employees.

Sylvia Perez's decision to publicly disparage and humiliate the FSR seems to have pushed the credit union into a precarious position. Fortunately, for the President and the Human Resources Department, the Board of Directors easily dredges money out of the credit union's coffers needed to forge defenses that utilize fraudulent allegations and evidence to try and defeat Plaintiffs and avoid what would assuredly be an embarrassing court trial.

The statement contained under #23, shown below, may indicate that the FSR exhausted the statue of limits which allowed her to file a complaint with the Department of Fair Employment and Housing though it is likely, the department advised her to seek legal counsel. .

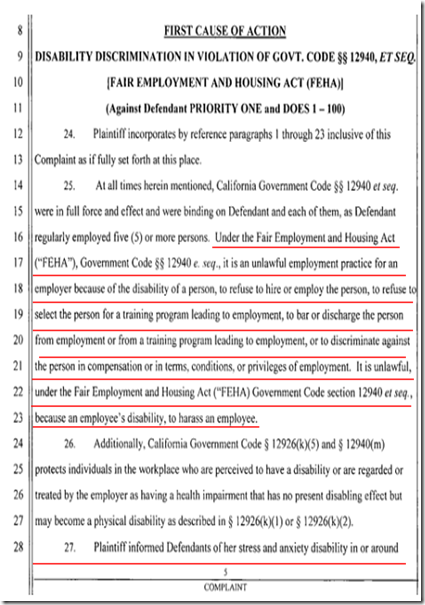

As shown below, FSR’s attorney asserts that it is unlawful in the state of California for an employer to discriminate against an employee because of a disability which includes, pregnancy.

The President has also recently disclosed that settlements paid to settle the lawsuit filed by the former Burbank Branch Manager and a former Business Development Representative were paid from credit union funds and not it's insurance, however, the credit union may now have to begin filing claims with it's carrier should they enter into settlements for this and other lawsuits which may arise in the future. Additionally, the President has stated it is imperative the credit union squash all future lawsuits before they can proceed to court. If what the President says is true, he is again refusing to contend with the fact there is a lot of documented evidence supporting allegations leveled in every lawsuit filed by former employees. And even if the credit union could by chance succeed in crushing any of the lawsuits filed against it, Priority One will still have to contend with the fact it is spending exorbitant amounts one legal fees including paying legal fees for it's former COO, Beatrice Walker, who is named in the lawsuit filed by the last Valencia Branch Manager.

VIOLATING CONFIDENTIALITY

During the process of revamping Priority One's webpage, President Wiggington and his staff have again violated confidentiality.

The following documents describe the scope of Priority One’s right to share confidential member information. We’ve recently discovered that the credit union provided Foresee, a consulting firm, the personal email addresses of some former and current employees, allegedly for the purpose of gathering information pertaining to the quality of member service provided by the credit union. The alleged purpose of providing the firm with address is so that current and former employees could be asked about their opinions concerning the credit union's services and products. However, one has to wonder why inquiries were also sent to former employees who were terminated by the credit union and others who sued an all who are no longer members?

The following documents describe the scope of Priority One’s right to share confidential member information. We’ve recently discovered that the credit union provided Foresee, a consulting firm, the personal email addresses of some former and current employees, allegedly for the purpose of gathering information pertaining to the quality of member service provided by the credit union. The alleged purpose of providing the firm with address is so that current and former employees could be asked about their opinions concerning the credit union's services and products. However, one has to wonder why inquiries were also sent to former employees who were terminated by the credit union and others who sued an all who are no longer members?

We believe the chronically unclever President Wiggington was hoping employees that signed severance or settlement agreements would elicit negative and critical reactions about the credit union. The agreements signed by former employees prohibit them from disparaging the credit union. Of course, one would have to define what disparaging actually includes. Does commenting negatively about the credit union's poor member service constitute a violation of an agreement? President Wiggington is well aware that a violation of the agreements entered into could force former employees to repay the amount of severance or settlement paid to them by Priority One.

But is the credit union's disclosure of addresses for former employees who are no longer members, actually legal? Why would the credit union want to solicit responses from individuals who closed their Priority One accounts. At the time an account is closed, members are asked to provide a reason for the closure. Doesn't also mailing out a letter to former employees who are no longer members and some, who were terminated, seem more than a little redundant? Is the credit union adhering to it's assurance "To protect your personal information from unauthorized access and use" when it is releasing personal information without the consent of the former employee?

In it's statement, the credit union also refers to "security measure" but what does the term really entail? The credit union does not provide anything that describes the alleged "security measures." The credit union also alludes to "computer safeguards" but what exactly is it referring to? We happen to know that all employees have access to member records maintained in XP. These include co-worker records. We also know the credit union forwards hardcopies of all documents to storage though no mention is made to this fact or how the credit union protects documents leaving any of it's remaining branches.

.

.

The following is an excerpt from the consulting firm to a former employee is not a member and whose was terminated but who later sued and was paid a settlement by the credit union:

WHEN A PERSON SHOWS

YOU WHO THEY ARE- BELIEVE IT!

