It shouldn't come as a surprise to anyone following Priority One's performance, that September 2014 proved to be another lackluster month for a Credit Union that can't escape its inability to market its products and services at a level required to amass profit, increase membership, and regain its former reputation as a respected and principled organization led by ethical and competent Managers.

Since being appointed President on January 1, 2007, President Wiggington and his so-called executive staff have failed quite publicly, to develop methodologies that translate into real growth and profit. Since 2010, the Credit Union has struggled to offset its continually increasing overhead and in 2014, is no longer able to provide convenience to Members living and working in many of the communities located within its vast territory stretching from the Santa Clarita Valley in the north to the Riverside/San Diego border, in the South.

The only significant change we noticed during the month of September was that the President abruptly ceased expounding about how his closure of six branches since 2010 were part of an elaborate and well-honed plan guaranteed to increase business, augment new memberships, and produce real physical growth. We aren't about to hold our breath awaiting fruition of his alleged plan, but his excuse struck as more than a absurd. Since when does eliminating convenience and an inability to provide quality member service reap growth and profit?

This post contains copies of documentation we've never published previously along with documentation presented in past posts, including biographies written in 2010 by Directors, Diedra Harris-Brooks, O. Glen Saffold, and Richard Hale. The intent of the biographies was to impress and sway voters to re-elect the three incumbents to the Board during the 2010 election. This, by the way, is the election the Board Chair and President disrupted when they tried to exclude a large contingent of Members from voting. The plan was of course foiled when we exposed it on this blog, forcing the Credit Union to conduct a second election.

The biographies were also published before Priority One was forced to close 6 of 9 branches, before it was forced to terminate a large contingent of full-time employees, replacing them with part-time staff, and before the Credit Union was forced to drastically reduce budgets once spent on successful, prize-winning marketing, advertising and business development.

Reader comments published in response to our last two posts suggest people have grown weary of the President's and Board Chair's excuses and far-fetched concoctions, created to excuse and even justify the Credit Union's lagging performance and possibly, suggesting that the propaganda churned out by the two officers may have finally and at long last, run its course.

THE WAYBACK MACHINE

There was a time when Priority One Credit Union could actually afford to publish a monthly and quarterly newsletter. The monthly newsletter ceased publication in 2010, when the Credit Union discovered Members were not reading it. Publication of the quarterly newsletter continued though abruptly ending in late 2013 and a victim of the President's often ermergent need to reduce spending. In an effort to avoid rumors that the quarterly newsletter was eliminated because the Credit Union could no longer afford to maintain it, the President stated that Members can obtain the latest news about the Credit Union on its droll and often inaccurate, News and Updates page, located on the Credit Union's webpage.

In Spring 2010 quarterly newsletter, the President declared that Priority One possesses the ability to help every Member achieve financial fitness.

Despite the dishonest manipulation of the Credit Union's books, President Wiggington arrogantly declared that the Credit Union possessed the ability to help every member achieve financial fitness yet inexplicably and contrary to its own self-promotion, the Credit Union apparently lacked the ability to help achieve its own financial fitness.

In his address, the President also states, “We realize that some of our members may already be financially fit, but still may need assistance”. The statement is absurd though quite typical of a President who doesn't possess the ability to perpetrate deceptions competently. Why would Members who are financially fit require the assistance of the Credit Union to help them improve their "financial fitness"? A Credit Union whose Net Income has decreased by more than $17 million since January 1,. 2007 is no one's financial fitness center and incapable of helping improve any member's financial status. President Wiggington continues…

“POCU has anew served referred to as “Balance”, which

is a financial fitness program.

Balance is offered by other Credit Union's and touted as an allegedly "free" financial education and counseling service though in actuality., it is not entirely free to Members who enroll in the program which is designed to help Members introduce control over their finances and achieve their personal financial goals.

President Wiggington was informed about Balance by Training and Education Manager, Robert West. Mr. West has periodically introduced FREE services to the Credit Union though none has survived the test of time and like his other offerings, Balance ceased to be offered during the same year it was introduced.

Balance is offered by other Credit Union's and touted as an allegedly "free" financial education and counseling service though in actuality., it is not entirely free to Members who enroll in the program which is designed to help Members introduce control over their finances and achieve their personal financial goals.

President Wiggington was informed about Balance by Training and Education Manager, Robert West. Mr. West has periodically introduced FREE services to the Credit Union though none has survived the test of time and like his other offerings, Balance ceased to be offered during the same year it was introduced.

THE PACT

"You know who Wiggington is as a man, by his associations. He is close with Smock who is a horrible human being. He is close with West who is no small hypocrite. He’s friends with Henry Justice. It was Wiggington who introduced Henry Justice to the credit union. After Henry Justice refused to surrender pink slips for 5 cars purchased from him by members of the credit union, Priority One had to file a suit in court against Mr. Justice but old wily, street smart Justice filed bankruptcy and said his daughter made off with the money. So Priority One couldn’t touch Henry. In 2009, Henry Justice shows up at the main office with his son and asks to meet with Wiggington. Wiggington comes out and hugs his buddy the thief, at the reception desk and takes him back to the board room. Then they leave the credit union for about 3 hours and have lunch at the Barkley where they talk about reintroducing Mr. Justice to Priority One and again, as a preferred auto broker.

The following week, Henry (Justice) shows up (at the South Pasadena branch) with his son an hands Wiggington a stack of business cards. They leave the office (branch) for about two and a half hours and the next day, Wiggington tells Patti Loiacano that Henry (Justice) is returning to Priority One. Patti reminds him that Mr. Justice (allegedly) stole money and owes the credit union more than $70,000. He (the President) shrugs it off and tells her Mr. Justice will pay back a part of what he owes. He (Henry Justice) pays back about $1300.00 and Wiggington passes out Henry's business cards to every loan officer and processor and tells them they're to promote Mr. Justice's new business as a "preferred broker." The loan people have more character than Wiggington because they all agreed not to promote Mr. Justice because of what he did to the credit union. Then a few days later, a post appears on this blog exposing Wiggington’s new plan. He comes out to the loan department and picks up Mr. Justice’s business cards, he tells the staff not to promote Mr. Justice and he calls Mr. Justice and tells him that if anyone from the board calls him to ask if he’s returning to Priority One that he’s supposed to say no and also say he hasn’t spoken to Wiggington in years. Yep, you can tell who Wiggington is by his associations.

