PREPARING FOR BATTLE

It shouldn’t come as a surprise to anyone who has come to know President Charles R. Wiggington, Sr., that since November 2012, the talkative President has divulged sufficient details to provide a wonderful picture of Priority One Credit Union’s defense in the lawsuit filed by the former Valencia Branch Manager.

Predictably, the President has continually decried the former Branch Manager’s allegations, labeling them untrue. He’s also insisted that he was fair in investigating her allegations originally filed in 2010 against former COO, Beatrice Walker, who is accused of carrying out a very public campaign, disparaging the Branch Manager’s professional and personal reputation. Unfortunately for President Wiggington, his “story” (for that is all it is), has more holes than a 50-pound block of Swiss cheese.

Last November 2012, the President boasted the lawsuit teetered on the verge of dismissal due to a conspicuous lack of evidence. In March 2013, the President disclosed that the credit union’s attorney had uncovered evidence impugning the former Branch Manager’s reputation and character, declaring that the lawsuit would soon be dismissed. It is now the end of July and lawsuit remains in litigation with absolutely no indication of its impending dismissal. Clearly, the Plaintiff possesses more than sufficient evidence to continue litigation of her lawsuit.

The Branch Manager’s lawsuit, unlike those which preceded it, pits the troubled scandal-ridden credit union against a former and respected member of the managerial sector. Understandably, potentially could expose information about the widespread corruption fostered by and under President Wiggington. Additionally, the cost of litigating this lawsuit and three others, filed by former employees, have been astronomical and embarrassing for the credit union.

As we will show, the credit union’s present defense is founded on distortions of the truth. Though a brunt of the accusations presented in the lawsuit pertain to the 2010 campaign carried out by then COO, Beatrice Walker, a weighty portion of the other allegations, implicate the President and Human Resources Department in violating credit union policy along with state and federal laws. The lawsuit also describes what appears to be an intentional and calculated refusal by the President and Human Resources Department to stop the COO’s scathing attack upon the Branch Manager.

The past May, the President could also not refrain from revealing that Executive Vice President, Rodger Smock, had been subpoenaed to answer questions at a deposition. The President disclosed that Mr. Smock attended the deposition in the capacity of Executive Vice President and Director over Human Resources and answered questions regarding the department’s investigation of the Branch Manager’s grievance.

The President’s statement about Mr. Smock, is easily refuted because at the beginning of September 2010, the date the Valencia Branch Manager lodged her verbal complaint against then COO, Beatrice Walker, Rodger Smock was not the Director of Human Resources. At the start of August 2010, Beatrice Walker, forcibly removed Mr. Smock’s authority over Human Resources and appointed herself Director.

What’s more, the actual investigation was not begun until mid-September 2010 and only after President Wiggington was first provided letters written at his request by the Valencia Branch Manager and the Business Development Representative assigned to the Santa Clarita Valley, each documenting the abuses allegedly committed by Beatrice Walker. On the date the investigation was begun, the newly appointed Director over Human Resources, was former Training and Education Manager, Robert West. Furthermore, on the date the investigation was begun, Mr. West had only been Director for about 14 days.

Based on the timeline of event, Mr. Smock was not involved in any part of the investigation as he was no longer a member of Human Resources, yet only earlier this year, he attended a deposition in the capacity of Human Resources Director and answered questions about an investigation he was not involved in. So did Mr. Smock perjure himself?

Evidently, in creating an alibi to escape accountability for their blundering of the 2010 investigation of Branch Manager’s complaint, neither the President, the Executive Vice President, or the credit union’s over-rated attorney, thought to concoct a story that adhered to factual events. Their present fabrication is outlandish and serves to denote the level of dishonesty and incompetency marring the credit union’s executive sector. Earlier this year, the President also revealed that at the time he received the complaint, he immediately delegated its investigation and resolution to Human Resources. As we will show, this never occurred and represents another not-so-clever and transparent attempt by Charles R. Wiggington, Sr. to rewrite history and escape culpability for the mayhem he created in 2010.

THE PRESIDENT’S INCRIMINATING LETTER

We thought it only appropriate to expose the discrepancies and inconsistences saturating the credit union's alibi, by disassembling President Wiggington’s latest fabrication through the use of his own documentation. The President may have forgotten that in a letter dated October 13, 2010 and sent to the Valencia Branch Manager, he describes his conclusions derived from his investigation of the complaint. This, by the way, is the first time we publish the President’s telling letter, which is shown below:

PARAGRAPH #1 OF THE LETTER

In his letter, the President admits he investigated “the circumstances surrounding the Branch Manager’s grievance” and admits it is he who conferred “with all parties involved.” His admittance is a stark contradiction to recent statements that he referred investigation of the complaint to Human Resources. What’s more, nowhere in the letter does he make reference to Human Resources. We suggest President Wiggington take the time to rummage through his file cabinet and reread all letters and memorandums issued by him in 2010, regarding this incident.

President Wiggington also admits it was he who “concluded” the Branch Manager’s complaint, “stems mostly from a misunderstanding with others and is not work-related.” In September 2010, the Branch Manager verbally informed Human Resources “clerk”, Esmeralda Sandoval, that she was being victimized by then COO, Beatrice Walker. The complaint alleged Ms. Walker had slandered the Branch Manager’s reputation to both management and non-management personnel. The emotionally volatile COO also inducted the assistance of some employees of the no longer existent Valencia branch, including former FSR’s, Dana Gilliam and Judith Barajas. We also know Ms. Walker’s plot was also assisted by AVP, Sylvia Perez. We’re very interesting in knowing how Ms. Walker’s inappropriate and illegal campaign was borne out of misunderstanding or how the always dishonest President concluded it was not work-related?

We also know that Ms. Walker verbally berated the Branch Manager’s abilities to the Business Development Representative assigned to Santa Clarita and also to Executive Vice President, Rodger Smock though it is doubtful the aged and cowardly EVP would ever admit to Ms. Walker’s verbalizations. So how did the President conclude that Ms. Walker’s campaign which occurred during business hours, involved the assistance of salaried personnel, and publicly impugned the Branch Manager’s professional and personal reputation was not work related? In his letter, the President also omits all specifics that prove the differences between the Branch Manager and the COO were the result of a misunderstanding on the part of the Branch Manager. He also excludes anything proving his conclusion that the incident was not work-related. The letter is lame in its intent and delivery and only serves to attest to the dishonest proclivities of Charles R. Wiggington, Sr.

It is also apparent that the language in the letter was intended to vilify, subjugate and shame, the Branch Manager. The President’s juvenile ploy was designed to manipulate the Branch Manager, invalidate and even ridicule her grievance, and somehow hold her accountable for the egregious acts committed by Beatrice Walker. What is evident is that Beatrice Walker’s campaign could never have flourished had it not been enabled by President Wiggington, Human Resources, and Board Chair, Diedra Harris-Brooks.

PARAGRAPH #2 OF THE LETTER

“I view, respect, teamwork and communication as extremely important values that contribute to the overall success and well-being of the credit union.”

Though grammatically incorrect, the President writes that he respects teamwork and communication and that in his opinion, these are factors which serve to ensure Priority One’s success. Normally, we might agree with this statement, however, within the context of Priority One Credit Union’s performance over the past 6 years and which includes the loss of 4 branches since October 2010; termination of the credit union’s COO and later, its CLO; the injury cased morale; and the inability of the President to introduce strategies that generate new business and membership, the statement is preposterous. The credit union’s performance proves President Wiggington knows absolutely nothing about building a team dynamic. Furthermore, since being appointed President, employees who made constructive suggestions that might have improved business, were quickly banished from the credit union. The ingredients to success, described by the President, have never been realized at Priority One simply because President Wiggington lacks the ability to lead the credit union.

PARAGRAPH #3 OF THE LETTER

“It is based on this belief that I hired Beatrice Walker as Chief Operation(s)- to strengthen the organization in an area that is integral to our success.”

The most revealing part of the President’s letter is his admittance that he hired Beatrice Walker as the credit union’s first Chief Operation(s) Officer. In September 2009, Beatrice Walker stood in the Loan Department in South Pasadena, addressing employees during one of the credit union’s quarterly All Staff meetings. During her speech, she inexplicably decided to tell employees how she came to be hired. She stated that she answered an ad seeking a COO and was afterwards, interviewed by the Board of Directors and offered the job. She made a point to add that prior to June 1, 2009, the date she was hired, she ever met Charles R. Wiggington, Sr.

