On the surface, 2014 appeared to be just another uneventful and unsuccessful year for Priority One Credit Union in South Pasadena, California. Business remained stagnant as the Credit Union continued experiencing tremendous difficulties trying to draw Member interest to their products and services. Relationships with Members fared poorly with ties to their once largest member sector- employees of the United States Postal Service, continuing to weaken. Complaints citing poor service continued to escalate for the unpopular Credit Union while the President continued to insist that sales take precedence above all else, including service.

Unlike previous years which were saturated with scandals, this year was marred by only one incident which surfaced during the last half of the year and involved a scheme designed by President Charles R. Wiggington, Sr.; Vice President of Operations, Yvonne Boutte; and Credit Resolutions Supervisor, Alex Suarez. The offensive tactic involved the creation of Facebook accounts, using the fictitious names and photographs of attractive young women. Ms. Suarez's staff were ordered to send "friend requests" from the bogus Facebook accounts to Members whose Credit Union accounts were the subject of collection proceedings. Members unwittingly accepting an invitation, were promptly sent a message to their Facebook account, informing them of their past due balances and demanding they remit payment, immediately. The tactic served as a reminder of the disdain Priority One's current management team has for Members in addition to the fact that the creation of fraudulent accounts were a violation of Facebook policy. The incident might never have come to light had the arrogant Ms. Suarez not chosen to boast about it to employees of the South Pasadena branch.

Surprisingly, few people knew that during 2014 the Credit Union's unraveling relationship with two businesses culminated in the filing of two separate lawsuits. grew strained. One business, a former business associate automobile broker, Auto Alliance, introduced to the Credit Union in early 2010 by then COO, Beatrice "Bea" Walker and with approval of President Charles R. Wiggington, Sr. The second lawsuit was filed by the Credit Union's own contracted accounting and auditing firm, Turner, Warren, Hwang & Conrad AC.

The lawsuits signal a new low for the Credit Union whose public image lies in tatters due to the horrendous decisions and acts committed by the President over the past seven years and the protection allotted him by the ignorant and inept, Board of Directors. Since January 1, 2007, President Wiggington's often injurious acts have laid waste to the Credit Union's once strong relationship to Members and business associates. The lawsuits remind us that Charles R. Wiggington, Sr. is a man who doesn't play or know how to play nice and who has no concept of how to make or keep friends.

Auto Alliance's Lawsuit

In this post, we will only focus on the lawsuit filed by Auto Alliance and we will report about the lawsuit filed by Turner, Warren, Hwang and Conrad AC in next month's post. Auto Alliance's lawsuit names Charles R. Wiggington, Sr. a Defendant. This is certainly not the first time the obnoxious President has been named a Defendant. In 2012, in a lawsuit filed by the former Valencia Branch Manager President Wiggington was accused of allowing his COO, the notorious, Beatrice "Bea" Walker to abuse, sexually harass, stalk, and retaliate against the Branch Manager. The Branch Manager had tried to bring an end to Ms. Walker's merciless attacks, reporting allegations of same-sex sexual harassment and numerous other violations of State and Federal law to President Wiggington; EVP, Rodger Smock; and then Human Resources "clerk", Esmeralda Sandoval. The three not only refused to intercede and stop Ms. Walker but at the direction of Boad Chairperson, Diedra Harris-Brooks, tooks steps to squash and even invalidate the egregious allegations brought against the horrendous COO. At the time, the lawsuit was filed, the Credit Union hired the services of attorney, Paul F. Schimley, of Richardson, Harman, Ober PC.. In forging a defense, Mr. Schimley accused the Plaintiff of lying. He promised that she would have to spend weekends attending depositions and even contacted her new employer, informing them that their newly hired executive had filed a lawsuit against her former employer. Of course, in hammering out a defense to exonerate his client, the bottom-feeder showed no qualms in creating duress for Mr. Wiggington and Ms. Walker's victim.

The attorney went further. He contacted the Plaintiff's attorney and informed her that his client, President Wiggington, was suffering from cancer and undergoing chemotherapy and was too ill to participate in litigation. He warned that if his client's name was not removed from the lawsuit, that he would have no choice but to file a motion informing the court about his client's health, which would result in postponements that would ultimately drag out litigation indefinitely. The Plaintiff agreed to remove the President's name as a Defendant though retaining the right to re-introduce his name if his health improved. The President's attorney used a simple manipulative ploy intended to frustrate the Plaintiff and her legal counsel. It amounted to nothing more than a rudimentary strategy at an elementary level.

Coincidentally, the President's alleged terminal illness had little effect on his behaviors. He continued to drive to and from the South Pasadena branch each day and took 2 to 3 hour lunches, something you would not think a terminally ill person would be able to do. He would also spend hours per day, strolling through the South Pasadena branch gossiping about staff, telling people about the treatments he was undergoing, complain about his son and wife an spew out boring stories about his cars, superior intellect and view of life in general. It certainly didn't sound like he was ill, much less terminally ill.

Nowadays, the President works a three-day week. He continues to take extended lunches, spends lots of time on personal calls using his company cellular, and walks about the South Pasadena branch pestering people who are actually working. We can't but wonder if his present legal team will try and force removal of the President's name from the lawsuit.

Auto Alliance's Allegations

Auto Alliance's complaint asserts that the auto broker entered into an agreement with the Credit Union in early 2010 at which time they would serve in the capacity of sole vehicle broker. The Plaintiff alleges that not only did the President rescind on his contractual assurance that the broker would be the Credit Union's sole automobile broker but as a result, the Plaintiff suffered financial losses.

In the demurrer, a long twenty-three page response to the Plaintiff's allegations the Credit Union's current attorneys, Frances O'Meara, Wendell F. Hall, and Jenny L. Burke of Thompson Coe and O'Meara, LLP, rebut every one of the Plaintiff's allegations, asserting that the accusations are groundless and unaccompanied by evidence. In the end, the long drawn out reply is generic in content, almost identical to responses filed in the past in response to numerous other lawsuits.