-MAYA ANGELOU -

January 1, 2013, will mark the sixth anniversary of Charles R. Wiggington, Sr.'s appointment to President. Can anyone name a single contribution he's made over the past six years that have contributed to the betterment of Priority One Credit Union?

Since his appointment, President Wiggington has immersed the credit union in scandals in caused it hundreds of thousands of dollars in legal spending. What's more, his business decisions have proven an abysmal failure while his hiring of executive personnel and consultants have done absolutely nothing to improve business and have further depleted the credit union's financial resources. Still, the Board of Directors and it's Chair, Diedra Harris-Brooks, have deemed it prudent to retain his employment and when necessary, have exacted all efforts to hide evidence proving he violated state and federal laws.

In response to the credit union's looming and seemingly unresolvable problems, the President spent even more credit union monies to hire consultants who have decided that what the credit union needs most to resolve it's internal and external problems is a brand new website. Evidently the more than past five years have taught Charles R. Wiggington, Sr., nothing about prioritization or about the importance and need to understand the credit union's ethnically diverse marketplaces.

Since April 2012, the amount of employees who have been terminated, who have resigned and who have left the credit union on medical leaves has skyrocketed and is unprecedented in the long history of the credit union. This past June, notorious and abusive AVP, Sylvia Perez fled the credit union on medical leave after being issued two written warnings for failing to meet her assigned monthly quotas. Why is it that in the years before quotas were issued, did Mrs. Perez boast about her alleged superior business development skills yet those excellent abilities disappeared suddenly with the advent of monthly sales quotas. Coincidence? Hardly. She not only spent years lying about her alleged non-evidenced accomplishments but she often berated her staff for failing to achieve her allegedly high standards. As 2012 proved, Mrs. Perez exaggerated her abilities and created a fictitious representation of her achievements. The fact is, Sylvia Perez knew nothing about developing new business as proven by her failure to achieve her monthly sales quotas during the months of February, March, April and May 2012. Yet in 2009 and without a single piece of evidence, the President declared that he wished all employees were like Sylvia Perez. We're 100% certain he'll never make that statement again.

We previously reported that late last year, President Wiggington promoted Assistant Loan Manager, Joseph Garcia, to the post of AVP of Sales and Business Development despite the fact Mr. Garcia had not proven record of accomplishment in sales or business development. What's more, he amassed a well-documented record of failures which resulted in his demotion of every position he was promoted to in 2010. Recently, Mr. Garcia left on his second leave of absence since mid-2011. According to Mr. Garcia, he is again suffering from work-induced stress.

Prior to his recent departure, Mr. Garcia confided to some staff members in South Pasadena that he is seeking new employment, complaining that CLO, Cindy Garvin, had demanded that he personally bring in new business or she would seek his termination. Initially, Mr. Garcia responded by visiting the communities in the San Fernando and Santa Clarita Valleys but his efforts failed to garner any new business. But this hardly should come as a surprise. Here is a summary of Mr. Garcia's promotions and demotions:

- January 2010: Promoted to the post of Call Center Supervisor. On January 2011, Mr. Garcia was stripped of his title of Call Center Supervisor

- February 2011: Promoted to Manager of Real Estate and Consumer Loan Development On July 2011, Mr. Garcia was stripped of his authority over Real Estate Development

- August 2011: Demoted to the post of Assistant Loan Manager

Mr. Garcia also revealed that Ms. Garvin ordered that he remain in the field until 4 p.m., Monday through Friday. Prior to be forced to work in the field, Mr. Garcia was often observed seeking new employment using his company-issued computer.

The credit union's current focus is emphasizing the convenience of "virtual" services but none of these are going to resolve Priority One's internal issues plaguing it's operation. The problems at the credit union will continue as long as Charles R. Wiggington, Sr. remains President and CEO and while Diedra Harris-Brooks remain Chairperson of the Board of Directors. In the meantime, continue to expect the filing of more lawsuits and increased spending on attorneys hired to create stories designed to exonerate Priority One's abhorrent President of wrongdoing.

To be continued......

Kindly Share The Love»»

|

|

|

Tweet | Save on Delicious |

124 comments:

So Theresa Haddad did sue. Wow. I know she's got a lot of dirt on Sylvia. I also know that no one who used to work there cares about Wigg He let Bea abuse some of them and then he left all of them without jobs. I'm sure they are happy not to work for him anymore. Unemployment, disability, anything is better than having to work for Wigg, Smock, Syliva, Yvonne or Joseph. Sylvia and Joseph get exactly what they deserve. Wigg was never their buddy and Cindy is no ones friend.

Hello,

This message is directed towards the owner and/or manger of this blog. My name is Nylonda Sharnese.

As you are aware, defamatory, private and untrue statements have been posted about me and my previous account with Priority One Credit Union. If Priority One is willing, would you be willing to post a comment(s)from Priority One Credit Union wherein they state that the defamatory remarks, confidential and private information are untrue?

Time is of the essence. Therefore, a speedy response is appreciated.

