IS YOUR MONEY REALLY SAFE?

During the month of May, Priority One Credit Union continued its investigation of transactions once processed by the former AVP of the Los Angeles and Airport branches. As we reported last month, the AVP was terminated on March 1, 2012 after 40 years of service though in-depth inquiries by a private investigative firm did not begin until after she had been terminated.

Though typically, any company gathers all evidence prior to an employee’s termination, the credit union’s current efforts seem to be driven by a desperate need to find whatever proof may impede the former AVP from taking legal action against the troubled credit union. Hardly ever adhering to their policy governing confidentiality, the credit union not only disclosed that the former AVP was implicated in thefts occurring at the Los Angeles branch, they also disclosed that a private investigative firm had been hired to dredge out whatever evidence can be gotten that will prove the credit union’s allegations. Earlier this month, private investigators arrived at the South Pasadena branch and over the past week outside auditors began auditing credit union records at the South Pasadena branch.

In the meantime, notorious Vice President, Yvonne Boutte, continues to oversee branch operations and has taken over the office once occupied by the former AVP. Mrs. Boutte, for those who may not know, is defined more by her former alliance to COO, Beatrice Walker, and her inept 2012 bungling of a member’s complaint which as a result of Mrs. Boutte’s strong-armed tactics, escalated into a lawsuit which the credit union expediently settled at the beginning of November 2012.

Despite her often caustic presence and condescending treatment of employees and members, Mrs. Boutte recently issued a warning to employees of the Los Angeles branch, prohibiting them from all communication with the former AVP. This includes communication while employees are at work or during their personal time away from the credit union.

Obviously, Mrs. Boutte is again demonstrating just how ignorant she is about what she is legally allowed to demand and not demand. Her latest directive is typical of the chronically dictatorial Vice President who has over the years, often overstepped her authority in her insecure effort to exact control over employees. She apparently forgot that just last year, her bombastic handling of a member’s complaint resulted in a settlement forcing the credit union to pay more than $20,000 in settlement and attorney fees.

Mrs. Boutte’s directive prohibiting all contact with the former AVP, also disparages the former officer’s reputation. In prohibiting employees from communicating to the former AVP, Mrs. Boutte may have again violated the credit union’s policy governing confidentiality. Rumors originating from the main branch in South Pasadena, California, allege the AVP failed to satisfactorily perform her assigned duties and allegedly was involved in internal thefts occurring at the Los Angeles branch. Mrs. Boutte’s order to employees seems to validate that fact. Has Mrs. Boutte slandered the former AVP?

On a side note, the phenomena of internal thefts increased exponentially after Charles R. Wiggington, Sr. was appointed President, suggesting security protocols are not being implemented and enforced; or that the credit union’s security measures are in dire need of an overhaul.

THE SAFETY OF YOUR MONEY

This past January, the President ordered initiation of a campaign which emphasized the credit union’s then newly acquired four-star rating issued by Bauer Financial. Along with adverting the four-star rating, a message was posted on the credit union’s webpage, declaring “Your money is safe at Priority One Credit Union.” However, the confident declaration to the safety of member money was removed shortly after rumors surfaced of more internal thefts occurring at the Los Angeles branch. It would appear the credit union’s proclamations about itself were less than accurate.

In 2010, a member complained that she opened a CD in 2009, in the amount of $11,000. When the CD matured, she visited the Los Angeles Branch and discovered the amount of her CD approximated $4000.00 and not $11,000. The credit union hired the firm of Turner Warren Hwang & Conrad AC who conducted an audit of the Los Angeles Branch’s records. Their 3-week audit verified that approximately $60,000 had been embezzled by a former Receptionist/FSR/Teller. At the time, then COO, Beatrice Walker, and President Charles Rodger Wiggington, Sr. agreed not to seek legal recourse so to avoid negative publicity or posting of the incident on this blog. They also agreed to only reimburse funds to members who reported losses on their accounts. At the time, the President also said monies would not be restored to accounts belonging to deceased members unless a beneficiary filed an official claim. It was due to their intended plan that we published the incident on this blog and which forced the credit union to file a criminal complaint against the former employee.

Shown below is a summary of the charge filed on December 2, 2009, against the former Los Angeles branch employee. The evidence was presented to a Grand Jury who determined the case should be tried. On January 27, 2011, the employee was found guilty and convicted of Grand Theft.

On January 27, 2011, the former employee withdrew her original not guilty plea and through her attorney, asked the judge to sentence her immediately.

The court ordered the former employee serve three-years in a state prison but suspended the sentence, placing her, instead, on formal probation for a period of 36-months. She also received credit for one-day served in the Los Angeles County Jail and was also ordered to pay the following amounts to the court:

Considering that $60,000 were stolen by the employee, the amount of $470.00 ordered paid by the court was a mere pat on the Defendant’s hand. And though the President might argue he is unaccountable for the thefts occurring at the Los Angeles branch, it is our opinion that he should have been terminated for failing to ensure security protocols were being maintained. The current investigation of the AVP, for recent thefts occurring at the Los Angeles branch along with the $60,000 stolen in 2009 by the former Receptionist/FSR/Teller, bring into scrutiny the ability of Priority One Credit Union to ensure the safety of member assets.

