It shouldn't come as a surprise to anyone following Priority One's performance, that September 2014 proved to be another lackluster month for a Credit Union that can't escape its inability to market its products and services at a level required to amass profit, increase membership, and regain its former reputation as a respected and principled organization led by ethical and competent Managers.

Since being appointed President on January 1, 2007, President Wiggington and his so-called executive staff have failed quite publicly, to develop methodologies that translate into real growth and profit. Since 2010, the Credit Union has struggled to offset its continually increasing overhead and in 2014, is no longer able to provide convenience to Members living and working in many of the communities located within its vast territory stretching from the Santa Clarita Valley in the north to the Riverside/San Diego border, in the South.

The only significant change we noticed during the month of September was that the President abruptly ceased expounding about how his closure of six branches since 2010 were part of an elaborate and well-honed plan guaranteed to increase business, augment new memberships, and produce real physical growth. We aren't about to hold our breath awaiting fruition of his alleged plan, but his excuse struck as more than a absurd. Since when does eliminating convenience and an inability to provide quality member service reap growth and profit?

This post contains copies of documentation we've never published previously along with documentation presented in past posts, including biographies written in 2010 by Directors, Diedra Harris-Brooks, O. Glen Saffold, and Richard Hale. The intent of the biographies was to impress and sway voters to re-elect the three incumbents to the Board during the 2010 election. This, by the way, is the election the Board Chair and President disrupted when they tried to exclude a large contingent of Members from voting. The plan was of course foiled when we exposed it on this blog, forcing the Credit Union to conduct a second election.

The biographies were also published before Priority One was forced to close 6 of 9 branches, before it was forced to terminate a large contingent of full-time employees, replacing them with part-time staff, and before the Credit Union was forced to drastically reduce budgets once spent on successful, prize-winning marketing, advertising and business development.

Reader comments published in response to our last two posts suggest people have grown weary of the President's and Board Chair's excuses and far-fetched concoctions, created to excuse and even justify the Credit Union's lagging performance and possibly, suggesting that the propaganda churned out by the two officers may have finally and at long last, run its course.

THE WAYBACK MACHINE

There was a time when Priority One Credit Union could actually afford to publish a monthly and quarterly newsletter. The monthly newsletter ceased publication in 2010, when the Credit Union discovered Members were not reading it. Publication of the quarterly newsletter continued though abruptly ending in late 2013 and a victim of the President's often ermergent need to reduce spending. In an effort to avoid rumors that the quarterly newsletter was eliminated because the Credit Union could no longer afford to maintain it, the President stated that Members can obtain the latest news about the Credit Union on its droll and often inaccurate, News and Updates page, located on the Credit Union's webpage.

In Spring 2010 quarterly newsletter, the President declared that Priority One possesses the ability to help every Member achieve financial fitness.

Despite the dishonest manipulation of the Credit Union's books, President Wiggington arrogantly declared that the Credit Union possessed the ability to help every member achieve financial fitness yet inexplicably and contrary to its own self-promotion, the Credit Union apparently lacked the ability to help achieve its own financial fitness.

In his address, the President also states, “We realize that some of our members may already be financially fit, but still may need assistance”. The statement is absurd though quite typical of a President who doesn't possess the ability to perpetrate deceptions competently. Why would Members who are financially fit require the assistance of the Credit Union to help them improve their "financial fitness"? A Credit Union whose Net Income has decreased by more than $17 million since January 1,. 2007 is no one's financial fitness center and incapable of helping improve any member's financial status. President Wiggington continues…

“POCU has anew served referred to as “Balance”, which

is a financial fitness program.

Balance is offered by other Credit Union's and touted as an allegedly "free" financial education and counseling service though in actuality., it is not entirely free to Members who enroll in the program which is designed to help Members introduce control over their finances and achieve their personal financial goals.

President Wiggington was informed about Balance by Training and Education Manager, Robert West. Mr. West has periodically introduced FREE services to the Credit Union though none has survived the test of time and like his other offerings, Balance ceased to be offered during the same year it was introduced.

Balance is offered by other Credit Union's and touted as an allegedly "free" financial education and counseling service though in actuality., it is not entirely free to Members who enroll in the program which is designed to help Members introduce control over their finances and achieve their personal financial goals.

President Wiggington was informed about Balance by Training and Education Manager, Robert West. Mr. West has periodically introduced FREE services to the Credit Union though none has survived the test of time and like his other offerings, Balance ceased to be offered during the same year it was introduced.

THE PACT

"You know who Wiggington is as a man, by his associations. He is close with Smock who is a horrible human being. He is close with West who is no small hypocrite. He’s friends with Henry Justice. It was Wiggington who introduced Henry Justice to the credit union. After Henry Justice refused to surrender pink slips for 5 cars purchased from him by members of the credit union, Priority One had to file a suit in court against Mr. Justice but old wily, street smart Justice filed bankruptcy and said his daughter made off with the money. So Priority One couldn’t touch Henry. In 2009, Henry Justice shows up at the main office with his son and asks to meet with Wiggington. Wiggington comes out and hugs his buddy the thief, at the reception desk and takes him back to the board room. Then they leave the credit union for about 3 hours and have lunch at the Barkley where they talk about reintroducing Mr. Justice to Priority One and again, as a preferred auto broker.

The following week, Henry (Justice) shows up (at the South Pasadena branch) with his son an hands Wiggington a stack of business cards. They leave the office (branch) for about two and a half hours and the next day, Wiggington tells Patti Loiacano that Henry (Justice) is returning to Priority One. Patti reminds him that Mr. Justice (allegedly) stole money and owes the credit union more than $70,000. He (the President) shrugs it off and tells her Mr. Justice will pay back a part of what he owes. He (Henry Justice) pays back about $1300.00 and Wiggington passes out Henry's business cards to every loan officer and processor and tells them they're to promote Mr. Justice's new business as a "preferred broker." The loan people have more character than Wiggington because they all agreed not to promote Mr. Justice because of what he did to the credit union. Then a few days later, a post appears on this blog exposing Wiggington’s new plan. He comes out to the loan department and picks up Mr. Justice’s business cards, he tells the staff not to promote Mr. Justice and he calls Mr. Justice and tells him that if anyone from the board calls him to ask if he’s returning to Priority One that he’s supposed to say no and also say he hasn’t spoken to Wiggington in years. Yep, you can tell who Wiggington is by his associations.

The following week, Henry (Justice) shows up (at the South Pasadena branch) with his son an hands Wiggington a stack of business cards. They leave the office (branch) for about two and a half hours and the next day, Wiggington tells Patti Loiacano that Henry (Justice) is returning to Priority One. Patti reminds him that Mr. Justice (allegedly) stole money and owes the credit union more than $70,000. He (the President) shrugs it off and tells her Mr. Justice will pay back a part of what he owes. He (Henry Justice) pays back about $1300.00 and Wiggington passes out Henry's business cards to every loan officer and processor and tells them they're to promote Mr. Justice's new business as a "preferred broker." The loan people have more character than Wiggington because they all agreed not to promote Mr. Justice because of what he did to the credit union. Then a few days later, a post appears on this blog exposing Wiggington’s new plan. He comes out to the loan department and picks up Mr. Justice’s business cards, he tells the staff not to promote Mr. Justice and he calls Mr. Justice and tells him that if anyone from the board calls him to ask if he’s returning to Priority One that he’s supposed to say no and also say he hasn’t spoken to Wiggington in years. Yep, you can tell who Wiggington is by his associations.

The Incident

In 1998, Charles R. Wiggington. Sr. introduced his friend, Henry Justice to the Credit Union, intending to promote Mr. Justice's dealership, Justice Auto Sales. What this meant was that Mr. Justice's dealership as a preferred broker. This meant that representatives of the Member Service and Loan Departments would recommend Mr. Justice's dealership to Members expressing an interest in buying an automobile. In our post, "It May be Fraud to You but not to Charles R. Wiggington, Sr" (Monday, January 26, 2009), we reported that in 2003, Mr. Justice refused to surrender Pink Slips for vehicles purchased by four Members of the Credit Union. Mr. Justice's refusal impeded the Credit Union from registering its name as lienholder of the four automobiles and though the Credit Union had entered into an agreement with Mr. Justice in good faith, the broker refused to surrender the vehicle titles. Due to Mr. Justice's refusal, Members could not obtain Registration Cards from the Department of Motor Vehicles ("DMV") forcing the Credit Union's DMV Specialists to visit the office of the DMV in Lincoln Park, each month, to obtain a temporary Registration Card so Members could legally operate their automobiles.

