RAISING A FULL-PROOF DEFENSE

Recently, a

reader of this blog and defender of the credit union, published the following

comment in response to our April post. The handle used by the poster is

"Priority MC."

Priority

One MC said...

There is no lawsuit from Suzanna like you keep on saying! Quinoes is now all done with. P1 just gave him a few beans to make him go away even though we all knew his lawyer was quitting anyway. He could of made more money working part time at Burger King then he got after a year of suing. P1 wins again. Bye bye Burger Boy.

May 15, 2012 2:16 PM

During the fist week of March, the Credit Union received a

letter from the attorney representing that former Valencia Branch Manager.

According to Member Services Manager, Yvonne Boutte, the complaint was written

to Senior Vice President, Rodger Smock, probably because he continues to

oversee Human Resources, though in an unofficial capacity. Mrs. Boutte said the

complaint was forwarded to the offices of Priority One’s attorneys- Richardson Harman Ober PC. A copy of the complaint was also submitted to CUMIS,

Priority One’s insurance carrier. CUMIS assigned a Case Manager to investigate

the allegations contained int he complaint but concluded that the attorneys

should conduct a more extensive investigation of the allegations and decide

whether the matter will proceed to court or be the subject of yet another

settlement agreement.

According

to Mrs. Boutte and President Wiggington, the credit union's attorneys have

chosen to "stall" and not respond to the complaint immediately. The

President again declared his innocence of all wrong doing and labeled

the complaint untrue and another attempt to "extort money from the

credit union." We were unaware that anyone has previously tried to extort

money from Priority One though we are aware of the credit union having

voluntarily offered money to settle to lawsuits in an effort to avoid a costly

and potentially embarrassing court trials. Is this what President Wiggington is

describing as extortion?

The

decision to "stall" a response seems juvenile and event

elementary. We would have thought that Richardson

Harman Ober PC were far more clever that to resort to

stalling as a strategy. We were wrong. It seems to contradict the firm's high

caliber description of what they are allegedly able to do for their clients.

Their website states:

“... [We] recognize that while many legal issues have

simple and traditional paths towards resolution, certain issues require

imaginative, "outside-the-box" thinking. We work with our clients to

develop a strategy, simple or creative, best suited to favorably resolve their

legal challenges in the most efficient manner.”

So is stalling and not responding to a Plaintiff a strategy that is best suited and most efficient means to resolve the lawsuit brought against

After

receiving notice they are being sued again, President Wiggington immediately

conferred with Vice President, Yvonne Boutte; AVP of Sales and Business

Development, Joseph Garcia; and CLO, Cindy Garvin. The Preident informed his

staff that the complaint contained "serious" accusations alleging

Priority One had commited egregious acts against a former employee. The

President told his staff that they must "prepare for battle." We

think the President and his staff should have begun preparing for battle back

in October 2010, when they were sued by the former Branch Manager of the now

defunct Burbank office.

Charles

R. Wiggington, Sr. is always an exaggerator, frequently a liar, often plays the

victim and in his case, melodramatic. During the meeting he disclosed that the

brunt of the allegations contained in the newest lawsuit were against acts

allegedly committed by former and notorious COO, Beatrice Walker. According to

the lawsuit, in mid-2010, Ms. Walker entered into a public campaign against the

then Valencia Branch Manager, during during which she inducted the assistance

of many of the Branch Manager's staff, other Branch Managers and AVP, Sylvia

Perez. The President also revealed that the complaint provides the credit

union with an ultimatum- settle or proceed to court!

The

President's decision to divulge the terms of the lawsuit proves once again that

Charles R. Wiggington, Sr. who just can't control his insatiable need to

verbalize everything and anything that is deemed confidential. Mrs. Boutte, Mr.

Garcia, and Ms. Garvin have absolutely no involvement in the allegations

contained in the complaint. None are attorneys and none will be involved in

litigating the lawsuit. So why did Charles R. Wiggington, Sr. believe it was

appropriate to divulge the reasons for the lawsuit to staff who have no

involvement with its allegations?