THIS POST

It’s been awhile since we’ve reported about the lawsuit filed in mid-2012 by the former Valencia Branch Manager. This past April, the credit union’s prized attorney, Paul F. Schimley of Richardson Harmon Ober pc, filed yet another wordy motion decrying the accusations contained in the lawsuit and asserting his client’s innocence. What most surprised us however, was the reappearance of President Wiggington’s name on the lawsuit. As some of you may remember, last year, just a few weeks after the lawsuit was filed, the President’s name was removed as a defendant in the lawsuit. We were more than a little perplexed why his named was withdrawn, particularly when one considers his duplicity in many plots initiated against many now former employees.

We actually have some good news to report. Priority One has finally paid off its remaining unpaid balance owed on the $20 million loan borrowed in mid-2008, by President Charles Roger Wiggington, Sr. from the credit union’s line-of-credit. In 2008, the President easily convinced Board Chair, Diedra E. Harris-Brooks, that taking out a loan on the credit union’s line-of-credit would increase the credit union’s net income on paper. The motivation for borrowing the money was purely narcisstic and intended to enhance the credit union’s financial image. In 2009, Mrs. Harris-Brooks had grown concerned over the credit union’s increasing inability to acquire new business. During the period of 2009 through 2011, Priority One paid approximately $30,000 per month in interest alone. The credit union’s Twitter page contains the following assurance of what Priority One will do to enhance the financial lives of members and employees, alike:

We have to conclude that knowing the value of money and how to spend it requires the ability to exercise discipline and wisdom. The reason why the President originally borrowed $20 million was neither prudent nor helpful to the credit union. Its purpose was only to augment Priority One’s net income on paper. The amount paid on interest alone served to dispel the credit union’s declaration they are a “financial fitness center” possessing the ability to help members and employees “win with money.” The President’s reason for borrowing the loan which could never have occurred without approval of the Board of Directors, was just another exercise in superficiality, devoid of substance and spurred by an insatiable desire to create the appearance of success where none existed.

BUT FIRST…..

We were wrong. In last month’s post, we erroneously reported President Wiggington’s son had been arrested during the month of December for violating Health and Safety Code 11359, which is the sale of marijuana. One of our readers corrected us, pointing out the actual violation (referenced below) was of code HS1377(A) which is possession of methamphetamines. As the reader also pointed out, Charles R. Wiggington, Jr. was charged with a felony, suggesting that he was in possession of more than one ounce of methamphetamines and which might also explain the amount of bail which was set at $50,000. As shown below, since publication of our last post, the President’s son was tried, found guilty, and subsequently convicted. Though we originally only intended on admitting that we erred, we obtained additional information about this case which we thought we’d share with readers.

Here are some additional facts concerning Charles R. Wiggington, Jr.’s case:

President Wiggington evidently chose not to hire an attorney for his son. It certainly couldn’t be because of a lack of funds. Failure by the President’s son to report to court on January 17th forced issuance of a bench warrant in the amount of $50,000. His failure to appear in court is reminiscent of President Wiggington’s own defiance of state and federal laws and credit union policies. We sincerely hope the younger Wiggington chooses to follow a different path than that tread by his father.

THE EPIOTOME OF INNOCENCE

The Credit Union Positions Itself for Battle

Last June, the President received notice that he had been named a defendant in the lawsuit filed by the former Valencia Branch Manager. Worried by the implications of being named a defendant, not the least of which was the potential impact the lawsuit could have upon his personal finances, the President contacted Attorney, Paul F. Schimley. A few weeks later, a motion was filed by the Plaintiff’s attorney to the Superior Court of Los Angeles, requesting removal of the President’s name from the lawsuit. We, of course, were perplexed why his name had been removed because as we’ve shown over the past three years, the many abuses committed against employees and in particular, those described in each of four lawsuits filed by former employees, President Wiggington has been shown to be either directly or indirectly involved. .

Of course, it didn’t take long for the President to reveal the reason why his name had been removed. According to him, Mr. Schimley allegedly contacted the Plaintiff’s attorney and informed her that the President was suffering from cancer and too ill to participate in litigation. If the President’s name was not removed from the lawsuit, Mr. Schimley threatened to file motions postponing litigation which could potentially delay litigation for a year or more. Of course, as we pointed out at the time, the attorney’s story was contradicted by the fact the President was driving himself to and from work without assistance, gaining weight, and walking about the main branch talking about his illness, his therapy, his family, his cars, the lawsuits and any number of non-work related topics. In a motion filed this past January by Mr. Schimley, the President’s name reappears as a defendant in the lawsuit. So should we assume the reappearance of the President’s name indicates he is in remission and well enough to participate in litigation?