The Credit Union's Defense

In the demurrer, a long twenty-three page response to the Plaintiff's allegations the Credit Union's current attorneys, Frances O'Meara, Wendell F. Hall, and Jenny L. Burke of Thompson Coe and O'Meara, LLP, rebut every one of the Plaintiff's allegations, asserting that the accusations are groundless and unaccompanied by evidence. In the end, the long drawn out reply is generic in content, almost identical to responses filed in the past in response to numerous other lawsuits.

As shown below, the response issued by Priority One's attorneys to the lawsuit, states that the Plaintiff's allegations are in essence, unfounded. What they may be hoping to do is obtain a motion from the court to dismiss the complaint.

Priority One's attorney's state the Plaintiff supposedly entered into an agreement with Priority One Credit Union that promised to make Auto Alliance their exclusive auto broker but contending that the Plaintiff failed to provide a copy of the agreement in accompaniment of its complaint.

The Plaintiff also alleges the President conspired against Auto Alliance and diverted business to other automobile brokers who provided the President with "bribes". For years, employees working closely with Charles R. Wiggington, Sr. before and after he was appointed President, alleged he was the recipient of kick-backs paid by Justice Auto Sales, a dealership and broker whose owner was also a close friend of the President. That dealership eventually made off with $80,000 paid to the owner for vehicles purchased from his company and financed by the Credit Union.

The President is also alleged to have received monies from Associated Management, the Credit Union's former collection agent*. In fact, it was the collection agent who repossessed a BMW from a Member and handed it to the President without an exchange of money. The President, a fan of BMW's, transferred ownership of the vehicle to himself. How coincidental that the current lawsuit, filed by Auto Alliance, alleges "bribes" paid to President Wiggington.

*Associated Management Company Inc, 150 East Meda Avenue # 100, Glendora, CA 91741, (626) 335-4000

If one believes the defense raised by the Credit Union's attorneys, the Plaintiff has no evidence to support his contentions against the President and Credit Union.

In late 2009, then COO, Beatrice Walker, met with the President; EVP, Rodger Smock; and Board Chairperson, Diedra Harris-Brooks. At the time, she informed them that though the Credit Union had successfully utilized the services of a single automobile broker- Universal Leasing and Auto Sales, for many years, she could guarantee more business and increased profits if the Credit Union would instead use the services of her friends at Auto Alliance. Mrs. Harris-Brooks agreed. And though Auto Alliance had not yet been contracted, the President prematurely ordered the Consumer Loan Department not to refer Members who were hoping to purchase an automobile, to Universal Auto Leasing and Sales.

As we've reported over the past 5 years, Charles R. Wiggington, Sr. is not a great tactician. Actually, he's not even a mediocre strategist. As is always be the case with anything the President hopes to do, his plan to displace one automobile broker with another would never quite pan out.

In the meantime, George Woods, a Business Development Representative assigned to the no longer existent Burbank branch, was attempting to forge an agreement between Wholesale Investments, Inc., another vehicle Broker, and the Credit Union. That broker enthusiastically signed an agreement and like Auto Alliance, spent its own money on advertising which promoted the Credit Union. Though the Broker entered into an agreement with Priority One Credit Union, the President began ignoring the newly inducted broker prompting complaints lodged with Mr. Woods. Now one has to wonder, why would a Credit Union that had a long-time automobile broker (Universal Leasing and Sales) and was planning on entering into an agreement with Auto Alliance, contract the services of Wholesale Investments? It may seem illogical but it is characteristic of the way Charles R. Wiggington, Sr. does business.

At the start of 2010, Auto Alliance became the Credit Union's premiere automobile broker. COO, Beatrice Walker, even created a space and assigned a desk within the Loan Department in South Pasadena, where a representative of Auto Alliance would sit during business hours and meet with Members who had either just been approved for an automobile loan or Members wanting the services of a vehicle broker to purchase a car. By the way, a desk had never been offered or set aside of Universal Leasing and Sales even though they had worked with Priority One for many years. During this period, both the President and Mrs. Walker ordered Consumer Loan staff to only recommend Auto Alliance. The staff, however, were loyal to Universal Leasing and Sales and informed the owner, Mr. Michael Martinez, of the President's orders though Mr. Martinez had already realized he was being provided less referrals.

In March 2010, the Credit Union conducted one of its all-staff meetings, which took place at Almansor Court in Alhambra, California. During the gathering, COO, Beatrice Walker, stood at the podium and spoke about Auto Alliance and how the broker was helping the Credit Union creating new business and providing superior service. There was no mention of Universal Leasing and Sales or Wholesale Investments, Inc. However, Auto Alliance's relationship with Priority One would come to an abrupt end in 2011. In July 2011, the President obtained authorization to terminate COO, Beatrice Walker, who had been hired as the Credit Union's first COO on June 1, 2009. During her brief stay at the Credit Union Ms. Walker's strategies allegedly designed to create new business and infuse profit into the Credit Union had chronically failed. Rumors of her sexuality had caused ripples in her once powerful relationship to Board Chair, Diedra Harris Brooks, but ultimately, it was her defiance and criticisms of the Board of Directors and what she referred to as their "lack of education" and her very public aspirations to displace President Wiggington, which ultimately sealed her fate.

A few weeks following Ms. Walker's quiet though humiliating ouster, the President suddenly ended the Credit Union's relationship with Auto Alliance, ordering the broker to vacate its desk in the Loan Department.

Nowadays the small, poorly performing and no longer competitive Credit Union promotes three different vehicle brokers on its website. Members have a choice of obtaining the services of Universal Auto Leasing and Sales, Wholesale Investments and Direct Auto Sales and Leases. If it seems like overkill, that's because it is. We find it more than a little unusual that Priority One is simultaneously promoting three automobile brokers. Why? We suspect that President knew that Auto Alliance might file a lawsuit against the Credit Union. By keeping the names of three automobile brokers on its website, the Credit Union creates the impression that it offers Members a variety of brokers to chose versus offering the services of a single broker, despite the practice seems more than a little unusual and rather illogical.

- We suggest that someone ask Universal Leasing and Sales owner, Michael Martinez, if he was aware the President was trying to severe the Credit Union's relationship with the broker back in 2010.