Thank you.

We have read the comments that appear to have been posted by an employee or member of management.

We agree to post any comment from the credit union which states the comments were untrue and constitute a violation of private and confidential information.

So Theresa Haddad is suing? Geez how many more lawsuits can they take. I bet none of this would ever have happened if they either had got rid of Wigg and Smock or Diedra.

Theresa sue that dukie outta P1 and no good Sylvia. These people made so may lives hell. You go and I hope you win!!!!!!!!!!!!!!!!!

Before putting her stamp of approval on our new webpage, Gema should have actually looked at it. I can't believe it has so many mistakes something overpaid Gema would know if she read it. Maybe she doesn't know how to read English which would explain a lot.

Not to mention she (Gema) comments on her employer's website with a facebook profile that has a collage of pics including a provocative picture of her in a bikini showing a tramp stamp. I thought employers reprimanded that type of representation, especially by an AVP. Maybe Yvonne will use that in her growing pile of reasons to fire Gema.

OMG! I never even paid attention to Gema's FB. Yikes! The pictures look like a PORN promo. What is she doing with that straw? Straws are for drinking out of not caressing. Geez bitch, don't you think employers and other people look at FB? Another class act. P1 is such a lowlife ghetto credit union.

Nice pic Gema. You forgot the for sale sign.

Yvonne should fire her own tired ass.

I can't believe they're being sued again and Wigg is still protected. What's up with that? Business is so bad and our phones are busy that even Yvonne's starting to answer them. She has Gema who is useless but who knows more about member service. And Cindy is breathing down everyone's neck, no wonder Joseph went out on leave though we all know he's looking for another job.

Wow Gema. Nice way to represent!

I went to their FB page. That link Daniel has doesn't even work. Figures.

Sharnese,

What kind of word is herein? You think your some kind of damn lawyer going around suing hard working people and worse of all, even you own people?

We know about your legal service job, but that don't make you a lawyer. We hire real lawyers who went to law school. Here's some advice. You're pushing 50 years old. Just pay your damn bills on time! I hope you herein me good.

Is P1 going to apologize to the member? So they are admitting they violated the privacy act? That's big and no like them at all.

Anonymous wrote.....

"Sharnese,

What kind of word is herein? You think your some kind of damn lawyer going around suing hard working people and worse of all, even you own people?

We know about your legal service job, but that don't make you a lawyer. We hire real lawyers who went to law school. Here's some advice. You're pushing 50 years old. Just pay your damn bills on time! I hope you herein me good.

November 13, 2012 3:28 PM"

Oh, Yvonne your so bitter. Just for you alone, HEREIN is defined as...

herein [ˌhɪərˈɪn]

adverb

1. (Law) Formal in or into this place, thing, document, etc.

2. Rare in this respect, circumstance, etc.

You are so stupid and should be sent packing back to the Ozarks, ASAP. You think we all forgot about your little coup with your ex-boyfriend, Bea Walker, when the 2 of you thought you'd kick Wigg out and take over the CU?

Internet Detective

Who is Priority One MC?

“What kind of a word is herein?”

Answer: Well she is someone uneducated so you know she’s in management.

“You think your some kind of damn lawyer going around suing hard working people and worse of all, even you own people?”

Answer: Who would be so bitter that they would accuse Sharnese, the member, of “suing hard working people and worse of all, even you own people?” The member sued the credit union and named Diedra Harris Brooks and Yvonne Boutte. Only one of those two would be bitter enough to be angry because they got exposed.

“We know about your legal service job, but that don't make you a lawyer. We hire real lawyers who went to law school. Here's some advice. You're pushing 50 years old. Just pay your damn bills on time! I hope you herein me good.”

A: Who knows about the member’s legal service job beside the Collections Department. When an account is collections they know where a person works, their title, and how much they earn. They also would also be the only ones to know if a person is involved in a dispute in collections.

Me thinks Priority MC is either Diedra or Yvonne, maybe Alex Suarez but I don’t think she could write a grocery list.

And NO, Priority One hires dishonest, unethical and conniving lawyers, just like the Board hired an uneducated, ghetto, gross President and overweight, over the hill, Missy Smock.

Welcome back Priority MC.

They're being sued for violating confidentiliaty and then some at the credit union posts AGAIN! That is like so dumb. Hey Wiggington, feed your dogs!!!!!

More lawsuits- no surprise.

Dropping loans- no surprise.

Employee moral down- no surprise

Yvonne or one of her dawgs still posting ont he blog- no surprise.

Priority MC, how do you know the member is pushing 50?

Isn't Yvonne pushing 50. How old is Alex? Its hard to tell under the layers of make-up.

Wigg is over 50 and Smock is WAY over 60.