The following week, Henry (Justice) shows up (at the South Pasadena branch) with his son an hands Wiggington a stack of business cards. They leave the office (branch) for about two and a half hours and the next day, Wiggington tells Patti Loiacano that Henry (Justice) is returning to Priority One. Patti reminds him that Mr. Justice (allegedly) stole money and owes the credit union more than $70,000. He (the President) shrugs it off and tells her Mr. Justice will pay back a part of what he owes. He (Henry Justice) pays back about $1300.00 and Wiggington passes out Henry's business cards to every loan officer and processor and tells them they're to promote Mr. Justice's new business as a "preferred broker." The loan people have more character than Wiggington because they all agreed not to promote Mr. Justice because of what he did to the credit union. Then a few days later, a post appears on this blog exposing Wiggington’s new plan. He comes out to the loan department and picks up Mr. Justice’s business cards, he tells the staff not to promote Mr. Justice and he calls Mr. Justice and tells him that if anyone from the board calls him to ask if he’s returning to Priority One that he’s supposed to say no and also say he hasn’t spoken to Wiggington in years. Yep, you can tell who Wiggington is by his associations.

The Incident

In 1998, Charles R. Wiggington. Sr. introduced his friend, Henry Justice to the Credit Union, intending to promote Mr. Justice's dealership, Justice Auto Sales. What this meant was that Mr. Justice's dealership as a preferred broker. This meant that representatives of the Member Service and Loan Departments would recommend Mr. Justice's dealership to Members expressing an interest in buying an automobile. In our post, "It May be Fraud to You but not to Charles R. Wiggington, Sr" (Monday, January 26, 2009), we reported that in 2003, Mr. Justice refused to surrender Pink Slips for vehicles purchased by four Members of the Credit Union. Mr. Justice's refusal impeded the Credit Union from registering its name as lienholder of the four automobiles and though the Credit Union had entered into an agreement with Mr. Justice in good faith, the broker refused to surrender the vehicle titles. Due to Mr. Justice's refusal, Members could not obtain Registration Cards from the Department of Motor Vehicles ("DMV") forcing the Credit Union's DMV Specialists to visit the office of the DMV in Lincoln Park, each month, to obtain a temporary Registration Card so Members could legally operate their automobiles.

To add insult to injury, Mr. Justice filed for bankruptcy. His bankruptcy filing was subsequently approved by the court, enabling Mr. Justice to avoid repayment of the monies due Priority One. Mr. Justice would later insist that the monies due the Credit Union were absconded by his daughter who had been employed by him at his dealership.

In 2002, in ongoing efforts to try and acquire the pink slips for each of the four automobiles purchased by Members from Justice Auto, the Credit Union mailed letters, like the one shown below, requesting the dealer provide a copy of the DMV Application so that the vehicles could be properly registered. Mr. Justice chose not to respond.

08/20/2002

JUSTICE AUTO SALES

20930 BONITA STREET

CARSON, CA 90746

We have enclosed a check in the amount of $ 7344.00 as payment in full for the

following vehicle 1997 HONDA CIVIC

Vehicle Identification Number # 2HGEJ6677VH575341

Being purchased by LISA M. XXXXXX ESTHER C. XXXXXXX

6412 XXXXXXX AVE BUENA PARK, CA 90621

We are now PAPERLESS TITLE. The application to Register New or Used Vehicles with the Department of Motor Vehicles must be Exactly in the name of.

PRIORITY ONE CU

1631 HUNTINGTON DR

S PASADENA CA 91030

As Lienholder and the Registered Owner as given above.

To perfect our interest, please send us a copy of the DMV Application to Register the Vehicle. Thank you for your cooperation.