To add insult to injury, Mr. Justice filed for bankruptcy. His bankruptcy filing was subsequently approved by the court, enabling Mr. Justice to avoid repayment of the monies due Priority One. Mr. Justice would later insist that the monies due the Credit Union were absconded by his daughter who had been employed by him at his dealership.

In 2002, in ongoing efforts to try and acquire the pink slips for each of the four automobiles purchased by Members from Justice Auto, the Credit Union mailed letters, like the one shown below, requesting the dealer provide a copy of the DMV Application so that the vehicles could be properly registered. Mr. Justice chose not to respond.

08/20/2002

JUSTICE AUTO SALES

20930 BONITA STREET

CARSON, CA 90746

We have enclosed a check in the amount of $ 7344.00 as payment in full for the

following vehicle 1997 HONDA CIVIC

Vehicle Identification Number # 2HGEJ6677VH575341

Being purchased by LISA M. XXXXXX ESTHER C. XXXXXXX

6412 XXXXXXX AVE BUENA PARK, CA 90621

We are now PAPERLESS TITLE. The application to Register New or Used Vehicles with the Department of Motor Vehicles must be Exactly in the name of.

PRIORITY ONE CU

1631 HUNTINGTON DR

S PASADENA CA 91030

As Lienholder and the Registered Owner as given above.

To perfect our interest, please send us a copy of the DMV Application to Register the Vehicle. Thank you for your cooperation.

Respectfully,

Loan Department Date: 08/20/2002

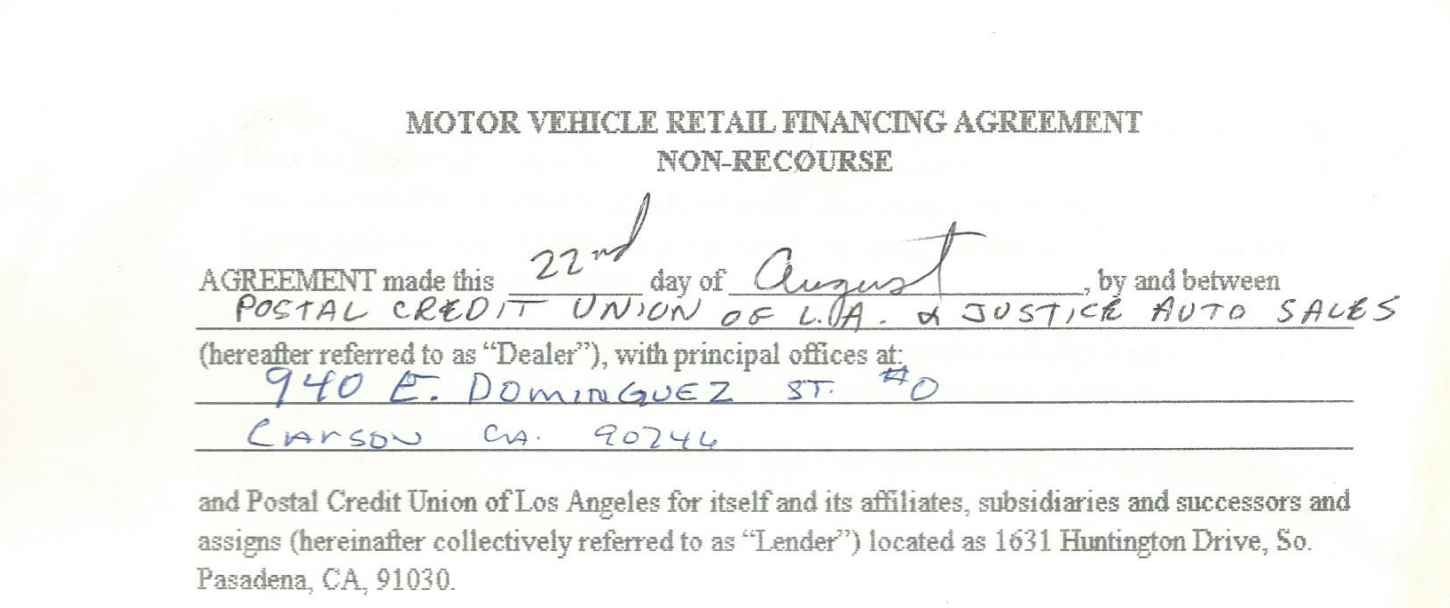

In 1998, at the time Mr. Justice was introduced to Priority One by his friend, Charles R. Wiggington, Sr., the dealer entered into a written agreement with the Credit Union, an excerpt of which is shown below. What we find perplexing is that Charles R. Wiggington, Sr. signed the agreement with Mr. Justice? Doesn't it seem a conflict of interest that Charles R. Wiggington., Sr., a friend of Mr. Justice, signed the agreement which allowed the dealer to become a preferred automobile broker?

Over the years, Charles R. Wiggington, Sr. has proven an immense inability to comprehend the inappropriateness of his actions. His friend's actions which culminated in bankruptcy, caused Priority One to lose more than $60,000.

The following letter, dated June 18, 2003, was sent to Priority One by its collection attorney, Bruce P. Needleman. If Mr. Needleman's name sounds familiar, he is the same lawyer who in 2012, responded to a complaint filed at Superior Court in Los Angeles by a Member who alleged Priority One violated the Privacy Act and published information about her automobile loan and her person, on the Internet. Mr. Needleman who was ill qualified to represent the Credit Union in the 2012 lawsuit and was subsequently replaced by an attorney qualified to respond to the Member's complaint.

The following letter, dated June 18, 2003, was sent to Priority One by its collection attorney, Bruce P. Needleman. If Mr. Needleman's name sounds familiar, he is the same lawyer who in 2012, responded to a complaint filed at Superior Court in Los Angeles by a Member who alleged Priority One violated the Privacy Act and published information about her automobile loan and her person, on the Internet. Mr. Needleman who was ill qualified to represent the Credit Union in the 2012 lawsuit and was subsequently replaced by an attorney qualified to respond to the Member's complaint.

Approval of Mr. Justice's bankruptcy should have signaled an end to the business relationship between the dealership and the Credit Union but not so for President Wiggington whose defiance to rules, laws and protocols impel him to seek out what is personally gratifying versus what is good for the Credit Union, Member-Owners, and employees.

In 2009, Mr. Justice and his son, arrived, unannounced in the lobby of the South Pasadena Branch. They asked the receptionist if they could speak to President Wiggington. The President who will never meet with people who haven't previously scheduled an appointment to meet with him, hurried to the lobby and loudly welcomed Mr. Justice and his son. He afterwards lead the two to the Board Room located at the back of the South Pasadena branch.

Ensuring security protocols are adhered to is pivotal to any business yet on the day of Mr. Justice's visit, the President invited Mr. Justice and his son into the back offices of the Credit Union's main branch despite the fact Mr. Justice ended his business relationship with the Credit Union just a few years earlier, owing more than $60,000 for vehicles whose titles he refused to surrender. In inviting Mr. Justice to the back offices, the President should absolutely no concern for the well-being of the Credit Union, it's assets and property.

Three days following Mr. Justice's visit to the South Pasadena branch, President Wiggington informed then Lending Director, Patricia Loiacano, that Mr. Justice was being reinstated as a preferred broker of the Credit Union. An image of Mr. Justice's business card was personally issued by the President to the Consumer and Real Estate Loan Officers along with instructions that they recommend Mr. Justice's dealership to Members hoping to purchase a vehicle. As shown below, Mr. Justice's new dealership was named Long's Auto Sales though the owner on record was Mr. Justice's son.

A PLAN ABORTED

As oft occurs whenever Charles R. Wiggington, Sr. chooses to manipulate circumstances, his plan to re-establish a relationship with Mr. Justice, encountered some obstacles. The first occurred when the Director of Lending, Mrs. Loiacano, reminded him that Mr. Justice owed the Credit Union more than $60,000, suggesting that Mr. Justice make some effort to repay a portion of the unpaid balance due Priority One. The President conferred with Mr. Justice and it was agreed he would pay the Credit Union approximately $1300.00 before being reinstated as a "preferred" auto broker.