Pure incompetence. You have Cindy who doesn't know squat but she's in charge of all branches and now that useless Joseph is out, she's in charge of sales. You have Wigg who couldn't teach a 6 year old how to touch their show laces and you have Smock who is as useful as two heads on a cat. The call center sucks. Sometimes you wait 20minutes plus before someone answers the phone. Most of the calls they get are complaints about poor service. People are closing their accounts because of poor service and ridiculous fees. They've been sued so manay times that you know that place sucks big time and that its never going to get better. And I just read the comment from priority mc that could only have come from a manager. The managers at P1 have so much time to play, while their people are working they go and post on the internet. Wonderful. This is a company in the toilet and going down fast. The only way they'll ever have a chance if you boot the entire black board out and Wigg, Smock, Saeid, and West. That's if its not too late.

I thought Wigg was 70.

Wigg was 57 in March ... he just looks 70 !!

LOL.

You know Priority MC is management and Black because she says "You think your some kind of damn lawyer going around suing hard working people and worse of all, even YOU OWN PEOPLE?"

What does that mean. Priority MC could be anyone on the board. They let Wigg backstab all people of all colors but if they get sued by a black person they pull out the race card. Stupid and ignorant.

Wigg was 57 in March. In what dog years?

I thought Irma, Wigg's asssitant was Priority MC? Wasn't that's why they fired her.

Cindy was saying loans went up a little but did they go up enough? No, because she's worried particularly since where whipping boy- useless Joseph is out which means she better produce work to show he's useless and to bring in money we need. And lately Yvonne looks like she's smelling poop. I can only imagine how her little world isn't what it used to be. Probably wishes her BF Bea was still at the credit union.

Well, we get more older people complaining about the new webpage that they don't like. Probably because Wigg didn't work out the bugs in it. I don't think he can ever do anything right.

So much hate being spewed out on here. I stumbled across this blog and after reading it I am left speechless and feeling sorry for the inconsiderate people who contribute to it. I don't understand why you think it's okay to post private details or make such offensive remarks about others. You all come across as bitter, hateful, and hypocritical. Just mind your own business and find something better to do. This is the first and last time I will spend my energy reading this trash.

I doubt you just happened upon this blog. You must be new to the internet and its obvious that you're either Bea Walker (you write just like her) or management (though none of them write well at all). You want hateful, go look at the political commentaries on Yahoo news. Since your supposedly come off as a stranger which is hard to believe, then make your comments when you actually know what's going on at P1 and when you know who Charles Wiggington and his monkey brigade really are.

Anonymous, you didn't just stumble on this blog you lying sack of cow crap. And if its your first time here and you're not coming back then don't let the door hit you on the ass, liar!

You're probably from Foresee. You know you f*cked up the credit union's webpage with all the stupid references that don't make sense and links that send people to the wrong pages. You have to wonder how much did dumb ass Wigg make the credit union spend on what they don't need? You can add that to his other list of failures like the call center and hiring Beatrice Walker and that stupid badge he had us wear a few years ago that said JUST ASK. You're just one of Wigg's lame people/flying monkeys trying to shame everyone. The ONLY one that should be ashamed is car stealing, sexual harasser, credit union destroying, shack-owning Charlie "Loser of the Year" Wiggington.

You forgot to mention the youth account signature cards. They are so outdated. Smock supposedly working on getting them updated for over 2 years but he's too busy doing squat. I'm pretty sure that an audit would show that a lot of the forms are outdated and maybe not even legl. They have a compliance officer who probably over her head and frankly, not really compliance material. They don't have anyone who makes sure cards are updated when laws change or updated.

What agencies are responsible to make sure their documents are in compliance?

So much hate being spewed out on here. Who do you people think you are, Charles Wiggington, Bea Walker or Rodger Smock? I stumbled across this blog just like P1 stumbled on top of four lawsuits.

I feel sorry for the credit union because they're going to be paying out settlements for a long time to come. I know Charles Wiggington talks shit about everyone but what makes you think you have a right to talk shit about him.... is what he would say if he had the balls to post on here using his name.

I waited 20 minutes today for someone to answer the phone. I finally hung up. I know I can't be the only person this happen to.Its sickening.

4 things that missed the mark-

1. The call center

2. The new webpage

3. Cindy Garvin

4. The Santa Clarita office

4 things that are sinking the credit union:

1. Charles Wiggington

2. Rodger Smock

3. Attorney fees

4. The board

John, thank you again. Can you post more pics in a future blog of Wigg's house? LOL.

Wigg said Theresa lost her case. He said she filed her lawsuit too late so that she doesn't have a case. He was really happy and said the lawyer already sent the court notice that they want her case dismissed.

Unless the lawyer already got a judge to rule on his motion, what Wigg says means nothing. The man is a liar and exaggerator and dishonest and stupid. I wouldn't believe him further than I could throw Smock.

Cindy says we need loans but we deny most loans so it doesn't make sense. They need to change how they approve people plus they need to promote loans because their is no real marketing.

They already made the risky move of upping the credit reports from 30 to 60 days so I don't think they need to make another ill conceived move that'll continue to leave the credit union susceptible to more risk in exchange for more loans.

Nylonda, I just read that you worked in a legal service. I've been repeatedly reprimanded at P1 for things outside my written job description. I'd rather not hire an attorney. What can I do to protect myself?