Respectfully,

Loan Department Date: 08/20/2002

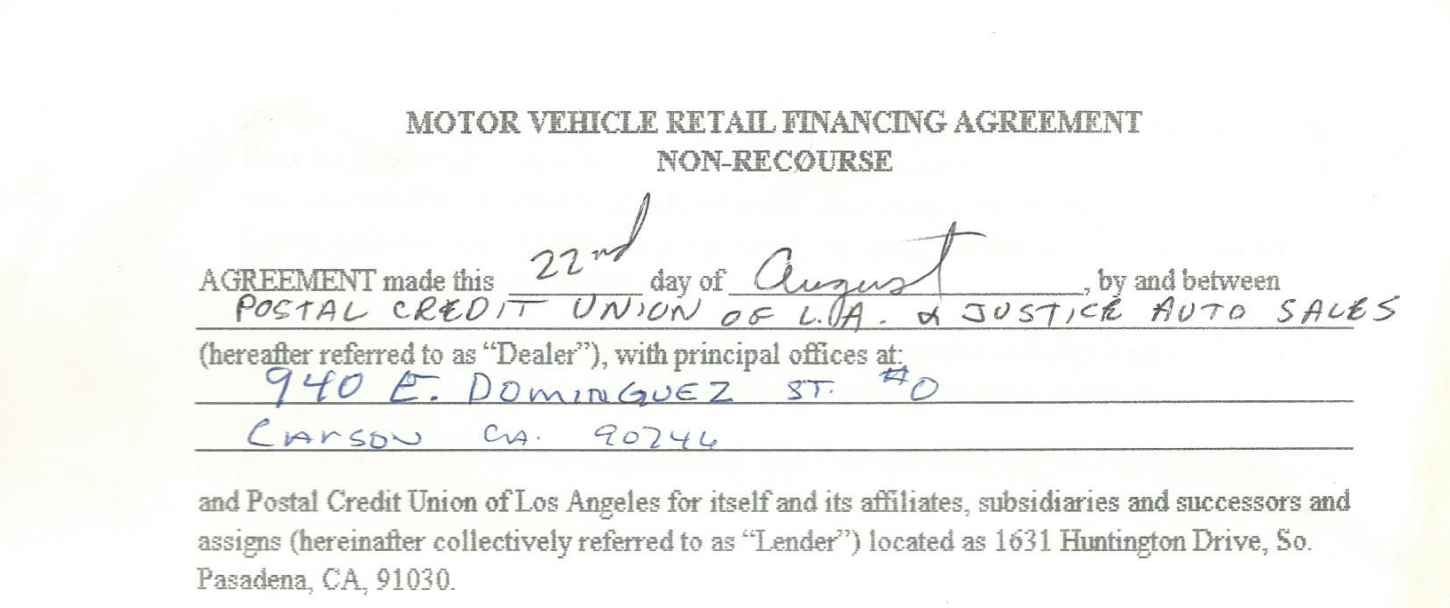

In 1998, at the time Mr. Justice was introduced to Priority One by his friend, Charles R. Wiggington, Sr., the dealer entered into a written agreement with the Credit Union, an excerpt of which is shown below. What we find perplexing is that Charles R. Wiggington, Sr. signed the agreement with Mr. Justice? Doesn't it seem a conflict of interest that Charles R. Wiggington., Sr., a friend of Mr. Justice, signed the agreement which allowed the dealer to become a preferred automobile broker?

Over the years, Charles R. Wiggington, Sr. has proven an immense inability to comprehend the inappropriateness of his actions. His friend's actions which culminated in bankruptcy, caused Priority One to lose more than $60,000.

The following letter, dated June 18, 2003, was sent to Priority One by its collection attorney, Bruce P. Needleman. If Mr. Needleman's name sounds familiar, he is the same lawyer who in 2012, responded to a complaint filed at Superior Court in Los Angeles by a Member who alleged Priority One violated the Privacy Act and published information about her automobile loan and her person, on the Internet. Mr. Needleman who was ill qualified to represent the Credit Union in the 2012 lawsuit and was subsequently replaced by an attorney qualified to respond to the Member's complaint.

The following letter, dated June 18, 2003, was sent to Priority One by its collection attorney, Bruce P. Needleman. If Mr. Needleman's name sounds familiar, he is the same lawyer who in 2012, responded to a complaint filed at Superior Court in Los Angeles by a Member who alleged Priority One violated the Privacy Act and published information about her automobile loan and her person, on the Internet. Mr. Needleman who was ill qualified to represent the Credit Union in the 2012 lawsuit and was subsequently replaced by an attorney qualified to respond to the Member's complaint.

Approval of Mr. Justice's bankruptcy should have signaled an end to the business relationship between the dealership and the Credit Union but not so for President Wiggington whose defiance to rules, laws and protocols impel him to seek out what is personally gratifying versus what is good for the Credit Union, Member-Owners, and employees.

In 2009, Mr. Justice and his son, arrived, unannounced in the lobby of the South Pasadena Branch. They asked the receptionist if they could speak to President Wiggington. The President who will never meet with people who haven't previously scheduled an appointment to meet with him, hurried to the lobby and loudly welcomed Mr. Justice and his son. He afterwards lead the two to the Board Room located at the back of the South Pasadena branch.

Ensuring security protocols are adhered to is pivotal to any business yet on the day of Mr. Justice's visit, the President invited Mr. Justice and his son into the back offices of the Credit Union's main branch despite the fact Mr. Justice ended his business relationship with the Credit Union just a few years earlier, owing more than $60,000 for vehicles whose titles he refused to surrender. In inviting Mr. Justice to the back offices, the President should absolutely no concern for the well-being of the Credit Union, it's assets and property.

Three days following Mr. Justice's visit to the South Pasadena branch, President Wiggington informed then Lending Director, Patricia Loiacano, that Mr. Justice was being reinstated as a preferred broker of the Credit Union. An image of Mr. Justice's business card was personally issued by the President to the Consumer and Real Estate Loan Officers along with instructions that they recommend Mr. Justice's dealership to Members hoping to purchase a vehicle. As shown below, Mr. Justice's new dealership was named Long's Auto Sales though the owner on record was Mr. Justice's son.

A PLAN ABORTED

As oft occurs whenever Charles R. Wiggington, Sr. chooses to manipulate circumstances, his plan to re-establish a relationship with Mr. Justice, encountered some obstacles. The first occurred when the Director of Lending, Mrs. Loiacano, reminded him that Mr. Justice owed the Credit Union more than $60,000, suggesting that Mr. Justice make some effort to repay a portion of the unpaid balance due Priority One. The President conferred with Mr. Justice and it was agreed he would pay the Credit Union approximately $1300.00 before being reinstated as a "preferred" auto broker.

Mr. Justice agreed to pay the small amount and the President proceeded with his plans. Unfortunately, for the undisciplined President, at the time he was preparing to re-introduce Mr. Justice to the Credit Union, we published a post describing Mr. Justice's past transgression which cost the Credit Union a total loss in excess of $60,000 and described the President's plan to promote Mr. Justice's new dealership. It is also important to point out that at the time the President promised to promote the dealership at no cost to Mr. Justice.

In January 2009, the President quickly moved forward with his plan and might have succeeded had we not exposed his intent on this blog. Panicked, the President returned to the Loan Department, picking up Mr. Justice's business cards and ordered Mrs. Loiacano to advise her staff not to promote the dealership until further notice. Returning to his office, he called Mr. Justice's cellular and instructed him to deny that the President had invited him to return to the Credit Union.

No doubt, Charles R. Wiggington, Sr. has no concept that as President, he is to serve the best interest of the Credit Union. His plan to enter into a new agreement with Mr. Justice was an effrontery to ethics, to the security of the credit union and its assets and disrespectful to the four members who had purchased automobiles from Justice Auto Sales and who for years were immensely inconvenienced by Mr. Justice's refusal to turn over pink slips for the four vehicles financed by the Credit Union.