Of course, immediately following conclusion of the meeting, then South Pasadena Branch Manager, Gema Pleitez, and Lead Loan Teller, Georgina Duenas, told employees that in January 2009, they had seen President Wiggington and Beatrice Walker leaving Applebee’s Restaurant in Alhambra, California. The two laughed loudly as they passed the employees who had hidden behind a parked automobile.

His admittance that he hired Ms. Walker immediately bring an end to their once well-touted lie that they never met prior to her arrival on June 1, 2009. In his letter, the President also states he hired Beatrice Walker to strengthen the organization which is consistent with statements made by Board Chair, Diedra Harris-Brooks during the May 2010 Annual Meeting in which she exclaimed that in her opinion and that of the Board, Beatrice Walker and then Loan Manager, Joseph Garcia, were “the right management team.” Nine months after the President issued his inane letter to the Branch Manager, Beatrice Walker was abruptly terminated for unsatisfactory performance and insubordination by the President and Board Chair, Diedra Harris-Brooks. So what happened to the President’s declaration that Beatrice Walker was hired to “strengthen the organization”? And what happened with the Board Chair’s praises that Ms. Walker was part of the “right management team”?

PARAGRAPH #4 OF THE LETTER

“Going forward, if you have any personal related concerns, please follow the “Employee Relations Protocols” (i.e., address your concern(s) with your immediate supervisor, and if your concern was addressed according to protocol but remains unresolved, direct your concern to the Human Resources Department). These protocols are provided as guidelines to help us safeguard the values and friendly working environment we enjoy.”

This is a quite a revealing paragraph, lending further credence to our belief that Charles R. Wiggington, Sr. is more than a little confused when recounting past incidents. He is also apparently incapable of keeping track of his lies.

In early September 2010, the Valencia Branch Manager drove to the South Pasadena office and lodged a verbal complaint with then Human Resources “clerk”, Esmeralda Sandoval. On the day the complaint was filed, Beatrice Walker was the Branch Manager’s and Miss Sandoval’s supervisor. For Ms. Sandoval, this placed her in the unenviable position of having to process a complaint against her then supervisor. In his letter, the President reminds the Branch Manager that there are protocols she must follow when reporting a complaint, including first conferring with her “immediate supervisor.” Following protocol, this meant Miss Sandoval would have had to first report the Branch Manager’s complaint to her then supervisor, Beatrice Walker. Of course, it is doubtful Ms. Walker would have been able to objectively investigate herself.

Instead of apprising her supervisor, Ms. Sandoval evidently violated the very protocols referred to by President Wiggington in his letter; instead deferring the complaint to Executive Vice President, Rodger Smock, whose authority over Human Resources had been removed one month earlier. So why would Ms. Sandoval believe she was exempt from adhering to the protocols referred to in the President’s letter?

What’s more, during the President’s September 2010 meeting at the Valencia Branch, the President asked the Valencia Branch Manager and the Business Development Representative for the Santa Clarita Valley to provide letters documenting their allegations against Ms. Walker. Why did he choose to violate the very protocols referenced in his October 13, 2010 letter? Instead of requesting letters why didn’t he advise each woman that there were protocols each must adhere to? In fact, on the day the Branch Manager filed her verbal complaint, why didn’t Human Resources “clerk”, Esmeralda Sandoval advise her that she must follow credit union protocols before visiting Human Resources?

The President ends the paragraph by declaring that credit union protocols are provided as “guidelines to help us safeguard the values and friendly working environment we enjoy.” What values is he referring to? The filing of four lawsuits by former employees and a lawsuit filed in mid-2012 by a member prove the credit union’s executive and managerial sector have refused to adhere to policies and laws. The President does state that the protocols serve as guidelines, suggesting the Branch Manager was in her right to file a complaint directly with Human Resources who in response, should have conducted an in depth and unbiased investigation.

We’ve also periodically referred to Charles R. Wiggington, Sr. as a man who marches to the tune of a different drummer- a drummer no one else sees or hears. His allusion to the credit union’s friendly working environment is completely absurd. The injuries caused employee morale by President Wiggington; former COO, Beatrice Walker; Executive vice President, Rodger Smock; and Employee Services Manager, Esmeralda Sandoval, have created a working environment that is oppressive and miserable. Over the years, we’ve received emails from members, vendors and associates of the credit union, who reported that while visiting the main branch, they observed how unhappy employees are, with many describing the environment as depressing. So whose working environment is Charles R. Wiggington, Sr. referring to?

A SORTED & TAWDRY TALE

In July 2011, Rodger Smock posted the following notice on the credit union’s Intranet, announcing that Human Resources was being renamed, Employee Services and that Robert West would be its new Director and Esmeralda Sandoval, its new Manager. The notice, shown below, clearly proves Robert West is and remains the department’s Director, yet just a few months ago, Rodger Smock appeared at the offices of Richardson, Harmon, Ober in Pasadena, California, during which he provided testimony in the capacity of Director of Human Resources. So how is that possible if he isn’t the department’s Director?

Or are we to believe that Priority One employs two full-time Directors? Why would a credit union that relies on expense reductions as a key means to its survival and which has lost 4 branches since October 2010 and terminated a large contingent of employees throughout 2012 including a COO and a CLO, require two Directors to oversee Human Resources/Employee Services?

In his announcement, Mr. Smock explains that “Employee Services encompasses key competencies of the human resources/education functions” such as staffing, employee engagement and special services he fails to specify. In typical Smock manner, his verbiage is an attempt to wax intellectual but in the end amounts to nothing more than empty generalizations. What he should have said was that Human Resources was renamed Employee Services and that under its new Director, the department would integrate human resource functions with staff development.

He also states that the internal changes to the department will “allow POCU to keep pace with the changing social environment within the world we live and work.” What does this actually mean? Is he referring to social media and its impact on business? Mr. Smock’s announcement was unclear. leaving us to wonder, who actually composed the ambiguous message to employees?

The real reason for the change in name and alleged change in focus was the lawsuits filed by the former Burbank Branch Manager and a former Business Development Representative. The allegations contained in both complaints included age, race, same-sex discrimination, harassment, and subjection to a hostile working environment. The credit union’s attorney informed the President that the allegations served to exposes lapses in policy by Human Resources. In an effort to cover-up the department’s failures and to create the impression that Human Resources is a well maintained machine, the President was urged to revamp the department and replace Mr. Smock with a new Director. However, the changes were disingenuous. The sly and dishonest President retained Mr. Smock in a covert capacity. He continued to oversee Human Resources/Employee Services as its unofficial and invisible Director. This means that Robert West is a puppet Director and understandably so, since he has no education or prior experience in anything related to Human Resources. The public relations ploy may be dishonest and unethical but its just another example of how the President chooses to do business.

A liar begins by making lies appear like the truth but ends up making the truth look like lies.

William Shenstone

If the allegations contained in the complaint were the product of the Valencia Branch Manager’s misunderstanding with others and was not in any way work-related, then why did the President disclose during the September 2010 meeting in Valencia, that he would immediately remove Beatrice Walker’s authority over Human Resources. On the date of his statement, the President had not yet received the letters he said he needed to begin an investigation. Also, it would be several more days before an actual investigation would begin. What’s more, three days following the meeting in Valencia, Executive Vice President, Rodger Smock, posted a notice on the credit union’s Intranet announcing that Robert West had been appointed the new Director over Human Resources, thus displacing Ms. Walker. Furthermore, Mr. West had no prior experience or education in anything related to Human Resources.

Curiously, Mr. Smock had served as Director over Human Resources for more than 10 years at the time Beatrice Walker removed his authority over the department. Yet, in September 2010, on the day the President removed Ms. Walker’s authority over Human Resources, why was control over the department not returned to Rodger Smock and instead handed over to the inexperienced and unqualified Training and Education Manager?

Credit Union policy explicitly requires the investigation of grievances before corrective measures are implemented yet in the case of Valencia Branch Manager’s complaint, the President violated policy and found Ms. Walker guilty before an investigation was ever begun.