It used to be that once you got approved you had 30 days to fund your loan. After Cindy arrived they changed it to 60 days. There is a very good reason why 30 days was the limit. In 30 days a person's credit score can drop. Debt ratio can go up. They can get more unsecured credit. They can be reported to collections by a creditor. Cindy changed it even though she is supposed to be some big time expert in loan funding. She knew it would the company at risk. Worse yet, Wigg knows that it would put the credit union at risk but he didn't care because he's desperate. You would think that Saeid or useless Rodger Smock would have insisted he didn't change the policy but they didn't. They are setting themselves up for failure like they always have. Wigg thinks breaking the rules is ok as long as the reports make it look like the credit union is doing good. Right now the only thing he can brag about is capital is high but funding is not good.

To anonymous-

I am not Nylonda but I thought I’d provide some information about performing duties that fall outside your job description.

Priority One is going to put itself in trouble AGAIN if they issuing out warnings for poor performance for tasks hat are not described in an employee’s job description. The credit union can put itself at legal risk if it holds employees accountable for work not specified in their job description. If Priority One had a competent HR Department they would know that disciplinary actions, write-ups, and denying raises should not be issued to employees who are forced to perform work that falls outside their job description.

There is a big difference between being asked to perform work that relates to your usual job duties and work that doesn't. It also doesn’t make sense that Priority One dings you for duties not in your job descripiton because your performance evaluation always considers how you’ve performed the duties described in your job description.

For more information, please visit the State of California’s Department of Industrial Relations at http://www.dir.ca.gov/dlse/ .

I remember when Joseph Garcia tried to get us to approve a loan application where the member had a 120% debt ratio. There was no co-applicant and he just couldn't understand how the person didn't qualify for the loan.

I don't understand why if they have such little business why you have to wait and wait when you call the office. Sometimes I wait as long as 25 minutes. Its ridiculous. In the web it says you can call but the wait is ridiculous.

Does anyone know what happend to Susan's lawsuit?

You're right that things aren't going well but at least Joseph isn't here and hopefully he's got another job or will get another job. Everyone was so tired of him and his micromanaging. I know he was under pressure because he said Wigg was riding him but he took it out on all of us, so him being away is a good thing for the rest of us except maybe Cindy who can't use him as her scapegoat.

Upper management knows what theyre doing. They know that they can't float at this point so they stay well capitalized and milk big pay checks. They're just going to do the same until they absolutely cannot milk this crooked system they have going on. Everyone works 4xs as hard as they used to and don't get paid any more than they've been making 5 years ago.

I know that Wiggington, Smock, Raad, Boutte, West, and Garvin (and her friends- Ballesteros and Huffman) are taking home the big bucks. Its like they're milking the credit union dry which buisness doesn't allow for it. I agree with you that they're miling it. The CU isn't making enough money, so employees haven't got raises for years which lets management keep getting the big bucks for doing absolutely nothing. This is the laziest, most useless, nastiest group of people I ever worked for.

So Agree.

Rodger is nastier than Wigg. Before we all knew what a low no moral lowlife he is, he had a lot of people foolwed acting like he was everybody's friend. He's always been out for himself. He should of been fired by Harris and sent back to San Francisco. Most of the board can't stand him including Thomas Gathers and Mrs. Irving. Years ago when Betty the old branch manager died, her daughter called Rodger and asked he be a pall bearer. He agreed but he said he didn't want to go and couldn't understand why had to go cause he didn't even like Betty. I know Wigg is THE problem but you got to blame Rodger to who has gotten a fat paycheck for doing nothing.

This blog really puts a fire in Wigg's pants. They're working on fixing all the mistakes you guys found on the new webpage. The consultants also told Wigg that she should bring back Mr Harris' old loan promos so they're going to start offering a holiday loan even though their policies still call it a Christmas loan.

Yvonne also had to speak to Gema and she was told she needs to change her facebook pic because they one she has posted where she's wearing a bikini and doing something with a straw is violation of policy. The circus is still in town. LOL.

Gema altered her photo. She took the one of her showing off her tramp stamp and replaced it with her looking like a 15 year old boy.

Lol we might not be able to fire Gema but if we can cause her discomfort and humiliation at work for pointing out her ghetto-ness then job well done.

It is as hard to point out to Gema's skills as it is Wigg's or Yvonne's. Gema has broken almost as many rules as Wigg and Yvonne but HR let her get away with a lot. Her pic with a tramp stamp is a perfect metaphor for P1.

Who would ever believe that Wigg, Smock, Gema, and Yvonne could make the worst employees imaginable look good?

Gema used to mention that she didn't like hiring girls because they were too much drama. Then she hired all males for tellers. Then she promoted johnny to a member service rep ahead of Lorena because she thought he was good eye candy. She liked flirting with all the males but Johnny always got the preferential treatment. So yes she committed same sex descrimination.

Then she started hiring females because none of the males would let her walk all over them. Louis didn't like her demeanor and transferred to the call center asap. Johnny went too, Jason had enough and found a different job and Alex went to IT. She likes guys but guys avoid her.