Just 3 months after being appointed President, Charles R. Wiggington, Sr.'s abilities were challenged by two separate incidents. The first incident involved a former Burbank Branch Manager who he personally picked and promoted to the newly created post of AVP which she began serving in on January 2, 2007. The problem was that the AVP had for many years, incurred NSF incidents on a monthly basis. She had also periodically borrowed money from co-workers despite the fact Priority One Credit Union policy prohibits borrowing money from co-workers. During the months of October and November 2006, then Vice President of Operations, Charles R. Wiggington, Sr. approved reversing 24 individual NSF fees from the manager's account. Despite her checking account abuses, Charles R. Wiggington, Sr. not only reversed NSF fees but found her qualified both in aptitude and ethically, to become one of his first AVP's.

Unfortunately, by April 2007, the AVPs account abuses surfaced after an anonymous letter was mailed to one of the Board Directors. The now former Director, conducted himself ethically and responsibly and personally delivered the letter to then Credit Union attorney, William Adler. An investigation by Mr. Adler revealed the AVP had committed kiting, a federal offense. Her crime involved writing bad checks from three checking accounts held at three different institutions including Priority One Credit Union. And though President Wiggington may not have known she was kiting, he was fully aware that during October and November 2006, she incurred from that 24 separate NSF incidents because it was he, who approved backing out all NSF fees. Not only did he deny any knowledge about the numerous NSF fees, Board Chair, Diedra Harris-Brooks, testified on his behalf, informing investigators that Mr. Wiggington had no knowledge that the AVP had kited while avoiding any queries regarding his knowledge that Mr. Wiggington knew about the NSF incidents or that it was he who approved the reversal of all NSF fees.

The AVP was rightfully terminated but an incensed Charles R. Wiggington., Sr. swore he would find out who had written the anonymous letter and make certain that person was terminated. Within days following termination of the AVP, he sat in the Consumer Loan Department and told the VISA Card Supervisor that he knew for a fact that the letter had been written by the former Director of Marketing who he demoted to Marketing Coordinator immediately upon becoming President. Unfortunately, the President allowed his vivid and insatiable imagination to overcome logic and reasoning. We happen to know who wrote the letter and it wasn't the former Director of Marketing who had no involvement in the exposure of the President's hand-picked AVP who had chosen to violate federal law.

Unfortunately, by April 2007, the AVPs account abuses surfaced after an anonymous letter was mailed to one of the Board Directors. The now former Director, conducted himself ethically and responsibly and personally delivered the letter to then Credit Union attorney, William Adler. An investigation by Mr. Adler revealed the AVP had committed kiting, a federal offense. Her crime involved writing bad checks from three checking accounts held at three different institutions including Priority One Credit Union. And though President Wiggington may not have known she was kiting, he was fully aware that during October and November 2006, she incurred from that 24 separate NSF incidents because it was he, who approved backing out all NSF fees. Not only did he deny any knowledge about the numerous NSF fees, Board Chair, Diedra Harris-Brooks, testified on his behalf, informing investigators that Mr. Wiggington had no knowledge that the AVP had kited while avoiding any queries regarding his knowledge that Mr. Wiggington knew about the NSF incidents or that it was he who approved the reversal of all NSF fees.

The AVP was rightfully terminated but an incensed Charles R. Wiggington., Sr. swore he would find out who had written the anonymous letter and make certain that person was terminated. Within days following termination of the AVP, he sat in the Consumer Loan Department and told the VISA Card Supervisor that he knew for a fact that the letter had been written by the former Director of Marketing who he demoted to Marketing Coordinator immediately upon becoming President. Unfortunately, the President allowed his vivid and insatiable imagination to overcome logic and reasoning. We happen to know who wrote the letter and it wasn't the former Director of Marketing who had no involvement in the exposure of the President's hand-picked AVP who had chosen to violate federal law.

Immediately following termination of the AVP another, far more detrimental incident arose which affected all Member-Owners and is the one incident which began the Credit Union's rapid public unraveling.

In the years preceding January 1, 2007, the date Charles R. Wiggington, Sr. began his appointment as President and CEO, during each annual election intended to fill seats of the Board of Directors and Supervisory Committee, a disc would be created containing the names and addresses of all active Members in good standing. The disc would be forwarded to the Credit Union's contracted printer, who would prepare ballots and envelopes, which would be sent to Members. However, before the disc was sent to the printer, the President would always examine its contents to ensure only member names and addresses were contained in the disc.

In the years preceding January 1, 2007, the date Charles R. Wiggington, Sr. began his appointment as President and CEO, during each annual election intended to fill seats of the Board of Directors and Supervisory Committee, a disc would be created containing the names and addresses of all active Members in good standing. The disc would be forwarded to the Credit Union's contracted printer, who would prepare ballots and envelopes, which would be sent to Members. However, before the disc was sent to the printer, the President would always examine its contents to ensure only member names and addresses were contained in the disc.

In 2009, the President chose not to examine the disc, instructing the IT Supervisor to send the uninspected disc to the printer.

A few weeks later, the printer provided the credit union with some of the envelopes which had been printed and prepared for mailing. President Wiggington's predecessor had established security protocols which required that he along with the Director of Marketing and a third employee, examine a batch of envelopes intended for mailing, just to ensure the mailings were prepared correctly. In 2007, when Charles R. Wiggington, Sr. was asked to examine a sample batch of the intended mailings, he replied, "I'm the President and I don't do that!"

The envelopes were mailed but a few days later, a Member visiting the Valencia branch with his envelope in hand, was informed by a Teller, that the envelope contained the Member's Credit Union and Social Security Numbers, printed just above the window where his name and address appeared.