- Former COO, Beatrice Walker, should be subpoenaed to explain what were the terms- written and verbal, presented to Auto Alliance. Was the broker ever told that he would be the Credit Union's sole automobile broker?

- Employees of the Consumer Loan Department- both past and present, who were employed by the Credit Union during late 2009 and early 2010, should be subpoenaed and asked if they were ever instructed to cease promoting Universal Auto Leasing and Sales and begin promoting Auto Alliance.

- Employees- past and present, of the Business Development team who were employed during the period beginning in late 2009 through early 2010, should also be subpoenaed and asked if they were ever instructed to start promoting Auto Alliance and stop promoting Universal Leasing and Sales.

From 2011 through 2013, Priority One spent more than $500,000 on legal fees, most of which went to hiring overpaid and often, unethical attorneys, who spun defenses intended to deflect attention from the allegations leveled against the Credit Union and instead, attack the character of each Plaintiff. How much CREDIT UNION MONEY will Board Chair, Diedra Harris-Brooks, and the Board of Directors authorize spent in defending the President and Credit Union against the allegations filed by Auto Alliance and the firm of Turner, Warren, Hwang and Conrad AC?

Where is the Newsletter and Their ATMs?

Last November, a reader of this blog posted the following comment:

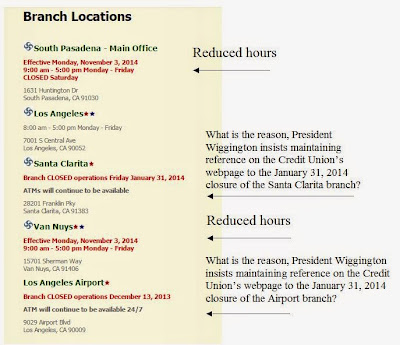

"I went to Priority One's website and noticed they removed their newsletter page. They're also closing three ATM's- Santa Clarita, Victorville, and the one located at the postal facility on Lincoln Avenue in Pasadena. More than a year ago, they posted on the web that they were going to introduce a VISA Credit Card but there's nothing. They duplicated a message twice. They still show a message that the Airport Branch is closing on December 13, 2013."

We thank the reader for taking the time to write. We visited the Credit Union's webpage and discovered they were absolutely correct on all points. Last November, the Credit Union removed the page which once displayed PDF copies of its quarterly newsletters, from itas webpage, though removal of the page came almost one year since the Credit Union last published a newsletter. The demise of the tedious and uninteresting publication is not in itself shocking but coupled with the closure of six branches and elimination of numerous ATMs, the end of the quarterly publication serves as more evidence that Priority One is a Credit Union in decline, despite the insistence of President Wiggington that closing branches somehow increases the potential for profit. Of course this doesn't make sense since he's also eliminated the Credit Union's ability to provide service and without service that meets the needs and expectations of the Membership, Priority One's ability to generate profit is almost impossible.

As of January 2015, Priority One no longer...

As of January 2015, Priority One no longer...

- Participates in community and chamber events

- Is unable to create effective and cutting edge marketing strategies

- Able to advertise at an effective level

- Able to afford a Business Development Department

- Able to provide quality service; and

- Is no longer competative

Despite the evidence proving Priority One's performance continues to falter, the President has not stopped from insisting that Priority One is every Member's and Employee's "Financial Fitness Center", able to help them "Win with Money."

ATM LOCATIONS

1. The LANDC

The ATM located at the Los Angeles National Distribution Center (LANDC) was often utilized by postal employees at that facility. Before Charles R. Wiggington., Sr. became President, the ATM was maintained by an in-house ATM Specialist, who ensured the popular ATM remained fully operational.

The ATM located at the Los Angeles National Distribution Center (LANDC) was often utilized by postal employees at that facility. Before Charles R. Wiggington., Sr. became President, the ATM was maintained by an in-house ATM Specialist, who ensured the popular ATM remained fully operational.

The Credit Union also maintained an office on the second floor of the facility. In early 2010, the post office created a wonderful and attractive space for the Credit Union on the first floor, between the post office's gift shop and cafeteria. However, Charles R. Wiggington, Sr. had no interest in maintaining a relationship with postal employees of the facility and refused to install a computer in the office, that linked to the Credit Union's network. Subsequently, Members of the credit union could not be provided their account balances or make payments to their loans or transfer monies between their accounts. By 2012, the office was not being utilized except by then AVP of Sales and Business Development, Joseph Garcia, who had been ordered by then CLO, Cindy Garvin, to "hit the streets" in search of new business. Not being sales savvy, Mr. Garcia spent his days napping in the office and avoiding the prying eyes of the CLO. Nowadays, the office lies abandoned.

2. PASADENA - USPS RETAIL STORE LOBBY

The Credit Union once strong relationship with the Postal Service's Pasadena Retail Store is clearly a thing of the past. The elimination of the ATM at the Pasadena location testifie again, to the rapid deterioration of the Credit Union's once strong relationship with its most loyal sector. The ATM ceased operation on 11/18/14.

3. SANTA CLARITA POSTAL PROCESSING PLANT

In a notice issued by the Credit Union on November 13, 2014, the ATM located in the Santa Clarita Processing Plant was "temporarily unavailable" pending upgrades slated to be completed by December 2, 2014. We've no news that the ATM is back online.

4. VICTORVILLE

In 2013, the Credit Union posted a message on its website announcing the temporary unavailability of their ATM in Victorville. Last month, the Credit Union amended its message, announcing the Victorville ATM "is no longer available."

Its more than a little peculiar that the ATM was temporarily closed down for a period of many months. Can't the Credit Union afford to maintain of what the 2013 Annual Report described as its "fleet" of ATMs? We think Charles R. Wiggington, Sr. should acquaint himself with what defines temporary versus permanent.

Its more than a little peculiar that the ATM was temporarily closed down for a period of many months. Can't the Credit Union afford to maintain of what the 2013 Annual Report described as its "fleet" of ATMs? We think Charles R. Wiggington, Sr. should acquaint himself with what defines temporary versus permanent.

MORE INDELIBLE SIGNS OF FAILURE

What Account Promotions?