DISMANTLING HUMAN RESOURCES

More evidence to the inexplicable and confused decision-making abilities of President Wiggington are attested to in the following chart documenting changes made to Human Resources during the period of July 2010 through July 2011, during which Directors were changed on four separate occasions. From a strategical perspective the changes are pointless and ineffective, prompting us to ask, “What was President Wiggington thinking?”

History Repeating Itself

The mishandling of the Branch Manager’s 2010 complaint is reminiscent of the 2008 investigation of President Wiggington. At the time, a former employee filed allegations with the credit union’s attorney, accusing the President of having sexually harassed her for a period of a few years. An investigator hired by the credit union provided evidence that the President had indeed violated federal law and recommended the President’s termination. The now infamous Board Chair, Diedra Harris-Brooks suppressed the evidence, invalidated the gravity of the complaint, vilified the grievant, and reinstated the President.

Last year, a member called Mrs. Harris-Brooks at her cellular and advised her that an employee of the credit union posted confidential information about her automobile loan and statements that slandered the member’s reputation. Mrs. Harris-Brooks referred the problem to the President who in turn, delegated its investigation and resolution to Vice President, Yvonne Boutte, who tried to bring to diffuse the member’s complaint by berating and trying to subjugating her. Mrs. Boutte’s methodologies led to the filing of a lawsuit and its quick and voluntary settlement by the credit union.

It may behoove the President and Executive Vice President to rethink their strategy. We advise they come up with an alibi that is a lot more believable and less factually flawed. For the moment, their fantastic story remains shrouded in fantasy and not grounded in anything that even remotely sounds believable.

THIS POST

The focus of this month’s post are some of the officers who help define Priority One Credit Union’s reputation and who are pivotal to the credit union’s internal organization. It is a widely accepted fact amongst many in the industry that President Wiggington is the person who has most contributed to Priority One’s decline, however, his destructive decisions and abhorrent behaviors have often been aided by the Human Resources Department, the Board of Directors who under Board Chair, Diedra Harris-Brooks, have fought to preserve Mr. Wiggington’s continued employment and hide all evidence that proves his incompetencies.

We recently learned that the President disclosed he does not wish to answer questions at either a deposition or trial. If the President has done nothing wrong, as he insists, then we cannot comprehend his trepidation. If he has nothing to hide and if his handling of the Valencia Branch Manager’s complaint was conducted ethically and in compliance to all applicable policies and state and federal laws, then he should actually be looking forward to his day in court to finally right a wrong and set the record straight. Of course that is all contingent on the simple fact that he did nothing wrong in 2010, on the day he allegedly conducted an investigation of the accusations brought against Beatrice Walker.

Only a few days after the President renamed a Defendant in the lawsuit, he suddenly reduced his work week from 40 to 8 and 16 hours per week. According to Executive Vice President, Rodger Smock, Mr. Wiggington has suffered a relapse of the illness(es) he experienced in 2011 and 2012. If timing is anything, then his sudden change in schedule is highly suspicious and we believe it nothing more than a ploy to avoid having to testify. We also don’t know what specific ailment Rodger Smock is referring to since in 2011, the President suffered a small stroke and was soon afterwards, diagnosed with what he referred to as “ball cancer.”

And one has to wonder, what does a President who only reports to work once or twice a week, contribute to the credit union? If he’s suffered a relapse, it is doubtful he does much work while in the office. Furthermore, a relapse suggests he is again, terminally ill. Is so, why haven’t the Board of Directors or Supervisory Committee refused to order that he retire immediately so he could convalesce in the comfort of his home? It is said that in life, timing is everything and it is more than coincidental that the President reduced his work hours only after disclosing he does not wish to answer questions at a deposition or trial.

BUT FIRST

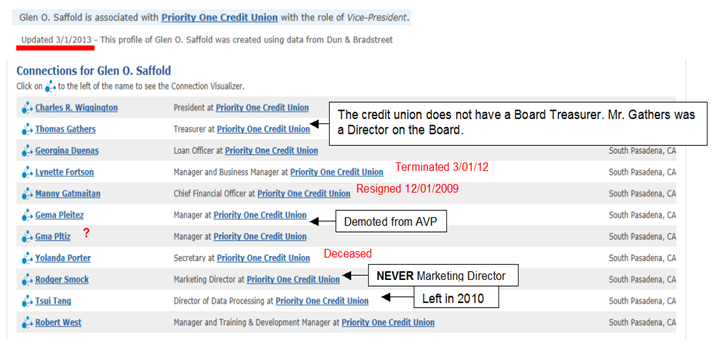

A few months back, we reported that President Wiggington authorized erroneous information to submitted to CorporationWiki.com, which stated volunteer Board Chair, O. Glen Saffold, is a salaried Vice President of Priority One Credit Union. As we also disclosed, Mr. Saffold is a postal carrier and has never been a salaried employee of the credit union or a Vice President of any company or organization. It is obvious, the misinformation was intended to embellish if not exaggerate Mr. Saffold’s role and importance at the credit union. We also know CorporationWiki doesn’t arbitrarily make-up titles for information published on their website.

A recent visit to CorporationWiki located new information, this time disclosing that former Board Member, Thomas Gathers, was the credit union’s Treasurer. The credit union has a CFO and the Board of Directors has a Treasurer, Joseph Marchica, but Mr. Saffold was not a Treasurer. According to the credit union’s 2011 Form 990 filing, shown below, Thomas Gathers was a voluntary, monetarily uncompensated Board Member who worked an average of one hour per week.

The information provided to CorporationWiki by the credit union was last updated on March 1, 2013, so it should be fairly accurate. In addition to the enhanced information provided to the website for Mr. Saffold and Mr. Gathers, the credit union has provided other inaccurate information proving the intention dissemination of fraudulent data.

In addition to the erroneous though intentional references which identify O. Glen Saffold as a Vice President and Thomas Gathers as the Treasurer, we’ve also identified the following errors in their CorporationWiki page:

- Georgina Duenas is a Lead Loan Officer.

- Lynnette Fortson was the AVP who until March 1st, oversaw management of the Los Angeles and Airport branches. She was suspended in February 2013 and later terminated.

- Manny Gaitmaitan resigned effective 12/31/2009.

- Gema Pleitez was an AVP for approximately one year. She now assists Vice President, Yvonne Boutte. Though her normal duties are to monitor calls coming into the Call Center, she temporarily oversees the Member Services Department in South Pasadena while Mrs. Boutte temporarily works out of the Los Angeles branch.

- Yolanda Porter died in 2009.

- Rodger Smock has never been a Marketing Director at Priority One Credit Union or any other company.

- Tsui Tang, another victim of former COO, Beatrice Walker and President Wiggington, was laid-off in 2010.

- Robert West is the Director of Employee Services.

The President, as we’ve shown in prior posts, has no inhibition dispensing inaccurate and fraudulent information on the Internet, but at times, does so for the purpose of embellishing the professional references of his friends on the Board, serving as yet another attestation of how President Charles R. Wiggington, Sr. chooses to do business.

JUGGLAR NOT SO EXTRAORDINAIRE

Most employees of Priority One are unaware that the credit union’s number one sycophant, Joseph Garcia, is no longer the AVP of Sales and Business Development. Though most are aware that his primary duty is visiting the communities served by Priority One in an effort to obtain new business and though they’ve realized he no longer conducts weekly staff meetings during which he reviews individual sales reports and expounds unendingly about the need that everyone try and obtain copious amounts of new business, the credit union has never posted notice of Mr. Garcia’s demotion.

Mr. Garcia’s history, beginning with his arrival at the main branch in South Pasadena has been characterized by frequent promotions and even more frequent demotions. It’s actually an amazing phenomena that speaks more of President Wiggington’s inability to make sound and rational decisions than it does about Mr. Garcia’s inability to satisfy his assigned duties. Unwittingly, Mr. Garcia has become the poster boy for all that is wrong with the credit union. In his latest incarnation as the sole business development representative for the shrinking credit union, Mr. Garcia is striving to find a niche which defines his competencies. It is important to remember, that at the pinnacle of success, he simultaneously held the titles of Call Center Supervisor, Loan Department Manager, and Credit Manager. He was also COO, Walker’s, constant companion and trusted confidant.