Some Members contacted Board Chair, Diedra Harris-Brooks, incensed that their account and Social Security Numbers had been printed on the outside of the envelopes containing that year's ballots. An irked Board convened at the main branch, demanding President Wiggington discover who was a fault and ordering that person's termination. The President told them the error had been caused by the IT Supervisor, but convinced the Board that rather than terminating the IT Supervisor, that they instead lay him off for three days without pay.

While informing the IT Supervisor that he was going to be placed on a three-day suspension because of the breach of security which he allegedly committed, the President also told the IT Supervisor that he "fought" to retain the Supervisor's employment because the Board had demanded his termination. Shortly after returning from his suspension, the humiliated and broker Supervisor resigned, obtaining a better and higher paid position with the city of Los Angeles.

Due to the widespread backlash, including the publication of an article by a Member and industry observers, the Credit Union hired at a cost of $100,000, the services of Equifax which monitored Member accounts for up to one year. But there was a catch, to qualify for the service, a Member had to contact the Credit Union and request inclusion in the service.

Despite the statements contained in his letter, Charles R. Wiggington, Sr. was not about to promote enrollment to Equifax's credit monitoring service which he often referred to as "expensive." He visited the Member Service and Loan Departments in South Pasadena to ordered them not to promote monitoring service adding that in his opinion, it was "highly unlikely an Member's account" would be compromised as a result of the security breach. The President's words showed how wholly disingenuous he was when he was forced to offer the credit monitoring service despite the fact the breach occurred because he though himself to elevated to adhere to the Credit Union's security protocols.

Furthermore, his opinion that Member accounts would not be compromised was just another fantastical concoction dredged up from the deepest recesses of his strange and convoluted imagination.

The President's instructions to employees seem more than a little inconsistent with statements containing in a memorandum issued by Executive Vice President, Rodger Smock, to employees and which provide some instruction on how they should respond to Member concerns regarding the security breach.

When the security breach became public, Rodger Smock's priorities appear to have become more than a little confused. In his memorandum, he seems to have forgotten that Members are Member-Owners and that any inquiries regarding the security breach are justified when one considers that the breach was the result of Charles R. Wiggington, Sr. elitist attitude that he was somehow to elevated to personally inspect a sample batch of the envelopes which were intended for mailing.

And contrary to Mr. Smock's assertion, the "important thing" should have been for all employees to exact steps needed help Members regain confidence in the Credit Union and its ability to protect Member assets.

Of course, the chronically dull EVP lacked the lucidity to respond appropriately to the mailing fiasco caused by his friend and supervisor, Charles R. Wiggington, Sr. This by the way, is the same officer, whose mismanagement of the Human Resources Department provoked the filing of four lawsuits by former employees during the years of 2010 through 2012.

THE DAMAGES

The President's horrendous decision to disregard security protocols resulted in the writing of letters by numerous, concerned Member-Owners. Though sent to his attention, the President chose not to read or reply to the letters, personally delivering these to the Business Development Department and instructing them to reply to every Member who had written a letter to his attention. The Members were contacted by telephone and when the project was complete, the letters returned to President Wiggington. The President chose not to file the letter but instead merely dropped them into his trash can. Despite the letters having been written about a security breach, the President chose not to shred or destroy the letters and again, violated Credit Union security protocols.

Here are copies of two Member letters:

This last letter was written by Member, Steve Bass. Mr. Bass. Mr. Bass who writes for PC World, published an article concerning the President Wiggington's mailing debacle. An excerpt of his original article is still available at NetWorld Article. One might have thought that in view of Mr. Bass' quite public complaint about the incident, that the President might have discarded the Member's letter in a manner consistent with security protocols.

THE BOARD

of Directors

Inarguably, it is Priority One Credit Union's Board of Directors who have in unison, enabled the circumstances which resulted in the bludgeoning of Priority One as a business and as an employer. Clearly, in 2014, Priority One is not what it was prior to the appointment of Charles R. Wiggington, Sr. as President.

The actions of the Board have revealed an arrogance in how each Director views himself. Their combined actions are not for the good of Members, the Credit Union or employees, but nothing more than what appears to be a need to exact their authority over a continually shrinking Credit Union.

So what are the abilities that each Director possesses that allegedly serves in helping each fill his or her assigned role on the Board?

In the Thursday, April 28, 2011 post, we published the biographies of incumbents whose seats were up for re-election. We've decided to again use the biographies written by three of the Directors- Diedra Harris-Brooks; O. Glen Saffold; and Richard Hale. As you read through these, consider what they say about their abilities an accomplishments and the state-of-affairs at the Credit Union. There is a clear disconnect and if the Credit Union remains trapped in a perpetual cycle of decline, then consider the abilities of each officer.

If one person can be attributed as the single most cause for Priority One's decline, it has to be Diedra Harris-Brooks. Contrary to her and President Charles R. Wiggington, Sr.'s addresses appearing in the Credit Union's annual reports, the U.S. economy and the national unemployment rate are not the catalysts which triggered the Credit Union's decline. In 2011, the President attempted to convince employees during one of the Credit Union's all-staff meetings that all Credit Unions are performing poorly, a statement that is easily verified to be untrue by studying the Financial Performance Reports ("FPRs") for other Credit Unions and available at NCUA.gov.

It is also evident that Charles R. Wiggington, Sr.'s rampant abuses of authority and horrendous business decisions could never have occurred had the Board and in particular, Diedra Harris-Brooks not enabled his destructive decisions making. It is also Mrs. Harris-Brooks who on her own volition, squashed evidence presented by an investigator to the Board in 2008, which proved Charles R. Wiggington, Sr. sexually harassed a female employee once assigned to the Loan Department.

- According to her biography, Mrs. Harris-Brooks has been a Member of the Credit Union for "more than 28 years". That is impressive, but how does that qualify her to serve as Board Chair?

- Mrs. Harris-Brooks attended the University of Phoenix where she completed Business Management and Marketing courses, attaining a 3.5 GPA. We'd certainly like to view her transcripts since her performance as Board Chair does not attest a proficiency in business management or marketing.