During

the meeting, the President also disclosed that Priority One Credit Union can no

longer afford to pay out settlements from its budget and any future settlements

will have to be paid by CUMIS its insurance carrier. He expressed concern that

future settlements could increase the costs of the credit union premiums that

would add stress to the organization which is scrambling to acquire new

business. His concerns are a stark contradictions to statements made in 2012

when he mocked the amount of settlements paid out to the former Burbank Branch

Manager and a former Business Development Representative and describing the

payments as "inconsequential" to the credit union. Furthermore,

didn't the President boast just 8 days ago during the annual meeting that

Priority One had overcome impediments that had once locked it in a state of

perpetual losses? What's more, in November and December of last year, he told

employees of the Burbank, Van Nuys and Los Angeles offices that Priority One

was generating real and substantial profit and that its high net capital was

synonymous (it's not) with profit.

As we've

reported often since 2009, Priority One is a credit union in decline due to

mismanagement, excessive spending and misappropriation of power by the derelict

President and the credit union's ignorant Board. With his boastings in mind,

the President has nothing to worry about unless of course his proclamations to

success were lies and attempts to defraud listeners to his incessant babbling.

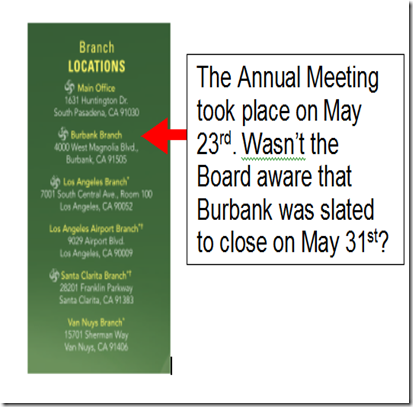

Annual

audits conducted in 2008, 2009, and 2010, by the DFI and NCUA resulted in the

issuance of warnings ordering Priority One find ways to reduce its expenses and

raise its net capital which had dropped to a dreaded 6.6%. Beginning in October

2010, the President ordered the closure of the Redlands and then, the Valencia

branches. In 2011, he closed the Riverside branch and four a few days ago, he

closed the Burbank branch. If this is all indicative of success then what

constitutes failure? There is something so Elmer

Fuddish about their current ploy.

THE VICTIM ROLE

Despite his underhanded treatment of employees, Charles R. Wiggington, Sr. easily cries victim whenever an employee takes the initiative and files a lawsuit against the credit union. He has accused Plaintiffs of trying to extort money from the credit union and of trying to overthrow him. According to President Wiggington their impetus is jealousy that he was appointed President back in January 2007.

However, his cries of innocence are nothing more than a knee-jerk reaction to the lawsuit and the means by which he is able deny all culpability in provoking the complaints. He has yet to realize that in 2012, he doesn't possess any credibility which once enabled him to hide behind an unending slew of excuses that provided the means by which to escape culpability for the decline in business which began in 2008. The President has become a pariah within the credit union industry and at this point of his game, his cries of victimization are both annoying and infantile.

A SECOND SETTLEMENT

Contrary

to the reader using the handle "Priority MC", who posted the comment

shown at the beginning of the post, in November 2011, Priority One offered a

settlement to a former Business Development Representative. Priority MC, likely

a member of the management team, posted that the Plaintiff's attorney resigned

when he suddenly realized that the lawsuit he agreed to litigate one year

earlier was actually frivolous.

The source of the misinformation published by Priority MC was no other than Charles R. Wiggington, Sr. who just can't seem to keep his mouth shut. We doubt that the attorney originally agreed to represent the Plaintiff if the lawsuit was deemed frivolous.

What's more, the misinformed President and his even more misinformed cronies, do not realize that an attorney cannot arbitrarily walk away from a case. An attorney who no longer wishes to represent a client must file a formal motion with the court. A hearing is then scheduled during which a judge decides whether the attorney can resign or if the attorney must continue representing their client.

The statements published by Priority MC were presumptuous as was the President who willingly chose to violate confidentiality and may have placed the credit union in yet another precarious legal situation. Like the lawsuit filed by the former Burbank Branch Manager in 2010, the credit union has decided to settle the lawsuit filed by a former Business Development Representative. According to Director, Yvonne Boutte, the attorneys offered the settlements at the request of the Board of Directors. Their chief concern is that embarrassing information could be divulged at a trial that could reveal publicly, many of the heinous acts committed by and under Charles R. Wiggington, Sr.

Possibly in an attempt to minimize the decision to settle the lawsuit, the President and some of his officers have described the amount of settlement payments as both "menial" and "paltry." The decision of the President to share details about the settlements is a vilation of confidentiality of the terms contained in each settlement agreement entered into by the credit union. The language in the agreements is very specific in warning that there shall be no violation of the terms of the agreements. Logically, does anyone really believe that Priority One would have voluntarily entered into a settlement agreement with any Plaintiff if they weren't guilty of some or all the allegations contained in each lawsuit.