Mr. Justice agreed to pay the small amount and the President proceeded with his plans. Unfortunately, for the undisciplined President, at the time he was preparing to re-introduce Mr. Justice to the Credit Union, we published a post describing Mr. Justice's past transgression which cost the Credit Union a total loss in excess of $60,000 and described the President's plan to promote Mr. Justice's new dealership. It is also important to point out that at the time the President promised to promote the dealership at no cost to Mr. Justice.

In January 2009, the President quickly moved forward with his plan and might have succeeded had we not exposed his intent on this blog. Panicked, the President returned to the Loan Department, picking up Mr. Justice's business cards and ordered Mrs. Loiacano to advise her staff not to promote the dealership until further notice. Returning to his office, he called Mr. Justice's cellular and instructed him to deny that the President had invited him to return to the Credit Union.

No doubt, Charles R. Wiggington, Sr. has no concept that as President, he is to serve the best interest of the Credit Union. His plan to enter into a new agreement with Mr. Justice was an effrontery to ethics, to the security of the credit union and its assets and disrespectful to the four members who had purchased automobiles from Justice Auto Sales and who for years were immensely inconvenienced by Mr. Justice's refusal to turn over pink slips for the four vehicles financed by the Credit Union.

Just 3 months after being appointed President, Charles R. Wiggington, Sr.'s abilities were challenged by two separate incidents. The first incident involved a former Burbank Branch Manager who he personally picked and promoted to the newly created post of AVP which she began serving in on January 2, 2007. The problem was that the AVP had for many years, incurred NSF incidents on a monthly basis. She had also periodically borrowed money from co-workers despite the fact Priority One Credit Union policy prohibits borrowing money from co-workers. During the months of October and November 2006, then Vice President of Operations, Charles R. Wiggington, Sr. approved reversing 24 individual NSF fees from the manager's account. Despite her checking account abuses, Charles R. Wiggington, Sr. not only reversed NSF fees but found her qualified both in aptitude and ethically, to become one of his first AVP's.

Unfortunately, by April 2007, the AVPs account abuses surfaced after an anonymous letter was mailed to one of the Board Directors. The now former Director, conducted himself ethically and responsibly and personally delivered the letter to then Credit Union attorney, William Adler. An investigation by Mr. Adler revealed the AVP had committed kiting, a federal offense. Her crime involved writing bad checks from three checking accounts held at three different institutions including Priority One Credit Union. And though President Wiggington may not have known she was kiting, he was fully aware that during October and November 2006, she incurred from that 24 separate NSF incidents because it was he, who approved backing out all NSF fees. Not only did he deny any knowledge about the numerous NSF fees, Board Chair, Diedra Harris-Brooks, testified on his behalf, informing investigators that Mr. Wiggington had no knowledge that the AVP had kited while avoiding any queries regarding his knowledge that Mr. Wiggington knew about the NSF incidents or that it was he who approved the reversal of all NSF fees.

The AVP was rightfully terminated but an incensed Charles R. Wiggington., Sr. swore he would find out who had written the anonymous letter and make certain that person was terminated. Within days following termination of the AVP, he sat in the Consumer Loan Department and told the VISA Card Supervisor that he knew for a fact that the letter had been written by the former Director of Marketing who he demoted to Marketing Coordinator immediately upon becoming President. Unfortunately, the President allowed his vivid and insatiable imagination to overcome logic and reasoning. We happen to know who wrote the letter and it wasn't the former Director of Marketing who had no involvement in the exposure of the President's hand-picked AVP who had chosen to violate federal law.

Unfortunately, by April 2007, the AVPs account abuses surfaced after an anonymous letter was mailed to one of the Board Directors. The now former Director, conducted himself ethically and responsibly and personally delivered the letter to then Credit Union attorney, William Adler. An investigation by Mr. Adler revealed the AVP had committed kiting, a federal offense. Her crime involved writing bad checks from three checking accounts held at three different institutions including Priority One Credit Union. And though President Wiggington may not have known she was kiting, he was fully aware that during October and November 2006, she incurred from that 24 separate NSF incidents because it was he, who approved backing out all NSF fees. Not only did he deny any knowledge about the numerous NSF fees, Board Chair, Diedra Harris-Brooks, testified on his behalf, informing investigators that Mr. Wiggington had no knowledge that the AVP had kited while avoiding any queries regarding his knowledge that Mr. Wiggington knew about the NSF incidents or that it was he who approved the reversal of all NSF fees.

The AVP was rightfully terminated but an incensed Charles R. Wiggington., Sr. swore he would find out who had written the anonymous letter and make certain that person was terminated. Within days following termination of the AVP, he sat in the Consumer Loan Department and told the VISA Card Supervisor that he knew for a fact that the letter had been written by the former Director of Marketing who he demoted to Marketing Coordinator immediately upon becoming President. Unfortunately, the President allowed his vivid and insatiable imagination to overcome logic and reasoning. We happen to know who wrote the letter and it wasn't the former Director of Marketing who had no involvement in the exposure of the President's hand-picked AVP who had chosen to violate federal law.

Immediately following termination of the AVP another, far more detrimental incident arose which affected all Member-Owners and is the one incident which began the Credit Union's rapid public unraveling.

In the years preceding January 1, 2007, the date Charles R. Wiggington, Sr. began his appointment as President and CEO, during each annual election intended to fill seats of the Board of Directors and Supervisory Committee, a disc would be created containing the names and addresses of all active Members in good standing. The disc would be forwarded to the Credit Union's contracted printer, who would prepare ballots and envelopes, which would be sent to Members. However, before the disc was sent to the printer, the President would always examine its contents to ensure only member names and addresses were contained in the disc.

In the years preceding January 1, 2007, the date Charles R. Wiggington, Sr. began his appointment as President and CEO, during each annual election intended to fill seats of the Board of Directors and Supervisory Committee, a disc would be created containing the names and addresses of all active Members in good standing. The disc would be forwarded to the Credit Union's contracted printer, who would prepare ballots and envelopes, which would be sent to Members. However, before the disc was sent to the printer, the President would always examine its contents to ensure only member names and addresses were contained in the disc.

In 2009, the President chose not to examine the disc, instructing the IT Supervisor to send the uninspected disc to the printer.

A few weeks later, the printer provided the credit union with some of the envelopes which had been printed and prepared for mailing. President Wiggington's predecessor had established security protocols which required that he along with the Director of Marketing and a third employee, examine a batch of envelopes intended for mailing, just to ensure the mailings were prepared correctly. In 2007, when Charles R. Wiggington, Sr. was asked to examine a sample batch of the intended mailings, he replied, "I'm the President and I don't do that!"

The envelopes were mailed but a few days later, a Member visiting the Valencia branch with his envelope in hand, was informed by a Teller, that the envelope contained the Member's Credit Union and Social Security Numbers, printed just above the window where his name and address appeared.

Some Members contacted Board Chair, Diedra Harris-Brooks, incensed that their account and Social Security Numbers had been printed on the outside of the envelopes containing that year's ballots. An irked Board convened at the main branch, demanding President Wiggington discover who was a fault and ordering that person's termination. The President told them the error had been caused by the IT Supervisor, but convinced the Board that rather than terminating the IT Supervisor, that they instead lay him off for three days without pay.

While informing the IT Supervisor that he was going to be placed on a three-day suspension because of the breach of security which he allegedly committed, the President also told the IT Supervisor that he "fought" to retain the Supervisor's employment because the Board had demanded his termination. Shortly after returning from his suspension, the humiliated and broker Supervisor resigned, obtaining a better and higher paid position with the city of Los Angeles.

Due to the widespread backlash, including the publication of an article by a Member and industry observers, the Credit Union hired at a cost of $100,000, the services of Equifax which monitored Member accounts for up to one year. But there was a catch, to qualify for the service, a Member had to contact the Credit Union and request inclusion in the service.

Despite the statements contained in his letter, Charles R. Wiggington, Sr. was not about to promote enrollment to Equifax's credit monitoring service which he often referred to as "expensive." He visited the Member Service and Loan Departments in South Pasadena to ordered them not to promote monitoring service adding that in his opinion, it was "highly unlikely an Member's account" would be compromised as a result of the security breach. The President's words showed how wholly disingenuous he was when he was forced to offer the credit monitoring service despite the fact the breach occurred because he though himself to elevated to adhere to the Credit Union's security protocols.

Furthermore, his opinion that Member accounts would not be compromised was just another fantastical concoction dredged up from the deepest recesses of his strange and convoluted imagination.