Conclusion

President Charles R. Wiggington, Sr. began 2014 boasting, as he does every year, that business was improving and even concocted a story rationalizing that he intentionally closed down 6 out of 9 branches as part of a formula that would increase profit. So where is the fabulous profit he said would be reaped as a result of branch closures?

In 2014, while sitting in the employee lounge room located inside the South Pasadena branch, he blurted out that he contacted the FBI who were investigating two former employees who were, without authorization, selling Credit Union owned property. The rumor came to a sudden end when his statements were published on the Internet.

What the President never mentioned throughout all of 2014 is that Priority One was sued twice during the year by two unrelated businesses. One lawsuit, filed by a former automobile broker and the second, by the Credit Union's contracted accounting and auditing firm. How peculiar that a lawsuit was filed by the accounting and auditing company when for years, Charles R. Wiggington, Sr. boasted that the accountants and auditors at Turner, Warren, Hwang and Conrad AC were his "friends" and "buddies. So what could have severed his "friendship" with the firm? Or is this another case of the delusional President misunderstanding what things constitute business and which constitute friendship?

The allegations contained in the lawsuit filed by Auto Alliance echo similar accusations and rumors about many of the unethical activities the President has immersed himself in over the years. The attorneys currently defending the Credit Union are merely creating a defense based on the story told to them by the President though unfortunately, there are sufficient witnesses who can attest that Auto Alliance was introduced to Priority One in 2010 by then COO, Beatrice Walker, and that she and President Wiggington intended to make the car broker, the Credit Union's sole automobile broker. This would have required the elimination of Universal Leasing and Sales, the Credit Union's only and long-time vehicle broker. Unfortunately, for the Auto Alliance, their stay at the Credit Union was contingent upon the continued employment of COO, Beatrice Walker. Subsequently, after Ms. Walker was ungraciously expelled from the Credit Union in July 2011, so was the auto broker who the President had no further need of.

The allegations contained in the lawsuit filed by Auto Alliance echo similar accusations and rumors about many of the unethical activities the President has immersed himself in over the years. The attorneys currently defending the Credit Union are merely creating a defense based on the story told to them by the President though unfortunately, there are sufficient witnesses who can attest that Auto Alliance was introduced to Priority One in 2010 by then COO, Beatrice Walker, and that she and President Wiggington intended to make the car broker, the Credit Union's sole automobile broker. This would have required the elimination of Universal Leasing and Sales, the Credit Union's only and long-time vehicle broker. Unfortunately, for the Auto Alliance, their stay at the Credit Union was contingent upon the continued employment of COO, Beatrice Walker. Subsequently, after Ms. Walker was ungraciously expelled from the Credit Union in July 2011, so was the auto broker who the President had no further need of.

President Wiggington's legal entanglements have come at a heavy cost to business, to Members and to employees. Despite proving he is the Credit Union's greatest liability, the all Black Board has spent immense amounts of Credit Union monies on protecting the President. If the complaint is not dismissed by the court, expect the matter settled with some sort of financial compensation paid to the former automobile broker though in this particular case, the cost will be hefty and probably paid from the Credit Union's insurance. In the meantime, continue expecting the Board to remove all stops ensuring the President remains well protected behind sham defenses and contrived stories that have no resemblance to the truth. And finally, ask yourselves, "Why would a three-branch Credit Union need to promote three separately owned automobile brokers?"

Kindly Share The Love»»

|

|

|

Tweet | Save on Delicious |

91 comments:

Sued by their car broker! Its like being sued by your dog. LOL.

I worked there in 2010 and Charles made it clear that he was getting rid of Mike Martinez. Charles is brain dead and he's still causing the credit union to lose money.

Way to go Wiggles. The little money Priority One makes goes to pay for legal. What a moron!

So right. Employees don't get raises probably because all the money they earn is going to hire lawyers to cover up Wig's f-ups. Why is this loser still president? The credit union never got sued when Mr Harris was president which tells you a lot about just how stupid Charles is.

John, I cannot wait for next months blog update to hear about the CPA firm of Turner, Warren, Hwang and Conrad's lawsuit against Priority One. They are a well-known west coast prestigious CPA firm specializing in credit union auditing - can't imagine why they would sue P1, but I suspect it has something to do witheir audit work at P1 and you've got the juicy details. Can you spill a bit of the dirt early?

It stands to reason that Wigg, a sexual harasser and bold faced liar, would do something to provoke two business associates to sue him. He spent years making up stories about employees he didn't like and then with the help of HR used those stories to fire them. He even back stabbed his so-called friends who he worked with at other companies like Gerardo, Bea, and Dane and he used to say Mike, the old collection agent, was his friend but he kicked him to the curb too. That story the attorneys are telling is a lie. Wigg did tell the broker he was going to be the only broker at P1. Hope he takes them to the cleaners. And where's that witch, Diedra, hiding. She's the reason they get sued so often. If she'd fired Wigg back in 2007 when he made that big mailing mistake that cost over $100,000 to try and fix, none of the lawsuits would ever have happened.

I agree with the Baron and Council. I can't wait. This jackass has done it again. They better hope Rodger's feederie takes off otherwise that credit union is headed towards bankruptcy.

Wiggington is the only man (?) I know who could probably get sued by the Girl Scouts. What a morooooonnnnnnnn!!!! Two more lawsuits and I agree, that where there few profits go to. They pay lawyers who probably charge more than $200 an hour, they pay filing fees, court costs, depositions, paying for copies, faxes, mailings all related to the lawsuits and for a stenographer and maybe even someone to videotape depositions. He may be the biggest jackass in credit union land and the biggest failure, but no one not even the smartest credit union CEO can ever get their credit union to get sued the way Wiggington has gotten himself and P1 sued.

Give me a W

Give me an I

Give me a G

Give me another G

Give me an I

Give me an N

Give me another G

Give me a T

Give me an O

Give me an N

Yay IDIOT!

Have you been to the main office? It is so depressing. First of all, its dark because of those tall partitions they put around every all those desks in member service and lending. Its so dark and depressing.