We also learned recently, that the former Business Development Representative's attorney boasted that she is a "friend" and "associate" of the credit union's attorney. Doesn't this smack of a conflict of interest?

We've

also discovered that the Plaintiff's attorney contacted the Credit Union’s

legal counsel and told them he was resigning due to irreparable differences

with his client. Immediately afterwards, the Credit Union’s attorney, William

F. Schimley, contacted Board Chair, Diedra Harris-Brooks, and President

Wiggington, and told them the Plaintiff's case had imploded.

However, the Plaintiff, was not aware that his attorney had said he had resigned until after he read Priority MC's comment on this blog. Clearly, Priority MC is a a manager and one of the President's cronies and ignorant of the fact that the credit union's legal counsel and the President have acted inappropriately and possibly even illegally.

After Priority MC’s comment was published on this blog, the Credit Union’s frantic attorney hurriedly moved to settle the lawsuit. The President and his staff’s latest violation of the law serves to us that Priority One’s highest echelons are populated by brutes who are incapable of comprehending the inappropriateness of their actions and of course, bringing to light the President's heinous behaviors. It is disdain for law that created the opportunities for former employees to file lawsuits. Priority One is a credit union that doesn't learn from its blunderings.

The two settlements entered into by the credit union should not be construed as indicators that Priority One is bringing an end to its legal problems. To the contrary, the allegations described in the first two lawsuits and those contained in the third lawsuit recently filed against the credit union, are all too similar, suggesting the abuses perpetrated by and under President Wiggngton have not subsided. What's more, even if the Plaintiffs in the first and second lawsuits are prohibited from publicly disclosing the terms of their settlements, they can still potentially serve as witnesses in the third lawsuit.

President Wiggington has amassed a well documented record of abuses proving he is a liability to Priority One Credit Union as a business and employer. His undisciplined decisions have incurred tremendous monetary losses to the credit union while injuring its once sound public reputation. His brazen disregard for policies and laws and free-wheeling use of slander and harassment have made the credit union a target for lawsuits. And though the reprehensible President and his abhorrent staff have boasted that the settlements paid out in the first and second lawsuit were puny and inconsequential to the credit union, there is no denying that branch closures, increasing complaints citing poor member service, lawsuits and settlements all point to a serious problem impacting the once reputable and thriving credit union. We believe that this is the beginning of what will be a long slew of more lawsuits all contributing to the credit union's eventual failure.

THE PRIVACY ACT

There is no doubt,

President Wiggington and his henchmen hate the law. President has never hidden

his disdain for social structures that are created to ensure order. Thanks to

expensive attorneys paid out of credit union financial reserves, President

Wiggington has been allowed to violate the law and escape retribution for his

many egregious acts.

The credit union's lone advocate and chronic violator of confidentiality, Priority MC, has posted comments which publicize highly confidential information about Plaintiffs and the settlements entered into with the credit union.

After posting that the second lawsuit had been "crushed" and the Plaintiff's complaint dismissed because it was frivolous in nature, Priority MC posted again, this time retracting :"her" statement by alleging it wasn't about the Plaintiff but about a member named "Sharnese Nylonda." In her retraction, Priority MC states that the member caused the credit union numerous legal problems as a result of her alleged refusal to submit payments on her automobile loan financed by the credit union. Priority MC wrote:

Priority One MC said...

It's nothing related to any you bloggers. All you are done with. Sharnese Nylonda got P1 involved with an auto insurance situation that's in court. That's all there is. Now try doing what you suppose to be doing for a change.

April 10, 2012 7:38 PM

We also believe that the disclosures made by Priority MC about the lawsuits filed by the last Burbank Branch Manager and the Business Development Representative may constitute a breach of ethics and suggest both Plaintiffs file complaints with the State of California citing misconduct by their respective attorneys.

The credit union's lone advocate and chronic violator of confidentiality, Priority MC, has posted comments which publicize highly confidential information about Plaintiffs and the settlements entered into with the credit union.

After posting that the second lawsuit had been "crushed" and the Plaintiff's complaint dismissed because it was frivolous in nature, Priority MC posted again, this time retracting :"her" statement by alleging it wasn't about the Plaintiff but about a member named "Sharnese Nylonda." In her retraction, Priority MC states that the member caused the credit union numerous legal problems as a result of her alleged refusal to submit payments on her automobile loan financed by the credit union. Priority MC wrote:

Priority One MC said...