The President's instructions to employees seem more than a little inconsistent with statements containing in a memorandum issued by Executive Vice President, Rodger Smock, to employees and which provide some instruction on how they should respond to Member concerns regarding the security breach.

When the security breach became public, Rodger Smock's priorities appear to have become more than a little confused. In his memorandum, he seems to have forgotten that Members are Member-Owners and that any inquiries regarding the security breach are justified when one considers that the breach was the result of Charles R. Wiggington, Sr. elitist attitude that he was somehow to elevated to personally inspect a sample batch of the envelopes which were intended for mailing.

And contrary to Mr. Smock's assertion, the "important thing" should have been for all employees to exact steps needed help Members regain confidence in the Credit Union and its ability to protect Member assets.

Of course, the chronically dull EVP lacked the lucidity to respond appropriately to the mailing fiasco caused by his friend and supervisor, Charles R. Wiggington, Sr. This by the way, is the same officer, whose mismanagement of the Human Resources Department provoked the filing of four lawsuits by former employees during the years of 2010 through 2012.

THE DAMAGES

The President's horrendous decision to disregard security protocols resulted in the writing of letters by numerous, concerned Member-Owners. Though sent to his attention, the President chose not to read or reply to the letters, personally delivering these to the Business Development Department and instructing them to reply to every Member who had written a letter to his attention. The Members were contacted by telephone and when the project was complete, the letters returned to President Wiggington. The President chose not to file the letter but instead merely dropped them into his trash can. Despite the letters having been written about a security breach, the President chose not to shred or destroy the letters and again, violated Credit Union security protocols.

Here are copies of two Member letters:

This last letter was written by Member, Steve Bass. Mr. Bass. Mr. Bass who writes for PC World, published an article concerning the President Wiggington's mailing debacle. An excerpt of his original article is still available at NetWorld Article. One might have thought that in view of Mr. Bass' quite public complaint about the incident, that the President might have discarded the Member's letter in a manner consistent with security protocols.

THE BOARD

of Directors

Inarguably, it is Priority One Credit Union's Board of Directors who have in unison, enabled the circumstances which resulted in the bludgeoning of Priority One as a business and as an employer. Clearly, in 2014, Priority One is not what it was prior to the appointment of Charles R. Wiggington, Sr. as President.

The actions of the Board have revealed an arrogance in how each Director views himself. Their combined actions are not for the good of Members, the Credit Union or employees, but nothing more than what appears to be a need to exact their authority over a continually shrinking Credit Union.

So what are the abilities that each Director possesses that allegedly serves in helping each fill his or her assigned role on the Board?

In the Thursday, April 28, 2011 post, we published the biographies of incumbents whose seats were up for re-election. We've decided to again use the biographies written by three of the Directors- Diedra Harris-Brooks; O. Glen Saffold; and Richard Hale. As you read through these, consider what they say about their abilities an accomplishments and the state-of-affairs at the Credit Union. There is a clear disconnect and if the Credit Union remains trapped in a perpetual cycle of decline, then consider the abilities of each officer.

If one person can be attributed as the single most cause for Priority One's decline, it has to be Diedra Harris-Brooks. Contrary to her and President Charles R. Wiggington, Sr.'s addresses appearing in the Credit Union's annual reports, the U.S. economy and the national unemployment rate are not the catalysts which triggered the Credit Union's decline. In 2011, the President attempted to convince employees during one of the Credit Union's all-staff meetings that all Credit Unions are performing poorly, a statement that is easily verified to be untrue by studying the Financial Performance Reports ("FPRs") for other Credit Unions and available at NCUA.gov.

It is also evident that Charles R. Wiggington, Sr.'s rampant abuses of authority and horrendous business decisions could never have occurred had the Board and in particular, Diedra Harris-Brooks not enabled his destructive decisions making. It is also Mrs. Harris-Brooks who on her own volition, squashed evidence presented by an investigator to the Board in 2008, which proved Charles R. Wiggington, Sr. sexually harassed a female employee once assigned to the Loan Department.

- According to her biography, Mrs. Harris-Brooks has been a Member of the Credit Union for "more than 28 years". That is impressive, but how does that qualify her to serve as Board Chair?

- Mrs. Harris-Brooks attended the University of Phoenix where she completed Business Management and Marketing courses, attaining a 3.5 GPA. We'd certainly like to view her transcripts since her performance as Board Chair does not attest a proficiency in business management or marketing.

- "Her knowledge in Marketing and computer skills has proven to be an asset to Priority One"? Really? How so? We'd like Mrs Harris-Brooks or one of her pack to provide a single shred of documented evidence proving that her alleged knowledge in marketing has proven an asset to the Credit Union. And what types of computer skills is she referred to? Is she a programmer, an IT Technician, a software developer or she referring to a proficiency in using Microsoft Word? What specifically have her computer skills contributed to the betterment of the Credit Union?

- Since there is no tangible evidence to substantiate the statements she makes about her accomplishments, we'll have to label her biography as unconfirmed and thus not yet proven to be true. In her biography, she states she retired from the U.S. Postal Service where she worked her way up from a clerk and during which she received an "exceptional managerial service and earned the respect of her employees." We've spoken to former co-workers of Mrs. Harris-Brooks and respect is not a word we'd associate to their remarks about her behavior while serving as a manager of the U.S. Postal Service. We'd also like to see the documented evidence that she was recognized for her "exceptional" managerial skills. There certainly isn't evidence to any of this while she has served as a Director of the Credit Union.

Unfortunately for Mr. Saffold, all that he wrote he accomplished is dispelled by the facts that 2008, he, Diedra Harris-Brooks; Director, Thomas Gathers, and Supervisory Committee Chair, Cornelia Simmons, squashed all evidence gathered by an investigator from EXTTI, Inc. proving Charles R. Wiggington, Sr. sexually harassed an employee. Not only did the four discard the evidence, but in a letter signed by Mrs. Harris-Brooks, the four corrupt officers vilified the victim, stating that based on their "understanding" of what constitutes sexual harassment as defined by federal law, the allegation of wrong doing never occurred. Mr. Saffold joined forces with the others to purposely suppress evidence so that they could retain Charles R. Wiggington, Sr. as President and CEO.

Mr. Saffold's states that at the time his biography was published, he'd served on the Board for "three terms." He ignores the fact that since 2009, the electoral process was changed when Mrs. Harris-Brooks and President Wiggington disrupted the electoral process in an effort to retain the same Board Directors who have blindly shown their loyalty to Mrs. Harris-Brooks versus the Credit Union and its Members.

Mr. Saffold states that he has been "steadfastly involved in the financial and member service improvements implemented by Priority One Credit Union." This is a rather odd statement when documentation including the Credit Union's Monthly Income Statements/Balance Sheets and quarterly Financial Performance Reports filed with the NCUA, clearly document a more than $17 million loss of net income since Charles R. Wiggington, Sr. became President on January 1, 2007. The reports also show that new membership openings are continually offset by account closures. The Credit Union has also closed six of its nine branches since October 2010. So where is the evidence that Mr. Saffold's participation on the Board has served to benefit the Credit Union?

We'd invite Mr. Saffold to provide documented evidence, versus verbalizations, proving his statements. On a side note, Member Service issues are a key problem at Priority One, further dispelling Mr. Saffold's alleged involvement in improvements that cannot be attested to by anything tangible or real. Mr. Saffold was not telling the truth when he wrote his embellished biography. Mr. Saffold continues, stating that during his employment with the United States Postal Service ("USPS") he has served in the capacities of:

We'd invite Mr. Saffold to provide documented evidence, versus verbalizations, proving his statements. On a side note, Member Service issues are a key problem at Priority One, further dispelling Mr. Saffold's alleged involvement in improvements that cannot be attested to by anything tangible or real. Mr. Saffold was not telling the truth when he wrote his embellished biography. Mr. Saffold continues, stating that during his employment with the United States Postal Service ("USPS") he has served in the capacities of:

1. Budget Analyst

2. Automation Programmer

3. Customer Service Representative

4. Certified Data Conversion Operator

5. Retail Specialist

6. Consumer Affairs Representative

7. International Airmail Records Clerk

8. Certified City Clerk

9. Mail Carrier

10. Mail Handler

So how have Mr. Saffold's skills gotten from the long list of positions he listed in his biography, positively impacted Priority One? We invite Mr. Saffold to explain losses, lawsuits, and failures that have occurred since Charles R. Wiggington, Sr. became President. More importantly, we'd like Mr. Saffold to explain why he and the other Directors have done everything in their power to ensure Charles R. Wiggington, Sr. remains President.