@Baron Zemo and the Krypton Council of Elders

I second the Baron's call to get a special early report on notable CPA firm Turner, Warren, Hwang and Conrad's lawsuit against P1 and its moronic CEO Wiggles. Please John give your readers some sort of preview on this breaking story.

As far as Smock's Rectal Tube Feederie chain of Weight Loss Centers what is the update.

Even I can't believe Jackass Wiggington has provoked 2 more lawsuits. This just proves the Board of Directors led by Diedra are all incompetent mental defectives.

So true.

According to Smock the feederie tube is functioning well but in his case, its doing nothing to stave off his obsession of whole chocolate cakes.

What's in Smock's feeding tube - Gravy? Chocolate cake? Or liquified Fat Burger?

All of the above.

I don't think that just because he lied about lots of ex-employees and back stabbed his "buddies" is reason enough to think Charles is guilty of everything that's in the lawsuits.

Sure he took that member's car and then put his name on the title and never paid a penny for the car and he had those phony auction papers made up to make it look like the car went to auction but that doesn't mean he's guilty of what the lawsuits say.

And yes, he committed sexual harassment and Diedra offered the victim $20,000 to settle the case but that doesn't make him guilty of what's in the lawsuit.

And sure he spent hundreds of thousands of dollars hiring Bea and Cindy to help him get rid of his enemies and then ended up firing them but again, that doesn't mean he's guilty of the accusations in the lawsuit.

And yes, he lied and blamed Alan for the big mess with all those ballots, but that has nothing to do with the lawsuit.

I could go on and on, but Charles is innocent until proven guilty. Anyway, does he look like a man who could ever do anything wrong?

@ Jethro

Smock's feeding tube is filled with purified ham, cream puffs, and green beans (ruffage is both good and a key component to the tube's success)

If only there was a way of channeling all that energy it takes to provoke lawsuits into getting new business.

I don't get it. You've got Rodger, who makes more than $100,000 a year and you have Yvonne who probably gets over $90,000 a year and you have Patti Loiacano (who knows what she gets) and on the board you have Diedra who says she was in management at the post office and O.Glen Saffold who studied law and still, the whole group can't figure out that Wiggington who has a BA in Afro-American Studies, is bad for business!

Mike Martinez knew Wiggington was trying to get rid of Universal back in 2010. I know this because we told him and he saw how he was not getting as many referrals. That's just how Wiggington treats good people. He tried the same thing with postal employees when he told us to to push SEGs and STOP putting effort into postal people even though they were the our member base, And even though the men on the board were mostly former postal workers like Diedra, they were never mail carriers, they were clerks and they had no loyalty to carriers who were the ones that opened the credit union. When he couldn't get business from SEGs, Wiggington backtracked but ever since then, the credit union has lost lots of postal employees plus postal employees now bad mouth the credit union because under Wiggington Priority One doesn't do anything to look out for postal workers.

You know what gets my jitters, that Charles Wiggington fired people for supposedly breaking policy like leaking information information about the credit union, but this big old dumb ass has leaked out out more confidential information than anyone else and still gets $150K plus a year. For what? He's also a proven sexual harasser which is a violation of federal law. He should have been prosecuted and fired.

Then there's the lies he and Diedra tell every year in the annual reports. They say things are getting better when they've closed branches and it looks like they can't get new business.

And all the lawsuits!!!! What the hell? The credit union opened in 1926 (not 1929 like Wiggington says) and since 1926 no other president/ceo has ever been sued by ex-employees, by members or by vendors. This man should of been kicked to the curb a long time ago so he could end his days in that cardboard shack he lives in.

They need to diversify. They sell movie tickets and zee's chocolate gift certificates during the holidays, how about doing take-out like pizza, selling office furniture and unused ATMs, selling porn or maybe filming porn. Sky is the limit.

Forget about kicking Wiggy to the curb - he needs a good old fashioned tar and feathering (I'm talking to you Professor Tar & Feathers).

By the way, is uncouth Wiggles still scratching his ball in public, and eating with his mouth full of food while smacking loudly?

Don't you mean is Wiggles still scratching his ballS, as opposed ball? He has 2 balls, right?

Yes, Wigg still scatches his ball or balls (I assumed they removed one or both when he suffered his bout with ball cancer). And yes, he eats with his mouth open and talk while he eats. Some things never change. And though you can't instill anything good in Wigg you also can't take anything bad away either. He just like that.

Last week at Fat Burger I spied Wiggy scratching his balls (or maybe he was yanking his crank) when he thought no one was looking.

So can anyone tell me why Diedra keeps this clown?

Many say Wiggington has compiled "Dirt" dossiers on each and every board member that he uses as a bargaining chip when the board of directors won't see things his way. Wiggy also assures that Diedra and several select board members get to attend ritzy credit union junkets on the credit union's dime.

It's a well known fact Diedra mostly spends her time in Vegas at either Bellagio, Mirage or Venetian bars during training sessions. Diedra insists on getting her daily food per diem allowance in casino chips - all sanctioned by Wiggles.

Why Diedra keeps this clown/loser is the biggest question in the industry. The second biggest question is why members keep this board? This has to be the worst and most embarrassing president in the entire industry. The board has to be the worst board in the industry. Its not because the president and the board are all black but the reason the president stays is probably because he is black. The board is biased or racist. They got rid of Bea because she was terrible but she was also white. They got rid of Cindy because she was terrible but she was also white. I think they really are influenced by color. Just a few months ago one black employee assaulted a non-black employee and it was the employee that got assaulted who got fired. They kept the criminal until what they did got out and after a complaint was filed by the employee who got attacked so they decided to fire the black employee.

It would be a stalemate if Wigg keeps dossiers on the board, actually Diedra and if Diedra keeps them on him. Logically, she has to be getting something from him. I say she, because Diedra is the board. The the other clowns- Hale, Saffold, and Thomas are just lifeless puppets who do her bidding. Every failure P1 has goes right back to Diedra. She's the one that approves all the spending. She's the one that approves hiring and firing. Bea and Cindy were hired by her not Wigg. Its all 100% Diedra.