PLUMMETING

Mr. Garcia’s rapid ascension, beginning in 2010 might have been a lot more impressive had it been accompanied by a record of actual accomplishments. His performance while simultaneously serving in the capacities of Call Center Supervisor, Loan Manager (Real Estate/Consumer), and Credit Manager were characterized by Mr. Garcia’s failure to introduce a single contribution that helped increase business. Under his supervision, the Call Center became the target of amassing complaints citing long wait periods while calling the Call Center, hurried staff, and a chronic inability by the department to rectify reported issues.

While Manager of the Loan Department, his inability to comprehend real estate procedures prompted removal of the Real Estate Department from under his authority and transferred to CFO, Saeid Raad.

As Manager of the Consumer Loan Department, Mr. Garcia never developed a single strategy that resulted in increased business. In fact, it was his ineffectiveness which forced the credit union to seek out an experienced full-time Director of Lending. On August 1, 2011, Cindy Garvin became the Director of Lending and on December 1, 2011, she was promoted to the post of Chief Lending Officer and appointed authority over operations of all branches. Mr. Garcia temporarily served as her assistant until late 2011, when he was promoted by President Wiggington, to the post of AVP of Sales and Business Development.

Mr. Garcia’s failures are less a reflection of his intellectual and professional limitations than they are of the haphazard and sloppy manner Charles R. Wiggington, Sr. and some of his executive staff choose to govern. Mr. Garcia’s promotions were undeserved based merely on the fact he was wholly unqualified to hold any of the positions he was elevated to by the former COO and the President. The promotions unfairly setup Mr. Garcia for failure. Some highlights of Mr. Garcia’s achievements and failures, are shown below:

2009

Branch Manager of the Redlands branch.

January 2010

Interim Call Center Supervisor

February 2010

Named Call Center Supervisor COO, by Beatrice Walker.

April 2010

Promoted by Bea Walker to the position of Loan Department Manager, overseeing the Consumer and Real Estate Loan Departments.

June 2010

Due to Mr. Garcia’s inability to learn real estate loan procedures, his authority over the Real Estate Loan Department is transferred to CFO, Saeid Raad.

December 2010

COO, Beatrice Walker, publicly begins criticizing Mr. Garcia, describing him as incapable of understanding the responsibilities he’s been given.

January 2011

Due to amassing member complaints citing poor service dispensed by the Call Center, Mr. Garcia is stripped of his title of Call Center Supervisor and the department is transferred by Beatrice Walker to newly appointed AVP, Gema Pleitez.

August 2011

Mr. Garcia is demoted to Assistant Consumer Loan Manager and under authority of then newly hired Director of Lending, Cindy Garvin.

December 2011

Director of Lending, Cindy Garvin is promoted to Chief Lending Officer while Mr. Garcia is named AVP of Sales and Lending despite having no proven track record in sales and no experience as an AVP. He is assigned authority over the Business Development team and over sales efforts by all branches.

February 2012

Mr. Garcia and Ms. Garvin implement monthly sales goals to almost all employees. Over the next approximate seven months, the two frequently identify employees who fail to meet their assigned quotas and issue warnings and authorize terminations.

June 2012

Ms. Garvin and the President Wiggington inform Mr. Garcia that his strategies which he once assured would reap high amounts of new business, are all failing and the credit union is on a monthly basis, failing to achieve its identified goals. Ms. Garvin informs Mr. Garcia that continued failure could result in his termination. She also orders him to immediately begin visiting the communities served by Priority One on a daily basis and informs him, that he cannot return to his office in South Pasadena prior to 4:30 p.m., Monday through Friday. Mr. Garcia begins complaining he is overworked and discloses, he is seeking new employment.

October 2012

Mr. Garcia leaves on a three-month leave of absence, alleging he is stressed.

January 15, 2013

Joseph Garcia returns to work. During his absence, CLO, Cindy Garvin and on his first day back to work, he is informed his position as AVP of Sales and Business Development, has been eliminated as part of yet another effort by President Wiggington to reconfigure his internal organization so that it my function more effectively. Mr. Garcia is offered the post of sole Business Development Representative for the entire credit union, which he accepts immediately. The territory he will try to cultivate new business is comprised of all of Riverside County, the city of Los Angeles, the Santa Clarita and San Fernando Valleys, including all post offices and SEGs. The appointment is a typical Charles R. Wiggington, Sr. and Rodger Smock plan. Realistically and logically, there is no way one person can adequately penetrate the massive territory. At best, Mr. Garcia’s success would be miniscule and inconsequential to a credit union in dire need of new business.

As a courtesy to Mr. Garcia, the President assured him he will not issue notice to employees announcing his demotion, though it is quite evident to almost all employees that Mr. Garcia is no longer and AVP or at least, that his authority has been severely curtailed.

A LONELY PLACE

Since his return to work on January 15, 2012, Mr. Garcia’s performance as the credit union’s only Business Development Representative has been punctuated by his consistent inability to attain his assigned monthly goal of $150,000. Since February, only $25,000 to $50,000 of his submitted loans have been funded. Subsequently, he has only succeeded tin acquiring an average of 30% (and often less) of his assigned monthly goal. Unlike the many employees he targeted for termination throughout most of 2012, Mr. Garcia’s employment remains secure, proving President Wiggington and the Human Resources Department, enforce policies inconsistently and in accordance to their whims.

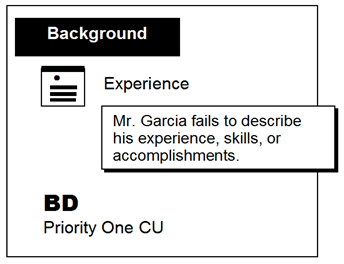

A search of the Internet also confirms the change to Mr. Garcia’s role and responsibilities at the credit union and as shown below, his LinkedIn account modestly describes his responsibilities as “BD for Priority One.”

Mr. Garcia apparently also does not comprehend the purpose of a LinkedIn account. Certainly the lack of information provided about himself lends credence to disclosures by staff of all branches, that Mr. Garcia allegedly lacks comprehension skills. His Spartan reference to his responsibility affirms that he is nowadays an almost invisible presence. Certainly, his efforts have not served to reverse Priority One’s business failures. And as attested to by his own LinkedIn account, he says absolutely nothing about what he’s contributed to the betterment of the credit union.

In May 2010, during the credit union’s Annual Meeting, Board Chair, Diedra Harris-Brooks, and declared that “in the Board’s opinion, we finally have the right management team in place” referring to then COO, Beatrice Walker, and Loan Manager, Joseph Garcia. Mrs. Harris-Brooks praised Ms. Walker’s efforts that were reversing the credit union’s former inability to acquire new business and she poured accolades upon Mr. Garcia’s single-handed efforts which were revitalizing employee morale. Within a few months, Mrs. Harris-Brooks statements would be nullified. A month after the Annual Meeting, the Real Estate Loan Department was removed from under Mr. Garcia’s authority and transferred to CFO, Saeid Raad. Eight months following the Annual Meeting, Mr. Garcia was stripped of his title and authority over the Call Center. And fourteen months after the Annual Meeting, Ms. Walker was terminated. So much for having the “right management team in place”. More importantly, the transference of Mr. Garcia’s authority and the dismissal of Beatrice Walker testify to the Board Chair’s immense ineptitude as leader of the Board and bringing into derision, her widespread bungling that has reduced Priority One to its current insignificant positioning. As for Mr. Garcia, his only accomplishment while in South Pasadena, was in becoming Beatrice Walker’s mule and tool and though his pandering sufficient to clinch promotions it was insufficient to keep any of the many positions he obtained through sheer manipulation.

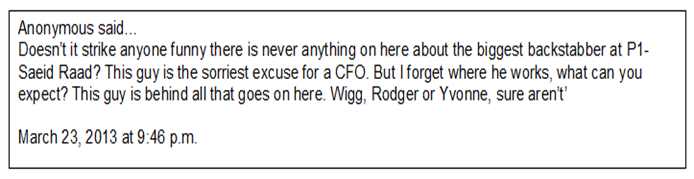

What does $133,832 get you?

Unfortunately, information we often intend to publish is often put aside because of more presenting topics, often forcing delay of our intended subjects. On March 23rd, a reader posted the following comment regarding our failure to post information about CFO, Saeid Raad and his impact upon the credit union’s working environment. We must begin by stating that unlike President Wiggington, Mr. Raad doesn’t seem starved for the limelight nor does he possess the same level of fear of rejection that forces the President to often seek validation. That said, Mr. Raad’s presence at the credit union has been marred by conflicts with others and amongst many employees, he is viewed as haughty and an elitist. In 2010, he complained to Executive Vice President, Rodger Smock, that he didn’t enjoy working 8 hour days and that he preferred spending the day golfing at the country club. It was these types of statements that sealed his reputation. His statement said much about his character and attitude.