Mr. Saffold also states he brings "a broad range of American economic and social expertise to the Board of Directors." We again invite Mr. Saffold to explain why since January 1, 2007, the date Mr. Wiggington began serving as President of the then successful Credit Union, the Credit Union's Net Income has dropped by $17 million (at times during the past 7 years, it's been more) and why six of nine branches have been closed since October 2010.

He ends his statement by stating that he is "committed to serving Priority One Credit Union with INTEGRITY and SEASONED experienced." Really? We again invite Mr. Saffold to explain how suppressing evidence proving Charles R. Wiggington, Sr. committed sexual harassment and repossessed a member's automobile whose ownership he transferred to himself without paying a cent for the vehicle proves Mr. Saffold's integrity. Due to the lack of all evidence supporting his so-called integrity, Mr. Saffold's words are meaningless. We suggest he also take a moment to acquaint himself with what defines integrity.

Mr. Hale states that his is not only a Director but also once served as Chairman of the Supervisory Committee. On paper, his biography suggests competency and experience yet uncannily we see no tangible evidence of these while he has served as a Director on the Board. To the contrary, like Mrs. Harris-Brooks and Mr. Saffold, Mr. Hale's presence on the Board is characterized by a gross incompetence and an inability to fulfill his duties. There is no denying that while he has served as Director, Priority One has morphed into a smaller, no longer impressive Credit Union. Furthermore, through the years, he has been an avid supporter of President Charles R. Wiggington, Sr. bringing into question Mr. Hale's ethics and competencies.

In his biography, ,Mr. Hale states he "completed" studies in "Real Estate Principles, Real Estate Appraisal, Property Management, Legal Aspects of Real Estate, Real Estate Practice, Real Estate Finance, Escrow Principles, and Eal Estate economics" while attending Los Angeles Southwest College. He adds that he received a CERTIFICATE in Real Estate. Since late 2010, Priority One has eliminated the varied types of Real Estate Loans it once offered to Members. Nowadays, the Credit Union's paltry real estate portfolio consists of mostly HELOCs. All other types of real estate loans are referred to CU Partners who pays the Credit Union a fee for approved and funded loans. Evidently, Mr. Hale's alleged vast expertise in real estate has not contributed anything to the Credit Union's real estate funding efforts which brings into question why he even mentioned it in his biograph?

In his biography, ,Mr. Hale states he "completed" studies in "Real Estate Principles, Real Estate Appraisal, Property Management, Legal Aspects of Real Estate, Real Estate Practice, Real Estate Finance, Escrow Principles, and Eal Estate economics" while attending Los Angeles Southwest College. He adds that he received a CERTIFICATE in Real Estate. Since late 2010, Priority One has eliminated the varied types of Real Estate Loans it once offered to Members. Nowadays, the Credit Union's paltry real estate portfolio consists of mostly HELOCs. All other types of real estate loans are referred to CU Partners who pays the Credit Union a fee for approved and funded loans. Evidently, Mr. Hale's alleged vast expertise in real estate has not contributed anything to the Credit Union's real estate funding efforts which brings into question why he even mentioned it in his biograph?

Mr. Hale also states he's "devoted a considerable amount of time to the Credit Union and understand the financial needs of its members." This is a very general statement lacking specifics and unsupported by anything tangible. According to the Credit Union's 9900 form filed with the IRS each year, Mr. Hale like the other board members contributes one (1) hour per month to the Credit Union. Is that what he considers "considerable"? So why should we believe Mr. Hale at face value? How has Mr. Hale's alleged understanding of the financial needs of members actually helped members? What has he contributed that has changed the financial standing for any member? And what members have benefited from his expertise?

The exaggerated and misleading biographies, riddled with generalizations and references that don't in anyway relate to the post of Director, speak volumes about the characters of Mrs. Harris-Brooks, Mr. Saffold, or Mr. Hale who try in earnest to convince readers that they actually have contributed to a Credit Union that has been in decline for seven years. Did they think no one notice that Priority One is is no longer a prosperous and growing Credit Union or that their perpetual protection of Charles R. Wiggington, Sr. would not serve as proof of their inability to make sound decisions that benefit the Credit Union, its Members, and its employees?.

Over the years, President Wiggington and Board Chairperson, Diedra Harris-Brooks, have expended tremendous time, energy and lots of Credit Union money, trying to hide evidence of the Credit Union's business failures and legal problems. Fortunately for the curious, President Wiggington is incapable of guarding confidentiality and in time, cannot help but verbalize information about the issues plaguing the Credit Union.

Before the first closure of branch offices in 2010 , the President was trying to contend with declining Net Capital. In 2008, in an effort to create the impression of success, the President borrowed $20 million from the Credit Union's line-of-credit which served to raise Priority One's Net Income on paper but which cost the Credit Union to pay interest in the approximate amount of $30,000 to $33,000 per month though for a very brief period, it did create the impression of success albeit it, non-existent success.

In 2009, Board Reports reveal the same mundane promises made by Charles R. Wiggington, Sr. to find a way of increasing membership, amassing new business and most importantly, increasing Net Capital well above the dreaded 6%. We've decided to publish his addresses to the Board, published in the May, June and July 2009 Board Reports. We must point out, that over the years, the President has prohibited the public disclosure of information which proves Priority One is in a state of decline though a look at the Credit Union's size in 2014 compared to its size in the years before Charles R. Wiggington, Sr. was appointed President, should suffice as evidence that his leadership is grossly deficient and has caused the Credit Union immense losses in income, Members, and its ability to sell its products.

Here are excepts from the May, June and July 2009 reports which are being made public for the first time:

Increasing the amount of the Credit Union's Net Capital became critically important in 2010 and by the end of that year, culminated in the closing of the Redlands and Valencia branches.

Since 2010, cutting expenses has become the primary means by which the Credit Union remains in business. The reliance in brutal expense reductions is born out of the fact that President Wiggington is quite incapable of implementing strategies that succeed in increasing sales and new memberships. It is this failure that has most undermined Priority One's ability to market its products and service the communities lying in Santa Clarita Valley in the north and extending south, to the Riverside/San Diego border.

What's more, closing branches and cutting other expenses was supposed to be a temporary solution intended to help Priority One regain its financial footing. In 2014, closing braches has become a normal part of business.

Not surprisingly, the Board's Directors seem disturbingly out-of-touch and incapable of comprehending that the as the President desperately seeks ways to increase Net Capital, Priority One's performance falls more and more into decline.

Since 2010, cutting expenses has become the primary means by which the Credit Union remains in business. The reliance in brutal expense reductions is born out of the fact that President Wiggington is quite incapable of implementing strategies that succeed in increasing sales and new memberships. It is this failure that has most undermined Priority One's ability to market its products and service the communities lying in Santa Clarita Valley in the north and extending south, to the Riverside/San Diego border.

What's more, closing branches and cutting other expenses was supposed to be a temporary solution intended to help Priority One regain its financial footing. In 2014, closing braches has become a normal part of business.

Not surprisingly, the Board's Directors seem disturbingly out-of-touch and incapable of comprehending that the as the President desperately seeks ways to increase Net Capital, Priority One's performance falls more and more into decline.

In late September, we learned President Wiggington feels unappreciated and declares people refuse to see or understand that there is an actual purpose to his actions that will ultimately benefit the Credit Union. His spiel is customary though usually consigned to all-staff meetings and the Board Reports which the ignorant Directors seem to believe. Why would the President believe people are going to continue indulging his excuses when over the past seven years, he has caused the decline of the Credit Union including closure of 6 of 9 branches and a $17 million decline of its Net Income. He would like listeners to believe that there is good in his intents but the fact is President Wiggington has behaved abominably proving he is not CEO material and at times, has violated state and federal laws, proving he is defiant to legal structure. Certainly the filing of lawsuits by four former employees and a lawsuit filed by a former Member whose personal information was published on the Internet by a member of the Credit Resolutions team all point to the President's unethical proclivities. In fact, 2013 ended with more than $500,000 spent on legal fees.