It's nothing related to any you bloggers. All you are done with. Sharnese Nylonda got P1 involved with an auto insurance situation that's in court. That's all there is. Now try doing what you suppose to be doing for a change.

April 10, 2012 7:38 PM

We've conducted an

investigation regarding "Sharnese

Nylonda", the name provided by Priority MC and discovered that the poster attempted rather ineptly to

distort the actual facts of the case involving the member. The Member's real name

is Nylonda Sharnese. Evidently, Priority MC was defiant enough to

violate federal law but not courageous enough to write the member's correct and

actual name. We're not surprised.

We also located the Case

Summary of a lawsuit filed by State Farm Mutual

Automobile Insurance Company against Ms. Sharnese and against Priority One

Credit Union.

Priority MC's comments

violate the Privacy Act. Under federal law, the penalties that can be levied

against the credit union can be substantial (more than $50,000 per incident).

One would think that a credit union that is experiencing financial difficulties

would want to veer as far away from violating any laws as is possible. Clearly,

they don't wish to.

What is evident is that Priority MC is an employee of Priority One. Not only is she an employee

of the credit union, she is likely a member of the management team. The

information she has commented is only available to members of the Credit

Resolutions Department and because it involves an allegedly delinquent loan and

a lawsuit, the only persons that could have knowledge about the case are

President Wiggington; Director of Project Management, Yvonne Boutte; and Credit

Resolutions Supervisor, Miss Alex Suarez. Thus Priority MC is more than likely, a

member of Priority One's management team. Here is the Case Summary

obtained from the Superior Court's database:

|

Case Number: 12C00147

STATE FARM MUTUAL AUTOMOBILE I VS. SHARNESE, NYLONDA

Filing Date: 01/23/2012

Case Type: CIVIL COMP. OTHER (Limited Jurisdiction)

Filing Court: Pasadena Courthouse

Status: PENDING

Future Hearings

06/01/2012 at 08:30 AM in department NEA at 300 East Walnut

Ave., Pasadena, CA 91101

CASE MANAGEMENT CONFERENCE

|

We invite Nylonda

Sharnese to visit this blog, read the comments posted by Priority MC and either

contact us or file a lawsuit against Priority One's violation of the Privacy

Act.

We also believe that the disclosures made by Priority MC about the lawsuits filed by the last Burbank Branch Manager and the Business Development Representative may constitute a breach of ethics and suggest both Plaintiffs file complaints with the State of California citing misconduct by their respective attorneys.

THE LITTLE ENGINES THAT CAN'T

Last month, chronically

inept AVP of Sales and Business Development, Joseph Garcia, at the request of

President Wiggington, issued yet another wave of written warnings to employees

who failed to meet their assigned monthly sales quotas.

The President is touting

the warnings as part of his latest mandate to implement corrective measures

that under threat of termination, will help develop a stronger, harder working

contingent of workers. According to Mr. Garcia, the warnings will serve to show

employees that "the credit union

means business." If the credit union

meant business then Mr. Garcia would have been terminated in 2010 when he was

stripped of his authority as Credit Manager, Real Estate Loan Manager and just

last year, of his title as Call Center Supervisor. And if the credit union was

sincerely intent on instilling corrective measures then shouldn't the President

have been terminated in 2008 when he was found guilty of sexually harassing a

former employee?

As we've reported in

prior posts, the assignment of monthly sales quotas is just another sham

designed by the worried and incompetent President. The credit union is tired of

being referred to as a failure and incompetent. He is tired of evidence being

presented publicly which proves his deficiencies. Due to the credit union's

present inability to acquire sufficient new business to offset overhead, he has

no choice but to reduce spending but each time he closes a branch, slashes a

budget, or lays-off an employee serves as yet more evidence of his gross

ineptitude to resolve the problems he created which have reduced the credit

union into a smaller and certainly no longer effective organization.

And so the monthly sales

quotas, developed by CLO, Cindy Garvin, and AVP, Joseph Garcia, allow the

termination of staff as a result of their inability to achieve their assigned

quotas and deters attention from the fact the President has no choice but to

reduce spending. It's clever and heinous, it's disingenuous and

hypocritical.

Ms. Garvin and Mr.