Mr. Raad’s arrival at Priority One was orchestrated by his friend and former business associate, Beatrice Walker. In late 2009, Ms. Walker and President Wiggington were in conflict with former CFO, Manny Gaitmaitan, who refused to violate state laws and manipulate reporting practices to create an impression that Priority One was generating profits versus losses. Because of his refusal to cooperate to their demands, Mr. Gaitmaitan soon found himself ostracized and alienated from the President’s inner circle which at the time was limited to Beatrice Walker, Rodger Smock, and himself. In late November 2009, alienated and finding himself the victim of negative commentaries spewed by the President and his two followers, Mr. Gaitmaitan submitted his letter of resignation, referencing December 29, 2009 as his final day of employment. However, due to increasing animosity, he did not report to work for almost the entire month of December 2009.

During the second week of February 2010, the credit union posted its Income Statement for the month of January 2010 and lo and behold, it showed an influx of new money for the month ending on January 31, 2010. Of course, some employees disputed the veracity of the report because 2009 had just ended with the credit union more than $5 million in the RED. What’s more, where did this alleged new business come from when historically, January is one of the slowest months of the year?

By March 2010, it was discovered that the President and COO transferred money from one of the credit union’s ledgers and reported it as income for the month of January. Not only was the practice unethical, it created the impression of profit where none occurred. By December 31, 2010, the credit union reported losses of more than $500,000 for the entire calendar year.

In January 2010, Ms. Walker informed the President and Board Chair, Diedra Harris-Brooks, that she knew of an accomplished CFO who was working on a contractual basis with other credit unions and the could come and work for Priority One on a temporary basis until a new and permanent CFO were hired. The doltish Board Chair agreed and soon Mr. Raad found himself employed as the interim CFO. What’s interesting is that the credit union was allegedly seeking a replacement for former CFO, Manny Gaitmaitan, yet no potential candidates were interviewed by the Board. While still working on a temporary, contractual basis, the verbose President once exclaimed, “You should see Saeid’s paychecks- he makes more money than me!”

Six months following his arrival, Ms. Walker conferred with the Board Chair, and praised Mr. Raad for his cooperation in working amicably to encourage those efforts being made by the credit union to attain a state of profitability. The Board Chair who proved more pliable that Gumby, wholeheartedly agreed and authorized offering Mr. Raad the job of the credit union’s new and permanent CFO.

Almost immediately following his arrival, Mr. Raad conflicted with the Accounting Department Manager, Jennifer Kelly. Ms. Kelly was resentful that Mr. Raad had been hired as CFO when just six months earlier, President Wiggington appointed her the credit union’s new Controller and as the replacement for the banished, Mr. Gaitmaitan. Incensed by what he called her “attitude”, Mr. Raad informed Ms. Walker and Credit Resolutions Manager, Yvonne Boutte, while standing in the Call Center, that he would “break” Miss Kelly. Apparently, he did what he promised do because soon afterwards, she began complying to his directives though their relationship remains strained but quiet.

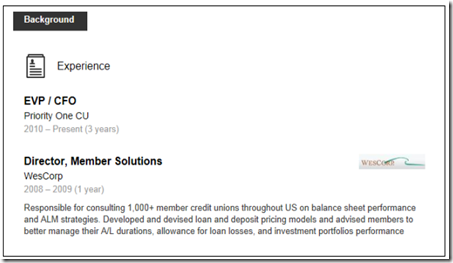

As shown below, prior to being hired by the credit union, Mr. Raad was employed by WesCorp, Continental FCU, and Focus One CU.

Priority One’s 2011 990 filing discloses Mr. Raad was paid $133,832 in 2011 which may not seem a substantial salary paid to a CFO but it is an exorbitant salary at a credit union whose sales continue to lag. It is an exorbitant amount at a credit union which lost four branches between 2010 and 2013. It is also exorbitant at a credit union which hired and paid large salaries to a COO and later, a CLO both of who were subsequently terminated for unsatisfactory performance. It is also an exorbitant amount paid to a credit union whose continued financial buoyancy is dependent upon expense reductions determined by the Mr. Raad. So is Mr. Raad worth $133,832?

ANGEL OR ANGRY BIRD?

The Fall of LalaSweetAngel

Years before being appointed Manager of Employee Services, Esmeralda Sandoval served as the Administrative Assistant to former President, William E. Harris. While in that capacity Miss Sandoval was best known for her ability to guard confidentiality, a quality required and highly desired in any administrative assistant. After January 1, 2007, the date Charles R. Wiggington, Sr. began serving as President, Miss Sandoval’s public demeanor underwent a significant and adverse change. On that date, Miss Sandoval was transferred to Human Resources by President Wiggington where she would assist then Vice President of Operations, Rodger Smock. In the years which followed, Miss Sandoval periodically disclosed she was relieved she had never been asked to serve President Wiggington because she did not know how she could have tolerated his incessant talking, volatile personality, and disorganization. Evidently, Miss Sandoval’s ability to guard confidentiality had come to a sudden end.

As Mr. Smock’s assistant, she was responsible for processing payroll and benefits administration; and interviewing candidates selected for potential employment. Because she had taken over so many of Mr. Smock’s responsibilities, the Executive Vice President’ in Human Resources was reduced to mostly participating in meetings during which employees were informed they were being terminated.

In 2009, Beatrice Walker was hired as the credit union’s first COO. Within a few weeks, she informed the President that Miss Sandoval did not fit into her vision for Human Resources. Specifically, pointed to the fact that Miss Sandoval did not possess a BA in Human Resources and that she did not look or dress the part of an officer and that her vocabulary was limited and laced with slang. Ms. Walker’s plan to eventually remove Miss Sandoval from Human Resources, was successfully intercepted by Mr. Smock who convinced President Wiggington that Miss Sandoval was knowledgeable and an asset to the credit union.

In late 2009 and for a part of 2010, Miss Sandoval began verbalizing criticisms about this blog, describing our disclosures as lies intended to destroy the credit union. She also reprimanded employees she overheard talking about the blog and at times, threatened termination to employees who said they read the blog. In 2010, we decided to satisfy Miss Sandoval’s apparent thirst for evidence and began publishing copies of the credit union’s documents which validated our accusations against the President. Soon afterwards, Miss Sandoval ceased her verbalizations condemning and maligning this blog.

Possibly motivated by fear of losing her job and hoping to endear herself to Beatrice Walker, Miss Sandoval became an informant for the President, COO, and Executive Vice President, providing them with the names of employees she said were criticizing management. At the start of 2010, her efforts increased and she soon became an active participant in the plots concocted by the President and COO, to drive out enemies to their mode of administration.

In August 2010, Beatrice Walker forcibly took control over Human Resources and Miss Sandoval became her assistant. However, Ms. Walker’s take-over would prove short-lived when she was accused of harassment by the Valencia Branch Manager. Upon receipt of the verbal complaint, Miss Sandoval ignored the protocols described under policy and reported the complaint to her former supervisor, Rodger Smock, whose authority over Human Resources had been removed just a few weeks earlier. As a result of the complaint, the President obtained authorization from Board Chair, Diedra Harris-Brooks, to strip Ms. Walker of all authority over Human Resources. Miss Sandoval would later disclose that she had been relieved when Human Resources was transferred under authority of then Training and Education Manager, Robert West.

Resolution of the complaint filed by the Valencia Branch Manager was abruptly aborted when Board Chair, Diedra Harris-Brooks, ordered the grievance squashed. However, Miss Sandoval continued her willing participation as a “tool” of the President, the COO, and the Executive Vice President. In early October 2010, Miss Sandoval, at the request of President Wiggington, called the Valencia Branch Manager on a Thursday morning and advised her that she must respond to an offer made by the President in September, which asked if the Branch Manager would accept a demotion and serve as the Assistant Branch Manager of the Burbank branch along with a 40% cut in pay; or accept a severance package that would pay her one week of salary for each of her three years of employment. Miss Sandoval ordered that the Branch Manager provide her answer by the end of the business day. The problem with Miss Sandoval story is that no such offer was ever extended to the Branch Manager. Not only was an offer never made, but the credit union has no documented evidence of the alleged offer.