Whatever the reason, the inclusion of Mr. Wiggington is actually a good thing for both the Plaintiff and anyone who has been victimized by his unscrupulous, reputation-assassinating plots. The President may finally have to answer questions concerning his decisions, campaigns, and verbalizations which slandered many employees. He may have to explain why he donned an apathetic attitude when informed that former COO, Beatrice Walker, had leveled a scurrilous campaign against the former Valencia Branch Manager. He may also finally provide some insight as to why Human Resources, under management of Executive Vice President, Rodgers Smock, and his assistant, Esmeralda Sandoval, refused to rectify the situation and why they each chose to ignore their obligation as described under credit union policy. The President can hardly deny knowledge of Ms. Walker’s vendetta as he was the recipient of a letter, written at his request by the former Valencia Branch Manager, describing Ms. Walker’s far flung campaign against the former officer. What the credit union has tried to conceal publicly is that at the time, Robert West served as the credit union’s HR Director a title also shared by Rodger Smock. It will be interesting to discover the extent of Mr. West’s inclusion in the incident and what corrective measures he personally undertook to bring an end to Ms. Walker’s campaign.

At the time, the President Wiggington also informed the chronically ineffective Board Chair, Diedra Harris-Brooks, about the incident. Mrs. Harris-Brooks not only chose to implement corrective measures but she urged the President to distance himself from both the then Valencia Branch Manager and her grievance. We also know that it was Mrs. Harris-Brooks who authorized the removal of Human resources from under control of Ms. Walker. At the time, Mrs. Harris-Brooks and some other Directors, expressed their displeasure over racist statements allegedly verbalized by Ms. Walker and rumors about her alleged sexual preference. A court trial will certainly prove if all of Priority One’s officers dropped the perennial ball or if they were all equally irresponsibly and allowed the abuses to continue.

However, overshadowing the abuses being committed by the COO was the Board Chair’s concern that the Valencia Branch Manager had dared to file a complaint against a high-level executive of the credit union. This is actually not so unusual. In 2008, Mrs. Harris-Brooks personally squashed evidence proving President Wiggington had sexually harassed a former Assistant Branch Manager. Mrs. Harris-Brooks told the President that if the COO was subjected to disciplinary action then this might show that the Board of Directors made another gross mistake when they chose to hire Beatrice Walker without verifying her performance while employed by other companies. The Board Chair ordered the President to distance himself from the Valencia Branch Manager and the complaint. Mrs. Harris-Brooks also authorized the President to immediately remove Human Resources from under control of then COO, Beatrice Walker. She and the President decided to extend an offer to the Valencia Branch Manager, whose office was scheduled to close at the end of October 2010. The Valencia Branch manager would be offered the position of Assistant Branch Manager of the now defunct Burbank branch. Her salary would be reduced by approximately 30% to 40%. If displeased with the credit union’s generosity, the Branch Manager could instead accept a severance package which would pay one week of salary for each year of employment. Since the Branch Manager had only been employed by the credit union for approximately three years, the amount of severance pay would approximate $3500 to $4000. Nowhere in their plot, did Mrs. Harris-Brooks or President Wiggington consider the gravity of the allegations made against the COO nor did either choose to act proactively or ethically and bring an immediate end to the COO’s heinous campaign. As the years have shown, Mrs. Harris-Brooks’ and President Wiggington’s decision not to end Ms. Walker’s attack on the Branch Manager, proved detrimental and costly to the credit union.

The reappearance of the President’s name in the lawsuit is actually a good thing. The President will now have to answer questions about his decisions at the time COO, Walker, carried out her public and egregious campaign against the former Branch Manager. He may have to explain why he allowed his former protégé’ to carryout a scurrilous vendetta which resorted to the use of illegal tactics. Of course, the President may resort to his usual modus operandi, which is to try and escape accountability and deny knowledge of Ms. Walker’s actions. He will also have to concoct a very convincing reason to explain the Human Resources Department chose to play possum even after being provided verbal and written complaints about Ms. Walker’s heinous campaign. For the credit union’s attorney, Paul F. Schimley, this may mean digging deep into his magic bag of tricks.

A trial may also force the President to finally answer the question, “Who is the real Director of Human Resources aka Employee Services?” As we reported last month, according to Executive Vice President, Rodger Smock’s online biography, he oversees all things related to human resources. We also provided excerpts from Robert West’s online biography in which he describes himself as Director of Employee Services aka Human Resources. There is also the matter of Esmeralda Sandoval’s actual role and responsibilities as Manager of the Employee Services Department aka Human Resources. We know that in 2010, Miss Sandoval was the recipient of the verbal complaint lodged by the former Valencia Branch Manager. We also know, it was Ms. Sandoval who extended the credit union’s offer to the former Branch Manager, that she either accept a post as the Assistant Branch Manager of the Burbank office or accept a severance package. It was also Ms. Sandoval who responded to the emails sent to her by the Branch Manager regarding both the complaint against former COO, Beatrice Walker, and the credit union’s not so generous offer. We also know that at the time of the incident, President Wiggington and Board Chair, Diedra Harris-Brooks, ordered Robert West to handle all inquiries sent to Miss Sandoval from the former Branch Manager. Obviously and contradictory to sound judgment, there were lots of hands in the perennial pot which may explain why the credit union lost control over what should have been an easily resolvable complaint and which due to the actions of Board Chair, Diedra Harris-Brooks; President Wiggington; Executive Vice President, Rodger Smock; Director of Human Resources, Robert West, and then Human Resources “clerk”, Esmeralda Sandoval; metamorphasized into a real live lawsuit. Rather than adhering to policies and state and federal mandates, the credit union’s officers did what they’ve always done- tried to squash the complaint and drive out the victim from the credit union while further enabling Beatrice Walker’s then horrendous behaviors.