I never understood why Gema was made branch manager. I know she knows a lot but she’s lazy and manipulative and she looks so unprofessional with the same suits she wears year after year and same flat beat-up shoes. Then there’s the way she talks. She talks to everyone- employees, management, and members using poor English and poor Spanish.

It’s no secret why Smock hired all those Latino boys to be tellers. Every time he walked through member services his eyes would go back and fourth like one of those cat clocks. Gema did promote Johnny because she “thought” he was eye candy and because he used to tell her how attractive she was. That boy was dumb- dumb as dirt, so he had to kiss ass all the time. He even told Bea Walker she had pretty hair. Johnny would say anything and do anything because I think deep down inside, he knew he didn’t cut it. He also kissed up to Joseph which got him promoted to call center supervisor but when he couldn’t do the job, he got written up by Gema. Guess she got over her crush. She then started riding him and when his wife got sick and he had to take time off to take care of her and his sons, Gema told him he was abusing his sick time and might bet fired. Then she dumped him on Suzanne and she tried to work with him by asking Mr. West to work something out with Robert West. But lazy, useless. dishonest Robert West threatened Johnny and Johnny quit. Johnny should have let them fire him so he could collect unemployment.

Gema did back stab Lorena. She even helped Yvonne and Cindy Garvin call Lorena into a meeting and threaten to fire her.

She liked the boys (which is hard to believe because a lot of us thought she is kind of boyish). They all ran away from her just like when you leave the yard door open and the dogs get out. She breaks policy, sells DVD’s at work, had people clock her in for years, lies, backstabs, kisses but, is lazy, didn’t like talking to members and still she makes the big bucks even though now days she has to work as one of Yvonne’s servants.

You forgot about Ernesto who was tight with Gema for a long time until she started riding him and then backstabbed him. I don't think Gema likes men, she likes to control them. If she looked like Megan Fox maybe they wouldn't have abandoned her so quickly but she's just some barrio girl with barrio habits. She lucked out when ble Virginia left on medical leave. If that hadn't happened, good for nothing Yvonne Boutte might have already have shown Gema the door and Gema knows it.

I do agree with all of the ideas you've presented on your post. They're really convincing and can definitely work.

Nonetheless, the posts are very short for novices.

Could you please extend them a little from next time? Thank you for the post.

Review my web blog - how to trade silver futures

That's true because anyone that has ever worked with Gema and Virginia knows that Virginia did EVERYTHING for Gema. The only work Gema would do is put her name on something that would give her brownie points with her bosses.

When Bea was COO, Gema would always call her Miss Walker. She used to tell us that "Whatever Bea says is right with me." She turned into a mindless robot. Then again, for awhile Yvonne turned into Bea's yes man and Joseph Garcia would follow Bea around the office like a dog follows its master. That all ended when she dumped him for Gema and promoted Gema. Then he started complaining that Bea didn't know how to talk or treat people and that he was afraid Bea was going to fire him. That's when he took off on his first medical leave. Since April he's been complaining that Wigg and Cindy are riding him and they expect too much from him. So now he's on his second leave.

What happened to the monthly goals? They haven't fired anyone lately because Wigg's plan was to LEGALLY fire people. This way they could hire new people with less pay and no or few benefits. Plus they're in so much trouble, he needed to make cut backs without making it look like they were being forced to cut back. Guess he never thought people can just look at the credit union's reports.

The goals are still in place they just aren't enforcing them. I think they know it didn't help and the problem isn't the employees its management. Plus they didn't train staff. Like anonymous said, they needed to cut back costs so firing people using the excuse that they didn't make their numbers was just an excuse. Business is still bad and a lot of older members don't like the new webpage.

I just read your blog. You are right, they do break confidntiality all the time. Well at least until they started geting sued but the worst was Wigg, Yvonne and Cindy. When things started getting hot they started whispering in secret and I had heard they were trying to find out what ex-employees say about them so they gave the consultants their email addresses that way the consultants could contact ex-employees and see if they said anything negative about the credit union. Wigg said they maybe get back severance pay they gave these people. The man should be focusing on how to fix his messes but instead wants to play detective. This is one old dog you can't teach new tricks to.

A lot of employees are looking for other jobs except that those I think are going to wait until P1 goes all the way under.

Wigg is getting word out that he's available for other jobs because even he knows he has screwed over the credit union and employees. Anyway the only one he cares about ks him and his salary.

At least it's better without Joseph. It doesn't look like Cindy or anyone else misses him.

An attorney talked to us about confidentiality. I don't know why they talked to all of us if everyone knows it's management that always breaks policy. It's like when Wiggington sexually harassed Kim, it was all the employees who had to go to sexual harassment classes. We were told not to post confidential member info on the block but everyone knows it was someone in management who posted info about the member who is suing. They even posted two weeks ago info only management knows about. Just sloppy.

Really? Another attorney? That's a hoot. Whenever Wigg or one of his lame managers screw-up, everybody (except management) pays. They call lawyers and consultants to speak to employees and warn them to stop breaking the rules even when its management who breaks the rules. Way to go Wigg, you're not ony a coward, you're lame too.