The only reason Wiggles would pulls his "crank" is because he wants to make sure it hasn't come unglued.

Wiggles said that less branches would make more money. Have you seen their report? They have less money than they had a year ago. I don't know how this used car salesman still has his job at the credit union. I have to agree, there's something suspicious about why the board keeps him.

Wiggles said that less branches would make more money. Have you seen their report? They have less money than they had a year ago. I don't know how this used car salesman still has his job at the credit union. I have to agree, there's something suspicious about why the board keeps him.

He's gotten to a point where he just doesn't care. When business started going bad, he gave the board his bullshit stories that business was good. And he couldn't of gotten away with the lies without Diedra. If the board is supposed to make sure things are being done right so that business grows then you know they covered up for him when profits started to drop, when they got sued, when they closed branches, when they hired and fired people who were supposed to fix the mess Wigg and the Board made. He knows that as long as he stays on payroll, he'll continue collecting $150,000 plus per year. Even if he still cant fix the mess he makes, he gets paid and if the credit union closes, he still got paid, he gets 2 pensions, a huge payout bonus and who knows what else. He's enough of a low life to have his desk delivered to his home though where it would fit is anybody's guess.

Wiggles will have a job as long as Slappy White lookalike Diedra is on the Board of Directors, and he keeps giving her casino chips for all her phony travel conferences. It's as simple as that.

Question of the Day: Is Smock still on his rectal feeding tube diet? And what about those Weight Loss Feederies?

Sloppy White look-a-like. Have you. Seen Cornelia, the supervisory committee chair? She looks like Redd Foxx or Lancelot Link except not as smart or pretty.

Yes, Smock is still using the feeding tube but he hasn't lost weight. Seems he got confused and thought the diet allowed 6 cheat days per week.

What does Smock, well W.C. Fields, do while at work?

He sits and pretends to work. Esmeralda who is disgusting is actually the one who handles HR. Robert West doesn't do anything because he's ignorant. She interviews potential new employees and processes benefits. Robert West sits at his desk, takes lunch, naps and goes home. Rodger eats chocolates, looks for recipes on the Internet, talks to his boyfriend, takes long lunches, jabbers with Wiggington and then goes home. Useless.

So you're confirming Smock has basically quit on his rectal feeding tube diet?

Smock stayed with the diet till January 9th. On the 10th he went to Fat Burger around midnight and sneak ordered 2 double burgers fully loaded with a large fries and a jumbo chocolate shake. After wolfing down the gluttonous meal he attempted to restart the diet the next day but his efforts were futile.

Wiggy's plans for franchising the Rectal Tube Feederies went down the drain went Smock refused to stay on the diet. And Wiggy is super-pissed his money-making scheme to hoodwink investors with excessive franchise fees are kaput.

Does anyone know exactly how much food Mofo Smock is pouring down his gullet on an average day?

It sure looks like Smock is fatter than he's ever been.

This short article posted only at the web site is truly good.how to build business credit fast

If HR cared about employees and the company they would have stepped up a long time ago and stopped Wiggington and the board from doing the things which has gotten them sued time and time again. If you think Wiggington or West or Rodger care about the credit union then why so many lawsuits?

Poor Charlie, he has

No Friends

Look at their December 5500 report. Membership growth is in the negative and why don't they show how much money is set aside to cover loan losses?

For the 4th quarter P1 reversed the Provision for Loan Losses expense by $250,000. In othe words, P1 set aside no money for loan losses for the entirety of 2014. It's the kind of accounting trick used to inflate the bottom line. Essentially, the balance sheet and management are saying that of all the loans made during 2014 none are projected to be write-offs. Of course, this is all accounting gymnastics and BS.

Sad sack Rodger has given up on his diet. I caught him the other day sipping a a few giant chocolate shakes while shoving dollops of Nutella down his gullet after the office was closed. He must have a death wish.

@ Professor Freud: Please correct me, but what you wrote is that P1 reversed its provision for loan losses by $250,000 in 2014 to inflate its bottom line in 2014. So, they covered loan losses without actually recording it on 5500 reports because they don't want people to discover just how bad business is. Is that correct? If that happened, that's not the first time they've done that. Never happened under Mr Harris, only under Wiggington. Now I know Yvonne tells people and the board that under her leadership, collections have decreased as have charge-offs. But is she fabricating a lie to make it look that things are far better than they are? The accounting department is still holding on to bills for 3 to 6 weeks before paying them because the credit union doesn't have enough money to pay these. Actually, the budget set by the credit union doesn't cover its outgoing expenses.

@Anonymous: LOL. Yes, "Sad Sack Rodger" is the perfect nickname for one of the worst HR Directors you'll ever have the misfortune of meeting. The old fat man is a liar just like Wiggington and a backstabbing, two-faced conniver. Now you might have caught Rodger "sipping a few giant chocolate shakes" but he'll deny it and claim "you were seeing things." Miss Rodger is an old overweight buzzard.

He is not Miss Rodger, he is Mrs Rodger!!!! Remember, he's got a young husband waiting at home.

After Mr Harris retired Wigg started playing with the books. It caused a rift with Manny the CFO so he hired Bea Walker who helped him drive,Manny out. One of the former board directors told us that Wig and Bea used to tell the board was not a team player and wouldn't do.what he was told to do. What he wouldn't do was playing with the numbers and big time jackass Diedra knew it. Wigg thinks lying on paper will keep people from knowing business is bad. People aren't blind or stupid as Wig.

Correct - P1 reversed $250,000 in Provision for Loan Losses Expenses for the 4th qtr. if you check the 5300 for 12/31/14 you can see the effect on the Allowance for Loan Looses Account on the balance sheet (this account is a reserve set-aside for probable loan write-offs) which went from $951k to $686k during the 4th qtr.

To me, it's an odd entry since the Loan Delinquecy percentage was virtually unchanged for the 4th quarter.

By lowering the Allowance for Loan Losses Wiggy and the Board of Directors are projecting lower future loan charge-offs then in previous years. In other words, they are painting a rosy lending future. This accounting strategy could backfire if Delinquency and Write-offs trend up!

Thanks for the explanation, Dr. Zsigmundy Freud.