This past May, President Wiggington disclosed Executive Vice President, Rodger Smock, received a summons to answer questions at a deposition. Being familiar with Rodger Smock’s devices, we believe he will shirk all accountability in the fiasco created by the President, Mrs. Harris-Brooks, and of course, the Human Resources Department. He, like the President, will have to finally provide a statement affirming his actual role at the credit union.

Mr. Schimley is not asking for very much is he? Mr. Schimley is like so many other run-of-the-mill defense attorneys who are paid large sums of money to create whatever defense exonerates their client and vilifies the Plaintiff.

Attorney Paul F. Schimley’s defense is typical of his other responses to the other lawsuits filed by former employees of the credit union. He again resorts to his usual and customary cry of innocence and his usual and customary request the court not award the Plaintiff any monetary compensation. Clearly, Mr. Schimley has registered another 10 on the yawn-o-meter. He is both predictable and droll. Attorney Schimley also asks that the court order the Plaintiff to pay all court fees along with his fees as might be deemed “just and proper” by the court.

Attorney Paul F. Schimley’s defense is typical of his other responses to the other lawsuits filed by former employees of the credit union. He again resorts to his usual and customary cry of innocence and his usual and customary request the court not award the Plaintiff any monetary compensation. Clearly, Mr. Schimley has registered another 10 on the yawn-o-meter. He is both predictable and droll. Attorney Schimley also asks that the court order the Plaintiff to pay all court fees along with his fees as might be deemed “just and proper” by the court.

Based only on what we’ve observed in his handling of each lawsuit, we’ve concluded the only person who has nothing to lose and much to gain, is Attorney Schimley and of course, his law firm. The law firm will collect payment for every second of effort contributed in defending the credit union. What we find peculiar is that during litigation of the lawsuits filed by a former Burbank Branch Manager and a Business Development Representative, the law firm disclosed that neither Plaintiff had provided sufficient evidence to prove their many allegations leveled against their former employer. However, the declaration of victories in each case were dispelled when Mr. Schimley’s law firm orchestrated settlement of each complaint.

A review of invoices submitted to Priority One reveals the law firm has charged the credit union for depositions, court filings, court hearings, telephone and face-to-face consultations, composition of letters, faxing documents sent to the court and opposing counsel, research conducted by the firm’s paralegals, interoffice meetings, preparation of memorandums and trips made to the court to file motions. Ultimately, the credit union might have saved tens of thousands of dollars had they merely settled each case and not wasted valuable time and money on lengthy litigation. The credit union could also have avoided the filing of all lawsuits had the Board of Directors terminated Charles R. Wiggington, Sr. in 2008, immediately after being provided evidence by an investigator from EXTTI, Inc. proving he sexually harassed a former employee.

Since December 2011, the credit union has settled the following cases:

Like any attorney paid large sums of money to defend their client, Mr. Schimley is doing whatever it takes to exonerate his scandal-ridden client. Mr. Schimley is intimately acquainted with the allegations of wrongdoing contained in each lawsuit. He is intimately familiar with the testimonies collected during each deposition and though he will never admit it, he has seen and understands the common threads binding all four lawsuits. He is also keenly aware of every egregious act committed by his client and knows that his client has lied. During depositions, he has noted the inconsistencies in his client’s statements and observed his client’s nervous glances when asked questions they were not prepared to answer. He’s also heard the subtle changes in his client’s voice and may have even cringed each time his client verbalized statements that served to undermine the attorney’s efforts to create an effective defense. Most of all, Mr. Schimley knows the differences between right and wrong, legal and illegal, innocent and guilty.

Though on paper, Mr. Schimley seeks what is “just” and “proper”, that fact is he is not concerned with either. His ultimate concern is to raise a defense which enables his client to escape retribution for the multitude of egregious acts he is accused of committing. If he can’t prove his client’s innocence, he will ask the court to reduce the amount of potential damages his client. We are fully confident that despite the inclusion of a confidentiality clause prohibiting the Plaintiff and Defense from disclosing the amount of settlement, that President Wiggington will again feel impelled to blab the details contained in the agreement because unlike Mr. Schimley, the President doesn’t have to feign he cares about what is “just” or “proper.”