LOL. What a surprise- more attorneys at the credit union. Let's just lock up Wiggington. Problem solved.

Valencia has zero business and only an FSR and teller. Wiggington and Cindy want to close it but don't know how they can do it without passing of the post office who own it. Business is so bad that we are stopping opening branches on Saturdays starting next month. Smock has taken Joseph's place overseeing branches but he is lazy. At least he's not a pest like Joseph.

Before the Santa Clarita branch opened this blog said it would fail because of the location. The office hasn't been the success Wigg said it would be because of the location. Seems like everyone but old, dumb as dirt Wigg knows what are bad moves for the credit union. Fire his ass! And Smock overseeing branches is like having a poodle oversee branches. What a stupid run credit union.

South Pasadena is the only office that's going to continue opening on Saturdays. Santa Clarita which has no business on any day and Van Nuys will stop opening Saturdays. Los Angeles doesn't offer Saturday hours. Another one of Wiggs and Cindys plans that went up on smoke, I mean smock.

Business sucks. That ought to be the name of the next annual report. Santa Clarita is another of Wiggs big failures. Well that and the new webpage which a lot of members don't like. Does he ever do anything goes right?

You'd have to be dreaming to ever think Wiggington can turn the current around. He is just too stupid.

Santa Clarita was doomed way before it was opened because it never occurred to Wiggington, Rodger, Cindy and Yvonne that maybe they should evaluae that opening a branch on some distant hill away from heavy traffic, would prove lucrative. Hard to believe that he's got overpaid "experts" and not one of them had the balls to say, "Hey Wigg, the location isn't a good one". He never thought that after closing the Valencia branch which offered convenience and made money and then disappearing for a whole year with no presence of Priority One that just maybe, members would forget about the credit union and take their business elsewhere. Wiggington should get the Moron of the Year award because this is truly a stupid man.

My thoughts exactly. He should've started advertising in the area instead of just posting info online and in the newsletter. I mean seriously, I am truly amazed and the depths of his stupidity and the arrogance he still carries on a daily basis. Now I know he gets paid more than us but I don't think he gets that it doesn't offset his lack of intelligence. This is a man with no morals or ethics and whose professional legacy will be remembered as the idiot who was too proud to step down and too dumb to see it that way.

Also if you look at the one comment on the priority one app under the google app store, it pretty much sums up the credit union. It goes something like this:

"I've been a Priority One Credit Union member for some time now and have been patiently waiting for them to catch up with the rest of the world...."

The member did go on to say how this app is great but this phrase hits the nail on the head. No matter what "new" strategy they take ( call center, new site, app) they are always playing catch up.

So true. Wigg used c.u. money to pay expensive consultants to improve business. He could of got the same advice for free if he got his lazy ass up and studied the competition and the marketplace. Of course that would mean spending less time on the phone with Aunt Jenny and less time gossiping. Wiggington is stupid. Just last month Providence St Joseph had a benefits fair and they contacted Rodgers to invite the c.u. to setup a booth but no one called them back and of course we didn't attend. Also notice how Wigg has elimitated business development so we don't visit SEG's, post offices or reach out go the community. Also notice how since Wiggtook over no more free financial education to members or participation in community events. The man is a failure and behind the times.

It seems to that Wigg wants Priority One to fail. The manuscript stupid and we pretty much all know that but how could he still be employed after doing so many destructive things, i.e. mail out envelopes with member account and social security numbers printed on the outside, sexual harassment, hiring Beach Walker, lying about income, shutting down branches, plotting against employees, getting rid of business development, ruining the relationship with Providence, promoting incompetent, ect? It looks like he's purposely sabotaging the credit union.

I can hardly wait until Wigg puts an ATM in at the main branch. That'll put him ahead of everyone else in the industry.

I'd just be happy if he wasn't so ghetto or such a lowlife.

Why would Wigg sabotage the credit union? I mean the place is a mess but I always thought it's because he is a dumbass. I know he is vindicative and did a lot of things to try and destroy people but purposely destroying the whole credit union is just crazy. If you can give more information.

Cindy is the one trying to run the show. Wigg doesn't do much except walking around looking stupid and lying like always. Smock looks old and fat, makes me feel bad for his boyfriend. All the loans we get are from calling members or members calling us or those dropping by the branch. No more posters or mailing stuffers and Wigg thinks putting messages on the company webpage is the best way to reach out to members. Its dumb but all Wigg.

Obviously Cindy isn't succeediing. She still has Wigg convinced that monthly goals for all emploees is key to success. Even Joseph couldn't bring in new business. They have Cindy's buddy working as the marketing specialist but do you see business being promoted? No posters or flyers and no business development people. The board should change the credit union's name to Invisible CU with the tagline 'we're here, you just can't see us.'

Well isn't that the problem with how Wigg does business? He has no idea about the role of marketing. He tinks advertising is the same. As marketing. He also thinks services=marketing. He isn't doing anything to promote the credit union other than hoping people will stumble into P1.