The Branch Manager chose the severance package and provided Miss Sandoval with her intended last day of employment. Pleased, Miss Sandoval informed the President, Beatrice Walker, and Rodger Smock of the Branch Manager’s decision. However, Ms. Walker became incensed and ordered Miss Sandoval to again contact the Branch Manager and advise her that she was not allowed to select a final date of employment. Furthermore, the Branch Manager would be required to work through November 15, 2010. In view of the complaint filed against the COO, Ms. Walker’s involvement in the incident was both inappropriate and deplorable. Ms. Walker should have excused herself from the proceedings and deferred the matter to newly appointed Human Resources Director, Robert West. Ms. Walker ordered that Miss Sandoval again contact the Branch Manager and advise her that unless she fully complied to the credit union’s dictates, she would not be eligible to a severance package. Miss Sandoval was instructed to inform that Branch Manager that if she left prior to November 15, 2010, the credit union would view her departure as a voluntary resignation which would automatically disqualify her for severance pay. In the end and after conferring with their attorney, the credit union was forced to concede with the Branch Manager’s request.

We hypothesize that Miss Sandoval, more than anyone else, is aware of her vast limitations as a representative of Human Resources. Certainly her willing participation in the President and COO’s efforts against the former Branch Manager and what appears to be collusion, to deprive her of the severance package they offered may have been a means by which Miss Sandoval thought she could ensure her continued employment. It is also due to Miss Sandoval’s clumsy and inept participation in the President’s and COO’s schemes that left the credit union open for the Valencia Branch Manager’s lawsuit. The severance package once offered by the credit union was never paid because the Branch Manager forgot to return the signed agreement. At the time, the Branch Manager contacted Human Resources and advised them that she forgot to return the signed agreement by the stipulated deadline and asked if they would allow her to return it after that date. Mr. West, who was the department’s director, conferred with Rodger Smock, President Wiggington, and Beatrice Walker. At the time, Ms. Walker would boast that the former Branch Manager had “begged” for the severance package but had been denied for failing to adhere to the deadline specified in the agreement. She and the President would also relish in the fact that the credit union would not be paying the former officer severance pay which we calculate would have amounted to less than $4000.00. The decision by the officers not to pay the severance package was not based on their desire to adhere to the agreement’s specific stipulations but a question of ego and a need to retaliate against the Branch Manager who had won the right to the severance package. This of course prompts us to ask-

- So how much has the credit union now spent on attorney fees?

- How much has been spent on other legal fees, i.e., court filings and depositions?

- How much could the credit union have to pay out to settle the lawsuit?

Obviously, when it comes to strategizing the President, the former COO, and the entire Human Resources Department are dolts, unable to see the big picture of any situation. It would have behooved them to amend the original severance agreement and issue payment. It would have avoided the filing of a lawsuit by the former Branch Manager and it would have impeded the subsequent and exorbitant amounts paid in legal fees and having to create a story that ineptly tries to convince a court that the President and his cronies did absolutely nothing wrong in 2010.

Additionally, in her zeal to help her superiors, Miss Sandoval willingly entered into email exchanges with the former Branch Manager, resulting in the creation of a large documented record which may prove detrimental to the credit union’s defense. It is obvious to us, that Miss Sandoval only did what she was told to do by the President, the COO, and the Executive Vice President. And though she may have only followed instruction, she is the person who for all intents and purposes, composed the emails and has through her acts, implicated herself in the illegal plots conceived by President and his staff.

Photo taken by Miss Sandoval of herself, while in her automobile. Notice the pursed lips?

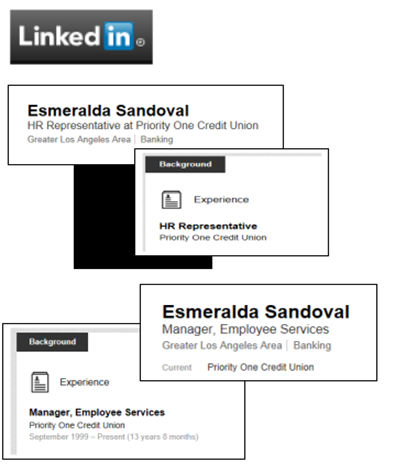

Miss Sandoval’s LinkedIn account is seemingly austere and uninspired. She omits all reference to her current responsibilities, any achievements, or education. Does Miss Sandoval understand the purpose of a LinkedIn profile? Her title is Manager of Employee Services yet she says nothing else about her role at Priority One Credit Union. In the summary, Miss Sandoval also states that:

- She is available for career opportunities which we assume means career opportunities that may be available at Priority One Credit Union though we can’t image what if any career opportunities are available at the notorious credit union.

- She is also available to also answer questions about her expertise even though she fails to provide a single specific describing her alleged expertise.

- She also states she is available for “business deals” though what types of dealings she is referring to remains a mystery.

Miss Sandoval has never been a contributor to the credit union’s efforts to acquire new business or increase membership. Her 2010 participation in undermining the Valencia Branch Manager’s complaint proved she was both ignorant about the intent of the credit union’s policies prohibiting harassment and about her responsibility to ensure policies are adhered to by all staff members. Miss Sandoval was also required to help initiate measures described under policy, that would have brought an end to the abuses committed by the former COO. Miss Sandoval failed on a colossal level and willingly violated credit union policies and state and federal laws.

While perusing the Internet we discovered much about Miss Sandoval’s many and varied interests including her fixation with exercise and dieting, fashion, food and many philosophical references asserting her politically correct attitude which is inconsistent with her willing participation in plots which bullied, abused and slandered employees and often times sealed their terminations.

Though unmarried, she always refers to her live-in boyfriend as her husband. Certainly, we have no issue with how she chooses to live her life, but her need to lie about her life further attests to her character and in particular, her integrity.

Photograph taken by Ms. Sandoval of herself, while in her automobile.

Amongst her many interests, Miss Sandoval seems preoccupied with philosophies and adages that edify herself and secondly, others, though this stands as a stark contradiction to the numerous acts she’s perpetrated against employees during her stint in Human Resources. Over the past 6 years, she has been involved in injuring employee reputations, undermining policies, and aborting careers. In her comment, shown below, Miss Sandoval tries to sound enlightened though her behaviors while in Human Resources suggest she’s learned nothing about ethics, righteousness or respect for others.

Sadly, Miss Sandoval represents the caliber of officer populating Priority One’s Human Resources Department. She like Executive Vice President, Rodger Smock, voluntarily chose to compromise ethics and violate policies to ensure the agendas of her superiors were realized. Throughout the Internet we found links and statements in which she professes her love for babies and children yet her malicious abuse of employees suggests that she is more than a little confused.

In her online posting, Miss Sandoval’s declares no one should judge her and arrogantly insists no one could handle the challenges she’s faced in life. We highly doubt this. She adds there’s a reason for her actions and a reason why she is who she is. Miss Sandoval is being too modest. We doubt there’s a single reason for what drives her to undermine others and we are absolutely certain that there’s a plethora of reasons for her disturbing behaviors, all of which contribute in defining who she is.

CONCLUSION

A VIRTUAL CIRCUS

In the 2012 Annual Report, distributed to attendees of the May 2013 Annual Meeting, the President and Board Chair declare that Net Income increased throughout 2012 and continues to increase. The Financial Performance Report discloses just the opposite. At best, their Net Income remains in a state of stagnation though at the end of June 2013, the total dropped by more than a total of $2 million during the months April, and June.

So how can their Net Income attest to a lack of new business while their capital remain consistently high? In the 2013 Annual Report, the Board’s Treasurer, Joseph Marchica, stated the credit union’s sustainability was due IN PART to expense reductions. Mr. Marchica was not being forthright. The credit union’s ability to remain financially buoyant is attributable to expense reductions and little else.