SO WHAT DO WE KNOW ABOUT MR. SCHIMLEY

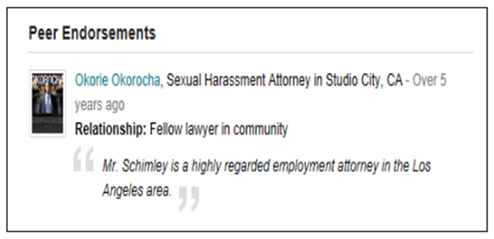

In 2010, Mr. Schimley was recognized as a “top” attorney in the city of Pasadena. Of course, the recognition came via his peers- other attorneys and not clients he has represented.

He also received an endorsement on AVVO.com, recognizing him as a “highly regarded employment attorney” though the endorsement came from another peer- Okorie Okoracha.

Though Ms. Walker’s employment ended abruptly on July 13, 2011, ONE of her LinkedIn accounts states Priority One Credit Union is her current employer. The reference is not so much perplexing as it is disturbing.

Beatrice Walker is just incorrigible…….. is what we would say if she were young and charming. It should come as no surprise that the former COO maintains a second LinkedIn account. We at first thought one of her accounts might be an old account but then we identified numerous discrepancies in both. We also note that the second account we located references her name as Beatrice W. and though the second record p

rovides a far more extensive history of her past employment, it omits the names of several past employers. The omitted names include Electricore, Inc. and AIRCO Federal Credit Union. Ms. Walker was employed by Electricore, Inc. just prior to her arrival at Priority One Credit Union. We called Electricore, Inc. in 2009, just two days after her arrival at Priority One Credit Union. We were told she had quit suddenly and unexpectedly, suggesting she may not have provided the customary two-week notice. We also know she was employed by AIRCO FCU because over the years, we’ve received emails from people who worked with her at that credit union and all of who allege, that due to her poor decision-making, the credit union incurred a large monetary loss which forced filing of an insurance claim with CUMIS, that credit union’s insurance carrier.

SPINNING MORE TALES

In his poorly written address which appears in the credit union’s Spring 2013 newsletter, President Wiggington chooses once again, to exaggerate the truth about the state-of-affairs at Priority One, reminding us of his undisciplined penchant for storytelling. His address is problematic on many levels including its weak journalistic style and gratuitous use of disingenuous platitudes.

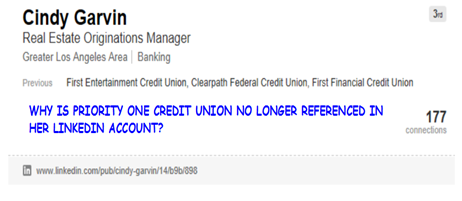

The address contains the President’s statement affirming 2012 was a successful year for the credit union despite real documented evidence that the now smaller, less competitive credit fared poorly in its efforts to generate new business. President Wiggington apparently forgot that in 2012 he ordered closure of the Burbank branch because the credit union could no longer afford to pay the location’s monthly lease. In 2012, the credit union also terminated a large number of employees for failing to achieve their assigned monthly goals, though the excuse justifying their ouster was merely a ploy by which to hide the fact the credit union was in desperate need to reduce expenses. On Thursday, December 28, 2012, the President terminated Chief Lending Officer, Cindy Garvin, for allegedly failing to resolve the problems impeding Priority One’s ability to acquisition new sorely needed business and acquiring desperately needed profit. Based solely on the facts, we think 2012 was neither productive or successful. What do you think?

Apathy. This was the general response by members of the credit union to this year’s election. In the many years before Charles R. Wiggington, Sr was appointed President, members enthusiastically submitted their names each year, nominating themselves as candidates for either a seat on the Board of Directors or Supervisory Committee. Not anymore. Thanks to the annual intrusions of the credit union’s electoral process, orchestrated by President Wiggington and Board Chair, Diedra Harris-Brooks, members have shown they no longer have an interest in the credit union’s future.

This year’s electoral process garnered no nominations, possibly attesting that members no longer have an interest in Priority One’s future. This may also serve to explain why many members are disinterested in the products and services offered by the credit union. For years, Board Chair, Diedra Harris-Brooks did all in her power to ensure the Board’s demographics remain unchanged and loyal to her every agenda. This year’s lack of response suggests she’s gotten exactly what she wanted though based on the credit union’s many internal problems, anything gained constitutes a hollow victory.

CONCLUSION

It doesn’t take any great feat of intellect to realize that Priority One’s many problems can be readily attributed to its President, Charles R. Wiggington, Sr. If he is the catalyst behind the disastrous decisions which have taken the credit union from success to failure then his removal is obviously the solution needed to bring an end to Priority One’s troubles.

In 2007, at the time he became President, the President boasted he would transform Priority One into a large and formative presence in the marketplace and implement the latest technologies that would serve to enhance a member’s personal banking needs. Unfortunately, like all else boasted about by the President, his spiel turned out to be another come-on with no substance. The problem lies in the fact that Charles R. Wiggington, Sr. was and is ill-equipped to lead Priority One Credit Union, even in its now smaller and less competitive form.