It is important to note that the Credit Union moved quickly to settle the lawsuits in an effort to avoid a costly and potentially embarrassing court trials though the President and Vice President, Yvonne Boutte, would later boast to staff members the settlements paid out were paltry and affordable to the Credit Union and settled because the Plaintiff's lawsuits lacked the substance needed to win in a court trial. This is the same type of contrived story-telling constantly resorted to by the same President who wanted people to believe closing six branches will reap huge profits.

The President's and Vice President's distortion of the facts are weak and declaring victories where none occurred. The big hole in their many stories is that they would like people to believe that the Plaintiff's filed frivolous lawsuits. If that were true, then why would the credit union agree to settle these and pay out monetary settlements?

And if the lawsuits lacked an evidentiary foundation then why was each Plaintiff required to sign settlements which stipulate that they are not to divulge the details of their cases or the subsequent settlements? The reason the Credit Union paid out settlements is because there was more than sufficient evidence to prove it guilty of retaliation, harassment, same sex harassment, age discrimination and racism.

In January 2009, we began reporting about how Charles R. Wiggington, Sr.'s business decisions could potentially injure and even destroy the Credit Union. We were correct. Since we first began reporting, the Credit Union's Net Income has declined by $17 million and 75% of its branches have been closed in an effort by President Wiggington to ensure Net Capital remains well above 6%.

In 2007, when an investigation confirmed that one of President Wiggington's hand-picked AVPs violated federal law when she purposely committed kiting, an incensed Board Chair issued a verbal warning to the Director who delivered an anonymous letter to the Credit Union's attorney, exposing more than 24 separate NSF violations during the months of October and November 2006. Mrs. Harris-Brooks not only chastised the Director for delivering the letter to the Credit Union's attorney but she order that any such future letters be given to the Board for investigation of allegations exposing wrongdoing. Now why would anyone turn over allegations of a federal offense to Mrs. Harris-Brooks when in 2007, she squashed evidence proving Charles R. Wiggington, Sr. sexually harassed an employee? She chooses not to remember that she possess are computer skills and that she is not an attorney or licensed investigator, clearly disqualifying her to investigate allegations that federal and state laws may have been violated.

It is important to note that the Credit Union moved quickly to settle the lawsuits in an effort to avoid a costly and potentially embarrassing court trials though the President and Vice President, Yvonne Boutte, would later boast to staff members the settlements paid out were paltry and affordable to the Credit Union and settled because the Plaintiff's lawsuits lacked the substance needed to win in a court trial. This is the same type of contrived story-telling constantly resorted to by the same President who wanted people to believe closing six branches will reap huge profits.

The President's and Vice President's distortion of the facts are weak and declaring victories where none occurred. The big hole in their many stories is that they would like people to believe that the Plaintiff's filed frivolous lawsuits. If that were true, then why would the credit union agree to settle these and pay out monetary settlements?

And if the lawsuits lacked an evidentiary foundation then why was each Plaintiff required to sign settlements which stipulate that they are not to divulge the details of their cases or the subsequent settlements? The reason the Credit Union paid out settlements is because there was more than sufficient evidence to prove it guilty of retaliation, harassment, same sex harassment, age discrimination and racism.

In January 2009, we began reporting about how Charles R. Wiggington, Sr.'s business decisions could potentially injure and even destroy the Credit Union. We were correct. Since we first began reporting, the Credit Union's Net Income has declined by $17 million and 75% of its branches have been closed in an effort by President Wiggington to ensure Net Capital remains well above 6%.

In 2007, when an investigation confirmed that one of President Wiggington's hand-picked AVPs violated federal law when she purposely committed kiting, an incensed Board Chair issued a verbal warning to the Director who delivered an anonymous letter to the Credit Union's attorney, exposing more than 24 separate NSF violations during the months of October and November 2006. Mrs. Harris-Brooks not only chastised the Director for delivering the letter to the Credit Union's attorney but she order that any such future letters be given to the Board for investigation of allegations exposing wrongdoing. Now why would anyone turn over allegations of a federal offense to Mrs. Harris-Brooks when in 2007, she squashed evidence proving Charles R. Wiggington, Sr. sexually harassed an employee? She chooses not to remember that she possess are computer skills and that she is not an attorney or licensed investigator, clearly disqualifying her to investigate allegations that federal and state laws may have been violated.

What's more, President Wiggington's mailing debacle in 2007 was disingenuously resolved but both the President and his executive staff seemed incapable of comprehending the damage incurred to Member confidence in the Credit Union's ability to safeguard Member information and Member assets. If the Executive Vice President could issue a memo providing employees information on how to "deal" with members, then it is quite clear that the Credit Union doesn't view Member-Owners as respectable or important.

The President's disdain for security protocols was again attested to in 2009 when he invited Henry Justice to return to the Credit Union as a preferred automobile broker even though Mr. Justice caused the Credit Union to lose more than $60,000 of its monies in 2003. The President's plan to return Mr. Justice to a "preferred" position within the Credit Union is astounding and again, it is clear he had absolutely no concern for the well-being of the Credit Union or its Members.

We will publish additional documentation in our next post, all supporting our 5-year assertion that Charles R. Wiggington., Sr, Diedra Harris-Brooks, and the Board of Directors have single-handedly caused widespread injury to the no longer competitive or respected Credit Union and stripped it of its ability to develop effective marketing needed to sell its wares and and compromising quality member service. Furthermore, if it were not for the Board, President Wiggington's rampant abuses which led to the ruination of the once prosperous Credit Union, might never have occurred.

Kindly Share The Love»»

|

|

|

Tweet | Save on Delicious |

293 comments:

1 – 200 of 293 Newer› Newest»John, you are so good at showing us how Wiggington didn't just become a horrible President recently but that he has been a walking disaster since the day he replaced Mr Harris. Lucky for him, he had morons like Rodger Smock and connivers like Diedra to help him commit all his horrible decisions.

And to quote Dr. Zsigmondy Freud

"In a classic gypsy grift for several years now Diedra and her henchman Wiggy continue to close branches and layoff staff claiming P1 needs to cut expenses."

Wig is dirty filthy nasty. The end.

Nice bio Diedra. I wouldn't hire you to work as a fry cook. And O. Glen, you are clearly a jack of all trades and a master of none. As for Richard Hale... WTF?

Is that Diedra or Prissy from Gone with the Wind? When was the picture taken, 1860, just before the civil war? Next time I hope she takes a full body shot so we can see her hoop skirt.

@Dr. Zsigmondy Freud

Thank you for pointing out the classic gypsy con Diedra and her cronies are perpetuating on Priority One. Yes, it's a long-con where these thugs are doing everything possible to wring out every single penny (in Diedra's case it's every single casino chip) out of P1's balance sheet to line their own greedy pockets.

Diedra is definitely related to Slappy White. The resemblance is uncanny.

A lot of us in the industry ask how could the board have kept Wiggington in office but an equally important question is how could members have kept the board intact?

It's once again time for me to extend the STFU Challenge to Charles Piggington. To encourage Piggy to accept the Challenge I am upping the prize award to $50,000. In order to earn the $50K the following stipulations must be met:

1. Wiggy you must STFU for 7 consecutive work days. This means total silence.

2. No ball scratching ot testicle adjusting for 7 days. Keep your grimy hands away from your crotch area. Exception: It's permissible to scratch your low-hanging balls in the privacy of your own residence.

3. No chewing your food with your mouth wide-open. No loud smacking as you eat. It's really unpleasant for the staff to see your choppers or extensive dental work as you chew.

I sincerely hope Wiggy finally decides to accept the STFU Challenge, especially since the total prize pool has been increased to $50,000. Very generounous of you Colonel. We all know Wiggy can use the extra spending cash.

Wiggington trying to bring back Henry Justice was not only an insult to the credit union that lost thousands of dollars to that con artist but it was an insult to the members who suffered because they couldn't get their titles for at least 3 1/2 years and it was an insult to every DMV specialist that had to drive down to the DMV each month to pick up the registration cards for the 4 members. But why should Wiggingont care? He wasn't the one left without a registration card and he certainly wasn't getting his old black ass in his car and driving down to the DMV each and every month to pick up registration cards. He wasn't the one having to listen to the 4 members complain about the credit union or that the credit union recommended Henry Justice. the credit union got screwed by Henry Justice but it got royally screwed by Charles Wiggington. And then to make it worse, old lowlife Wiggington decides he wants to invite his friend back to the credit union. Why? So he could rip us off again? Charles Wiggington is the biggest idiot I ever met and he's sickening too.