In the past priority one has failed to achieve the "future" amounts of losses and growth that would be achieved. To cover up the losses, Wiggington always orders that monies be taken from one of the credit union's many GL's and post the profits in accounts where he can create the impression loan losses decreased or profits increased. He's playing a chess game with the credit union monies. Saeid used to always go along with what Wigg, Rodger and Diedra wanted but now that he's gone, I'm not sure who he uses to "play" with the numbers.

Sad Sack fatboy Rodger Smock is pathetic. Sitting in his office for hours on end sipping giant Chocolate shakes and nibbling Nutella straight from the jar is downright slovenly.

Now I understand he spends weekends sucking on a giant Tootsie Roll, or at least he's sucking on something that's pretty large and thick.

Robert The Moocher taking people lunches again !

Poor Smock. He'll never be slim or pretty but a girl can try.

Robert West is the worst. He's a moocher but he's also the one who told Charlie that Wendy "took" a sandwich without permission that the company bought for employees who were in training. Its okay for Charlie to sexual harass and its okay for Robert West to lie, violate company policy and backstab but taking a 6 inch sandwich is what will get you terminated at the suckiest credit union in Southern California.

At this point Smock has completely fallen off the diet wagon. Slurping chocolate shakes, gorging on brownies and chomping on fried chicken wings is more than enough proof fatboy Rodger is a psychopathic aeriel glutton.

If P1's Management Team or even anyone on the Board of Directors (I'm talking to you Casino Chip Diedra) cared a bit about the Director of HR they would perform a Fatso Intervention. How 'bout it Wiggy?

This is a weird organization. Over the past 7 years, lots of employees got fired for allegedly violating confidentiality, taking a sandwich without permission, gossiping in the office and for being overweight (i.e, Patty in loans) but Wiggington violates confidentiality and keeps his job and he also stole car from a member, lied to lawyers, gossiped about why he fired employees, sexually harassed, reported false profit and still kept his job. Same for Smock who used lies to seal employee terminations and West who mooches off people's food during special events. There's Esmeralda and Yvonne who are the biggest liars you'll ever meet. Something stinks at Priority One.

And yes, someone get Miss Smock to lose some weight. She's looks like Devine

Yes, sad sack Rodger is looking more and more like Devine everyday. I have no doubt Rodger also has gleefully reenacted Devine's turd eating scene from Pink Flamingos many times.

Wiggy should have been fired for being a serial sexual harasser long ago.

Rodger Smock is obese. His attempt to lose weight via the rectal feeding tube has failed badly.

Fatso Rodger needs an immediate health intervention. Imany of us have tried to talk to him on numerous occasions about his insatiable love of deep fried Oreos. But talking to him is futile - he just won't listen. Smock needs the kind of intervention that starts with a straitjacket, assuring he cannot use his hands to stuff food down his pie hole.

Wiggy needs to take the lead here before Smock kicks-off at work.

@Chief Jay Strongbow

You are 100% correct about Smock and Wiggles.

Its not just a "weird organization" its a psycho ward. The president is nuts and if you've been around Yvonne or Alex for any length of time, you know these broads are delusional. Smock is not as crazy but he is corrupt. West lives in a fantasy land where he is a pristine prince when in fact he's just an average, run-of-the-mill shyster.

I agree with Chief Jay Strongbow, Rodger is looking like Devine without the talent. I do believe you're right, Rodger has probably recreated that memorable and gross scene in Pink Flamingos but then again, he's been eating Wigg's poop for more than 7 years.

Wigg used to ogle so many women and brag about his sexual conquests before he was investigated. The investigation pricked his balloon (no pun intended).

@Anonymous: Rodger's diet has failed just like he failed employees, the credit union and HR for more than 10 years. Wigg used to say that Rodger wore the biggest pants he'd ever seen on a man. Makes you wonder how many other men Wigg's been ogling. Rodger wants to stay fat. Look at his candy dish atop his desk. And look at what he eats at lunch. Piggy would be an apt name. I wonder if Rodger has named Wigg as a beneficiary in his will?

Woggy is so devious and calculated it would not surprise anyone if he's personally paying premiums on a $5 million life insurance policy for Smock, in which he's the sole beneficiary.

A life insurance policy on out-of-shape fatboy Smock is guaranteed to pay-off real soon. Let's face it, Rodger's heart is about to attack him soon - it's like a ticking time-bomb.

Why is Rodger still employed by the credit union? Weight aside, the man is useless. He is not only the worst HR director imaginable, you don't need him, West and (fat) Esmeralda in a credit union that has 3 branches. Rodger's least worst quality is his weight.

Why is Rodger still employed by the credit union? Weight aside, the man is useless. He is not only the worst HR director imaginable, you don't need him, West and (fat) Esmeralda in a credit union that has 3 branches. Rodger's least worst quality is his weight.

John, Did you see the article on Priority One in the on-line edition of Credit Union Times today about the $1 million theft and accompanying lawsuit? Any more insight on it?

@Chief Jay Strongbow: I'm sorry but we've been away for a few weeks and are just getting re-started. No, we hadn't heard about the newest theft at the credit union but we will look into it. Thanks.

John, The Theft story on Priority one was published March 7th in the CU Times online edition. In summary the article says the money/cash was taken out of a branch vault. I gather the theft was discovered in 2013 when the branch manager was fired. It appears a suit has been filed against Turner Warren Conrad, etc. who the attorney says should have been aware of the vault shortage during their audit. I did a search on the CU Times website just now to recover the article by searching Priority One.

@Chief Strongbow: Thank you. We actually located the article shortly after reading your comment. The incident ties in to the lawsuit filed by Turner Warren Conrad against Priority One in response to a lawsuit filed by CUMIS, the insurance carrier, who alleges Turner, Warner and Conrad should have discovered the vault shortage during their February 2015 audit. We will be reporting on the matter either on Tuesday or Wednesday. Thank you, again.

Congrats to our President Charles Wiggington for filing a lawsuit against the external auditor. P1 may actually have a valid case if it can prove negligence on the part of Turner, Warren. Seriously good job to the Board of Dire tors.