Over the years, the President and the Board of Directors have asserted Priority One is a minority credit union yet nothing on their website speaks personally to the alleged minorities they state form the largest portion of their membership. According to their NCUA filings, more than 50% of their members and managers are either Black or Hispanic Americans. We’d certainly like to review the credit union’s records proving what percentage of members are Hispanic Americans and which percentage are Black Americans.

During a recent credit union event, we listened while representatives of various credit unions said they could not understand why members have not demanded the removal of the entire Board of Directors and the President. Based on what we heard, it seems the only one glib about the credit union’s reputation in the industry and its performance, is President Wiggington.

Adding to the credit union’s business and financial problems is the credit union’s current legal wranglings which remain unresolved. The lawsuit filed by the former Valencia Branch Manager may finally force the President to court where he will have to answer questions regarding his handling (actually mishandling) of the Branch Manager’s complaint. He may have to also provide answers explaining why he allowed former COO, Beatrice Walker, to carryout a very public campaign against the former Valencia Branch Manager and why he and Human Resources proved useless in bringing an end to the COO’s vicious campaign.

What is acutely clear is that the President’s statements praising Priority One’s performance are invalidated by actual documentation which prove Priority One is no longer competitive or prospering. His statement are nothing more than unfounded and fictitious postulating by a President who is more invested in creating the impression of success then he is in rectifying his wide-spread blunders. In the meantime, we must wait, hoping that members of Priority One current and past executive staff will finally have to appear in a court of law and answer questions about why they chose to defy state and federal laws and help perpetuate a vicious campaign carried out by a COO whose inability to act appropriately, professionally, or ethically resulted in her eventual ouster. We predict that if the lawsuit goes to trial, that President and his staff will point fingers at one another, each denying their personal involvement in the treacherous acts committed by former COO, Beatrice Walker. However, it would be incredibly dull for anyone to believe that Ms. Walker’s vendetta could have continued, unimpeded, without assistance of President Wiggington, the embarrassing Board of Directors, and the entire disgraceful Human Resources Department.

We did not locate a single recommendation written by any former client of Mr. Schimley.

Source: AVVO

So what can things do we know about attorney, Schimley? We know that at times, he declared victories over all the Plaintiffs, only to later urge the credit union to enter into a settlement agreement. We know that his mode of defense involves vilifying Plaintiffs. We know other attorneys recognize him as an expert in employment law.

SOME LAWYERS HAVE TO TELL YOU HOW GOOD THEY ARE, WHILE OTHERS SHOW YOU

Within days, following her termination, former CLO, Cindy Garvin, amended her LinkedIn biography, removing all references to her role as CLO of Priority One Credit Union. Its rather peculiar that having been employed with the credit union from August 1, 2011 though December 28, 2012, she chose to remove the reference to Priority One, leaving conspicuous gap in her employment history. So is Cindy Garvin trying to distance herself from her notorious former employer?

“I CAN’T QUIT YOU.”

In contrast to CLO, Cindy Garvin, who appears to be exacting efforts to distance herself from the credit union, former COO, Beatrice Walker, seems quite incapable of extricating herself from the dysfunctional organization.

Though Ms. Walker’s employment ended abruptly on July 13, 2011, ONE of her LinkedIn accounts states Priority One Credit Union is her current employer. The reference is not so much perplexing as it is disturbing.

During her 25 month reign of terror which began on June 1, 2009 and ended abruptly on July 13, 2011, Ms. Walker became known for her ruthless and abusive treatment of employees, obsession with gossip, indulgence in the creating schemes usurping employee reputations, and excessive spending of credit union monies on a long series of failed projects. On the day she was terminated, Ms. Walker was not allowed to clean out her desk and was promptly escorted to the employee entrance located on La France Avenue. Descending the staircase with only her purse in hand, she disappeared into the night, never to be seen again by employees of the credit union. A few days later, her personal belongings were packed into boxes and shipped off to her home. Apparently, the credit union had no reservations of severing their relationship with the infamous and troubled COO.

In 2012, the credit union was served court filings informing them they were being sued by the former Valencia Branch Manager. Ms. Walker was named a defendant in the lawsuit and amongst the many allegations leveled against her, was same-sex sexual harassment. One would have thought that the notoriety which surrounds Ms. Walker would have motivated her to try and severe her all associations with her former employer. According to the reference found in her LinkedIn account, as shown below, Ms. Walker has found it impossible to end her relationship with the credit union. We strongly urge Ms. Walker to invest in a dictionary and acquaint herself with what defines “current” and “termination”. In 2012, Ms. Walker returned to work for a short time for a former employer, Honda Federal Credit Union, located in Torrance, California. Since then she’s worked on a contractual capacity for other credit unions though as shown below, she makes no reference to this in her LinkedIn account.