Garcia helped implement quotas but which the two failed to do was provided

desperately needed training needed to ensure employees were given the tools

which would enable them to achieve success. The omission was intentional

because the real purpose of quotas is to ensure employees fail.

What's more, Mr. Garcia is unqualified to teach anyone about sales. He just doesn't possess the knowledges, experience or ability.

We're going to give Ms. Garvin the benefit of the doubt and state that she is too busy to actually train employees. She after all has been given the task to oversee branch operations for all offices.

Yvonne Boutte has assisted in so-called Saturday training sessions but Mrs. Boutte knows as much about sales as she does about treating staff with respect.

Certainly, the President and Executive Vice President, Rodger Smock, are devoid of any skills in developing new business.

And what about former Training and Education Manager, Robert West, who nowadays serves as Director of Employee Services? He was a terrible and incompetent trainer known for conducting "boring" classes. What's more, at his request, he was often assisted by other staff because his knowledge is at best, superficial. Priority One's managers and executives delegate and dictate but staff development falls far outside of their expertise.

Ms. Garvin is also proving to be just as inept at business as was her predecessor, Beatrice Walker, and as is President Wiggington. More disturbingly is the fact she seems to share the same proclivity to gossip as did Ms. Walker and as does the President. Her fabulous though unevidenced competencies are overshadowed by her apparent impatience and vindictive nature and intolerance to constructive criticism. What's more, on the day Ms. Walker arrived at the credit union in August 2011, Executive Vice President, Rodger Smock, issued a memorandum proclaiming Ms. Walker's expertise in real estate and consumer loan development, marketing, and in business development. Mr. Smock also issued a similar memorandum on June 2, 2009, when he proclaimed the vast expertise possessed by Beatrice Walker though her employment ended abruptly on July 8, 2011.

Ms. Garvin's management

style compliment those of the President and Mr. Garcia, which implement the use

of threats to achieve goals. It's nothing shore of astounding that the

President and Mr. Garcia who have proven they are both equally incompetent at

anything they attempt to accomplish and both of who have contributed to the

credit union's loss of business and income would garner the gall and arrogance

to develop strategies that try to force staff into submission and in

accomplishing goals that the two are incapable of ever achieving. Neither can

impart knowledge they don't possess.

But Mr. Garcia's abusive tendencies have become a point of concern to the credit union. Since March, there has been a noticeable spike in complaints filed against Mr. Garcia by employees. Usually, ,Mr. Smock, the unofficial Director of Human Resources would quietly sweep the complaints aside but three lawsuits filed by former employees have forced the inept and aged officer to address the complaints which have been fueled the South Pasadena branch's gossip mill.

In April, Mr. Smock at the request of the President, called Mr. Garcia to his office and informed that his ruthless treatment of employees is creating dissension and the credit union does not wish to be embroiled in yet another lawsuit. He was also told that his strong-armed methods are doing absolutely nothing to improve business. Mr. Garcia who is known to be volatile, temperamental, and abusive, became incensed. Immediately following the meeting, Mr. Garcia volunteered to assist employees at the Van Nuys branch to prove that he both is able to treat employees kindly and fairly and to show he possesses the ability to obtain new business.

Mr. Garcia's trek to Van Nuys proved to be a bust. He visited businesses served by the Van Nuys branch but discovered that not one person he spoke to was interested in the products or services offered by the credit union. He returned to the South Pasadena branch, defeated and despondent and spent the next several days reviewing employee production reports and members of the business development team to obtain a record of new business they's acquired.

The problem with Mr. Garcia is not his lack of competency but the President and former COO, Beatrice Walker, both of who thought it prudent to bestow titles upon him and who despite his inability to fulfill his duties, granted him increases in pay. Here is a record of his promotions:

- In 2010, Mrs. Walker and then AVP of Operations, Rodger

Smock, appointed him the title of Call Center Supervisor despite the fact

he had no experience in managing a call center.

- Two months later, Ms. Walker with the approval of

President Wiggington and Board Chair, Diedra Harris-Brooks, added the

titles of Real Estate and Consumer Loan Manager despite the fact he had

absolutely no experience in anything related to real estate loan funding

and his experience in consumer loan funding was limited to opening new

loan applications.

- Thirty days later, Ms. Walker added the title of Credit

Manager to Mr. Garcia's impressive repertoire of titles.