Now the other jack ass at the credit union who should be held responsible for letting Charles do his dirty deeds is Rodger Smock. I don't care that Rodger is a fag. I don't care that he used to oogle the latino boys. I don't care that he lives with a young man who he says is his son. What I do care about is that he is HR and he is the worst violator of policy. Rodger is the reason why Wiggington got away breaking policies and the law and Rodger is the reason why the credit union got sued. Rodger is the worst, the bottom of the barrel. He had his little relationship with Henry when he was Director of HR. Is that appropriate? Well yes it is to a moron like Rodger who doesn't know anything about what is appropriate. For awhile he was hiring so many latino boys and you should have seen him staring at them. Yeah, a perv is what you should always want in an HR director.

And lastly there is that beaver look alike, Diedra. Why does she use so many variations of her last name? I thought only people who were passing bad checks did that. Diedra is the reason why Wiggington got away sexually harassing Kim. Diedra is the reason why Wiggington was able to take that member's car and transfer it to his name without paying a dime. Diedra is the reason why Rodger Smock got away breaking policies and behind Rodger and Wiggington, she's the reason the credit union got sued and lost those ex-employee lawsuits.

$50.000! That's a lot of mula but old, tired, worn out, frothing at the mouth Wiggy won't be able to do it.

His mouth has a mind of its own even though everything that comes out of it is stupid. Total silence? You might have more luck getting a herd of seals to keep quiet for 7 days.

Ball scratching? Rumor has it those are sympathetic itches he feels since he lost his balls a few years ago while hospitalized at Kaiser.

As one of his victims, I know what its like to have a piece of food shoot out of his mouth at 90 mph. I luckily ducked, keeping me from getting decapitated. Maybe if he puts two bricks in his mouth, that'll keep food from bursting out though I know 2 bricks isn't enough to stop him from yabbering.

Gee wilagers and holy smoke, what's happening at the credit union?

LOL. Slappy White. That's rich.

@Lieutenant Colonel Doom and Chief Jay Strongbow: So agree

Charles con su cara de baboso a danado a la compania.

Henry Justice doesn’t give the credit union the pink slips to 4 cars. $60,000

Charles Wiggington hires a COO to do his dirty work and fires her 2 years later. $210,000

Charles gets accused of breaking federal law. $500,000

Charles is found guilty of sexual harassment. Priceless.

@Lieutenant Colonel Doom

Colonel, $50,000 is a huge amount of moolah - really quite a generous prize.

Rest easy, I'd say your money is quite safe. If Wiggy really tried very hard he might be able to keep his claptrap shut for a week. It's even possible Wig could chew without a wide-open mouth. And chances are Wiggs could go a week without ball scratching if he made a Herculean effort. But it's a are a trillion-to-one impossibility Piggly-Wiggly could accomplish all 3 tasks in the same 7 day period. So do not worry Colonel, the odds are in your favor.

I don't think Wiggington has the discipline to STFU. Might be easier to get Smock to change his sexual preference.

I'm confused. Which photo belongs to Diedra and which belong to Saffold and Hale?

I gotta give credit to Wiggy for what he has done in such a short timeframe. Perhaps his most impressive achievement is the ruination of Priority One Credit Union.

Since taking over as CEO in 2007 Wiggs turned a thriving once proud financial institution into an industry laughingstock. With branch closures, mass layoffs, arbitrary firings, sexual harassment lawsuit settlements, Facebook fraud and member service cutbacks P1 is now just a shell of what it was under Mr. Harris.

Of course, Wiggy had lots of help with a supporting cast of inept idiotic managers (Smock, West, etc.). And he could not have gone as far as he has without the corrupt, greedy, no-nothing Board of Directors led by Casino Chips Queen Diedra.

OMG! It's as if Slappy White and LaWanda Page had a child - out pops Diedra!

Slappy White is not a name you ever hear anymore. Good call Commissioner.

Yep, its basically a ship of fools at the credit union with Wig and Diedra vying for lead role. They both win as the biggest dufuses to hit any business. Diedra the ex-postal worker with an uncontrolled penchant for lying and squashing evidence of criminal activity, i.e., sexual harassment, etc. can't help being Wig's accomplice in breaking laws. And Wig who never met a business he couldn't ruin has had the support of his unforgettable side-kick Rodger "Sancho Panza" Smock and Robert "R2D2" West along with HR Circus Fat Girl, Esmeralda Sandoval, all who add their own special flavor that makes P1 what it is today. Its like a really bad sitcom starring really unattractive people. Kuddos to Diedra and Wig.

And I never realized just how attractive the Board is until I saw their photos. Niiiiccccceeee.

Not one of those bios mentions anything specific any of the directors accomplished in decades at the post office. They tell you their titles and Diedra is so general. I'd like to know what she contributed to marketing at the USPS.

And Richard Hale is quite the looker. Is he single? Somebody better snatch up this babe before he gets away. And John, you got it all wrong. After seeing O. Glen and Richard's photos it's so obvious that Diedra didn't tamper with the elections to keep the board black, she did it because she wanted to be surrounded with a stable of the handsomest black men you'll ever find. Move over Boris Kodjoe.

Diedra's academic credentials listed on her bio or so phony. It's all smoke and mirrors with this Casino Chip Queen.

Let's review: Diedra attended the University of Phoenix - that's a correspondence school. Did she graduate - NO. A few correspondence classes, BFD! I don't even believe any of her education claims.

Last month a commenter said she couldn't even graduate from MacDonald's Hamburger - that's something I could believe.

You're right, she doesn't say when she graduated or the degree she earned. But even if she did say it, I wouldn't believe her. This is a woman who lies all the time and yet has the nerve to go after people who she and Wigg say violate policy. Its quite hypocritical.

Notice O.Glen's bio. Lots of talk about all the titles he's had at the post office. He's either really accomplished or he wasn't good at any of his jobs which might explain why he got upset that they took his supervisor over clerks job and made him a postal carrier. Why is a guy who supposedly studied law, served as an arbitrator, and is a supposedly experienced Director delivering mail? Should he be at the very least an executive at the post office. I smell bullshit and its all coming from the board.

Bares repeating "Diedra's academic credentials listed on her bio are so phony. It's all smoke and mirrors with this Casino Chip Queen."

You mean Casino Bull Chip Queen.

I remember Henry Justice quite well. Everyone in the loan and dmv departments were affected, that's why when Wiggington tried to bring Henry Justice back, a lot of employees threw away the business cards Wiggington had given us and all agreed not to recommend Justice to anyone. Of course, Wiggington never knew this. He ignored all the problems Henry created for every employee in the loan department and for all the dmv people who had to go each month to pick up registrations and listen each time one of the angry members called and chewed them out for something they had nothing to do with. Not only that, but Wiggington always had an excuse. When Henry ripped off the credit union, wiggington had the same old lame excuse that he didn't know Henry was going to steal money. But after Mr Harris retired, Henry hooks back up with Wiggington and Wiggington who is now president, ignores the cost. The actual amount lost for the cars was closer to $80,000 and doesn't include lawyer and court fees. You're looking at losses at about $120,000 to $130,000. Thats what Henry did and Wiggington still thought it was a good thing to bring him back. If it wasn't for the blog, he might have succeeded. I don't want to use the words that I want to use with Wiggington who is the most dishonest, disrespectful, and uncouth lowlife anyone will ever meet. His wife and son must be prooud.

Part 1

Well, I doubt very much that Chuckie, Charles' son, or Pam, his wife, are proud. Can you imagine what it's like to live with that big mouth, day in and day out? I can't. I would of checked myself into the nearest mental hospital. Its not just that he talks, its that he talks about stupid things. His favorite subject is himself which is one of the stupid things he talks about.

Back in 2009, just after Muffin Face, Bea Walker, got hired, he would meet with her and Rodger to plot against employees who he was convinced wanted his job. She, Bea, had this bright idea to hire a consultant at a mere $30,000, who would help them flush out the blogger, the bloggers, and any blog supporters. They decided to keep the whole thing hush, hush and scheduled a meeting at Rodger's home located at 1829 Lucretia Avenue, Echo Park, CA. They ordered lunch catered by Eastside Italian Deli located at 1013 Alpine Street, Los Angeles, CA.