We are not surprised that Ms. Walker would continue to perpetrate a lie about her actual current employment though we are surprised she may have thought her deception would never be discovered. Beatrice Walker is not a woman lent to telling the truth. In February 2010, during a meeting in her office with three employees, she declared the credit union generated sufficient business at the beginning of the new year to generate more than $200,000 in profit for the month of January. This was particularly noteworthy because the credit union had just ended 2009 with more than $5 million in the negative. However, by March new business was again in decline and it was soon revealed by one of her immediate staff that she along with President Wiggington and Executive Vice President, Rodger Smock, transferred monies from a general ledger and fraudulently reported it as income to create the impression that business had begun to boom in 2010. Evidently for Ms. Walker, retaining a reference to Priority One Credit Union on her LinkedIn account is possibly intended to create the impression she remains their COO, a fact which can be easily verified to be untrue.

Beatrice Walker is just incorrigible…….. is what we would say if she were young and charming. It should come as no surprise that the former COO maintains a second LinkedIn account. We at first thought one of her accounts might be an old account but then we identified numerous discrepancies in both. We also note that the second account we located references her name as Beatrice W. and though the second record p

rovides a far more extensive history of her past employment, it omits the names of several past employers. The omitted names include Electricore, Inc. and AIRCO Federal Credit Union. Ms. Walker was employed by Electricore, Inc. just prior to her arrival at Priority One Credit Union. We called Electricore, Inc. in 2009, just two days after her arrival at Priority One Credit Union. We were told she had quit suddenly and unexpectedly, suggesting she may not have provided the customary two-week notice. We also know she was employed by AIRCO FCU because over the years, we’ve received emails from people who worked with her at that credit union and all of who allege, that due to her poor decision-making, the credit union incurred a large monetary loss which forced filing of an insurance claim with CUMIS, that credit union’s insurance carrier.

As shown below, the record also does not make reference to Priority One Credit union. Frankly, we’re more than a little confused. The omission of Priority One Credit Union may suggest that this is an older account. However, her inclusion of Priority One as her current employer in her other LinkedIn account, denotes that the other account is also old and possibly not updated or the information is intentional and thus fraudulent.

Ms. Walker confidently provides a list of skills and areas of expertise, some of which have been endorsed by what appears to be the same people. Its well-known that while serving as COO of Priority One Credit Union, business declined and morale decayed. Though we attribute the origin of the the credit union’s decline to President Wiggington, Ms. Walker exacerbated the credit union’s losses. Hired as an alleged expert in marketing and business development, as having a proven track record in reducing expenses and touted as an astute strategist who would implement new streams of income which would increase business. During her stay, many of her products failed to achieve the results she and the President boasted would be attained. She entered into a massive spending campaign which included implementation of the credit union’s Call Center, which has proven a fiasco and incapable of resolving Priority One’s service problems. She also spent exorbitant amounts in remodeling of the main branch in South Pasadena and the Burbank branch. According to Ms. Walker, revamping of both locations would increase business. As time quickly proved, remodeling did absolutely nothing to increase business. What’s more on May 31, 2012, the Burbank branch was permanently closed. While serving as COO, the credit union closed the Redlands, Riverside and Valencia branches. She also was pivotal in the ruination of employee morale and it was her conspiracies and horrendous illegal and unethical acts which resulted in the filing of lawsuits by the former Burbank Branch Manager, a former Business Development Representative, and the former Valencia Branch Manager. This may explain why she has chosen to omit her last name from her second LinkedIn account.

Source: LinkedIn

We’d be very interested in seeing Ms. Walker’s job application and resume, submitted to Priority One Credit Union prior to being hired as its first Chief Operations Officer. We wonder if her employment applications and resume also omitted past employer names or embellished her credentials. We’d also be interested in knowing if President Wiggington was aware of any omissions or exaggerations contained in her resume. It would be interesting to know if Honda Federal Credit Union was aware that she’d been terminated by Priority One Credit Union in 2011. Logically, only a person who has something to hide alters their own work history and we believe Beatrice Walker is a woman with much to hide.

In his poorly written address which appears in the credit union’s Spring 2013 newsletter, President Wiggington chooses once again, to exaggerate the truth about the state-of-affairs at Priority One, reminding us of his undisciplined penchant for storytelling. His address is problematic on many levels including its weak journalistic style and gratuitous use of disingenuous platitudes.

The address contains the President’s statement affirming 2012 was a successful year for the credit union despite real documented evidence that the now smaller, less competitive credit fared poorly in its efforts to generate new business. President Wiggington apparently forgot that in 2012 he ordered closure of the Burbank branch because the credit union could no longer afford to pay the location’s monthly lease. In 2012, the credit union also terminated a large number of employees for failing to achieve their assigned monthly goals, though the excuse justifying their ouster was merely a ploy by which to hide the fact the credit union was in desperate need to reduce expenses. On Thursday, December 28, 2012, the President terminated Chief Lending Officer, Cindy Garvin, for allegedly failing to resolve the problems impeding Priority One’s ability to acquisition new sorely needed business and acquiring desperately needed profit. Based solely on the facts, we think 2012 was neither productive or successful. What do you think?

Certainly the credit union’s own Financial Performance Reports attest that 2012 was neither productive or successful. We hardly view 2012 as a stellar year when we consider the loss of four branches since 2010 (Burbank, Redlands, Riverside, and Valencia) and the decline of their Net Income by approximately $20 million since January 1, 2007, the day Charles R. Wiggington, Sr. began his stint as President and CEO of the now smaller credit union.