His fall from grace was

even more impressive than his promotions. Here is a record of his demotions:

- By mid-2010, Mr. Garcia was stripped of his title of

Real Estate Loan Manager because he could never learn the procedures or

comprehend the principles governing real estate loan funding.

- Shortly afterwards he was stripped of his title of

Credit Manager, again because he couldn't comprehend the responsibilities

of the position.

- In January 2011, due to mounting member service

complaints, he was stripped of his title of Consumer Loan Manager.

- In August 2011, he was demoted to the post of Assistant

Consumer Loan Manager.

Like the President who

should have been terminated for his chronic blunder and personal and illegal

behaviors, Mr. Garcia should have been ousted but instead and inexplicably, has

been retained even in a lesser capacity which he is apparently unqualified to

serve in. In view of his long list

of failures, why has President Wiggington deemed it reasonable to once again

promote Mr. Garcia, this time to the post of AVP of Sales and Business

Development?

In our

last post, we reported that Joseph Garcia had disclosed that a letter had been

mailed to members by the Burbank branch, disclosing that the branch was slated

to close. According to Mr. Garcia would “help us avoid problems”.

Unless the letter was imbued with magical properties, we couldn't begin to imagine how a single reason why members would want to retain their Priority One accounts if they were no longer able to easily access a physical branch. The credit union pointed to the problems affecting the national economy as the reason for deciding to close the branch. Apparently, that's far more palatable than citing mismanagement.

In response, many members called the Burbank branch to request closure of their accounts while others were not fooled by the President's deceptive excuses and blamed the closure on mismanagement. The closure has also further exacerbated the credit union's already strained relationship with it's largest Select Employer Group- Providence St. Joseph Medical Center.

In 2010, in a gesture of good-will, the medical center tried to enter into a agreement with the credit union which would have allowed Priority One to relocate the Burbank branch to the hospital basement. The hospital's attempts to communicate with officers of the credit union failed. Phone calls and emails sent to President Wiggington; COO, Beatrice Walker; Director, Yvonne Boutte; AVP, Sylvia Perez; and Senior Vice President, Rodger Smock, were not responded to provoking the administrators to rescind their offer and to withdraw their long standing invitation to the credit union which had allowed business development representatives to attend monthly new hire orientations during which they would invite new employees to join the credit union.

Some of officers of the credit union have also recently disclosed that they intend to invite CITI Bank to open a branch within the medical enter. CITI Bank is the where the medical center deposits it's payroll.

The credit union's relationship to its member is frayed and with regards to the medical center, on the verge of collapse. What took decades to build and maintain has been weakened by President Wiggington in slightly less than a 6-year period.

STRESSING OVER HER FUTURE

During the month of April,

caustic and polarizing AVP, Sylvia Perez, complained incessantly to the

staffs at the Burbank, Van Nuys and Santa Clarita branches that she is in fear

that she will soon be terminated. She disclosed that the President; Executive

Vice President, Rodger Smock; and Employee Services Director, Robert West, are

not returning her calls. If anyone should be familiar with the unscrupulous

tactics employed by the credit union's it's Mrs. Perez who through the years

recruited the willing assistance of Executive Vice President, Rodger Smock, and

President Wiggington to target, abuse and terminate staff she viewed her

personal enemy.

The

President intentionally avoided informing the staff in Burbank about his

decision to close the branch until April. Immediately upon being informed that

the branch was scheduled to close, Mrs. Perez hurriedly began packing personal

items in her office and expended tremendous time and effort to tell employees

that she was packing. The drama queen, even called the South Pasadena branch

and left messages stating she had finished packing. Her efforts to manipulate

by exacting a reaction from the President and other executives failed, as no

one returned her calls.

Mrs.

Perez has also complained that the refusal by the President to tell her if she

is to be retained after the branch closes or what her future, if any, might be

at the credit union, has caused her to lose weight, lose sleep, lose hair and

caused arguments with her husband and daughter. It's interesting to see

that Mrs. Perez is as unaccountable in her personal life as she is at work.

Mrs.

Perez spent years, boasting about her above-average abilities to develop new

business and obtain new members. She even used her alleged expertise to

disparage her staffs who she said could never live up to her high standards.

Mrs.

Perez's self-proclamations suffered fissures starting in February, when the

credit union assigned every employee including all AVP's, monthly sales quotas.