Wigg is using the webpage instead of mail delivery to notify members of changes. Yvonne says it saves on postage.

I can't believe how Wigg still walks around with that stupid look on his face after all the shit he's done. I ran into a former employee who said she quit in 2008 because she could already see how he was ruining the credit union. He turned a nice credit union into a dump.

Business without marketing always the road to failure.

Business with Wigg always the road to failure, too.

Theresa has a lot of nerve suing. She knew procedure but everyone knew she was rude to members plus she was a big complainer. Her useless husband once called her to her their dog was sick. Theresa started crying and called Sylvia who was in a meeting at the main office and told her she needed to go home immediately. Sylvia was mad and had to leave the meeting and drive back to South Pasadena so Theresa could go home. I don't like Sylvia but Theresa was just like her. She shouldn't get two cents. She was a knowledgeable employee with a sucky attitude.

Too true. Even Smock got tired of all the complaints.

Smock gets tired of anything that makes him work.

Thank you John, you are a hero.

Theresa and Sylvia worked off each others bad energy though Theresa was a lot smarter than Sylvia who is nothing more than a glorified parking attendant. Still, everyone knew Theresa was a snotty pain in the ass.

Either Theresa will lose her case because she doesn't have a good case and the company can prove she was a bad employee or her lawyer will tell her she needs to settle because if her case goes to court she'll lose. The attorneys have it all worked out because that's what third rate attorneys do. If she goes to court her attorney would have to work for his money when it's so much easier settling. Does anybody know who her lawyer is?

What doesn't suck at Priority One?

Theresa is being defended by Joe Lovretovich. He is the same lawyer who defended David and who Wigg said is a friend of P1's attorney. Guess she'll be losing her case.

We have so many members closing accounts because our service is so bad, because they hate what Wigg has done to the credit union, and because other credit unions offer better products. We also get complaints from members who say they wait as much as twenty to thirty minutes before someone answer.

We don't put up posters, pass out flyers, use mailing stuffers, or do presentations at businesses in the community. Any surprise business is bad.

How many new employees do they have? Everytime I call someone new answers the phone and only one was nice. Unbelievable that Wig fires knowledgeable employees and replaces them with a small army of ignorant ones- no fault of their own.

They have a lot and they're all pretty miserable. They got two at Santa Clarita with no branch manager because that office makes almost zero business. Cindy has everyone focusing on getting loans but member sservice is bad and we have no business development to speak of.

Its already December and they haven't offered us the annual opportunity to change our medical coverage. Or if you are a new employee, a chance to enroll in coverage. Maybe West and Smock think no one will notice. Stupid.

No raises and maybe no medical benefits. Way to say thank you to employees. Bet Wigg and Smock have real nice benefits.

If they haven't given the paperwork to continue or change their medical benefits does that mean the c.u. will not be continuing medical benefis to non-exempt staff in 2013?

Thats a question u ask upper management or the board

Wigg, Miss Smock and Big Foot haven't mentioned anything and neither has useless evil old Robert West. I think they hope no one notices and then surprise everyone by announcing that if employees want medical benefits they'll have to pay for it themselves. For years useless Smock used the same insurance broker without ever shopping around to see if he could get better less expensive deals for employees. You can do that when you're an overpaid has-been. West is over HR but he doesn't know anything about benefits. He's too busy taking long lunches, hiding in his office, and working on on-work related things. The new better HR department was supposedly supposed to make things better for all employees but since West took over more employees have lost their jobs and management is still being protected even when they break policy. Look and Cindy and Yvonne and Joseph who's hiding on leave.

If you ask upper management or the board they wouldn't tell the truth. They're liars.

If they don't offer us insurance anymore then that would be the straw that breaks the camels back. I would be willing to stage a walk-out and strike. Maybe even call a local news station so we get our message out there because that would be ridiculous.

Who would be with me?

I'd bet money Yvonne's husband cheats on her. I mean who wouldn't.

I am really enjoying the theme/design of your blog.

Do you ever run into any internet browser compatibility problems?

A couple of my blog visitors have complained about my website not working correctly in Explorer but looks

great in Opera. Do you have any recommendations to help fix this issue?

my page: forex trading demo

A walk out might be effective. They certainly have shown any courtesy particularly at this late date, to advise their employees if their medical benefits will continue into 2013 or if they ill end at the end of this month. Do they even have time to distribute the forms which let employees amend their coverage?

Usually they pass out the forms in late October. Its Dec 6th. Knowing how lazy and incompetent they are, they are really going to be pushing it if they want to make sure everyone has there forms back in before the end of the month.

Yvonne's husband is a truck driver. I don't know that he'd have time to cheat on her. Anyway, she used to spend weekends at Bea's house before their friendship ended. Kind a weird that two old hags would be acting like 16 year olds. Yvonne is ambitious but she can never be a high power executive at any company because she's too rough around the edges and way too ghetto. Then again Wigg is married to a waitress and Smock supports a boy he calls his son. Doesn't seem like any of them married into power or money.