Since Charles R. Wiggington, Sr.’s appointment to President on January 1, 2007, the credit union’s filings to the NCUA verify a cycle of continual decline. As shown above, in 2007, Priority One was physically and financially larger, more prosperous credit union. So how has President Charles Roger Wiggington, Sr. concluded that “Priority One had a productive and successful 2012?” As we’ve often said, President Wiggington marches to the sound of a different drummer- a drummer no one else hears or sees.

THE 2013 ELECTION

The Election That Never Was

Apathy. This was the general response by members of the credit union to this year’s election. In the many years before Charles R. Wiggington, Sr was appointed President, members enthusiastically submitted their names each year, nominating themselves as candidates for either a seat on the Board of Directors or Supervisory Committee. Not anymore. Thanks to the annual intrusions of the credit union’s electoral process, orchestrated by President Wiggington and Board Chair, Diedra Harris-Brooks, members have shown they no longer have an interest in the credit union’s future.

This year’s electoral process garnered no nominations, possibly attesting that members no longer have an interest in Priority One’s future. This may also serve to explain why many members are disinterested in the products and services offered by the credit union. For years, Board Chair, Diedra Harris-Brooks did all in her power to ensure the Board’s demographics remain unchanged and loyal to her every agenda. This year’s lack of response suggests she’s gotten exactly what she wanted though based on the credit union’s many internal problems, anything gained constitutes a hollow victory.

CONCLUSION

TARGETING THE PROBLEM

It doesn’t take any great feat of intellect to realize that Priority One’s many problems can be readily attributed to its President, Charles R. Wiggington, Sr. If he is the catalyst behind the disastrous decisions which have taken the credit union from success to failure then his removal is obviously the solution needed to bring an end to Priority One’s troubles.

In 2007, at the time he became President, the President boasted he would transform Priority One into a large and formative presence in the marketplace and implement the latest technologies that would serve to enhance a member’s personal banking needs. Unfortunately, like all else boasted about by the President, his spiel turned out to be another come-on with no substance. The problem lies in the fact that Charles R. Wiggington, Sr. was and is ill-equipped to lead Priority One Credit Union, even in its now smaller and less competitive form.

Over the years, the President and the Board of Directors have asserted Priority One is a minority credit union yet nothing on their website speaks personally to the alleged minorities they state form the largest portion of their membership. According to their NCUA filings, more than 50% of their members and managers are either Black or Hispanic Americans. We’d certainly like to review the credit union’s records proving what percentage of members are Hispanic Americans and which percentage are Black Americans.

In view of President Wiggington’s well documented history of failures, he continues to garner the gall to boast Priority One is doing well financially. Does he even realize the credit union lost four branches since 2010 or that their asset size has declined by more than $20 million since January 1, 2007?

During a recent credit union event, we listened while representatives of various credit unions said they could not understand why members have not demanded the removal of the entire Board of Directors and the President. Based on what we heard, it seems the only one glib about the credit union’s reputation in the industry and its performance, is President Wiggington.

Adding to the credit union’s business and financial problems is the credit union’s current legal wranglings which remain unresolved. The lawsuit filed by the former Valencia Branch Manager may finally force the President to court where he will have to answer questions regarding his handling (actually mishandling) of the Branch Manager’s complaint. He may have to also provide answers explaining why he allowed former COO, Beatrice Walker, to carryout a very public campaign against the former Valencia Branch Manager and why he and Human Resources proved useless in bringing an end to the COO’s vicious campaign.

What is acutely clear is that the President’s statements praising Priority One’s performance are invalidated by actual documentation which prove Priority One is no longer competitive or prospering. His statement are nothing more than unfounded and fictitious postulating by a President who is more invested in creating the impression of success then he is in rectifying his wide-spread blunders. In the meantime, we must wait, hoping that members of Priority One current and past executive staff will finally have to appear in a court of law and answer questions about why they chose to defy state and federal laws and help perpetuate a vicious campaign carried out by a COO whose inability to act appropriately, professionally, or ethically resulted in her eventual ouster. We predict that if the lawsuit goes to trial, that President and his staff will point fingers at one another, each denying their personal involvement in the treacherous acts committed by former COO, Beatrice Walker. However, it would be incredibly dull for anyone to believe that Ms. Walker’s vendetta could have continued, unimpeded, without assistance of President Wiggington, the embarrassing Board of Directors, and the entire disgraceful Human Resources Department.

Technorati Tags: Charles Roger Wiggington Sr.,Charles Rodger Wiggington Jr.,Rodger Smock,Robert West,Esmeralda Sandoval,Yvonne Boutte,Paul F. Schimley,Turner Warren,Hwang & Conrad AC,Richardson Harmon Ober PC,Los Angeles Branch,embezzlement,Grand Theft,methamphetamines,marijuana,probation,restitution,Beatrice W. Beatrice Walker,former COO