At the end of February, she failed to achieve her assigned sales quota of

$150,000. She failed again at the end of March and again in April. She was

issued warnings by AVP, Joseph Garcia, who warned she could be terminated

unless she began to attain her quotas. Unlike other employees, she was not

terminated though under the new rules failure to attain one's assigned goals

during a consecutive two month period would result in termination.

So how

could the once self-proclaimed expert in business development lose her

abilities to acquire new business? She didn't. She never possessed the ability

to obtain new business she fervently boasted about. Mrs. Perez spent years

riding the fabricated success of her own hyperbole. She was also enabled by the

President who touted about her keen skills and even once said he wished all

employees were like Mrs. Perez. Thankfully, they weren't.

The

assignment of quotas not only brought an end to her illustrious though

fictitious reputation as an expert in sales but for the first time in her

employment at Priority One Credit Union, her failure to satisfy her monthly

quotas placed her on the verge of being terminated.

Last

month and only as a result to the President's political system, Mrs. Perez was

informed that she will be working out of the Santa Clarita branch located at

the northern end of the Santa Clarita Valley. Mrs. Perez complained that being

relocated would place her far from her home in Van Nuys, California. She was

too emotional to remember that this is a tactic adopted by the credit union in

2009 and introduced by then COO, Beatrice Walker, who told managers that if you

wish to expel an employee, assign them to a branch located far from their home.

The inconvenience of having to drive a long distance to work will force them to

resign and the credit union won't have to pay unemployment benefits.

Mrs.

Perez has also complained that though her reassignment allows her to retain her

title of AVP she will be reduced to the role of Business Development

Representative. She boasted for years about her alleged and obviously

fictitious business development skills, so being appointed a business

development representative would seem almost appropriate. It may be that the

credit union has realized Mrs.Perez is not executive material but thanks to the

President, not until many employees succumbed to her often ruthless and

disparaging tactics.

We

certainly are excited to see the positive impacted Sylvia Perez will have upon

business in the entire Santa Clarita Valley. Maybe she'll be able to transform

the faltering and obscurely located new Santa Clarita branch into an important

hub for new business or maybe she'll have the same stigmatizing effect she had

upon the Burbank branch.

Meet Me In the Alley

Some members of Priority One's

executive sector pick the most unusual and inappropriate places in which to

meet to discuss business and of course, gossip.

In 2009 and part of 2010, former COO, Beatrice Walker, often met to confer in "secret" with then Director of Credit Resolutions, Yvonne Boutte, in the alleyways located around the main branch in South Pasadena, California. Their daily meetings were witnessed by many employees of the branch. They would also meet in the parking lot located under the branch and on Marengo and also on La France Avenue and at a nearby park.

Their ritual ended when the alliance between the COO and Director ended in 2010, however in recent months, Mrs. Boutte has coaxed CLO, Cindy Garvin, into resurrecting the practice of meeting at these offsite locations and unwittingly, not realizing they are being observed by employees. There's a psychological issue prompting their clandestine meetings. Is what they have to say so secretive, so potentially impacting that they easily compromise decorum and self-dignity to conduct meetings in alleys? Interesting that the two, over-paid officers would choose a venue strewn with trash cans and bins.

EMBELLISHING TRUTHS

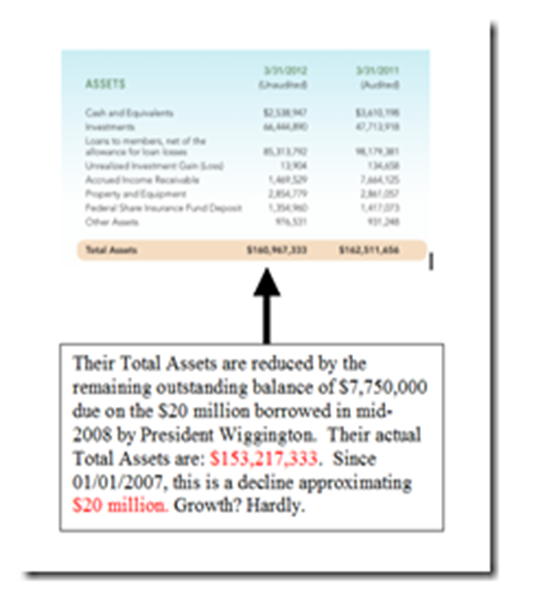

President Wiggington is

addicted to distorting truths. Like his insistence that the credit union

advertise itself as a “progressive $175 million credit union” he

has found it necessary to embellish his life, his home, and his lifestyle. What

he doesn't realize is that few people believe anything he has to say.