- "Her knowledge in Marketing and computer skills has proven to be an asset to Priority One"? Really? How so? We'd like Mrs Harris-Brooks or one of her pack to provide a single shred of documented evidence proving that her alleged knowledge in marketing has proven an asset to the Credit Union. And what types of computer skills is she referred to? Is she a programmer, an IT Technician, a software developer or she referring to a proficiency in using Microsoft Word? What specifically have her computer skills contributed to the betterment of the Credit Union?

- Since there is no tangible evidence to substantiate the statements she makes about her accomplishments, we'll have to label her biography as unconfirmed and thus not yet proven to be true. In her biography, she states she retired from the U.S. Postal Service where she worked her way up from a clerk and during which she received an "exceptional managerial service and earned the respect of her employees." We've spoken to former co-workers of Mrs. Harris-Brooks and respect is not a word we'd associate to their remarks about her behavior while serving as a manager of the U.S. Postal Service. We'd also like to see the documented evidence that she was recognized for her "exceptional" managerial skills. There certainly isn't evidence to any of this while she has served as a Director of the Credit Union.

Unfortunately for Mr. Saffold, all that he wrote he accomplished is dispelled by the facts that 2008, he, Diedra Harris-Brooks; Director, Thomas Gathers, and Supervisory Committee Chair, Cornelia Simmons, squashed all evidence gathered by an investigator from EXTTI, Inc. proving Charles R. Wiggington, Sr. sexually harassed an employee. Not only did the four discard the evidence, but in a letter signed by Mrs. Harris-Brooks, the four corrupt officers vilified the victim, stating that based on their "understanding" of what constitutes sexual harassment as defined by federal law, the allegation of wrong doing never occurred. Mr. Saffold joined forces with the others to purposely suppress evidence so that they could retain Charles R. Wiggington, Sr. as President and CEO.

Mr. Saffold's states that at the time his biography was published, he'd served on the Board for "three terms." He ignores the fact that since 2009, the electoral process was changed when Mrs. Harris-Brooks and President Wiggington disrupted the electoral process in an effort to retain the same Board Directors who have blindly shown their loyalty to Mrs. Harris-Brooks versus the Credit Union and its Members.

Mr. Saffold states that he has been "steadfastly involved in the financial and member service improvements implemented by Priority One Credit Union." This is a rather odd statement when documentation including the Credit Union's Monthly Income Statements/Balance Sheets and quarterly Financial Performance Reports filed with the NCUA, clearly document a more than $17 million loss of net income since Charles R. Wiggington, Sr. became President on January 1, 2007. The reports also show that new membership openings are continually offset by account closures. The Credit Union has also closed six of its nine branches since October 2010. So where is the evidence that Mr. Saffold's participation on the Board has served to benefit the Credit Union?

We'd invite Mr. Saffold to provide documented evidence, versus verbalizations, proving his statements. On a side note, Member Service issues are a key problem at Priority One, further dispelling Mr. Saffold's alleged involvement in improvements that cannot be attested to by anything tangible or real. Mr. Saffold was not telling the truth when he wrote his embellished biography. Mr. Saffold continues, stating that during his employment with the United States Postal Service ("USPS") he has served in the capacities of:

We'd invite Mr. Saffold to provide documented evidence, versus verbalizations, proving his statements. On a side note, Member Service issues are a key problem at Priority One, further dispelling Mr. Saffold's alleged involvement in improvements that cannot be attested to by anything tangible or real. Mr. Saffold was not telling the truth when he wrote his embellished biography. Mr. Saffold continues, stating that during his employment with the United States Postal Service ("USPS") he has served in the capacities of:

1. Budget Analyst

2. Automation Programmer

3. Customer Service Representative

4. Certified Data Conversion Operator

5. Retail Specialist

6. Consumer Affairs Representative

7. International Airmail Records Clerk

8. Certified City Clerk

9. Mail Carrier

10. Mail Handler

So how have Mr. Saffold's skills gotten from the long list of positions he listed in his biography, positively impacted Priority One? We invite Mr. Saffold to explain losses, lawsuits, and failures that have occurred since Charles R. Wiggington, Sr. became President. More importantly, we'd like Mr. Saffold to explain why he and the other Directors have done everything in their power to ensure Charles R. Wiggington, Sr. remains President.

Mr. Saffold also states he brings "a broad range of American economic and social expertise to the Board of Directors." We again invite Mr. Saffold to explain why since January 1, 2007, the date Mr. Wiggington began serving as President of the then successful Credit Union, the Credit Union's Net Income has dropped by $17 million (at times during the past 7 years, it's been more) and why six of nine branches have been closed since October 2010.

He ends his statement by stating that he is "committed to serving Priority One Credit Union with INTEGRITY and SEASONED experienced." Really? We again invite Mr. Saffold to explain how suppressing evidence proving Charles R. Wiggington, Sr. committed sexual harassment and repossessed a member's automobile whose ownership he transferred to himself without paying a cent for the vehicle proves Mr. Saffold's integrity. Due to the lack of all evidence supporting his so-called integrity, Mr. Saffold's words are meaningless. We suggest he also take a moment to acquaint himself with what defines integrity.

Mr. Hale states that his is not only a Director but also once served as Chairman of the Supervisory Committee. On paper, his biography suggests competency and experience yet uncannily we see no tangible evidence of these while he has served as a Director on the Board. To the contrary, like Mrs. Harris-Brooks and Mr. Saffold, Mr. Hale's presence on the Board is characterized by a gross incompetence and an inability to fulfill his duties. There is no denying that while he has served as Director, Priority One has morphed into a smaller, no longer impressive Credit Union. Furthermore, through the years, he has been an avid supporter of President Charles R. Wiggington, Sr. bringing into question Mr. Hale's ethics and competencies.