Less loan funding including the elimination of most types of Real Estate loans, is only one factor contributing to retention of high capital. With the closure of four branches since October 2010, the credit union’s former expenses paid to lease each location, have been eliminated. The credit union also employs more part-time staff, which means reduced benefit payments. The terminations of the COO and later, the CLO, have added to the credit union’s monthly savings. The problem with expense reductions is that they are not synonymous with new business. Since being appointed President, Charles R. Wiggington, Sr. has proven incapable of developing strategies that generate growth. His butchering of the Marketing Department compromised the credit union’s ability to market its products and promote its name. Nowadays, its external business development is the responsibility of a single, ineffective Business Development Representative which further thwarts any aspirations the President may have to reverse the messes he created. Coupling the credit union’s failing internal dynamic is the fact Priority One is populated by many inept executives and managers and an incompetent Board of Directors. For the credit union, its performance is a continual roller coaster ride without progress. As Bankrate.com concluded earlier this year, Priority One is a credit union has above average overhead, the cause of which is easily pinpointed to its inability to generate new business.

“We continue to reduce operating expenses, improve overall credit union operations and reduce loan losses.

MOST IMPORTANTLY, WE ARE IMPROVING OUR NET INCOME.”

Message from the President/CEO & Board Chairperson, 2013 Annual Report, May 2013

The President’s complaints that he does not wish to answer questions regarding his handling (actually mishandling) of the 2010 grievance filed by the former Valencia Branch Manager and annoyance that he has been renamed a Defendant, appear to be nothing more than childish whining and a moot point. Almost immediately after expressing his rants, the President reduced his work schedule to 1 and 2 days per week revealing that Charles R. Wiggington, Sr. is better at behind-the-scene plotting than he is at answering questions in the light of day. His reduced work schedule also provides insight into his importance and relevancy to Priority One’s ability to function. Obviously, the credit union doesn’t need him and his reduced work schedule hasn’t adversely impacted the poorly performing credit union whose business continues to lag and remains reliant on expense reductions. If the President were truly innocent, then he should feel no trepidation about answering questions which would serve to justify every action he committed during his alleged investigation of the Branch Manager’s complaint. Unfortunately, for Charles R. Wiggington, Sr. his own defense is overshadowed by his October 13, 2010 letter to the former Valencia Branch Manager. His admittance that it was he who conducted the investigation and he again, who derived a conclusion from the facts he supposedly collected dispels the involvement of any other parties.

Exacerbating President Wiggington’s lies are the voluntary involvement of Executive Vice President, Rodger Smock, in the credit union’s fraudulent defense. Mr. Smock attended a deposition in the capacity of Director of Human Resources when in his announcement issued to all employees on July 28, 2011, declares that the department’s new Director was Robert West. Also, in September 2010, the date the Valencia Branch Manager filed her verbal complaint against former COO, Beatrice Walker, the then newly appointed Director was also, Robert West. Evidently, Mr. Smock has no qualms perpetrating a charade intended to potentially dupe a court should the lawsuit proceed to trial.

The credit union’s attorney realizes the problems in his client’s defense which explains why he and the credit union have suddenly taken a quieter demeanor. The challenge for the attorney will be to forge a convincing defense around all the discrepancies plaguing his client’s story. We don’t know if the attorney may hope to win a trial through sheer luck, convincing the court that Charles R. Wiggington, Sr.’s conduct is nothing less than pristine. Unless the President succumbs to his alleged illnesses before a trial begins, his current efforts to stall litigation are only serving to prolong the inevitable.

Dwarfing the lawsuit and the President’s story is the widespread damage Charles R. Wiggington, Sr. has inflicted upon the credit union. His accomplice, the Human Resources Department is hypocritically responsible for ensuring policies and laws are adhered to, yet under Rodger Smock, there has been no hesitation to manipulate and violate these whenever convenient and beneficial to the credit union. Under Rodger Smock, Robert West and Esmeralda Sandoval, the department has been reduced to a puppet-state, adhering to every one of the President’s whims irrelevant of their illegality. The department has also failed to act responsibly as a liaison between employees and the credit union and has voluntarily and all too willingly chosen to serve as a vehicle through which the President was able to carryout his attacks on targeted employees.

Priority One’s highest echelon remains inhabited by officers who contribute nothing to the betterment of the credit union and all of who are unqualified to resolve the many problems created by Charles R. Wiggington, Sr. What is most disturbing are the amount of officers who have over the years, willingly assisted the President’s numerous heinous plots. We suggest Charles R. Wiggington, Sr. man it up and face what lies ahead. Even horrendous Board Chair, Diedra Harris-Brooks, can’t control what may occur should the lawsuit proceed to trial.

To see what is right and what is good and choose evil instead, is utter cowardice.

Confucius (paraphrased)

Technorati Tags: Charles R. Wiggington Sr,Rodger Smock,Saeid Raad,Esmeralda Sandoval,lalasweetangel,Pinterest,lawsuit,Diedra Harris-Brooks,Board of Directors,Board Chair,Supervisory Committee Chair,Human Resources,Employee Services,Beatrice Walker,COO,Bea Walker,Yvonne Boutte,lawsuits,Burbank Branch Manager,race discrimination,same-sex discrimination,hostile work environment

Kindly Share The Love»»

|

|

|

Tweet | Save on Delicious |

91 comments:

OK, Wigg and Smock are idiots but what I really find INCREDIBLE is that Esmeralda is into dieting and exercise. Obviously, she's doing something wrong plus she eats so much Mexican food. I suggest some clear soup and a lot of walking.

Wow. Charlie needs to re-enroll in liar school.

I didn't know Joseph got demoted. Why isn't he been fired? He isn't making his goals so that should get him kicked out.

Wigg you better spend more time sharpening your mad lying skills baby because you need it.

Poor Wigg and Miss Smock. Guess they lied so much they can't remember their stories. I'm sure they'll get it together before the trial unless Wigg gets a note from his mamma excusing him from going.

"If you tell a lie big enough and keep repeating it, people will eventually come to believe it."

Joseph Goebbels, Adolf Hitler's Master of Propaganda.

You are being too nice about Esmeralda. That woman is the worst.

Charles does not need to re-enroll in liars school he needs to be teaching that class.

This is really crazy Wiggington and the board should have been let go along time ago. This is so hard to understand why the boad has gone along with all of this BS, can they not see the difference betweent what that credit union was under mr. Harris and this moron who now is runing the cu to the ground.This credit Union is a joke in the industry.

What are the chances any credit union could have so many horrible managers? Its got to be abnormal! Wigg is awful but you can blame that on the stupid board, actually on Diedra who is actually the one letting the cu fail. Rodger is just a symptom. And Esmeralda knows she's too stupid to be a manager at any other company. I doubt she could ever pass tests to prove she is competent. And Saeid is actually smart, laughing all the way to the bank knowing he does nothing but gets the big bucks anyway.

What a bunch of liars! They fire employees who violate policy but Smock and Wiggington lie and lie and lie and all they get is raises. Everyone should send thank you cards to Diedra for jacking up what used to be a great credit union.

Joseph is out in the field all the time but no one knows where he is. I doubt he's spending all his time visiting businesses. Last month he only got $12,000 out of his $150,000 he supposed to bring in every month.

They hired a new branch manager of LA. Let's long they stay with the credit union. That all so means Big Foot Boutte will be back working full-time in South Pasadena.

Saeid told Wiggington we need to get some money to start coming in because they can't keep relying on cutting back spending. I thought the annual report said we did great last year and we're going to do great this year? That's a load of crap, just that Wigg and Deedra don't ever think people look at the real figures. They are all a bunch of liars from that old hag, Smock to that petri dish, Wiggington.

I can't believe Esmeralda is into diet and exercise. Doesn't she way like 280?

The board are a bunch of con artists like Wigg. They aren't about to let one of their own go. What do you expect from a herd of low life, uneducated, gum smacking, ex-postal worker ghetto goons? Next time i'll comment on that James Brown look alike, Cornelua Simmons on the Planet of the Apes Supervisory committee.

If Esmeralda only weighs 280 then that means she lost weight.

I can't believe Saeid gets paid that much money! He's not a good CEO. All he does is choose where they're going to stop spending money. He's got Wigg and Miss Smock in his hands. He's the puppet master. But if they're doing so bad how can they afford paying Saeid $130,000+ and paying Wigg $150,000+, and paying Miss Smock $110,000+? That makes no sense.

What do you call a person who turns a trick for money? An officer of Priority One CU.