They met with the consultant, Loren Lillestrand, who demonstrated some tests he would administer to employees and would help him identify employee talents, likes, dislikes and most importantly, if they were plotting against the Credit Union. Rodger who is so two-faced he should have 2 names, handed Loren a list of employee names who he and Charles were masterminding the President's overthrow. If only.

Lillestrand shows up at the credit union and begins his soft testing and interrogation of all employees from all 9 branches. Yes, 9 not the present 3 branches Charles has whittled the credit union down to.

I have to admit, the employees were clever. Most knew almost instinctively that the consultant was up to something though they didn't know exactly what. The consultant handed out questionnaires that were designed to gauge employee strengths, likes and interests. After collecting these, he used a few of the employee responses to show where they might best fit into the credit union. Nothing wrong with that, right?

Part 2

On his first day, he conducted two sessions attended by all employees of the South Pasadena branch. At the end of the first and again, at the end of the second, he called out specific employees who he wanted to meet with privately in the board room. According to Loren, he just wanted to ask them questions to obtain a profile about the credit union, employee attitudes and how people felt about Charles and the other managers.

His interviews went uneventful with really little to report to the anxious President and his 2 accomplices.

He returned a week later and asked the BSA Specialist out to lunch. Now this was interesting because Bea Walker suspected the BSA Specialist was either a blogger or leaking information to the blog. While at lunch, Loren clumsily tried to extract information from the BSA Specialist but the problem was, she was not in anyway involved with the blog. The woman had a sick mother and children to attend to and was too busy to spend time writing or reporting to a blog but then again, you could never convince the certifiable President or incompetent Bea Walker and laughable Rodger Smock of this. When these 3 put their heads together, they formed 1/2 a dog head.

The board even joined in to the President's antics and at the suggestion of Bea Walker and the President, started meeting at Carrows for their monthly meetings because they were convinced the board room was bugged. Employees of Priority One don't get paid enough to afford buying electronic surveillance equipment. Never thought of it before but Charles earns $150,000 plus a year and Bea earned more than $100,000 a year and Rodger Earns more than $110,000 a year. Maybe one of them bugged the board room.

Jethro, you're right about Diedra though it seems strange to use "Diedra" and "academic credentials" in the same sentence. Now Diedra and "crook" or "grits" or "scofflaw" I can associate with her and with no problem.

That's quite an enlightening story about Consultant Loren Lillestrand; one I had never heard before. In just that one instance, idiotic Wiggy spent $30k in credit union funds to discover the identity of John the Blogger. My question is how in the hell is spending $30K a benefit to the credit union? It's not. Its a total waste Of money and expenses on a personal matter. If anything, Wiggy should have used his personal funds to investigate the blogger. In my mind Wiggy owes P1 $30k. It would be akin to Wiggy getting a $500 speeding ticket on the way to work and then having the credit union pay the fine. As a minimum, The DFI should force Wiggy to reimburse P1 $30k for the misuse of CU funds. Hell, this could even be grounds for termination.

Now we hear Wiggy and Diedra were afraid of bugs in the Board Room. Wonder how much money they wasted with an electronic sweep? Plus, it's certain that a lot more than $30K has been wasted in time and attorney's fees on this wild goose chase. And who knows how many forensic consultants were hired to discover John the Blogger over the years.

Eureka!! After hearing all this, I'm now 100% convinced Charles Wiggington himself is the mysterious secret "man behind the curtain" John the Blogger, who created the blog in a crazed paranoid haze to ferret out his enemies.

Dr. Zsigmondy Freud, you’re right. Wigg should have spent HIS OWN MONEY trying to find out who the blogger was. Spending credit union money on personal projects is something he and the board love to do.

When he thought his office was bugged, he hired Sepia Consultants to scan his office and find all the bugs he knew were planted inside the room. They found nothing but Sepia got paid with credit union money.

When he was investigated for sexual harassment, the board suspended him with pay. The investigator provided evidence Wiggington did sexually harass an employee but the board brought him back. If he was suspended it should have been WITHOUT PAY. When he was found guilty he should have been fired!

And he should have paid for the investigator and for company attorney's services.

When Suzanne used to head card services, she told Smock that there were termites flying all around the back office. Smock looks around the back room and says, “they’re not bad.” What the hell does that mean?

A few days later, the termites come into Wigg’s and Bea’s offices. Smock gets yelled at by Bea and then he calls an inspector to do a spot treatment which as anyone knows, won't fix the problem.

Wigg did hire consultants and investigators to flush John out. When that didn't work, he made up stories about employees and fired them using lies. Smock, Esmeralda and Robert West helped him with the lies.

You might be right. Wigg is mental and I don't mean intellectual. But if Wigg is the blogger, then Diedra must be an accomplice which probably means she's nuts too. Maybe they both hear voices no one else hears or see people and things, no one else sees. He should have been fired a long time ago but that would probably mean the board would have to fire itself too.

Smock says "They're not bad" in reference to the termites flying around Suzanne's work area. You ask what the hell does that mean.

Answer:

I am pretty sure that comment by Smock was taken out of context. It would be like someone asking me how I liked Granny Clampett's fried possum paws. My response was always "Theyre not bad."

It's obvious blubber boy Smock was really hungry and was snacking on the flying termites when Suzanne mentioned them, if you think about it.

Well termites are a wonderful source of protein but why did Smock only eat the male termites?

Never eaten fried possum paws. Are they good?

Fried possum paws - Granny cooks em "mountain-style" with turnips and dandelion greens, smothered in beaver gravy with all the fixin's. They're not bad.

I'm certain Smock would salivate like a starving raccoon over fried possum paws, if a grip of buttered flying termites were served as a side dish.

LOL. Its funny because its probably true. Poor hungry Smock.

I don't think Loren Lillestrand was an evil man but I think his mistake was he agreed to do Bea and Wigg's dirty work without knowing all the facts. They convinced him that there were a group employees who were trying to ruin the credit union and that they were leaking information out to the internet. If that was true, then wouldn't screwing over the credit union cause them to lose their jobs? Wigg's stories always stupid and don't make sense. Thats why he is the laughing stock of the industry.

Loren believed them because he and Bea were friends. He really believed she was a kind person. He didn't know that Robert West, Rodger Smock, and Esmeralda Sandoval along with all branch mangers, couldn't stand her and thought she was vicious. He admitted they were friends, that he met her when she worked at Toyota FCU and he thought she wsa professional. Guess he didn't know that when she worked at Toyota one of her employees embezzled more than $70,000 from under Bea's nose.

I don't know if they're still friends but hopefully he cut her lose because she's not a good association to have. Even Wigg couldn't stand her at the end.

"I'm certain Smock would salivate like a starving raccoon over fried possum paws, if a grip of buttered flying termites were served as a side dish."

I can think of a few other things that make Smock salivate and they aren't possum.

Wiggington is the reason why Priority One has so many horrible managers. It wasn't that way before he became president. He turned the credit union into his home.

There were some bad managers under Mr Harris but they either behaved or they put up a front like Lynnette and Aaron.

But Wiggington promoted Liz knowing she had overdrawn her account over and over and over for years and years. She was also borrowing money from co-workers which is against policy.

He promoted Sylvia who was a horrible manager and stupid. I mean really stupid. Rodger used to bad mouth Sylvia because he said she was Christian and Christians don't like gays. If she was a Christian then Rodger must be a runway model.

He promoted Aaron even though for years, employees had complained that Aaron harassed them and was always making sexual comments. Rodger knew this but as HR never stepped up to say Wiggington shouldn't promote him.

Yvonne is horrible person. She thinks she's smart which makes her dangerous. Its like putting a bazooka in a 5 year old's hand. She has created so much dissention since she arrived and she is a control freak. She and Bea were "close" but when their "friendship" ended, Yvonne turned completely against Bea and I think had something to do with running Bea out of the CU. The day after Bea got canned, Yvonne was telling the call center and collection people that she hoped they'd make her the next COO. Then she sends Bea a text message asking her if she's OK. She forgot to tell Bea she wanted her job.

Wow, they're still in business. Come on, just close down.

Yeah, they're all horrible people. I forgot about Sylvia. What's she doing these days? Haunting houses, 0maybe.

And Aaron. What a spoiled fat boy. That man(?) used to have hizzy fits. I heard he is at another credit union. Guess they needed a manager that breaks policies and likes to talk about sex like Wiggles.

To defend Yvonne, she's a Big Foot. They don't make good managers.