Finally some praise for Priority on this website. Hope P1 prevails in the lawsuit since the auditor should have caught the shortage in the vault.

If P1 is victorious in recovering the stolen vault funds (which is likely), then everyone must conclude Wiggington is the luckiest MOFO on earth.

Wiggington did not file the lawsuit. In fact, he wanted to make sure this did not become public. The stolen money was reported to their insurance company who paid the claim. That has absolutely nothing to do with worthless and super industry moron, Charles R. Wiggington! If you're looking for lies that speak well of the president then ask him to provide you with one of his fictitious bios. The lawsuit that has been filed is by the insurance company and again, NOT CHARLIE THE HACK WIGGINGTON!!!! You could actually start a blog about how stupidly managed the insurance company is. They've paid so many claims and kept P1 as their client. They're either stupid, brain dead, or dishonest.

The credit union is not recuperating the monies!!! The insurance has already paid for the loss!!! Wiggington is not lucky and never will be because he's the village idiot!!!!What the loss should serve as is just another indicator as to how stupid Wiggington and his clown board are. Under him there have been internal thefts, sexual harassment, stealing of a member's car, lying about financials, etc. Yup, this is one dishonest MOFO!!!

@Anonymous

You wrote "Congrats to our President Charles Wiggington for filing a lawsuit against the external auditor. P1 may actually have a valid case if it can prove negligence on the part of Turner, Warren. Seriously good job to the Board of Directors."

You're either Wiggington, Smock, Yvonne or just a run of the mill pinhead. The loss occurred under Wiggington just like all the other losses that have occurred since he became president. He and the board have nothing to do with the lawsuit. The lawsuit has been filed by the insurance company. Get your facts straight before you spew off your lame propaganda! The insurance company has filed suit against the auditors and the auditors are suing Priority One. If you see a win/win for the credit union then you need a brain transplant. Idiot!

Is it possible Wiggy, Smock or Yvonne is posting fake congratulations on this site? Are they that calculated?

That would be the kind phony praise and disinformation spread by the Soviets in their heyday.

Yes, but unlike the Soviets, Wiggington, Smock and Yvonne are brain dead. Any doubts, look at how much they're worth now ($148 million) and how much they were worth on the day Wiggington was named President ($172 million). Still doubt that this yokel is the biggest incompetent to hit any credit union? Then look at the 3 branches they have now and the 9 they had on the day shit for brains was named President. Yeah, let's congratulate the sexual harasser for ruining the credit union which was never experienced the amount of internal thefts it has had under Wiggington. The accolades were probably posted by Miss Smock as she lay in bed with her much younger husband, playing on her laptop.

LOL. Remember how a couple of years ago Wiggington posted that P1 was named a perfect 5 star credit union by Bauer Financial when they really had been given a 4. After he got exposed and Bauer contacted them, they changed the number to 4. And remember how for years they posted on the website they were a $172 million credit union even when they fell to $163 million, $158 million, $141 million and most recently, $148 million. You know its one of these lying sacks of camel poop who is trying to twist it so it looks like P1 filed a lawsuit when it is completely out of their hands and it is their dumb ass insurance company- CUMIS that is suing even though CUMIS has paid other claims over the past 7 years and they know P1 is a corrupt credit union has been sued and mismanaged by Wiggington. CUMIS made their bed, let them lie in it.

I love the one or two people who sometimes post "lies" supporting Wiggington. Like Wiggington, the people who support him are liars. They always try to get people to look away from the facts and have them focus on the "stories" they and their master hope people will believe. They need to shut-up and keep their lies to themselves. Its embarrassing that these losers still think anyone's going to buy into their crap.

You guys are throwing a hissy fit cause our President Charles Wiggington finally has some positive news about P1. That positive news is a lawsuit against Turner, Warren, etc. which likley will have a successful outcome. When Wiggington is vindicated I hope the Board gives him and his management team a raise and a parade!

Anonymous wrote "You guys are throwomg a hissy it cause our President Charles Wiggington finally has some positive news about P1."

No tard, that's not why. He did not sue the auditors, CUMIS did, but you're stupid and you lie so you've got to make this piece of shit look

like your hero.

And moron, Turner, Warren, Hwang and Conrad have counter-sued the Credit Union. Moron. Get your fact straight you lowlife dumb ass.

And let me correct you. You meant to write, "When Wiggington the sexual harasser, car thief, liar, and father of a drug dealer is vindicated I hope the Board gives him and his management team a raise and a parade!" Yeah, let's give him a parade right after he gets tar and feathered.

Is this smelly West praising Wiggy on here lmao..West's hero is Wiggy . What happen west no more repairs for you to do of old pens, or perhaps another phony book !

Whats Alex the Man up to these days ? still making phony facebook accounts ?

charles you are Garbage SOB ! to you harass the people . and then you go tell all the people your the rrreal ! you are worst then Hulk Hogan or Brian Blair! somebody needs to put you in the Camel cluch and break your back to you be humble again.

I'm always ready for a rousing tar and feathers party. And guess what - the guest of honor always gets run out of town on a rail.

@Anonymous

I like your reference to the Camel Clutch. It certainly would make Wiggy humble.

Are you the Iron Shiek?

I RESPECT the Kennedy McMahon!! but that no good SOB WIggington and his partner West two of the worstest Garbage to set foot in the south Pasadena!

The only people who would ever try to praise Wiggington are Smock, Yvonne, West and Diedra. After all, he's their master and these groveling ass bites need to make Mr. Disaster look and sound like he's their hero when he's been the bubonic plague to the credit union and its underpaid workers.

It could be Smock writing from his bed with his much younger boyfriend at his side or the comments are being posted by West, Wiggington and Smock while the three are in bed giggling and snickering.

Aye calamba. What did you do Wiggy.

Good day friends, I am so happy I got my loan from Mr Steven Ryan Finance, I saw recommendation on TV that Mr Steven Ryan grants business loan, personal loans, mortgage loans, debt consolidation loans and more so I emailed him via(Stevenryanfinance@gmail.com) you can also email him if you need a loan okay.

Post a Comment