They don't even attend chapter or community events. When's the last time you saw anyone from P1 at a community street fair or at a chapter meeting? They don't provide any type of education to members and non-members in the communities they serve. One of the perks credit unions enjoy is being tax-exempt but that doesn't come without some requirements. Credit unions have to help their communities but its been years since P1 has done any of the things their supposed to do. They are enjoying the perks all credit unions get but they don't do a thing to earn those rights. Presidents like Wigg make it bad for all credit unions and what's worse, he doesn't care.

They used to go to the LA county fair, post office fairs, the VIA luncheons in Santa Clarita and Burbank chapter meetings every month. Not no more. They don't even know the importance of promoting their name. Actually, they can't really afford it either which puts a big hole in the lies Wigg and Diedra tell that everything is great! Whenever Wigg or Diedra say things are good, know that its the exact opposite!

Don't Tax My Credit Union campaign was intended to preserve the tax-exempt status for all credit union. If the industry's tax exempt status is taken away by the federal government, this would bring an end to the ability of credit unions to provide products and services that benefit members. That said, it isn't unreasonable to believe most credit unions care about members and about the communities they serve. Unfortunately, for the entire industry, there are credit unions like Priority One which taint the contributions of all other organizations. President Wiggington is an embarrassment and under him, Priority One is not doing its part to help the communities it serves. No financial education or other efforts that are contributed to the community only help fuel efforts to remove our tax exempt status. Though President Wiggington is clearly in the minority, his actions affect his credit union's members and employees but the reputation of the entire industry.

Wiggington is cleary out of his mind along with the board, you half to fell bad for the dude, he wants power so bad and wants to be the main man but he has no clue of how to run a business , not even how to run his own family.

there is a buzz going around looks like P1 will bit the dust soon

"Wiggington is cleary out of his mind along with the board, you half to fell bad for the dude, he wants power so bad and wants to be the main man but he has no clue of how to run a business , not even how to run his own family."

Anonymous you are so right. He is out of his mind but the board are just a bunch of uneducated lowlifes. He never had a clue on how to run the credit union except maybe into the ground. He thought he could turn it into a bank and he claimed he had all these great ideas that would push the cu into the 24th century. And his son being in rehab for meth and his step daughters getting knocked up is probably more due to how horrible he is then on anything else. I feel sorry for his kids and wife.

I heard too that he's been meeting with other credit unions to see if someone will merge with P1. He knows that high capital bullshit he's been pulling can't last forever since it comes from not spending and in the meantime, the credit union is not making enough business. And that idiot, Diedra doesn't know what to do except keep staring into the headlights as the car gets ready to hit her and the backwoods board.

Isn't Priority One already dust? The only thing that hasn't happened is that they close their doors or they get bought out by a credit union that actually knows what its doing. If it closes, I'm sure the "executive" team will be able to get jobs real easily.

- Wiggington could become a consultant for companies that don't want to be successful.

- Patti L can open a charm school.

- Yvonne can sell photos of herself to The Enquirer.

- Rodger can open an all boys school.

- Esmeralda can open a gym.

- West can finally take off the lamb costume and go back to being an out of the closet hypocrite.

The world is their oyster and they should all do great!!!

If they do have to merge then no one should be surprised. There's only so long you can survive by reducing spending. After you've closed almost 50% of your branches and fired lots of employees and stopped spending on marketing and are spending the little profit you get on lawyers and consultants, the only thing left is to sell, close, or merge.

The biggest mystery in the industry is why the board hasn't been removed by the state, fired by members, or put in a capsule and shot to Mars. Nothing they do is good and everything they do is to cover Wigg's flat, sick ass. Last year, Mr. Numb Nuts got into his head that the solution to ALL of the CU's problems was a new webpage with lots of pretty colors and icons just like a real IPhone. So what did it do that made business better? Not a damn thing! The man is plain old stupid. Some men can turn women on. Some men can turn other men on. Wigg couldn't turn on a light switch if his life depended on it.

He's probably tried to turn on a light switch but stopped when it threatened sexual harassment.

A light switch would have thrown up.

When be became President, Wigg told us he didn't want to use a lot of the products Mr. Harris created and he was going to replace them with better ones. That included the tax, back to school, computer and holiday loans. That's why you haven't seen them since 2007. He has a meeting a few months ago and says he's going to start introducing seasonal loans like the tax, back to school, computer and holiday loan. Like someone wrote, he is stupid. Wigg would not be president if Mr Harris hadn't hired which I'm sure Mr Harris is sorry he did. I have no idea why Wigg hates Mr Harris and why he has done everything to erase what Mr Harris accomplished. But now 6 years later, he's trying to resurrect the things that used to make us money. I do think Wigg is nuts. Seriously. No way anyone can act the way he does and does all the things he's done if they were sane.

Mr. Harris didn't hire Wiggington. Wiggington was hired by John Weston who was President before Mr. Harris.

Mr. Weston was a good man. Not perfect because he hired Charles but a good man anyway.

How did Wigg remain employed for so long? I heard he was a horrible VP. He was always telling people who asked him questions to go and ask other people plus he was lazy, had a big mouth and refused to meet with angry members. Hum. If he was that way as a VP then how did he become President? It couldn't of been because he won the swimsuit contest.

Why is Wigg still president? Well let's see. The Board is Black except for Joe Marchica, but Joe is asleep in la la land. The supervisory committee is all Black. Now they'll all tell you color has nothing to do with keeping Wigg but they fired Bea and Cindy who were both White and they didn't do the amount of damage Wigg did. If it walks like its black, and looks like its black its probably black.

Charels has always been jealous of Mr. Harris, that's why he blamed Mr. Harris when they credit union starting going under ,telling everyone that Mr. Harris left him a mess, WRONG Chrales aand Diedra are the ones who have brought that credit union down .

Charles is like a big brat, cry's wolf and always blames some one else.

Charles Wiggington is one of the biggest liars you'll ever meet. In 2007 when the accounts for the members that merged from Inland Counties Postal FCU with P1 didn't post correctly, he blamed Mr Harris. He could of fixed the problem immediately but he waited days and days trying to save money and in the end we lost a whole lot of the Inland members.

In 2007 when CHARLES didn't check the sample batch of ballots that were going to be mailed out and that resulted in members getting ballots with their account and social security numbers printed on the outside of the envelope. Charles blamed Alan the old IT supervisor but it was ALL 100% Charles Wiggington who was at fault.

In 2009 when the credit union ended the year in the red he tells that stupid uneducated board that it was the economy and it was the problems he inherited that caused the credit union to lose lots of money. Thats why on January 2010, he had us transfer money from one ledger to another so that it looked like we made money from new business but that never happened.

I'm surprised Charles hasn't blamed his dog, his druggy son or his wife for the problems at the credit union. The man is a sack of bull crap who can't tell the truth ever. He is a BIG excuse factory who always blames everyone else for the messes he creates. If he poops in his pants, he'll probably blame Mr. Harris because he's that stupid and immature. No wonder his mamma used to lock him in a closet.

Wig should of been fired when he was still a VP. EVERY EMPLOYEE knew he would be a horrible CEO because he sucked as a VP but the board who are a bunch of losers, thought he'd make a great leader. Go figure. He's hardly at work and who's running the place. It it Smock or Saeid? He should be fired since he is getting a big salary for mostly spending his time at home faking he's sick.

Charlie should be jealous. Under Mr Harris the credit union acquired smaller credit unions and increased its size. They replaced 1or 2 trailers that were used as branches with actual offices. The number of employees grew and Mr Harris was respected by employees, by credit union vendors, lawyers and other credit unions. Exit Mr Harris and in comes dumb ass of the century. Charles has caused the credit union to lose branches, employees, vendors and has had to hire shyster lawyers to replace the great lawyers they had. They employ the other biggest and backstabbing dumb ass, Rodger, I mean Miss Rodger Smock who is as useful as a shoe with no sole. They have four-eyed, king of the nerds Robert West supposedly overseeing HR but we all know he only has the title so that he can have a job. They have two faced backstabbing and hefty, Esmeralda Sandoval a real life chola acting as manager when she should be selling burritos at El Tepeyac. Yvonne is a walking 10 foot nightmare who thinks she is an expert at everything but she's really ignorant so ghetto. Yeah Charlie should be jealous because he and his pack have nothing on Mr Harris.

Please do not insult El Tepeyac, They have good food and a great staff. Put her on the corner selling corn!

OMG! LOL!