In his biography, ,Mr. Hale states he "completed" studies in "Real Estate Principles, Real Estate Appraisal, Property Management, Legal Aspects of Real Estate, Real Estate Practice, Real Estate Finance, Escrow Principles, and Eal Estate economics" while attending Los Angeles Southwest College. He adds that he received a CERTIFICATE in Real Estate. Since late 2010, Priority One has eliminated the varied types of Real Estate Loans it once offered to Members. Nowadays, the Credit Union's paltry real estate portfolio consists of mostly HELOCs. All other types of real estate loans are referred to CU Partners who pays the Credit Union a fee for approved and funded loans. Evidently, Mr. Hale's alleged vast expertise in real estate has not contributed anything to the Credit Union's real estate funding efforts which brings into question why he even mentioned it in his biograph?

In his biography, ,Mr. Hale states he "completed" studies in "Real Estate Principles, Real Estate Appraisal, Property Management, Legal Aspects of Real Estate, Real Estate Practice, Real Estate Finance, Escrow Principles, and Eal Estate economics" while attending Los Angeles Southwest College. He adds that he received a CERTIFICATE in Real Estate. Since late 2010, Priority One has eliminated the varied types of Real Estate Loans it once offered to Members. Nowadays, the Credit Union's paltry real estate portfolio consists of mostly HELOCs. All other types of real estate loans are referred to CU Partners who pays the Credit Union a fee for approved and funded loans. Evidently, Mr. Hale's alleged vast expertise in real estate has not contributed anything to the Credit Union's real estate funding efforts which brings into question why he even mentioned it in his biograph?

Mr. Hale also states he's "devoted a considerable amount of time to the Credit Union and understand the financial needs of its members." This is a very general statement lacking specifics and unsupported by anything tangible. According to the Credit Union's 9900 form filed with the IRS each year, Mr. Hale like the other board members contributes one (1) hour per month to the Credit Union. Is that what he considers "considerable"? So why should we believe Mr. Hale at face value? How has Mr. Hale's alleged understanding of the financial needs of members actually helped members? What has he contributed that has changed the financial standing for any member? And what members have benefited from his expertise?

The exaggerated and misleading biographies, riddled with generalizations and references that don't in anyway relate to the post of Director, speak volumes about the characters of Mrs. Harris-Brooks, Mr. Saffold, or Mr. Hale who try in earnest to convince readers that they actually have contributed to a Credit Union that has been in decline for seven years. Did they think no one notice that Priority One is is no longer a prosperous and growing Credit Union or that their perpetual protection of Charles R. Wiggington, Sr. would not serve as proof of their inability to make sound decisions that benefit the Credit Union, its Members, and its employees?.

Over the years, President Wiggington and Board Chairperson, Diedra Harris-Brooks, have expended tremendous time, energy and lots of Credit Union money, trying to hide evidence of the Credit Union's business failures and legal problems. Fortunately for the curious, President Wiggington is incapable of guarding confidentiality and in time, cannot help but verbalize information about the issues plaguing the Credit Union.

Before the first closure of branch offices in 2010 , the President was trying to contend with declining Net Capital. In 2008, in an effort to create the impression of success, the President borrowed $20 million from the Credit Union's line-of-credit which served to raise Priority One's Net Income on paper but which cost the Credit Union to pay interest in the approximate amount of $30,000 to $33,000 per month though for a very brief period, it did create the impression of success albeit it, non-existent success.

In 2009, Board Reports reveal the same mundane promises made by Charles R. Wiggington, Sr. to find a way of increasing membership, amassing new business and most importantly, increasing Net Capital well above the dreaded 6%. We've decided to publish his addresses to the Board, published in the May, June and July 2009 Board Reports. We must point out, that over the years, the President has prohibited the public disclosure of information which proves Priority One is in a state of decline though a look at the Credit Union's size in 2014 compared to its size in the years before Charles R. Wiggington, Sr. was appointed President, should suffice as evidence that his leadership is grossly deficient and has caused the Credit Union immense losses in income, Members, and its ability to sell its products.

Here are excepts from the May, June and July 2009 reports which are being made public for the first time:

Increasing the amount of the Credit Union's Net Capital became critically important in 2010 and by the end of that year, culminated in the closing of the Redlands and Valencia branches.

Since 2010, cutting expenses has become the primary means by which the Credit Union remains in business. The reliance in brutal expense reductions is born out of the fact that President Wiggington is quite incapable of implementing strategies that succeed in increasing sales and new memberships. It is this failure that has most undermined Priority One's ability to market its products and service the communities lying in Santa Clarita Valley in the north and extending south, to the Riverside/San Diego border.

What's more, closing branches and cutting other expenses was supposed to be a temporary solution intended to help Priority One regain its financial footing. In 2014, closing braches has become a normal part of business.

Not surprisingly, the Board's Directors seem disturbingly out-of-touch and incapable of comprehending that the as the President desperately seeks ways to increase Net Capital, Priority One's performance falls more and more into decline.

Since 2010, cutting expenses has become the primary means by which the Credit Union remains in business. The reliance in brutal expense reductions is born out of the fact that President Wiggington is quite incapable of implementing strategies that succeed in increasing sales and new memberships. It is this failure that has most undermined Priority One's ability to market its products and service the communities lying in Santa Clarita Valley in the north and extending south, to the Riverside/San Diego border.

What's more, closing branches and cutting other expenses was supposed to be a temporary solution intended to help Priority One regain its financial footing. In 2014, closing braches has become a normal part of business.

Not surprisingly, the Board's Directors seem disturbingly out-of-touch and incapable of comprehending that the as the President desperately seeks ways to increase Net Capital, Priority One's performance falls more and more into decline.

In late September, we learned President Wiggington feels unappreciated and declares people refuse to see or understand that there is an actual purpose to his actions that will ultimately benefit the Credit Union. His spiel is customary though usually consigned to all-staff meetings and the Board Reports which the ignorant Directors seem to believe. Why would the President believe people are going to continue indulging his excuses when over the past seven years, he has caused the decline of the Credit Union including closure of 6 of 9 branches and a $17 million decline of its Net Income. He would like listeners to believe that there is good in his intents but the fact is President Wiggington has behaved abominably proving he is not CEO material and at times, has violated state and federal laws, proving he is defiant to legal structure. Certainly the filing of lawsuits by four former employees and a lawsuit filed by a former Member whose personal information was published on the Internet by a member of the Credit Resolutions team all point to the President's unethical proclivities. In fact, 2013 ended with more than $500,000 spent on legal fees.