The Credit Union's monthly

Income Statements and their Financial Performance Reports ("FPR")

submitted to the NCUA on a quarterly basis confirm that the last time Priority

One's assets approximated $175 million and without assistance of a loan

borrowed from it's line-of-credit, was January 1, 2007, the date

Charles R. Wiggington, Sr. began his appointment to President.

The President's exaggerations about the credit union's actual worth are is just part of a pattern of behavior by a President who has to exaggerate the credit union's performance which includes falsifying financial reporting and refusing at times, to post the credit union's Monthly Income Statement.

Last November he boasted that the new Santa Clarita branch would drive groves of people begging to become members of the credit union. Opened four months ago, the branch is a virtual ghost town and it's quite apparent, people in Santa Clarita including employees of the United States Postal Service are not arriving by the bus load, seeking either membership to the credit union or obtainment of its financial products and services.

"There's been rumors that people are going to lose their jobs now that I'm president. Let me tell you, no one will ever lose their job while I'm president. You can take my word on that."

Charles R. Wiggington, Sr., President/CEO

Thursday, January 4, 2007

2012 has been a stellar year at the credit union, for employee terminations. Despite the President's assurances in 2007, that no employee would succumb to termination, his promise has been proven to be yet another of his many lies. Initially, he targeted, harassed and then terminated employees he believed were conspiring against him. His efforts were encouraged by the wily and useless, Rodger Smock, and at first, by the cunning and incompetent, Beatrice Walker.

In 2012, he has little choice but to terminate employees so that he can reduce spending and raise net capital. Terminations are nowadays important and necessary to keeping the operation going. His opening of the Santa Clarita branch was poorly thought out and we predict that he will be forced to order it's closure at some point in the not-so-distant future.

However, the President could never have committed the level of failures or entered into scandals without being enabled by the Board of Directors and it's Chair, Diedra Harris-Brooks. The Board Chair has proven that she will violate ethics in her zeal to ensure the President remains employed, all at a cost to the credit union which is rapidly slipping into a state of ruination.

At the end of 2011, President Wiggington boasted that the credit union's bottom feeding attorney, Paul F. Schimley, had created a full-proof defense which was guaranteed to squash th lawsuits filed by the Burbank Branch Manager and describing her complaint as "frivolous" and devoid of all merit. He declared the case would never go to trial.

He also publicly disclosed that the Burbank Branch Manager had refused to carryout her assigned responsibilities, that she refused to visit the community in Burbank and that she was a racist who hates Latinos. What he failed to consider is that the Branch Manager was laid-off, allegedly because the credit union had to reduce spending. Also, at no time during her employment was ever issued a warning citing that she was insubordinate or a racist, the two of which are terminable offenses of credit union policy.

Last December, the credit union's attorney contacted the former Burbank Branch Manager's attorney and requested mediation to arrive at a settlement. So what happened to the President's declarations that the lawsuit would be dismissed because it was frivolous? And what happened to attorney, Paul F. Schimley's allegations that his firm had gathered sufficient evidence proving the Burbank Branch Manager was insubordinate and a racist?

We've also conferred with former officer, Nora Torres (Neale) who said she and AVP, Sylvia Perez, were scheduled to provide testimony that the Burbank Branch Manager was unwilling to work, a racist and abusive.

As luck would have it, the former Burbank Branch Manager obtained a copy of the letter composed and signed by the last Valencia Branch Manager in which she described a heinous campaign carried out by former COO, Beatrice Walker, in which she harassed, sexually harassed and stalked the branch manager. What's more, the letter served as evidence that despite being presented with a documented record describing abuses that constitute a far flung violation of federal and state laws, Priority One Credit Union, it's President, Human Resources, and the Board of Directors chose to squash the complaint, invalidate the allegations and reduce the accusations leveled against Ms. Walker to a mere conflict of personalities. The single letter was enough to rent a gaping hole in Mr. Schmaltzy strategy and in the President's presumptive declarations to a non-existent victory.

It shouldn't elude anyone that Priority One's President is a man who has been proven to be a sexual harasser; who repossessed a BMW owned by a member and transferred ownership to himself and who has fabricated slanderous and fictitious accusations against employees he targeted for termination.

NOTHING IN THE WORLD IS MORE DANGEROUS THAN SINCERE IGNORANCE AND CONSCIENTIOUS STUPIDITY.

MARTIN LUTHER KING