It is important to note that the Credit Union moved quickly to settle the lawsuits in an effort to avoid a costly and potentially embarrassing court trials though the President and Vice President, Yvonne Boutte, would later boast to staff members the settlements paid out were paltry and affordable to the Credit Union and settled because the Plaintiff's lawsuits lacked the substance needed to win in a court trial. This is the same type of contrived story-telling constantly resorted to by the same President who wanted people to believe closing six branches will reap huge profits.

The President's and Vice President's distortion of the facts are weak and declaring victories where none occurred. The big hole in their many stories is that they would like people to believe that the Plaintiff's filed frivolous lawsuits. If that were true, then why would the credit union agree to settle these and pay out monetary settlements?

And if the lawsuits lacked an evidentiary foundation then why was each Plaintiff required to sign settlements which stipulate that they are not to divulge the details of their cases or the subsequent settlements? The reason the Credit Union paid out settlements is because there was more than sufficient evidence to prove it guilty of retaliation, harassment, same sex harassment, age discrimination and racism.

In January 2009, we began reporting about how Charles R. Wiggington, Sr.'s business decisions could potentially injure and even destroy the Credit Union. We were correct. Since we first began reporting, the Credit Union's Net Income has declined by $17 million and 75% of its branches have been closed in an effort by President Wiggington to ensure Net Capital remains well above 6%.

In 2007, when an investigation confirmed that one of President Wiggington's hand-picked AVPs violated federal law when she purposely committed kiting, an incensed Board Chair issued a verbal warning to the Director who delivered an anonymous letter to the Credit Union's attorney, exposing more than 24 separate NSF violations during the months of October and November 2006. Mrs. Harris-Brooks not only chastised the Director for delivering the letter to the Credit Union's attorney but she order that any such future letters be given to the Board for investigation of allegations exposing wrongdoing. Now why would anyone turn over allegations of a federal offense to Mrs. Harris-Brooks when in 2007, she squashed evidence proving Charles R. Wiggington, Sr. sexually harassed an employee? She chooses not to remember that she possess are computer skills and that she is not an attorney or licensed investigator, clearly disqualifying her to investigate allegations that federal and state laws may have been violated.

It is important to note that the Credit Union moved quickly to settle the lawsuits in an effort to avoid a costly and potentially embarrassing court trials though the President and Vice President, Yvonne Boutte, would later boast to staff members the settlements paid out were paltry and affordable to the Credit Union and settled because the Plaintiff's lawsuits lacked the substance needed to win in a court trial. This is the same type of contrived story-telling constantly resorted to by the same President who wanted people to believe closing six branches will reap huge profits.

The President's and Vice President's distortion of the facts are weak and declaring victories where none occurred. The big hole in their many stories is that they would like people to believe that the Plaintiff's filed frivolous lawsuits. If that were true, then why would the credit union agree to settle these and pay out monetary settlements?

And if the lawsuits lacked an evidentiary foundation then why was each Plaintiff required to sign settlements which stipulate that they are not to divulge the details of their cases or the subsequent settlements? The reason the Credit Union paid out settlements is because there was more than sufficient evidence to prove it guilty of retaliation, harassment, same sex harassment, age discrimination and racism.

In January 2009, we began reporting about how Charles R. Wiggington, Sr.'s business decisions could potentially injure and even destroy the Credit Union. We were correct. Since we first began reporting, the Credit Union's Net Income has declined by $17 million and 75% of its branches have been closed in an effort by President Wiggington to ensure Net Capital remains well above 6%.

In 2007, when an investigation confirmed that one of President Wiggington's hand-picked AVPs violated federal law when she purposely committed kiting, an incensed Board Chair issued a verbal warning to the Director who delivered an anonymous letter to the Credit Union's attorney, exposing more than 24 separate NSF violations during the months of October and November 2006. Mrs. Harris-Brooks not only chastised the Director for delivering the letter to the Credit Union's attorney but she order that any such future letters be given to the Board for investigation of allegations exposing wrongdoing. Now why would anyone turn over allegations of a federal offense to Mrs. Harris-Brooks when in 2007, she squashed evidence proving Charles R. Wiggington, Sr. sexually harassed an employee? She chooses not to remember that she possess are computer skills and that she is not an attorney or licensed investigator, clearly disqualifying her to investigate allegations that federal and state laws may have been violated.

What's more, President Wiggington's mailing debacle in 2007 was disingenuously resolved but both the President and his executive staff seemed incapable of comprehending the damage incurred to Member confidence in the Credit Union's ability to safeguard Member information and Member assets. If the Executive Vice President could issue a memo providing employees information on how to "deal" with members, then it is quite clear that the Credit Union doesn't view Member-Owners as respectable or important.

The President's disdain for security protocols was again attested to in 2009 when he invited Henry Justice to return to the Credit Union as a preferred automobile broker even though Mr. Justice caused the Credit Union to lose more than $60,000 of its monies in 2003. The President's plan to return Mr. Justice to a "preferred" position within the Credit Union is astounding and again, it is clear he had absolutely no concern for the well-being of the Credit Union or its Members.

We will publish additional documentation in our next post, all supporting our 5-year assertion that Charles R. Wiggington., Sr, Diedra Harris-Brooks, and the Board of Directors have single-handedly caused widespread injury to the no longer competitive or respected Credit Union and stripped it of its ability to develop effective marketing needed to sell its wares and and compromising quality member service. Furthermore, if it were not for the Board, President Wiggington's rampant abuses which led to the ruination of the once prosperous Credit Union, might never have occurred.